Companies in the warranty management system market are fulfilling business continuity plans amidst the COVID-19 (coronavirus) outbreak. They are maintaining operational readiness to address challenges created by the pandemic. In order to ensure employee and partner safety, companies in the warranty management system market are adhering to guidelines issued by local governments and health organizations to successfully contain the spread of the coronavirus.

Seamless and robust remote working environments are being established for employees to ensure secure collaboration between teams. Companies are adopting tools and resources that facilitate remote working so that employees can address the issues and requests of their partners and customers. They are establishing a highly distributed workforce to deliver the highest level of support and services to partners. Employees are closely monitoring all logged calls and support requests from its customers, while working remotely amidst the coronavirus pandemic.

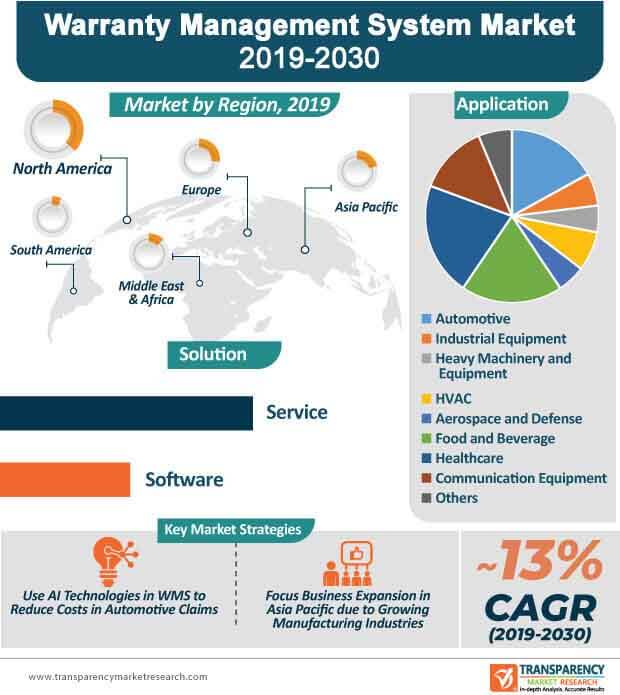

Next-gen warranty management systems (WMS) are integrated with artificial intelligence (AI) and machine learning (ML) capabilities to ensure customer satisfaction. For instance, California-based software company Tavant Technologies is promoting its end-to-end warranty management system that helps organizations reduce warranty costs and improve aftermarket experience. Thus, AI and ML innovations in warranty lifecycle management solutions are contributing toward a robust CAGR of ~13% for the market during the assessment period.

AI and ML deliver actionable insights about a product’s warranty lifecycle. Vendors in the warranty management system market are increasing efforts to provide customized warranty solutions to end users by feeding key intelligence outputs back into the supply chain. End users are able to create a dynamic framework with the help of the warranty lifecycle management software that deploy continuous improvements in products. Software developers are focusing on robust data management is an important aspect for continuous improvements in products.

Intelligent warranty management systems are witnessing high demand in the market landscape. Hence, MSX International— a provider of technology-enabled business process outsourcing (BPO) services to OEMs has identified pain points of automotive companies and harnessed the advantages of AI to reinvent the warranty management software. It has been found that automotive companies spend several billion dollars on warranty claims most of which are misdiagnosed or fraudulent. Hence, vendors in the warranty management system market are using AI to deploy accuracy and transparency in warranty claims by customers.

Software developers are increasing efforts to solve the issue of fraudulent claims made by customers in the automotive OEM sector. Vendors in the warranty management system market are combining the capabilities of AI and ML to intelligently apply data science for prioritizing each claim.

The warranty management system market is projected to climb a revenue of US$ 11.1 Bn by 2030 from US$ 3.2 Bn in 2020. The increased output of manufacturing industries in countries of Asia Pacific, such as China and India, are contributing toward exponential market growth. For instance, an Indian multinational technology company Tech Mahindra has adopted an integrated warranty management system provided by the U.S. software company Pegasystems Inc. to improve productivity in the company and increase profitability. Thus, manufacturing industries are able to eliminate time-consuming manual efforts associated with warranty management, and deploy integration among OEM warranty systems and dealer management systems.

Companies in the warranty management system market are helping manufacturing companies replace outdated legacy systems with integrated warranty management solutions to effectively collaborate with OEMs. Warranty management systems help to deal with significant fluctuations in inventory levels.

Cloud-based warranty management systems are playing a pivotal role in laboratory information management. Though warranty management is only a part of the overall laboratory information management system (LIMS), it helps to effectively collaborate with other partners in the value chain. However, traditional cloud-based solutions tend to be less configurable as compared to on-premise solutions. Hence, companies in the warranty management system market are improving the technology of cloud-based warranty management systems that make it desirable in big and small laboratory information management operations.

Warranty management systems are growing popular in web-based LIMS architectures. As such, the demand for WMS is rising with the need for fast claims management and for reducing warranty costs in the warranty management system market. Cloud-based warranty management systems are delivering performance-oriented operations and catering toward customer-focused warranty services.

Integrated warranty management systems are capturing the market with increasing demand for safe and secure warehouse support. For instance, Inspirisys Solutions Limited - an Indian information technology services company, is increasing its portfolio in integrated warranty management systems to cater to IT, telecom, and medical equipment companies. Companies in the warranty management system market are expanding their business streams in sectors of security surveillance platforms and home automation solutions.

Vendors in the warranty management system market are increasing their capabilities to assimilate new technologies and processes in systems, owing to the ever-evolving nature of the WMS technology. They are increasing efforts to boost their credibility as reliable partners for after-sales services in order to gain a competitive edge over other service and software providers. Vendors are eyeing new clients and customers by providing online warranty support and many customers prefer the convenience of online operations.

Analysts’ Viewpoint

Companies are offering free learning webinars for its customers and partners to educate them about their warranty management software amidst the COVID-19 outbreak. They are providing extended warranty programs to increase the lifecycle of products. Vendors are devoted to deliver continuous innovation solutions in warranty management systems to achieve flexibility and service quality in operations. However, stringent SLAs (Service Level Agreements) by various product vendors pose as a restraint for growth of the warranty management system market. Hence, companies should acquire proficiency in managing forward & reverse logistics, including import & re-export of spares to adhere strict SLAs given by product vendors.

1. Preface

1.1. Market Introduction

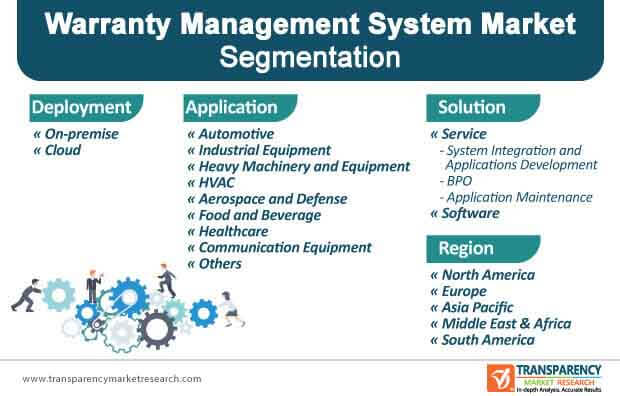

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary - Global Warranty Management System Market

4. Market Overview

4.1. Market Definition

4.2. Macroeconomic Factors

4.2.1. World GDP Indicator – For Top Economies

4.2.2. Global ICT Spending (US$ Mn)

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/ Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.4.1. By Solution

4.4.2. By Deployment

4.4.3. By Application

4.5. Competitive Scenario and Trends

4.5.1. Warranty Management System Market Concentration Rate

4.5.1.1. List of Emerging, Prominent and Leading Players

4.5.2. Mergers & Acquisitions, Expansions

4.6. Impact Analysis of COVID-19 on the Warranty Management System Market

4.7. Market Outlook

5. Global Warranty Management System Market Analysis and Forecast

5.1.1. Market Revenue Analysis (US$ Mn), 2015-2030

5.1.1.1. Historic Growth Trends, 2015-2019

5.1.1.2. Forecast Trends, 2020-2030

6. Global Warranty Management System Market Analysis, by Solution

6.1. Key Segment Analysis

6.2. Warranty Management System Market Size (US$ Mn) Forecast, by Solution, 2018 - 2030

6.2.1. Service

6.2.1.1. System Integration and Applications Development

6.2.1.2. BPO

6.2.1.3. Application Maintenance

6.2.2. Software

7. Global Warranty Management System Market Analysis, by Deployment

7.1. Key Segment Analysis

7.2. Warranty Management System Market Size (US$ Mn) Forecast, by Deployment, 2018 - 2030

7.2.1. On-premise

7.2.2. Cloud

8. Global Warranty Management System Market Analysis, by Application

8.1. Key Segment Analysis

8.2. Warranty Management System Market Size (US$ Mn) Forecast, by Application, 2018 - 2030

8.2.1. Automotive

8.2.2. Industrial Equipment

8.2.3. Heavy Machinery and Equipment

8.2.4. HVAC

8.2.5. Aerospace and Defense

8.2.6. Food and Beverage

8.2.7. Healthcare

8.2.8. Communication Equipment

8.2.9. Others

9. Global Warranty Management System Market Analysis and Forecast, By Region

9.1. Key Findings

9.2. Warranty Management System Market Size (US$ Mn) Forecast, by Region, 2018 - 2030

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Warranty Management System Market Analysis

10.1. Regional Outlook

10.2. Warranty Management System Market Size (US$ Mn) Analysis and Forecast (2018 - 2030)

10.2.1. By Solution

10.2.2. By Deployment

10.2.3. By Application

10.3. Warranty Management System Market Size (US$ Mn) Forecast, by Country, 2018 - 2030

10.3.1. U.S.

10.3.2. Canada

10.3.3. Mexico

11. Europe Warranty Management System Market Analysis and Forecast

11.1. Regional Outlook

11.2. Warranty Management System Market Size (US$ Mn) Analysis and Forecast (2018 - 2030)

11.2.1. By Solution

11.2.2. By Deployment

11.2.3. By Application

11.3. Warranty Management System Market Size (US$ Mn) Forecast, by Country & Sub-region, 2018 - 2030

11.3.1. Italy

11.3.2. France

11.3.3. U.K.

11.3.4. Germany

11.3.5. Rest of Europe

12. APAC Warranty Management System Market Analysis and Forecast

12.1. Regional Outlook

12.2. Warranty Management System Market Size (US$ Mn) Analysis and Forecast (2018 - 2030)

12.2.1. By Solution

12.2.2. By Deployment

12.2.3. By Application

12.3. Warranty Management System Market Size (US$ Mn) Forecast, by Country & Sub-region, 2018 - 2030

12.3.1. China

12.3.2. India

12.3.3. Japan

12.3.4. ASEAN

12.3.5. Rest of Asia Pacific

13. Middle East & Africa (MEA) Warranty Management System Market Analysis and Forecast

13.1. Regional Outlook

13.2. Warranty Management System Market Size (US$ Mn) Analysis and Forecast (2018 - 2030)

13.2.1. By Solution

13.2.2. By Deployment

13.2.3. By Application

13.3. Warranty Management System Market Size (US$ Mn) Forecast, by Country & Sub-region, 2018 - 2030

13.3.1. United Arab Emirates

13.3.2. South Africa

13.3.3. Rest of Middle East & Africa (MEA)

14. South America Warranty Management System Market Analysis and Forecast

14.1. Regional Outlook

14.2. Warranty Management System Market Size (US$ Mn) Analysis and Forecast (2018 - 2030)

14.2.1. By Solution

14.2.2. By Deployment

14.2.3. By Application

14.3. Warranty Management System Market Size (US$ Mn) Forecast, by Country & Sub-region, 2018 - 2030

14.3.1. Brazil

14.3.2. Argentina

14.3.3. Rest of South America

15. Competition Landscape

15.1. Market Competition Matrix, by Leading Players

15.2. Market Revenue Share Analysis (%), by Leading Players (2019)

16. Company Profiles

16.1. IFS World Operations AB

16.1.1. Business Overview

16.1.2. Product Portfolio

16.1.3. Geographical Footprint

16.1.4. Revenue and Strategy

16.2. Mize, Inc.

16.2.1. Business Overview

16.2.2. Product Portfolio

16.2.3. Geographical Footprint

16.2.4. Revenue and Strategy

16.3. Oracle Corporation

16.3.1. Business Overview

16.3.2. Product Portfolio

16.3.3. Geographical Footprint

16.3.4. Revenue and Strategy

16.4. Pegasystems Inc.

16.4.1. Business Overview

16.4.2. Product Portfolio

16.4.3. Geographical Footprint

16.4.4. Revenue and Strategy

16.5. PTC Inc.

16.5.1. Business Overview

16.5.2. Product Portfolio

16.5.3. Geographical Footprint

16.5.4. Revenue and Strategy

16.6. SAP SE

16.6.1. Business Overview

16.6.2. Product Portfolio

16.6.3. Geographical Footprint

16.6.4. Revenue and Strategy

16.7. ServiceMax, Inc.

16.7.1. Business Overview

16.7.2. Product Portfolio

16.7.3. Geographical Footprint

16.7.4. Revenue and Strategy

16.8. Tavant Technologies, Inc.

16.8.1. Business Overview

16.8.2. Product Portfolio

16.8.3. Geographical Footprint

16.8.4. Revenue and Strategy

16.9. Turn Key Web Solutions

16.9.1. Business Overview

16.9.2. Product Portfolio

16.9.3. Geographical Footprint

16.9.4. Revenue and Strategy

16.10. Zafire Limited

16.10.1. Business Overview

16.10.2. Product Portfolio

16.10.3. Geographical Footprint

16.10.4. Revenue and Strategy

17. Key Takeaways

List of Tables

Table 1: Global Warranty Management System Market Value (US$ Mn) Forecast, by Solution, 2018 - 2030

Table 2: Global Warranty Management System Market Value (US$ Mn) Forecast, by Deployment, 2018 - 2030

Table 3: Global Warranty Management System Market Value (US$ Mn) Forecast, by Application, 2018 - 2030

Table 4: Global Warranty Management System Market Value (US$ Mn) Forecast, by Region, 2018 - 2030

Table 5: North America Warranty Management System Market Value (US$ Mn) Forecast, by Solution, 2018 - 2030

Table 6: North America Warranty Management System Market Value (US$ Mn) Forecast, by Deployment, 2018 - 2030

Table 7: North America Warranty Management System Market Value (US$ Mn) Forecast, by Application, 2018 - 2030

Table 8: North America Warranty Management System Market Value (US$ Mn) Forecast, by Country, 2018 - 2030

Table 9: Europe Warranty Management System Market Value (US$ Mn) Forecast, by Solution, 2018 - 2030

Table 10: Europe Warranty Management System Market Value (US$ Mn) Forecast, by Deployment, 2018 - 2030

Table 11: Europe Warranty Management System Market Value (US$ Mn) Forecast, by Application, 2018 - 2030

Table 12: Europe Warranty Management System Market Value (US$ Mn) Forecast, by Country, 2018 - 2030

Table 13: Asia Pacific Warranty Management System Market Value (US$ Mn) Forecast, by Solution, 2018 - 2030

Table 14: Asia Pacific Warranty Management System Market Value (US$ Mn) Forecast, by Deployment, 2018 - 2030

Table 15: Asia Pacific Warranty Management System Market Value (US$ Mn) Forecast, by Application, 2018 - 2030

Table 16: Asia Pacific Warranty Management System Market Value (US$ Mn) Forecast, by Country, 2018 - 2030

Table 17: Middle East & Africa Warranty Management System Market Value (US$ Mn) Forecast, by Solution, 2018 - 2030

Table 18: Middle East & Africa Warranty Management System Market Value (US$ Mn) Forecast, by Deployment, 2018 - 2030

Table 19: Middle East & Africa Warranty Management System Market Value (US$ Mn) Forecast, by Application, 2018 - 2030

Table 20: Middle East & Africa Warranty Management System Market Value (US$ Mn) Forecast, by Country, 2018 - 2030

Table 21: South America Warranty Management System Market Value (US$ Mn) Forecast, by Solution, 2018 - 2030

Table 22: South America Warranty Management System Market Value (US$ Mn) Forecast, by Deployment, 2018 - 2030

Table 23: South America Warranty Management System Market Value (US$ Mn) Forecast, by Application, 2018 - 2030

Table 24: South America Warranty Management System Market Value (US$ Mn) Forecast, by Country, 2018 - 2030

Table 25: Competition Matrix – Capabilities & Potential to Grow

List of Figures

Figure 1: Global Warranty Management System Market Size (US$ Mn) Forecast, 2018 – 2030

Figure 2: Global Warranty Management System Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2020E

Figure 3: Top Segment Analysis

Figure 4: Global Warranty Management System Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2030F

Figure 5: GDP (US$ Mn), Top Countries (2014 – 2019)

Figure 6: Top Economies GDP Landscape, 2019

Figure 7: Global ICT Spending (%), by Region, 2019

Figure 8: Global ICT Spending (US$ Mn), Regional Contribution, 2019

Figure 9: Global ICT Spending (US$ Mn), Spending Solution Contribution, 2019

Figure 10: Global ICT Spending (%), by Solution, 2019

Figure 11: Global Warranty Management System Market Attractiveness Assessment, by Solution

Figure 12: Global Warranty Management System Market Relative Attractiveness Assessment, by Solution

Figure 13: Global Warranty Management System Market Attractiveness Assessment, by Deployment

Figure 14: Global Warranty Management System Market Relative Attractiveness Assessment, by Deployment

Figure 15: Global Warranty Management System Market Attractiveness Assessment, by Application

Figure 16: Global Warranty Management System Market Relative Attractiveness Assessment, by Application

Figure 17: Global Warranty Management System Market Attractiveness Assessment, by Region

Figure 18: Global Warranty Management System Market Relative Attractiveness Assessment, by Region

Figure 19: Global Warranty Management System Market, by Solution, CAGR (%) (2020 – 2030)

Figure 20: Global Warranty Management System Market, by Application, CAGR (%) (2020 – 2030)

Figure 21: Global Warranty Management System Market, by Deployment, CAGR (%) (2020 – 2030)

Figure 22: Global Warranty Management System Market, by Region, CAGR (%) (2020 – 2030)

Figure 23: Global Warranty Management System Market Revenue (US$ Mn) Historic Trends, 2015 - 2019

Figure 24: Global Warranty Management System Market Revenue Opportunity (US$ Mn) Historic Trends, 2015 - 2019

Figure 25: Global Warranty Management System Market Revenue (US$ Mn) and Y-o-Y Growth (Revenue %) Forecast, 2020 - 2030

Figure 26: Global Warranty Management System Market Revenue Opportunity (US$ Mn) Forecast, 2020 - 2030

Figure 27: Global Warranty Management System Market Value Share Analysis, by Solution, 2020

Figure 28: Global Warranty Management System Market Value Share Analysis, by Solution, 2030

Figure 29: Global Warranty Management System Market Value Share Analysis, by Deployment, 2020

Figure 30: Global Warranty Management System Market Value Share Analysis, by Deployment, 2030

Figure 31 : Global Warranty Management System Market Value Share Analysis, by Application, 2020

Figure 32: Global Warranty Management System Market Value Share Analysis, by Application, 2030

Figure 33: Global Warranty Management System Market Value Share Analysis, by Region, 2020

Figure 34 : Global Warranty Management System Market Value Share Analysis, by Region, 2030

Figure 35: North America Warranty Management System Market Value Share Analysis, by Solution, 2020

Figure 36: North America Warranty Management System Market Value Share Analysis, by Solution, 2030

Figure 37: North America Warranty Management System Market Value Share Analysis, by Deployment, 2020

Figure 38: North America Warranty Management System Market Value Share Analysis, by Deployment, 2030

Figure 39: North America Warranty Management System Market Value Share Analysis, by Application, 2020

Figure 40: North America Warranty Management System Market Value Share Analysis, by Application, 2030

Figure 41: North America Warranty Management System Market Value Share Analysis, by Country, 2020

Figure 42: North America Warranty Management System Market Value Share Analysis, by Country, 2030

Figure 43: Europe Warranty Management System Market Value Share Analysis, by Solution, 2020

Figure 44: Europe Warranty Management System Market Value Share Analysis, by Solution, 2030

Figure 45: Europe Warranty Management System Market Value Share Analysis, by Deployment, 2020

Figure 46: Europe Warranty Management System Market Value Share Analysis, by Deployment, 2030

Figure 47: Europe Warranty Management System Market Value Share Analysis, by Application, 2020

Figure 48: Europe Warranty Management System Market Value Share Analysis, by Application, 2030

Figure 49: Europe Warranty Management System Market Value Share Analysis, by Country, 2020

Figure 50: Europe Warranty Management System Market Value Share Analysis, by Country, 2030

Figure 51: Asia Pacific Warranty Management System Market Value Share Analysis, by Solution, 2020

Figure 52: Asia Pacific Warranty Management System Market Value Share Analysis, by Solution, 2030

Figure 53: Asia Pacific Warranty Management System Market Value Share Analysis, by Deployment, 2020

Figure 54: Asia Pacific Warranty Management System Market Value Share Analysis, by Deployment, 2030

Figure 55: Asia Pacific Warranty Management System Market Value Share Analysis, by Application, 2020

Figure 56: Asia Pacific Warranty Management System Market Value Share Analysis, by Application, 2030

Figure 57: Asia Pacific Warranty Management System Market Value Share Analysis, by Country, 2020

Figure 58: Asia Pacific Warranty Management System Market Value Share Analysis, by Country, 2030

Figure 59: Middle East & Africa Warranty Management System Market Value Share Analysis, by Solution, 2020

Figure 60: Middle East & Africa Warranty Management System Market Value Share Analysis, by Solution, 2030

Figure 61: Middle East & Africa Warranty Management System Market Value Share Analysis, by Deployment, 2020

Figure 62: Middle East & Africa Warranty Management System Market Value Share Analysis, by Deployment, 2030

Figure 63: Middle East & Africa Warranty Management System Market Value Share Analysis, by Application, 2020

Figure 64: Middle East & Africa Warranty Management System Market Value Share Analysis, by Application, 2030

Figure 65: Middle East & Africa Warranty Management System Market Value Share Analysis, by Country, 2020

Figure 66: Middle East & Africa Warranty Management System Market Value Share Analysis, by Country, 2030

Figure 67: South America Warranty Management System Market Value Share Analysis, by Solution, 2020

Figure 68: South America Warranty Management System Market Value Share Analysis, by Solution, 2030

Figure 69: South America Warranty Management System Market Value Share Analysis, by Deployment, 2020

Figure 70: South America Warranty Management System Market Value Share Analysis, by Deployment, 2030

Figure 71: South America Warranty Management System Market Value Share Analysis, by Application, 2020

Figure 72: South America Warranty Management System Market Value Share Analysis, by Application, 2030

Figure 73: South America Warranty Management System Market Value Share Analysis, by Country, 2020

Figure 74: South America Warranty Management System Market Value Share Analysis, by Country, 2030

Figure 75: Market Revenue Share (%) Analysis – Major players and Other players