Analysts’ Viewpoint

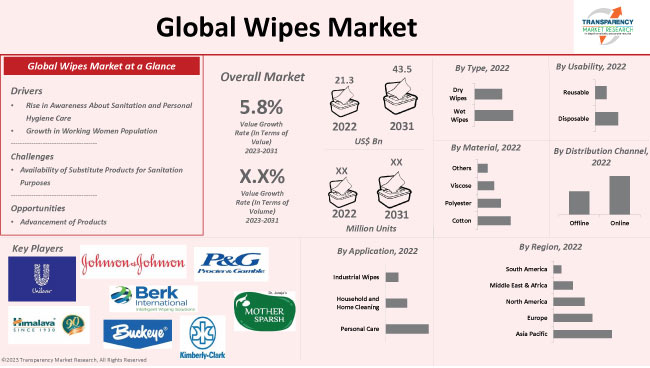

Increase in awareness about the importance of personal hygiene and sanitation, especially after the onset of the COVID-19 disease, is boosting the wipes market value. Rapid urbanization and changes in lifestyle are also augmenting market progress. Launch of products with organic and eco-friendly features is anticipated to further bolster the demand for wipes. However, rise in availability of substitute products for sanitation, such as towels and handkerchiefs, is likely to hamper wipes market share.

Wipes manufacturers are partnering with various distributors to expand their business. Key players are focusing on untapped regions to capitalize on lucrative wipes market opportunities and broaden their revenue streams.

Wipes are products that are used for personal hygiene purposes. They are usually made up of soft fabrics such as cotton and polyester. Wipes are available in different sizes and shapes, and can be used for various hygiene-related purposes.

Dry wipes and wet wipes are the two types of wipes. Dry wipes are typically made up of cotton and are safe for cleaning purposes, as they do not have any added fragrances. Wet wipes are generally made up of non-woven fabrics, water, and some additives.

Growth in population of working women, rise in urbanization, and surge in consumer expenditure on personal hygiene care products are driving market dynamics. Rise in awareness about personal cleanliness and disinfection is also bolstering market statistics. Rapid urbanization has led to an increase in air pollution. This has also increased the usage of wipes among consumers.

The outbreak of COVID-19 disease has made people more aware about the importance of hygiene and personal care in their daily lives. Wipes are convenient and easy to carry while travelling. They are also lightweight. These properties are driving the demand for wipes across the globe.

Increase in female population is driving the demand for makeup removing wipes. These wipes are manufactured by the cosmetics industry. Thus, growth in the global cosmetics sector is leading to wipes market development.

Advancement in products with organic and eco-friendly features is boosting the demand for wipes. Rise in awareness about diseases and infections is propelling the demand for household and home cleaning wipes across the globe.

Wipes are also used in industrial and automotive settings for cleaning and maintenance of the exterior and interior parts of cars and trucks, including dashboards and windows. They are also used to clean and polish wheels, tires, and other car parts. The market for automotive and industrial wipes is expected to grow significantly in the near future, driven by factors such as increase in industrialization and rise in globalization. Growth in awareness about the importance of maintaining industrial and automotive equipment in good health, and need for cost-effective and efficient cleaning solutions are also increasing the wipes market size.

Based on type, the wipes market segmentation entails wet wipes and dry wipes. The wet wipes segment is expected to expand significantly in the near future. These wipes are saturated with solutions that are beneficial to the skin.

Wet wipes can be used for various applications such as baby care, personal hygiene, and household cleaning. Demand for wet wipes is higher than that for dry wipes due to the moisturizing properties of these wipes. Wet wipes also help in removal of dirt and makeup. Furthermore, other resources such as water are not needed to remove dirt in certain situations.

Wet wipes also keep the skin soft, moisturized, and healthy. They are used to wipe the sensitive skin of infants. These factors are boosting the wet wipes segment.

According to the wipes industry research report, the personal care segment is likely to account for the largest share during the forecast period. This can be ascribed to the increase in awareness about personal care and hygiene among the people across the globe.

This personal care sector includes baby wipes, cleansing wipes, and pet care wipes. Demand for personal hygiene wipes such as baby wipes and makeup remover wipes has been rising due to the growth in adoption of the modern lifestyle among the people. New parents are increasingly using baby wipes, as these wipes are sensitive to the skin of infants.

According to the wipes market forecast, Asia Pacific is likely to dominate the global landscape during the forecast period. This can be ascribed to the rise in population and increase in adoption of modern lifestyle among the people in the region. Surge in working women population is also driving the demand for wipes in Asia Pacific. The region is likely to be followed by Europe and North America.

The global landscape is highly fragmented, with the presence of many local, regional, and international players. These players are adopting various strategies such as mergers, acquisitions, and partnerships to increase their market share. Manufacturers of wipes are increasingly focusing on product development. They are striving to introduce wipes at reasonable prices to meet the rising demand.

Prominent manufacturers of wipes include Procter & Gamble, S. C. Johnson & Son, Kimberly-Clark Corporation, Reckitt Benckiser Group plc, Weiman Products LLC., Rockline Industries, 3M Manufacturing Company, DuPont de Nemours Inc., Ecolab Inc. and The Clorox Company.

These players have been profiled in the wipes market report based on parameters such as company overview, product portfolio, financial overview, business strategies, recent developments, and business segments.

|

Attribute |

Detail |

|

Market Value in 2022 (Base Year) |

US$ 21.3 Bn |

|

Market Value in 2031 |

US$ 43.5 Bn |

|

Growth Rate (CAGR) |

5.8% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Mn for Value and Million Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 21.3 Bn in 2022.

It is anticipated to reach US$ 43.5 Bn by 2031.

The CAGR is estimated to be 5.8% by 2031.

Rise in awareness about sanitation and personal hygiene care and growth in cosmetics sector.

Based on type, the wet wipes segment held major share in 2022.

Asia Pacific is a highly attractive region for companies, followed by Europe and North America.

Procter & Gamble, S. C. Johnson & Son, Kimberly-Clark Corporation, Reckitt Benckiser Group plc, Weiman Products LLC., Rockline Industries, 3M Manufacturing Company, DuPont de Nemours Inc., Ecolab Inc. and The Clorox Company.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Raw Material Analysis

5.5. Key Market Indicators

5.5.1. Overall Home Cleaning Products Overview

5.5.2. Overall Personal Care Products Industry Overview

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Global Wipes Market Analysis and Forecast, 2017 – 2031

5.9.1. Market Value Projection (US$ Mn)

5.9.2. Market Volume Projection (Million Units)

6. Global Wipes Market Analysis and Forecast, By Type

6.1. Wipes Market Size (US$ Mn and Million Units) Forecast, By Type, 2017 – 2031

6.1.1. Wet Wipes

6.1.2. Dry Wipes

6.2. Incremental Opportunity, By Type

7. Global Wipes Market Analysis and Forecast, By Usability

7.1. Wipes Market Size (US$ Mn and Million Units) Forecast, By Usability, 2017 – 2031

7.1.1. Disposable

7.1.2. Reusable

7.2. Incremental Opportunity, By Usability

8. Global Wipes Market Analysis and Forecast, By Material

8.1. Wipes Market Size (US$ Mn and Million Units) Forecast, By Material, 2017 – 2031

8.1.1. Cotton

8.1.2. Polyester

8.1.3. Viscose

8.1.4. Others

8.2. Incremental Opportunity, By Material

9. Global Wipes Market Analysis and Forecast, By Application

9.1. Wipes Market Size (US$ Mn and Million Units) Forecast, By Application, 2017 – 2031

9.1.1. Personal Care

9.1.1.1. Baby Wipes

9.1.1.2. Cleansing Wipes

9.1.1.3. Personal Hygiene Wipes

9.1.1.4. Pet Wipes

9.1.1.5. Others

9.1.2. Household and Home Cleaning

9.1.2.1. Kitchen Wipes

9.1.2.2. Bathroom Wipes

9.1.2.3. Food Service Wipes

9.1.2.4. Others

9.1.3. Industrial Wipes

9.2. Incremental Opportunity, By Application

10. Global Wipes Market Analysis and Forecast, By Distribution Channel

10.1. Wipes Market Size (US$ Mn and Million Units) Forecast, By Distribution Channel, 2017 – 2031

10.1.1. Online

10.1.1.1. E-commerce Websites

10.1.1.2. Company-owned Websites

10.1.2. Offline

10.1.2.1. Hypermarkets and Supermarkets

10.1.2.2. Pharmaceutical and Drug Stores

10.1.2.3. Other Retail Stores

10.2. Incremental Opportunity, By Distribution Channel

11. Global Wipes Market Analysis and Forecast, By Region

11.1. Wipes Market Size (US$ Mn and Million Units) Forecast, By Region, 2017 – 2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Incremental Opportunity, By Region

12. North America Wipes Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Price

12.3. Key Trends Analysis

12.3.1. Demand Side Analysis

12.3.2. Supply Side Analysis

12.4. Brand Analysis

12.5. Consumer Buying Behavior Analysis

12.6. Wipes Market Size (US$ Mn and Million Units) Forecast, By Type, 2017 – 2031

12.6.1. Wet Wipes

12.6.2. Dry Wipes

12.7. Wipes Market Size (US$ Mn and Million Units) Forecast, By Usability, 2017 – 2031

12.7.1. Disposable

12.7.2. Reusable

12.8. Wipes Market Size (US$ Mn and Million Units) Forecast, By Material, 2017 – 2031

12.8.1. Cotton

12.8.2. Polyester

12.8.3. Viscose

12.8.4. Others

12.9. Wipes Market Size (US$ Mn and Million Units) Forecast, By Application, 2017 – 2031

12.9.1. Personal Care

12.9.1.1. Baby Wipes

12.9.1.2. Cleansing Wipes

12.9.1.3. Personal Hygiene Wipes

12.9.1.4. Pet Wipes

12.9.1.5. Others

12.9.2. Household and Home Cleaning

12.9.2.1. Kitchen Wipes

12.9.2.2. Bathroom Wipes

12.9.2.3. Food Service Wipes

12.9.2.4. Others

12.9.3. Industrial Wipes

12.10. Wipes Market Size (US$ Mn and Million Units) Forecast, By Distribution Channel, 2017 – 2031

12.10.1. Online

12.10.1.1. E-commerce Websites

12.10.1.2. Company-owned Websites

12.10.2. Offline

12.10.2.1. Hypermarkets and Supermarkets

12.10.2.2. Pharmaceutical and Drug Stores

12.10.2.3. Other Retail Stores

12.11. Wipes Market Size (US$ Bn) (Mn Units) Forecast, by Country, 2017 – 2027

12.11.1. The U.S.

12.11.2. Canada

12.11.3. Rest of North America

12.12. Incremental Opportunity Analysis

13. Europe Wipes Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Price

13.3. Key Trends Analysis

13.3.1. Demand Side Analysis

13.3.2. Supply Side Analysis

13.4. Brand Analysis

13.5. Consumer Buying Behavior Analysis

13.6. Wipes Market Size (US$ Mn and Million Units) Forecast, By Type, 2017 – 2031

13.6.1. Wet Wipes

13.6.2. Dry Wipes

13.7. Wipes Market Size (US$ Mn and Million Units) Forecast, By Usability, 2017 – 2031

13.7.1. Disposable

13.7.2. Reusable

13.8. Wipes Market Size (US$ Mn and Million Units) Forecast, By Material, 2017 – 2031

13.8.1. Cotton

13.8.2. Polyester

13.8.3. Viscose

13.8.4. Others

13.9. Wipes Market Size (US$ Mn and Million Units) Forecast, By Application, 2017 – 2031

13.9.1. Personal Care

13.9.1.1. Baby Wipes

13.9.1.2. Cleansing Wipes

13.9.1.3. Personal Hygiene Wipes

13.9.1.4. Pet Wipes

13.9.1.5. Others

13.9.2. Household and Home Cleaning

13.9.2.1. Kitchen Wipes

13.9.2.2. Bathroom Wipes

13.9.2.3. Food Service Wipes

13.9.2.4. Others

13.9.3. Industrial Wipes

13.10. Wipes Market Size (US$ Mn and Million Units) Forecast, By Distribution Channel, 2017 – 2031

13.10.1. Online

13.10.1.1. E-commerce Websites

13.10.1.2. Company-owned Websites

13.10.2. Offline

13.10.2.1. Hypermarkets and Supermarkets

13.10.2.2. Pharmaceutical and Drug Stores

13.10.2.3. Other Retail Stores

13.11. Wipes Market Size (US$ Bn) (Mn Units) Forecast, by Country, 2017 – 2031

13.11.1. U.K.

13.11.2. Germany

13.11.3. France

13.11.4. Rest of Europe

13.12. Incremental Opportunity Analysis

14. Asia Pacific Wipes Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Price

14.3. Key Trends Analysis

14.3.1. Demand Side Analysis

14.3.2. Supply Side Analysis

14.4. Brand Analysis

14.5. Consumer Buying Behavior Analysis

14.6. Wipes Market Size (US$ Mn and Million Units) Forecast, By Type, 2017 – 2031

14.6.1. Wet Wipes

14.6.2. Dry Wipes

14.7. Wipes Market Size (US$ Mn and Million Units) Forecast, By Usability, 2017 – 2031

14.7.1. Disposable

14.7.2. Reusable

14.8. Wipes Market Size (US$ Mn and Million Units) Forecast, By Material, 2017 – 2031

14.8.1. Cotton

14.8.2. Polyester

14.8.3. Viscose

14.8.4. Others

14.9. Wipes Market Size (US$ Mn and Million Units) Forecast, By Application, 2017 – 2031

14.9.1. Personal Care

14.9.1.1. Baby Wipes

14.9.1.2. Cleansing Wipes

14.9.1.3. Personal Hygiene Wipes

14.9.1.4. Pet Wipes

14.9.1.5. Others

14.9.2. Household and Home Cleaning

14.9.2.1. Kitchen Wipes

14.9.2.2. Bathroom Wipes

14.9.2.3. Food Service Wipes

14.9.2.4. Others

14.9.3. Industrial Wipes

14.10. Wipes Market Size (US$ Mn and Million Units) Forecast, By Distribution Channel, 2017 – 2031

14.10.1. Online

14.10.1.1. E-commerce Websites

14.10.1.2. Company-owned Websites

14.10.2. Offline

14.10.2.1. Hypermarkets and Supermarkets

14.10.2.2. Pharmaceutical and Drug Stores

14.10.2.3. Other Retail Stores

14.11. Wipes Market Size (US$ Bn) (Mn Units) Forecast, by Country, 2017 – 2031

14.11.1. China

14.11.2. India

14.11.3. Japan

14.11.4. Rest of Asia Pacific

14.12. Incremental Opportunity Analysis

15. Middle East & Africa Wipes Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Price

15.3. Key Trends Analysis

15.3.1. Demand Side Analysis

15.3.2. Supply Side Analysis

15.4. Brand Analysis

15.5. Consumer Buying Behavior Analysis

15.6. Wipes Market Size (US$ Mn and Million Units) Forecast, By Type, 2017 – 2031

15.6.1. Wet Wipes

15.6.2. Dry Wipes

15.7. Wipes Market Size (US$ Mn and Million Units) Forecast, By Usability, 2017 – 2031

15.7.1. Disposable

15.7.2. Reusable

15.8. Wipes Market Size (US$ Mn and Million Units) Forecast, By Material, 2017 – 2031

15.8.1. Cotton

15.8.2. Polyester

15.8.3. Viscose

15.8.4. Others

15.9. Wipes Market Size (US$ Mn and Million Units) Forecast, By Application, 2017 – 2031

15.9.1. Personal Care

15.9.1.1. Baby Wipes

15.9.1.2. Cleansing Wipes

15.9.1.3. Personal Hygiene Wipes

15.9.1.4. Pet Wipes

15.9.1.5. Others

15.9.2. Household and Home Cleaning

15.9.2.1. Kitchen Wipes

15.9.2.2. Bathroom Wipes

15.9.2.3. Food Service Wipes

15.9.2.4. Others

15.9.3. Industrial Wipes

15.10. Wipes Market Size (US$ Mn and Million Units) Forecast, By Distribution Channel, 2017 – 2031

15.10.1. Online

15.10.1.1. E-commerce Websites

15.10.1.2. Company-owned Websites

15.10.2. Offline

15.10.2.1. Hypermarkets and Supermarkets

15.10.2.2. Pharmaceutical and Drug Stores

15.10.2.3. Other Retail Stores

15.11. Wipes Market Size (US$ Bn) (Mn Units) Forecast, by Country, 2017 – 2031

15.11.1. GCC

15.11.2. South Africa

15.11.3. Rest of Middle East & Africa

15.12. Incremental Opportunity Analysis

16. South America Wipes Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Price Trend Analysis

16.2.1. Weighted Average Price

16.3. Key Trends Analysis

16.3.1. Demand Side Analysis

16.3.2. Supply Side Analysis

16.4. Brand Analysis

16.5. Consumer Buying Behavior Analysis

16.6. Wipes Market Size (US$ Mn and Million Units) Forecast, By Type, 2017 – 2031

16.6.1. Wet Wipes

16.6.2. Dry Wipes

16.7. Wipes Market Size (US$ Mn and Million Units) Forecast, By Usability, 2017 – 2031

16.7.1. Disposable

16.7.2. Reusable

16.8. Wipes Market Size (US$ Mn and Million Units) Forecast, By Material, 2017 – 2031

16.8.1. Cotton

16.8.2. Polyester

16.8.3. Viscose

16.8.4. Others

16.9. Wipes Market Size (US$ Mn and Million Units) Forecast, By Application, 2017 – 2031

16.9.1. Personal Care

16.9.1.1. Baby Wipes

16.9.1.2. Cleansing Wipes

16.9.1.3. Personal Hygiene Wipes

16.9.1.4. Pet Wipes

16.9.1.5. Others

16.9.2. Household and Home Cleaning

16.9.2.1. Kitchen Wipes

16.9.2.2. Bathroom Wipes

16.9.2.3. Food Service Wipes

16.9.2.4. Others

16.9.3. Industrial Wipes

16.10. Wipes Market Size (US$ Mn and Million Units) Forecast, By Distribution Channel, 2017 – 2031

16.10.1. Online

16.10.1.1. E-commerce Websites

16.10.1.2. Company-owned Websites

16.10.2. Offline

16.10.2.1. Hypermarkets and Supermarkets

16.10.2.2. Pharmaceutical and Drug Stores

16.10.2.3. Other Retail Stores

16.11. Wipes Market Size (US$ Bn) (Mn Units) Forecast, by Country, 2017 – 2031

16.11.1. Brazil

16.11.2. Rest of South America

16.12. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Market Player – Competition Dashboard

17.2. Market Share Analysis – 2022 (%)

17.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

17.3.1. Procter & Gamble

17.3.1.1. Details – Company Overview

17.3.1.2. Sales Area/Geographical Presence

17.3.1.3. Revenue

17.3.1.4. Strategy & Business Overview

17.3.2. S. C. Johnson & Son

17.3.2.1. Details – Company Overview

17.3.2.2. Sales Area/Geographical Presence

17.3.2.3. Revenue

17.3.2.4. Strategy & Business Overview

17.3.3. Kimberly-Clark Corporation

17.3.3.1. Details – Company Overview

17.3.3.2. Sales Area/Geographical Presence

17.3.3.3. Revenue

17.3.3.4. Strategy & Business Overview

17.3.4. Reckitt Benckiser Group plc

17.3.4.1. Details – Company Overview

17.3.4.2. Sales Area/Geographical Presence

17.3.4.3. Revenue

17.3.4.4. Strategy & Business Overview

17.3.5. Weiman Products, LLC.

17.3.5.1. Details – Company Overview

17.3.5.2. Sales Area/Geographical Presence

17.3.5.3. Revenue

17.3.5.4. Strategy & Business Overview

17.3.6. Rockline Industries

17.3.6.1. Details – Company Overview

17.3.6.2. Sales Area/Geographical Presence

17.3.6.3. Revenue

17.3.6.4. Strategy & Business Overview

17.3.7. 3M Manufacturing Company

17.3.7.1. Details – Company Overview

17.3.7.2. Sales Area/Geographical Presence

17.3.7.3. Revenue

17.3.7.4. Strategy & Business Overview

17.3.8. DuPont de Nemours, Inc.

17.3.8.1. Details – Company Overview

17.3.8.2. Sales Area/Geographical Presence

17.3.8.3. Revenue

17.3.8.4. Strategy & Business Overview

17.3.9. Ecolab Inc.

17.3.9.1. Details – Company Overview

17.3.9.2. Sales Area/Geographical Presence

17.3.9.3. Revenue

17.3.9.4. Strategy & Business Overview

17.3.10. The Clorox Company

17.3.10.1. Details – Company Overview

17.3.10.2. Sales Area/Geographical Presence

17.3.10.3. Revenue

17.3.10.4. Strategy & Business Overview

18. Key Takeaways

List of Tables

Table 1: Global Wipes Market by Type, Million Units 2017-2031

Table 2: Global Wipes Market by Type, US$ Mn 2017-2031

Table 3: Global Wipes Market by usability, Million Units 2017-2031

Table 4: Global Wipes Market by usability, US$ Mn 2017-2031

Table 5: Global Wipes Market by material, Million Units 2017-2031

Table 6: Global Wipes Market by material, US$ Mn 2017-2031

Table 7: Global Wipes Market by Application, Million Units, 2017-2031

Table 8: Global Wipes Market by Application, US$ Mn 2017-2031

Table 9: Global Wipes Market by Distribution Channel, Million Units, 2017-2031

Table 10: Global Wipes Market by Distribution Channel, US$ Mn 2017-2031

Table 11: Global Wipes Market by Region, Million Units, 2017-2031

Table 12: Global Wipes Market by Region, US$ Mn 2017-2031

Table 13: North America Wipes Market by Type, Million Units 2017-2031

Table 14: North America Wipes Market by Type, US$ Mn 2017-2031

Table 15: North America Wipes Market by usability, Million Units 2017-2031

Table 16: North America Wipes Market by usability, US$ Mn 2017-2031

Table 17: North America Wipes Market by Material, Million Units 2017-2031

Table 18: North America Wipes Market by Material, US$ Mn 2017-2031

Table 19: North America Wipes Market by Application, Million Units, 2017-2031

Table 20: North America Wipes Market by Application, US$ Mn 2017-2031

Table 21: North America Wipes Market by Distribution Channel, Million Units, 2017-2031

Table 22: North America Wipes Market by Distribution Channel, US$ Mn 2017-2031

Table 23: Europe Wipes Market by Type, Million Units 2017-2031

Table 24: Europe Wipes Market by Type, US$ Mn 2017-2031

Table 25: Europe Wipes Market by usability, Million Units 2017-2031

Table 26: Europe Wipes Market by usability, US$ Mn 2017-2031

Table 27: Europe Wipes Market by Material, Million Units 2017-2031

Table 28: Europe Wipes Market by Material, US$ Mn 2017-2031

Table 29: Europe Wipes Market by Application, Million Units, 2017-2031

Table 30: Europe Wipes Market by Application, US$ Mn 2017-2031

Table 31: Europe Wipes Market by Distribution Channel, Million Units, 2017-2031

Table 32: Europe Wipes Market by Distribution Channel, US$ Mn 2017-2031

Table 33: Asia-Pacific Wipes Market by Type, Million Units 2017-2031

Table 34: Asia-Pacific Wipes Market by Type, US$ Mn 2017-2031

Table 35: Asia-Pacific Wipes Market by usability, Million Units 2017-2031

Table 36: Asia-Pacific Wipes Market by usability, US$ Mn 2017-2031

Table 37: Asia-Pacific Wipes Market by Material, Million Units 2017-2031

Table 38: Asia-Pacific Wipes Market by Material, US$ Mn 2017-2031

Table 39: Asia-Pacific Wipes Market by Application, Million Units, 2017-2031

Table 40: Asia-Pacific Wipes Market by Application, US$ Mn 2017-2031

Table 41: Asia-Pacific Wipes Market by Distribution Channel, Million Units, 2017-2031

Table 42: Asia-Pacific Wipes Market by Distribution Channel, US$ Mn 2017-2031

Table 43: Middle East & Africa Wipes Market by Type, Million Units 2017-2031

Table 44: Middle East & Africa Wipes Market by Type, US$ Mn 2017-2031

Table 45: Middle East & Africa Wipes Market by usability, Million Units 2017-2031

Table 46: Middle East & Africa Wipes Market by usability, US$ Mn 2017-2031

Table 47: Middle East & Africa Wipes Market by Material, Million Units 2017-2031

Table 48: Middle East & Africa Wipes Market by Material, US$ Mn 2017-2031

Table 49: Middle East & Africa Wipes Market by Application, Million Units, 2017-2031

Table 50: Middle East & Africa Wipes Market by Application, US$ Mn 2017-2031

Table 51: Middle East & Africa Wipes Market by Distribution Channel, Million Units, 2017-2031

Table 52: Middle East & Africa Wipes Market by Distribution Channel, US$ Mn 2017-2031

Table 53: South America Wipes Market by Type, Million Units 2017-2031

Table 54: South America Wipes Market by Type, US$ Mn 2017-2031

Table 55: South America Wipes Market by usability, Million Units 2017-2031

Table 56: South America Wipes Market by usability, US$ Mn 2017-2031

Table 57: South America Wipes Market by Material, Million Units 2017-2031

Table 58: South America Wipes Market by Material, US$ Mn 2017-2031

Table 59: South America Wipes Market by Application, Million Units, 2017-2031

Table 60: South America Wipes Market by Application, US$ Mn 2017-2031

Table 61: South America Wipes Market by Distribution Channel, Million Units, 2017-2031

Table 62: South America Wipes Market by Distribution Channel, US$ Mn 2017-2031

List of Figures

Figure 1: Global Wipes Market Projections, by Type, Million Units 2017-2031

Figure 2: Global Wipes Market Projections, by Type, US$ Mn 2017-2031

Figure 3: Global Wipes Market, Incremental Opportunity, by Type, US$ Mn 2023 -2031

Figure 4: Global Wipes Market Projections, Usability, Million Units, 2017-2031

Figure 5: Global Wipes Market Projections, Usability, US$ Mn 2017-2031

Figure 6: Global Wipes Market, Incremental Opportunity, Usability, US$ Mn 2023 -2031

Figure 7: Global Wipes Market Projections, by Material, Million Units, 2017-2031

Figure 8: Global Wipes Market Projections, by Material, US$ Mn 2017-2031

Figure 9: Global Wipes Market, Incremental Opportunity, by Material, US$ Mn 2023 -2031

Figure 10: Global Wipes Market Projections, by Application, Million Units, 2017-2031

Figure 11: Global Wipes Market Projections, by Application, US$ Mn 2017-2031

Figure 12: Global Wipes Market, Incremental Opportunity, by Application, US$ Mn 2023 -2031

Figure 13: Global Wipes Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 14: Global Wipes Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 15: Global Wipes Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023 -2031

Figure 16: Global Wipes Market Projections, by Region, Million Units, 2017-2031

Figure 17: Global Wipes Market Projections, by Region, US$ Mn 2017-2031

Figure 18: Global Wipes Market, Incremental Opportunity, by Region, US$ Mn 2023 -2031

Figure 19: North America Wipes Market Projections, by Type, Million Units 2017-2031

Figure 20: North America Wipes Market Projections, by Type, US$ Mn 2017-2031

Figure 21: North America Wipes Market, Incremental Opportunity, by Type, US$ Mn 2023 -2031

Figure 22: North America Wipes Market Projections, Usability, Million Units, 2017-2031

Figure 23: North America Wipes Market Projections, Usability, US$ Mn 2017-2031

Figure 24: North America Wipes Market, Incremental Opportunity, Usability, US$ Mn 2023 -2031

Figure 25: North America Wipes Market Projections, by Material, Million Units, 2017-2031

Figure 26: North America Wipes Market Projections, by Material, US$ Mn 2017-2031

Figure 27: North America Wipes Market, Incremental Opportunity, by Material, US$ Mn 2023 -2031

Figure 28: North America Wipes Market Projections, by Application, Million Units, 2017-2031

Figure 29: North America Wipes Market Projections, by Application, US$ Mn 2017-2031

Figure 30: North America Wipes Market, Incremental Opportunity, by Application, US$ Mn 2023 -2031

Figure 31: North America Wipes Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 32: North America Wipes Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 33: North America Wipes Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023 -2031

Figure 34: Europe Wipes Market Projections, by Type, Million Units 2017-2031

Figure 35: Europe Wipes Market Projections, by Type, US$ Mn 2017-2031

Figure 36: Europe Wipes Market, Incremental Opportunity, by Type, US$ Mn 2023 -2031

Figure 37: Europe Wipes Market Projections, Usability, Million Units, 2017-2031

Figure 38: Europe Wipes Market Projections, Usability, US$ Mn 2017-2031

Figure 39: Europe Wipes Market, Incremental Opportunity, Usability, US$ Mn 2023 -2031

Figure 40: Europe Wipes Market Projections, by Material, Million Units, 2017-2031

Figure 41: Europe Wipes Market Projections, by Material, US$ Mn 2017-2031

Figure 42: Europe Wipes Market, Incremental Opportunity, by Material, US$ Mn 2023 -2031

Figure 43: Europe Wipes Market Projections, by Application, Million Units, 2017-2031

Figure 44: Europe Wipes Market Projections, by Application, US$ Mn 2017-2031

Figure 45: Europe Wipes Market, Incremental Opportunity, by Application, US$ Mn 2023 -2031

Figure 46: Europe Wipes Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 47: Europe Wipes Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 48: Europe Wipes Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023 -2031

Figure 49: Asia-Pacific Wipes Market Projections, by Type, Million Units 2017-2031

Figure 50: Asia-Pacific Wipes Market Projections, by Type, US$ Mn 2017-2031

Figure 51: Asia-Pacific Wipes Market, Incremental Opportunity, by Type, US$ Mn 2023 -2031

Figure 52: Asia-Pacific Wipes Market Projections, Usability, Million Units, 2017-2031

Figure 53: Asia-Pacific Wipes Market Projections, Usability, US$ Mn 2017-2031

Figure 54: Asia-Pacific Wipes Market, Incremental Opportunity, Usability, US$ Mn 2023 -2031

Figure 55: Asia-Pacific Wipes Market Projections, by Material, Million Units, 2017-2031

Figure 56: Asia-Pacific Wipes Market Projections, by Material, US$ Mn 2017-2031

Figure 57: Asia-Pacific Wipes Market, Incremental Opportunity, by Material, US$ Mn 2023 -2031

Figure 58: Asia-Pacific Wipes Market Projections, by Application, Million Units, 2017-2031

Figure 59: Asia-Pacific Wipes Market Projections, by Application, US$ Mn 2017-2031

Figure 60: Asia-Pacific Wipes Market, Incremental Opportunity, by Application, US$ Mn 2023 -2031

Figure 61: Asia-Pacific Wipes Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 62: Asia-Pacific Wipes Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 63: Asia-Pacific Wipes Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023 -2031

Figure 64: Middle East & Africa Wipes Market Projections, by Type, US$ Mn 2017-2031

Figure 65: Middle East & Africa Wipes Market, Incremental Opportunity, by Type, US$ Mn 2023 -2031

Figure 66: Middle East & Africa Wipes Market Projections, Usability, Million Units, 2017-2031

Figure 67: Middle East & Africa Wipes Market Projections, Usability, US$ Mn 2017-2031

Figure 68: Middle East & Africa Wipes Market, Incremental Opportunity, Usability, US$ Mn 2023 -2031

Figure 69: Middle East & Africa Wipes Market Projections, by Material, Million Units, 2017-2031

Figure 70: Middle East & Africa Wipes Market Projections, by Material, US$ Mn 2017-2031

Figure 71: Middle East & Africa Wipes Market, Incremental Opportunity, by Material, US$ Mn 2023 -2031

Figure 72: Middle East & Africa Wipes Market Projections, by Application, Million Units, 2017-2031

Figure 73: Middle East & Africa Wipes Market Projections, by Application, US$ Mn 2017-2031

Figure 74: Middle East & Africa Wipes Market, Incremental Opportunity, by Application, US$ Mn 2023 -2031

Figure 75: Middle East & Africa Wipes Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 76: Middle East & Africa Wipes Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 77: Middle East & Africa Wipes Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023 -2031

Figure 78: South America Wipes Market Projections, by Type, US$ Mn 2017-2031

Figure 79: South America Wipes Market, Incremental Opportunity, by Type, US$ Mn 2023 -2031

Figure 80: South America Wipes Market Projections, Usability, Million Units, 2017-2031

Figure 81: South America Wipes Market Projections, Usability, US$ Mn 2017-2031

Figure 82: South America Wipes Market, Incremental Opportunity, Usability, US$ Mn 2023 -2031

Figure 83: South America Wipes Market Projections, by Material, Million Units, 2017-2031

Figure 84: South America Wipes Market Projections, by Material, US$ Mn 2017-2031

Figure 85: South America Wipes Market, Incremental Opportunity, by Material, US$ Mn 2023 -2031

Figure 86: South America Wipes Market Projections, by Application, Million Units, 2017-2031

Figure 87: South America Wipes Market Projections, by Application, US$ Mn 2017-2031

Figure 88: South America Wipes Market, Incremental Opportunity, by Application, US$ Mn 2023 -2031

Figure 89: South America Wipes Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 90: South America Wipes Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 91: South America Wipes Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023 -2031