Analysts’ Viewpoint on Market Scenario

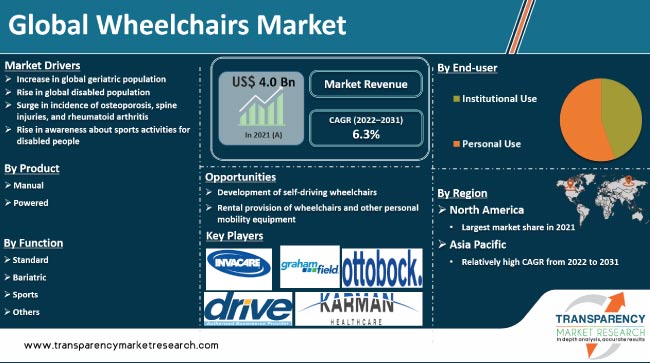

Increase in geriatric population, surge in disabled population, growth in awareness & adoption of advanced wheelchairs, improvement in healthcare infrastructure, and favorable reimbursement policies are expected to drive the global wheelchairs market during the forecast period.

Development of self-driving wheelchairs has benefited people with mobility challenges. Demand for this type of wheelchair is high in old-age homes. Self-driving wheelchair is likely to offer significant opportunities to several companies investing in this new technology.

New developments and innovations, such as sports wheelchair, stair climbing wheelchair, and smart wheelchair, are expected to drive the global wheelchairs industry size in the near future.

Wheelchair is used for mobility purposes by disabled persons or persons who are unable to walk post injury or certain illnesses such as cerebral palsy. These can be used for outdoor as well as indoor purposes.

Wheelchairs are available in two types: manual wheelchair and power chair or electric wheelchair. Electric wheelchair is a motorized wheelchair equipped with wheels and a set of batteries to provide the required power to move the wheelchair in the desired direction, causing less physical exertion. These chairs do not require any human assistance for mobility. Manual wheelchairs are useful for people who need to use wheelchairs on a temporary basis.

The COVID-19 pandemic has had a negative effect on the wheelchairs market in terms of sales and service. However, easing of lockdowns has led to an increase in demand for advanced wheelchairs.

According to the United Nations, the geriatric population of 60+ years is expected to double by 2050 and triple by 2100. It is projected to rise from 962 million in 2017 to 2.1 billion in 2050 and 3.1 billion by 2100.

Globally, the geriatric population is increasing at a faster pace than the young population. Global geriatric population stood at 962 million in 2017, or 13% of the global population, and is growing at a rate of about 3% every year. Furthermore, the number of persons aged 80 years or above is estimated to be triple by 2050, from 137 million in 2017 to 425 million by 2050. Currently, Europe has a significantly large geriatric population.

Aging is associated with decline in support for long-term care by families and highly expensive formal long-term care services. These structural changes in society are likely to lead to a rise in demand for mobility aid devices such as powered wheel chair, thus augmenting the powered wheelchair market and foldable powered wheelchair market.

People suffering from disabilities are expected to increasingly require mobility devices to carry out their day-to-day activities, as geriatric diseases often co-exist with obesity and disability.

Rise in obesity and lifestyle-related disabilities among those entering old age is expected to fuel the demand for rehab as well as bariatric wheelchairs, power chairs/motorized chairs, and manual propelled wheelchairs.

According to the Wheelchair Foundation data (2017), 34 developing countries had 10,000,000 people, that is 1% of the population, who required wheelchairs, while developed countries had 121,800,000 people, which is 2%, who needed wheelchairs. Furthermore, 131,800,000 people across the globe, which is 1.85% of the global population, required wheelchairs.

In terms of product, the powered wheelchair segment dominated the global wheelchairs market in terms of value in 2021, owing to advanced functions and rise in adoption of powered wheelchairs among the patient population.

Powered wheelchairs are easy to operate and cost-effective. These wheelchairs are available in several options such as folding and standing. Surge in demand for portable chairs with long lasting battery life is driving the powered wheelchair segment. Furthermore, technological advancements and rise in awareness about various types of powered wheelchair are likely to augment the segment during the forecast period.

Based on function, the global wheelchairs market has been divided into standard, bariatric, sports, and others. The standard segment held major share of the global market in 2021. The trend is expected to continue during the forecast period, owing to high preference for standard wheelchairs over other wheelchairs, as they are easy to operate for daily activities.

Standard wheelchairs are extensively used across the globe. They cater to the needs of various patients. These wheelchairs are lighter than powered or manual wheelchairs. Moreover, these have accessories that make them more efficient. Several companies are investing in the development of standard wheelchairs with light and ultra-light form in order to provide more comfort to patients. Standard wheelchairs are usually made of steel; however, the lighter versions are made of aluminum.

In terms of end-user, the global market has been bifurcated into institutional use and personal use. The personal use segment held the largest global wheelchairs market share in 2021. This can be ascribed to the preference of wheelchair for personal use, which helps improve the daily quality of life of patients.

Rise in number of nuclear families is another factor for the increase in preference of wheelchairs for personal use. Geriatric users need wheelchairs due to increase in dependence on homecare treatment.

As per the market segmentation analysis, North America dominated the global market in 2021. The market in the region is driven by the rise in prevalence of lifestyle diseases, osteoporosis, and other autoimmune diseases, which leads to dependence on wheelchairs.

Technological advancements in powered wheelchairs, increase in number of baby boomers, surge in geriatric population, and rise in disabled patient population are the other factors propelling the market in North America.

The wheelchairs market in Europe is anticipated to grow at a CAGR of more than 6.0% during the forecast period. Asia Pacific is expected to be the fastest growing market for wheelchairs during the forecast period. The market in the region is projected to grow at a high CAGR of 7.3% from 2022 to 2031. This can be ascribed to improvement in health care infrastructure, rise in acceptance of advanced wheelchairs, surge in disposable income, increase in awareness about powered & new variants of wheelchairs, and rise in investment by companies in the development of personal mobility aids.

This report provides profiles of leading players operating in the global wheelchairs market. These include Invacare Corporation, Numotion, Sunrise Medical LLC, Ottobock, Permobil, Pride Mobility Products Corp, Drive Medical, GF Health Products, Inc., 21st Century Scientific, Inc., Karman Healthcare, and Hoveround. Key players are engaging in mergers & acquisitions, strategic collaborations, and new product launches to increase their global footprint.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US 4.0 Bn |

|

Market Forecast Value in 2031 |

More than US$ 7.3 Bn |

|

Compound Annual Growth Rate (CAGR) |

6.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 4.0 Bn in 2021

The market is projected to reach more than US$ 7.3 Bn by 2031

The global market is anticipated to grow at a CAGR of 6.3% from 2022 to 2031

Increase in global geriatric population and rise in global disabled population

Invacare Corporation, Numotion, Sunrise Medical LLC, Ottobock, Permobil, Pride Mobility Products Corp, Drive Medical, GF Health Products, Inc., 21st Century Scientific, Inc., Karman Healthcare, and Hoveround

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Wheelchairs Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Wheelchairs Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Value Chain Analysis

5.2. Technological Advancement

5.3. Rising Incidences of Osteoporosis and Rheumatoid Arthritis

5.4. Reimbursement Scenario by Region/Globally

5.5. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

6. Global Wheelchairs Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Manual

6.3.2. Powered

6.4. Market Attractiveness Analysis, by Product

7. Global Wheelchairs Market Analysis and Forecast, by Function

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Function, 2017–2031

7.3.1. Standard

7.3.2. Bariatric

7.3.3. Sports

7.3.4. Others

7.4. Market Attractiveness Analysis, by Function

8. Global Wheelchairs Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Institutional Use

8.3.2. Personal Use

8.4. Market Attractiveness Analysis, by End-user

9. Global Wheelchairs Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Wheelchairs Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2031

10.2.1. Manual

10.2.2. Powered

10.3. Market Value Forecast, by Function, 2017–2031

10.3.1. Standard

10.3.2. Bariatric

10.3.3. Sports

10.3.4. Others

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Institutional Use

10.4.2. Personal Use

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Function

10.6.3. By End-user

10.6.4. By Country

11. Europe Wheelchairs Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Manual

11.2.2. Powered

11.3. Market Value Forecast, by Function, 2017–2031

11.3.1. Standard

11.3.2. Bariatric

11.3.3. Sports

11.3.4. Others

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Institutional Use

11.4.2. Personal Use

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Function

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Wheelchairs Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Manual

12.2.2. Powered

12.3. Market Value Forecast, by Function, 2017–2031

12.3.1. Standard

12.3.2. Bariatric

12.3.3. Sports

12.3.4. Others

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Institutional Use

12.4.2. Personal Use

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Function

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Wheelchairs Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Manual

13.2.2. Powered

13.3. Market Value Forecast, by Function, 2017–2031

13.3.1. Standard

13.3.2. Bariatric

13.3.3. Sports

13.3.4. Others

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Institutional Use

13.4.2. Personal Use

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Function

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Wheelchairs Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017–2031

14.2.1. Manual

14.2.2. Powered

14.3. Market Value Forecast, by Function, 2017–2031

14.3.1. Standard

14.3.2. Bariatric

14.3.3. Sports

14.3.4. Others

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Institutional Use

14.4.2. Personal Use

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Function

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Invacare Corporation

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Strategic Overview

15.3.2. Sunrise Medical LLC

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Strategic Overview

15.3.3. Ottobock

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Strategic Overview

15.3.4. Permobil

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Strategic Overview

15.3.5. Pride Mobility Products Corp

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Strategic Overview

15.3.6. Drive Medical

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Strategic Overview

15.3.7. GF Health Products Inc.

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Strategic Overview

15.3.8. 21st century Scientific Inc.

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Strategic Overview

15.3.9. Karman Healthcare

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Strategic Overview

15.3.10. Hoveround

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Strategic Overview

List of Tables

Table 01: Global Revenue Share, by Product and End-user 2021

Table 02: Global Revenue Share, by Functions 2021

Table 03: Global Wheelchairs Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 04: Global Wheelchairs Market Volume (Units) Forecast, by Product, 2017–2031

Table 05: Global Wheelchairs Market Value (US$ Mn) Forecast, by Function, 2017–2031

Table 06: Global Wheelchairs Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 07: Global Wheelchairs Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 08: North America Wheelchairs Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 09: North America Wheelchairs Market Volume (Units) Forecast, by Product, 2017–2031

Table 10: North America Wheelchairs Market Value (US$ Mn) Forecast, by Function, 2017–2031

Table 11: North America Wheelchairs Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 12: North America Wheelchairs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Europe Wheelchairs Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 14: Europe Wheelchairs Market Volume (Units) Forecast, by Product, 2017–2031

Table 15: Europe Wheelchairs Market Value (US$ Mn) Forecast, by Function, 2017–2031

Table 16: Europe Wheelchairs Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Europe Wheelchairs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Asia Pacific Wheelchairs Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 19: Asia Pacific Wheelchairs Market Volume (Units) Forecast, by Product, 2017–2031

Table 20: Asia Pacific Wheelchairs Market Value (US$ Mn) Forecast, by Function, 2017–2031

Table 21: Asia Pacific Wheelchairs Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 22: Asia Pacific Wheelchairs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 23: Latin America Wheelchairs Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 24: Latin America Wheelchairs Market Volume (Units) Forecast, by Product, 2017–2031

Table 25: Latin America Wheelchairs Market Value (US$ Mn) Forecast, by Function, 2017–2031

Table 26: Latin America Wheelchairs Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 27: Latin America Wheelchairs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 28: Middle East & Africa Wheelchairs Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 29: Middle East & Africa Wheelchairs Market Volume (Units) Forecast, by Product, 2017–2031

Table 30: Middle East & Africa Wheelchairs Market Value (US$ Mn) Forecast, by Function, 2017–2031

Table 31: Middle East & Africa Wheelchairs Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 32: Middle East & Africa Wheelchairs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Wheelchairs Market Snapshot

Figure 02: Global Wheelchairs Market Segments with Leading Market Share (%), 2021

Figure 03: Key Industry Developments (Wheelchairs Market)

Figure 04: Global Wheelchairs Market Value (US$ Mn) Forecast, 2017‒2031

Figure 05: Global Wheelchairs Market Value Share (%), by Product (2021)

Figure 06: Global Wheelchairs Market Value Share (%), by Function (2021)

Figure 07: Global Wheelchairs Market Value Share (%), by End-user (2021)

Figure 08: Global Wheelchairs Market Value Share (%), by Region (2021)

Figure 09: Global Wheelchairs Market Volume (Units) Forecast, 2017‒2031

Figure 10: Global Wheelchairs Market Value Share Analysis, by Product, 2021 and 2031

Figure 11: Global Wheelchairs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Manual, 2017‒2031

Figure 12: Global Wheelchairs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Powered, 2017‒2031

Figure 13: Global Wheelchairs Market Attractiveness, by Product, 2022–2031

Figure 14: Global Wheelchairs Market Value Share Analysis, by Function, 2021 and 2031

Figure 15: Global Wheelchairs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Standard, 2017‒2031

Figure 16: Global Wheelchairs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Bariatric, 2017‒2031

Figure 17: Global Wheelchairs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Sports, 2017‒2031

Figure 18: Global Wheelchairs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2017‒2031

Figure 19: Global Wheelchairs Market Attractiveness, by Function, 2022–2031

Figure 20: Global Wheelchairs Market Value Share (%), by End-user, 2021 and 2031

Figure 21: Global Wheelchairs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Institutional Use, 2017–2031

Figure 22: Global Wheelchairs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Personal Use, 2017–2031

Figure 23: Global Wheelchairs Market Attractiveness, by End-user, 2022–2031

Figure 24: Global Wheelchairs Market Value Share Analysis, by Region 2021 and 2031

Figure 25: Global Wheelchairs Market Attractiveness, by Region, 2022–2031

Figure 26: North America Wheelchairs Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2031

Figure 27: North America Wheelchairs Market Volume (Units) Forecast, 2017–2031

Figure 28: North America Wheelchairs Market Value Share (%), by Product, 2021 and 2031

Figure 29: North America Wheelchairs Market Attractiveness, by Product, 2022–2031

Figure 30: North America Wheelchairs Market Value Share (%), by Function, 2021 and 2031

Figure 31: North America Wheelchairs Market Attractiveness, by Function, 2022–2031

Figure 32: North America Wheelchairs Market Value Share (%), by End-user, 2021 and 2031

Figure 33: North America Wheelchairs Market Attractiveness, by End-user, 2022–2031

Figure 34: North America Wheelchairs Market Value Share (%), by Country, 2021 and 2031

Figure 35: North America Wheelchairs Market Attractiveness, by Country, 2022–2031

Figure 36: Europe Wheelchairs Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2031

Figure 37: Europe Wheelchairs Market Volume (Units) Forecast, 2017–2031

Figure 38: Europe Wheelchairs Market Value Share (%), by Product, 2021 and 2031

Figure 39: Europe Wheelchairs Market Attractiveness, by Product, 2022–2031

Figure 40: Europe Wheelchairs Market Value Share (%), by Function, 2021 and 2031

Figure 41: Europe Wheelchairs Market Attractiveness, by Function, 2022–2031

Figure 42: Europe Wheelchairs Market Value Share (%), by End-user, 2021 and 2031

Figure 43: Europe Wheelchairs Market Attractiveness, by End-user, 2022–2031

Figure 44: Europe Wheelchairs Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 45: Europe Wheelchairs Market Attractiveness, by Country/Sub-region, 2022–2031

Figure 46: Asia Pacific Wheelchairs Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2031

Figure 47: Asia Pacific Wheelchairs Market Volume (Units) Forecast, 2017–2031

Figure 48: Asia Pacific Wheelchairs Market Value Share (%), by Product, 2021 and 2031

Figure 49: Asia Pacific Wheelchairs Market Attractiveness, by Product, 2022–2031

Figure 50: Asia Pacific Wheelchairs Market Value Share (%), by Function, 2021 and 2031

Figure 51: Asia Pacific Wheelchairs Market Attractiveness, by Function, 2022–2031

Figure 52: Asia Pacific Wheelchairs Market Value Share (%), by End-user, 2021 and 2031

Figure 53: Asia Pacific Wheelchairs Market Attractiveness, by End-user, 2022–2031

Figure 54: Asia Pacific Wheelchairs Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 55: Asia Pacific Wheelchairs Market Attractiveness, by Country/Sub-region, 2022–2031

Figure 56: Latin America Wheelchairs Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2031

Figure 57: Latin America Wheelchairs Market Volume (Units) Forecast, 2017–2031

Figure 58: Latin America Wheelchairs Market Value Share (%), by Product, 2021 and 2031

Figure 59: Latin America Wheelchairs Market Attractiveness, by Product, 2022–2031

Figure 60: Latin America Wheelchairs Market Value Share (%), by Function, 2021 and 2031

Figure 61: Latin America Wheelchairs Market Attractiveness, by Function, 2022–2031

Figure 62: Latin America Wheelchairs Market Value Share (%), by End-user, 2021 and 2031

Figure 63: Latin America Wheelchairs Market Attractiveness, by End-user, 2022–2031

Figure 64: Latin America Wheelchairs Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 65: Latin America Wheelchairs Market Attractiveness, by Country/Sub-region, 2022–2031

Figure 66: Middle East & Africa Wheelchairs Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2031

Figure 67: Middle East & Africa Wheelchairs Market Volume (Units) Forecast, 2017–2031

Figure 68: Middle East & Africa Wheelchairs Market Value Share (%), by Product, 2021 and 2031

Figure 69: Middle East & Africa Wheelchairs Market Attractiveness, by Product, 2022–2031

Figure 70: Middle East & Africa Wheelchairs Market Value Share (%), by Function, 2021 and 2031

Figure 71: Middle East & Africa Wheelchairs Market Attractiveness, by Function, 2022–2031

Figure 72: Middle East & Africa Wheelchairs Market Value Share (%), by End-user, 2021 and 2031

Figure 73: Middle East & Africa Wheelchairs Market Attractiveness, by End-user, 2022–2031

Figure 74: Middle East & Africa Wheelchairs Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 75: Middle East & Africa Wheelchairs Market Attractiveness, by Country/Sub-region, 2022–2031