Analysts’ Viewpoint

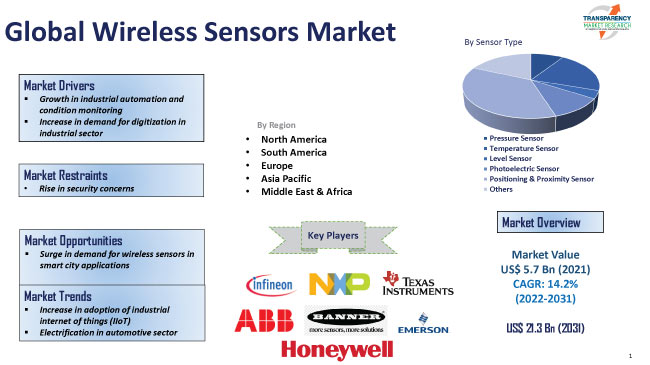

Increase in adoption of wireless technology in various end-use industries such as consumer electronics, healthcare, and automotive & transportation is driving the wireless sensors market share. Growth in demand for digitization in the industrial sector is further contributing to market development.

Demand for IoT devices with wireless sensors is rising in residential, industrial, and commercial applications. Increase in smart city projects, electrification of automobiles, rise in adoption of Industrial internet of Things (IIoT), and rapid penetration of Industry 4.0 are other key factors of market expansion. Leading manufacturers are following the wireless sensors industry trends to gain lucrative growth opportunities.

Wireless sensors are measurement devices used to observe and monitor the state of the environment. Wireless sensing solutions can give access to sensor data as well as useful information that can be utilized for predictive maintenance, energy conservation, and boosting productivity.

Temperature sensors, pressure sensors, vibration sensors, and level sensors are the key sensors used in industrial applications. Wireless sensors are extensively adopted in smart home applications such as intelligent home appliances, home automation systems, metering, and security and surveillance systems.

Connected sensing or monitoring of tools in a wireless network is more cost-effective than that in wired technologies. Infrastructure required for a wireless system is minimal. Furthermore, wireless system is easier to implement than wired system.

Advancement of technology has led to the introduction of many new types of sensors that help meet the needs of various industries and applications. Demand for wireless sensors is driven by the need for cost-effective and efficient solutions for data collection and analysis in various industries.

According to the wireless sensors market analysis, the global business is likely to grow at a promising pace during the forecast period, owing to the rise in application of wireless sensors in consumer electronics, automotive, energy & utility, and healthcare industries.

Internet of Things (IoT) refers to technologies that link various devices, such as industrial and consumer electronics, to the internet. On the other hand, Industrial Internet of Things (IIoT) refers to industrial applications. Increase in adoption of handheld portable devices is boosting the wireless sensors market demand.

The number of IoT connections is increasing at a significant pace across the globe. IoT technology is being used in various end-use industries such as consumer electronics, automotive & transportation, aerospace & defense, and healthcare. Thus, growth in penetration of IoT in various industries is augmenting market statistics.

Wireless technology can be widely used in industrial automation systems for higher productivity and better asset management. Wireless sensors are used to provide flexibility, safety, monitoring, and control in industrial environment. They offer benefits such as low cost, easy maintenance, easy installation, and convenience. Wireless sensors are used in SCADA systems, i.e. supervisory control and data acquisition, to efficiently address the requirements of various industrial applications.

Wireless sensors can monitor pressure and temperature parameters in critical process applications. As automated equipment becomes more complicated, the demand for monitoring their condition grows. This is anticipated to positively impact the global wireless sensors market value in the near future.

Wireless sensors collect data related to air and water quality, traffic congestion, energy consumption, and weather conditions in smart city applications. This data is then analyzed to help city officials make informed decisions about how to improve the efficiency and livability of the city.

Wireless sensors use various wireless communication technologies such as Wi-Fi, Zigbee, and cellular networks to transmit data to a central location where it can be analyzed and used to improve city services and infrastructure.

Environmental monitoring, traffic management, energy management, public safety, public services, intelligent transportation, smart lighting, and smart waste management are some of the prominent smart city applications of wireless sensors.

In Asia Pacific, smart cities have been using technologies such as IoT, big data, and AI to improve the efficiency of transportation, energy, and public safety operations. For Instance, smart street lighting is a technology that uses sensors, wireless communication, and advanced control systems to optimize the performance of street lights. It can improve energy efficiency, reduce costs, and enhance public safety.

Smart street lighting systems are being implemented in several cities in India. In 2016, Jaipur, a city in India, installed a smart street lighting system in partnership with Philips Lighting. The smart street lighting system uses LED lights and wireless controls to reduce energy consumption by 60%. The system also includes a remote monitoring system that allows city officials to monitor and control lights in real-time, and a citizen engagement app that allows residents to report faulty street lights.

According to the global wireless sensors market forecast report, Asia Pacific is expected to dominate the global business during the forecast period, owing to the high demand for wireless sensors in automotive, industrial, and consumer electronics industries, particularly in countries such as China, India, and Japan. Rapid growth in industrialization and increase in investment in smart city projects are also contributing to wireless sensors market growth in the region.

North America wireless sensors market size is anticipated to increase during the forecast period, owing to the growth in penetration of IoT and Industry 4.0. Wireless sensors are increasingly used in healthcare, industrial, and automotive industries in the region.

The global wireless sensors market is fragmented, with large numbers of big players controlling majority of the share. Leading companies are focusing on providing application-specific solutions to their customers. These organizations are following strategies such as expansion of product portfolios and mergers and acquisitions to expand their businesses.

Key players operating in the global market are ABB Ltd, Ambient Micro, Banner Engineering Corp., CAREL INDUSTRIES S.p.A., E+E Elektronik Ges.m.b.H., Emerson Electric Co., Honeywell International Inc., Monnit Corporation, OMEGA Engineering Inc., TE Connectivity, Texas Instruments Incorporated, Siemens AG, NXP Semiconductors, Omron Corporation, STMicroelectronics, and Murata.

Key players have been profiled in the wireless sensors market report based on parameters such as company overview, product portfolio, business segments, financial overview, recent developments, and business strategies.

| Attribute | Detail |

|---|---|

| Market Size Value in 2021 | US$ 5.7 Bn |

| Market Forecast Value in 2031 | US$ 21.3 Bn |

| Growth Rate (CAGR) | 14.2% |

| Forecast Period | 2022-2031 |

| Historical Data Available for | 2017-2020 |

| Quantitative Units | US$ Bn for Value and Million Units for Volume |

| Market Analysis | It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 5.7 Bn in 2021.

It is expected to advance at a CAGR of 14.2% by 2031.

It would be worth US$ 21.3 Bn in 2031.

ABB Ltd, Ambient Micro, Banner Engineering Corp., CAREL INDUSTRIES S.p.A., E+E Elektronik Ges.m.b.H., Emerson Electric Co., Honeywell International Inc., Monnit Corporation, OMEGA Engineering Inc., TE Connectivity, and Texas Instruments Incorporated.

It accounted for approximately 30.5% share in 2021.

Increase in demand for wireless sensors in smart city applications.

Asia Pacific is a more lucrative region for vendors.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Wireless Sensors Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Sensors Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Global Wireless Sensors Market Analysis By Sensor Type

5.1. Wireless Sensors Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Sensor Type, 2017-2031

5.1.1. Pressure Sensor

5.1.2. Temperature Sensor

5.1.3. Level Sensor

5.1.4. Photoelectric Sensor

5.1.5. Positioning & Proximity Sensor

5.1.6. Gas Sensor

5.1.7. Environmental sensor

5.1.8. Others

5.2. Market Attractiveness Analysis, By Sensor Type

6. Global Wireless Sensors Market Analysis By Application

6.1. Wireless Sensors Market Value (US$ Mn) Analysis & Forecast, By Application, 2017-2031

6.1.1. Industrial Monitoring

6.1.2. Water Quality Monitoring

6.1.3. Health Monitoring

6.1.4. Area Monitoring

6.1.5. Air Pollution Monitoring

6.1.6. Security & Surveillance

6.1.7. Others

6.2. Market Attractiveness Analysis, By Application

7. Global Wireless Sensors Market Analysis By End-user

7.1. Wireless Sensors Market Value (US$ Mn) Analysis & Forecast, By End-user, 2017-2031

7.1.1. Consumer Electronics

7.1.2. Automotive & Transportation

7.1.3. Aerospace & Defense

7.1.4. IT & Telecommunication

7.1.5. Industrial

7.1.6. Energy & Utility

7.1.7. Healthcare

7.1.8. Others

7.2. Market Attractiveness Analysis, By End-user

8. Global Wireless Sensors Market Analysis and Forecast, By Region

8.1. Wireless Sensors Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Region, 2017-2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, By Region

9. North America Wireless Sensors Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Wireless Sensors Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Sensor Type, 2017-2031

9.3.1. Pressure Sensor

9.3.2. Temperature Sensor

9.3.3. Level Sensor

9.3.4. Photoelectric Sensor

9.3.5. Positioning & Proximity Sensor

9.3.6. Gas Sensor

9.3.7. Environmental sensor

9.3.8. Others

9.4. Wireless Sensors Market Value (US$ Mn) Analysis & Forecast, By Application, 2017-2031

9.4.1. Industrial Monitoring

9.4.2. Water Quality Monitoring

9.4.3. Health Monitoring

9.4.4. Area Monitoring

9.4.5. Air Pollution Monitoring

9.4.6. Security & Surveillance

9.4.7. Others

9.5. Wireless Sensors Market Value (US$ Mn) Analysis & Forecast, By End-user, 2017-2031

9.5.1. Consumer Electronics

9.5.2. Automotive & Transportation

9.5.3. Aerospace & Defense

9.5.4. IT & Telecommunication

9.5.5. Industrial

9.5.6. Energy & Utility

9.5.7. Healthcare

9.5.8. Others

9.6. Wireless Sensors Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

9.6.1. The U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By Sensor Type

9.7.2. By Application

9.7.3. By End-user

9.7.4. By Country/Sub-region

10. Europe Wireless Sensors Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Wireless Sensors Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Sensor Type, 2017-2031

10.3.1. Pressure Sensor

10.3.2. Temperature Sensor

10.3.3. Level Sensor

10.3.4. Photoelectric Sensor

10.3.5. Positioning & Proximity Sensor

10.3.6. Gas Sensor

10.3.7. Environmental sensor

10.3.8. Others

10.4. Wireless Sensors Market Value (US$ Mn) Analysis & Forecast, By Application, 2017-2031

10.4.1. Industrial Monitoring

10.4.2. Water Quality Monitoring

10.4.3. Health Monitoring

10.4.4. Area Monitoring

10.4.5. Air Pollution Monitoring

10.4.6. Security & Surveillance

10.4.7. Others

10.5. Wireless Sensors Market Value (US$ Mn) Analysis & Forecast, By End-user, 2017-2031

10.5.1. Consumer Electronics

10.5.2. Automotive & Transportation

10.5.3. Aerospace & Defense

10.5.4. IT & Telecommunication

10.5.5. Industrial

10.5.6. Energy & Utility

10.5.7. Healthcare

10.5.8. Others

10.6. Wireless Sensors Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

10.6.1. The U.K.

10.6.2. Germany

10.6.3. France

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Sensor Type

10.7.2. By Application

10.7.3. By End-user

10.7.4. By Country/Sub-region

11. Asia Pacific Wireless Sensors Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Wireless Sensors Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Sensor Type, 2017-2031

11.3.1. Pressure Sensor

11.3.2. Temperature Sensor

11.3.3. Level Sensor

11.3.4. Photoelectric Sensor

11.3.5. Positioning & Proximity Sensor

11.3.6. Gas Sensor

11.3.7. Environmental sensor

11.3.8. Others

11.4. Wireless Sensors Market Value (US$ Mn) Analysis & Forecast, By Application, 2017-2031

11.4.1. Industrial Monitoring

11.4.2. Water Quality Monitoring

11.4.3. Health Monitoring

11.4.4. Area Monitoring

11.4.5. Air Pollution Monitoring

11.4.6. Security & Surveillance

11.4.7. Others

11.5. Wireless Sensors Market Value (US$ Mn) Analysis & Forecast, By End-user, 2017-2031

11.5.1. Consumer Electronics

11.5.2. Automotive & Transportation

11.5.3. Aerospace & Defense

11.5.4. IT & Telecommunication

11.5.5. Industrial

11.5.6. Energy & Utility

11.5.7. Healthcare

11.5.8. Others

11.6. Wireless Sensors Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

11.6.1. China

11.6.2. India

11.6.3. Japan

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Sensor Type

11.7.2. By Application

11.7.3. By End-user

11.7.4. By Country/Sub-region

12. Middle East & Africa Wireless Sensors Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Wireless Sensors Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Sensor Type, 2017-2031

12.3.1. Pressure Sensor

12.3.2. Temperature Sensor

12.3.3. Level Sensor

12.3.4. Photoelectric Sensor

12.3.5. Positioning & Proximity Sensor

12.3.6. Gas Sensor

12.3.7. Environmental sensor

12.3.8. Others

12.4. Wireless Sensors Market Value (US$ Mn) Analysis & Forecast, By Application, 2017-2031

12.4.1. Industrial Monitoring

12.4.2. Water Quality Monitoring

12.4.3. Health Monitoring

12.4.4. Area Monitoring

12.4.5. Air Pollution Monitoring

12.4.6. Security & Surveillance

12.4.7. Others

12.5. Wireless Sensors Market Value (US$ Mn) Analysis & Forecast, By End-user, 2017-2031

12.5.1. Consumer Electronics

12.5.2. Automotive & Transportation

12.5.3. Aerospace & Defense

12.5.4. IT & Telecommunication

12.5.5. Industrial

12.5.6. Energy & Utility

12.5.7. Healthcare

12.5.8. Others

12.6. Wireless Sensors Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of the Middle East & Africa

12.7. Market Attractiveness Analysis

12.7.1. By Sensor Type

12.7.2. By Application

12.7.3. By End-user

12.7.4. By Country/Sub-region

13. South America Wireless Sensors Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Wireless Sensors Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Sensor Type, 2017-2031

13.3.1. Pressure Sensor

13.3.2. Temperature Sensor

13.3.3. Level Sensor

13.3.4. Photoelectric Sensor

13.3.5. Positioning & Proximity Sensor

13.3.6. Gas Sensor

13.3.7. Environmental sensor

13.3.8. Others

13.4. Wireless Sensors Market Value (US$ Mn) Analysis & Forecast, By Application, 2017-2031

13.4.1. Industrial Monitoring

13.4.2. Water Quality Monitoring

13.4.3. Health Monitoring

13.4.4. Area Monitoring

13.4.5. Air Pollution Monitoring

13.4.6. Security & Surveillance

13.4.7. Others

13.5. Wireless Sensors Market Value (US$ Mn) Analysis & Forecast, By End-user, 2017-2031

13.5.1. Consumer Electronics

13.5.2. Automotive & Transportation

13.5.3. Aerospace & Defense

13.5.4. IT & Telecommunication

13.5.5. Industrial

13.5.6. Energy & Utility

13.5.7. Healthcare

13.5.8. Others

13.6. Wireless Sensors Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Sensor Type

13.7.2. By Application

13.7.3. By End-user

13.7.4. By Country/Sub-region

14. Competition Assessment

14.1. Global Wireless Sensors Market Competition Matrix - a Dashboard View

14.1.1. Global Wireless Sensors Market Company Share Analysis, by Value (2021)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. ABB Ltd

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Ambient Micro

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. Banner Engineering Corp.

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. CAREL INDUSTRIES S.p.A.

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. E+E Elektronik Ges.m.b.H.

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Emerson Electric Co.

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. Honeywell International Inc

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Monnit Corporation

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. OMEGA Engineering Inc.

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. TE Connectivity

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. Texas Instruments Incorporated

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

16. Recommendation

16.1. Opportunity Assessment

16.1.1. By Sensor Type

16.1.2. By Application

16.1.3. By End-user

16.1.4. By Region

List of Tables

Table 1: Global Wireless Sensors Market Value (US$ Mn) & Forecast, By Sensor Type, 2017-2031

Table 2: Global Wireless Sensors Market Volume (Million Units) & Forecast, By Sensor Type, 2017-2031

Table 3: Global Wireless Sensors Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 4: Global Wireless Sensors Market Value (US$ Mn) & Forecast, by End-user, 2017-2031

Table 5: Global Wireless Sensors Market Value (US$ Mn) & Forecast, by Region, 2017-2031

Table 6: Global Wireless Sensors Market Volume (Million Units) & Forecast, by Region, 2017-2031

Table 7: North America Wireless Sensors Market Value (US$ Mn) & Forecast, By Sensor Type, 2017-2031

Table 8: North America Wireless Sensors Market Volume (Million Units) & Forecast, By Sensor Type, 2017-2031

Table 9: North America Wireless Sensors Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 10: North America Wireless Sensors Market Value (US$ Mn) & Forecast, by End-user, 2017-2031

Table 11: North America Wireless Sensors Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017-2031

Table 12: North America Wireless Sensors Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017-2031

Table 13: Europe Wireless Sensors Market Value (US$ Mn) & Forecast, By Sensor Type, 2017-2031

Table 14: Europe Wireless Sensors Market Volume (Million Units) & Forecast, By Sensor Type, 2017-2031

Table 15: Europe Wireless Sensors Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 16: Europe Wireless Sensors Market Value (US$ Mn) & Forecast, by End-user, 2017-2031

Table 17: Europe Wireless Sensors Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017-2031

Table 18: Europe Wireless Sensors Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017-2031

Table 19: Asia Pacific Wireless Sensors Market Value (US$ Mn) & Forecast, By Sensor Type, 2017-2031

Table 20: Asia Pacific Wireless Sensors Market Volume (Million Units) & Forecast, By Sensor Type, 2017-2031

Table 21: Asia Pacific Wireless Sensors Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 22: Asia Pacific Wireless Sensors Market Value (US$ Mn) & Forecast, by End-user, 2017-2031

Table 23: Asia Pacific Wireless Sensors Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017-2031

Table 24: Asia Pacific Wireless Sensors Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017-2031

Table 25: Middle East & Africa Wireless Sensors Market Value (US$ Mn) & Forecast, By Sensor Type, 2017-2031

Table 26: Middle East & Africa Wireless Sensors Market Volume (Million Units) & Forecast, By Sensor Type, 2017-2031

Table 27: Middle East & Africa Wireless Sensors Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 28: Middle East & Africa Wireless Sensors Market Value (US$ Mn) & Forecast, by End-user, 2017-2031

Table 29: Middle East & Africa Wireless Sensors Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017-2031

Table 30: South America Wireless Sensors Market Value (US$ Mn) & Forecast, By Sensor Type, 2017-2031

Table 31: South America Wireless Sensors Market Volume (Million Units) & Forecast, By Sensor Type, 2017-2031

Table 32: South America Wireless Sensors Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 33: South America Wireless Sensors Market Value (US$ Mn) & Forecast, by End-user, 2017-2031

Table 34: South America Wireless Sensors Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017-2031

Table 35: South America Wireless Sensors Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017-2031

List of Figures

Figure 01: Supply Chain Analysis - Global Wireless Sensors

Figure 02: Global Wireless Sensors Price Trend Analysis (Average Price, US$)

Figure 03: Porter Five Forces Analysis - Global Wireless Sensors

Figure 04: Technology Road Map - Global Wireless Sensors

Figure 05: Global Wireless Sensors Market, Value (US$ Mn), 2017-2031

Figure 06: Global Wireless Sensors Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 07: Global Wireless Sensors Market, Volume (Million Units), 2017-2031

Figure 08: Global Wireless Sensors Market Size & Forecast, Y-O-Y, Volume (Million Units), 2017-2031

Figure 09: Global Wireless Sensors Market Projections By Sensor Type, Value (US$ Mn), 2017-2031

Figure 10: Global Wireless Sensors Market, Incremental Opportunity, By Sensor Type, 2022-2031

Figure 11: Global Wireless Sensors Market Share Analysis, By Sensor Type, 2021 and 2031

Figure 12: Global Wireless Sensors Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 13: Global Wireless Sensors Market, Incremental Opportunity, by Application, 2022-2031

Figure 14: Global Wireless Sensors Market Share Analysis, by Application, 2021 and 2031

Figure 15: Global Wireless Sensors Market Projections by End-user, Value (US$ Mn), 2017-2031

Figure 16: Global Wireless Sensors Market, Incremental Opportunity, by End-user, 2022-2031

Figure 17: Global Wireless Sensors Market Share Analysis, by End-user, 2021 and 2031

Figure 18: Global Wireless Sensors Market Projections by Region, Value (US$ Mn), 2017-2031

Figure 19: Global Wireless Sensors Market, Incremental Opportunity, by Region, 2021‒2031

Figure 20: Global Wireless Sensors Market Share Analysis, by Region, 2021 and 2031

Figure 21: North America Wireless Sensors Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 22: North America Wireless Sensors Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 23: North America Wireless Sensors Market, Volume (Million Units), 2017-2031

Figure 24: North America Wireless Sensors Market Size & Forecast, Y-O-Y, Volume (Million Units), 2017-2031

Figure 25: North America Wireless Sensors Market Projections By Sensor Type Value (US$ Mn), 2017-2031

Figure 26: North America Wireless Sensors Market, Incremental Opportunity, By Sensor Type, 2022-2031

Figure 27: North America Wireless Sensors Market Share Analysis, By Sensor Type, 2021 and 2031

Figure 28: North America Wireless Sensors Market Projections by Application Value (US$ Mn), 2017-2031

Figure 29: North America Wireless Sensors Market, Incremental Opportunity, by Application, 2022-2031

Figure 30: North America Wireless Sensors Market Share Analysis, by Application, 2021 and 2031

Figure 31: North America Wireless Sensors Market Projections by End-user, Value (US$ Mn), 2017-2031

Figure 32: North America Wireless Sensors Market, Incremental Opportunity, by End-user, 2022-2031

Figure 33: North America Wireless Sensors Market Share Analysis, by End-user, 2021 and 2031

Figure 34: North America Wireless Sensors Market Projections by Country and sub-region, Value (US$ Mn), 2017-2031

Figure 35: North America Wireless Sensors Market, Incremental Opportunity, by Country and sub-region, 2022-2031

Figure 36: North America Wireless Sensors Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 37: Europe Wireless Sensors Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 38: Europe Wireless Sensors Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 39: Europe Wireless Sensors Market, Volume (Million Units), 2017-2031

Figure 40: Europe Wireless Sensors Market Size & Forecast, Y-O-Y, Volume (Million Units), 2017-2031

Figure 41: Europe Wireless Sensors Market Projections By Sensor Type Value (US$ Mn), 2017-2031

Figure 42: Europe Wireless Sensors Market, Incremental Opportunity, By Sensor Type, 2022-2031

Figure 43: Europe Wireless Sensors Market Share Analysis, By Sensor Type, 2021 and 2031

Figure 44: Europe Wireless Sensors Market Projections by Application Value (US$ Mn), 2017-2031

Figure 45: Europe Wireless Sensors Market, Incremental Opportunity, by Application, 2022-2031

Figure 46: Europe Wireless Sensors Market Share Analysis, by Application, 2021 and 2031

Figure 47: Europe Wireless Sensors Market Projections by End-user, Value (US$ Mn), 2017-2031

Figure 48: Europe Wireless Sensors Market, Incremental Opportunity, by End-user, 2022-2031

Figure 49: Europe Wireless Sensors Market Share Analysis, by End-user, 2021 and 2031

Figure 50: Europe Wireless Sensors Market Projections by Country and sub-region, Value (US$ Mn), 2017-2031

Figure 51: Europe Wireless Sensors Market, Incremental Opportunity, by Country and sub-region, 2022-2031

Figure 52: Europe Wireless Sensors Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 53: Asia Pacific Wireless Sensors Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 54: Asia Pacific Wireless Sensors Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 55: Asia Pacific Wireless Sensors Market, Volume (Million Units), 2017-2031

Figure 56: Asia Pacific Wireless Sensors Market Size & Forecast, Y-O-Y, Volume (Million Units), 2017-2031

Figure 57: Asia Pacific Wireless Sensors Market Projections By Sensor Type Value (US$ Mn), 2017-2031

Figure 58: Asia Pacific Wireless Sensors Market, Incremental Opportunity, By Sensor Type, 2022-2031

Figure 59: Asia Pacific Wireless Sensors Market Share Analysis, By Sensor Type, 2021 and 2031

Figure 60: Asia Pacific Wireless Sensors Market Projections by Application Value (US$ Mn), 2017-2031

Figure 61: Asia Pacific Wireless Sensors Market, Incremental Opportunity, by Application, 2022-2031

Figure 62: Asia Pacific Wireless Sensors Market Share Analysis, by Application, 2021 and 2031

Figure 63: Asia Pacific Wireless Sensors Market Projections by End-user, Value (US$ Mn), 2017-2031

Figure 64: Asia Pacific Wireless Sensors Market, Incremental Opportunity, by End-user, 2022-2031

Figure 65: Asia Pacific Wireless Sensors Market Share Analysis, by End-user, 2021 and 2031

Figure 66: Asia Pacific Wireless Sensors Market Projections by Country and sub-region, Value (US$ Mn), 2017-2031

Figure 67: Asia Pacific Wireless Sensors Market, Incremental Opportunity, by Country and sub-region, 2022-2031

Figure 68: Asia Pacific Wireless Sensors Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 69: MEA Wireless Sensors Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 70: MEA Wireless Sensors Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 71: MEA Wireless Sensors Market, Volume (Million Units), 2017-2031

Figure 72: MEA Wireless Sensors Market Size & Forecast, Y-O-Y, Volume (Million Units), 2017-2031

Figure 73: MEA Wireless Sensors Market Projections By Sensor Type Value (US$ Mn), 2017-2031

Figure 74: MEA Wireless Sensors Market, Incremental Opportunity, By Sensor Type, 2022-2031

Figure 75: MEA Wireless Sensors Market Share Analysis, By Sensor Type, 2021 and 2031

Figure 76: MEA Wireless Sensors Market Projections by Application Value (US$ Mn), 2017-2031

Figure 77: MEA Wireless Sensors Market, Incremental Opportunity, by Application, 2022-2031

Figure 78: MEA Wireless Sensors Market Share Analysis, by Application, 2021 and 2031

Figure 79: MEA Wireless Sensors Market Projections by End-user, Value (US$ Mn), 2017-2031

Figure 80: MEA Wireless Sensors Market, Incremental Opportunity, by End-user, 2022-2031

Figure 81: MEA Wireless Sensors Market Share Analysis, by End-user, 2021 and 2031

Figure 82: MEA Wireless Sensors Market Projections by Country and sub-region, Value (US$ Mn), 2017-2031

Figure 83: MEA Wireless Sensors Market, Incremental Opportunity, by Country and sub-region, 2022-2031

Figure 84: MEA Wireless Sensors Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 85: South America Wireless Sensors Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 86: South America Wireless Sensors Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 87: South America Wireless Sensors Market, Volume (Million Units), 2017-2031

Figure 88: South America Wireless Sensors Market Size & Forecast, Y-O-Y, Volume (Million Units), 2017-2031

Figure 89: South America Wireless Sensors Market Projections By Sensor Type Value (US$ Mn), 2017-2031

Figure 90: South America Wireless Sensors Market, Incremental Opportunity, By Sensor Type, 2022-2031

Figure 91: South America Wireless Sensors Market Share Analysis, By Sensor Type, 2021 and 2031

Figure 92: South America Wireless Sensors Market Projections by Application Value (US$ Mn), 2017-2031

Figure 93: South America Wireless Sensors Market, Incremental Opportunity, by Application, 2022-2031

Figure 94: South America Wireless Sensors Market Share Analysis, by Application, 2021 and 2031

Figure 95: South America Wireless Sensors Market Projections by End-user, Value (US$ Mn), 2017-2031

Figure 96: South America Wireless Sensors Market, Incremental Opportunity, by End-user, 2022-2031

Figure 97: South America Wireless Sensors Market Share Analysis, by End-user, 2021 and 2031

Figure 98: South America Wireless Sensors Market Projections by Country and sub-region, Value (US$ Mn), 2017-2031

Figure 99: South America Wireless Sensors Market, Incremental Opportunity, by Country and sub-region, 2022-2031

Figure 100: South America Wireless Sensors Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 101: Global Wireless Sensors Market Competition

Figure 102: Global Wireless Sensors Market Company Share Analysis