Analysts’ Viewpoint

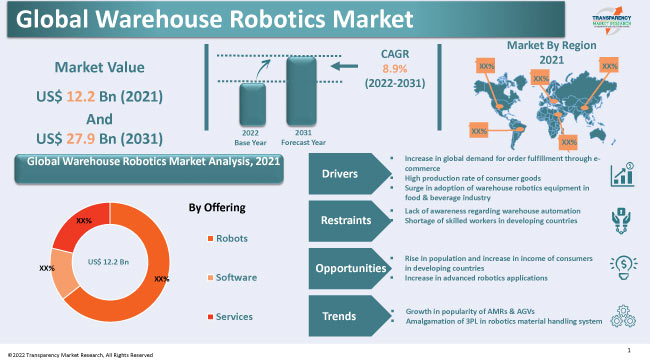

Rise in adoption of warehouse robotics solutions in storage facilities in food & beverage, fast-moving consumer goods, 3PL, and retail sectors is a key factor driving warehouse robotics industry growth across the globe. Increase in collaboration between warehouse robotics and e-commerce companies is further contributing to market development.

Autonomous mobile robots (AMRs) are widely used in warehouses to increase the productivity of operations. Leading warehouse robotics companies are focusing on introducing innovative offerings to meet end-user requirements. Prominent players are following the warehouse robotics market trends to strengthen their industry position.

Warehouse robotics is an amalgamation of computerized technologies with hardware that uses robots as an alternative to human labor. Robots are used to lift, push, sort, pull, store, and retrieve end-products. Adoption of the robotic technology leads to high productivity and transformation in manufacturing and warehouse plants.

Warehouse robotics offers improved cycle times, easier relocation of materials, efficient usage of labor, reduced contamination, compliance with regulatory standards, greater efficiency, lower wastage, decline in costs, better usage of warehouse space, and increased employee safety.

Most warehouse experts are likely to recognize the need for industrial automation systems and different types of warehouse robots during the forecast period. Growth in the e-commerce sector, high production rate of consumer goods, and rise in adoption of warehouse robotics equipment in frozen food and cold storage are some of the major factors contributing to warehouse robotics market growth.

Warehouse robotics helps store and transport frozen foods and other chilled foodstuffs efficiently with appropriate warehouse material handling practices. Manufacturers are focusing on selecting the right equipment that can keep the foodstuffs at a suitable temperature through the handling process to deliver standard practices of cold storage. Cold storage facility deploys various types of robots for palletizing, depalletizing, loading, unloading, sortation, and storage applications.

The Food and Drug Administration regulates cold chain products in countries in North America such as Canada and the U.S. Temperature-sensitive goods such as meat, seafood, fruits, frozen foods, and vaccines need to be stored efficiently to maintain their freshness and quality. Automated freezer warehouses offer benefits such as reduced space for storage, lower operating costs, decrease in energy consumption, and reduction in number of workers required for job execution. Additionally, rise in popularity of ready-to-eat meals among the younger generation and adolescent population is contributing to market growth.

Automated guided vehicles (AGVs) are the ideal choice for automating transportation activities such as storage, picking, and sorting. AGVs are used in warehouses when there is a need for tedious, constant material deliveries.

Warehouse service providers are increasingly focusing on reducing the work time of each process in end-of-line packaging functions such as labeling, quality check, and inspections. AGVs and AMRs also help in dealing with work delays and other glitches.

Some AGVs have been integrated with robot arms to automatically pick and place goods. AGVs have further progressed into keener autonomous mobile robots (AMR) in expectation of the arrival of the smart manufacturing era. Thus, the warehouse robotics market size is anticipated to increase during the forecast period, owing to the rise in adoption of AMRs and AGVs across the globe.

In terms of offering, the global industry has been classified into robots, software, and services. The robots segment held major share of 66.9% in 2021. It is likely to maintain its dominance during the forecast period. Increase in demand for AGVs and AMRs in the e-commerce sector is a key factor that is projected to boost the robots segment in the near future.

Increase in adoption of robots in warehouses across the globe can primarily be ascribed to the COVID-19 outbreak. Advent of Industrial Internet of Things (IIoT) is also contributing to the rise in adoption of robots in industries in order to improve operational productivity. Thus, the warehouse robotics market share is likely to increase during the forecast period.

According to the global warehouse robotics market forecast report, the automated guided vehicles (AGVs) segment held 28.9% share of the global market in terms of robots in 2021. AGVs are armed with cameras, sensors, and laser heads. These features of AGVs help offer safety to machinery, structures, and employees in a facility.

AGVs assist in refining the correctness of workflows, thus augmenting productivity. Therefore, demand for automated guided vehicles is rising across the globe. This is estimated to positively impact warehouse robotics market dynamics during the forecast period.

According to the global warehouse robotics market analysis, North America held 37.7% share of the global business in 2021. The region is anticipated to maintain its dominance during the forecast period owing to the early adoption of warehouse automation solutions.

The U.S. is a significant market for vendors offering solutions for automated factories, warehouses, distribution centers, and storage facilities. The country is on the verge of the fifth industrial revolution, where robotics would be used on a large scale for planning and executing production activities.

Europe is also a key market for warehouse robotics. The region held vital share of 26.5% in 2021, led by the presence of several prominent manufacturing corporations. Key countries in Europe such as Germany, Sweden, Denmark, Italy, Benelux, Spain, France, Switzerland, and Slovenia are expected to grab lucrative warehouse robotics market opportunities in the next few years. This can be ascribed to the rise in adoption of robots in the manufacturing sector in these countries.

Increase in industrial control & factory automation solutions and growth in the warehouse industry in Asia Pacific are contributing to warehouse robotics market development in the region. The warehouse robotics industry in Asia Pacific is expected to grow at a rapid pace due to the rise in investment by market players in warehouse robotics solutions along with the presence of a large number of end-use customers demanding these solutions. Proactive governmental support for manufacturing industries and industrial automation is another factor driving market progress in Asia Pacific.

The global warehouse robotics business is fragmented, with the presence of established players holding large share of the business. Most of the warehouse robotics companies are investing significantly in comprehensive research & development activities to introduce fully automated, precise, and environment-friendly systems. Furthermore, new product development and mergers & acquisitions are some of the notable strategies adopted by key players.

Some of the prominent warehouse robotics market players operating across the globe are ABB, ATS Automation Tooling Systems Inc., Omron Corporation, FANUC America Corporation, Fortna Inc., Geekplus Technology Co., Ltd., HAI ROBOTICS, KUKA AG, Locus Robotics, Multiway Robotics (Shenzhen) Company, Prime Robotics, RightHand Robotics, Inc., Sage Automation Inc., Schneider Electric, YASKAWA ELECTRIC CORPORATION, and Zebra Technologies.

Key players have been profiled in the warehouse robotics market research report based on parameters such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 12.2 Bn |

|

Market Forecast Value in 2031 |

US$ 27.9 Bn |

|

Growth Rate (CAGR) |

8.9% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 12.2 Bn in 2021.

It is expected to grow at a CAGR of 8.9% by 2031.

It is likely to reach US$ 27.9 Bn in 2031.

ABB, ATS Automation Tooling Systems Inc., FANUC America Corporation, Fortna Inc., Geekplus Technology Co., Ltd., HAI ROBOTICS, KUKA AG, Locus Robotics, Multiway Robotics (Shenzhen) Company, Omron Corporation, Prime Robotics, RightHand Robotics, Inc., Sage Automation Inc., Schneider Electric, YASKAWA ELECTRIC CORPORATION, and Zebra Technologies.

The U.S. accounted for approximately 33.8% share in 2021.

Based on offering, the robots segment held 66.9% share in 2021.

Growth in popularity of AMR & AGVs and amalgamation of 3PL in robotics material handling system.

Asia Pacific is a more lucrative region for vendors.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Warehouse Robotics Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Robots Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. Covid-19 Impact and Recovery Analysis

5. Global Warehouse Robotics Market Analysis By Offering

5.1. Warehouse Robotics Market Size (US$ Mn) and Volume (Units) Analysis & Forecast, By Offering, 2022-2031

5.1.1. Robots

5.1.1.1. Autonomous Mobile Robots (AMRs)

5.1.1.2. Automated Guided Vehicles (AGVs)

5.1.1.3. Gantry Robots

5.1.1.4. Articulated Arm Robots

5.1.1.5. Others

5.1.2. Software

5.1.3. Services

5.1.3.1. Training & Consulting Services

5.1.3.2. Repair & Maintenance Services

5.2. Others Market Attractiveness Analysis, By Offering

6. Global Warehouse Robotics Market Analysis By Application

6.1. Warehouse Robotics Market Size (US$ Mn) Analysis & Forecast, By Application, 2022-2031

6.1.1. Palletizing & Depalletizing

6.1.2. Loading & Unloading

6.1.3. Sortation & Storage

6.1.4. Others

6.2. Market Attractiveness Analysis, By Application

7. Global Warehouse Robotics Market Analysis By End-use Industry

7.1. Warehouse Robotics Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2022-2031

7.1.1. Food & Beverage

7.1.2. FMCG

7.1.3. Non-Durable Goods

7.1.4. Durable Goods

7.1.5. Fashion & Apparel

7.1.6. Pharmaceutical

7.1.7. Automotive

7.1.8. Retail

7.1.9. 3PL

7.1.10. Others

7.2. Market Attractiveness Analysis, By End-use Industry

8. Global Warehouse Robotics Market Analysis and Forecast, By Region

8.1. Warehouse Robotics Market Size (US$ Mn) and Volume (Units) Analysis & Forecast, By Region, 2022-2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, By Region

9. North America Warehouse Robotics Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Warehouse Robotics Market Size (US$ Mn) and Volume (Units) Analysis & Forecast, By Offering, 2022-2031

9.3.1. Robots

9.3.1.1. Autonomous Mobile Robots (AMRs)

9.3.1.2. Automated Guided Vehicles (AGVs)

9.3.1.3. Gantry Robots

9.3.1.4. Articulated Arm Robots

9.3.1.5. Others

9.3.2. Software

9.3.3. Services

9.3.3.1. Training & Consulting Services

9.3.3.2. Repair & Maintenance Services

9.4. Warehouse Robotics Market Size (US$ Mn) Analysis & Forecast, By Application, 2022-2031

9.4.1. Palletizing & Depalletizing

9.4.2. Loading & Unloading

9.4.3. Sortation & Storage

9.4.4. Others

9.5. Warehouse Robotics Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2022-2031

9.5.1. Food & Beverage

9.5.2. FMCG

9.5.3. Non-Durable Goods

9.5.4. Durable Goods

9.5.5. Fashion & Apparel

9.5.6. Pharmaceutical

9.5.7. Automotive

9.5.8. Retail

9.5.9. 3PL

9.5.10. Others

9.6. Warehouse Robotics Market Size (US$ Mn) and Volume (Units) Analysis & Forecast, By Country & Sub-Region, 2022-2031

9.6.1. The U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By Offering

9.7.2. By Application

9.7.3. By End-use Industry

9.7.4. By Country/Sub-region

10. Europe Warehouse Robotics Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Warehouse Robotics Market Size (US$ Mn) and Volume (Units) Analysis & Forecast, By Offering, 2022-2031

10.3.1. Robots

10.3.1.1. Autonomous Mobile Robots (AMRs)

10.3.1.2. Automated Guided Vehicles (AGVs)

10.3.1.3. Gantry Robots

10.3.1.4. Articulated Arm Robots

10.3.1.5. Others

10.3.2. Software

10.3.3. Services

10.3.3.1. Training & Consulting Services

10.3.3.2. Repair & Maintenance Services

10.4. Warehouse Robotics Market Size (US$ Mn) Analysis & Forecast, By Application, 2022-2031

10.4.1. Palletizing & Depalletizing

10.4.2. Loading & Unloading

10.4.3. Sortation & Storage

10.4.4. Others

10.5. Warehouse Robotics Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2022-2031

10.5.1. Food & Beverage

10.5.2. FMCG

10.5.3. Non-Durable Goods

10.5.4. Durable Goods

10.5.5. Fashion & Apparel

10.5.6. Pharmaceutical

10.5.7. Automotive

10.5.8. Retail

10.5.9. 3PL

10.5.10. Others

10.6. Warehouse Robotics Market Size (US$ Mn) and Volume (Units) Analysis & Forecast, By Country & Sub-Region, 2022-2031

10.6.1. The U.K.

10.6.2. Germany

10.6.3. France

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Offering

10.7.2. By Application

10.7.3. By End-use Industry

10.7.4. By Country/Sub-region

11. Asia Pacific Warehouse Robotics Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Warehouse Robotics Market Size (US$ Mn) and Volume (Units) Analysis & Forecast, By Offering, 2022-2031

11.3.1. Robots

11.3.1.1. Autonomous Mobile Robots (AMRs)

11.3.1.2. Automated Guided Vehicles (AGVs)

11.3.1.3. Gantry Robots

11.3.1.4. Articulated Arm Robots

11.3.1.5. Others

11.3.2. Software

11.3.3. Services

11.3.3.1. Training & Consulting Services

11.3.3.2. Repair & Maintenance Services

11.4. Warehouse Robotics Market Size (US$ Mn) Analysis & Forecast, By Application, 2022-2031

11.4.1. Palletizing & Depalletizing

11.4.2. Loading & Unloading

11.4.3. Sortation & Storage

11.4.4. Others

11.5. Warehouse Robotics Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2022-2031

11.5.1. Food & Beverage

11.5.2. FMCG

11.5.3. Non-Durable Goods

11.5.4. Durable Goods

11.5.5. Fashion & Apparel

11.5.6. Pharmaceutical

11.5.7. Automotive

11.5.8. Retail

11.5.9. 3PL

11.5.10. Others

11.6. Warehouse Robotics Market Size (US$ Mn) and Volume (Units) Analysis & Forecast, By Country & Sub-Region, 2022-2031

11.6.1. China

11.6.2. India

11.6.3. Japan

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Offering

11.7.2. By Application

11.7.3. By End-use Industry

11.7.4. By Country/Sub-region

12. Middle East and Africa Global Warehouse Robotics Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Warehouse Robotics Market Size (US$ Mn) and Volume (Units) Analysis & Forecast, By Offering, 2022-2031

12.3.1. Robots

12.3.1.1. Autonomous Mobile Robots (AMRs)

12.3.1.2. Automated Guided Vehicles (AGVs)

12.3.1.3. Gantry Robots

12.3.1.4. Articulated Arm Robots

12.3.1.5. Others

12.3.2. Software

12.3.3. Services

12.3.3.1. Training & Consulting Services

12.3.3.2. Repair & Maintenance Services

12.4. Warehouse Robotics Market Size (US$ Mn) Analysis & Forecast, By Application, 2022-2031

12.4.1. Palletizing & Depalletizing

12.4.2. Loading & Unloading

12.4.3. Sortation & Storage

12.4.4. Others

12.5. Warehouse Robotics Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2022-2031

12.5.1. Food & Beverage

12.5.2. FMCG

12.5.3. Non-Durable Goods

12.5.4. Durable Goods

12.5.5. Fashion & Apparel

12.5.6. Pharmaceutical

12.5.7. Automotive

12.5.8. Retail

12.5.9. 3PL

12.5.10. Others

12.6. Warehouse Robotics Market Size (US$ Mn) and Volume (Units) Analysis & Forecast, By Country & Sub-Region, 2022-2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of the Middle East and Africa

12.7. Market Attractiveness Analysis

12.7.1. By Offering

12.7.2. By Application

12.7.3. By End-use Industry

12.7.4. By Country/Sub-region

13. South America Warehouse Robotics Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Warehouse Robotics Market Size (US$ Mn) and Volume (Units) Analysis & Forecast, By Offering, 2022-2031

13.3.1. Robots

13.3.1.1. Autonomous Mobile Robots (AMRs)

13.3.1.2. Automated Guided Vehicles (AGVs)

13.3.1.3. Gantry Robots

13.3.1.4. Articulated Arm Robots

13.3.1.5. Others

13.3.2. Software

13.3.3. Services

13.3.3.1. Training & Consulting Services

13.3.3.2. Repair & Maintenance Services

13.4. Warehouse Robotics Market Size (US$ Mn) Analysis & Forecast, By Application, 2022-2031

13.4.1. Palletizing & Depalletizing

13.4.2. Loading & Unloading

13.4.3. Sortation & Storage

13.4.4. Others

13.5. Warehouse Robotics Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2022-2031

13.5.1. Food & Beverage

13.5.2. FMCG

13.5.3. Non-Durable Goods

13.5.4. Durable Goods

13.5.5. Fashion & Apparel

13.5.6. Pharmaceutical

13.5.7. Automotive

13.5.8. Retail

13.5.9. 3PL

13.5.10. Others

13.6. Warehouse Robotics Market Size (US$ Mn) and Volume (Units) Analysis & Forecast, By Country & Sub-Region, 2022-2031

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Offering

13.7.2. By Application

13.7.3. By End-use Industry

13.7.4. By Country/Sub-region

14. Competition Assessment

14.1. Global Warehouse Robotics Market Competition Matrix - a Warehouse Robotics Dashboard View

14.1.1. Global Market Company Share Analysis, by Value (2021)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. ABB

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. ATS Automation Tooling Systems Inc.

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. FANUC America Corporation

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Fortna Inc.

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Geekplus Technology Co., Ltd.

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. HAI ROBOTICS

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. KUKA AG

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Locus Robotics

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Multiway Robotics (Shenzhen) Company

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Omron Corporation

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. Prime Robotics

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

15.12. RightHand Robotics, Inc.

15.12.1. Overview

15.12.2. Product Portfolio

15.12.3. Sales Footprint

15.12.4. Key Subsidiaries or Distributors

15.12.5. Strategy and Recent Developments

15.12.6. Key Financials

15.13. Sage Automation Inc.

15.13.1. Overview

15.13.2. Product Portfolio

15.13.3. Sales Footprint

15.13.4. Key Subsidiaries or Distributors

15.13.5. Strategy and Recent Developments

15.13.6. Key Financials

15.14. Schneider Electric

15.14.1. Overview

15.14.2. Product Portfolio

15.14.3. Sales Footprint

15.14.4. Key Subsidiaries or Distributors

15.14.5. Strategy and Recent Developments

15.14.6. Key Financials

15.15. YASKAWA ELECTRIC CORPORATION

15.15.1. Overview

15.15.2. Product Portfolio

15.15.3. Sales Footprint

15.15.4. Key Subsidiaries or Distributors

15.15.5. Strategy and Recent Developments

15.15.6. Key Financials

15.16. Zebra Technologies

15.16.1. Overview

15.16.2. Product Portfolio

15.16.3. Sales Footprint

15.16.4. Key Subsidiaries or Distributors

15.16.5. Strategy and Recent Developments

15.16.6. Key Financials

16. Recommendation

16.1. Opportunity Assessment

16.1.1. By Offering

16.1.2. By Application

16.1.3. By End-use Industry

16.1.4. By Region

List of Tables

Table 01: Global Warehouse Robotics Market Size & Forecast, By Offering, Value (US$ Mn), 2017-2031

Table 02: Global Warehouse Robotics Market Size & Forecast, By Robots, Volume (Units), 2017-2031

Table 03: Global Warehouse Robotics Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 04: Global Warehouse Robotics Market Size & Forecast, By End-use Industry, Value (US$ Mn), 2017-2031

Table 05: Global Warehouse Robotics Market Size & Forecast, By Region, Value (US$ Mn), 2017-2031

Table 06: Global Warehouse Robotics Market Size & Forecast, By Region, Value (US$ Mn), 2017-2031

Table 07: North America Warehouse Robotics Market Size & Forecast, By Offering, Value (US$ Mn), 2017-2031

Table 08: North America Warehouse Robotics Market Size & Forecast, By Robots, Volume (Units), 2017-2031

Table 09: North America Warehouse Robotics Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 10: North America Warehouse Robotics Market Size & Forecast, By End-use Industry, Value (US$ Mn), 2017-2031

Table 11: North America Warehouse Robotics Market Size & Forecast, By Country, Value (US$ Mn), 2017-2031

Table 12: North America Warehouse Robotics Market Size & Forecast, By Country, Volume (Units), 2017-2031

Table 13: Europe Warehouse Robotics Market Size & Forecast, By Offering, Value (US$ Mn), 2017-2031

Table 14: Europe Warehouse Robotics Market Size & Forecast, By Robots, Volume (Units), 2017-2031

Table 15: Europe Warehouse Robotics Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 16: Europe Warehouse Robotics Market Size & Forecast, By End-use Industry, Value (US$ Mn), 2017-2031

Table 17: Europe Warehouse Robotics Market Size & Forecast, By Country, Value (US$ Mn), 2017-2031

Table 18: Europe Warehouse Robotics Market Size & Forecast, By Country, Volume (Units), 2017-2031

Table 19: Asia Pacific Warehouse Robotics Market Size & Forecast, By Offering, Value (US$ Mn), 2017-2031

Table 20: Asia Pacific Warehouse Robotics Market Size & Forecast, By Robots, Volume (Units), 2017-2031

Table 21: Asia Pacific Warehouse Robotics Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 22: Asia Pacific Warehouse Robotics Market Size & Forecast, By End-use Industry, Value (US$ Mn), 2017-2031

Table 23: Asia Pacific Warehouse Robotics Market Size & Forecast, By Country, Value (US$ Mn), 2017-2031

Table 24: Asia Pacific Warehouse Robotics Market Size & Forecast, By Country, Volume (Units), 2017-2031

Table 25: Middle East and Africa Warehouse Robotics Market Size & Forecast, By Offering, Value (US$ Mn), 2017-2031

Table 26: Middle East and Africa Warehouse Robotics Market Size & Forecast, By Robots, Volume (Units), 2017-2031

Table 27: Middle East and Africa Warehouse Robotics Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 28: Middle East and Africa Warehouse Robotics Market Size & Forecast, By End-use Industry, Value (US$ Mn), 2017-2031

Table 29: Middle East and Africa Warehouse Robotics Market Size & Forecast, By Country, Value (US$ Mn), 2017-2031

Table 30: Middle East and Africa Warehouse Robotics Market Size & Forecast, By Country, Volume (Units), 2017-2031

Table 31: South America Warehouse Robotics Market Size & Forecast, By Offering, Value (US$ Mn), 2017-2031

Table 32: South America Warehouse Robotics Market Size & Forecast, By Robots, Volume (Units), 2017-2031

Table 33: South America Warehouse Robotics Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 34: South America Warehouse Robotics Market Size & Forecast, By End-use Industry, Value (US$ Mn), 2017-2031

Table 35: South America Warehouse Robotics Market Size & Forecast, By Country, Value (US$ Mn), 2017-2031

Table 36: South America Warehouse Robotics Market Size & Forecast, By Country, Volume (Units), 2017-2031

List of Figures

Figure 01: North America Price Trend Analysis (Thousand US$) (2020, 2026, 2031)

Figure 02: Europe Price Trend Analysis (Thousand US$) (2020, 2026, 2031)

Figure 03: Asia Pacific Price Trend Analysis (Thousand US$) (2020, 2026, 2031)

Figure 04: Middle East and Africa Price Trend Analysis (Thousand US$) (2020, 2026, 2031)

Figure 05: South America Price Trend Analysis (Thousand US$) (2020, 2026, 2031)

Figure 06: Global Warehouse Robotics Market, Value (US$ Mn), 2017-2031

Figure 07: Global Warehouse Robotics Market, Volume (Units), 2017-2031

Figure 08: Global Warehouse Robotics Market Size & Forecast, By Offering, Revenue (US$ Mn), 2017-2031

Figure 09: Global Warehouse Robotics Market Attractiveness, By Offering, Value (US$ Mn), 2022-2031

Figure 10: Global Warehouse Robotics Market Share Analysis, by Offering, 2021 and 2031

Figure 11: Global Warehouse Robotics Market Size & Forecast, By Region, Revenue (US$ Mn), 2017-2031

Figure 12: Global Warehouse Robotics Market Attractiveness, By Region, Value (US$ Mn), 2022-2031

Figure 13: Global Warehouse Robotics Market Share Analysis, by Region, 2021 and 2031

Figure 14: Global Warehouse Robotics Market Size & Forecast, By End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 15: Global Warehouse Robotics Market Attractiveness, By End-use Industry, Value (US$ Mn), 2022-2031

Figure 16: Global Warehouse Robotics Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 17: Global Warehouse Robotics Market Size & Forecast, By Region, Revenue (US$ Mn), 2017-2031

Figure 18: Global Warehouse Robotics Market Attractiveness, By Region, Value (US$ Mn), 2022-2031

Figure 19: Global Warehouse Robotics Market Share Analysis, by Region, 2021 and 2031

Figure 20: North America Warehouse Robotics Market, Value (US$ Mn), 2017-2031

Figure 21: North America Warehouse Robotics Market, Volume (Units), 2017-2031

Figure 22: North America Warehouse Robotics Market Size & Forecast, By Offering, Revenue (US$ Mn), 2017-2031

Figure 23: North America Warehouse Robotics Market Attractiveness, By Offering, Value (US$ Mn), 2022-2031

Figure 24: North America Warehouse Robotics Market Share Analysis, by Offering, 2021 and 2031

Figure 25: North America Warehouse Robotics Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 26: North America Warehouse Robotics Market Attractiveness, By Application, Value (US$ Mn), 2022-2031

Figure 27: North America Warehouse Robotics Market Share Analysis, by Application, 2021 and 2031

Figure 28: North America Warehouse Robotics Market Size & Forecast, By End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 29: North America Warehouse Robotics Market Attractiveness, By End-use Industry, Value (US$ Mn), 2022-2031

Figure 30: North America Warehouse Robotics Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 31: North America Warehouse Robotics Market Size & Forecast, By Country, Revenue (US$ Mn), 2017-2031

Figure 32: North America Warehouse Robotics Market Attractiveness, By Country, Value (US$ Mn), 2022-2031

Figure 33: North America Warehouse Robotics Market Share Analysis, by Country, 2021 and 2031

Figure 34: Europe Warehouse Robotics Market, Value (US$ Mn), 2017-2031

Figure 35: Europe Warehouse Robotics Market, Volume (Units), 2017-2031

Figure 36: Europe Warehouse Robotics Market Size & Forecast, By Offering, Revenue (US$ Mn), 2017-2031

Figure 37: Europe Warehouse Robotics Market Attractiveness, By Offering, Value (US$ Mn), 2022-2031

Figure 38: Europe Warehouse Robotics Market Share Analysis, by Offering, 2021 and 2031

Figure 39: Europe Warehouse Robotics Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 40: Europe Warehouse Robotics Market Attractiveness, By Application, Value (US$ Mn), 2022-2031

Figure 41: Europe Warehouse Robotics Market Share Analysis, by Application, 2021 and 2031

Figure 42: Europe Warehouse Robotics Market Size & Forecast, By End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 43: Europe Warehouse Robotics Market Attractiveness, By End-use Industry, Value (US$ Mn), 2022-2031

Figure 44: Europe Warehouse Robotics Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 45: Europe Warehouse Robotics Market Size & Forecast, By Country, Revenue (US$ Mn), 2017-2031

Figure 46: Europe Warehouse Robotics Market Attractiveness, By Country, Value (US$ Mn), 2022-2031

Figure 47: Europe Warehouse Robotics Market Share Analysis, by Country, 2021 and 2031

Figure 48: Asia Pacific Warehouse Robotics Market, Value (US$ Mn), 2017-2031

Figure 49: Asia Pacific Warehouse Robotics Market, Volume (Units), 2017-2031

Figure 50: Asia Pacific Warehouse Robotics Market Size & Forecast, By Offering, Revenue (US$ Mn), 2017-2031

Figure 51: Asia Pacific Warehouse Robotics Market Attractiveness, By Offering, Value (US$ Mn), 2022-2031

Figure 52: Asia Pacific Warehouse Robotics Market Share Analysis, by Offering, 2021 and 2031

Figure 53: Asia Pacific Warehouse Robotics Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 54: Asia Pacific Warehouse Robotics Market Attractiveness, By Application, Value (US$ Mn), 2022-2031

Figure 55: Asia Pacific Warehouse Robotics Market Share Analysis, by Application, 2021 and 2031

Figure 56: Asia Pacific Warehouse Robotics Market Size & Forecast, By End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 57: Asia Pacific Warehouse Robotics Market Attractiveness, By End-use Industry, Value (US$ Mn), 2022-2031

Figure 58: Asia Pacific Warehouse Robotics Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 59: Asia Pacific Warehouse Robotics Market Size & Forecast, By Country, Revenue (US$ Mn), 2017-2031

Figure 60: Asia Pacific Warehouse Robotics Market Attractiveness, By Country, Value (US$ Mn), 2022-2031

Figure 61: Asia Pacific Warehouse Robotics Market Share Analysis, by Country, 2021 and 2031

Figure 62: Middle East and Africa Warehouse Robotics Market, Value (US$ Mn), 2017-2031

Figure 63: Middle East and Africa Warehouse Robotics Market, Volume (Units), 2017-2031

Figure 64: Middle East and Africa Warehouse Robotics Market Size & Forecast, By Offering, Revenue (US$ Mn), 2017-2031

Figure 65: Middle East and Africa Warehouse Robotics Market Attractiveness, By Offering, Value (US$ Mn), 2022-2031

Figure 66: Middle East and Africa Warehouse Robotics Market Share Analysis, by Offering, 2021 and 2031

Figure 67: Middle East and Africa Warehouse Robotics Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 68: Middle East and Africa Warehouse Robotics Market Attractiveness, By Application, Value (US$ Mn), 2022-2031

Figure 69: Middle East and Africa Warehouse Robotics Market Share Analysis, by Application, 2021 and 2031

Figure 70: Middle East and Africa Warehouse Robotics Market Size & Forecast, By End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 71: Middle East and Africa Warehouse Robotics Market Attractiveness, By End-use Industry, Value (US$ Mn), 2022-2031

Figure 72: Middle East and Africa Warehouse Robotics Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 73: Middle East and Africa Warehouse Robotics Market Size & Forecast, By Country, Revenue (US$ Mn), 2017-2031

Figure 74: Middle East and Africa Warehouse Robotics Market Attractiveness, By Country, Value (US$ Mn), 2022-2031

Figure 75: Middle East and Africa Warehouse Robotics Market Share Analysis, by Country, 2021 and 2031

Figure 76: South America Warehouse Robotics Market, Value (US$ Mn), 2017-2031

Figure 77: South America Warehouse Robotics Market, Volume (Units), 2017-2031

Figure 78: South America Warehouse Robotics Market Size & Forecast, By Offering, Revenue (US$ Mn), 2017-2031

Figure 79: South America Warehouse Robotics Market Attractiveness, By Offering, Value (US$ Mn), 2022-2031

Figure 80: South America Warehouse Robotics Market Share Analysis, by Offering, 2021 and 2031

Figure 81: South America Warehouse Robotics Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 82: South America Warehouse Robotics Market Attractiveness, By Application, Value (US$ Mn), 2022-2031

Figure 83: South America Warehouse Robotics Market Share Analysis, by Application, 2021 and 2031

Figure 84: South America Warehouse Robotics Market Size & Forecast, By End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 85: South America Warehouse Robotics Market Attractiveness, By End-use Industry, Value (US$ Mn), 2022-2031

Figure 86: South America Warehouse Robotics Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 87: South America Warehouse Robotics Market Size & Forecast, By Country, Revenue (US$ Mn), 2017-2031

Figure 88: South America Warehouse Robotics Market Attractiveness, By Country, Value (US$ Mn), 2022-2031

Figure 89: South America Warehouse Robotics Market Share Analysis, by Country, 2021 and 2031