As COVID-19 continues to have catastrophic effects on the lives of human beings throughout the world, healthcare facilities are under scrutiny for providing proper care and diagnosis for patients. In order to support healthcare systems, companies in the X-ray detectors market are leveraging their supply chains and after-sales services to ensure long-term relationships with customers, partners, and clients. Chest X-ray being one of the most easily available and least expensive option has sparked the demand for robust X-ray detector machines to improve medical outcomes.

Although Reverse Transcription Polymerase Chain Reaction (RT-PCR) tests are accurate in detecting COVID-19 in individuals, the test is very complicated, time-consuming, and costly. Stakeholders in the market are taking advantage of this opportunity to increase the availability of radiological examination through X-ray such as CT (Computed Tomography) scans, which is a cost-efficient and easily available option.

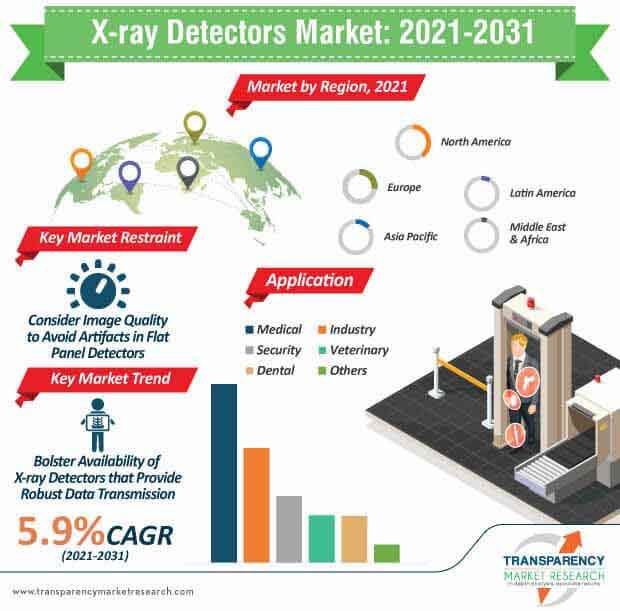

Flat panel detectors are emerging as an alternative to conventional X-ray film in order to simplify the process. This is evident since flat panel detectors allows a digitized image while taking an X-ray. However, disadvantages such as high cost as compared to traditional film systems, low spatial resolution, and possibility of artifacts are influencing the sales of flat panel detectors. Nevertheless, medical practitioners and healthcare stakeholders are taking into consideration different criteria including image quality, flexibility in applications, and device size before investing in flat panel detectors.

Outside of different criteria taken into consideration before investing in flat panel detectors, end users are taking into various advantages such as simplified image storage, portability, and ability of software processing. Such advantages compensate for its drawbacks.

The X-ray detectors market is projected to mature from a revenue of US$ 2.5 Bn in 2020 and reach US$ 4.6 Bn by 2031. The burgeoning growth of advanced industrial and scientific X-ray imaging applications are creating revenue opportunities for machine manufactures. In February 2021, data storage experts Spectrum Logic, announced the launch of their 2824HR CMOS X-ray detector that aligns with advanced industrial and scientific X-ray imaging applications. Competitor companies are taking cues from such innovations to develop CMOS (complementary metal oxide semiconductor) technology-based X-ray flat panel detectors that provide high-resolution images and are capable of covering a wide energy range.

The growing demand for ultra-high resolution images in pre-clinical, pathology, radiography, and X-ray diffraction applications are contributing to the growth of the global X-ray detectors market. Flat panel detectors are being specially designed for high-energy X-ray applications.

Breakthrough innovations such as flexible and wearable X-ray detectors are grabbing the attention of stakeholders in the market. Researchers from China and the U.S. are being publicized for developing a flexible and wearable X-ray detector made from metal-organic frameworks layered with gold electrodes and plastic. Such devices hold promising potentials as a safe and environment-safe system for developing next-gen radiology devices.

Traditional radiation detectors for X-ray imaging such as CT scanners or the small bitewing detectors used by dentists are typically fashioned into rigid panels. Such findings hold potentials for companies in the market who are increasing their R&D in flexible sensors, thus allowing detectors to conform to rounded body parts or to be molded into the inside of confined spaces.

The X-ray detectors market is undergoing a significant change with cutting-edge X-ray line detectors. Detection Technology - a global provider of X-ray imaging solutions is being publicized for its modular and easily scalable X-ray line detectors. Manufacturers are increasing efforts to build end-to-end detector subsystems for various X-ray screening systems and configurations.

In order to gain a competitive edge over other solution providers, companies in the market are providing standard detector module lengths available off-the-shelf and customized line camera sizes with short lead times. Companies are increasing the availability of dual- and single-energy solutions that are typically applied within linear detector arrays (LDA) in order to form high performance LDAs. Such X-ray imaging solutions are helping medical practitioners and other stakeholders to enter markets faster and provide best-in-class image quality to customers.

Besides medical applications, companies in the X-ray detectors industry are now increasing focus on cost-efficient checkpoint, baggage, and small cargo X-ray inspection systems. Sensing Products - an innovator in commercially deployed solutions currently focused on radar sensors is unlocking growth opportunities with X-ray body scanning systems developed by LINEV ADANI - a manufacturer in Minsk, Belarus, to overcome threats posed due to 3D printed weapons, drugs, and explosives.

Manufacturers in the market are increasing the availability of full body X-ray scanners that answers the demand for corrections, transportation, and customs, and meet the needs of border protection professionals. Companies are bolstering their manufacturing capabilities in scanners built with the compact scanning technology and high resolution imaging performance. The growing demand for advanced detection capabilities is fueling the demand for full body X-ray scanners.

Large area X-ray imaging is gaining prominence in various imaging modalities that spans across scientific and technological fields. Companies in the X-ray detectors market are bullish on flat panel X-ray imagers (FPXIs) since they are being extensively used in fluoroscopy, image-guided radiation therapy and cone beam CT amongst other applications. Stakeholders in the market are tapping revenue opportunities in non-medical fields like cultural heritage investigations, metrology and material sciences research to expand their income sources by increasing availability for flat panel X-ray imagers.

On the other hand, manufacturers are boosting their output capacities in X-ray item scanning systems. Parcel, baggage, and small cargo inspection systems are helping manufacturers to expand their income sources. With the help of comprehensive operating software, an operator can easily acquire advanced quality images and pass to the image adjustment tools.

Analysts’ Viewpoint

In recent days, flat panel X-ray imagers are being extensively used for COVID-19 diagnosis such as for radiographic chest scans. X-ray line detectors provide robust data transmission and fast synchronization between detector units and a system computer enabling high scanning speeds. These detectors are being optimized for various industrial inspection and material sorting applications. Flat panel detectors are under scrutiny for obsolescence and high cost for infrequent use. Hence, companies in the X-ray detectors market are increasing awareness about the advantages of flat panel detectors such as efficiency in better reproducibility of processes and reduction of the time required to acquire an image to offset its shortcomings.

X-ray Detectors Market Snapshot

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

US$ 2.5 Bn |

|

Market Forecast Value in 2031 |

US$ 4.6 Bn |

|

Growth Rate (CAGR) |

5.9% |

|

Forecast Period |

2021–2031 |

|

Quantitative Units |

US$ Mn for Value & ‘000 Units for Volume |

|

Market Analysis |

The report includes cross segment analysis at global as well as regional level. Qualitative analysis includes drivers, restraints, opportunities, key trends, etc. The report includes volume of various X-ray detectors across regional and global level. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was worth US$ 2.5 Bn and is projected to reach a value of US$ 4.6 Bn by the end of 2031

The market is anticipated to grow at a CAGR of 5.9% during the forecast period

North America accounted for a major share of the global market

The growing demand for ultra-high resolution images in pre-clinical, pathology, radiography, and X-ray diffraction applications are driving the growth of the market

Key players in the market includes Agfa-Gevaert Group, Varian Medical Systems, Konica Minolta, Inc., Analogic Corporation, Thales Group, FUJIFILM Holdings Corporation, Hamamatsu Photonics K.K, Mirion Technologies, Inc., Varex Imaging Corporation, Canon Medical Systems Corporation, Teledyne Technologies, Inc., and OR Technology - Oehm und Rehbein GmbH

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global X-ray Detectors Market

4. Market Overview

4.1. Introduction

4.1.1. Market Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global X-ray Detectors Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. COVID-19 Pandemics Impact on Industry (value chain and short / mid / long term impact)

5.2. Technological Advancements

5.3. Key Industry Events

5.4. Overview - Diagnostic Imaging

5.5. Pricing Analysis

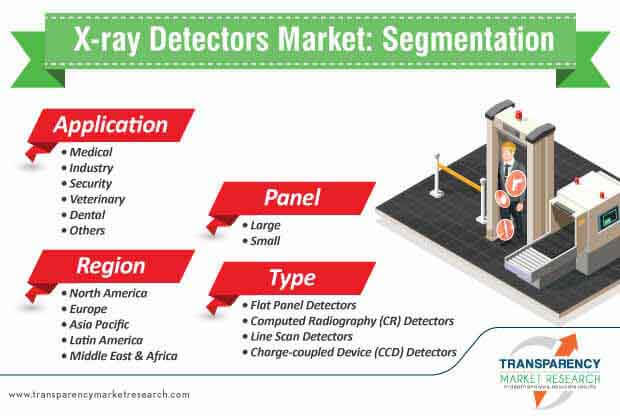

6. Global X-ray Detectors Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Global X-ray Detectors Market Value (US$ Mn) Forecast, by Type, 2017–2031

6.3.1. Flat Panel Detectors

6.3.2. Computed Radiography (CR) Detectors

6.3.3. Line Scan Detectors

6.3.4. Charge-coupled Device (CCD) Detectors

6.4. Global X-ray Detectors Market Attractiveness Analysis, by Type

7. Global X-ray Detectors Market Analysis and Forecast, by Application, 2017-2031

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Global X-ray Detectors Market Value (US$ Mn) Forecast, by Application, 2017–2031

7.3.1. Medical

7.3.2. Industrial

7.3.3. Security

7.3.4. Veterinary

7.3.5. Dental

7.3.6. Others

7.4. Global X-ray Detectors Market Attractiveness Analysis, by Application

8. Global X-ray Detectors Market Analysis and Forecast, by Panel

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Global X-ray Detectors Market Value (US$ Mn) Forecast, by Panel, 2017–2031

8.3.1. Large

8.3.2. Small

8.4. Global X-ray Detectors Market Attractiveness Analysis, by Panel

9. Global X-ray Detectors Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Global X-ray Detectors Market Value (US$ Mn) Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global X-ray Detectors Market Attractiveness Analysis, by Region

10. North America X-ray Detectors Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. North America X-ray Detectors Market Value (US$ Mn) Forecast, by Type, 2017–2031

10.2.1. Flat Panel Detectors

10.2.2. Computed Radiography (CR) Detectors

10.2.3. Line Scan Detectors

10.2.4. Charge-coupled Device (CCD) Detectors

10.3. North America X-ray Detectors Market Value (US$ Mn) Forecast, by Application, 2017–2031

10.3.1. Medical

10.3.2. Industrial

10.3.3. Security

10.3.4. Veterinary

10.3.5. Dental

10.3.6. Others

10.4. North America X-ray Detectors Market Value (US$ Mn) Forecast, by Panel, 2017–2031

10.4.1. Large

10.4.2. Small

10.5. North America X-ray Detectors Market Value (US$ Mn) Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. North America X-ray Detectors Market Attractiveness Analysis, 2017–2031

11. Europe X-ray Detectors Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Europe X-ray Detectors Market Value (US$ Mn) Forecast, by Type, 2017–2031

11.2.1. Flat Panel Detectors

11.2.2. Computed Radiography (CR) Detectors

11.2.3. Line Scan Detectors

11.2.4. Charge-coupled Device (CCD) Detectors

11.3. Europe X-ray Detectors Market Value (US$ Mn) Forecast, by Application, 2017–2031

11.3.1. Medical

11.3.2. Industrial

11.3.3. Security

11.3.4. Veterinary

11.3.5. Dental

11.3.6. Others

11.4. Europe X-ray Detectors Market Value (US$ Mn) Forecast, by Panel, 2017–2031

11.4.1. Large

11.4.2. Small

11.5. Europe X-ray Detectors Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Europe X-ray Detectors Market Attractiveness Analysis, 2017–2031

12. Asia Pacific X-ray Detectors Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Asia Pacific X-ray Detectors Market Value (US$ Mn) Forecast, by Type, 2017–2031

12.2.1. Flat Panel Detectors

12.2.2. Computed Radiography (CR) Detectors

12.2.3. Line Scan Detectors

12.2.4. Charge-coupled Device (CCD) Detectors

12.3. Asia Pacific X-ray Detectors Market Value (US$ Mn) Forecast, by Application, 2017–2031

12.3.1. Medical

12.3.2. Industrial

12.3.3. Security

12.3.4. Veterinary

12.3.5. Dental

12.3.6. Others

12.4. Asia Pacific X-ray Detectors Market Value (US$ Mn) Forecast, by Panel, 2017–2031

12.4.1. Large

12.4.2. Small

12.5. Asia Pacific X-ray Detectors Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

12.5.1. Japan

12.5.2. China

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Asia Pacific X-ray Detectors Market Attractiveness Analysis, 2017–2031

13. Latin America X-ray Detectors Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Latin America X-ray Detectors Market Value (US$ Mn) Forecast, by Type, 2017–2031

13.2.1. Flat Panel Detectors

13.2.2. Computed Radiography (CR) Detectors

13.2.3. Line Scan Detectors

13.2.4. Charge-coupled Device (CCD) Detectors

13.3. Latin America X-ray Detectors Market Value (US$ Mn) Forecast, by Application, 2017–2031

13.3.1. Medical

13.3.2. Industrial

13.3.3. Security

13.3.4. Veterinary

13.3.5. Dental

13.3.6. Others

13.4. Latin America X-ray Detectors Market Value (US$ Mn) Forecast, by Panel, 2017–2031

13.4.1. Large

13.4.2. Small

13.5. Latin America X-ray Detectors Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Latin America X-ray Detectors Market Attractiveness Analysis, 2017–2031

14. Middle East & Africa X-ray Detectors Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Middle East & Africa X-ray Detectors Market Value (US$ Mn) Forecast, by Type, 2017–2031

14.2.1. Flat Panel Detectors

14.2.2. Computed Radiography (CR) Detectors

14.2.3. Line Scan Detectors

14.2.4. Charge-coupled Device (CCD) Detectors

14.3. Middle East & Africa X-ray Detectors Market Value (US$ Mn) Forecast, by Application, 2017–2031

14.3.1. Medical

14.3.2. Industrial

14.3.3. Security

14.3.4. Veterinary

14.3.5. Dental

14.3.6. Others

14.4. Middle East & Africa X-ray Detectors Market Value (US$ Mn) Forecast, by Panel, 2017–2031

14.4.1. Large

14.4.2. Small

14.5. Middle East & Africa X-ray Detectors Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Middle East & Africa X-ray Detectors Market Attractiveness Analysis, 2017–2031

15. Competitive Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2020

15.3. Company Profiles

15.3.1. Hamamatsu Photonics K.K.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. Strategic Overview

15.3.1.5. SWOT Analysis

15.3.2. Mirion Technologies, Inc.

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Strategic Overview

15.3.2.4. SWOT Analysis

15.3.3. Varex Imaging Corporation

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. Strategic Overview

15.3.3.5. SWOT Analysis

15.3.4. Analogic Corporation

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Strategic Overview

15.3.4.4. SWOT Analysis

15.3.5. Canon Medical Systems Corporation

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. Strategic Overview

15.3.5.5. SWOT Analysis

15.3.6. Agfa-Gevaert Group

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. Strategic Overview

15.3.6.5. SWOT Analysis

15.3.7. Varian Medical Systems

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. Strategic Overview

15.3.7.5. SWOT Analysis

15.3.8. Konica Minolta, Inc.

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. Strategic Overview

15.3.8.5. SWOT Analysis

15.3.9. Thales Group

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. Strategic Overview

15.3.9.5. SWOT Analysis

15.3.10. FUJIFILM Holdings Corporation

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. Strategic Overview

15.3.10.5. SWOT Analysis

15.3.11. Teledyne Technologies Incorporated

15.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.11.2. Product Portfolio

15.3.11.3. Financial Overview

15.3.11.4. Strategic Overview

15.3.11.5. SWOT Analysis

15.3.12. OR Technology - Oehm und Rehbein GmbH

15.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.12.2. Product Portfolio

15.3.12.3. Strategic Overview

15.3.12.4. SWOT Analysis

List of Tables

Table 01: Global X-ray Detectors Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 02: Global X-ray Detectors Market Volume (Units) Forecast, by Type, 2017–2031

Table 03: Global X-ray Detectors Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 04: Global X-ray Detectors Market Value (US$ Mn) Forecast, by Panel, 2017–2031

Table 05: Global X-ray Detectors Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 06: North America X-ray Detector Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 07: North America X-ray Detector Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 08: North America X-ray Detectors Market Volume (Units) Forecast, by Type, 2017–2031

Table 09: North America X-ray Detector Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 10: North America X-ray Detector Market Value (US$ Mn) Forecast, by Panel, 2017–2031

Table 11: Europe X-ray Detectors Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 12: Europe X-ray Detectors Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 13: Europe X-ray Detectors Market Volume (Units) Forecast, by Type, 2017–2031

Table 14: Europe X-ray Detectors Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 15: Europe X-ray Detectors Market Value (US$ Mn) Forecast, by Panel, 2017–2031

Table 16: Asia Pacific X-ray Detector Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Asia Pacific X-ray Detector Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 18: Asia Pacific X-ray Detectors Market Volume (Units) Forecast, by Type, 2017–2031

Table 19: Asia Pacific X-ray Detector Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 20: Asia Pacific X-ray Detector Market Value (US$ Mn) Forecast, by Panel, 2017–2031

Table 21: Latin America X-ray Detectors Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Latin America X-ray Detectors Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 23: Latin America X-ray Detectors Market Volume (Units) Forecast, by Type, 2017–2031

Table 24: Latin America X-ray Detectors Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 25: Latin America X-ray Detectors Market Value (US$ Mn) Forecast, by Panel, 2017–2031

Table 26: Middle East & Africa X-ray Detectors Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 27: Middle East & Africa X-ray Detectors Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 28: Middle East & Africa X-ray Detectors Market Volume (Units) Forecast, by Type, 2017–2031

Table 29: Middle East & Africa X-ray Detectors Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 30: Middle East & Africa X-ray Detectors Market Value (US$ Mn) Forecast, by Panel, 2017–2031

List of Figures

Figure 01: Global X-ray Detectors Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global X-ray Detectors Market Value Share, by Type, 2020

Figure 03: Global X-ray Detectors Market Value Share, by Application, 2020

Figure 04: Global X-ray Detectors Value Share, by Panel, 2020

Figure 05: Global X-ray Detectors Value Share, by Region, 2020

Figure 06: Global X-ray Detectors Market Value Share Analysis, by Type , 2020 and 2031

Figure 07: Global X-ray Detectors Market Attractiveness Analysis, by Type, 2021–2031

Figure 08: Global X-ray Detectors Market Revenue (US$ Mn), by Flat Panel Detectors (DR), 2017–2031

Figure 09: Global X-ray Detectors Market Revenue (US$ Mn), by Computed Radiography (CR) Detectors, 2017–2031

Figure 10: Global X-ray Detectors Market Revenue (US$ Mn), by Line Scan Detectors, 2017–2031

Figure 11: Global X-ray Detectors Market Revenue (US$ Mn), by Charge-coupled Device (CCD) Detectors, 2017–2031

Figure 12: Global X-ray Detectors Market Value Share Analysis, by Application, 2020 and 2031

Figure 13: Global X-ray Detectors Market Attractiveness Analysis, by Application, 2021–2031

Figure 14: Global X-ray Detectors Market Revenue (US$ Mn), by Medical, 2017–2031

Figure 15: Global X-ray Detectors Market Revenue (US$ Mn), by Industrial, 2017–2031

Figure 16: Global X-ray Detectors Market Revenue (US$ Mn), by Security, 2017–2031

Figure 17: Global X-ray Detectors Market Revenue (US$ Mn), by Veterinary, 2017–2031

Figure 18: Global X-ray Detectors Market Revenue (US$ Mn), by Dental, 2017–2031

Figure 19: Global X-ray Detectors Market Revenue (US$ Mn), by Others, 2017–2031

Figure 20: Global X-ray Detectors Market Value Share Analysis, by Panel, 2020 and 2031

Figure 21: Global X-ray Detectors Market Attractiveness Analysis, by Panel, 2021–2031

Figure 22: Global X-ray Detectors Market Value (US$ Mn), by Large, 2017–2031

Figure 23: Global X-ray Detectors Market Value (US$ Mn), by Small, 2017–2031

Figure 24: Global X-ray Detectors Market Value Share Analysis, by Region, 2020 and 2031

Figure 25: Global X-ray Detectors Market Attractiveness Analysis, by Region, 2021–2031

Figure 26: North America X-ray Detector Market Value (US$ Mn) Forecast, 2017–2031

Figure 27: North America X-ray Detector Market Value Share Analysis, by Country, 2020 and 2031

Figure 28: North America X-ray Detector Market Attractiveness Analysis, by Country, 2021–2031

Figure 29: North America X-ray Detector Market Value Share Analysis, by Type, 2020 and 2031

Figure 30: North America X-ray Detector Market Attractiveness Analysis, by Type, 2021–2031

Figure 31: North America X-ray Detector Market Value Share Analysis, by Application, 2020 and 2031

Figure 32: North America X-ray Detector Market Attractiveness Analysis, by Application, 2021–2031

Figure 33: North America X-ray Detector Market Value Share Analysis, by Panel, 2020 and 2031

Figure 34: North America X-ray Detector Market Attractiveness Analysis, by Panel, 2021–2031

Figure 35: Europe X-ray Detectors Market Value (US$ Mn) Forecast, 2017–2031

Figure 36: Europe X-ray Detectors Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 37: Europe X-ray Detectors Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 38: Europe X-ray Detectors Market Value Share Analysis, by Type, 2020 and 2031

Figure 39: Europe X-ray Detectors Market Attractiveness Analysis, by Type, 2021–2031

Figure 40: Europe X-ray Detectors Market Value Share Analysis, by Application, 2020 and 2031

Figure 41: Europe X-ray Detectors Market Attractiveness Analysis, by Application, 2021–2031

Figure 42: Europe X-ray Detectors Market Value Share Analysis, by Panel, 2020 and 2031

Figure 43: Europe X-ray Detectors Market Attractiveness Analysis, by Panel, 2021–2031

Figure 44: Asia Pacific X-ray Detector Market Value (US$ Mn) Forecast, 2017–2031

Figure 45: Asia Pacific X-ray Detector Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 46: Asia Pacific X-ray Detector Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 47: Asia Pacific X-ray Detector Market Value Share Analysis, by Type, 2020 and 2031

Figure 48: Asia Pacific X-ray Detector Market Attractiveness Analysis, by Type, 2021–2031

Figure 49: Asia Pacific X-ray Detector Market Value Share Analysis, by Application, 2020 and 2031

Figure 50: Asia Pacific X-ray Detector Market Attractiveness Analysis, by Application, 2021–2031

Figure 51: Asia Pacific X-ray Detector Market Value Share Analysis, by Panel, 2020 and 2031

Figure 52: Asia Pacific X-ray Detector Market Attractiveness Analysis, by Panel, 2021–2031

Figure 53: Latin America X-ray Detectors Market Value (US$ Mn) Forecast, 2017–2031

Figure 54: Latin America X-ray Detectors Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 55: Latin America X-ray Detectors Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 56: Latin America X-ray Detectors Market Value Share Analysis, by Type, 2020 and 2031

Figure 57: Latin America X-ray Detectors Market Attractiveness Analysis, by Type, 2021–2031

Figure 58: Latin America X-ray Detectors Market Value Share Analysis, by Application, 2020 and 2031

Figure 59: Latin America X-ray Detectors Market Attractiveness Analysis, by Application, 2021–2031

Figure 60: Latin America X-ray Detectors Market Value Share Analysis, by Panel, 2020 and 2031

Figure 61: Latin America X-ray Detectors Market Attractiveness Analysis, by Panel, 2021–2031

Figure 62: Middle East & Africa X-ray Detectors Market Value (US$ Mn) Forecast, 2017–2031

Figure 63: Middle East & Africa X-ray Detectors Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 64: Middle East & Africa X-ray Detectors Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 65: Middle East & Africa X-ray Detectors Market Value Share Analysis, by Type, 2020 and 2031

Figure 66: Middle East & Africa X-ray Detectors Market Attractiveness Analysis, by Type, 2021–2031

Figure 67: Middle East & Africa X-ray Detectors Market Value Share Analysis, by Application, 2020 and 2031

Figure 68: Middle East & Africa X-ray Detectors Market Attractiveness Analysis, by Application, 2021–2031

Figure 69: Middle East & Africa X-ray Detectors Market Value Share Analysis, by Panel, 2020 and 2031

Figure 70: Middle East & Africa X-ray Detectors Market Attractiveness Analysis, by Panel, 2021–2031

Figure 71: Global X-ray Detectors Control Unit Market Share Analysis, by Company, (2020)