Zipline closure system is acquiring popularity as a non-invasive solution for skin lacerations in the wound closure strips market. Individuals are benefitting from these novel strips, since the system does not penetrate the skin. The uptake of zipline closure system is anticipated to rise in the coming years, owing to their advantages in emergency cases and in operation theatres. Companies in the market for wound closure strips are increasing their production capabilities to manufacture zip-like skin closure systems that mimic traditional skin closure systems such as sutures, staples, and glue (cyanoacrylates), among others.

Companies in the wound closure strips market are increasing R&D to develop zipline closure system made from adhesive strips and zip ties that help to close the wound site and improve patient outcomes. Non-invasive nature of these novel systems are catching the attention of healthcare providers, since the strips are safe and easy to apply.

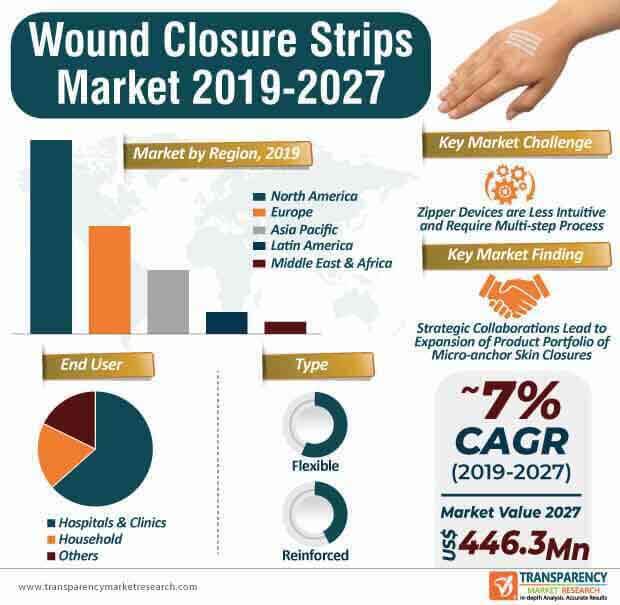

Companies in the wound closure strips market are collaborating to innovate in skin closure systems that transform operating rooms. For instance, in July 2019, Bandgrip— a leading Chicago-based medical device company, announced partnership with Indianapolis-based orthopedic practice OrthoIndy, to innovate in micro-anchor skin closures. Introduction of new products are boosting market growth, since the wound closure strips market is estimated to reach a revenue of US$ 446.3 Mn by the end of 2027.

Healthcare providers are increasingly opting for faster skin closure alternatives. This trend has triggered the demand for micro-anchor skin closures in the market for wound closure strips. Thus, micro-anchor skin closures are being highly publicized as an alternative to conventional skin sutures and staples. Novel micro-anchor skin closures alleviate the incidence of inflammation in the incision area of left for prolonged days. Companies in the market for wound closure strips are increasing research to develop skin closures that are clear and allow direct monitoring of the incision and adjacent skin.

Though plastic is infamous for its harmful repercussions on the environment, the innovative material is transforming the wound closure strips market. For instance, 3M— a global leader in medical devices, has introduced the 3M Steri Strips that are non-invasive, sterile, and designed to treat low-tension wounds. As such, sterile wound closure strips are predicted for exponential growth during the forecast period. Manufacturers are increasing their efficacy in novel plastic materials such as soft polyurethane pads, interlaced with polyester filaments that provide high tensile strength to secure skin closure for any length of the wound.

The uptake of sterile strips is anticipated to grow in the wound closure strips market in the coming years, since they enhance patient comfort and reduce the chances of infection. These attributes of sterile strips are helping toward speedy recovery from injuries and help to improve patient quality of life. Companies in the market for wound closure strips are increasing production capacities to manufacture sterile strips, owing to their time-saving option for medical professionals.

The wound closure strips market is continuously growing with leading players accounting to ~60-70% of the market stake. However, limitations of zipper devices are likely to slow down market growth. For instance, zipper devices are less intuitive and require a multi-step process to apply. Such disadvantages of zipper strips pose as a barrier for large-scale adoption in hospitals and clinics. Hence, companies are tapping opportunities in other wound closure strips alternatives such as sterile strips that offer closure to even larger wounds.

On the other hand, companies in the wound closure strips market are manufacturing ZipStich strips that are gaining popularity as surgical-quality wound closures. These novel strips provide the added benefit of eliminating the need for stitches after an individual suffers an injury. Companies are strategically positioning ZipStich strips to cater to the needs of individuals who have suffered minor lacerations.

Analysts’ Viewpoint

Companies in the wound closure strips market are eyeing opportunities in North America, since the region is projected to lead the wound closure strips market during the forecast period. Another driver that is fueling market growth in North America is the introduction of micro-anchor skin closures that are highly preferred by hospitals and clinics in the U.S.

Zipper devices are gaining popularity for their adjustable ratchet ties for the convenience of the end users. However, the raised plastic profile has the potential risk of hooking onto loose clothing, thus creating inconvenience for end users. Hence, companies should develop non-invasive sterile strips that have high tensile strength and eliminate the need for stitches after suffering an injury.

Wound closure strips market is estimated to reach a revenue of US$ 446.3 Mn by the end of 2027

Wound closure strips market is projected to expand at a CAGR of ~7% from 2019 to 2027

Wound closure strips market is driven by increase in prevalence of wounds and injuries and rise in surgical site infections

North America accounted for major share of the global wound closure strips market in 2018 and the trend is anticipated to continue during the forecast period

Key players in the global wound closure strips market include 3M, McKesson Medical-Surgical Inc. (McKesson Corporation), Cardinal Health, BSN medical (Essity Aktiebolag (publ.)), DermaRite Industries, LLC.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Wound Closure Strips Market

4. Market Overview

4.1. Introduction

4.1.1. Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Wound Closure Strips Market Analysis and Forecast, 2017–2027

4.4.1. Market Revenue Projections (US$ Mn)

5. Market Outlook

5.1. Epidemiology of Various Wounds

5.2. Key Industry Events (Mergers, Acquisitions, Product Launch, etc.)

6. Global Wound Closure Strips Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Type, 2017–2027

6.3.1. Flexible

6.3.2. Reinforced

6.4. Market Attractiveness, by Type

7. Global Wound Closure Strips Market Analysis and Forecast, by Sterility

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Sterility, 2017–2027

7.3.1. Sterile

7.3.2. Non-sterile

7.4. Market Attractiveness, by Sterility

8. Global Wound Closure Strips Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2027

8.3.1. Hospitals & Clinics

8.3.2. Household

8.3.3. Others

8.4. Market Attractiveness by End-user

9. Global Wound Closure Strips Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness, by Region

10. North America Wound Closure Strips Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Type, 2017–2027

10.2.1. Flexible

10.2.2. Reinforced

10.3. Market Value Forecast, by Sterility, 2017–2027

10.3.1. Sterile

10.3.2. Non-sterile

10.4. Market Value Forecast, by End-user, 2017–2027

10.4.1. Hospitals & Clinics

10.4.2. Household

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2027

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By Sterility

10.6.3. By End-user

10.6.4. By Country

11. Europe Wound Closure Strips Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type, 2017–2027

11.2.1. Flexible

11.2.2. Reinforced

11.3. Market Value Forecast, by Sterility, 2017–2027

11.3.1. Sterile

11.3.2. Non-sterile

11.4. Market Value Forecast, by End-user, 2017–2027

11.4.1. Hospitals & Clinics

11.4.2. Household

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2027

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Russia

11.5.7. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By Sterility

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Wound Closure Strips Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2017–2027

12.2.1. Flexible

12.2.2. Reinforced

12.3. Market Value Forecast, by Sterility, 2017–2027

12.3.1. Sterile

12.3.2. Non-sterile

12.4. Market Value Forecast, by End-user, 2017–2027

12.4.1. Hospitals & Clinics

12.4.2. Household

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2027

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By Sterility

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Wound Closure Strips Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2017–2027

13.2.1. Flexible

13.2.2. Reinforced

13.3. Market Value Forecast, by Sterility, 2017–2027

13.3.1. Sterile

13.3.2. Non-sterile

13.4. Market Value Forecast by, End-user, 2017–2027

13.4.1. Hospitals & Clinics

13.4.2. Household

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2027

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Type

13.6.2. By Sterility

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Wound Closure Strips Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Type, 2017–2027

14.2.1. Flexible

14.2.2. Reinforced

14.3. Market Value Forecast, by Sterility, 2017–2027

14.3.1. Sterile

14.3.2. Non-sterile

14.4. Market Value Forecast, by End-user, 2017–2027

14.4.1. Hospitals & Clinics

14.4.2. Household

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2027

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Israel

14.5.4. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Type

14.6.2. By Sterility

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis, by Company (2018)

15.3. Company Profiles

15.3.1. 3M

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Growth Strategies

15.3.1.3. SWOT Analysis

15.3.2. McKesson Medical-Surgical Inc. (McKesson Corporation)

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Growth Strategies

15.3.2.3. SWOT Analysis

15.3.3. Cardinal Health

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Growth Strategies

15.3.3.3. SWOT Analysis

15.3.4. BSN medical (Essity Aktiebolag (publ.))

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Growth Strategies

15.3.4.3. SWOT Analysis

15.3.5. DermaRite Industries, LLC.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Growth Strategies

15.3.5.3. SWOT Analysis

15.3.6. Dynarex Corporation

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Growth Strategies

15.3.6.3. SWOT Analysis

15.3.7. DUKAL

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Growth Strategies

15.3.7.3. SWOT Analysis

15.3.8. Zipline Medical (Stryker)

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Growth Strategies

15.3.8.3. SWOT Analysis

15.3.9. priMED Medical Products, Inc.

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Growth Strategies

15.3.9.3. SWOT Analysis

15.3.10. Smith & Nephew plc

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Growth Strategies

15.3.10.3. SWOT Analysis

*Note: Financial details for companies that do not report this information in public domain might not be captured

List of Tables

Table 01: Global Wound Closure Strips Market Value (US$ Mn) Forecast, by Type, 2017–2027

Table 02: Global Wound Closure Strips Market Value (US$ Mn) Forecast, by Sterility, 2017–2027

Table 03: Global Wound Closure Strips Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 04: Global Wound Closure Strips Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 05: North America Wound Closure Strips Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 06: North America Wound Closure Strips Market Value (US$ Mn) Forecast, by Type, 2017–2027

Table 07: North America Wound Closure Strips Market Value (US$ Mn) Forecast, by Sterility, 2017–2027

Table 08: North America Wound Closure Strips Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 09: Europe Wound Closure Strips Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 10: Europe Wound Closure Strips Market Value (US$ Mn) Forecast, by Type, 2017–2027

Table 11: Europe Wound Closure Strips Market Value (US$ Mn) Forecast, by Sterility, 2017–2027

Table 12: Europe Wound Closure Strips Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 13: Asia Pacific Wound Closure Strips Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 14: Asia Pacific Wound Closure Strips Market Value (US$ Mn) Forecast, by Type, 2017–2027

Table 15: Asia Pacific Wound Closure Strips Market Value (US$ Mn) Forecast, by Sterility, 2017–2027

Table 16: Asia Pacific Wound Closure Strips Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 17: Latin America Wound Closure Strips Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 18: Latin America Wound Closure Strips Market Value (US$ Mn) Forecast, by Type, 2017–2027

Table 19: Latin America Wound Closure Strips Market Value (US$ Mn) Forecast, by Sterility, 2017–2027

Table 20: Latin America Wound Closure Strips Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 21: Middle East & Africa Wound Closure Strips Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 22: Middle East & Africa Wound Closure Strips Market Value (US$ Mn) Forecast, by Type, 2017–2027

Table 23: Middle East & Africa Wound Closure Strips Market Value (US$ Mn) Forecast, by Sterility, 2017–2027

Table 24: Middle East & Africa Wound Closure Strips Market Value (US$ Mn) Forecast, by End-user, 2017–2027

List of Figures

Figure 01: Global Wound Closure Strips Market Value (US$ Mn) and Distribution, by Region, 2018 and 2027

Figure 02: Global Wound Closure Strips Market Value (US$ Mn), by Type, 2018

Figure 03: Global Wound Closure Strips Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 04: Global Wound Closure Strips Market Value Share (%), by Type, 2018 and 2027

Figure 05: Global Wound Closure Strips Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Flexible, 2017–2027

Figure 06: Global Wound Closure Strips Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Reinforced, 2017–2027

Figure 07: Global Wound Closure Strips Market Attractiveness Analysis, by Type, 2019–2027

Figure 08: Global Wound Closure Strips Market Value Share, by Sterility, 2018 and 2027

Figure 09: Global Wound Closure Strips Market Attractiveness, by Sterility, 2019–2027

Figure 10: Global Wound Closure Strips Market Value (US$ Mn) and Y-o-Y Growth, by Sterile, 2017–2027

Figure 11: Global Wound Closure Strips Market Value (US$ Mn) and Y-o-Y Growth, by Non-sterile, 2017–2027

Figure 12: Global Wound Closure Strips Market Value Share, by End-user, 2018 and 2027

Figure 13: Global Wound Closure Strips Market Attractiveness, by End-user, 2019–2027

Figure 14: Global Wound Closure Strips Market Value (US$ Mn) and Y-o-Y Growth, by Hospitals & Clinics, 2017–2027

Figure 15: Global Wound Closure Strips Market Value (US$ Mn) and Y-o-Y Growth, by Household, 2017–2027

Figure 16: Global Wound Closure Strips Market Value (US$ Mn) and Y-o-Y Growth, by Others, 2017–2027

Figure 17: Global Wound Closure Strips Market Value Share, by Region, 2018 and 2027

Figure 18: Global Wound Closure Strips Market Attractiveness, by Region, 2019–2027

Figure 19: North America Wound Closure Strips Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 20: North America Wound Closure Strips Market Value Share (%), by Country, 2018 and 2027

Figure 21: North America Wound Closure Strips Market Attractiveness, by Country, 2019–2027

Figure 22: North America Wound Closure Strips Market Value Share, by Type, 2018 and 2027

Figure 23: North America Wound Closure Strips Market Attractiveness, by Type, 2019–2027

Figure 24: North America Wound Closure Strips Market Value Share, by Sterility, 2018 and 2027

Figure 25: North America Wound Closure Strips Market Attractiveness, by Sterility, 2019–2027

Figure 26: North America Wound Closure Strips Market Value Share Analysis, by End-user, 2018 and 2027

Figure 27: North America Wound Closure Strips Market Attractiveness, by End-user, 2019–2027

Figure 28: Europe Wound Closure Strips Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 29: Europe Wound Closure Strips Market Value Share (%), by Country/Sub-region, 2018 and 2027

Figure 30: Europe Wound Closure Strips Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 31: Europe Wound Closure Strips Market Value Share, by Type, 2018 and 2027

Figure 32: Europe Wound Closure Strips Market Attractiveness, by Type, 2019–2027

Figure 33: Europe Wound Closure Strips Market Value Share, by Sterility, 2018 and 2027

Figure 34: Europe Wound Closure Strips Market Attractiveness, by Sterility, 2019–2027

Figure 35: Europe Wound Closure Strips Market Value Share, by End-user, 2018 and 2027

Figure 36: Europe Wound Closure Strips Market Attractiveness, by End-user, 2019–2027

Figure 37: Asia Pacific Wound Closure Strips Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 38: Asia Pacific Wound Closure Strips Market Value Share (%), by Country/Sub-region, 2018 and 2027

Figure 39: Asia Pacific Wound Closure Strips Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 40: Asia Pacific Wound Closure Strips Market Value Share, by Type, 2018 and 2027

Figure 41: Asia Pacific Wound Closure Strips Market Attractiveness, by Type, 2019–2027

Figure 42: Asia Pacific Wound Closure Strips Market Value Share, by Sterility, 2018 and 2027

Figure 43: Asia Pacific Wound Closure Strips Market Attractiveness, by Sterility, 2019–2027

Figure 44: Asia Pacific Wound Closure Strips Market Value Share, by End-user, 2018 and 2027

Figure 45: Asia Pacific Wound Closure Strips Market Attractiveness, by End-user, 2019–2027

Figure 46: Latin America Wound Closure Strips Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 47: Latin America Wound Closure Strips Market Value Share (%), by Country/Sub-region, 2018 and 2027

Figure 48: Latin America Wound Closure Strips Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 49: Latin America Wound Closure Strips Market Value Share, by Type, 2018 and 2027

Figure 50: Latin America Wound Closure Strips Market Attractiveness, by Type, 2019–2027

Figure 51: Latin America Wound Closure Strips Market Value Share, by Sterility, 2018 and 2027

Figure 52: Latin America Wound Closure Strips Market Attractiveness, by Sterility, 2019–2027

Figure 53: Latin America Wound Closure Strips Market Value Share, by End-user, 2018 and 2027

Figure 54: Latin America Wound Closure Strips Market Attractiveness, by End-user, 2019–2027

Figure 55: Middle East & Africa Wound Closure Strips Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 56: Middle East & Africa Wound Closure Strips Market Value Share (%), by Country/Sub-region, 2018 and 2027

Figure 57: Middle East & Africa Wound Closure Strips Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 58: Middle East & Africa Wound Closure Strips Market Value Share, by Type, 2018 and 2027

Figure 59: Middle East & Africa Wound Closure Strips Market Attractiveness, by Type, 2019–2027

Figure 60: Middle East & Africa Wound Closure Strips Market Value Share, by Sterility, 2018 and 2027

Figure 61: Middle East & Africa Wound Closure Strips Market Attractiveness, by Sterility, 2019–2027

Figure 62: Middle East & Africa Wound Closure Strips Market Value Share, by End-user, 2018 and 2027

Figure 63: Middle East & Africa Wound Closure Strips Market Attractiveness, by End-user, 2019–2027

Figure 64: Market Position Analysis, 2018, by Tier and Size of the Company

Figure 65: 3M Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure 65: 3M R&D Expenses (US$ Mn) & Y-o-Y Growth (%), 2016-2018

Figure 67: 3M Breakdown of Net Sales (%), by Region, 2018

Figure 68: 3M Breakdown of Net Sales (%), by Business Segment, 2018

Figure 69: McKesson Medical-Surgical Inc. Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2019

Figure 70: McKesson Corporation R&D Expenses (US$ Mn) & Y-o-Y Growth (%), 2017-2019

Figure 71: McKesson Corporation Breakdown of Net Sales (%), by Business Segment, 2019

Figure 72: McKesson Corporation Breakdown of Net Sales (%), by Region, 2019

Figure 73: Cardinal Health Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2019

Figure 74: Cardinal Health Breakdown of Net Sales (%), by Region, 2019

Figure 75: Cardinal Health Breakdown of Net Sales (%), by Business Segment, 2019

Figure 76: Essity Aktiebolag (publ.), Revenue (US$ Bn) and Y-o-Y Growth (%), 2016–2018

Figure 77: Essity Aktiebolag (publ.), Breakdown of Net Sales, by Business Segment, 2018

Figure 78: Essity Aktiebolag (publ.), Breakdown of Net Sales, by Personal Care Sub segment, 2018

Figure 79: Essity Aktiebolag (publ.), Breakdown of Net Sales, by Region, 2018

Figure 80: Stryker, Revenue (US$ Bn) and Y-o-Y Growth (%), 2015–2018

Figure 81: Stryker, R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2014- 2018

Figure 82: Stryker, Breakdown of Net Sales (%), by Business Segment, 2018

Figure 83: Stryker, Breakdown of Net Sales (%), by Business Segment, 2018

Figure 84: Smith & Nephew plc Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 85: Smith & Nephew plc R&D Expenses (US$ Mn), 2016–2018

Figure 86: Smith & Nephew plc Breakdown of Net Sales (%), by Business Segment - Advanced Wound Management, 2018

Figure 87: Smith & Nephew plc Breakdown of Net Sales (%), by Region, 2018