Wind power is a form of energy conversion, where the turbines transform the kinetic energy of wind into mechanical or electrical energy. This transformation of energy is considered a renewable energy source. The energy from wind is generated for centuries for tasks such as grinding grain and pumping water. Current commercial wind turbines generate electricity by using rotational energy to run an electrical generator. They are usually made of a rotor or blade. Wind power is one of the fastest-growing renewable energy technologies and offers several benefits with low air pollution and zero water consumption. Moreover, wind energy is also the most affordable source of power creation. The wind turbine used to generate energy from wind can operate for more than 20 years once installed. All these factors are contributing to making wind energy an ideal alternative to fuel, which is one of the significant factors driving the wind power market.

Before five years, wind energy was contributing around 4% of the world’s total electricity. Since then, the generation of wind power has been increased dramatically, owing to concerns over the price of petroleum and impacts of fossil fuel combustion on the weather and environment. China is one of the nations with the most number of installed wind capacity. In 2016, China was generating 168.7 GW of energy, which increased to 281 GW in 2020. With China's new capacity of generating energy from wind, they are the largest in the world by a wide margin. Moreover, with steady economic growth and rise in industrial demand, the demand for electricity has increased majorly. Moreover, fast-developing industries and rapid urbanization in China are most likely to increase the demand for electricity. This will result in an increased growth rate for wind power market in China and globally in the upcoming future.

The COVID-19 pandemic has had a wide and devastating impact on global industries, including the wind power market. Most producers had shut down their plants at the start of 2020, resuming production on a limited scale. Regulation to contain the spread of the virus has caused traffic bans and quarantine measures in China, impacting the supply chain. The production capacity in regards to elements and turbines has declined drastically. Loads of wind turbines are expected to further decline during the year 2021. The wind project installation in China is growing much slower than predicted. Moreover, the global COVID-19 outbreak has worsened the previously severe shortage of key components, adding pressure on wind power development in China. Furthermore, restrictions on global trade impacted the supply chain of raw materials and technology, which China is heavily dependent on other countries. All these factors contributed to the hindrance in the wind power market amid the pandemic.

Although most facilities are not yet functioning at full capacity, and many workers and employees are working from home, the restoration of manufacturing suggests that the recovery to normal has already begun. However, the impact caused during the shutdown of global industries will take a while to recover. Moreover, restraints on trade activities, travel, and border closings have distinctly decreased the energy demand in various industries, lowering the consumption of wind power. Developing macroeconomic hurdles may provoke the dissolution or suspension of investment decisions for both large and small-scale designs under development. However, with rising population and energy demand, the wind power market is anticipated to increase its production to full capacity in order to flatten the demand curve. The post-COVID-19 pandemic is expected to bring new opportunities in the regional market, as all the closed businesses will require energy to restore their processes.

Wind power is one of the clean sources of renewable energy that does not contribute to air or water pollution. The operational costs are almost nothing once a turbine is installed. In addition, government incentives in China to encourage wind energy development and production to make turbines cheaper are major factors for an increasing number of wind power sources in China. Moreover, wind power is one of the cheapest land-based utility energy sources available in present times. The electricity from the wind farms is usually sold at a steady price, while other energy source prices vary with time and circumstances. Most other power plants rely on the combustion of fossil fuels, such as coal or natural gas, which release particulate matter, nitrogen oxides, and sulfur dioxide that cause human health problems and economic damages. Wind power does not contribute to air pollution as well as does not allow atmospheric emissions that cause acid rain, smog, or greenhouse gases.

The wind is a form of solar energy, as it is caused by the heating of the atmosphere by the sun, while the earth is rotating with its surface irregularities. Thus, the infinite source of wind can be transformed into energy for a long time. The increased production of wind energy is also proving propitious in the economy in rural areas, where most of the best wind sites are found. Moreover, China has strict policies regarding limiting carbon dioxide emission and the government is offering incentives to adopt renewable energy sources. All these factors are anticipated to fuel the growth of the wind power market during the forecast period.

The wind power market is estimated to exceed US$ 1.5 Trn by 2031, expanding at a CAGR of ~10% during the forecast period. The rising need for electricity while the country is developing at a rapid pace is majorly contributing to the growth rate. Moreover, the Government of China has plans to increase the share of non-fossil fuels in primary energy consumption to around 25% by 2030. This is most likely to improve the demand for wind power equipment in the upcoming period. The plans include a road map to install 1200 GW of wind and solar energy by the end of the forecast period.

Analysts’ Viewpoint

China is a global leader in the generation of wind power with the largest installed capacity. The long landmass and coastline contribute significantly to the wind power generation. The exploitable capacity of China in the sea is around 200 GW and it is 2380 GW on land. With this amount of capacity, the efficiency to create wind power has a tremendous potential to increase in the upcoming years. In addition, presently, the wind is the third-largest source of electricity in China. With government plans to increase the wind power in the country, the growth rate for China wind power market is expected to rise during the projected period.

1. Executive Summary

1.1. Market Outlook

1.2. Key Facts and Figures

1.3. Key Trends

2. Market Overview

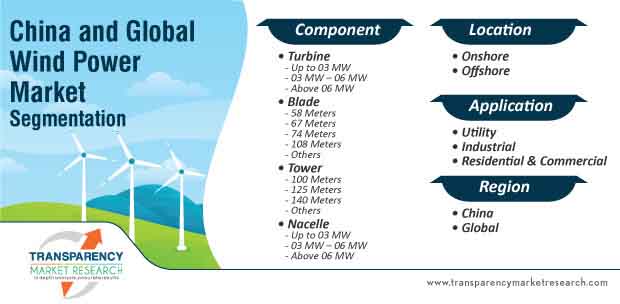

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Dynamics

2.4. Drivers and Restraints Snapshot Analysis

2.4.1.1. Drivers

2.4.1.2. Restraints

2.4.1.3. Opportunities

2.5. Regulatory Scenario

2.6. Porter’s Five Forces Analysis

2.6.1. Threat of Substitutes

2.6.2. Bargaining Power of Buyers

2.6.3. Bargaining Power of Suppliers

2.6.4. Threat of New Entrants

2.6.5. Degree of Competition

2.7. Value Chain Analysis

3. CAPEX Analysis

4. COVID-19 Impact Analysis

5. China Wind Power Market Volume (Units) and Value (US$ Bn) Analysis, by Component

5.1. Key Findings and Introduction

5.2. China Wind Power Market Volume (Units) and Value (US$ Bn) Forecast, by Component, 2020 - 2031

5.2.1. China Wind Power Market Volume and Value (US$ Bn) Forecast, by Turbine, 2020 – 2031

5.2.1.1. China Wind Power Market Volume and Value (US$ Bn) Forecast, Up to 03 MW, 2020 – 2031

5.2.1.2. China Wind Power Market Volume and Value (US$ Bn) Forecast, 03 MW – 06 MW, 2020 – 2031

5.2.1.3. China Wind Power Market Volume and Value (US$ Bn) Forecast, Above 06 MW, 2020 - 2031

5.2.2. China Wind Power Market Volume (Units) and Value (US$ Bn) Forecast, by Blade, 2020 – 2031

5.2.2.1. China Wind Power Market Volume (Units) and Value (US$ Bn) Forecast, 58 Meters, 2020 – 2031

5.2.2.2. China Wind Power Market Volume (Units) and Value (US$ Bn) Forecast, 67 Meters, 2020 – 2031

5.2.2.3. China Wind Power Market Volume (Units) and Value (US$ Bn) Forecast, 74 Meters, 2020 – 2031

5.2.2.4. China Wind Power Market Volume (Units) and Value (US$ Bn) Forecast, 108 Meters, 2020 – 2031

5.2.2.5. China Wind Power Market Volume (Units) and Value (US$ Bn) Forecast, Others, 2020 – 2031

5.2.3. China Wind Power Market Volume (Units) and Value (US$ Bn) Forecast, by Tower, 2020 – 2031

5.2.3.1. China Wind Power Market Volume (Units) and Value (US$ Bn) Forecast, 100 Meters, 2020 – 2031

5.2.3.2. China Wind Power Market Volume (Units) and Value (US$ Bn) Forecast, 125 Meters, 2020 – 2031

5.2.3.3. China Wind Power Market Volume (Units) and Value (US$ Bn) Forecast, 140 Meters, 2020 – 2031

5.2.3.4. China Wind Power Market Volume (Units) and Value (US$ Bn) Forecast, Others, 2020 – 2031

5.2.4. China Wind Power Market Volume (Units) and Value (US$ Bn) Forecast, by Nacelle, 2020 – 2031

5.2.4.1. China Wind Power Market Volume (Units) and Value (US$ Bn) Forecast, Up to 03 MW, 2020 – 2031

5.2.4.2. China Wind Power Market Volume (Units) and Value (US$ Bn) Forecast, 03 MW – 06 MW, 2020 – 2031

5.2.4.3. China Wind Power Market Volume (Units) and Value (US$ Bn) Forecast, Above 06 MW, 2020 – 2031

5.3. China Wind Power Market Attractive Analysis, by Component

6. China Wind Power Market Volume (MW) and Value (US$ Bn) Analysis, by Location

6.1. Key Findings and Introduction

6.2. China Wind Power Market Volume (MW) and Value (US$ Bn) Forecast, by Location, 2020 - 2031

6.2.1. China Wind Power Market Volume (MW) and Value (US$ Bn) Forecast, by Onshore, 2020 - 2031

6.2.2. China Wind Power Market Volume (MW) and Value (US$ Bn) Forecast, by Offshore, 2020 - 2031

6.3. China Wind Power Market Attractive Analysis, by Location

7. China Wind Power Market Volume (MW) and Value (US$ Bn) Analysis, by Application

7.1. Key Findings and Introduction

7.2. China Wind Power Market Volume (MW) and Value (US$ Bn) Forecast, by Application, 2020 - 2031

7.2.1. China Wind Power Market Volume (MW) and Value (US$ Bn) Forecast, by Utility, 2020 - 2031

7.2.2. China Wind Power Market Volume (MW) and Value (US$ Bn) Forecast, by Industrial, 2020 - 2031

7.2.3. China Wind Power Market Volume (MW) and Value (US$ Bn) Forecast, by Residential & Commercial, 2020 - 2031

7.3. China Wind Power Market Attractive Analysis, by Application

8. Global Wind Power Market Volume (MW) and Value (US$ Bn) Analysis, by Region

8.1. Global Wind Power Market Volume (MW) and Value (US$ Bn) Forecast, by Region

8.1.1. North America

8.1.1.1. U.S.

8.1.1.2. Canada

8.1.2. Europe

8.1.2.1. Germany

8.1.2.2. U.K.

8.1.2.3. France

8.1.2.4. Italy

8.1.2.5. Spain

8.1.2.6. Russia & CIS

8.1.2.7. Rest of Europe

8.1.3. Asia Pacific

8.1.3.1. China

8.1.3.2. India

8.1.3.3. Japan

8.1.3.4. ASEAN

8.1.3.5. Rest of Asia Pacific

8.1.4. Latin America

8.1.4.1. Brazil

8.1.4.2. Mexico

8.1.4.3. Rest of Latin America

8.1.5. Middle East & Africa

8.1.5.1. GCC

8.1.5.2. South Africa

8.1.5.3. Rest of Middle East & Africa

8.2. Global Wind Power Market Attractiveness Analysis, by Region

9. Competition Landscape

9.1. Competition Matrix

9.2. China and Global Wind Power Market Share Analysis, by Company (2020)

9.3. Market Footprint Analysis

9.4. Company Profiles

9.4.1. HZ Windpower NA

9.4.1.1. Company Details

9.4.1.2. Company Description

9.4.1.3. Business Overview

9.4.2. GOLDWIND

9.4.2.1. Company Details

9.4.2.2. Company Description

9.4.2.3. Business Overview

9.4.2.4. Financial Details

9.4.2.5. Strategic Overview

9.4.3. Sinovel Wind Group Co., Ltd.

9.4.3.1. Company Details

9.4.3.2. Company Description

9.4.3.3. Business Overview

9.4.4. Mingyang Smart Energy

9.4.4.1. Company Details

9.4.4.2. Company Description

9.4.4.3. Business Overview

9.4.5. ENVISION GROUP

9.4.5.1. Company Details

9.4.5.2. Company Description

9.4.5.3. Business Overview

9.4.6. Vestas

9.4.6.1. Company Details

9.4.6.2. Company Description

9.4.6.3. Business Overview

9.4.6.4. Financial Details

9.4.6.5. Strategic Overview

9.4.7. Siemens Gamesa Renewable Energy.

9.4.7.1. Company Details

9.4.7.2. Company Description

9.4.7.3. Business Overview

9.4.7.4. Financial Details

9.4.7.5. Strategic Overview

9.4.8. Suzlon Energy Limited

9.4.8.1. Company Details

9.4.8.2. Company Description

9.4.8.3. Business Overview

9.4.8.4. Financial Details

9.4.8.5. Strategic Overview

9.4.9. GENERAL ELECTRIC

9.4.9.1. Company Details

9.4.9.2. Company Description

9.4.9.3. Business Overview

9.4.9.4. Financial Details

9.4.9.5. Strategic Overview

9.4.10. Dongfang Electric Co. Ltd.

9.4.10.1. Company Details

9.4.10.2. Company Description

9.4.10.3. Business Overview

9.4.11. CRRC Corporation Limited

9.4.11.1. Company Details

9.4.11.2. Company Description

9.4.11.3. Business Overview

9.4.11.4. Financial Details

9.4.11.5. Strategic Overview

10. Primary Research – Key Insights

11. Appendix

11.1. Research Methodology and Assumptions

List of Tables

Table 01: China Wind Power Market Volume (Units) Forecast, by Component, 2020–2031

Table 02: China Wind Power Market Value (US$ Bn) Forecast, by Component, 2020–2031

Table 03: China Wind Power Market Volume (MW) Forecast, by Location, 2020–2031

Table 04: China Wind Power Market Value (US$ Bn) Forecast, by Location, 2020–2031

Table 05: China Wind Power Market Volume (MW) Forecast, by Application, 2020–2031

Table 06: China Wind Power Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 07: Global Wind Power Market Volume (MW) Forecast, by Region, 2020–2031

Table 08: Global Wind Power Market Value (US$ Bn) Forecast, by Region, 2020–2031

Table 09: North America Wind Power Market Volume (MW) Forecast, by Country, 2020–2031

Table 10: North America Wind Power Market Value (US$ Bn) Forecast, by Country, 2020–2031

Table 11: Europe Wind Power Market Volume (MW) Forecast, by Country and Sub-region, 2020–2031

Table 12: Europe Wind Power Market Value (US$) Forecast, by Country and Sub-region, 2020–2031

Table 13: Asia Pacific Wind Power Market Volume (MW) Forecast, by Country and Sub-region, 2020–2031

Table 14: Asia Pacific Wind Power Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 15: Latin America Wind Power Market Volume (MW) Forecast, by Country and Sub-region, 2020–2031

Table 16: Latin America Wind Power Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 17: Middle East & Africa Wind Power Market Volume (MW) Forecast, by Country and Sub-region, 2020–2031

Table 18: Middle East & Africa Wind Power Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

List of Figures

Figure 01: China Wind Power Market Value Share Analysis, by Component

Figure 02: China Wind Power Market Attractiveness Analysis, by Component

Figure 03: China Wind Power Market Value Share Analysis, by Location

Figure 04: China Wind Power Market Attractiveness Analysis, by Location

Figure 05: China Wind Power Market Value Share Analysis, by Application

Figure 06: China Wind Power Market Attractiveness Analysis, by Application

Figure 07: Global Wind Power Market Share Analysis, by Region

Figure 08: Global Wind Power Market Attractiveness Analysis, by Region

Figure 09: North America Wind Power Market Share Analysis, by Country

Figure 10: North America Wind Power Market Attractiveness Analysis, by Country

Figure 11: Europe Wind Power Market Share Analysis, by Country and Sub-region

Figure 12: Europe Wind Power Market Attractiveness Analysis, by Country and Sub-region

Figure 13: Asia Pacific Wind Power Market Share Analysis, by Country and Sub-region

Figure 14: Asia Pacific Wind Power Market Attractiveness Analysis, by Country and Sub-region

Figure 15: Latin America Wind Power Market Share Analysis, by Country and Sub-region

Figure 16: Latin America Wind Power Market Attractiveness Analysis, by Country and Sub-region

Figure 17: Middle East & Africa Wind Power Market Share Analysis, by Country and Sub-region

Figure 18: Middle East & Africa Wind Power Market Attractiveness Analysis, by Country and Sub-region