Western Europe Teleradiology Market: Snapshot

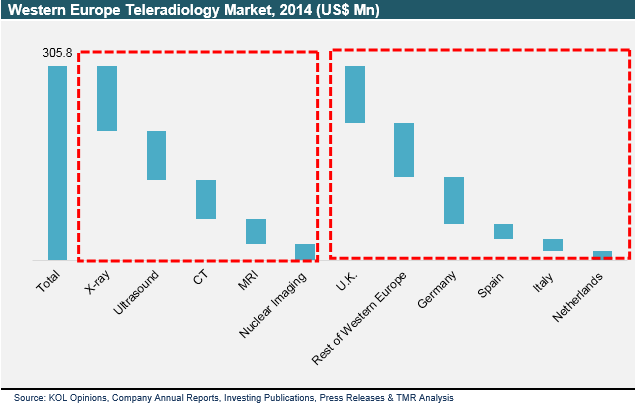

Of late, the Western Europe market for teleradiology has been experiencing a substantial surge, thanks to the constant evolution of information and communication technologies in this region. Going forward, the shortage of expert radiologists across Europe is likely to fuel the demand for teleradiology solutions in the near future, reflecting greatly on this market. In 2014, the opportunity in the Western Europe teleradiology market was US$305.8 mn. Expanding at a CAGR of 18.50% during the period from 2015 to 2023, it is likely to reach US$1443.7 mn by 2023 end. The cost efficiency of teleradiology solutions, emergency coverage, and the rising number of imaging procedures are projected to boost this market over the next few years. However, the complex regulations, high initial investment, and language barrier are expected to limit the growth of this regional market in the years to come.

Demand for X-ray to Remain Strong

Majorly, the Western Europe teleradiology market is analyzed on the basis of the modality into magnetic resonance imaging (MRI), X-ray, computed tomography, ultrasound, and nuclear imaging. Among these, the demand for X-ray has been relatively higher and this trend is anticipated to remain so over the forthcoming years, thanks to rising number of X-ray procedures and the need for expert radiologist advice due to complexity of images.

Among others, ultrasound teleradiology has been reporting a high adoption rate, thanks to the advent of 3D and 4D ultrasound platforms, improved image quality, and the absence of ionizing radiation. CT teleradiology, on the other hand, is expected to surface as a highly lucrative segment over the forecast period, owing to favorable reimbursement policies and its ability to easily visualize complex body parts, such as lungs, brain, and cardiac abnormalities.

U.K. to Retain Dominance

The Western Europe market for teleradiology is spread across the U.K., the Netherlands, Spain, Germany, Italy, and the Rest of Western Europe. The U.K. and Germany together accounted for the largest share of the market. In 2014, the U.K. led the teleradiology market in Western Europe and this scenario is anticipated to remain so in the years to come. The advancements in digital image processing technology, increasing implementation of picture archiving communication systems (PACS), and the presence of a large pool of well-established market players, together with a number of domestic service providers, are the key factors behind the growth of the U.K. market for teleradiology. Germany stood second in 2014 and is projected to retain its position over the forthcoming years. The dearth of expert radiologists and the rising number of government initiatives are likely to support the teleradiology market in this country.

Agfa-Gevaert N.V., ONRAD Inc., Telemedicine Clinic, Cybernet Medical Corp., Sectra AB, and Global Diagnostics Ltd. are some of the key vendors of teleradiology solutions in the Western Europe. The market demonstrates a fragmented and highly competitive business landscape. The leading companies are expected to involve into strategic partnerships and mergers and acquisitions over the next few years.

COVID-19 Pandemic to Fuel Growth Prospects across the Teleradiology Market

The rapid shift of the healthcare sector toward a value-based model will serve as a prominent growth-generating factor for the global teleradiology market across the assessment period of 2015-2023. The varied advantages offered by teleradiology such as affordability and emergency coverage will bring good growth opportunities during the forecast period of 2015-2023.

1. Introduction

1.1 Report Description

1.2 Research Methodology

1.3 Market Segmentation

2. Executive Summary

2.1 Market Snapshot

2.2 Western Europe Teleradiology Market, by Modality, 2014 (US$ Mn)

3. Western Europe Teleradiology Market Overview

3.1 Introduction

3.2 Recent Market Trends: Western Europe Teleradiology Market

3.3 Market Dynamics

3.4 Drivers

3.4.1 Advancements in digital technology

3.4.2 Increasing introduction of mHealth services

3.4.3 Rise in health care expenditure

3.5 Restraints

3.5.1 High cost of technology

3.5.2 Language barrier

3.5.3 Stringent and complex regulations

3.6 Opportunity

3.6.1 Investment in teleradiology services to upgrade digital infrastructure

3.7 Porter’s Five Forces Analysis

3.8 Regulatory Framework

3.9 Market Attractiveness Analysis

4. Market Segmentation - By Modality

4.1 Introduction Western Europe Teleradiology Market

4.2 Market Revenue of X-ray, 2013–2023, (US$ Mn)

4.3 Ultrasound

4.4 CT

4.5 MRI

4.6 Nuclear Imaging

5. Market Segmentation - By Country

5.1 Introduction

5.2 U.K.

5.3 Germany

5.4 Spain

5.5 Italy

5.6 Netherlands

5.7 Western Europe

6. Recommendations

6.1 Adoption of New Business Models Enabling the Development of the Teleradiology Market

7. Company Profiles

7.1 Agfa-Gevaert N.V.

7.2 Cybernet Medical Corporation

7.3 ONRAD, Inc.

7.4 Sectra AB

7.5 Telemedicine Clinic

7.6 Global Diagnostics Ltd.