Analysts’ Viewpoint on Wound Irrigation Systems Market Scenario

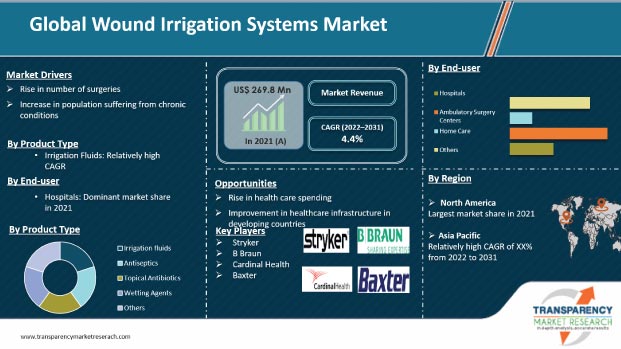

Surgical or chronic wounds represent a substantial clinical and economic burden on patients and the healthcare system. Demand for wound care as well as associated products, especially wound irrigation systems, is expected to increase steadily during the forecast period. Rise in number of surgeries and rapid increase in geriatric population are likely to drive the wound irrigation systems market. Companies operating in the market are focusing on technological advancements in wound irrigation devices to keep businesses growing post the COVID-19 pandemic.

Wound irrigation is a non-invasive procedure, wherein a steady flow of a solution is used to achieve wound hydration. It can sometimes be performed under local anesthesia or sedation, depending on the extent of the wound.

Wound irrigation products are intended to remove cellular debris and excess germs contained in wound exudates or residues from topically applied wound care products. Compared to swiping or bathing, wound irrigation is considered one of the most effective ways to clean wounds. Wound infection is one of the most important risk factors for wound management and wound closure. Wound cleansing is a vital part of controlling chronic and severe ulcers such as diabetic foot ulcers.

Wound infections make it difficult to recover from surgery and increase the cost of postoperative wound care. Development of new and effective strategies for the prevention and treatment of wound infections is key to effective wound management.

According to a published article on ‘Burden of Wound care’ by Guest et al, there is a 71% increase (from 2.2 million to 3.8 million) in the annual prevalence of wounds, with the largest rise related to acute wound types (80%). There were an estimated 3.8 million patients with a wound managed by the NHS in 2017–2018.

The number of patients suffering from chronic diseases is rising along with patient awareness and their purchasing power. This is likely to increase the number of surgical procedures, which in turn is projected to augment the global wound irrigation systems market.

According to Aesthetic Plastic Surgery statistics, surgical procedures increased by 54%, while non-surgical procedures rose by 44% in 2021. 365,000 breast augmentations were performed in 2021. Additionally, 148,000 women had implants removed and replaced and 71,000 had their implants. According to European Union (EU) statistics related to surgical operations and procedures, cataract surgery was conducted 4.3 million times and cesarean section was performed at least 1.16 million times across the EU Member States in 2018. Rise in number of surgeries increases surgical site infections and wounds. This factor is propelling the global wound irrigation systems market.

According to World Population Ageing 2019 by United Nations, the number of older persons is projected to double to 1.5 billion in Europe in 2050. The UN Population Division has estimated that the number of people aged 60 years and above will increase significantly during 2015–2030. People aged above 60 are more prone to chronic conditions such as pressure ulcers, diabetes, and resultant diabetic foot ulcers. This increases the demand for wound care products among the elderly population.

Conditions such as vascular ulcers, diabetic foot ulcers, pressure ulcers, and surgical ulcers can compromise the quality of life. Rise in the number of elderly people who are more prone to these chronic diseases is likely to drive demand for wound irrigation systems.

The prevalence of chronic diseases such as cancer, diabetes, and neurological disorders has increased due to the rise in the geriatric population and changing lifestyles in developing economies. Changing demographics in developing countries such as China, India, Brazil, and South Africa are expected to provide lucrative opportunities for health care product manufacturers in the next few years. Public and private health care expenditure is projected to increase in these countries. This is likely to boost the number of hospitals in these countries in the near future. Presence of a large number of undiagnosed patients in developing countries such as India, China, and Brazil makes these countries highly promising markets for wound irrigation products. This is anticipated to drive the demand for better wound care measures. In turn, this presents opportunities to companies operating in the global wound irrigation systems market.

In terms of product type, the global wound irrigation systems market has been classified into irrigation fluids, antiseptics, topical antibiotics, wetting agents, and others. The irrigation fluids segment dominated the global wound irrigation systems market in 2021. The trend is anticipated to continue during the forecast period due to applications in all surgical disciplines, with the highest in plastic surgery and general surgery.

Based on wound type, the global wound irrigation systems market has been segregated into burns, diabetic foot ulcers, surgical wounds, traumatic wounds, and others. The burns segment dominated the global market in 2021.

According to WHO, 180,000 deaths are caused due to burns each year. Most of these occur in low- and middle-income countries. Non-fatal burns is the leading cause of illness, long hospital stay, malnutrition, and paralysis, which often result in stigma and rejection.

North America dominated the global wound irrigation systems market, accounting for around 37% share in 2021. The trend is projected to continue during the forecast period. Rise in surgical procedures and increase in geriatric population can be ascribed to North America’s large market share.

Asia Pacific was the fastest growing region of the global wound irrigation systems market in 2021. The market in the region is likely to grow at a CAGR of 4.0% during the forecast period.

The global wound irrigation systems market is fragmented, with the presence of large number of leading players. Expansion of product portfolio and mergers & acquisitions are the key strategies adopted by major players. Key players operating in the market include Stryker, B Braun, Cardinal Health, Baxter, Zimmer Biomet, Becton, Dickinson and Company, Schulke, Bionix, Cooper Surgical, Sanara MedTech, Mölnlycke Health Care AB, Irrisept, Actimaris, and Pulsecare Medical.

Each of these players has been profiled in the wound irrigation systems market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 269.8 Mn |

|

Market Forecast Value in 2031 |

More than US$ 419.1 Mn |

|

Growth Rate |

CAGR of 4.4% from 2022–2031 |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, the qualitative analysis includes drivers, restraints, opportunities, key trends, and a parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global wound irrigation systems market was valued at US$ 269.8 Mn in 2021

The global wound irrigation systems market is projected to reach more than US$ 419.1 Mn by 2031

The global wound irrigation systems market grew at a CAGR of 1.5% from 2017 to 2021

The global wound irrigation systems market is anticipated to grow at a CAGR of 4.4% from 2022 to 2031

The irrigation fluids segment held around 40% share of the global wound irrigation systems market in 2021

Stryker, B Braun, Cardinal Health, Baxter, Zimmer Biomet, Becton, Dickinson and Company, Schulke, Bionix, Cooper Surgical, Sanara MedTech, Mölnlycke Health Care AB, Irrisept, Actimaris, and Pulsecare Medical

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Wound Irrigation Systems Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Wound Irrigation Systems Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological advancements

5.2. Regulatory scenario by Region/Globally

5.3. Key Industry Events (mergers, acquisitions, partnerships, etc.)

5.4. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

6. Global Wound Irrigation Systems Market Analysis and Forecasts, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Wetting Agents

6.3.2. Topical Antibiotics

6.3.3. Antiseptics

6.3.4. Irrigation Fluids

6.4. Market Attractiveness Analysis, by Product Type

7. Global Wound Irrigation Systems Market Analysis and Forecast, by Wound Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Wound Type, 2017–2031

7.3.1. Burns

7.3.2. Diabetic Foot Ulcers

7.3.3. Surgical Wounds

7.3.4. Traumatic Wounds

7.3.5. Others

7.4. Market Attractiveness Analysis, by Wound Type

8. Global Wound Irrigation Systems Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Ambulatory Surgery Centers

8.3.3. Home Care

8.3.4. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Wound Irrigation Systems Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Country/Region

10. North America Wound Irrigation Systems Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017–2031

10.2.1. Wetting Agents

10.2.2. Topical Antibiotics

10.2.3. Antiseptics

10.2.4. Irrigation Fluids

10.3. Market Value Forecast, by Wound Type, 2017–2031

10.3.1. Burns

10.3.2. Diabetic Foot Ulcers

10.3.3. Surgical Wounds

10.3.4. Traumatic Wounds

10.3.5. Others

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Ambulatory Surgery Centers

10.4.3. Home Care

10.4.4. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Wound Type

10.6.3. By End-user

10.6.4. By Country

11. Europe Wound Irrigation Systems Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017–2031

11.2.1. Wetting Agents

11.2.2. Topical Antibiotics

11.2.3. Antiseptics

11.2.4. Irrigation Fluids

11.3. Market Value Forecast, by Wound Type, 2017–2031

11.3.1. Burns

11.3.2. Diabetic Foot Ulcers

11.3.3. Surgical Wounds

11.3.4. Traumatic Wounds

11.3.5. Others

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Ambulatory Surgery Centers

11.4.3. Home Care

11.4.4. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Wound Type

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Wound Irrigation Systems Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017–2031

12.2.1. Wetting Agents

12.2.2. Topical Antibiotics

12.2.3. Antiseptics

12.2.4. Irrigation Fluids

12.3. Market Value Forecast, by Wound Type, 2017–2031

12.3.1. Burns

12.3.2. Diabetic Foot Ulcers

12.3.3. Surgical Wounds

12.3.4. Traumatic Wounds

12.3.5. Others

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Ambulatory Surgery Centers

12.4.3. Home Care

12.4.4. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Wound Type

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Wound Irrigation Systems Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–2031

13.2.1. Wetting Agents

13.2.2. Topical Antibiotics

13.2.3. Antiseptics

13.2.4. Irrigation Fluids

13.3. Market Value Forecast, by Wound Type, 2017–2031

13.3.1. Burns

13.3.2. Diabetic Foot Ulcers

13.3.3. Surgical Wounds

13.3.4. Traumatic Wounds

13.3.5. Others

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Ambulatory Surgery Centers

13.4.3. Home Care

13.4.4. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Wound Type

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Wound Irrigation Systems Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2017–2031

14.2.1. Wetting Agents

14.2.2. Topical Antibiotics

14.2.3. Antiseptics

14.2.4. Irrigation Fluids

14.3. Market Value Forecast, by Wound Type, 2017–2031

14.3.1. Burns

14.3.2. Diabetic Foot Ulcers

14.3.3. Surgical Wounds

14.3.4. Traumatic Wounds

14.3.5. Others

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals

14.4.2. Ambulatory Surgery Centers

14.4.3. Home Care

14.4.4. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Wound Type

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Stryker

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. B Braun

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Cardinal Health

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Baxter

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.5. Zimmer Biomet

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Becton, Dickinson and Company

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Schulke

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Bionix

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Cooper surgical

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. Sanara MedTech

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

15.3.11. Mölnlycke Health Care AB

15.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.11.2. Product Portfolio

15.3.11.3. Financial Overview

15.3.11.4. SWOT Analysis

15.3.11.5. Strategic Overview

15.3.12. Irrisept

15.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.12.2. Product Portfolio

15.3.12.3. Financial Overview

15.3.12.4. SWOT Analysis

15.3.12.5. Strategic Overview

15.3.13. Actimaris

15.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.13.2. Product Portfolio

15.3.13.3. Financial Overview

15.3.13.4. SWOT Analysis

15.3.13.5. Strategic Overview

15.3.14. Pulsecare medical

15.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.14.2. Product Portfolio

15.3.14.3. Financial Overview

15.3.14.4. SWOT Analysis

15.3.14.5. Strategic Overview

List of Tables

Table 01: Global Wound Irrigation Systems Market Value (US$ Mn) Forecast, by Product Type 2017–2031

Table 02: Global Wound Irrigation Systems Market Value (US$ Mn) Forecast, by Wound Type 2017–2031

Table 03: Global Wound Irrigation Systems Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 04: Global Wound Irrigation Systems Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Wound Irrigation Systems Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Wound Irrigation Systems Market Value (US$ Mn) Forecast, by Product Type 2017–2031

Table 07: North America Wound Irrigation Systems Market Value (US$ Mn) Forecast, by Wound Type 2017–2031

Table 08: North America Wound Irrigation Systems Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 09: Europe Wound Irrigation Systems Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 10: Europe Wound Irrigation Systems Market Value (US$ Mn) Forecast, by Product Type 2017–2031

Table 11: Europe Wound Irrigation Systems Market Value (US$ Mn) Forecast, by Wound Type 2017–2031

Table 12: Europe Wound Irrigation Systems Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 13: Asia Pacific Wound Irrigation Systems Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 14: Asia Pacific Wound Irrigation Systems Market Value (US$ Mn) Forecast, by Product Type 2017–2031

Table 15: Asia Pacific Wound Irrigation Systems Market Value (US$ Mn) Forecast, by Wound Type 2017–2031

Table 16: Asia Pacific Wound Irrigation Systems Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 17: Latin America Wound Irrigation Systems Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 18: Latin America Wound Irrigation Systems Market Value (US$ Mn) Forecast, by Product Type 2017–2031

Table 19: Latin America Wound Irrigation Systems Market Value (US$ Mn) Forecast, by Wound Type 2017–2031

Table 20: Latin America Wound Irrigation Systems Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 21: Middle East & Africa Wound Irrigation Systems Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 22: Middle East & Africa Wound Irrigation Systems Market Value (US$ Mn) Forecast, by Product Type 2017–2031

Table 23: Middle East & Africa Wound Irrigation Systems Market Value (US$ Mn) Forecast, by Wound Type 2017–2031

Table 24: Middle East & Africa Wound Irrigation Systems Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

List of Figures

Figure 01: Global Wound Irrigation Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Wound Irrigation Systems Market Value Share, by Product Type, 2021

Figure 03: Global Wound Irrigation Systems Market Value Share, by Wound Type, 2021

Figure 04: Global Wound Irrigation Systems Market Value Share, by End-user, 2021

Figure 05: Global Wound Irrigation Systems Market, by Product Type, 2021 and 2031

Figure 06: Global Wound Irrigation Systems Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 07: Global Wound Irrigation Systems Market (US$ Mn), by Wetting Agents, 2017–2031

Figure 08: Global Wound Irrigation Systems Market (US$ Mn), by Topical Antibiotics, 2017–2031

Figure 09: Global Wound Irrigation Systems Market (US$ Mn), by Antiseptics, 2017–2031

Figure 10: Global Wound Irrigation Systems Market (US$ Mn), by Irrigation Fluids, 2017–2031

Figure 11: Global Wound Irrigation Systems Market, by Wound Type, 2021 and 2031

Figure 12: Global Wound Irrigation Systems Market Attractiveness Analysis, by Wound Type, 2021–2031

Figure 13: Global Wound Irrigation Systems Market (US$ Mn), by Burns, 2017–2031

Figure 14: Global Wound Irrigation Systems Market (US$ Mn), by Diabetic Foot Ulcers, 2017–2031

Figure 15: Global Wound Irrigation Systems Market (US$ Mn), by Surgical Wounds, 2017–2031

Figure 16: Global Wound Irrigation Systems Market (US$ Mn), by Traumatic Wounds, 2017–2031

Figure 17: Global Wound Irrigation Systems Market (US$ Mn), by Others, 2017–2031

Figure 18: Global Wound Irrigation Systems Market, by End-user, 2021 and 2031

Figure 19: Global Wound Irrigation Systems Market Attractiveness Analysis, by End-user, 2021–2031

Figure 20: Global Wound Irrigation Systems Market (US$ Mn), by Hospitals, 2017–2031

Figure 21: Global Wound Irrigation Systems Market (US$ Mn), by Ambulatory Surgery Centers, 2017–2031

Figure 22: Global Wound Irrigation Systems Market (US$ Mn), by Home Care, 2017–2031

Figure 23: Global Wound Irrigation Systems Market (US$ Mn), by Others, 2017–2031

Figure 24: Global Wound Irrigation Systems Market Value Share Analysis, by Region, 2021 and 2031

Figure 25: Global Wound Irrigation Systems Market Attractiveness Analysis, by Region, 2017–2031

Figure 26: North America Wound Irrigation Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 27: North America Wound Irrigation Systems Market Value Share Analysis, by Country, 2021 and 2031

Figure 28: North America Wound Irrigation Systems Market Attractiveness Analysis, by Country, 2021–2031

Figure 29: North America Wound Irrigation Systems Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 30: North America Wound Irrigation Systems Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 31: North America Wound Irrigation Systems Market Value Share Analysis, by Wound Type, 2021 and 2031

Figure 32: North America Wound Irrigation Systems Market Attractiveness Analysis, by Wound Type, 2021–2031

Figure 33: North America Wound Irrigation Systems Market Value Share Analysis, by End-user, 2021 and 2031

Figure 34: North America Wound Irrigation Systems Market Attractiveness Analysis, by End-user, 2021–2031

Figure 35: Europe Wound Irrigation Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 36: Europe Wound Irrigation Systems Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 37: Europe Wound Irrigation Systems Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 38: Europe Wound Irrigation Systems Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 39: Europe Wound Irrigation Systems Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 40: Europe Wound Irrigation Systems Market Value Share Analysis, by Wound Type, 2021 and 2031

Figure 41: Europe Wound Irrigation Systems Market Attractiveness Analysis, by Wound Type, 2021–2031

Figure 42: Europe Wound Irrigation Systems Market Value Share Analysis, by End-user, 2021 and 2031

Figure 43: Europe Wound Irrigation Systems Market Attractiveness Analysis, by End-user, 2021–2031

Figure 44: Asia Pacific Wound Irrigation Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 45: Asia Pacific Wound Irrigation Systems Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 46: Asia Pacific Wound Irrigation Systems Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 47: Asia Pacific Wound Irrigation Systems Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 48: Asia Pacific Wound Irrigation Systems Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 49: Asia Pacific Wound Irrigation Systems Market Value Share Analysis, by Wound Type, 2021 and 2031

Figure 50: Asia Pacific Wound Irrigation Systems Market Attractiveness Analysis, by Wound Type, 2021–2031

Figure 51: Asia Pacific Wound Irrigation Systems Market Value Share Analysis, by End-user, 2021 and 2031

Figure 52: Asia Pacific Wound Irrigation Systems Market Attractiveness Analysis, by End-user, 2021–2031

Figure 53: Latin America Wound Irrigation Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 54: Latin America Wound Irrigation Systems Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 55: Latin America Wound Irrigation Systems Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 56: Latin America Wound Irrigation Systems Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 57: Latin America Wound Irrigation Systems Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 58: Latin America Wound Irrigation Systems Market Value Share Analysis, by Wound Type, 2021 and 2031

Figure 59: Latin America Wound Irrigation Systems Market Attractiveness Analysis, by Wound Type, 2021–2031

Figure 60: Latin America Wound Irrigation Systems Market Value Share Analysis, by End-user, 2021 and 2031

Figure 61: Latin America Wound Irrigation Systems Market Attractiveness Analysis, by End-user, 2021–2031

Figure 62: Middle East & Africa Wound Irrigation Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 63: Middle East & Africa Wound Irrigation Systems Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 64: Middle East & Africa Wound Irrigation Systems Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 65: Middle East & Africa Wound Irrigation Systems Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 66: Middle East & Africa Wound Irrigation Systems Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 67: Middle East & Africa Wound Irrigation Systems Market Value Share Analysis, by Wound Type, 2021 and 2031

Figure 68: Middle East & Africa Wound Irrigation Systems Market Attractiveness Analysis, by Wound Type, 2021–2031

Figure 69: Middle East & Africa Wound Irrigation Systems Market Value Share Analysis, by End-user, 2021 and 2031

Figure 70: Middle East & Africa Wound Irrigation Systems Market Attractiveness Analysis, by End-user, 2021–2031