White oak is used in winemaking to alter color, taste, tannin profile, and texture of the wine. Various domestic wines, bourbon, and other spirits are aged in white oak barrels to impart highly desirable qualities to the liquid contained. In order to resemble the qualities of white oak, manufacturers have introduced alternatives such as chips, spirals, or staves. White oak’s cellular arrangement allows small measures of oxygen to penetrate barrel staves and scatter its contents, which was lacking in the alternatives. Chemical reactions help qualify tannins from the wood and stabilize the color of the liquid. Producers are carbonizing and preserving the oak alternatives before production to impart fragrance and flavor. Liquor consumers across the world are showing an affinity toward flavorful and longer consumption time drinks, along with delightful flavors. Thus, the consumer knowledge for production quality is increasing and driving the white oak alternatives market in the upcoming future.

Quercus Alba, popularly known as white oak, dominates the whiskey industry due to its mandatory uses for new charred oak barrels for bourbon aging. However, white is not legally mandatory to use, but the availability and consumer preference for flavor has made it a de facto choice. Moreover, the barrels can be reused for a second life for other whiskeys and even for rum, brandy, or tequila. If the whiskey is not stored in barrels, it would lack the toasty, caramel, nutty, or vanilla notes that bring flavor to taste. As many individuals believe, without oak, the whiskey will not taste the same. Thus, due to increasing consumer preference for liquors preserved in oak barrels, the demand for the global white oak alternatives market is expected to shrink during the forecast period.

The COVID-19 pandemic has disrupted almost every type of industry as production reduced, customers got self-isolated at their homes, and the restrictions of global trade in several countries. The spread of coronavirus has severely impacted the white oak market due to stringent regulations for production and supply chain for finished wood products and interrelated markets for raw materials and inputs. Moreover, halted work for employee safety are resulting in low manufacturing outcomes, resulting in decreased demand for oak barrels as well as other finished wood products. Lockdowns and stay-at-home regulations have limited purchasing and availability of liquors in the market. As with fewer sales of liquor, new production batches of white oak have halted. However, the conditions are expected to improve post-pandemic as people with no current access to white oak alcohol will be looking to fulfill their desire, thus fueling the growth of the white oak alternatives market during the forecast period.

The impacts of COVID-19 can be observed in the packaging industry, owing to the consequences of self-isolation guidelines and therefore, manufacturers are moving supply chains away from Asia and transforming packaging materials used for essential commodities. This had led to a slowdown in the demand for white oak alternatives market. The recovery from the losses faced during the pandemic can be a hopeful scenario. Thus, growth in consumption of alcohol and increase in liquor consuming population are anticipated to propel the global white oak alternatives market during the forecast period.

In recent years, chips have been the most prevalent alternative both commercially and at home to impart white oak flavors. As white oak barrels can be expensive, with more weight, storage, care, spoilage, etc, consumers and producers are preferring the alternatives to save it all. Moreover, chips impart instant unattached and simple monochromatic flavor contours, leaving them bitter and harsh. Most styles of toasting chips allow a simple presence of a toasty flavor. However, with no complexity in the flavor as compared to actual barrels, the flavor is similar but not the same. Nevertheless, when used in combination with barrel aging, oak alternatives are a natural way to use complete oak to obtain a new variety of flavors that can improve the complexity of a spirit.

The popularity of white oak alternatives is very recent. Oak alternatives were unpopular and banned from being used in the winemaking or brewing processes in some nations. The U.S. and European Union discarded the restrictions to use oak chips few years ago. With the limited life span of white oak barrels and high maintenance cost to prevent contamination, the total production cost for alcoholic beverages increases. Thus, preserving spirits with oak alternatives is proving to be an efficient way and is anticipated to boost the global white oak alternatives market during the forecast period.

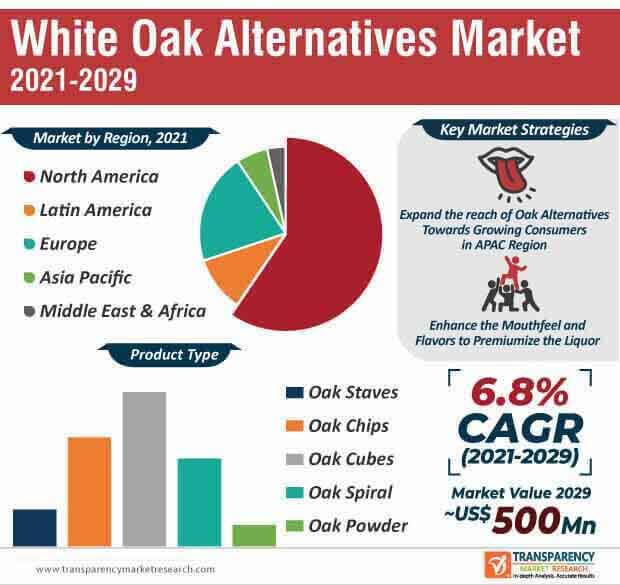

Oak is grown in a variety of regions differing in degrees of toast and forms. It affects the wine in almost every aspect of the mouthfeel. Oak alternatives resemble the mouthfeel most cost-effectively without using the oak barrels. However, an increasing number of people are limiting their alcohol consumption due to health and well-being concerns across the world. Thus, many individuals are attracted to low-alcoholic drinks without compromising quality or taste. This is possible due to the flavors and aroma induced by the oak alternatives in low-alcoholic drinks. Thus, the white oak alternatives market is expected to reach the revenue of US$ 470.8 Mn by 2029, at a CAGR of 6.8% during the forecast period.

White oak is preeminent hardwood from North America. The increased white oak production in the region is resulting in increased demand for white oak products. Thus, North America contributes significantly to the white oak alternatives market and is expected to rise in demand in the near future. Moreover, growing products appeal to consumers by emphasizing the superior quality of white oak is influencing European consumers toward white oak alternatives. The European white oak alternatives market is expected to reach US$ 100.1 Mn by the end of 2029.

Analysts’ Viewpoint

The world is witnessing an increased demand for alcoholic beverages, owing to rising population and lifestyle trends. On the other hand, an increasing number of people is lowering the alcohol content in their drinks due to growing health concerns and awareness. Hence, manufacturers offer white oak alternatives to provide the taste and aroma to the drinks without spending on expensive oak barrels. Moreover, the growing demand for premiumization of alcoholic beverages by consumers where oak alternatives play a meaningful role in improving the taste, aroma, and mouthfeel of alcohol is anticipated to drive the global white oak alternatives market during the forecast period.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

1.4. Opportunity Analysis

2. Market Viewpoint

2.1. Market Definition

2.2. Market Taxonomy

3. White Oak Alternatives Market Overview

3.1. Introduction

3.2. Global White Oak Alternatives Market Overview

3.3. Macro-economic Factors – Correlation Analysis

3.4. Forecast Factors – Relevance & Impact

3.5. White Oak Alternatives Market Value Chain Analysis

3.5.1. Exhaustive List of Active Participants

3.5.1.1. Manufacturers

3.5.1.2. Distributors/Retailers

3.5.1.3. End Use

3.5.2. Profitability Margins

4. Impact of COVID-19

4.1. Current Statistics and Probable Future Impact

4.2. Impact of COVID-19 on White Oak Alternatives Market

5. White Oak Alternatives Market Analysis

5.1. Pricing Analysis

5.1.1. Pricing Assumption

5.1.2. Price Projections By Region

5.2. Market Size (US$ Mn) and Forecast

5.2.1. Market Size and Y-o-Y Growth

5.2.2. Absolute $ Opportunity

6. White Oak Alternatives Market Dynamics

6.1. Drivers

6.2. Restraints

6.3. Opportunity Analysis

6.4. Trends

7. Global White Oak Alternatives Market Analysis and Forecast, By Product Type

7.1. Introduction

7.1.1. Market share and Basis Points (BPS) Analysis, By Product Type

7.1.2. Y-o-Y Growth Projections, By Product Type

7.2. Historical Market Value(US$ Mn) and Volume (Tonnes), 2016-2020, By Product Type

7.2.1. Oak Staves

7.2.2. Oak Chips

7.2.3. Oak Cubes

7.2.4. Oak Spiral

7.2.5. Oak Powder

7.3. Market Size (US$ Mn) and Volume (Tonnes) Forecast Analysis 2020-2030, By Product Type

7.3.1. Oak Staves

7.3.2. Oak Chips

7.3.3. Oak Cubes

7.3.4. Oak Spiral

7.3.5. Oak Powder

7.4. Market Attractiveness Analysis, By Product Type

8. Global White Oak Alternatives Market Analysis and Forecast, By End Use

8.1. Introduction

8.1.1. Market share and Basis Points (BPS) Analysis, By End Use

8.1.2. Y-o-Y Growth Projections, By End Use

8.2. Historical Market Value(US$ Mn) and Volume (Tonnes), 2016-2020, By End Use

8.2.1. Wine

8.2.2. Whiskey

8.2.3. Beer

8.2.4. Other Alcoholic Beverages

8.3. Market Size (US$ Mn) and Volume (Tonnes) Forecast Analysis 2020-2030, By End Use

8.3.1. Wine

8.3.2. Whiskey

8.3.3. Beer

8.3.4. Other Alcoholic Beverages

8.4. Market Attractiveness Analysis, By End Use

8.5. Prominent Trends

9. Global White Oak Alternatives Market Analysis and Forecast, By Region

9.1. Introduction

9.1.1. Market share and Basis Points (BPS) Analysis By Region

9.1.2. Y-o-Y Growth Projections By Region

9.2. Historical Market Value(US$ Mn) and Volume (Tonnes), 2016-2020, By Region

9.2.1. North America

9.2.2. Latin America

9.2.3. Europe

9.2.4. Asia Pacific

9.2.5. Middle East & Africa (MEA)

9.3. Market Size (US$ Mn) and Volume (Tonnes) Forecast Analysis 2020-2030 By Region

9.3.1. North America

9.3.2. Latin America

9.3.3. Europe

9.3.4. Asia Pacific

9.3.5. Middle East & Africa (MEA)

9.4. Market Attractiveness Analysis By Region

9.5. Prominent Trends

10. North America White Oak Alternatives Market Analysis and Forecast

10.1. Introduction

10.1.1. Market share and Basis Points (BPS) Analysis, By Country

10.1.2. Y-o-Y Growth Projections, By Country

10.2. Historical Market Value(US$ Mn) and Volume (Tonnes), 2016-2020, By Country

10.3. Market Size (US$ Mn) and Volume (Tonnes) Forecast Analysis 2021-2029, By Country

10.3.1. U.S.

10.3.2. Canada

10.4. Historical Market Value(US$ Mn) and Volume (Tonnes), 2016-2020, By Product Type

10.5. Market Size (US$ Mn) and Volume (Tonnes) Forecast Analysis 2021-2029, By Product Type

10.5.1. Oak Staves

10.5.2. Oak Chips

10.5.3. Oak Cubes

10.5.4. Oak Spiral

10.5.5. Oak Powder

10.6. Historical Market Value(US$ Mn) and Volume (Tonnes), 2016-2020, By End Use

10.7. Market Size (US$ Mn) and Volume (Tonnes) Forecast Analysis 2021-2029, By End Use

10.7.1. Wine

10.7.2. Whiskey

10.7.3. Beer

10.7.4. Other Alcoholic Beverages

10.8. Market Attractiveness Analysis

10.8.1. By Country

10.8.2. By Product Type

10.8.3. By End Use

10.9. Prominent Trends

10.10. Drivers and Restraints: Impact Analysis

11. Latin America White Oak Alternatives Market Analysis and Forecast

11.1. Introduction

11.1.1. Market share and Basis Points (BPS) Analysis, By Country

11.1.2. Y-o-Y Growth Projections, By Country

11.2. Historical Market Value(US$ Mn) and Volume (Tonnes), 2016-2020, By Country

11.3. Market Size (US$ Mn) and Volume (Tonnes) Forecast Analysis 2021-2029, By Country

11.3.1. Brazil

11.3.2. Mexico

11.3.3. Argentina

11.3.4. Rest of Latin America

11.4. Historical Market Value(US$ Mn) and Volume (Tonnes), 2016-2020, By Product Type

11.5. Market Size (US$ Mn) and Volume (Tonnes) Forecast Analysis 2021-2029, By Product Type

11.5.1. Oak Staves

11.5.2. Oak Chips

11.5.3. Oak Cubes

11.5.4. Oak Spiral

11.5.5. Oak Powder

11.6. Historical Market Value(US$ Mn) and Volume (Tonnes), 2016-2020, By End Use

11.7. Market Size (US$ Mn) and Volume (Tonnes) Forecast Analysis 2021-2029, By End Use

11.7.1. Wine

11.7.2. Whiskey

11.7.3. Beer

11.7.4. Other Alcoholic Beverages

11.8. Market Attractiveness Analysis

11.8.1. By Country

11.8.2. By Product Type

11.8.3. By End Use

11.9. Prominent Trends

11.10. Drivers and Restraints: Impact Analysis

12. Europe White Oak Alternatives Market Analysis and Forecast

12.1. Introduction

12.1.1. Market share and Basis Points (BPS) Analysis, By Country

12.1.2. Y-o-Y Growth Projections, By Country

12.2. Historical Market Value(US$ Mn) and Volume (Tonnes), 2016-2020, By Country

12.3. Market Size (US$ Mn) and Volume (Tonnes) Forecast Analysis 2021-2029, By Country

12.3.1. Germany

12.3.2. Spain

12.3.3. Italy

12.3.4. France

12.3.5. U.K.

12.3.6. BENELUX

12.3.7. Nordic

12.3.8. Russia

12.3.9. Poland

12.3.10. Rest of Europe

12.4. Historical Market Value(US$ Mn) and Volume (Tonnes), 2016-2020, By Product Type

12.5. Market Size (US$ Mn) and Volume (Tonnes) Forecast Analysis 2021-2029, By Product Type

12.5.1. Oak Staves

12.5.2. Oak Chips

12.5.3. Oak Cubes

12.5.4. Oak Spiral

12.5.5. Oak Powder

12.6. Historical Market Value(US$ Mn) and Volume (Tonnes), 2016-2020, By End Use

12.7. Market Size (US$ Mn) and Volume (Tonnes) Forecast Analysis 2021-2029, By End Use

12.7.1. Wine

12.7.2. Whiskey

12.7.3. Beer

12.7.4. Other Alcoholic Beverages

12.8. Market Attractiveness Analysis

12.8.1. By Country

12.8.2. By Product Type

12.8.3. By End Use

12.9. Prominent Trends

12.10. Drivers and Restraints: Impact Analysis

13. Asia Pacific White Oak Alternatives Market Analysis and Forecast

13.1. Introduction

13.1.1. Market share and Basis Points (BPS) Analysis, By Country

13.1.2. Y-o-Y Growth Projections, By Country

13.2. Historical Market Value(US$ Mn) and Volume (Tonnes), 2016-2020, By Country

13.3. Market Size (US$ Mn) and Volume (Tonnes) Forecast Analysis 2021-2029, By Country

13.3.1. China

13.3.2. India

13.3.3. Japan

13.3.4. ASEAN

13.3.5. Australia and New Zealand

13.3.6. Rest of APAC

13.4. Historical Market Value(US$ Mn) and Volume (Tonnes), 2016-2020, By Product Type

13.5. Market Size (US$ Mn) and Volume (Tonnes) Forecast Analysis 2021-2029, By Product Type

13.5.1. Oak Staves

13.5.2. Oak Chips

13.5.3. Oak Cubes

13.5.4. Oak Spiral

13.5.5. Oak Powder

13.6. Historical Market Value(US$ Mn) and Volume (Tonnes), 2016-2020, By End Use

13.7. Market Size (US$ Mn) and Volume (Tonnes) Forecast Analysis 2021-2029, By End Use

13.7.1. Wine

13.7.2. Whiskey

13.7.3. Beer

13.7.4. Other Alcoholic Beverages

13.8. Market Attractiveness Analysis

13.8.1. By Country

13.8.2. By Product Type

13.8.3. By End Use

13.9. Prominent Trends

13.10. Drivers and Restraints: Impact Analysis

14. Middle East & Africa White Oak Alternatives Market Analysis and Forecast

14.1. Introduction

14.1.1. Market share and Basis Points (BPS) Analysis, By Country

14.1.2. Y-o-Y Growth Projections, By Country

14.2. Historical Market Value(US$ Mn) and Volume (Tonnes), 2016-2020, By Country

14.3. Market Size (US$ Mn) and Volume (Tonnes) Forecast Analysis 2021-2029, By Country

14.3.1. North Africa

14.3.2. GCC countries

14.3.3. South Africa

14.3.4. Turkey

14.3.5. Rest of MEA

14.4. Historical Market Value(US$ Mn) and Volume (Tonnes), 2016-2020, By Product Type

14.5. Market Size (US$ Mn) and Volume (Tonnes) Forecast Analysis 2021-2029, By Product Type

14.5.1. Oak Staves

14.5.2. Oak Chips

14.5.3. Oak Cubes

14.5.4. Oak Spiral

14.5.5. Oak Powder

14.6. Historical Market Value(US$ Mn) and Volume (Tonnes), 2016-2020, By End Use

14.7. Market Size (US$ Mn) and Volume (Tonnes) Forecast Analysis 2021-2029, By End Use

14.7.1. Wine

14.7.2. Whiskey

14.7.3. Beer

14.7.4. Other Alcoholic Beverages

14.8. Market Attractiveness Analysis

14.8.1. By Country

14.8.2. By Product Type

14.8.3. By End Use

14.9. Prominent Trends

14.10. Drivers and Restraints: Impact Analysis

15. Competitive Landscape

15.1. Market Structure

15.2. Competition Dashboard

15.3. Company Market Share Analysis

15.4. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

15.5. Competition Deep Dive

(Global Players)

15.5.1. Suber Oak International

15.5.1.1. Overview

15.5.1.2. Financials

15.5.1.3. Strategy

15.5.1.4. Recent Developments

15.5.1.5. SWOT Analysis

(The same will be provided for all the companies)

15.5.2. Speyside Bourbon Cooperage,Inc.

15.5.2.1. Overview

15.5.2.2. Financials

15.5.2.3. Strategy

15.5.2.4. Recent Developments

15.5.2.5. SWOT Analysis

15.5.3. Protéa France

15.5.3.1. Overview

15.5.3.2. Financials

15.5.3.3. Strategy

15.5.3.4. Recent Developments

15.5.3.5. SWOT Analysis

15.5.4. Oak Chips, Inc.

15.5.4.1. Overview

15.5.4.2. Financials

15.5.4.3. Strategy

15.5.4.4. Recent Developments

15.5.4.5. SWOT Analysis

15.5.5. G3 Enterprises, Inc.

15.5.5.1. Overview

15.5.5.2. Financials

15.5.5.3. Strategy

15.5.5.4. Recent Developments

15.5.5.5. SWOT Analysis

15.5.6. J. RETTENMAIER & SÖHNE GmbH + Co KG

15.5.6.1. Overview

15.5.6.2. Financials

15.5.6.3. Strategy

15.5.6.4. Recent Developments

15.5.6.5. SWOT Analysis

15.5.7. Bouchard Cooperages

15.5.7.1. Overview

15.5.7.2. Financials

15.5.7.3. Strategy

15.5.7.4. Recent Developments

15.5.7.5. SWOT Analysis

15.5.8. Innerstave

15.5.8.1. Overview

15.5.8.2. Financials

15.5.8.3. Strategy

15.5.8.4. Recent Developments

15.5.8.5. SWOT Analysis

15.5.9. Gusmer Enterprises, Inc.

15.5.9.1. Overview

15.5.9.2. Financials

15.5.9.3. Strategy

15.5.9.4. Recent Developments

15.5.9.5. SWOT Analysis

15.5.10. Canadell SAS

15.5.10.1. Overview

15.5.10.2. Financials

15.5.10.3. Strategy

15.5.10.4. Recent Developments

15.5.10.5. SWOT Analysis

15.5.11. The Barrel Mill®

15.5.11.1. Overview

15.5.11.2. Financials

15.5.11.3. Strategy

15.5.11.4. Recent Developments

15.5.11.5. SWOT Analysis

15.5.12. The Vintner Vault

15.5.12.1. Overview

15.5.12.2. Financials

15.5.12.3. Strategy

15.5.12.4. Recent Developments

15.5.12.5. SWOT Analysis

16. Assumptions and Acronyms Used

17. Research Methodology

List of Tables

Table 01: Global White Oak Alternatives Market Volume (Tonnes) Analysis by Product Type, 2016H-2029F

Table 02: Global White Oak Alternatives Market Value (US$ Mn) Analysis by Product Type, 2016H-2029F

Table 03: Global White Oak Alternatives Market Volume (Tonnes) Analysis by End Use, 2016H-2029F

Table 04: Global White Oak Alternatives Market Value (US$ Mn) Analysis by End Use, 2016H-2029F

Table 05: Global White Oak Alternatives Market Volume (Tonnes) Analysis by Region, 2016H-2029F

Table 06: Global White Oak Alternatives Market Value (US$ Mn) Analysis by Region, 2016H-2029F

Table 07: North America White Oak Alternatives Market Volume (Tonnes) Analysis by Product Type, 2016H-2029F

Table 08: North America White Oak Alternatives Market Value (US$ Mn) Analysis by Product Type, 2016H-2029F

Table 09: North America White Oak Alternatives Market Volume (Tonnes) Analysis by End Use, 2016H-2029F

Table 10: North America White Oak Alternatives Market Value (US$ Mn) Analysis by End Use, 2016H-2029F

Table 11: North America White Oak Alternatives Market Volume (Tonnes) Analysis by Country, 2016H-2029F

Table 12: North America White Oak Alternatives Market Value (US$ Mn) Analysis by Country, 2016H-2029F

Table 13: Latin America White Oak Alternatives Market Volume (Tonnes) Analysis by Product Type, 2016H-2029F

Table 14: Latin America White Oak Alternatives Market Value (US$ Mn) Analysis by Product Type, 2016H-2029F

Table 15: Latin America White Oak Alternatives Market Volume (Tonnes) Analysis by End Use, 2016H-2029F

Table 16: Latin America White Oak Alternatives Market Value (US$ Mn) Analysis by End Use, 2016H-2029F

Table 17: Latin America White Oak Alternatives Market Volume (Tonnes) Analysis by Country, 2016H-2029F

Table 18: Latin America White Oak Alternatives Market Value (US$ Mn) Analysis by Country, 2016H-2029F

Table 19: Europe White Oak Alternatives Market Volume (Tonnes) Analysis by Product Type, 2016H-2029F

Table 20: Europe White Oak Alternatives Market Value (US$ Mn) Analysis by Product Type, 2016H-2029F

Table 21: Europe White Oak Alternatives Market Volume (Tonnes) Analysis by End Use, 2016H-2029F

Table 22: Europe White Oak Alternatives Market Value (US$ Mn) Analysis by End Use, 2016H-2029F

Table 23: Europe White Oak Alternatives Market Volume (Tonnes) Analysis by Country, 2016H-2029F

Table 24: Europe White Oak Alternatives Market Value (US$ Mn) Analysis by Country, 2016H-2029F

Table 25: Asia Pacific White Oak Alternatives Market Volume (Tonnes) Analysis by Product Type, 2016H-2029F

Table 26: Asia Pacific White Oak Alternatives Market Value (US$ Mn) Analysis by Product Type, 2016H-2029F

Table 27: Asia Pacific White Oak Alternatives Market Volume (Tonnes) Analysis by End Use, 2016H-2029F

Table 28: Asia Pacific White Oak Alternatives Market Value (US$ Mn) Analysis by End Use, 2016H-2029F

Table 29: Asia Pacific White Oak Alternatives Market Volume (Tonnes) Analysis by Country, 2016H-2029F

Table 30: Asia Pacific White Oak Alternatives Market Value (US$ Mn) Analysis by Country, 2016H-2029F

Table 31: MEA White Oak Alternatives Market Volume (Tonnes) Analysis by Product Type, 2016H-2029F

Table 32: MEA White Oak Alternatives Market Value (US$ Mn) Analysis by Product Type, 2016H-2029F

Table 33: MEA White Oak Alternatives Market Volume (Tonnes) Analysis by End Use, 2016H-2029F

Table 34: MEA White Oak Alternatives Market Value (US$ Mn) Analysis by End Use, 2016H-2029F

Table 35: MEA White Oak Alternatives Market Volume (Tonnes) Analysis by Country, 2016H-2029F

Table 36: MEA White Oak Alternatives Market Value (US$ Mn) Analysis by Country, 2016H-2029F

List of Figures

Figure 01: Global White Oak Alternatives Market Share Analysis by Product Type, 2021E & 2029F

Figure 02: Global White Oak Alternatives Market Attractiveness Analysis by Product Type, 2021E-2029F

Figure 03: Global White Oak Alternatives Market Y-o-Y Analysis by Product Type, 2019H-2029F

Figure 04: Global White Oak Alternatives Market Share Analysis by End Use, 2021E & 2029F

Figure 05: Global White Oak Alternatives Market Attractiveness Analysis by End Use, 2021E-2029F

Figure 06: Global White Oak Alternatives Market Y-o-Y Analysis by End Use, 2019H-2029F

Figure 07: Global White Oak Alternatives Market Share Analysis by Region, 2021E & 2029F

Figure 08: Global White Oak Alternatives Market Attractiveness Analysis by Region, 2021E-2029F

Figure 09: Global White Oak Alternatives Market Y-o-Y Analysis by Region, 2019H-2029F

Figure 10: North America White Oak Alternatives Market Attractiveness Analysis by End Use, 2021E-2029F

Figure 11: North America White Oak Alternatives Market Share Analysis by End Use, 2021E & 2029F

Figure 12: North America White Oak Alternatives Market Share Analysis by Country, 2021E & 2029F

Figure 13: Latin America White Oak Alternatives Market Attractiveness Analysis by End Use, 2021E-2029F

Figure 14: Latin America White Oak Alternatives Market Share Analysis by End Use, 2021E & 2029F

Figure 15: Latin America White Oak Alternatives Market Share Analysis by Country, 2021E & 2029F

Figure 16: Europe White Oak Alternatives Market Attractiveness Analysis by End Use, 2021E-2029F

Figure 17: Europe White Oak Alternatives Market Share Analysis by End Use, 2021E & 2029F

Figure 18: Europe White Oak Alternatives Market Share Analysis by Country, 2021E & 2029F

Figure 19: Asia Pacific White Oak Alternatives Market Attractiveness Analysis by End Use, 2021E-2029F

Figure 20: Asia Pacific White Oak Alternatives Market Share Analysis by End Use, 2021E & 2029F

Figure 21: Asia Pacific White Oak Alternatives Market Share Analysis by Country, 2021E & 2029F

Figure 22: MEA White Oak Alternatives Market Attractiveness Analysis by End Use, 2021E-2029F

Figure 23: MEA White Oak Alternatives Market Share Analysis by End Use, 2021E & 2029F

Figure 24: MEA White Oak Alternatives Market Share Analysis by Country, 2021E & 2029F