Analysts’ Viewpoint on Market Scenario

Wireless power technology allows for the elimination of the cord connections required to recharge portable electronic devices. This promising technology has evolved significantly over the last few decades and presently includes a plethora of user-friendly applications. Rise in demand for wireless chargers for smartphones, wearables, autonomous guided vehicles, autonomous robots as well as electric vehicles is anticipated to impact the global wireless charger market in the near future.

Wireless chargers provide better user interaction, availability, reachability, and automation, as compared to wired charging. These chargers are expected to become smaller and more portable during the forecast period, owing to the improvement in GaN materials and emergence of new circuit design. Companies operating in the market are focusing on innovation and R&D in wireless chargers by implementing strategies such as mergers & acquisitions and expansion of product portfolios to broaden their revenue streams.

The transfer of power from a power outlet to a user device without the use of a connecting cable is known as wireless charging. It consists of a power transmitting pad and a receiver, which can be in the form of a case attached to or built into a user's device. Wireless charging is gaining traction in the healthcare, automotive, and manufacturing industries because it promises increased mobility and advancements that could allow tiny internet of things (IoT) devices to get power from a charger many feet away.

The most popular wireless technologies in use currently rely on an electromagnetic field created by two copper coils, limiting the distance between a device and a charging pad to a bare minimum. Presently, a 100W charger is the size of a bar of soap. EV charging can result in a significant increase in electricity demand. The most significant impediment to faster implementation of an electrified transportation system is the lack of reachability and availability of charging infrastructure. This is projected to hamper market development during the forecast period.

Any battery-powered appliance with a wireless charger can be charged by simply putting it close to a wireless power transmitter or a designated charging station. Consequently, it is possible to make the appliance case totally sealed and even waterproof. Therefore, the market expansion has been fueled by the rapid adoption of wireless charging for smartphones, portable media players, digital cameras, tablets, and wearables. Near Field Communication (NFC) and Bluetooth can coexist alongside wireless charging, allowing access to some highly inventive solutions.

Wireless power transfer is advantageous for numerous applications, including headsets, wireless speakers, mice, and keyboards. Tablet PCs, laptops, ultrabooks, and laptops are all potential hosts or clients for wireless charging. Major players are increasing their investments in R&D to introduce cutting-edge products to gain a competitive advantage.

For instance, in August 2021, Western Digital Technologies, Inc. launched SanDisk Ixpand wireless charger Sync and SanDisk Ixpand wireless charger 15W with an adapter. These are the company’s first products in the wireless charging segment. The SanDisk Ixpand wireless charger offers dual functions such as wireless charging and automatic data storage and backup for Qi-compatible devices. The product has a local storage capacity of about 256GB.

The particular challenge is that deploying charging pads (transmitters) in public places necessitates safe and secure solutions. These public access terminal wireless chargers can be installed in a variety of coffee shops, airport kiosks, and hotels. Thus, rise in demand for wireless chargers across the consumer electronic industry is projected to fuel market expansion during the forecast period.

Mobile phones and key fobs can be charged wirelessly by simply placing them on the dashboard or the center console of the vehicle, without the need for bulky wires. Additionally, pairing NFC with wireless charging enables the user to not only charge the phone but also automatically connect it to the car's Wi-fi and Bluetooth networks without the need for any additional setup.

EVs are more environment-friendly and fuel-efficient as compared to internal combustion engines. Owning and using an electric vehicle is hassle-free; however, the process of charging one frequently causes confusion, anxiety, and irritation. Magnetic resonance technology of a wireless charger enables a driver to just park their electric vehicle (EV) over a charging pad and proceed with their day knowing that their vehicle would recharge with the same quickness and effectiveness as plugging into Level 2 equipment. This technology is estimated to help automakers and Tier 1 suppliers to set their EVs above the competition.

According to the IEA (The International Energy Agency), global sales of electric cars rising strongly in 2022, with 2 million cars sold in the first quarter. Moreover, in June 2022, Siemens invested US$ 25 million and acquires a minority stake in U.S.-based WiTricity, a wireless charging technology company. Siemens and WiTricity, together, aimed to drive innovation in the emerging market for wireless EV charging. However, the development of a wireless charging system for EVs is currently under the nascent phase and focuses on unidirectional stationary charging of EVs and Plug-In Hybrid electric vehicles (PHEV).

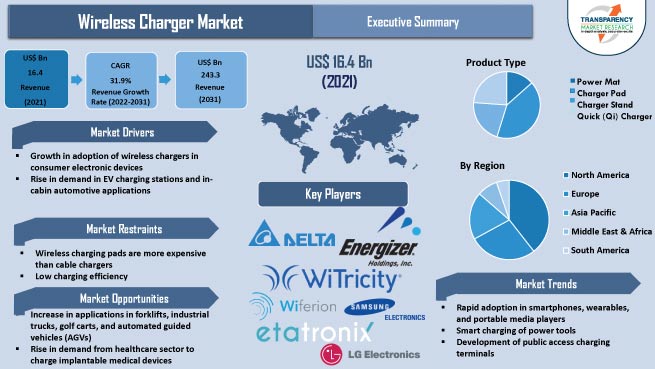

In terms of product type, the global wireless charger market segmentation comprises power mat, charger pad, charger stand, and Quick (Qi) charger. The charger pad segment held major share of the global market in 2021.

The use of a charging cable is no longer necessary owing to inductive charging technology. When a user places a device on a special charging pad, wireless power is instantly accessible. One of the best features of charger pads is their ability to work with virtually all cell phones, regardless of the size or shape of their charging sockets. Charger pads provide safe charging because all charging occurs inside the phone, eliminating the risk of corroded USB ports and lowering the possibility of charging errors or electrical problems. Therefore, their demand is increasing in various end-use industries across the globe.

In terms of technology, the global wireless charger market has been classified into inductive, magnetic, radio frequency, and resonant. The inductive segment accounted for a notable share of the global market in 2021. In inductive technology, the battery and a charger pad make up the entire system. Planar coils are utilized in each component to transmit energy from the charging pad to the battery.

The electrical energy is modulated to enable communication between the battery and the charging pad. This enables the charging pad to make sure a functioning battery is installed before transmitting the full power to the battery. This technology is widely used in wireless chargers made for smartphones. Moreover, chargers using inductive technology are widely being used in healthcare sector to charge various medical devices.

North America dominated the global wireless charger market in 2021. This growth is attributed to the rise in demand for wireless charging in electric vehicles along with high penetration of premium smartphone brands with flagship products and other electronic gadgets in the region. Increase in sales of electric vehicles is a major factor fueling the market progress in North America.

Asia Pacific and Europe are prominent markets of wireless chargers. Electric vehicle sales in 2021 were the highest in China (3.3 million), followed by Europe with 2.3 million. Moreover, in 2020, China declared a new national standard for wireless electric vehicle charging, which is projected to play a key role in the market development. The new standard is based on WiTricity’s technology’s magnetic resonance technology. Thus, rise in demand for wireless chargers in EVs and various consumer electronics devices is likely to propel the market share in these regions during the forecast period.

The global market is consolidated, with a small number of large-scale vendors controlling majority of the share. Most of the companies are significantly investing in introduction of new products and extensive R&D activities. Moreover, key players emphasize on mergers, acquisitions, and widening of their respective portfolios.

Delta Electronics, Inc., Drone Power Pvt. Ltd., Energizer Holdings, Inc., Energous Corporation, etatronix GmbH, Fulton Innovation LLC., InductEV, Integrated Device Technology, Inc., IPT Technology GmbH, LG Electronics, Meredot SIA, Qualcomm Technologies, Inc., Samsung Electronics Co., Ltd., Sony Corporation, Wiferion GmbH, and Witricity Corporation are the prominent entities operating in the market.

Key players have been profiled in the global wireless charger market research report based on financial overview, business strategies, product portfolio, company overview, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 16.4 Bn |

|

Market Forecast Value in 2031 |

US$ 243.4 Bn |

|

Growth Rate (CAGR) |

31.9% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market size of wireless charger stood at US$ 16.4 Bn in 2021

The market is expected to advance at a CAGR of 31.9% from 2022 to 2031

Growth in adoption of wireless chargers in consumer electronic devices and rise in demand for wireless chargers in EV charging stations and in-cabin automotive applications

Consumer electronics was the largest end-use industry segment that held 44.3% share in 2021

North America is a more attractive region for vendors in the global market

Delta Electronics, Inc., Drone Power Pvt. Ltd., Energizer Holdings, Inc., Energous Corporation, etatronix GmbH, Fulton Innovation LLC., InductEV, Integrated Device Technology, Inc., IPT Technology GmbH, LG Electronics, Meredot SIA, Qualcomm Technologies, Inc., Samsung Electronics Co., Ltd., Sony Corporation, Wiferion GmbH, and Witricity Corporation

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Wireless Charger Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Charging Adapter Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Global Wireless Charger Market Analysis, by Product Type

5.1. Wireless Charger Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Product Type, 2017–2031

5.1.1. Power Mat

5.1.2. Charger Pad

5.1.3. Charger Stand

5.1.4. Quick (Qi) Charger

5.2. Market Attractiveness Analysis, By Product Type

6. Global Wireless Charger Market Analysis, by Technology

6.1. Wireless Charger Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Technology, 2017–2031

6.1.1. Inductive

6.1.2. Magnetic

6.1.3. Radio Frequency

6.1.4. Resonant

6.2. Market Attractiveness Analysis, By Technology

7. Global Wireless Charger Market Analysis, by Rated Power

7.1. Wireless Charger Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Rated Power, 2017–2031

7.1.1. Up to 15 W

7.1.2. 16 W to 50 W

7.1.3. 51 W to 500 W

7.1.4. 501 W to 1 KW

7.1.5. Above 1 KW

7.2. Market Attractiveness Analysis, By Rated Power

8. Global Wireless Charger Market Analysis, by Application

8.1. Wireless Charger Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

8.1.1. Laptops

8.1.2. Smartphones/Tablets

8.1.3. Power Tools

8.1.4. Smart Home Devices

8.1.5. Electric Vehicles

8.1.6. Industrial Electric Vehicles

8.1.7. Service Robots

8.1.8. Speakers

8.1.9. Wearables

8.1.10. Others

8.2. Market Attractiveness Analysis, By Application

9. Global Wireless Charger Market Analysis, by End-use Industry

9.1. Wireless Charger Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

9.1.1. Aerospace & Defense

9.1.2. Automotive & Transportation

9.1.3. Consumer Electronics

9.1.4. Healthcare

9.1.5. IT & Telecommunication

9.1.6. Others

9.2. Market Attractiveness Analysis, By End-use Industry

10. Global Wireless Charger Market Analysis and Forecast, by Region

10.1. Wireless Charger Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Region, 2017–2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Market Attractiveness Analysis, By Region

11. North America Wireless Charger Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Wireless Charger Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Product Type, 2017–2031

11.3.1. Power Mat

11.3.2. Charger Pad

11.3.3. Charger Stand

11.3.4. Quick (Qi) Charger

11.4. Wireless Charger Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Technology, 2017–2031

11.4.1. Inductive

11.4.2. Magnetic

11.4.3. Radio Frequency

11.4.4. Resonant

11.5. Wireless Charger Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Rated Power, 2017–2031

11.5.1. Up to 15 W

11.5.2. 16 W to 50 W

11.5.3. 51 W to 500 W

11.5.4. 501 W to 1 KW

11.5.5. Above 1 KW

11.6. Wireless Charger Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

11.6.1. Laptops

11.6.2. Smartphones/Tablets

11.6.3. Power Tools

11.6.4. Smart Home Devices

11.6.5. Electric Vehicles

11.6.6. Industrial Electric Vehicles

11.6.7. Service Robots

11.6.8. Speakers

11.6.9. Wearables

11.6.10. Others

11.7. Wireless Charger Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

11.7.1. Aerospace & Defense

11.7.2. Automotive & Transportation

11.7.3. Consumer Electronics

11.7.4. Healthcare

11.7.5. IT & Telecommunication

11.7.6. Others

11.8. Wireless Charger Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.8.1. U.S.

11.8.2. Canada

11.8.3. Rest of North America

11.9. Market Attractiveness Analysis

11.9.1. By Product Type

11.9.2. By Technology

11.9.3. By Rated Power

11.9.4. By Application

11.9.5. By End-use Industry

11.9.6. By Country/Sub-region

12. Europe Wireless Charger Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Wireless Charger Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Product Type, 2017–2031

12.3.1. Power Mat

12.3.2. Charger Pad

12.3.3. Charger Stand

12.3.4. Quick (Qi) Charger

12.4. Wireless Charger Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Technology, 2017–2031

12.4.1. Inductive

12.4.2. Magnetic

12.4.3. Radio Frequency

12.4.4. Resonant

12.5. Wireless Charger Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Rated Power, 2017–2031

12.5.1. Up to 15 W

12.5.2. 16 W to 50 W

12.5.3. 51 W to 500 W

12.5.4. 501 W to 1 KW

12.5.5. Above 1 KW

12.6. Wireless Charger Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

12.6.1. Laptops

12.6.2. Smartphones/Tablets

12.6.3. Power Tools

12.6.4. Smart Home Devices

12.6.5. Electric Vehicles

12.6.6. Industrial Electric Vehicles

12.6.7. Service Robots

12.6.8. Speakers

12.6.9. Wearables

12.6.10. Others

12.7. Wireless Charger Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

12.7.1. Aerospace & Defense

12.7.2. Automotive & Transportation

12.7.3. Consumer Electronics

12.7.4. Healthcare

12.7.5. IT & Telecommunication

12.7.6. Others

12.8. Wireless Charger Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.8.1. U.K.

12.8.2. Germany

12.8.3. France

12.8.4. Rest of Europe

12.9. Market Attractiveness Analysis

12.9.1. By Product Type

12.9.2. By Technology

12.9.3. By Rated Power

12.9.4. By Application

12.9.5. By End-use Industry

12.9.6. By Country/Sub-region

13. Asia Pacific Wireless Charger Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Wireless Charger Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Product Type, 2017–2031

13.3.1. Power Mat

13.3.2. Charger Pad

13.3.3. Charger Stand

13.3.4. Quick (Qi) Charger

13.4. Wireless Charger Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Technology, 2017–2031

13.4.1. Inductive

13.4.2. Magnetic

13.4.3. Radio Frequency

13.4.4. Resonant

13.5. Wireless Charger Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Rated Power, 2017–2031

13.5.1. Up to 15 W

13.5.2. 16 W to 50 W

13.5.3. 51 W to 500 W

13.5.4. 501 W to 1 KW

13.5.5. Above 1 KW

13.6. Wireless Charger Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

13.6.1. Laptops

13.6.2. Smartphones/Tablets

13.6.3. Power Tools

13.6.4. Smart Home Devices

13.6.5. Electric Vehicles

13.6.6. Industrial Electric Vehicles

13.6.7. Service Robots

13.6.8. Speakers

13.6.9. Wearables

13.6.10. Others

13.7. Wireless Charger Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

13.7.1. Aerospace & Defense

13.7.2. Automotive & Transportation

13.7.3. Consumer Electronics

13.7.4. Healthcare

13.7.5. IT & Telecommunication

13.7.6. Others

13.8. Wireless Charger Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.8.1. China

13.8.2. Japan

13.8.3. India

13.8.4. South Korea

13.8.5. ASEAN

13.8.6. Rest of Asia Pacific

13.9. Market Attractiveness Analysis

13.9.1. By Product Type

13.9.2. By Technology

13.9.3. By Rated Power

13.9.4. By Application

13.9.5. By End-use Industry

13.9.6. By Country/Sub-region

14. Middle East & Africa Wireless Charger Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Wireless Charger Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Product Type, 2017–2031

14.3.1. Power Mat

14.3.2. Charger Pad

14.3.3. Charger Stand

14.3.4. Quick (Qi) Charger

14.4. Wireless Charger Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Technology, 2017–2031

14.4.1. Inductive

14.4.2. Magnetic

14.4.3. Radio Frequency

14.4.4. Resonant

14.5. Wireless Charger Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Rated Power, 2017–2031

14.5.1. Up to 15 W

14.5.2. 16 W to 50 W

14.5.3. 51 W to 500 W

14.5.4. 501 W to 1 KW

14.5.5. Above 1 KW

14.6. Wireless Charger Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

14.6.1. Laptops

14.6.2. Smartphones/Tablets

14.6.3. Power Tools

14.6.4. Smart Home Devices

14.6.5. Electric Vehicles

14.6.6. Industrial Electric Vehicles

14.6.7. Service Robots

14.6.8. Speakers

14.6.9. Wearables

14.6.10. Others

14.7. Wireless Charger Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

14.7.1. Aerospace & Defense

14.7.2. Automotive & Transportation

14.7.3. Consumer Electronics

14.7.4. Healthcare

14.7.5. IT & Telecommunication

14.7.6. Others

14.8. Wireless Charger Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

14.8.1. GCC

14.8.2. South Africa

14.8.3. Rest of Middle East and Africa

14.9. Market Attractiveness Analysis

14.9.1. By Product Type

14.9.2. By Technology

14.9.3. By Rated Power

14.9.4. By Application

14.9.5. By End-use Industry

14.9.6. By Country/Sub-region

15. South America Wireless Charger Market Analysis and Forecast

15.1. Market Snapshot

15.2. Drivers and Restraints: Impact Analysis

15.3. Wireless Charger Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Product Type, 2017–2031

15.3.1. Power Mat

15.3.2. Charger Pad

15.3.3. Charger Stand

15.3.4. Quick (Qi) Charger

15.4. Wireless Charger Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Technology, 2017–2031

15.4.1. Inductive

15.4.2. Magnetic

15.4.3. Radio Frequency

15.4.4. Resonant

15.5. Wireless Charger Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Rated Power, 2017–2031

15.5.1. Up to 15 W

15.5.2. 16 W to 50 W

15.5.3. 51 W to 500 W

15.5.4. 501 W to 1 KW

15.5.5. Above 1 KW

15.6. Wireless Charger Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

15.6.1. Laptops

15.6.2. Smartphones/Tablets

15.6.3. Power Tools

15.6.4. Smart Home Devices

15.6.5. Electric Vehicles

15.6.6. Industrial Electric Vehicles

15.6.7. Service Robots

15.6.8. Speakers

15.6.9. Wearables

15.6.10. Others

15.7. Wireless Charger Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

15.7.1. Aerospace & Defense

15.7.2. Automotive & Transportation

15.7.3. Consumer Electronics

15.7.4. Healthcare

15.7.5. IT & Telecommunication

15.7.6. Others

15.8. Wireless Charger Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

15.8.1. Brazil

15.8.2. Rest of South America

15.9. Market Attractiveness Analysis

15.9.1. By Product Type

15.9.2. By Technology

15.9.3. By Rated Power

15.9.4. By Application

15.9.5. By End-use Industry

15.9.6. By Country/Sub-region

16. Competition Assessment

16.1. Global Wireless Charger Market Competition Matrix - a Dashboard View

16.1.1. Global Wireless Charger Market Company Share Analysis, by Value (2021)

16.1.2. Technological Differentiator

17. Company Profiles (Global Manufacturers/Suppliers)

17.1. Delta Electronics, Inc.

17.1.1. Overview

17.1.2. Product Portfolio

17.1.3. Sales Footprint

17.1.4. Key Subsidiaries or Distributors

17.1.5. Strategy and Recent Developments

17.1.6. Key Financials

17.2. Drone Power Pvt. Ltd.

17.2.1. Overview

17.2.2. Product Portfolio

17.2.3. Sales Footprint

17.2.4. Key Subsidiaries or Distributors

17.2.5. Strategy and Recent Developments

17.2.6. Key Financials

17.3. Energizer Holdings, Inc.

17.3.1. Overview

17.3.2. Product Portfolio

17.3.3. Sales Footprint

17.3.4. Key Subsidiaries or Distributors

17.3.5. Strategy and Recent Developments

17.3.6. Key Financials

17.4. Energous Corporation

17.4.1. Overview

17.4.2. Product Portfolio

17.4.3. Sales Footprint

17.4.4. Key Subsidiaries or Distributors

17.4.5. Strategy and Recent Developments

17.4.6. Key Financials

17.5. etatronix GmbH

17.5.1. Overview

17.5.2. Product Portfolio

17.5.3. Sales Footprint

17.5.4. Key Subsidiaries or Distributors

17.5.5. Strategy and Recent Developments

17.5.6. Key Financials

17.6. Fulton Innovation LLC.

17.6.1. Overview

17.6.2. Product Portfolio

17.6.3. Sales Footprint

17.6.4. Key Subsidiaries or Distributors

17.6.5. Strategy and Recent Developments

17.6.6. Key Financials

17.7. InductEV

17.7.1. Overview

17.7.2. Product Portfolio

17.7.3. Sales Footprint

17.7.4. Key Subsidiaries or Distributors

17.7.5. Strategy and Recent Developments

17.7.6. Key Financials

17.8. Integrated Device Technology, Inc.

17.8.1. Overview

17.8.2. Product Portfolio

17.8.3. Sales Footprint

17.8.4. Key Subsidiaries or Distributors

17.8.5. Strategy and Recent Developments

17.8.6. Key Financials

17.9. IPT Technology GmbH

17.9.1. Overview

17.9.2. Product Portfolio

17.9.3. Sales Footprint

17.9.4. Key Subsidiaries or Distributors

17.9.5. Strategy and Recent Developments

17.9.6. Key Financials

17.10. LG Electronics

17.10.1. Overview

17.10.2. Product Portfolio

17.10.3. Sales Footprint

17.10.4. Key Subsidiaries or Distributors

17.10.5. Strategy and Recent Developments

17.10.6. Key Financials

17.11. Meredot SIA

17.11.1. Overview

17.11.2. Product Portfolio

17.11.3. Sales Footprint

17.11.4. Key Subsidiaries or Distributors

17.11.5. Strategy and Recent Developments

17.11.6. Key Financials

17.12. Powermat Technologies Ltd.

17.12.1. Overview

17.12.2. Product Portfolio

17.12.3. Sales Footprint

17.12.4. Key Subsidiaries or Distributors

17.12.5. Strategy and Recent Developments

17.12.6. Key Financials

17.13. Qualcomm Technologies, Inc.

17.13.1. Overview

17.13.2. Product Portfolio

17.13.3. Sales Footprint

17.13.4. Key Subsidiaries or Distributors

17.13.5. Strategy and Recent Developments

17.13.6. Key Financials

17.14. Samsung Electronics Co., Ltd.

17.14.1. Overview

17.14.2. Product Portfolio

17.14.3. Sales Footprint

17.14.4. Key Subsidiaries or Distributors

17.14.5. Strategy and Recent Developments

17.14.6. Key Financials

17.15. Sony Corporation

17.15.1. Overview

17.15.2. Product Portfolio

17.15.3. Sales Footprint

17.15.4. Key Subsidiaries or Distributors

17.15.5. Strategy and Recent Developments

17.15.6. Key Financials

17.16. WiBotic

17.16.1. Overview

17.16.2. Product Portfolio

17.16.3. Sales Footprint

17.16.4. Key Subsidiaries or Distributors

17.16.5. Strategy and Recent Developments

17.16.6. Key Financials

17.17. Wiferion GmbH

17.17.1. Overview

17.17.2. Product Portfolio

17.17.3. Sales Footprint

17.17.4. Key Subsidiaries or Distributors

17.17.5. Strategy and Recent Developments

17.17.6. Key Financials

17.18. Witricity Corporation

17.18.1. Overview

17.18.2. Product Portfolio

17.18.3. Sales Footprint

17.18.4. Key Subsidiaries or Distributors

17.18.5. Strategy and Recent Developments

17.18.6. Key Financials

18. Recommendation

18.1. Opportunity Assessment

18.1.1. By Product Type

18.1.2. By Technology

18.1.3. By Rated Power

18.1.4. By Application

18.1.5. By End-use Industry

18.1.6. By Region

List of Tables

Table 1: Global Wireless Charger Market Size & Forecast, by Product Type, Value (US$ Bn), 2017-2031

Table 2: Global Wireless Charger Market Size & Forecast, by Product Type, Volume (Million Units), 2017-2031

Table 3: Global Wireless Charger Market Size & Forecast, by Technology, Value (US$ Bn), 2017-2031

Table 4: Global Wireless Charger Market Size & Forecast, by Technology, Volume (Million Units), 2017-2031

Table 5: Global Wireless Charger Market Size & Forecast, by Rated Power, Value (US$ Bn), 2017-2031

Table 6: Global Wireless Charger Market Size & Forecast, by Rated Power, Volume (Million Units), 2017-2031

Table 7: Global Wireless Charger Market Size & Forecast, by Application, Value (US$ Bn), 2017-2031

Table 8: Global Wireless Charger Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017-2031

Table 9: Global Wireless Charger Market Size & Forecast, by Region, Value (US$ Bn), 2017-2031

Table 10: Global Wireless Charger Market Size & Forecast, by Region, Volume (Million Units), 2017-2031

Table 11: North America Wireless Charger Market Size & Forecast, by Product Type, Value (US$ Bn), 2017-2031

Table 12: North America Wireless Charger Market Size & Forecast, by Product Type, Volume (Million Units), 2017-2031

Table 13: North America Wireless Charger Market Size & Forecast, by Technology, Value (US$ Bn), 2017-2031

Table 14: North America Wireless Charger Market Size & Forecast, by Technology, Volume (Million Units), 2017-2031

Table 15: North America Wireless Charger Market Size & Forecast, by Rated Power, Value (US$ Bn), 2017-2031

Table 16: North America Wireless Charger Market Size & Forecast, by Rated Power, Volume (Million Units), 2017-2031

Table 17: North America Wireless Charger Market Size & Forecast, by Application, Value (US$ Bn), 2017-2031

Table 18: North America Wireless Charger Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017-2031

Table 19: North America Wireless Charger Market Size & Forecast, by Country, Value (US$ Bn), 2017-2031

Table 20: North America Wireless Charger Market Size & Forecast, by Country, Volume (Million Units), 2017-2031

Table 21: Europe Wireless Charger Market Size & Forecast, by Product Type, Value (US$ Bn), 2017-2031

Table 22: Europe Wireless Charger Market Size & Forecast, by Product Type, Volume (Million Units), 2017-2031

Table 23: Europe Wireless Charger Market Size & Forecast, by Technology, Value (US$ Bn), 2017-2031

Table 24: Europe Wireless Charger Market Size & Forecast, by Technology, Volume (Million Units), 2017-2031

Table 25: Europe Wireless Charger Market Size & Forecast, by Rated Power, Value (US$ Bn), 2017-2031

Table 26: Europe Wireless Charger Market Size & Forecast, by Rated Power, Volume (Million Units), 2017-2031

Table 27: Europe Wireless Charger Market Size & Forecast, by Application, Value (US$ Bn), 2017-2031

Table 28: Europe Wireless Charger Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017-2031

Table 29: Europe Wireless Charger Market Size & Forecast, by Country, Value (US$ Bn), 2017-2031

Table 30: Europe Wireless Charger Market Size & Forecast, by Country, Volume (Million Units), 2017-2031

Table 31: Asia Pacific Wireless Charger Market Size & Forecast, by Product Type, Value (US$ Bn), 2017-2031

Table 32: Asia Pacific Wireless Charger Market Size & Forecast, by Product Type, Volume (Million Units), 2017-2031

Table 33: Asia Pacific Wireless Charger Market Size & Forecast, by Technology, Value (US$ Bn), 2017-2031

Table 34: Asia Pacific Wireless Charger Market Size & Forecast, by Technology, Volume (Million Units), 2017-2031

Table 35: Asia Pacific Wireless Charger Market Size & Forecast, by Rated Power, Value (US$ Bn), 2017-2031

Table 36: Asia Pacific Wireless Charger Market Size & Forecast, by Rated Power, Volume (Million Units), 2017-2031

Table 37: Asia Pacific Wireless Charger Market Size & Forecast, by Application, Value (US$ Bn), 2017-2031

Table 38: Asia Pacific Wireless Charger Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017-2031

Table 39: Asia Pacific Wireless Charger Market Size & Forecast, by Country, Value (US$ Bn), 2017-2031

Table 40: Asia Pacific Wireless Charger Market Size & Forecast, by Country, Volume (Million Units), 2017-2031

Table 41: Middle East & Africa Wireless Charger Market Size & Forecast, by Product Type, Value (US$ Bn), 2017-2031

Table 42: Middle East & Africa Wireless Charger Market Size & Forecast, by Product Type, Volume (Million Units), 2017-2031

Table 43: Middle East & Africa Wireless Charger Market Size & Forecast, by Technology, Value (US$ Bn), 2017-2031

Table 44: Middle East & Africa Wireless Charger Market Size & Forecast, by Technology, Volume (Million Units), 2017-2031

Table 45: Middle East & Africa Wireless Charger Market Size & Forecast, by Rated Power, Value (US$ Bn), 2017-2031

Table 46: Middle East & Africa Wireless Charger Market Size & Forecast, by Rated Power, Volume (Million Units), 2017-2031

Table 47: Middle East & Africa Wireless Charger Market Size & Forecast, by Application, Value (US$ Bn), 2017-2031

Table 48: Middle East & Africa Wireless Charger Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017-2031

Table 49: Middle East & Africa Wireless Charger Market Size & Forecast, by Country, Value (US$ Bn), 2017-2031

Table 50: Middle East & Africa Wireless Charger Market Size & Forecast, by Country, Volume (Million Units), 2017-2031

Table 51: South America Wireless Charger Market Size & Forecast, by Product Type, Value (US$ Bn), 2017-2031

Table 52: South America Wireless Charger Market Size & Forecast, by Product Type, Volume (Million Units), 2017-2031

Table 53: South America Wireless Charger Market Size & Forecast, by Technology, Value (US$ Bn), 2017-2031

Table 54: South America Wireless Charger Market Size & Forecast, by Technology, Volume (Million Units), 2017-2031

Table 55: South America Wireless Charger Market Size & Forecast, by Rated Power, Value (US$ Bn), 2017-2031

Table 56: South America Wireless Charger Market Size & Forecast, by Rated Power, Volume (Million Units), 2017-2031

Table 57: South America Wireless Charger Market Size & Forecast, by Application, Value (US$ Bn), 2017-2031

Table 58: South America Wireless Charger Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017-2031

Table 59: South America Wireless Charger Market Size & Forecast, by Country, Value (US$ Bn), 2017-2031

Table 60: South America Wireless Charger Market Size & Forecast, by Country, Volume (Million Units), 2017-2031

List of Figures

Figure 01: Global Wireless Charger Price Trend Analysis (Average Price per Product)

Figure 02: Global Wireless Charger Market, Value (US$ Bn), 2017-2031

Figure 03: Global Wireless Charger Market, Volume (Million Units), 2017-2031

Figure 04: Global Wireless Charger Market Size & Forecast, by Product Type, Revenue (US$ Bn), 2017-2031

Figure 05: Global Wireless Charger Market Share Analysis, by Product Type, 2022 and 2031

Figure 06: Global Wireless Charger Market Attractiveness, By Product Type, Value (US$ Bn), 2022-2031

Figure 07: Global Wireless Charger Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017-2031

Figure 08: Global Wireless Charger Market Share Analysis, by Technology, 2022 and 2031

Figure 09: Global Wireless Charger Market Attractiveness, By Technology, Value (US$ Bn), 2022-2031

Figure 10: Global Wireless Charger Market Size & Forecast, by Rated Power, Revenue (US$ Bn), 2017-2031

Figure 11: Global Wireless Charger Market Share Analysis, by Rated Power, 2022 and 2031

Figure 12: Global Wireless Charger Market Attractiveness, By Rated Power, Value (US$ Bn), 2022-2031

Figure 13: Global Wireless Charger Market Size & Forecast, by Application, Revenue (US$ Bn), 2017-2031

Figure 14: Global Wireless Charger Market Share Analysis, by Application, 2022 and 2031

Figure 15: Global Wireless Charger Market Attractiveness, By Application, Value (US$ Bn), 2022-2031

Figure 16: Global Wireless Charger Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017-2031

Figure 17: Global Wireless Charger Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 18: Global Wireless Charger Market Attractiveness, By End-use Industry, Value (US$ Bn), 2022-2031

Figure 19: Global Wireless Charger Market Size & Forecast, by Region, Revenue (US$ Bn), 2017-2031

Figure 20: Global Wireless Charger Market Share Analysis, by Region, 2022 and 2031

Figure 21: Global Wireless Charger Market Attractiveness, By Region, Value (US$ Bn), 2022-2031

Figure 22: North America Wireless Charger Market, Value (US$ Bn), 2017-2031

Figure 23: North America Wireless Charger Market, Volume (Million Units), 2017-2031

Figure 24: North America Wireless Charger Market Size & Forecast, by Product Type, Revenue (US$ Bn), 2017-2031

Figure 25: North America Wireless Charger Market Share Analysis, by Product Type, 2022 and 2031

Figure 26: North America Wireless Charger Market Attractiveness, By Product Type, Value (US$ Bn), 2022-2031

Figure 27: North America Wireless Charger Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017-2031

Figure 28: North America Wireless Charger Market Share Analysis, by Technology, 2022 and 2031

Figure 29: North America Wireless Charger Market Attractiveness, By Technology, Value (US$ Bn), 2022-2031

Figure 30: North America Wireless Charger Market Size & Forecast, by Rated Power, Revenue (US$ Bn), 2017-2031

Figure 31: North America Wireless Charger Market Share Analysis, by Rated Power, 2022 and 2031

Figure 32: North America Wireless Charger Market Attractiveness, By Rated Power, Value (US$ Bn), 2022-2031

Figure 33: North America Wireless Charger Market Size & Forecast, by Application, Revenue (US$ Bn), 2017-2031

Figure 34: North America Wireless Charger Market Share Analysis, by Application, 2022 and 2031

Figure 35: North America Wireless Charger Market Attractiveness, By Application, Value (US$ Bn), 2022-2031

Figure 36: North America Wireless Charger Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017-2031

Figure 37: North America Wireless Charger Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 38: North America Wireless Charger Market Attractiveness, By End-use Industry, Value (US$ Bn), 2022-2031

Figure 39: North America Wireless Charger Market Size & Forecast, by Country, Revenue (US$ Bn), 2017-2031

Figure 40: North America Wireless Charger Market Share Analysis, by Country, 2022 and 2031

Figure 41: North America Wireless Charger Market Attractiveness, By Country, Value (US$ Bn), 2022-2031

Figure 42: Europe Wireless Charger Market, Value (US$ Bn), 2017-2031

Figure 43: Europe Wireless Charger Market, Volume (Million Units), 2017-2031

Figure 44: Europe Wireless Charger Market Size & Forecast, by Product Type, Revenue (US$ Bn), 2017-2031

Figure 45: Europe Wireless Charger Market Share Analysis, by Product Type, 2022 and 2031

Figure 46: Europe Wireless Charger Market Attractiveness, By Product Type, Value (US$ Bn), 2022-2031

Figure 47: Europe Wireless Charger Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017-2031

Figure 48: Europe Wireless Charger Market Share Analysis, by Technology, 2022 and 2031

Figure 49: Europe Wireless Charger Market Attractiveness, By Technology, Value (US$ Bn), 2022-2031

Figure 50: Europe Wireless Charger Market Size & Forecast, by Rated Power, Revenue (US$ Bn), 2017-2031

Figure 51: Europe Wireless Charger Market Share Analysis, by Rated Power, 2022 and 2031

Figure 52: Europe Wireless Charger Market Attractiveness, By Rated Power, Value (US$ Bn), 2022-2031

Figure 53: Europe Wireless Charger Market Size & Forecast, by Application, Revenue (US$ Bn), 2017-2031

Figure 54: Europe Wireless Charger Market Share Analysis, by Application, 2022 and 2031

Figure 55: Europe Wireless Charger Market Attractiveness, By Application, Value (US$ Bn), 2022-2031

Figure 56: Europe Wireless Charger Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017-2031

Figure 57: Europe Wireless Charger Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 58: Europe Wireless Charger Market Attractiveness, By End-use Industry, Value (US$ Bn), 2022-2031

Figure 59: Europe Wireless Charger Market Size & Forecast, by Country, Revenue (US$ Bn), 2017-2031

Figure 60: Europe Wireless Charger Market Share Analysis, by Country, 2022 and 2031

Figure 61: Europe Wireless Charger Market Attractiveness, By Country, Value (US$ Bn), 2022-2031

Figure 62: Asia Pacific Wireless Charger Market, Value (US$ Bn), 2017-2031

Figure 63: Asia Pacific Wireless Charger Market, Volume (Million Units), 2017-2031

Figure 64: Asia Pacific Wireless Charger Market Size & Forecast, by Product Type, Revenue (US$ Bn), 2017-2031

Figure 65: Asia Pacific Wireless Charger Market Share Analysis, by Product Type, 2022 and 2031

Figure 66: Asia Pacific Wireless Charger Market Attractiveness, By Product Type, Value (US$ Bn), 2022-2031

Figure 67: Asia Pacific Wireless Charger Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017-2031

Figure 68: Asia Pacific Wireless Charger Market Share Analysis, by Technology, 2022 and 2031

Figure 69: Asia Pacific Wireless Charger Market Attractiveness, By Technology, Value (US$ Bn), 2022-2031

Figure 70: Asia Pacific Wireless Charger Market Size & Forecast, by Rated Power, Revenue (US$ Bn), 2017-2031

Figure 71: Asia Pacific Wireless Charger Market Share Analysis, by Rated Power, 2022 and 2031

Figure 72: Asia Pacific Wireless Charger Market Attractiveness, By Rated Power, Value (US$ Bn), 2022-2031

Figure 73: Asia Pacific Wireless Charger Market Size & Forecast, by Application, Revenue (US$ Bn), 2017-2031

Figure 74: Asia Pacific Wireless Charger Market Share Analysis, by Application, 2022 and 2031

Figure 75: Asia Pacific Wireless Charger Market Attractiveness, By Application, Value (US$ Bn), 2022-2031

Figure 76: Asia Pacific Wireless Charger Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017-2031

Figure 77: Asia Pacific Wireless Charger Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 78: Asia Pacific Wireless Charger Market Attractiveness, By End-use Industry, Value (US$ Bn), 2022-2031

Figure 79: Asia Pacific Wireless Charger Market Size & Forecast, by Country, Revenue (US$ Bn), 2017-2031

Figure 80: Asia Pacific Wireless Charger Market Share Analysis, by Country, 2022 and 2031

Figure 81: Asia Pacific Wireless Charger Market Attractiveness, By Country, Value (US$ Bn), 2022-2031

Figure 82: Middle East & Africa Wireless Charger Market, Value (US$ Bn), 2017-2031

Figure 83: Middle East & Africa Wireless Charger Market, Volume (Million Units), 2017-2031

Figure 84: Middle East & Africa Wireless Charger Market Size & Forecast, by Product Type, Revenue (US$ Bn), 2017-2031

Figure 85: Middle East & Africa Wireless Charger Market Share Analysis, by Product Type, 2022 and 2031

Figure 86: Middle East & Africa Wireless Charger Market Attractiveness, By Product Type, Value (US$ Bn), 2022-2031

Figure 87: Middle East & Africa Wireless Charger Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017-2031

Figure 88: Middle East & Africa Wireless Charger Market Share Analysis, by Technology, 2022 and 2031

Figure 89: Middle East & Africa Wireless Charger Market Attractiveness, By Technology, Value (US$ Bn), 2022-2031

Figure 90: Middle East & Africa Wireless Charger Market Size & Forecast, by Rated Power, Revenue (US$ Bn), 2017-2031

Figure 91: Middle East & Africa Wireless Charger Market Share Analysis, by Rated Power, 2022 and 2031

Figure 92: Middle East & Africa Wireless Charger Market Attractiveness, By Rated Power, Value (US$ Bn), 2022-2031

Figure 93: Middle East & Africa Wireless Charger Market Size & Forecast, by Application, Revenue (US$ Bn), 2017-2031

Figure 94: Middle East & Africa Wireless Charger Market Share Analysis, by Application, 2022 and 2031

Figure 95: Middle East & Africa Wireless Charger Market Attractiveness, By Application, Value (US$ Bn), 2022-2031

Figure 96: Middle East & Africa Wireless Charger Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017-2031

Figure 97: Middle East & Africa Wireless Charger Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 98: Middle East & Africa Wireless Charger Market Attractiveness, By End-use Industry, Value (US$ Bn), 2022-2031

Figure 99: Middle East & Africa Wireless Charger Market Size & Forecast, by Country, Revenue (US$ Bn), 2017-2031

Figure 100: Middle East & Africa Wireless Charger Market Share Analysis, by Country, 2022 and 2031

Figure 101: Middle East & Africa Wireless Charger Market Attractiveness, By Country, Value (US$ Bn), 2022-2031

Figure 102: South America Wireless Charger Market, Value (US$ Bn), 2017-2031

Figure 103: South America Wireless Charger Market, Volume (Million Units), 2017-2031

Figure 104: South America Wireless Charger Market Size & Forecast, by Product Type, Revenue (US$ Bn), 2017-2031

Figure 105: South America Wireless Charger Market Share Analysis, by Product Type, 2022 and 2031

Figure 106: South America Wireless Charger Market Attractiveness, By Product Type, Value (US$ Bn), 2022-2031

Figure 107: South America Wireless Charger Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017-2031

Figure 108: South America Wireless Charger Market Share Analysis, by Technology, 2022 and 2031

Figure 109: South America Wireless Charger Market Attractiveness, By Technology, Value (US$ Bn), 2022-2031

Figure 110: South America Wireless Charger Market Size & Forecast, by Rated Power, Revenue (US$ Bn), 2017-2031

Figure 111: South America Wireless Charger Market Share Analysis, by Rated Power, 2022 and 2031

Figure 112: South America Wireless Charger Market Attractiveness, By Rated Power, Value (US$ Bn), 2022-2031

Figure 113: South America Wireless Charger Market Size & Forecast, by Application, Revenue (US$ Bn), 2017-2031

Figure 114: South America Wireless Charger Market Share Analysis, by Application, 2022 and 2031

Figure 115: South America Wireless Charger Market Attractiveness, By Application, Value (US$ Bn), 2022-2031

Figure 116: South America Wireless Charger Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017-2031

Figure 117: South America Wireless Charger Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 118: South America Wireless Charger Market Attractiveness, By End-use Industry, Value (US$ Bn), 2022-2031

Figure 119: South America Wireless Charger Market Size & Forecast, by Country, Revenue (US$ Bn), 2017-2031

Figure 120: South America Wireless Charger Market Share Analysis, by Country, 2022 and 2031

Figure 121: South America Wireless Charger Market Attractiveness, By Country, Value (US$ Bn), 2022-2031