Analysts’ Viewpoint

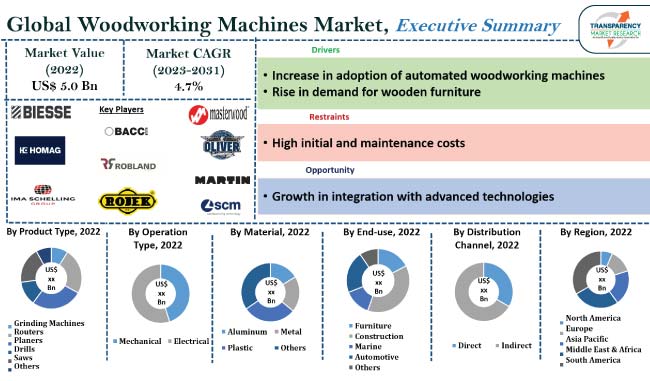

Increase in adoption of automated woodworking machines, and growth in demand for wooden furniture are projected to boost the global woodworking machines market share.

Consumers are increasingly using creative panel artworks to maintain their home or office aesthetics. Therefore, rise in residential and commercial infrastructure settings would boost the demand for wooden products, which is estimated to fuel the woodworking machines market size in the near future. With the emerging trend of automated woodworking machines, industries are switching to using robots to operate the machinery, which can improve safety and free up an operator's time.

Key players in the woodworking machines industry are focusing on the latest technological advancements, such as IoT for woodworking machines, to strengthen their foothold in the market.

Woodworking machines are specialized equipment used in workshops to cut, saw, and drill wood for manufacturing furniture. It mostly requires electric or mechanical motors to function. There are various types of woodworking machines, such as grinding machines, wood routers, wood planers, drills, saws, wood lathes, and wood CNC machines. Woodworking machinery is also called wood lathe, and its processing object is lumber.

A woodworking machine is widely used to provide fine dimensions and designs to doors, windows, stair railings, and polished surfaces. It is widely used in construction and furniture industries, for maintenance of wood products in units, and in the home decoration industry. The machine is mainly used for processing timber and wood materials for producing all kinds of wooden furniture.

In most machines and tools used for woodworking, a blade is included, which helps in removing pieces of timber. Sometimes, a spinning knife, which can efficiently cut the timber into at least two pieces, is also included.

Automation in the carpentry industry supports production with computers, which are installed in the machine. The computers perform the necessary operations and checks on the processing. The high requirement for specialized woodworking technology in the production process to ensure flexibility and customization in furniture products is driving the woodworking industry.

Automation technology is being integrated into conventional woodworking machinery. Key players in the woodworking machines industry are focused on incorporating the latest technological advancements in the machines. For instance, on January 20, 2023, The Felder Group launched its new product FELDER G 500 EX. It is a modern, heavy-duty, compact edge bander for tough everyday multi-shift operations. The development of the new product was all about gaining maximum productivity with ease of use. Controls are simple and laid out in a straightforward manner on a control panel in this product.

Integration is gaining prominence in all functions with the use of automated and IoT-enabled equipment. Additionally, user-friendly automated woodworking machines throughout the entire development process of new wood products is resulting in the growing demand for automated woodworking machines.

Increase in residential and commercial structures and preference of consumers for their buildings to have a pleasing look are driving the woodworking machines market demand. Furthermore, in recent years, customers are replacing their old furniture and buying new wooden furnished products to redesign their home or office. According to Home Furnishings Business, in 2022, traditional retailers witnessed a 21.8% increase in sales and 13.2% in profits in the wooden furniture business.

Expansion of e-commerce platforms, which helps customers to have a wide variety of furniture products, and changing customer preference toward home décor products, such as wood-based furniture, boosts the demand for woodworking machines. According to ComScore Digital Commerce Measurement, in 2021, the furniture and appliances category was one of the top three growing categories in digital commerce in the U.S. These factors are anticipated to create lucrative woodworking machines market opportunities in the near future.

According to the latest global woodworking machines market analysis and forecast, Europe accounts for major share due to the presence of large number of sawmills and wood manufacturers and the exponentially growing demand for wood and its products in the region. According to Peak, that invests in early-stage companies, there were over 35,000 sawmills and 400,000 wood manufacturers as of 2022 in Europe.

The woodworking machines market revenue in Asia Pacific is expected to witness substantial growth, ascribed to the surge in demand for wooden furniture products and rise in construction of both residential as well as commercial spaces. According to China’s Ministry of Housing and Urban-Rural Development, there are 600 million buildings in cities as well as villages as of 2023. Rise in number of buildings propels the demand for furniture, which eventually increases the need for woodworking machines. China, India, and, Japan hold major market share in the region due to rapid urbanization and infrastructure development.

Detailed profiles of companies are provided in the woodworking machines market report to evaluate their financials, key product offerings, recent developments, and strategies. Most companies that manufacture woodworking machines are spending significantly on comprehensive R&D activities, primarily to develop innovative products.

Expansion of product portfolios and mergers & acquisitions are the key strategies adopted by manufacturers in the industry. Leading players are also following the latest woodworking machines market trends to avail lucrative revenue opportunities.

BIESSE GROUP, HOMAG Group, IMA Schelling Group GmbH, Masterwood SpA, Oliver Machinery Company, Otto Martin Maschinenbau GmbH & Co. KG, Paolino Bacci, Robland, Rojek, and SCM Group are the prominent woodworking machine manufacturers.

Each of these players has been profiled in the global woodworking machines market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 (Base Year) |

US$ 5.0 Bn |

|

Market Forecast Value in 2031 |

US$ 7.5 Bn |

|

Growth Rate (CAGR) |

4.7% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 5.0 Bn in 2022

It is expected to reach US$ 7.5 Bn by 2031

Increase in adoption of automated woodworking machines and rise in demand for wooden furniture

The saws segment accounts for largest share

Asia Pacific contributed about 34% share in 2022

BIESSE GROUP, HOMAG Group, IMA Schelling Group GmbH, Masterwood SpA, Oliver Machinery Company, Otto Martin Maschinenbau GmbH & Co. KG, Paolino Bacci, Robland, Rojek, and SCM Group

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Industry SWOT Analysis

5.6. Porter’s Five Forces Analysis

5.7. Value Chain Analysis

5.8. COVID-19 Impact Analysis

5.9. Technology Analysis

5.10. Global Woodworking Machines Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Bn)

5.10.2. Market Volume Projections (Thousand Units)

6. Global Woodworking Machines Market Analysis and Forecast, By Product Type

6.1. Global Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Product Type, 2017 - 2031

6.1.1. Grinding Machines

6.1.2. Routers

6.1.3. Planers

6.1.4. Drills

6.1.5. Saws

6.1.6. Others (Lathe, Chain/Chisel Mortiser, etc.)

6.2. Incremental Opportunity, By Product Type

7. Global Woodworking Machines Market Analysis and Forecast, By Operation Type

7.1. Global Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Operation Type, 2017 - 2031

7.1.1. Mechanical

7.1.2. Electrical

7.2. Incremental Opportunity, By Operation Type,

8. Global Woodworking Machines Market Analysis and Forecast, By Material

8.1. Global Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Material, 2017 - 2031

8.1.1. Aluminum

8.1.2. Metal

8.1.3. Plastic

8.1.4. Others (Copper, Iron, etc.)

8.2. Incremental Opportunity, By Material

9. Global Woodworking Machines Market Analysis and Forecast, By End-use

9.1. Global Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By End-use, 2017 - 2031

9.1.1. Furniture

9.1.2. Construction

9.1.3. Marine

9.1.4. Automotive

9.1.5. Others (Locomotive, Industrial Manufacturing, etc.)

9.2. Incremental Opportunity, By End-use

10. Global Woodworking Machines Market Analysis and Forecast, By Distribution Channel

10.1. Global Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

10.1.1. Direct

10.1.2. Indirect

10.2. Incremental Opportunity, By Distribution Channel

11. Global Woodworking Machines Market Analysis and Forecast, By Region

11.1. Global Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Region, 2017 - 2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Incremental Opportunity, By Region

12. North America Woodworking Machines Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Trends Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Selling Price (US$)

12.4. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Product Type, 2017 - 2031

12.4.1. Grinding Machines

12.4.2. Routers

12.4.3. Planers

12.4.4. Drills

12.4.5. Saws

12.4.6. Others (Lathe, Chain/Chisel Mortiser, etc.)

12.5. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Operation Type, 2017 - 2031

12.5.1. Mechanical

12.5.2. Electrical

12.6. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Material, 2017 - 2031

12.6.1. Aluminum

12.6.2. Metal

12.6.3. Plastic

12.6.4. Others (Copper, Iron, etc.)

12.7. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By End-use, 2017 - 2031

12.7.1. Furniture

12.7.2. Construction

12.7.3. Marine

12.7.4. Automotive

12.7.5. Others (Locomotive, Industrial Manufacturing, etc.)

12.8. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

12.8.1. Direct

12.8.2. Indirect

12.9. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

12.9.1. U.S.

12.9.2. Canada

12.9.3. Rest of North America

12.10. Incremental Opportunity Analysis

13. Europe Woodworking Machines Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Trends Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Selling Price (US$)

13.4. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Product Type, 2017 - 2031

13.4.1. Grinding Machines

13.4.2. Routers

13.4.3. Planers

13.4.4. Drills

13.4.5. Saws

13.4.6. Others (Lathe, Chain/Chisel Mortiser, etc.)

13.5. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Operation Type, 2017 - 2031

13.5.1. Mechanical

13.5.2. Electrical

13.6. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Material, 2017 - 2031

13.6.1. Aluminum

13.6.2. Metal

13.6.3. Plastic

13.6.4. Others (Copper, Iron, etc.)

13.7. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By End-use, 2017 - 2031

13.7.1. Furniture

13.7.2. Construction

13.7.3. Marine

13.7.4. Automotive

13.7.5. Others (Locomotive, Industrial Manufacturing, etc.)

13.8. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

13.8.1. Direct

13.8.2. Indirect

13.9. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

13.9.1. U.K.

13.9.2. Germany

13.9.3. France

13.9.4. Rest of Europe

13.10. Incremental Opportunity Analysis

14. Asia Pacific Woodworking Machines Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Trends Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Selling Price (US$)

14.4. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Product Type, 2017 - 2031

14.4.1. Grinding Machines

14.4.2. Routers

14.4.3. Planers

14.4.4. Drills

14.4.5. Saws

14.4.6. Others (Lathe, Chain/Chisel Mortiser, etc.)

14.5. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Operation Type, 2017 - 2031

14.5.1. Mechanical

14.5.2. Electrical

14.6. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Material, 2017 - 2031

14.6.1. Aluminum

14.6.2. Metal

14.6.3. Plastic

14.6.4. Others (Copper, Iron, etc.)

14.7. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By End-use, 2017 - 2031

14.7.1. Furniture

14.7.2. Construction

14.7.3. Marine

14.7.4. Automotive

14.7.5. Others (Locomotive, Industrial Manufacturing, etc.)

14.8. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

14.8.1. Direct

14.8.2. Indirect

14.9. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

14.9.1. China

14.9.2. India

14.9.3. Japan

14.9.4. Rest of Asia Pacific

14.10. Incremental Opportunity Analysis

15. Middle East & Africa Woodworking Machines Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Trends Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Selling Price (US$)

15.4. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Product Type, 2017 - 2031

15.4.1. Grinding Machines

15.4.2. Routers

15.4.3. Planers

15.4.4. Drills

15.4.5. Saws

15.4.6. Others (Lathe, Chain/Chisel Mortiser, etc.)

15.5. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Operation Type, 2017 - 2031

15.5.1. Mechanical

15.5.2. Electrical

15.6. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Material, 2017 - 2031

15.6.1. Aluminum

15.6.2. Metal

15.6.3. Plastic

15.6.4. Others (Copper, Iron, etc.)

15.7. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By End-use, 2017 - 2031

15.7.1. Furniture

15.7.2. Construction

15.7.3. Marine

15.7.4. Automotive

15.7.5. Others (Locomotive, Industrial Manufacturing, etc.)

15.8. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

15.8.1. Direct

15.8.2. Indirect

15.9. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

15.9.1. GCC

15.9.2. South Africa

15.9.3. Rest of Middle East & Africa

15.10. Incremental Opportunity Analysis

16. South America Woodworking Machines Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Trends Analysis

16.3. Price Trend Analysis

16.3.1. Weighted Average Selling Price (US$)

16.4. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Product Type, 2016 - 2031

16.4.1. Grinding Machines

16.4.2. Routers

16.4.3. Planers

16.4.4. Drills

16.4.5. Saws

16.4.6. Others (Lathe, Chain/Chisel Mortiser, etc.)

16.5. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Operation Type, 2016 - 2031

16.5.1. Mechanical

16.5.2. Electrical

16.6. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Material, 2016 - 2031

16.6.1. Aluminum

16.6.2. Metal

16.6.3. Plastic

16.6.4. Others (Copper, Iron, etc.)

16.7. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By End-use, 2016 - 2031

16.7.1. Furniture

16.7.2. Construction

16.7.3. Marine

16.7.4. Automotive

16.7.5. Others (Locomotive, Industrial Manufacturing, etc.)

16.8. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2016 - 2031

16.8.1. Direct

16.8.2. Indirect

16.9. Woodworking Machines Market (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2016 - 2031

16.9.1. Brazil

16.9.2. Rest of South America

16.10. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Market Player - Competition Dashboard

17.2. Market Share Analysis (%), 2022

17.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

17.3.1. BIESSE GROUP

17.3.1.1. Company Overview

17.3.1.2. Sales Area/Geographical Presence

17.3.1.3. Financial/Revenue

17.3.1.4. Strategy & Business Overview

17.3.1.5. Sales Channel Analysis

17.3.1.6. Size Portfolio

17.3.2. HOMAG Group

17.3.2.1. Company Overview

17.3.2.2. Sales Area/Geographical Presence

17.3.2.3. Financial/Revenue

17.3.2.4. Strategy & Business Overview

17.3.2.5. Sales Channel Analysis

17.3.2.6. Size Portfolio

17.3.3. IMA Schelling Group GmbH

17.3.3.1. Company Overview

17.3.3.2. Sales Area/Geographical Presence

17.3.3.3. Financial/Revenue

17.3.3.4. Strategy & Business Overview

17.3.3.5. Sales Channel Analysis

17.3.3.6. Size Portfolio

17.3.4. Masterwood SpA

17.3.4.1. Company Overview

17.3.4.2. Sales Area/Geographical Presence

17.3.4.3. Financial/Revenue

17.3.4.4. Strategy & Business Overview

17.3.4.5. Sales Channel Analysis

17.3.4.6. Size Portfolio

17.3.5. Oliver Machinery Company

17.3.5.1. Company Overview

17.3.5.2. Sales Area/Geographical Presence

17.3.5.3. Financial/Revenue

17.3.5.4. Strategy & Business Overview

17.3.5.5. Sales Channel Analysis

17.3.5.6. Size Portfolio

17.3.6. Otto Martin Maschinenbau GmbH & Co. KG

17.3.6.1. Company Overview

17.3.6.2. Sales Area/Geographical Presence

17.3.6.3. Financial/Revenue

17.3.6.4. Strategy & Business Overview

17.3.6.5. Sales Channel Analysis

17.3.6.6. Size Portfolio

17.3.7. Paolino Bacci

17.3.7.1. Company Overview

17.3.7.2. Sales Area/Geographical Presence

17.3.7.3. Financial/Revenue

17.3.7.4. Strategy & Business Overview

17.3.7.5. Sales Channel Analysis

17.3.7.6. Size Portfolio

17.3.8. Robland

17.3.8.1. Company Overview

17.3.8.2. Sales Area/Geographical Presence

17.3.8.3. Financial/Revenue

17.3.8.4. Strategy & Business Overview

17.3.8.5. Sales Channel Analysis

17.3.8.6. Size Portfolio

17.3.9. Rojek

17.3.9.1. Company Overview

17.3.9.2. Sales Area/Geographical Presence

17.3.9.3. Financial/Revenue

17.3.9.4. Strategy & Business Overview

17.3.9.5. Sales Channel Analysis

17.3.9.6. Size Portfolio

17.3.10. SCM Group

17.3.10.1. Company Overview

17.3.10.2. Sales Area/Geographical Presence

17.3.10.3. Financial/Revenue

17.3.10.4. Strategy & Business Overview

17.3.10.5. Sales Channel Analysis

17.3.10.6. Size Portfolio

17.3.11. Other Key Players

17.3.11.1. Company Overview

17.3.11.2. Sales Area/Geographical Presence

17.3.11.3. Financial/Revenue

17.3.11.4. Strategy & Business Overview

17.3.11.5. Sales Channel Analysis

17.3.11.6. Size Portfolio

18. Go to Market Strategy

18.1. Identification of Potential Market Spaces

18.2. Understanding the Buying Process of Customers

18.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Woodworking Machines Market Value, US$ Bn, by Product Type, 2017-2031

Table 2: Global Woodworking Machines Market Volume, Thousand Units, by Product Type, 2017-2031

Table 3: Global Woodworking Machines Market Value, US$ Bn, by Operation Type, 2017-2031

Table 4: Global Woodworking Machines Market Volume, Thousand Units, by Operation Type, 2017-2031

Table 5: Global Woodworking Machines Market Value, US$ Bn, by Material, 2017-2031

Table 6: Global Woodworking Machines Market Volume, Thousand Units, by Material, 2017-2031

Table 7: Global Woodworking Machines Market Value, US$ Bn, by End-use, 2017-2031

Table 8: Global Woodworking Machines Market Volume, Thousand Units, by End-use, 2017-2031

Table 9: Global Woodworking Machines Market Value, US$ Bn, by Distribution Channel, 2017-2031

Table 10: Global Woodworking Machines Market Volume, Thousand Units, by Distribution Channel, 2017-2031

Table 11: Global Woodworking Machines Market Value, US$ Bn, by Region, 2017-2031

Table 12: Global Woodworking Machines Market Volume, Thousand Units, by Region, 2017-2031

Table 13: North America Woodworking Machines Market Value, US$ Bn, by Product Type, 2017-2031

Table 14: North America Woodworking Machines Market Volume, Thousand Units, by Product Type, 2017-2031

Table 15: North America Woodworking Machines Market Value, US$ Bn, by Operation Type, 2017-2031

Table 16: North America Woodworking Machines Market Volume, Thousand Units, by Operation Type, 2017-2031

Table 17: North America Woodworking Machines Market Value, US$ Bn, by Material, 2017-2031

Table 18: North America Woodworking Machines Market Volume, Thousand Units, by Material, 2017-2031

Table 19: North America Woodworking Machines Market Value, US$ Bn, by End-use, 2017-2031

Table 20: North America Woodworking Machines Market Volume, Thousand Units, by End-use, 2017-2031

Table 21: North America Woodworking Machines Market Value, US$ Bn, by Distribution Channel, 2017-2031

Table 22: North America Woodworking Machines Market Volume, Thousand Units, by Distribution Channel, 2017-2031

Table 23: North America Woodworking Machines Market Value, US$ Bn, by Country/Sub-Region, 2017-2031

Table 24: North America Woodworking Machines Market Volume, Thousand Units, by Country/Sub-Region, 2017-2031

Table 25: Europe Woodworking Machines Market Value, US$ Bn, by Product Type, 2017-2031

Table 26: Europe Woodworking Machines Market Volume, Thousand Units, by Product Type, 2017-2031

Table 27: Europe Woodworking Machines Market Value, US$ Bn, by Operation Type, 2017-2031

Table 28: Europe Woodworking Machines Market Volume, Thousand Units, by Operation Type, 2017-2031

Table 29: Europe Woodworking Machines Market Value, US$ Bn, by Material, 2017-2031

Table 30: Europe Woodworking Machines Market Volume, Thousand Units, by Material, 2017-2031

Table 31: Europe Woodworking Machines Market Value, US$ Bn, by End-use, 2017-2031

Table 32: Europe Woodworking Machines Market Volume, Thousand Units, by End-use, 2017-2031

Table 33: Europe Woodworking Machines Market Value, US$ Bn, by Distribution Channel, 2017-2031

Table 34: Europe Woodworking Machines Market Volume, Thousand Units, by Distribution Channel, 2017-2031

Table 35: Europe Woodworking Machines Market Value, US$ Bn, by Country/Sub-Region, 2017-2031

Table 36: Europe Woodworking Machines Market Volume, Thousand Units, by Country/Sub-Region, 2017-2031

Table 37: Asia Pacific Woodworking Machines Market Value, US$ Bn, by Product Type, 2017-2031

Table 38: Asia Pacific Woodworking Machines Market Volume, Thousand Units, by Product Type, 2017-2031

Table 39: Asia Pacific Woodworking Machines Market Value, US$ Bn, by Operation Type, 2017-2031

Table 40: Asia Pacific Woodworking Machines Market Volume, Thousand Units, by Operation Type, 2017-2031

Table 41: Asia Pacific Woodworking Machines Market Value, US$ Bn, by Material, 2017-2031

Table 42: Asia Pacific Woodworking Machines Market Volume, Thousand Units, by Material, 2017-2031

Table 43: Asia Pacific Woodworking Machines Market Value, US$ Bn, by End-use, 2017-2031

Table 44: Asia Pacific Woodworking Machines Market Volume, Thousand Units, by End-use, 2017-2031

Table 45: Asia Pacific Woodworking Machines Market Value, US$ Bn, by Distribution Channel, 2017-2031

Table 46: Asia Pacific Woodworking Machines Market Volume, Thousand Units, by Distribution Channel, 2017-2031

Table 47: Asia Pacific Woodworking Machines Market Value, US$ Bn, by Country/Sub-Region, 2017-2031

Table 48: Asia Pacific Woodworking Machines Market Volume, Thousand Units, by Country/Sub-Region, 2017-2031

Table 49: Middle East & Africa Woodworking Machines Market Value, US$ Bn, by Product Type, 2017-2031

Table 50: Middle East & Africa Woodworking Machines Market Volume, Thousand Units, by Product Type, 2017-2031

Table 51: Middle East & Africa Woodworking Machines Market Value, US$ Bn, by Operation Type, 2017-2031

Table 52: Middle East & Africa Woodworking Machines Market Volume, Thousand Units, by Operation Type, 2017-2031

Table 53: Middle East & Africa Woodworking Machines Market Value, US$ Bn, by Material, 2017-2031

Table 54: Middle East & Africa Woodworking Machines Market Volume, Thousand Units, by Material, 2017-2031

Table 55: Middle East & Africa Woodworking Machines Market Value, US$ Bn, by End-use, 2017-2031

Table 56: Middle East & Africa Woodworking Machines Market Volume, Thousand Units, by End-use, 2017-2031

Table 57: Middle East & Africa Woodworking Machines Market Value, US$ Bn, by Distribution Channel, 2017-2031

Table 58: Middle East & Africa Woodworking Machines Market Volume, Thousand Units, by Distribution Channel, 2017-2031

Table 59: Middle East & Africa Woodworking Machines Market Value, US$ Bn, by Country/Sub-Region, 2017-2031

Table 60: Middle East & Africa Woodworking Machines Market Volume, Thousand Units, by Country/Sub-Region, 2017-2031

Table 61: South America Woodworking Machines Market Value, US$ Bn, by Product Type, 2017-2031

Table 62: South America Woodworking Machines Market Volume, Thousand Units, by Product Type, 2017-2031

Table 63: South America Woodworking Machines Market Value, US$ Bn, by Operation Type, 2017-2031

Table 64: South America Woodworking Machines Market Volume, Thousand Units, by Operation Type, 2017-2031

Table 65: South America Woodworking Machines Market Value, US$ Bn, by Material, 2017-2031

Table 66: South America Woodworking Machines Market Volume, Thousand Units, by Material, 2017-2031

Table 67: South America Woodworking Machines Market Value, US$ Bn, by End-use, 2017-2031

Table 68: South America Woodworking Machines Market Volume, Thousand Units, by End-use, 2017-2031

Table 69: South America Woodworking Machines Market Value, US$ Bn, by Distribution Channel, 2017-2031

Table 70: South America Woodworking Machines Market Volume, Thousand Units, by Distribution Channel, 2017-2031

Table 71: South America Woodworking Machines Market Value, US$ Bn, by Country/Sub-Region, 2017-2031

Table 72: South America Woodworking Machines Market Volume, Thousand Units, by Country/Sub-Region, 2017-2031

List of Figures

Figure 1: Global Woodworking Machines Market Value, US$ Bn, by Product Type, 2017-2031

Figure 2: Global Woodworking Machines Market Volume, Thousand Units, by Product Type, 2017-2031

Figure 3: Global Woodworking Machines Market Incremental Opportunity, by Product Type, 2021-2031

Figure 4: Global Woodworking Machines Market Value, US$ Bn, by Operation Type, 2017-2031

Figure 5: Global Woodworking Machines Market Volume, Thousand Units, by Operation Type, 2017-2031

Figure 6: Global Woodworking Machines Market Incremental Opportunity, by Operation Type, 2021-2031

Figure 7: Global Woodworking Machines Market Value, US$ Bn, by Material, 2017-2031

Figure 8: Global Woodworking Machines Market Volume, Thousand Units, by Material, 2017-2031

Figure 9: Global Woodworking Machines Market Incremental Opportunity, by Material, 2021-2031

Figure 10: Global Woodworking Machines Market Value, US$ Bn, by End-use, 2017-2031

Figure 11: Global Woodworking Machines Market Volume, Thousand Units, by End-use, 2017-2031

Figure 12: Global Woodworking Machines Market Incremental Opportunity, by End-use, 2021-2031

Figure 13: Global Woodworking Machines Market Value, US$ Bn, by Distribution Channel, 2017-2031

Figure 14: Global Woodworking Machines Market Volume, Thousand Units, by Distribution Channel, 2017-2031

Figure 15: Global Woodworking Machines Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 16: Global Woodworking Machines Market Value, US$ Bn, by Region, 2017-2031

Figure 17: Global Woodworking Machines Market Volume, Thousand Units, by Region, 2017-2031

Figure 18: Global Woodworking Machines Market Incremental Opportunity, by Region, 2021-2031

Figure 19: North America Woodworking Machines Market Value, US$ Bn, by Product Type, 2017-2031

Figure 20: North America Woodworking Machines Market Volume, Thousand Units, by Product Type, 2017-2031

Figure 21: North America Woodworking Machines Market Incremental Opportunity, by Product Type, 2021-2031

Figure 22: North America Woodworking Machines Market Value, US$ Bn, by Operation Type, 2017-2031

Figure 23: North America Woodworking Machines Market Volume, Thousand Units, by Operation Type, 2017-2031

Figure 24: North America Woodworking Machines Market Incremental Opportunity, by Operation Type, 2021-2031

Figure 25: North America Woodworking Machines Market Value, US$ Bn, by Material, 2017-2031

Figure 26: North America Woodworking Machines Market Volume, Thousand Units, by Material, 2017-2031

Figure 27: North America Woodworking Machines Market Incremental Opportunity, by Material, 2021-2031

Figure 28: North America Woodworking Machines Market Value, US$ Bn, by End-use, 2017-2031

Figure 29: North America Woodworking Machines Market Volume, Thousand Units, by End-use, 2017-2031

Figure 30: North America Woodworking Machines Market Incremental Opportunity, by End-use, 2021-2031

Figure 31: North America Woodworking Machines Market Value, US$ Bn, by Distribution Channel, 2017-2031

Figure 32: North America Woodworking Machines Market Volume, Thousand Units, by Distribution Channel, 2017-2031

Figure 33: North America Woodworking Machines Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 34: North America Woodworking Machines Market Value, US$ Bn, by Country/Sub-Region, 2017-2031

Figure 35: North America Woodworking Machines Market Volume, Thousand Units, by Country/Sub-Region, 2017-2031

Figure 36: North America Woodworking Machines Market Incremental Opportunity, by Country/Sub-Region, 2021-2031

Figure 37: Europe Woodworking Machines Market Value, US$ Bn, by Product Type, 2017-2031

Figure 38: Europe Woodworking Machines Market Volume, Thousand Units, by Product Type, 2017-2031

Figure 39: Europe Woodworking Machines Market Incremental Opportunity, by Product Type, 2021-2031

Figure 40: Europe Woodworking Machines Market Value, US$ Bn, by Operation Type, 2017-2031

Figure 41: Europe Woodworking Machines Market Volume, Thousand Units, by Operation Type, 2017-2031

Figure 42: Europe Woodworking Machines Market Incremental Opportunity, by Operation Type, 2021-2031

Figure 43: Europe Woodworking Machines Market Value, US$ Bn, by Material, 2017-2031

Figure 44: Europe Woodworking Machines Market Volume, Thousand Units, by Material, 2017-2031

Figure 45: Europe Woodworking Machines Market Incremental Opportunity, by Material, 2021-2031

Figure 46: Europe Woodworking Machines Market Value, US$ Bn, by End-use, 2017-2031

Figure 47: Europe Woodworking Machines Market Volume, Thousand Units, by End-use, 2017-2031

Figure 48: Europe Woodworking Machines Market Incremental Opportunity, by End-use, 2021-2031

Figure 49: Europe Woodworking Machines Market Value, US$ Bn, by Distribution Channel, 2017-2031

Figure 50: Europe Woodworking Machines Market Volume, Thousand Units, by Distribution Channel, 2017-2031

Figure 51: Europe Woodworking Machines Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 52: Europe Woodworking Machines Market Value, US$ Bn, by Country/Sub-Region, 2017-2031

Figure 53: Europe Woodworking Machines Market Volume, Thousand Units, by Country/Sub-Region, 2017-2031

Figure 54: Europe Woodworking Machines Market Incremental Opportunity, by Country/Sub-Region, 2021-2031

Figure 55: Asia Pacific Woodworking Machines Market Value, US$ Bn, by Product Type, 2017-2031

Figure 56: Asia Pacific Woodworking Machines Market Volume, Thousand Units, by Product Type, 2017-2031

Figure 57: Asia Pacific Woodworking Machines Market Incremental Opportunity, by Product Type, 2021-2031

Figure 58: Asia Pacific Woodworking Machines Market Value, US$ Bn, by Operation Type, 2017-2031

Figure 59: Asia Pacific Woodworking Machines Market Volume, Thousand Units, by Operation Type, 2017-2031

Figure 60: Asia Pacific Woodworking Machines Market Incremental Opportunity, by Operation Type, 2021-2031

Figure 61: Asia Pacific Woodworking Machines Market Value, US$ Bn, by Material, 2017-2031

Figure 62: Asia Pacific Woodworking Machines Market Volume, Thousand Units, by Material, 2017-2031

Figure 63: Asia Pacific Woodworking Machines Market Incremental Opportunity, by Material, 2021-2031

Figure 64: Asia Pacific Woodworking Machines Market Value, US$ Bn, by End-use, 2017-2031

Figure 65: Asia Pacific Woodworking Machines Market Volume, Thousand Units, by End-use, 2017-2031

Figure 66: Asia Pacific Woodworking Machines Market Incremental Opportunity, by End-use, 2021-2031

Figure 67: Asia Pacific Woodworking Machines Market Value, US$ Bn, by Distribution Channel, 2017-2031

Figure 68: Asia Pacific Woodworking Machines Market Volume, Thousand Units, by Distribution Channel, 2017-2031

Figure 69: Asia Pacific Woodworking Machines Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 70: Asia Pacific Woodworking Machines Market Value, US$ Bn, by Country/Sub-Region, 2017-2031

Figure 71: Asia Pacific Woodworking Machines Market Volume, Thousand Units, by Country/Sub-Region, 2017-2031

Figure 72: Asia Pacific Woodworking Machines Market Incremental Opportunity, by Country/Sub-Region, 2021-2031

Figure 73: Middle East & Africa Woodworking Machines Market Value, US$ Bn, by Product Type, 2017-2031

Figure 74: Middle East & Africa Woodworking Machines Market Volume, Thousand Units, by Product Type, 2017-2031

Figure 75: Middle East & Africa Woodworking Machines Market Incremental Opportunity, by Product Type, 2021-2031

Figure 76: Middle East & Africa Woodworking Machines Market Value, US$ Bn, by Operation Type, 2017-2031

Figure 77: Middle East & Africa Woodworking Machines Market Volume, Thousand Units, by Operation Type, 2017-2031

Figure 78: Middle East & Africa Woodworking Machines Market Incremental Opportunity, by Operation Type, 2021-2031

Figure 79: Middle East & Africa Woodworking Machines Market Value, US$ Bn, by Material, 2017-2031

Figure 80: Middle East & Africa Woodworking Machines Market Volume, Thousand Units, by Material, 2017-2031

Figure 81: Middle East & Africa Woodworking Machines Market Incremental Opportunity, by Material, 2021-2031

Figure 82: Middle East & Africa Woodworking Machines Market Value, US$ Bn, by End-use, 2017-2031

Figure 83: Middle East & Africa Woodworking Machines Market Volume, Thousand Units, by End-use, 2017-2031

Figure 84: Middle East & Africa Woodworking Machines Market Incremental Opportunity, by End-use, 2021-2031

Figure 85: Middle East & Africa Woodworking Machines Market Value, US$ Bn, by Distribution Channel, 2017-2031

Figure 86: Middle East & Africa Woodworking Machines Market Volume, Thousand Units, by Distribution Channel, 2017-2031

Figure 87: Middle East & Africa Woodworking Machines Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 88: Middle East & Africa Woodworking Machines Market Value, US$ Bn, by Country/Sub-Region, 2017-2031

Figure 89: Middle East & Africa Woodworking Machines Market Volume, Thousand Units, by Country/Sub-Region, 2017-2031

Figure 90: Middle East & Africa Woodworking Machines Market Incremental Opportunity, by Country/Sub-Region, 2021-2031

Figure 91: South America Woodworking Machines Market Value, US$ Bn, by Product Type, 2017-2031

Figure 92: South America Woodworking Machines Market Volume, Thousand Units, by Product Type, 2017-2031

Figure 93: South America Woodworking Machines Market Incremental Opportunity, by Product Type, 2021-2031

Figure 94: South America Woodworking Machines Market Value, US$ Bn, by Operation Type, 2017-2031

Figure 95: South America Woodworking Machines Market Volume, Thousand Units, by Operation Type, 2017-2031

Figure 96: South America Woodworking Machines Market Incremental Opportunity, by Operation Type, 2021-2031

Figure 97: South America Woodworking Machines Market Value, US$ Bn, by Material, 2017-2031

Figure 98: South America Woodworking Machines Market Volume, Thousand Units, by Material, 2017-2031

Figure 99: South America Woodworking Machines Market Incremental Opportunity, by Material, 2021-2031

Figure 100: South America Woodworking Machines Market Value, US$ Bn, by End-use, 2017-2031

Figure 101: South America Woodworking Machines Market Volume, Thousand Units, by End-use, 2017-2031

Figure 102: South America Woodworking Machines Market Incremental Opportunity, by End-use, 2021-2031

Figure 103: South America Woodworking Machines Market Value, US$ Bn, by Distribution Channel, 2017-2031

Figure 104: South America Woodworking Machines Market Volume, Thousand Units, by Distribution Channel, 2017-2031

Figure 105: South America Woodworking Machines Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 106: South America Woodworking Machines Market Value, US$ Bn, by Country/Sub-Region, 2017-2031

Figure 107: South America Woodworking Machines Market Volume, Thousand Units, by Country/Sub-Region, 2017-2031

Figure 108: South America Woodworking Machines Market Incremental Opportunity, by Country/Sub-Region, 2021-2031