Amid the COVID-19 pandemic and its impact on almost every industry, the global wire bonding market is creating potential revenue opportunities by adopting new strategies and development skills to recover from the losses. The market players are now trying to find sustainable solutions to increase chances of business growth. Bonding wire are widely used in electronics devices, semiconductor industries, and microelectronics to connect transistors, resistors, and other electronic components in an Integrated Circuit (IC). The increasing demand and production of electronic devices during the pandemic creates profitable business opportunities for the key players in the wire bonding market. The rising competition between semiconductor manufacturing companies in developing regions such as India and China ensures business continuity amid COVID-19.

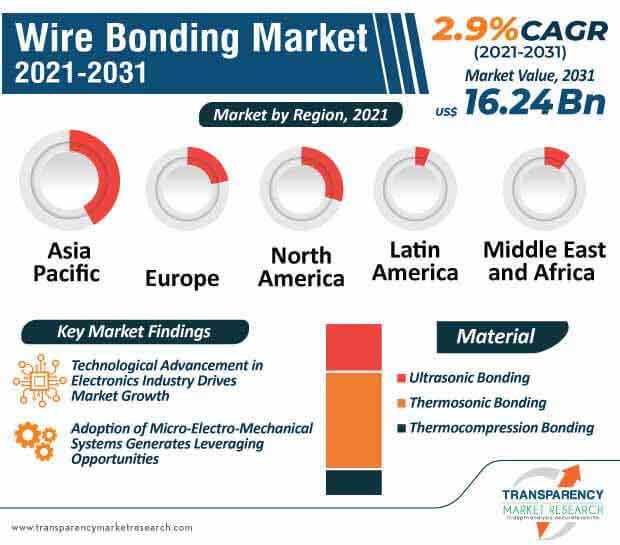

The wire bonding market is projected to advance at a CAGR of 2.9% during the forecast period. The wire bonding market is expected to cross US$ 16.24 Bn by 2031. Owing to the surging demand from the semiconductor packaging industry, microelectronics, and micro-electro-mechanical (MEMs) systems, wire bonding market is expected to witness potential revenue opportunities during the forecast period. The increasing demand from MEMs packaging, IC devices packaging, and miniaturization in the semiconductor industry drives the adoption of bonding wires as a major part of electronic assemblies. Bonding wires of gold, copper, and palladium can be widely used in the process. Market stakeholders need to be stay updated as per the advancement in the technology used in wire bonding for benefit. The proliferation of the electronics sector is translating into value-grab opportunities for the companies in the wire bonding market.

Wire bonding is a method of creating electrical interconnections between ICs, semiconductors, and silicon chips. Bonding wires are made from gold, copper, and aluminum. Brands such as Zhaojin Mining Industry, Airproducts, and The Prince & Izant are gaining popularity due to increasing applications in electronics and semiconductor packaging industries. With the increasing usage of bonding wires in semiconductor packaging, electronic component packaging, and high-power applications, many small-scale manufacturing companies are taking advantage by establishing their businesses. Digitalization and technological growth boost the demand for electronic devices. Moreover, the surge in adoption of ICs in mobiles, tablets, etc. further drives the market. Apart from consumer electronics, wire bonding can be used in automobile and defense & aerospace industries.

Increasing competition between manufacturers, technological advancements, and growth of electronics sector, and expansion of the semiconductor industry are some of the major factors contributing to the growth of the wire bonding market. Even though there are lucrative opportunities for the manufacturers operating in developing countries such as India and China, some challenges can hinder the global market growth such as the expensive manufacturing and operational costs of the semiconductor bonding equipment. Increasing challenges related to the reliability of copper bonding wires are also expected to hamper market growth. However, manufactures should invest on improving production process and acquiring good quality equipment. There are certain challenges related to reliability of copper bonding wires and increasing gold prices.

Analysts’ Viewpoint

The wire bonding market is booming after the threatening coronavirus pandemic. Growth and advancements in Micro-electro-mechanical systems (MEMS) are creating revenue opportunities for the manufacturers operating in the wire bonding market. The wire bonding market is expected to witness continuing growth at the global level due to increasing applications in various end-use industries such as automobiles, consumer electronics, healthcare, aerospace & defense, telecommunication, etc. The growing demand for electronic gadgets globally is expected to boost the demand for ICs, which further contributes to revenue growth. Bonding wires are abundantly used in semiconductor and microelectronics field to interconnect and manufacture components of ICs, transistors, resistors, etc. However, manufacturing companies should focus on overcoming challenges in the wire bonding market.

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

US$ 11.87 Bn |

|

Market Forecast Value in 2031 |

US$ 16.24 Bn |

|

Growth Rate (CAGR) |

2.9% |

|

Forecast Period |

2021-2031 |

|

Quantitative Units |

US$ Bn for Value |

|

Market analysis |

It includes cross segment analysis at global as well as regional level. Further, qualitative analysis includes drivers, restraints, opportunities, key trends, porters five forces analysis, supply chain analysis, parent industry overview, etc. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) or word + Excel |

|

Regions Covered |

|

|

Countries Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

Wire Bonding Market – Segmentation

TMR’s study of the global wire bonding market segments the market based on bonding process type, wire thickness, material, wire product type, application, end-use industry, and region. Changing market trends and other crucial market dynamics associated with segments of the global wire bonding market have been discussed in detail in TMR’s study.

| Bonding Process Type |

|

| Wire Thickness |

|

| Material |

|

| Wire Product Type |

|

| Application |

|

| End-use Industry |

|

| Region |

|

Wire Bonding Market to expand at a CAGR of 2.9% during the forecast period 2031

Asia Pacific is estimated to show prominent growth in the Wire Bonding Market

Key players operating in the global wire bonding market are Cirexx International Inc., Powertech Technology Inc., Alter Technology, Würth Elektronik GmbH & Co. KG, QP Technologies, Tektronix, Inc., NEOTech Inc., SMART Microsystems Ltd., JCET Group Co., Ltd., Corintech Ltd., Amkor Technology, Inc., and ASE Technology Holding Co., Ltd.

The Wire Bonding Market is studied from 2021-2031

Wire Bonding Market is expected to rise to US$ 16.24 Bn by 2030

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Wire Bonding Market Analysis and Forecast

2.2. Regional Outline

2.3. Global Market Analysis, by End-use Industry

2.4. Global Market – Competition Analysis

2.5. Market Dynamics Snapshot

2.6. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Key Market Indicator

3.3. Drivers

3.3.1. Economic Drivers

3.3.2. Supply Side Drivers

3.3.3. Demand Side Drivers

3.4. Market Restraints and Opportunities

3.5. Market Trends

3.5.1. Demand Side

3.5.2. Supply Side

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview

4.2. Supply Chain Analysis

4.3. Technology Roadmap Analysis

4.4. Industry SWOT Analysis

4.5. Porter Five Forces Analysis

4.6. Summary of Alternative Packaging Technology - Comparative Analysis

5. Global Wire Bonding Market Analysis, by Bonding Process Type

5.1. Global Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Bonding Process Type, 2017‒2031

5.1.1. Thermocompression Bonding

5.1.2. Thermosonic Bonding

5.1.3. Ultrasonic Bonding

5.2. Global Wire Bonding Market Attractiveness Analysis, by Bonding Process Type

6. Global Wire Bonding Market Analysis, by Wire Thickness

6.1. Global Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Wire Thickness, 2017‒2031

6.1.1. 0 µm- 75µm

6.1.2. 75µm-150µm

6.1.3. 150µm-300µm

6.1.4. 300µm-500µm

6.2. Global Wire Bonding Market Attractiveness Analysis, by Wire Thickness

7. Global Wire Bonding Market Analysis, by Material

7.1. Global Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Material, 2017‒2031

7.1.1. Gold

7.1.2. Copper

7.1.3. Aluminum

7.1.4. Silver

7.1.5. Palladium-coated copper (PCC)

7.1.6. Others (PdAg and Other Alloys)

7.2. Global Wire Bonding Market Attractiveness Analysis, by Material

8. Global Wire Bonding Market Analysis, by Wire Product Type

8.1. Global Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Wire Product Type, 2017‒2031

8.1.1. Ball Bonders

8.1.2. Wedge Bonders

8.1.3. Stud/Bump Bonders

8.1.4. Peg Bonders

8.2. Global Wire Bonding Market Attractiveness Analysis, by Wire Product Type

9. Global Wire Bonding Market Analysis, by Application

9.1. Global Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Application, 2017‒2031

9.1.1. MEMS (Micro-Electro-Mechanical Systems)

9.1.2. Optoelectronics System

9.1.3. Memory

9.1.4. Sensors

9.1.5. Others (LCD, Microcontrollers, RF chips, etc.)

9.2. Global Wire Bonding Market Attractiveness Analysis, by Application

10. Global Wire Bonding Market Analysis, by End-use Industry

10.1. Global Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017‒2031

10.1.1. Aerospace and Defense

10.1.2. Consumer Electronics

10.1.3. Automotive

10.1.4. Healthcare

10.1.5. Energy

10.1.6. Telecommunications

10.1.7. Others (Transportation, Agriculture, etc.)

10.2. Global Wire Bonding Market Attractiveness Analysis, by End-use Industry

11. Global Wire Bonding Market Analysis and Forecast, by Region

11.1. Global Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Region, 2017–2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Global Wire Bonding Market Attractiveness Analysis, by Region

12. North America Wire Bonding Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. North America Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Bonding Process Type, 2017‒2031

12.3.1. Thermocompression Bonding

12.3.2. Thermosonic Bonding

12.3.3. Ultrasonic Bonding

12.4. North America Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Wire Thickness, 2017‒2031

12.4.1. 0 µm- 75µm

12.4.2. 75µm-150µm

12.4.3. 150µm-300µm

12.4.4. 300µm-500µm

12.5. North America Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Material, 2017‒2031

12.5.1. Gold

12.5.2. Copper

12.5.3. Aluminum

12.5.4. Silver

12.5.5. Palladium-coated copper (PCC)

12.5.6. Others (PdAg and Other Alloys)

12.6. North America Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Wire Product Type, 2017‒2031

12.6.1. Ball Bonders

12.6.2. Wedge Bonders

12.6.3. Stud/Bump Bonders

12.6.4. Peg Bonders

12.7. North America Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Application, 2017‒2031

12.7.1. MEMS (Micro-Electro-Mechanical Systems)

12.7.2. Optoelectronics System

12.7.3. Memory

12.7.4. Sensors

12.7.5. Others (LCD, Microcontrollers, RF chips, etc.)

12.8. North America Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017‒2031

12.8.1. Aerospace and Defense

12.8.2. Consumer Electronics

12.8.3. Automotive

12.8.4. Healthcare

12.8.5. Energy

12.8.6. Telecommunications

12.8.7. Others (Transportation, Agriculture, etc.)

12.9. North America Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Country & Sub-region, 2017–2031

12.9.1. U.S.

12.9.2. Canada

12.9.3. Rest of North America

12.10. North America Wire Bonding Market Attractiveness Analysis

12.10.1. By Bonding Process Type

12.10.2. By Wire Thickness

12.10.3. By Material

12.10.4. By Wire Product Type

12.10.5. By Application

12.10.6. By End-use Industry

12.10.7. By Country & Sub-region

13. Asia Pacific Wire Bonding Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Asia Pacific Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Bonding Process Type, 2017‒2031

13.3.1. Thermocompression Bonding

13.3.2. Thermosonic Bonding

13.3.3. Ultrasonic Bonding

13.4. Asia Pacific Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Wire Thickness, 2017‒2031

13.4.1. 0 µm- 75µm

13.4.2. 75µm-150µm

13.4.3. 150µm-300µm

13.4.4. 300µm-500µm

13.5. Asia Pacific Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Material, 2017‒2031

13.5.1. Gold

13.5.2. Copper

13.5.3. Aluminum

13.5.4. Silver

13.5.5. Palladium-coated copper (PCC)

13.5.6. Others (PdAg and Other Alloys)

13.6. Asia Pacific Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Wire Product Type, 2017‒2031

13.6.1. Ball Bonders

13.6.2. Wedge Bonders

13.6.3. Stud/Bump Bonders

13.6.4. Peg Bonders

13.7. Asia Pacific Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Application, 2017‒2031

13.7.1. MEMS (Micro-Electro-Mechanical Systems)

13.7.2. Optoelectronics System

13.7.3. Memory

13.7.4. Sensors

13.7.5. Others (LCD, Microcontrollers, RF chips, etc.)

13.8. Asia Pacific Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017‒2031

13.8.1. Aerospace and Defense

13.8.2. Consumer Electronics

13.8.3. Automotive

13.8.4. Healthcare

13.8.5. Energy

13.8.6. Telecommunications

13.8.7. Others (Transportation, Agriculture, etc.)

13.9. Asia Pacific Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Country & Sub-region, 2017‒2031

13.9.1. China

13.9.2. Taiwan

13.9.3. Japan

13.9.4. South Korea

13.9.5. ASEAN

13.9.6. Rest of Asia Pacific

13.10. Asia Pacific Wire Bonding Market Attractiveness Analysis

13.10.1. By Bonding Process Type

13.10.2. By Wire Thickness

13.10.3. By Material

13.10.4. By Wire Product Type

13.10.5. By Application

13.10.6. By End-use Industry

13.10.7. By Country & Sub-region

14. Europe Wire Bonding Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Europe Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Bonding Process Type, 2017‒2031

14.3.1. Thermocompression Bonding

14.3.2. Thermosonic Bonding

14.3.3. Ultrasonic Bonding

14.4. Europe Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Wire Thickness, 2017‒2031

14.4.1. 0 µm- 75µm

14.4.2. 75µm-150µm

14.4.3. 150µm-300µm

14.4.4. 300µm-500µm

14.5. Europe Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Material, 2017‒2031

14.5.1. Gold

14.5.2. Copper

14.5.3. Aluminum

14.5.4. Silver

14.5.5. Palladium-coated copper (PCC)

14.5.6. Others (PdAg and Other Alloys)

14.6. Europe Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Wire Product Type, 2017‒2031

14.6.1. Ball Bonders

14.6.2. Wedge Bonders

14.6.3. Stud/Bump Bonders

14.6.4. Peg Bonders

14.7. Europe Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Application, 2017‒2031

14.7.1. MEMS (Micro-Electro-Mechanical Systems)

14.7.2. Optoelectronics System

14.7.3. Memory

14.7.4. Sensors

14.7.5. Others (LCD, Microcontrollers, RF chips, etc.)

14.8. Europe Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017‒2031

14.8.1. Aerospace and Defense

14.8.2. Consumer Electronics

14.8.3. Automotive

14.8.4. Healthcare

14.8.5. Energy

14.8.6. Telecommunications

14.8.7. Others (Transportation, Agriculture, etc.)

14.9. Europe Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Country & Sub-region, 2017‒2031

14.9.1. U.K.

14.9.2. Germany

14.9.3. France

14.9.4. Italy

14.9.5. Russia

14.9.6. Rest of Europe

14.10. Europe Wire Bonding Market Attractiveness Analysis

14.10.1. By Bonding Process Type

14.10.2. By Wire Thickness

14.10.3. By Material

14.10.4. By Wire Product Type

14.10.5. By Application

14.10.6. By End-use Industry

14.10.7. By Country & Sub-region

15. South America Wire Bonding Market Analysis and Forecast

15.1. Market Snapshot

15.2. Drivers and Restraints: Impact Analysis

15.3. South America Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Bonding Process Type, 2017‒2031

15.3.1. Thermocompression Bonding

15.3.2. Thermosonic Bonding

15.3.3. Ultrasonic Bonding

15.4. South America Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Wire Thickness, 2017‒2031

15.4.1. 0 µm- 75µm

15.4.2. 75µm-150µm

15.4.3. 150µm-300µm

15.4.4. 300µm-500µm

15.5. South America Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Material, 2017‒2031

15.5.1. Gold

15.5.2. Copper

15.5.3. Aluminum

15.5.4. Silver

15.5.5. Palladium-coated copper (PCC)

15.5.6. Others (PdAg and Other Alloys)

15.6. South America Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Wire Product Type, 2017‒2031

15.6.1. Ball Bonders

15.6.2. Wedge Bonders

15.6.3. Stud/Bump Bonders

15.6.4. Peg Bonders

15.7. South America Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Application, 2017‒2031

15.7.1. MEMS (Micro-Electro-Mechanical Systems)

15.7.2. Optoelectronics System

15.7.3. Memory

15.7.4. Sensors

15.7.5. Others (LCD, Microcontrollers, RF chips, etc.)

15.8. South America Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017‒2031

15.8.1. Aerospace and Defense

15.8.2. Consumer Electronics

15.8.3. Automotive

15.8.4. Healthcare

15.8.5. Energy

15.8.6. Telecommunications

15.8.7. Others (Transportation, Agriculture, etc.)

15.9. South America Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Country & Sub-region, 2017‒2031

15.9.1. Brazil

15.9.2. Rest of South America

15.10. South America Wire Bonding Market Attractiveness Analysis

15.10.1. By Bonding Process Type

15.10.2. By Wire Thickness

15.10.3. By Material

15.10.4. By Wire Product Type

15.10.5. By Application

15.10.6. By End-use Industry

15.10.7. By Country & Sub-region

16. Middle East & Africa (MEA) Wire Bonding Market Analysis and Forecast

16.1. Market Snapshot

16.2. Drivers and Restraints: Impact Analysis

16.3. Middle East & Africa Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Bonding Process Type, 2017‒2031

16.3.1. Thermocompression Bonding

16.3.2. Thermosonic Bonding

16.3.3. Ultrasonic Bonding

16.4. Middle East & Africa Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Wire Thickness, 2017‒2031

16.4.1. 0 µm- 75µm

16.4.2. 75µm-150µm

16.4.3. 150µm-300µm

16.4.4. 300µm-500µm

16.5. Middle East & Africa Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Material, 2017‒2031

16.5.1. Gold

16.5.2. Copper

16.5.3. Aluminum

16.5.4. Silver

16.5.5. Palladium-coated copper (PCC)

16.5.6. Others (PdAg and Other Alloys)

16.6. Middle East & Africa Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Wire Product Type, 2017‒2031

16.6.1. Ball Bonders

16.6.2. Wedge Bonders

16.6.3. Stud/Bump Bonders

16.6.4. Peg Bonders

16.7. Middle East & Africa Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Application, 2017‒2031

16.7.1. MEMS (Micro-Electro-Mechanical Systems)

16.7.2. Optoelectronics System

16.7.3. Memory

16.7.4. Sensors

16.7.5. Others (LCD, Microcontrollers, RF chips, etc.)

16.8. Middle East & Africa Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017‒2031

16.8.1. Aerospace and Defense

16.8.2. Consumer Electronics

16.8.3. Automotive

16.8.4. Healthcare

16.8.5. Energy

16.8.6. Telecommunications

16.8.7. Others (Transportation, Agriculture, etc.)

16.9. Middle East & Africa Wire Bonding Market Value (US$ Bn) Analysis & Forecast, by Country & Sub-region, 2017‒2031

16.9.1. GCC

16.9.2. South Africa

16.9.3. Rest of Middle East & Africa

16.10. Middle East & Africa Wire Bonding Market Attractiveness Analysis

16.10.1. By Bonding Process Type

16.10.2. By Wire Thickness

16.10.3. By Material

16.10.4. By Wire Product Type

16.10.5. By Application

16.10.6. By End-use Industry

16.10.7. By Country & Sub-region

17. Competition Assessment

17.1. Global Wire Bonding Market Competition Matrix - a Dashboard View

17.1.1. Global Wire Bonding Market Company Share Analysis, by Value (2020) and Volume

17.1.2. Technological Differentiator

18. Company Profiles (Manufacturers/Suppliers)

18.1. Cirexx International Inc.

18.1.1. Overview

18.1.2. Product Portfolio

18.1.3. Sales Footprint

18.1.4. Key Subsidiaries or Distributors

18.1.5. Strategy and Recent Developments

18.1.6. Financial Analysis

18.2. Powertech Technology Inc.

18.2.1. Overview

18.2.2. Product Portfolio

18.2.3. Sales Footprint

18.2.4. Key Subsidiaries or Distributors

18.2.5. Strategy and Recent Developments

18.2.6. Financial Analysis

18.3. Alter Technology

18.3.1. Overview

18.3.2. Product Portfolio

18.3.3. Sales Footprint

18.3.4. Key Subsidiaries or Distributors

18.3.5. Strategy and Recent Developments

18.3.6. Financial Analysis

18.4. Würth Elektronik GmbH & Co. KG (1/2)

18.4.1. Overview

18.4.2. Product Portfolio

18.4.3. Sales Footprint

18.4.4. Key Subsidiaries or Distributors

18.4.5. Strategy and Recent Developments

18.4.6. Financial Analysis

18.5. QP Technologies

18.5.1. Overview

18.5.2. Product Portfolio

18.5.3. Sales Footprint

18.5.4. Key Subsidiaries or Distributors

18.5.5. Strategy and Recent Developments

18.5.6. Financial Analysis

18.6. Tektronix, Inc.

18.6.1. Overview

18.6.2. Product Portfolio

18.6.3. Sales Footprint

18.6.4. Key Subsidiaries or Distributors

18.6.5. Strategy and Recent Developments

18.6.6. Financial Analysis

18.7. NEOTech Inc.

18.7.1. Overview

18.7.2. Product Portfolio

18.7.3. Sales Footprint

18.7.4. Key Subsidiaries or Distributors

18.7.5. Strategy and Recent Developments

18.7.6. Financial Analysis

18.8. SMART Microsystems Ltd.

18.8.1. Overview

18.8.2. Product Portfolio

18.8.3. Sales Footprint

18.8.4. Key Subsidiaries or Distributors

18.8.5. Strategy and Recent Developments

18.8.6. Financial Analysis

18.9. JCET Group Co., Ltd.

18.9.1. Overview

18.9.2. Product Portfolio

18.9.3. Sales Footprint

18.9.4. Key Subsidiaries or Distributors

18.9.5. Strategy and Recent Developments

18.9.6. Financial Analysis

18.10. Corintech Ltd.

18.10.1. Overview

18.10.2. Product Portfolio

18.10.3. Sales Footprint

18.10.4. Key Subsidiaries or Distributors

18.10.5. Strategy and Recent Developments

18.10.6. Financial Analysis

18.11. Amkor Technology, Inc.

18.11.1. Overview

18.11.2. Product Portfolio

18.11.3. Sales Footprint

18.11.4. Key Subsidiaries or Distributors

18.11.5. Strategy and Recent Developments

18.11.6. Financial Analysis

18.12. ASE Technology Holding Co., Ltd.

18.12.1. Overview

18.12.2. Product Portfolio

18.12.3. Sales Footprint

18.12.4. Key Subsidiaries or Distributors

18.12.5. Strategy and Recent Developments

18.12.6. Financial Analysis

19. Recommendation

19.1. Opportunity Assessment

19.1.1. By Bonding Process Type

19.1.2. By Wire Thickness

19.1.3. By Material

19.1.4. By Wire Product Type

19.1.5. By Application

19.1.6. By End-use Industry

19.1.7. By Region

List of Tables

Table 01: Global Wire Bonding Market Value (US$ Bn) & Forecast, by Bonding Process Type 2017‒2031

Table 02: Global Wire Bonding Market Size & Forecast, by Wire Thickness, Value (US$ Bn), 2017‒2031

Table 03: Global Wire Bonding Market Value (US$ Bn) & Forecast, by Material 2017‒2031

Table 04: Global Wire Bonding Market Size & Forecast, by Wire Product Type, Value (US$ Bn), 2017‒2031

Table 05: Global Wire Bonding Market Value (US$ Bn) & Forecast, by Application2017‒2031

Table 06: Global Wire Bonding Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017‒2031

Table 07: Global Wire Bonding Market Size & Forecast, by Region, Value (US$ Bn), 2017‒2031

Table 08: Global Wire Bonding Market Value (US$ Bn) & Forecast, by Bonding Process Type 2017‒2031

Table 09: North America Wire Bonding Market Value (US$ Bn) & Forecast, by Wire Thickness 2017‒2031

Table 10: North America Wire Bonding Market Value (US$ Bn) & Forecast, by Material 2017‒2031

Table 11: North America Wire Bonding Market Value (US$ Bn) & Forecast, by Wire Product Type 2017‒2031

Table 12: North America Wire Bonding Market Value (US$ Bn) & Forecast, by Application2017‒2031

Table 13: North America Wire Bonding Market Value (US$ Bn) & Forecast, by End-use Industry 2017‒2031

Table 14: North America Wire Bonding Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 15: Asia Pacific Wire Bonding Market Value (US$ Bn) & Forecast, by Bonding Process Type 2017‒2031

Table 16: Asia Pacific Wire Bonding Market Value (US$ Bn) & Forecast, by Wire Thickness 2017‒2031

Table 17: Asia Pacific Wire Bonding Market Value (US$ Bn) & Forecast, by Material 2017‒2031

Table 18: Asia Pacific Wire Bonding Market Value (US$ Bn) & Forecast, by Wire Product Type 2017‒2031

Table 19: Asia Pacific Wire Bonding Market Value (US$ Bn) & Forecast, by Application2017‒2031

Table 20: Asia Pacific Wire Bonding Market Value (US$ Bn) & Forecast, by End-use Industry 2017‒2031

Table 21: Asia Pacific Wire Bonding Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 22: Europe Wire Bonding Market Value (US$ Bn) & Forecast, by Bonding Process Type 2017‒2031

Table 23: Europe Wire Bonding Market Value (US$ Bn) & Forecast, by Wire Thickness 2017‒2031

Table 24: Europe Wire Bonding Market Value (US$ Bn) & Forecast, by Material 2017‒2031

Table 25: Europe Wire Bonding Market Value (US$ Bn) & Forecast, by Wire Product Type 2017‒2031

Table 26: Europe Wire Bonding Market Value (US$ Bn) & Forecast, by Application2017‒2031

Table 27: Europe Wire Bonding Market Value (US$ Bn) & Forecast, by End-use Industry 2017‒2031

Table 28: Europe Wire Bonding Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 29: South America Wire Bonding Market Value (US$ Bn) & Forecast, by Bonding Process Type 2017‒2031

Table 30: South America Wire Bonding Market Value (US$ Bn) & Forecast, by Wire Thickness 2017‒2031

Table 31: South America Wire Bonding Market Value (US$ Bn) & Forecast, by Material 2017‒2031

Table 32: South America Wire Bonding Market Value (US$ Bn) & Forecast, by Wire Product Type 2017‒2031

Table 33: South America Wire Bonding Market Value (US$ Bn) & Forecast, by Application2017‒2031

Table 34: South America Wire Bonding Market Value (US$ Bn) & Forecast, by End-use Industry 2017‒2031

Table 35: South America Wire Bonding Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 36: South America Wire Bonding Market Value (US$ Bn) & Forecast, by Bonding Process Type 2017‒2031

Table 37: Middle East & Africa Wire Bonding Market Value (US$ Bn) & Forecast, by Wire Thickness 2017‒2031

Table 38: Middle East & Africa Wire Bonding Market Value (US$ Bn) & Forecast, by Material 2017‒2031

Table 39: Middle East & Africa Wire Bonding Market Value (US$ Bn) & Forecast, by Wire Product Type 2017‒2031

Table 40: Middle East & Africa Wire Bonding Market Value (US$ Bn) & Forecast, by Application2017‒2031

Table 41: Middle East & Africa Wire Bonding Market Value (US$ Bn) & Forecast, by End-use Industry 2017‒2031

Table 42: Middle East & Africa Wire Bonding Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

List of Figures

Figure 01: Global Wire Bonding Market, Value (US$ Bn), 2017‒2031

Figure 02: Global Wire Bonding Market, Year-on-Year Growth, Global Overview, 2021‒2031

Figure 03: Global Wire Bonding Market Value (US$ Bn) Projections, by Bonding Process Type, 2017‒2031

Figure 04: Global Wire Bonding Market, Incremental Opportunity, by Bonding Process Type, Value (US$ Bn), 2021‒2031

Figure 05: Global Wire Bonding Market Share Analysis, by Bonding Process Type, 2021 and 2031

Figure 06: Global Wire Bonding Market Value (US$ Bn) Projections, by Wire Thickness 2017‒2031

Figure 07: Global Wire Bonding Market, Incremental Opportunity, by Wire Thickness (US$ Bn), 2021‒2031

Figure 08: Global Wire Bonding Market Share Analysis, by Wire Thickness, 2021 and 2031

Figure 09: Global Wire Bonding Market Value (US$ Bn) Projections, by Material 2017‒2031

Figure 10: Global Wire Bonding Market, Incremental Opportunity, by Material, Value (US$ Bn), 2021‒2031

Figure 11: Global Wire Bonding Market Share Analysis, by Material, 2021 and 2031

Figure 12: Global Wire Bonding Market Value (US$ Bn) Projections, by Wire Product Type 2017‒2031

Figure 13: Global Wire Bonding Market, Incremental Opportunity, by Wire Product Type, Value (US$ Bn), 2021‒2031

Figure 14: Global Wire Bonding Market Share Analysis, by Wire Product Type, 2021 and 2031

Figure 15: Global Wire Bonding Market Value (US$ Bn) Projections, by Application 2017‒2031

Figure 16: Global Wire Bonding Market, Incremental Opportunity, by Application, Value (US$ Bn), 2021‒2031

Figure 17: Global Wire Bonding Market Share Analysis, by Application, 2021 and 2031

Figure 18: Global Wire Bonding Market Value (US$ Bn) Projections, by End-use Industry 2017‒2031

Figure 19: Global Wire Bonding Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2021‒2031

Figure 20: Global Wire Bonding Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 21: Global Wire Bonding Market Value (US$ Bn) Projections, by Region 2017‒2031

Figure 22: Global Wire Bonding Market, Incremental Opportunity, by Region, Value (US$ Bn), 2021‒2031

Figure 23: Global Wire Bonding Market Share Analysis, by Region, 2021 and 2031

Figure 24: North America Wire Bonding Market, Year-on-Year Growth, 2021‒2031

Figure 25: North America Wire Bonding Market Value (US$ Bn) Projections, by Bonding Process Type 2017‒2031

Figure 26: North America Wire Bonding Market, Incremental Opportunity, by Bonding Process Type, Value (US$ Bn), 2021‒2031

Figure 27: North America Wire Bonding Market Share Analysis, by Bonding Process Type, 2021 and 2031

Figure 28: North America Wire Bonding Market Value (US$ Bn) Projections, by Wire Thickness 2017‒2031

Figure 29: North America Wire Bonding Market, Incremental Opportunity, by Wire Thickness (US$ Bn), 2021‒2031

Figure 30: North America Wire Bonding Market Share Analysis, by Wire Thickness, 2021 and 2031

Figure 31: North America Wire Bonding Market Value (US$ Bn) Projections, by Material 2017‒2031

Figure 32: North America Wire Bonding Market, Incremental Opportunity, by Material, Value (US$ Bn), 2021‒2031

Figure 33: North America Wire Bonding Market Share Analysis, by Material, 2021 and 2031

Figure 34: North America Wire Bonding Market Value (US$ Bn) Projections, by Wire Product Type 2017‒2031

Figure 35: North America Wire Bonding Market, Incremental Opportunity, by Wire Product Type, Value (US$ Bn), 2021‒2031

Figure 36: North America Wire Bonding Market Share Analysis, by Wire Product Type, 2021 and 2031

Figure 37: North America Wire Bonding Market Value (US$ Bn) Projections, by Application 2017‒2031

Figure 38: North America Wire Bonding Market, Incremental Opportunity, by Application, Value (US$ Bn), 2021‒2031

Figure 39: North America Wire Bonding Market Share Analysis, by Application, 2021 and 2031

Figure 40: North America Wire Bonding Market Value (US$ Bn) Projections, by End-use Industry 2017‒2031

Figure 41: North America Wire Bonding Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2021‒2031

Figure 42: North America Wire Bonding Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 43: North America Wire Bonding Market Value (US$ Bn) Projections, by Country & Sub-region 2017‒2031

Figure 44: North America Wire Bonding Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 45: North America Wire Bonding Market Share Analysis, by Country & Sub-region, 2021 and 2031

Figure 46: Asia Pacific Wire Bonding Market, Year-on-Year Growth, 2021‒2031

Figure 47: Asia Pacific Wire Bonding Market Value (US$ Bn) Projections, by Bonding Process Type 2017‒2031

Figure 48: Asia Pacific Wire Bonding Market, Incremental Opportunity, by Bonding Process Type, Value (US$ Bn), 2021‒2031

Figure 49: Asia Pacific Wire Bonding Market Share Analysis, by Bonding Process Type, 2021 and 2031

Figure 50: Asia Pacific Wire Bonding Market Value (US$ Bn) Projections, by Wire Thickness 2017‒2031

Figure 51: Asia Pacific Wire Bonding Market, Incremental Opportunity, by Wire Thickness (US$ Bn), 2021‒2031

Figure 52: Asia Pacific Wire Bonding Market Share Analysis, by Wire Thickness, 2021 and 2031

Figure 53: Asia Pacific Wire Bonding Market Value (US$ Bn) Projections, by Material 2017‒2031

Figure 54: Asia Pacific Wire Bonding Market, Incremental Opportunity, by Material, Value (US$ Bn), 2021‒2031

Figure 55: Asia Pacific Wire Bonding Market Share Analysis, by Material, 2021 and 2031

Figure 56: Asia Pacific Wire Bonding Market Value (US$ Bn) Projections, by Wire Product Type 2017‒2031

Figure 57: Asia Pacific Wire Bonding Market, Incremental Opportunity, by Wire Product Type, Value (US$ Bn), 2021‒2031

Figure 58: Asia Pacific Wire Bonding Market Share Analysis, by Wire Product Type, 2021 and 2031

Figure 59: Asia Pacific Wire Bonding Market Value (US$ Bn) Projections, by Application 2017‒2031

Figure 60: Asia Pacific Wire Bonding Market, Incremental Opportunity, by Application, Value (US$ Bn), 2021‒2031

Figure 61: Asia Pacific Wire Bonding Market Share Analysis, by Application, 2021 and 2031

Figure 62: Asia Pacific Wire Bonding Market Value (US$ Bn) Projections, by End-use Industry 2017‒2031

Figure 63: Asia Pacific Wire Bonding Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2021‒2031

Figure 64: Asia Pacific Wire Bonding Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 65: Asia Pacific Wire Bonding Market Value (US$ Bn) Projections, by Country & Sub-region 2017‒2031

Figure 66: Asia Pacific Wire Bonding Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 67: Asia Pacific Wire Bonding Market Share Analysis, by Country & Sub-region, 2021 and 2031

Figure 68: Europe Wire Bonding Market, Year-on-Year Growth, 2021‒2031

Figure 69: Europe Wire Bonding Market Value (US$ Bn) Projections, by Bonding Process Type 2017‒2031

Figure 70: Europe Wire Bonding Market, Incremental Opportunity, by Bonding Process Type, Value (US$ Bn), 2021‒2031

Figure 71: Europe Wire Bonding Market Share Analysis, by Bonding Process Type, 2021 and 2031

Figure 72: Europe Wire Bonding Market Value (US$ Bn) Projections, by Wire Thickness 2017‒2031

Figure 73: Europe Wire Bonding Market, Incremental Opportunity, by Wire Thickness (US$ Bn), 2021‒2031

Figure 74: Europe Wire Bonding Market Share Analysis, by Wire Thickness, 2021 and 2031

Figure 75: Europe Wire Bonding Market Value (US$ Bn) Projections, by Material 2017‒2031

Figure 76: Europe Wire Bonding Market, Incremental Opportunity, by Material, Value (US$ Bn), 2021‒2031

Figure 77: Europe Wire Bonding Market Share Analysis, by Material, 2021 and 2031

Figure 78: Europe Wire Bonding Market Value (US$ Bn) Projections, by Wire Product Type 2017‒2031

Figure 79: Europe Wire Bonding Market, Incremental Opportunity, by Wire Product Type, Value (US$ Bn), 2021‒2031

Figure 80: Europe Wire Bonding Market Share Analysis, by Wire Product Type, 2021 and 2031

Figure 81: Europe Wire Bonding Market Value (US$ Bn) Projections, by Application 2017‒2031

Figure 82: Europe Wire Bonding Market, Incremental Opportunity, by Application, Value (US$ Bn), 2021‒2031

Figure 83: Europe Wire Bonding Market Share Analysis, by Application, 2021 and 2031

Figure 84: Europe Wire Bonding Market Value (US$ Bn) Projections, by End-use Industry 2017‒2031

Figure 85: Europe Wire Bonding Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2021‒2031

Figure 86: Europe Wire Bonding Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 87: Europe Wire Bonding Market Value (US$ Bn) Projections, by Country & Sub-region 2017‒2031

Figure 88: Europe Wire Bonding Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 89: Europe Wire Bonding Market Share Analysis, by Country & Sub-region, 2021 and 2031

Figure 90: South America Wire Bonding Market, Year-on-Year Growth, 2021‒2031

Figure 91: South America Wire Bonding Market Value (US$ Bn) Projections, by Bonding Process Type 2017‒2031

Figure 92: South America Wire Bonding Market, Incremental Opportunity, by Bonding Process Type, Value (US$ Bn), 2021‒2031

Figure 93: South America Wire Bonding Market Share Analysis, by Bonding Process Type, 2021 and 2031

Figure 94: South America Wire Bonding Market Value (US$ Bn) Projections, by Wire Thickness 2017‒2031

Figure 95: South America Wire Bonding Market, Incremental Opportunity, by Wire Thickness (US$ Bn), 2021‒2031

Figure 96: South America Wire Bonding Market Share Analysis, by Wire Thickness, 2021 and 2031

Figure 97: South America Wire Bonding Market Value (US$ Bn) Projections, by Material 2017‒2031

Figure 98: South America Wire Bonding Market, Incremental Opportunity, by Material, Value (US$ Bn), 2021‒2031

Figure 99: South America Wire Bonding Market Share Analysis, by Material, 2021 and 2031

Figure 100: South America Wire Bonding Market Value (US$ Bn) Projections, by Wire Product Type 2017‒2031

Figure 101: South America Wire Bonding Market, Incremental Opportunity, by Wire Product Type, Value (US$ Bn), 2021‒2031

Figure 102: South America Wire Bonding Market Share Analysis, by Wire Product Type, 2021 and 2031

Figure 103: South America Wire Bonding Market Value (US$ Bn) Projections, by Application 2017‒2031

Figure 104: South America Wire Bonding Market, Incremental Opportunity, by Application, Value (US$ Bn), 2021‒2031

Figure 105: South America Wire Bonding Market Share Analysis, by Application, 2021 and 2031

Figure 106: South America Wire Bonding Market Value (US$ Bn) Projections, by End-use Industry 2017‒2031

Figure 107: South America Wire Bonding Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2021‒2031

Figure 108: South America Wire Bonding Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 109: South America Wire Bonding Market Value (US$ Bn) Projections, by Country & Sub-region 2017‒2031

Figure 110: South America Wire Bonding Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 111: South America Wire Bonding Market Share Analysis, by Country & Sub-region, 2021 and 2031

Figure 112: Middle East & Africa Wire Bonding Market, Year-on-Year Growth, 2021‒2031

Figure 113: Middle East & Africa Wire Bonding Market Value (US$ Bn) Projections, by Bonding Process Type 2017‒2031

Figure 114: Middle East & Africa Wire Bonding Market, Incremental Opportunity, by Bonding Process Type, Value (US$ Bn), 2021‒2031

Figure 115: Middle East & Africa Wire Bonding Market Share Analysis, by Bonding Process Type, 2021 and 2031

Figure 116: Middle East & Africa Wire Bonding Market Value (US$ Bn) Projections, by Wire Thickness 2017‒2031

Figure 117: Middle East & Africa Wire Bonding Market, Incremental Opportunity, by Wire Thickness (US$ Bn), 2021‒2031

Figure 118: Middle East & Africa Wire Bonding Market Share Analysis, by Wire Thickness, 2021 and 2031

Figure 119: Middle East & Africa Wire Bonding Market Value (US$ Bn) Projections, by Material 2017‒2031

Figure 120: Middle East & Africa Wire Bonding Market, Incremental Opportunity, by Material, Value (US$ Bn), 2021‒2031

Figure 121: Middle East & Africa Wire Bonding Market Share Analysis, by Material, 2021 and 2031

Figure 122: Middle East & Africa Wire Bonding Market Value (US$ Bn) Projections, by Wire Product Type 2017‒2031

Figure 123: Middle East & Africa Wire Bonding Market, Incremental Opportunity, by Wire Product Type, Value (US$ Bn), 2021‒2031

Figure 124: Middle East & Africa Wire Bonding Market Share Analysis, by Wire Product Type, 2021 and 2031

Figure 125: Middle East & Africa Wire Bonding Market Value (US$ Bn) Projections, by Application 2017‒2031

Figure 126: Middle East & Africa Wire Bonding Market, Incremental Opportunity, by Application, Value (US$ Bn), 2021‒2031

Figure 127: Middle East & Africa Wire Bonding Market Share Analysis, by Application, 2021 and 2031

Figure 128: Middle East & Africa Wire Bonding Market Value (US$ Bn) Projections, by End-use Industry 2017‒2031

Figure 129: Middle East & Africa Wire Bonding Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2021‒2031

Figure 130: Middle East & Africa Wire Bonding Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 131: Middle East & Africa Wire Bonding Market Value (US$ Bn) Projections, by Country & Sub-region 2017‒2031

Figure 132: Middle East & Africa Wire Bonding Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 133: Middle East & Africa Wire Bonding Market Share Analysis, by Country & Sub-region, 2021 and 2031