Offshore mooring systems aid in the anchoring of marine assets such as vessels, barges, tugs, and support ships. A mooring is a permanent structure to which a vessel is moored or tied. A mooring system collectively stops a ship's free movement on water, allowing it to be used for its intended purpose. The West Africa offshore mooring system market is anticipated to develop rapidly owing to the expansion of the oil and gas sector. The increasing need for subsea explorations, as well as the expanded commercialization of wind and hydro-energy, will act as a critical growth driver for the West Africa offshore mooring system market. The rising renewable energy efforts will provide tremendous growth opportunities for the West Africa offshore mooring system market.

Moreover, the existence of several untapped locations for oil and gas exploration and development in West Africa and the launch of technologically advanced mooring products is projected to drive the West Africa offshore mooring system market in the coming years.

The West Africa offshore mooring system market is projected to reach US$470.2 million by the end of 2024, growing at a 4.90% CAGR during the forecast period (2016-2024).

The availability of vast offshore oil and gas reserves in the West African region has boosted the need for offshore mooring systems for obtaining oil and gas. Production from offshore fields will expand dramatically as a result of increasing investment in offshore fields by various oil and gas corporations. This will increase the number of mobile offshore drilling equipment and offshore platforms. To remain steady, these platforms will need a mooring system. As a result, the need for offshore mooring systems will rise, bolstering the West Africa offshore mooring system market.

Based on application, the FPSO (Floating, Production, Storage, and Offloading) vessels segment dominated the West Africa offshore mooring system industry in 2015, with a share of 43.55%, and is expected to continue dominance in the near future. The growth is attributed to West Africa's increased need for natural gas and crude oil storage and refinement. Moreover, the increasing use of offshore mooring in FPSOs to maintain the drilling hole in position is likely to increase the demand for offshore mooring.

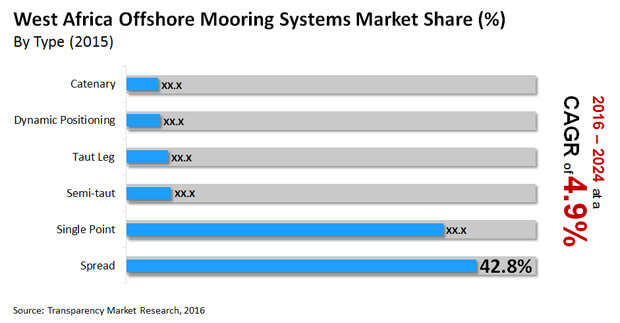

Based on the product type, the West Africa offshore mooring system market is segmented into catenary, semi-taut system, spread mooring, single point mooring, taut leg system, and dynamic positioning. Presently, spread mooring systems are in higher demand than other systems. Spread mooring systems can be employed in applications that need a long service life, at any depth of water, and on any vessel size. Spread mooring systems use numerous mooring lines to anchor vessels to the seabed. While the vessel is on a constant course relative to the seabed, its bow normally heads into the dominating environment, which is usually the direction of the strongest waves.

The major countries in the West Africa offshore mooring system market are Angola, Senegal, Equatorial Guinea, Guinea, Ghana, Congo Brazzaville, Mauritania, Cameroon, Ivory Coast, and Gabon. Angola dominated the West Africa offshore mooring system market in 2015 with a share of US$45.1 million, and is anticipated to retain the top slot in the foreseeable future. The Ivory Coast, Angola, Gabo, and Ghana, are likely to become attractive regional markets in the West Africa offshore mooring system market in the coming years. In the years ahead, the increased focus on energy supplies, continuous exploration and development operations, and increased expenditures are expected to bolster the West Africa offshore mooring system market.

FMC Technologies Inc., SBM Offshore N.V., Trelleborg Marine Systems, BW Offshore Ltd., MDEC Inc., Timberland Equipment Ltd., Mampaey Offshore Industries B.V., Delmar Systems Inc., and Grup Servicii Petroliere S.A., are some of the prominent players in the West Africa offshore mooring system market.

In 2015, West Africa Offshore Mooring Systems Market was valued at US$169.70 mn

West Africa Offshore Mooring Systems Market is expected to Reach US$470.2 mn By 2024

West Africa Offshore Mooring Systems Market is estimated to rise at a CAGR of 4.9% during forecast period

The existence of several untapped locations for oil and gas exploration and development in West Africa and the launch of technologically advanced mooring products is projected to drive the West Africa offshore mooring system market in the coming years

Key players of West Africa Offshore Mooring Systems Market are FMC Technologies Inc., SBM Offshore N.V., Trelleborg Marine Systems, BW Offshore Ltd., MDEC Inc., Timberland Equipment Ltd., Mampaey Offshore Industries B.V., Delmar Systems Inc., and Grup Servicii Petroliere S.A

1.Preface

1.1.Market Definition and Scope

1.2.Market Segmentation

1.3.Key Research Objectives

1.4.Research Highlights

2.Assumptions and Research Methodology

3.Executive Summary: West Africa Offshore Mooring Systems Market

4.Market Overview

4.1.Introduction

4.1.1.Offshore Mooring Systems Definition

4.1.2.Industry Evolution / Developments

4.2.Offshore Mooring Systems Market Overview

4.3.Key Market Indicators

4.4.Market Dynamics

4.4.1.Drivers

4.4.2.Restraints

4.4.3.Opportunity

4.5.West Africa Offshore Mooring Systems Market Analysis and Forecasts, 2015 – 2024

4.5.1.Market Revenue (US$ Mn) Projections

4.6.Porter’s Five Force Analysis

4.7.Value Chain Analysis

5.West Africa Offshore Mooring Systems Market Analysis and Forecasts, by Type

5.1.Introduction

5.2.Key Findings

5.3.Offshore Mooring Systems Market Revenue (US$ Mn) Forecast, by Type

5.3.1.Catenary System

5.3.2.Taut Leg System

5.3.3.Semi-Taut Leg System

5.3.4.Single Point Mooring Systems

5.3.5.Spread Mooring Systems

5.3.6.Dynamic Positioning

5.4.Offshore Mooring Systems Market Attractiveness Analysis, by Type

6.West Africa Offshore Mooring Systems Market Analysis and Forecasts, by Anchorage

6.1.Introduction

6.2.Key Findings

6.3.Offshore Mooring Systems Market Revenue (US$ Mn) Forecast, by Anchorage

6.3.1.Drag Embedded Anchors

6.3.2.Suction Anchors

6.3.3.Vertical Load Anchors

6.4.Offshore Mooring Systems Market Attractiveness Analysis, by Anchorage

7.West Africa Offshore Mooring Systems Market Analysis and Forecasts, by Application

7.1.Introduction

7.2.Key Findings

7.3.Offshore Mooring Systems Market Revenue (US$ Mn) Forecast, by Application

7.3.1.Tension Leg Platform (TLP)

7.3.2.Semi-Submersible Platforms

7.3.3.Spar Platforms

7.3.4.Floating, Production, Storage & Offloading (FPSO) Vessels

7.3.5.Floating, Drilling, Production, Storage & Offloading (FDPSO) Vessels

7.3.6.Floating, Liquefied Natural Gas (FLNG) Vessels

7.4.Offshore Mooring Systems Market Attractiveness Analysis, by Application

8.West Africa Offshore Mooring Systems Market Analysis and Forecasts, By Country

8.1.Key Findings

8.2.Offshore Mooring Systems Market Revenue (US$ Mn) Forecast, by Country

8.2.1.Mauritania

8.2.2.Senegal

8.2.3.Guinea

8.2.4.Ivory Coast

8.2.5.Ghana

8.2.6.Cameroon

8.2.7.Equatorial Guinea

8.2.8.Gabon

8.2.9.Democratic Republic of Congo

8.2.10.Congo-Brazzaville

8.2.11.Angola

8.3.Market Attractiveness By Country

9.Competition Landscape

9.1.Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

9.2. Global/Regional Market Players

9.2.1.SBM Offshore N.V.

9.2.1.1.Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

9.2.1.2.Company Description

9.2.1.3.Business Overview

9.2.1.4.SWOT Analysis

9.2.1.5.Net Sales Breakdown, by Region (2015) in US$ Mn

9.2.1.6.Net Revenue (US$ Mn) and Y-o-Y Growth (%)

9.2.1.7.Strategic Overview

9.2.2.MDEC, Inc.

9.2.2.1.Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

9.2.2.2.Company Description

9.2.2.3.Business Overview

9.2.2.4.SWOT Analysis

9.2.2.5.Distribution of Shareholders, by Geography (2015) in %

9.2.2.6.Net Revenue (US$ Mn) and Y-o-Y Growth (%)

9.2.2.7.Strategic Overview

9.2.3.Grup Servicii Petroliere S.A

9.2.3.1.Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

9.2.3.2.Company Description

9.2.3.3.Business Overview

9.2.4.Mampaey Offshore Industries B.V

9.2.4.1.Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

9.2.4.2.Company Description

9.2.4.3.Business Overview

9.2.5.FMC Technologies Inc.

9.2.5.1.Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

9.2.5.2.Company Description

9.2.5.3.Business Overview

9.2.6.BW Offshore Ltd.

9.2.6.1.Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

9.2.6.2.Company Description

9.2.6.3.Business Overview

9.2.6.4.SWOT Analysis

9.2.6.5.Distribution of Shareholders, by Geography (2015) in %

9.2.6.6.Net Revenue (US$ Mn) and Y-o-Y Growth (%)

9.2.6.7.Strategic Overview

9.2.7.Trelleborg Marine Systems

9.2.7.1.Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

9.2.7.2.Company Description

9.2.7.3.Business Overview

9.2.8.Timberland Equipment Ltd.

9.2.8.1.Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

9.2.8.2.Company Description

9.2.8.3.Business Overview

9.2.9.Mooring Systems Inc.

9.2.9.1.Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

9.2.9.2.Company Description

9.2.9.3.Business Overview

9.2.10.Delmar Systems, Inc.

9.2.10.1.Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

9.2.10.2.Company Description

9.2.10.3.Business Overview

List of Tables

Table 01: West Africa Offshore Mooring Systems Market Size (US$ Mn) Forecast, By Type, 2015–2024

Table 02: West Africa Offshore Mooring Market Size (US$ Mn) Forecast, by Application, 2015–2024

Table 03: West Africa Offshore Mooring Market Size (US$ Mn) Forecast, by Anchorage, 2015–2024

List of Figures

Figure 01: West Africa Offshore Mooring Market Revenue (US$ Mn) Forecast, 2015–2014

Figure 02: West Africa Offshore Mooring Systems Market Value Share Analysis, By Type, 2015 and 2024

Figure 03: West Africa Catenary Offshore Mooring Systems Market Size (US$ Mn), 2015–2024

Figure 04: West Africa Taut Leg Offshore Mooring Systems Market Size (US$ Mn), 2015–2024

Figure 05: West Africa Semi-Taut Offshore Mooring Systems Market Size (US$ Mn), 2015–2024

Figure 06: West Africa Spread Offshore Mooring Systems Market Size (US$ Mn), 2015–2024

Figure 07: West Africa Single Point Offshore Mooring Systems Market Size (US$ Mn), 2015–2024

Figure 08: West Africa Dynamic Positioning Offshore Mooring Systems Market Size (US$ Mn), 2015–2024

Figure 09: West Africa Offshore Mooring Systems Market Attractiveness Analysis, By Type

Figure 10: West Africa Offshore Mooring Market Value Share Analysis, by Application, 2015 and 2024

Figure 11: West Africa Offshore Mooring Systems Market Size (US$ Mn), by FPSO Vessels, 2015–2024

Figure 12: West Africa Offshore Mooring Systems Market Size (US$ Mn), by FDPSO Vessels, 2015–2024

Figure 13: West Africa Offshore Mooring Systems Market Size (US$ Mn), by FLNG Vessels, 2015–2024

Figure 14: West Africa Offshore Mooring Systems Market Size (US$ Mn), by Tension Leg Platform, 2015–2024

Figure 15: West Africa Offshore Mooring Systems Market Size (US$ Mn), by SPAR Platforms, 2015–2024

Figure 16: West Africa Offshore Mooring Systems Market Size (US$ Mn), by Semi-submersible Platforms, 2015–2024

Figure 17: West Africa Offshore Mooring Systems Market Size (US$ Mn), by Others, 2015–2024

Figure 18: West Africa Offshore Mooring Market Attractiveness Analysis, by Application

Figure 19: West Africa Offshore Mooring Market Value Share Analysis, by Anchorage, 2015 and 2024

Figure 20: West Africa Offshore Mooring Systems Market Size (US$ Mn), Drag Embedment of Anchors, 2015–2024

Figure 21: West Africa Offshore Mooring Systems Market Size (US$ Mn), Suction Anchors, 2015–2024

Figure 22: West Africa Offshore Mooring Systems Market Size (US$ Mn), Vertical Load Anchors, 2015–2024

Figure 23: West Africa Offshore Mooring Market Attractiveness Analysis, by Anchorage

Figure 24: West Africa Offshore Mooring Systems Market Size (US$ Mn) Mauritania, 2015–2024

Figure 25: West Africa Offshore Mooring Systems Market Size (US$ Mn), Senegal, 2015–2024

Figure 26: West Africa Offshore Mooring Systems Market Size (US$ Mn), Guinea, 2015–2024

Figure 27: West Africa Offshore Mooring Systems Market Size (US$ Mn), Ivory Coast, 2015–2024

Figure 28: West Africa Offshore Mooring Systems Market Size (US$ Mn), Ghana, 2015–2024

Figure 29: West Africa Offshore Mooring Systems Market Size (US$ Mn), Cameroon, 2015–2024

Figure 30: West Africa Offshore Mooring Systems Market Size (US$ Mn) Equatorial Guinea, 2015–2024

Figure 31: West Africa Offshore Mooring Systems Market Size (US$ Mn), Gabon, 2015–2024

Figure 32: West Africa Offshore Mooring Systems Market Size (US$ Mn), Democratic Republic of Congo, 2015–2024

Figure 33: West Africa Offshore Mooring Systems Market Size (US$ Mn), Angola, 2015–2024

Figure 34: West Africa Offshore Mooring Systems Market Size (US$ Mn), Congo Brazzaville, 2015–2024