White Biotechnology Market: Snapshot

With the increasing awareness level of consumers pertaining to the benefits of white biotechnology-based eco-friendly products, the market for white biotechnology is gaining significant traction across the world. As the governments across a number of economies is increasingly focusing on raising the level of awareness among people regarding the need for taking up greener technologies, especially white biotechnology, across a number of industries.

Funds allocated to increase the research and development activities in this area and the implementation of stringent emission regulations are encouraging industries to uptake white biotechnology products and principles. This, as a result, is reflecting greatly on the worldwide market for white biotechnology.

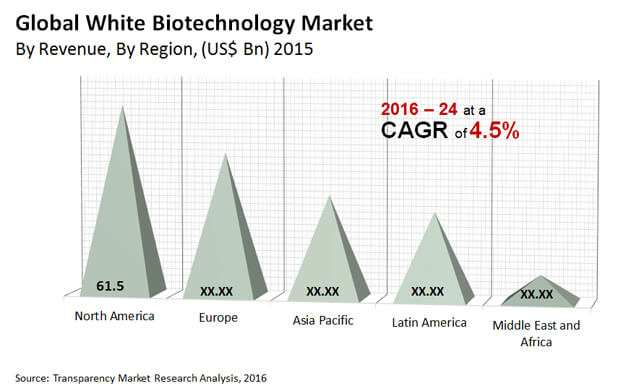

In 2015, the global white biotechnology market was worth US$178.1 bn. Expanding at a 4.50% CAGR between 2016 and 2024, the market is anticipated to reach US$262.3 bn by the end of the 2024.

North America to Retain Dominant Position

Europe, the Middle East and Africa, Asia pacific, Latin America, and North America are the key regional markets for white biotechnology across the world. Presently, North America leads the global market and had held a share of more than 35% in the overall market in 2015. With the support of large government funds for research and development activities in the field of white biotechnology and the increasing demand for green products, this regional market is anticipated to remain on the dominant position over the next few years. The expanding range of applications across various industries, such as energy, food, pharmaceuticals, and feed, is also projected to boost the North America market for white biotechnology in the near future.

The Asia Pacific market for white biotechnology will also be witnessing a high-paced growth over the forthcoming years, thanks to the augmenting demand for renewable resources in emerging economies, such as India and China, in the region. The plenty of raw materials that can be utilized for the manufacturing of white technology products will also support the Asia Pacific white biotechnology market in gaining momentum in the years to come.

Biofuel to Continue to Witness High Demand

Biochemical, biomaterial, biofuel, and bioproducts are the key type of products available in the global white biotechnology market. In 2015, the biofuel segment led the overall market with a share of 38.16%. Researchers anticipate the demand for biofuel to remain strong throughout the period of the forecast.

White biotechnology solutions find a widespread application in the pharmaceuticals, food and feed, pulp and paper, energy, and the textile sector. Currently the demand for these solutions is significantly high in the energy sector and the scenario is likely to continue like this in the years to come.

The global market for white biotechnology is mostly consolidated, with DuPont, Cargill Inc., Novozymes, BASF SE, and Archer Daniels Midland Co. largely driving the market. Other prominent players in this market are Lesaffre, DSM, and Corbion.

Rapid Depletion of Fossil Fuels to Increase the Demand across the White Biotechnology Market

The white biotechnology market is estimated to gain a considerable growth-share across the forecast period of 2016-2024. The growing demand for embracing sustainability will serve as a prominent growth factor. The booming population is increasing the energy demand extensively. All these factors bring profitable growth opportunities for the white biotechnology market during the assessment period of 2016-2024.

Section - 1 Preface

1.1 Report scope and market segmentation

1.2 Research highlights

Section - 2 Assumptions and research methodology

2.1 Assumptions and acronyms used

2.2 Research methodology

Section - 3 Executive summary

3.1 Global white biotechnology: market snapshot

3.2 Global white biotechnology market: opportunity map

Section - 4 Market overview

4.1 Global white biotechnology market: key industry developments

Section - 5 Market dynamics

5.1 Drivers and Restraints Snapshot Analysis

5.1.2 Drivers

5.1.2.1 Government initiatives

5.1.2.2 Less emission of greenhouse gases

5.1.2.3 Growing Demand for Green Products

5.1.2.4 Increasing Adaptability of White Biotechnology

5.1.2.5 Increasing Demand for Bio - crops

5.1.2.6 Increase in R&D Investment

5.1.2.7 Innovation for Yield Enhancement

5.1.2.8 Chemical Cost Reduction

5.1.3 Restraints

5.1.3.1 Reducing agricultural soil fertility

5.1.3.2 Consumer Preference for Traditional Foods and Fuels

5.1.3.3 Seasonality of Agriculture Market and Weather Patterns

5.1.4 Opportunity Analysis

5.1.4.1 Use of Less Productive Lands

5.1.4.2 Commercialization of White Biotechnology Products

5.2 Key Trends

5.3 Global White Biotechnology Market Revenue Projection

5.4 Porter’s Five Forces Analysis

5.5 White Biotechnology Market Outlook

Section - 6 White Biotechnology Market Analysis, by Product Type

6.1 Key Findings

6.2 Introduction

6.3 Global White Biotechnology Market Value Share Analysis, by Product Type

6.4 Global White Biotechnology Market Forecast, by Product Type

6.4.1 Biochemical

6.4.2 Biofuel

6.4.3 Biomaterial

6.4.4 Bioproduct

6.5 Global White Biotechnology Market Attractiveness Analysis, by Product Type

Section - 7 Global White Biotechnology Market Analysis, by Application

7.1 Key Findings

7.2 Introduction

7.3 Global White Biotechnology Market Value Share Analysis, y Application Type

7.4 Global White Biotechnology Market Forecast, by Application Type

7.4.1 Food & Feed

7.4.2 Pharmaceuticals

7.4.3 Pulp & Paper

7.4.4 Textile

7.4.5 Energy

7.4.6 Others

7.5 Global White Biotechnology Market Attractiveness Analysis, by Application Type

Section - 8 Global White Biotechnology Market Analysis, by Application

8.1 Key Findings

8.2 Introduction

8.3 Global White Biotechnology Market Value Share Analysis, by Feedstock Type

8.4 Global White Biotechnology Market Forecast, by Feedstock Type

8.4.1 Grains & Starch Crops

8.4.2 Agricultural Residues

8.4.3 Food Waste

8.4.4 Forestry Material

8.4.5 Animal By - product

8.4.6 Energy Crops

8.4.7 Urban & Suburban Waste

8.5 Global White Biotechnology Market Attractiveness Analysis, by Feedstock Type

Section - 9 Global White Biotechnology Market Analysis, by Region

9.1 Global Regulatory Scenario

9.2 Global White Biotechnology Market Value Share Analysis, by Region

9.3 Global White Biotechnology Market Forecast, by Region

9.4 Global White Biotechnology Market Attractiveness Analysis, by Region Type

Section - 10 North America White Biotechnology Market Analysis

10.1 Key Findings

10.2 North America ABC Market Overview

10.3 North America Market Value Share Analysis, by Product Type

10.3.1 North America Market Forecast, by Product Type

10.4 North America Market Value Share Analysis, by Application

10.4.1 North America Market Forecast, by Application Type

10.5 North America Market Value Share Analysis, by Feedstock

10.5.1 North America Market Forecast, by Feedstock

10.6 North America Market Forecast, by Country

10.7 North America Market Attractiveness Analysis

10.8 North America Market Trends

Section - 11 Europe White Biotechnology Market Analysis

11.1 Key Findings

11.2 Europe ABC Market Overview

11.3 Europe Market Value Share Analysis, by Product Type

11.3.1 Europe Market Forecast, by Product Type

11.4 Europe Market Value Share Analysis, by Application

11.4.1 Europe Market Forecast, by Application Type

11.5 Europe Market Value Share Analysis, by Feedstock

11.5.1 Europe Market Forecast, by Feedstock

11.6 Europe Market Forecast, by Country

11.7 Europe Market Attractiveness Analysis

11.8 Europe Market Trends

Section - 12 Asia Pacific White Biotechnology Market Analysis

12.1 Key Findings

12.2 Asia Pacific ABC Market Overview

12.3 Asia Pacific Market Value Share Analysis, by Product Type

12.3.1 Asia Pacific Market Forecast, by Product Type

12.4 Asia Pacific Market Value Share Analysis, by Application

12.4.1 Asia Pacific Market Forecast, by Application Type

12.5 Asia Pacific Market Value Share Analysis, by Feedstock

12.5.1 Asia Pacific Market Forecast, by Feedstock

12.6 Asia Pacific Market Forecast, by Country

12.7 Asia Pacific Market Attractiveness Analysis

12.8 Asia Pacific Market Trends

Section - 13 Latin America White Biotechnology Market Analysis

13.1 Key Findings

13.2 Latin America ABC Market Overview

13.3 Latin America Market Value Share Analysis, by Product Type

13.3.1 Latin America Market Forecast, by Product Type

13.4 Latin America Market Value Share Analysis, by Application

13.4.1 Latin America Market Forecast, by Application Type

13.5 Latin America Market Value Share Analysis, by Feedstock

13.5.1 Latin America Market Forecast, by Feedstock

13.6 Latin America Market Forecast, by Country

13.7 Latin America Market Attractiveness Analysis

13.8 Latin America Market Trends

Section - 14 Middle East and Africa White Biotechnology Market Analysis

14.1 Key Findings

14.2 Middle East and Africa Market Overview

14.3 Middle East and Africa Market Value Share Analysis, by Product Type

14.3.1 Middle East and Africa Market Forecast, by Product Type

14.4 Middle East and Africa Market Value Share Analysis, by Application

14.4.1 Middle East and Africa Market Forecast, by Application Type

14.5 Middle East and Africa Market Value Share Analysis, by Feedstock

14.5.1 Middle East and Africa Market Forecast, by Feedstock

14.6 Middle East and Africa Market Forecast, by Country

14.7 Middle East and Africa Market Attractiveness Analysis

Section - 15 Competition Landscape

15.1. Competition Matrix

15.2. Company Profiles

15.2.1. Archer Daniels Midland Company

15.2.1.1 Company Details

15.2.1.2 Company Description

15.2.1.3 Business Overview

15.2.1.4 SWOT Analysis

15.2.1.5 Financials

15.2.1.6 Strategic Overview

15.2.1.7 Product Portfolio

15.2.1.8 Recent Developments

15.2.2 BASF SE

15.2.2.1 Company Details

15.2.2.2 Company Description

15.2.2.3 Business Overview

15.2.2.4 SWOT Analysis

15.2.2.5 Financials

15.2.2.6 Strategic Overview

15.2.2.7 Product Portfolio

15.2.2.8 Recent Developments

15.2.3 Cargill, Inc.

15.2.3.1 Company Details

15.2.3.2 Company Description

15.2.3.3 Business Overview

15.2.3.4 SWOT Analysis

15.2.3.5 Financials

15.2.3.6 Strategic Overview

15.2.3.7 Product Portfolio

15.2.3.8 Recent Developments

15.2.4 Corbion

15.2.4.1 Company Details

15.2.4.2 Company Description

15.2.4.3 Business Overview

15.2.4.4 SWOT Analysis

15.2.4.5 Financials

15.2.4.6 Strategic Overview

15.2.4.7 Product Portfolio

15.2.4.8 Recent Developments

15.2.5 DSM

15.2.5.1 Company Details

15.2.5.2 Company Description

15.2.5.3 Business Overview

15.2.5.4 SWOT Analysis

15.2.5.5 Financials

15.2.5.6 Strategic Overview

15.2.5.7 Product Portfolio

15.2.5.8 Recent Developments

15.2.6 DuPont

15.2.6.1 Company Details

15.2.6.2 Company Description

15.2.6.3 Business Overview

15.2.6.4 SWOT Analysis

15.2.6.5 Financials

15.2.6.6 Strategic Overview

15.2.6.7 Product Portfolio

15.2.6.8 Recent Developments

15.2.7 Lesaffre

15.2.7.1 Company Details

15.2.7.2 Company Description

15.2.7.3 Business Overview

15.2.7.4 SWOT Analysis

15.2.7.5 Financials

15.2.7.6 Strategic Overview

15.2.7.7 Product Portfolio

15.2.7.8 Recent Developments

15.2.8 Novozymes

15.2.8.1 Company Details

15.2.8.2 Company Description

15.2.8.3 Business Overview

15.2.8.4 SWOT Analysis

15.2.8.5 Financials

15.2.8.6 Strategic Overview

15.2.8.7 Product Portfolio

15.2.8.8 Recent Developments

List of Tables

Table 01: Global White Biotechnology Market Size (US$ Bn) Forecast, by Product Type, 2014–2024

Table 02: Global White Biotechnology Market Size (US$ Bn) and Forecast, by Application, 2014–2024

Table 03: Global White Biotechnology Market Size (US$ Bn) Forecast, by Feedstock Type, 2014–2024

Table 04: Global White Biotechnology Market Size (US$ Bn) Forecast, by Region, 2014–2024

Table 05: North America White Biotechnology Market Size (US$ Bn) Forecast, by Product Type, 2014–2024

Table 06: North America White Biotechnology Market Size (US$ Bn), by Application, 2014–2024

Table 07: North America White Biotechnology Market Size (US$ Bn), by Feedstock, 2014–2024

Table 08: North America White Biotechnology Market Size (US$ Bn) Forecast, by Country, 2014–2024

Table 09: Europe White Biotechnology Market Size (US$ Bn) Forecast, by Product Type, 2014–2024

Table 10: Europe White Biotechnology Market Size (US$ Bn) Forecast, by Application, 2014–2024

Table 11: Europe White Biotechnology Market Size (US$ Bn) Forecast, by Feedstock, 2014–2024

Table 12: Europe White Biotechnology Market Size (US$ Bn) Forecast, by Country, 2014–2024

Table 13: Asia Pacific White Biotechnology Market Size (US$ Bn) Forecast, by Product Type, 2014–2024

Table 14: Asia Pacific White Biotechnology Market Size (US$ Bn), by Application, 2014–2024

Table 15: Asia Pacific White Biotechnology Market Size (US$ Bn), by Feedstock, 2014–2024

Table 16: Asia Pacific White Biotechnology Market Size (US$ Bn) Forecast, by Country, 2014–2024

Table 17: Latin America White Biotechnology Market Size (US$ Bn) Forecast, by Product Type, 2014–2024

Table 18: Latin America White Biotechnology Market Size (US$ Bn) Forecast, by Application, 2014–2024

Table 19: Latin America White Biotechnology Market Size (US$ Bn) Forecast, by Feedstock, 2014–2024

Table 20: Latin America White Biotechnology Market Size (US$ Bn) Forecast, by Country, 2014–2024

Table 21: MEA White Biotechnology Market Size (US$ Bn) Forecast, by Product Type, 2014–2024

Table 22: MEA White Biotechnology Market Size (US$ Bn) Forecast, by Application, 2014-2024

Table 23: MEA White Biotechnology Market Size (US$ Bn) Forecast, by Feedstock, 2014–2024

Table 24: MEA White Biotechnology Market Size (US$ Bn) Forecast, by Country, 2014-2024

List of Figures

Figure 01: Global White Biotechnology Market Size (US$ Bn) Forecast, 2014–2024

Figure 02: Global White Biotechnology Market Value Share Analysis, by Product Type, 2016 and 2024

Figure 03: White Biotechnology Market Attractiveness Analysis, by Product Type

Figure 04: Global White Biotechnology Market Value Share Analysis, by Application, 2016 and 2024

Figure 05: White Biotechnology Market Attractiveness Analysis, by Application

Figure 06: Global White Biotechnology Market Value Share Analysis, by Feedstock, 2015 and 2024

Figure 07: White Biotechnology Market Attractiveness Analysis, by Feedstock Type

Figure 08: White Biotechnology Market Value Share Analysis, by Region, 2015 and 2024

Figure 08 highlights market value share of the white biotechnology market, by region, over the forecast period

Figure 09: White Biotechnology Market Attractiveness Analysis, by Region

Figure 10: North America White Biotechnology Market Size (US$ Bn) Forecast, 2014–2024

Figure 11: North America White Biotechnology Market Size Y-o-Y Growth Projections, 2015–2024

Figure 12: North America Market Attractiveness Analysis, by Country

Figure 13: North America Market Value Share Analysis, by Product Type, 2015 and 2024

Figure 14: North America Market Value Share Analysis, by Application, 2015 and 2024

Figure 15: North America Market Value Share Analysis, by Feedstock, 2015 and 2024

Figure 16: Europe White Biotechnology Market Size (US$ Bn) Forecast, 2015–2024

Figure 17: Europe White Biotechnology Market Size Y-o-Y Growth Projections, 2015–2024

Figure 18: Europe Market Attractiveness Analysis, by Country

Figure 19: Europe Market Value Share Analysis, by Product Type, 2014 and 2024

Figure 20: Europe Market Value Share Analysis, by Application, 2015 and 2024

Figure 21: Europe Market Value Share Analysis, by Feedstock, 2015 and 2024

Figure 22: Asia Pacific White Biotechnology Market Size (US$ Bn) Forecast, 2014–2024

Figure 23: Asia Pacific White Biotechnology Market Size Y-o-Y Growth Projection, 2015–2024

Figure 24: Asia Pacific Market Attractiveness Analysis, by Country

Figure 25: Asia Pacific Market Value Share Analysis, by Product Type, 2015 and 2024

Figure 26: Asia Pacific Market Value Share Analysis, by Application Type, 2015 and 2024

Figure 27: Asia Pacific Market Value Share Analysis, by Feedstock, 2015 and 2024

Figure 28: Latin America White Biotechnology Market Size (US$ Bn) Forecast, 2014–2024

Figure 29: Latin America White Biotechnology Market Size Y-o-Y Growth Projections, 2015–2024

Figure 30: Latin America Market Attractiveness Analysis, by Country

Figure 31: Latin America Market Value Share Analysis, by Product Type, 2016 and 2024

Figure 32: Latin America Market Value Share Analysis, by Application, 2015 and 2024

Figure 33: Latin America Market Value Share Analysis, by Feedstock, 2015 and 2024

Figure 34: MEA White Biotechnology Market Size (US$ Bn) Forecast, 2014–2024

Figure 35: MEA White Biotechnology Market Size Y-o-Y Growth Projections, 2015–2024

Figure 36: MEA Market Attractiveness Analysis, by Country

Figure 37: MEA Market Value Share Analysis, by Product Type, 2015 and 2024

Figure 38: MEA Market Value Share Analysis, by Application, 2015 and 2024

Figure 39: MEA Market Value Share Analysis, by Feedstock, 2015 and 2024

Figure 40: Global White Biotechnology Market Share Analysis, by Company (2015)