The coronavirus pandemic is expected to not stop immediately and has led the global population to face a long working, social, and economic recovery time. As a result, a large part of the population is avoiding, cancelling or postponing dental and endodontic treatment unless it is an emergency. Hence, companies in the zinc eugenol market are increasing efforts to keep economies running through telemedicine and online dentist consultations for products and treatments.

Since most individuals are finding it difficult to overcome the fear of the COVID-19 infection, manufacturers in the zinc eugenol market are capitalizing on this opportunity to strengthen their supply chains via eCommerce, telemedicine, and online dentist consultation. This is evident since dental practices are a major source of possible infections.

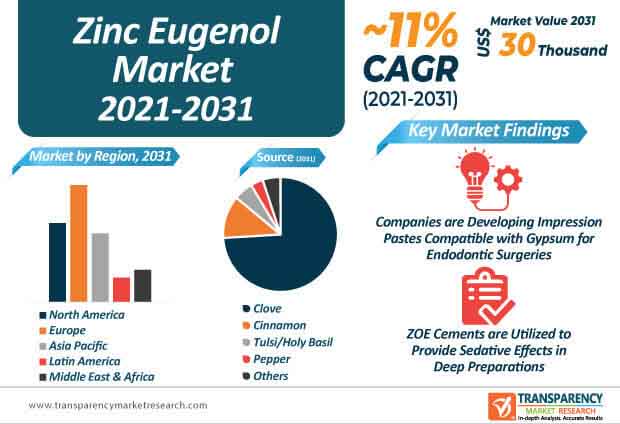

In terms of value, the global zinc eugenol market is anticipated to expand at a robust CAGR of ~11% during the forecast period. However, zinc oxide eugenol (ZOE) is being publicized as a successful root canal filling material; but it is also subject to disadvantages such as low strength, low abrasion resistance, and high solubility. Thus, manufacturers are boosting their research efforts to authenticate the success achieved with new mixture of materials associated with zinc oxide eugenol.

Manufacturers are gaining awareness about complete chemo-mechanical debridement and its role in any successful endodontic therapy. Hence, they are increasing their production capabilities in ZOE-induced root canal filling materials to improve patient quality of life.

Apart from cements and fillings, companies in the zinc eugenol market are boosting their production capacities in ZOE impression pastes. They are increasing the availability of two-part impression system involving a eugenol catalyst paste and a zinc oxide base paste component. These systems are being made with two different contrasting colors in pastes to offer clear indication.

ZOE impression pastes are gaining popularity as a self-curing material suitable for taking dental impressions. Manufacturers in the zinc eugenol market are increasing the availability of high-quality impression pastes that deliver dimensional stability and can be easily mixed to cut surgery time.

Companies in the zinc eugenol market are boosting their output capacities. They are manufacturing ZOE cement, which is used to provide a sedative effect in deep preparations. However, these cements are being associated with low compressive strength and present clinical limitations. In order to strengthen ZOE cements, manufacturers in the zinc eugenol market are adding acrylic resin and alumina reinforcers in products.

Due to advantages of sedative effects, ZOE cements are considered as the gold standard for pulp chamber filling, followed by pulpotomies or pulpectomies in the primary dentition application. In addition, a glass ionomer cement base is being placed over ZOE before the placement of resin-based composite in order to avoid polymerization.

Companies in the zinc eugenol market are developing impression pastes that are compatible with gypsum to provide smooth surface after dental and endodontic surgeries. These impression pastes are being used to manufacture dentures, especially for edentulous patients. ZOE impression pastes are acquiring prominence in enabling mal-fitting dentures to be relined. They are being used as dressing material on surgical raw wounds after wide excision of oral potentially malignant disorders (PMDs).

The chemical, physiological, and biological properties of ZOE have proved to be successful as a dressing material and is creating incremental opportunities for manufacturers in the zinc eugenol market. These dressings are being used in cases of raw wound formed after excision of oral PMDs.

Analysts’ Viewpoint

Owing to persistence of biological agents in operating rooms, eCommerce and telemedicine are helping to create revenue opportunities and revive market growth for manufacturers in the zinc eugenol market during the COVID-19 pandemic. However, zinc phosphate and glass ionomer cements pose as a threat to the sales of ZOE cements. Hence, manufacturers should educate dentists and endodontists to use glass ionomer cement base in combination with ZOE cements to place resin-based composites in order to avoid polymerization. They should increase the availability of two-part ZOE impression pastes that offer clear identification for developing dentures. Manufacturers are developing ZOE dressings used in cases of raw wound formed after excision of oral PMDs.

Zinc Eugenol Market: Overview

Zinc Eugenol Market: Key Drivers and Restraints

Zinc Eugenol Market: Major Sources

North America to be Highly Lucrative Region of Zinc Eugenol Market

Zinc Eugenol Market: Competition Landscape

1. Executive Summary

1.1. Global Market Outlook

1.2. Key Facts and Figures

2. Market Overview

2.1. Market Segmentation

2.2. Product Overview

2.3. Market Definitions/Indicator

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Porters Five Forces Analysis

2.6. Regulatory Landscape

2.7. Value Chain Analysis

2.7.1. List of Potential Customers

3. Patent Analysis

4. Global Production Output Analysis, 2024 (Tons)

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East & Africa

5. Global Zinc Eugenol Market Analysis and Forecast, by Source

5.1. Global Zinc Eugenol Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2024–2031

5.1.1. Clove

5.1.2. Cinnamon

5.1.3. Tulsi/Holy Basil

5.1.4. Pepper

5.1.5. Others

5.2. Global Zinc Eugenol Market Attractiveness Analysis, by Source

6. Global Zinc Eugenol Market Analysis and Forecast, by Region

6.1. Key Findings

6.2. Global Zinc Eugenol Market Volume (Tons) and Value (US$ Mn), by Region, 2024–2031

6.2.1. North America

6.2.2. Latin America

6.2.3. Europe

6.2.4. Asia Pacific

6.2.5. Middle East & Africa

7. Competition Landscape

7.1. Potential Zinc Eugenol Manufacturers Footprint Analysis

7.1.1. By Source

7.2. Company Profiles

7.2.1. WINFIELD SOLUTIONS, LLC

7.2.1.1. Company Description

7.2.1.2. Business Overview

7.2.1.3. Product Type

7.2.2. Van Aroma

7.2.2.1. Company Description

7.2.2.2. Business Overview

7.2.2.3. Product Type

7.2.3. CV. Indaroma

7.2.3.1. Company Description

7.2.3.2. Business Overview

7.2.3.3. Product Type

7.2.4. Sigma-Aldrich

7.2.4.1. Company Description

7.2.4.2. Business Overview

7.2.4.3. Product Type

7.2.5. Givaudan

7.2.5.1. Company Description

7.2.5.2. Business Overview

7.2.5.3. Product Type

7.2.6. Penta Manufacturing Company

7.2.6.1. Company Description

7.2.6.2. Business Overview

7.2.6.3. Product Type

List of Tables

Table 1: Global Zinc Eugenol Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2024–2031

Table 2: Global Zinc Eugenol Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2024–2031

List of Figures

Figure 1: Global Zinc Eugenol Market Share Analysis, by Source

Figure 2: Global Zinc Eugenol Market Attractiveness Analysis, by Source

Figure 3: Global Zinc Eugenol Market Share Analysis, by Region

Figure 4: Global Zinc Eugenol Market Attractiveness Analysis, by Region