Analysts’ Viewpoint on Market Scenario

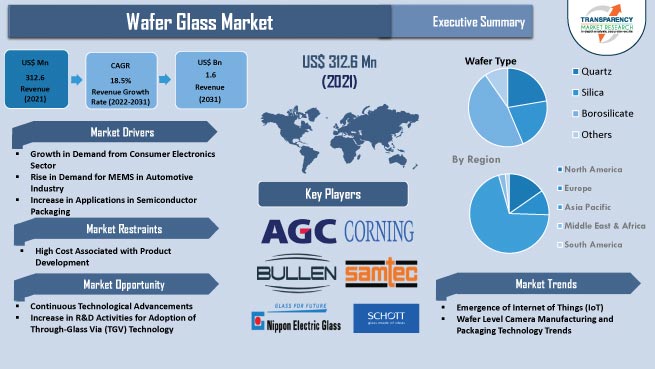

Rise in demand for glass wafers from MEMS and image sensors is anticipated to fuel the global wafer glass market in the next few years. A large market potential for semiconductor glass wafers has been created by the emergence and growth of the Internet of Things (IoT). Additionally, consistent R&D activities for the development of glass substrates in last few years have prompted numerous players to produce novel, ground-breaking, cost-effective, and efficient products with better design.

Wafer-level packaging technology has been gaining popularity for the last few years, replacing traditional individual-piece packaging. Consequently, the demand for glass as a carrier substrate in packaging is increasing. Key manufacturers of wafer glass are focused on the development of products with diameters between 25mm and 300mm in order to gain lucrative opportunities. This is because glass wafers with such physical dimensions are more frequently used for MEMS and image sensor applications.

Glass wafers are thin precision glass discs that are typically made of borosilicate glass, quartz, or fused silica and are utilized as a substrate carrier for bonding silicon and other substrates. Glass wafers are also used in display engineering and display glass inspection systems. Glass wafers offer several advantages over silicon wafers, which include low electrical loss, better warp management, and the potential to optimize processes. Wafer glass are employed in various applications such as wafer packaging, substrate carrier, and TGV interposer. Growth in demand for glass wafer fabrication in microelectronic mechanical systems (MEMS) and consumer electronics for wafer packaging and substrate carriers is projected to propel market development during the forecast period.

Glass wafers are increasingly being used as a technological component of MEMS, image sensors, and other electronics applications as an alternative to silicon wafers. Glass wafers protect these sensitive components by preventing corrosion and other damage. Indeed, glass wafer packaging is becoming more common in MEMS technology due to the unique material properties of glass versus other wafer materials such as silicon or ceramic.

Glass wafer fabrication innovation is increasingly contributing to the advancement of MEMS technology, due to the development in consumer electronics and automotive sector. Thus, these are widely used in wafer packaging for MEMS as well as substrates carriers in various consumer electronics devices. Moreover, rise in popularity of Internet of Things (IoT), smartphones, automation, and portable electronics is driving the consumer electronics market in which MEMS plays a significant role. According to the India Brand Equity Foundation, the appliances and consumer electronics (ACE) industry is expected to grow at a CAGR of 9% and reach a value of US$ 48.4 Bn by 2022. Thus, growth in consumer electronics is likely to fuel the demand for wafer glass during the forecast period.

New emerging electronic packaging requirements are broadening the scope of the wafer glass business. Some of the key market players are introducing new products to gain revenue benefits. For instance, in June 2022, Corning Inc. announced the introduction of its new Ultra-Low TTV Glass Carrier Wafers, which enable advanced semiconductor manufacturing as well as applications for 5G connectivity.

MEMS sensors, which combine electronic and mechanical elements to combine signal processing abilities on a single small chip, are widely used in automobiles. MEMS are manufactured using integrated circuit (IC) batch processing techniques, and their sizes range from a few micrometers to millimeters.

MEMS sensors could be used in diverse applications, including tier pressure monitoring systems, oil pressure sensing, pedestrian protection, exhaust gas recirculation, rollover detection, and navigation systems. Sales of electric vehicles, such as battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), increased in 2020 despite a weak auto sector, and they nearly doubled to 6.6 million in 2021. The EV sales growth rate in Europe was highest around 61%, in 2021, surpassing China (58%) and the U.S. (32%). Thus, growth in the automotive sector leads to increase the demand of MEMS devices, which in turn is boosting market progression.

Governments of various nations have an intense interest in forming standards and regulations for automotive MEMS sensors, which in turn is estimated to fuel the wafer glass industry in the next few years. Increased demand for IoT technologies, vehicle safety and security, and advanced technology are also expected to boost the demand for wafer glass in the automotive sector in the next few years.

Based on wafer type, the global wafer glass market has been segmented into quartz, silica, borosilicate, and others. The borosilicate segment held 46.7% share of the market in 2021, and it is anticipated to dominate the market during the forecast period. Borosilicate glass is strong and durable, hence suitable for different applications. It is less expensive than other types of wafer glass. The borosilicate segment is likely to maintain its dominance during the forecast period, owing to an increase in adoption in semiconductor devices, optical lenses, optical filters, and sensors applications.

In terms of end-use, the global wafer glass market has been classified into MEMS, image sensors, semiconductors, and others. The image sensors segment dominated and held 38.2% share of the global business in 2021. Increase in demand for image sensors in smartphones, laptops, tablets, TVs, and surveillance cameras is projected to fuel the segment in the next few years.

Furthermore, increase in usage of image sensors in ADAS systems in a vehicle is also contributing to the segment growth. The image sensor uses a glass wafer for wafer-level capping, which is bonded to the image sensor wafer through an adhesive bonding process.

Asia Pacific dominated the global market with 70.1% share in 2021 due to the presence of substantial wafer end users, as well as the largest wafer production capacity and competence among regional players. China and Japan are projected to contribute significant market share of Asia Pacific during the forecast period. Rise in demand for smartphones and computer devices along with increase in adoption of autonomous vehicles in Asia Pacific is expected to fuel market expansion in the region. Moreover, Taiwan held 20.1% share of the global market in 2021, owing to the presence of major wafer producer foundries in the country.

North America and Europe held 15.3% and 10.2% share, respectively, of the global market in 2021. Increase in R&D activities in the U.S. and government initiatives for the growth of the semiconductor sector are likely to boost the market in North America during the forecast period. Furthermore, growth in end-use industries such as automobile, consumer electronics in North America is also contributing to market development in the region.

The global wafer glass market is consolidated, with a small number of large-scale vendors controlling majority of the share. Most of the wafer glass companies are investing significantly in comprehensive research and development activities for new product development. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by key players.

AGC Inc., Bullen, Coresix Precision Glass, Inc., Corning Incorporated, Nippon Electric Glass, Plan Optik AG, Samtec, Inc., SCHOTT AG, Shin-Etsu Chemical Co., Ltd, and Swift Glass are the prominent entities operating in the global market.

Key players have been profiled in the market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 312.6 Mn |

|

Market Forecast Value in 2031 |

US$ 1.6 Bn |

|

Growth Rate (CAGR) |

18.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn/Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market stood at US$ 312.6 Mn in 2021

The market is expected to advance at a CAGR of 18.5% from 2022 to 2031

Growth in demand from consumer electronics industry, increase in applications in semiconductor packaging, and rise in demand for MEMS in automotive sector

Consumer electronics was the largest industry vertical segment that held 49.1% share in 2021

Asia Pacific is a more attractive region for vendors in the global market

AGC Inc., Bullen, Coresix Precision Glass, Inc., Corning Incorporated, Nippon Electric Glass, Plan Optik AG, Samtec, Inc., SCHOTT AG, Shin-Etsu Chemical Co., Ltd, and Swift Glass

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Wafer Glass Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Printed Circuit Boards Industry Overview

4.2. Supply Chain Analysis

4.3. Technology Roadmap

4.4. Industry SWOT Analysis

4.5. Porter’s Five Forces Analysis

4.6. COVID-19 Impact and Recovery Analysis

5. Global Wafer Glass Market Analysis, by Wafer Type

5.1. Wafer Glass Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Wafer Type, 2017–2031

5.1.1. Quartz

5.1.2. Silica

5.1.3. Borosilicate

5.1.4. Others

5.2. Market Attractiveness Analysis, By Wafer Type

6. Global Wafer Glass Market Analysis, by Wafer Diameter

6.1. Wafer Glass Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Wafer Diameter, 2017–2031

6.1.1. Up to 100mm

6.1.2. 125mm

6.1.3. 150mm

6.1.4. 200mm

6.1.5. 300mm

6.1.6. Above 300mm

6.2. Market Attractiveness Analysis, By Wafer Diameter

7. Global Wafer Glass Market Analysis, by Application

7.1. Wafer Glass Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

7.1.1. Wafer Packaging

7.1.2. Substrate Carrier

7.1.3. TGV Interposer

7.2. Market Attractiveness Analysis, By Application

8. Global Wafer Glass Market Analysis, by End-use

8.1. Wafer Glass Market Size (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

8.1.1. MEMS

8.1.2. Image Sensors

8.1.3. Semiconductors

8.1.4. Others

8.2. Market Attractiveness Analysis, By End-use

9. Global Wafer Glass Market Analysis, by Industry Vertical

9.1. Wafer Glass Market Size (US$ Mn) Analysis & Forecast, by Industry Vertical, 2017–2031

9.1.1. Automotive

9.1.2. Consumer Electronics

9.1.3. IT & Telecommunication

9.1.4. Others

9.2. Market Attractiveness Analysis, By Industry Vertical

10. Global Wafer Glass Market Analysis and Forecast, by Region

10.1. Wafer Glass Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Region, 2017–2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Market Attractiveness Analysis, By Region

11. North America Wafer Glass Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Wafer Glass Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Wafer Type, 2017–2031

11.3.1. Quartz

11.3.2. Silica

11.3.3. Borosilicate

11.3.4. Others

11.4. Electronic Wafer Glass Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Wafer Diameter, 2017–2031

11.4.1. Up to 100mm

11.4.2. 125mm

11.4.3. 150mm

11.4.4. 200mm

11.4.5. 300mm

11.4.6. Above 300mm

11.5. Wafer Glass Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

11.5.1. Wafer Packaging

11.5.2. Substrate Carrier

11.5.3. TGV Interposer

11.6. Wafer Glass Market Size (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

11.6.1. MEMS

11.6.2. Image Sensors

11.6.3. Semiconductors

11.6.4. Others

11.7. Wafer Glass Market Size (US$ Mn) Analysis & Forecast, by Industry Vertical, 2017–2031

11.7.1. Automotive

11.7.2. Consumer Electronics

11.7.3. IT & Telecommunication

11.7.4. Others

11.8. Others Wafer Glass Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.8.1. The U.S.

11.8.2. Canada

11.8.3. Rest of North America

11.9. Market Attractiveness Analysis

11.9.1. By Wafer Type

11.9.2. By Wafer Diameter

11.9.3. By Application

11.9.4. By End-use

11.9.5. By Industry Vertical

11.9.6. By Country/Sub-region

12. Europe Wafer Glass Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Wafer Glass Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Wafer Type, 2017–2031

12.3.1. Quartz

12.3.2. Silica

12.3.3. Borosilicate

12.3.4. Others

12.4. Electronic Wafer Glass Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Wafer Diameter, 2017–2031

12.4.1. Up to 100mm

12.4.2. 125mm

12.4.3. 150mm

12.4.4. 200mm

12.4.5. 300mm

12.4.6. Above 300mm

12.5. Wafer Glass Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

12.5.1. Wafer Packaging

12.5.2. Substrate Carrier

12.5.3. TGV Interposer

12.6. Wafer Glass Market Size (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

12.6.1. MEMS

12.6.2. Image Sensors

12.6.3. Semiconductors

12.6.4. Others

12.7. Wafer Glass Market Size (US$ Mn) Analysis & Forecast, by Industry Vertical, 2017–2031

12.7.1. Automotive

12.7.2. Consumer Electronics

12.7.3. IT & Telecommunication

12.7.4. Others

12.8. Wafer Glass Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.8.1. The U.K.

12.8.2. Germany

12.8.3. France

12.8.4. Rest of Europe

12.9. Market Attractiveness Analysis

12.9.1. By Wafer Type

12.9.2. By Wafer Diameter

12.9.3. By Application

12.9.4. By End-use

12.9.5. By Industry Vertical

12.9.6. By Country/Sub-region

13. Asia Pacific Wafer Glass Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Wafer Glass Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Wafer Type, 2017–2031

13.3.1. Quartz

13.3.2. Silica

13.3.3. Borosilicate

13.3.4. Others

13.4. Electronic Wafer Glass Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Wafer Diameter, 2017–2031

13.4.1. Up to 100mm

13.4.2. 125mm

13.4.3. 150mm

13.4.4. 200mm

13.4.5. 300mm

13.4.6. Above 300mm

13.5. Wafer Glass Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

13.5.1. Wafer Packaging

13.5.2. Substrate Carrier

13.5.3. TGV Interposer

13.6. Wafer Glass Market Size (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

13.6.1. MEMS

13.6.2. Image Sensors

13.6.3. Semiconductors

13.6.4. Others

13.7. Wafer Glass Market Size (US$ Mn) Analysis & Forecast, by Industry Vertical, 2017–2031

13.7.1. Automotive

13.7.2. Consumer Electronics

13.7.3. IT & Telecommunication

13.7.4. Others

13.8. Wafer Glass Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.8.1. China

13.8.2. Japan

13.8.3. India

13.8.4. South Korea

13.8.5. Taiwan

13.8.6. Rest of Asia Pacific

13.9. Market Attractiveness Analysis

13.9.1. By Wafer Type

13.9.2. By Wafer Diameter

13.9.3. By Application

13.9.4. By End-use

13.9.5. By Industry Vertical

13.9.6. By Country/Sub-region

14. Middle East & Africa Wafer Glass Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Wafer Glass Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Wafer Type, 2017–2031

14.3.1. Quartz

14.3.2. Silica

14.3.3. Borosilicate

14.3.4. Others

14.4. Electronic Wafer Glass Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Wafer Diameter, 2017–2031

14.4.1. Up to 100mm

14.4.2. 125mm

14.4.3. 150mm

14.4.4. 200mm

14.4.5. 300mm

14.4.6. Above 300mm

14.5. Wafer Glass Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

14.5.1. Wafer Packaging

14.5.2. Substrate Carrier

14.5.3. TGV Interposer

14.6. Wafer Glass Market Size (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

14.6.1. MEMS

14.6.2. Image Sensors

14.6.3. Semiconductors

14.6.4. Others

14.7. Wafer Glass Market Size (US$ Mn) Analysis & Forecast, by Industry Vertical, 2017–2031

14.7.1. Automotive

14.7.2. Consumer Electronics

14.7.3. IT & Telecommunication

14.7.4. Others

14.8. Wafer Glass Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

14.8.1. GCC

14.8.2. South Africa

14.8.3. Rest of Middle East & Africa

14.9. Market Attractiveness Analysis

14.9.1. By Wafer Type

14.9.2. By Wafer Diameter

14.9.3. By Application

14.9.4. By End-use

14.9.5. By Industry Vertical

14.9.6. By Country/Sub-region

15. South America Wafer Glass Market Analysis and Forecast

15.1. Market Snapshot

15.2. Drivers and Restraints: Impact Analysis

15.3. Wafer Glass Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Wafer Type, 2017–2031

15.3.1. Quartz

15.3.2. Silica

15.3.3. Borosilicate

15.3.4. Others

15.4. Electronic Wafer Glass Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Wafer Diameter, 2017–2031

15.4.1. Up to 100mm

15.4.2. 125mm

15.4.3. 150mm

15.4.4. 200mm

15.4.5. 300mm

15.4.6. Above 300mm

15.5. Wafer Glass Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

15.5.1. Wafer Packaging

15.5.2. Substrate Carrier

15.5.3. TGV Interposer

15.6. Wafer Glass Market Size (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

15.6.1. MEMS

15.6.2. Image Sensors

15.6.3. Semiconductors

15.6.4. Others

15.7. Wafer Glass Market Size (US$ Mn) Analysis & Forecast, by Industry Vertical, 2017–2031

15.7.1. Automotive

15.7.2. Consumer Electronics

15.7.3. IT & Telecommunication

15.7.4. Others

15.8. Wafer Glass Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

15.8.1. Brazil

15.8.2. Rest of South America

15.9. Market Attractiveness Analysis

15.9.1. By Wafer Type

15.9.2. By Wafer Diameter

15.9.3. By Application

15.9.4. By End-use

15.9.5. By Industry Vertical

15.9.6. By Country/Sub-region

16. Competition Assessment

16.1. Global Wafer Glass Market Competition Matrix - a Dashboard View

16.1.1. Global Wafer Glass Market Company Share Analysis, by Value (2021)

16.1.2. Technological Differentiator

17. Company Profiles (Global Manufacturers/Suppliers)

17.1. AGC Inc.

17.1.1. Overview

17.1.2. Product Portfolio

17.1.3. Sales Footprint

17.1.4. Key Subsidiaries or Distributors

17.1.5. Strategy and Recent Developments

17.1.6. Key Financials

17.2. Bullen

17.2.1. Overview

17.2.2. Product Portfolio

17.2.3. Sales Footprint

17.2.4. Key Subsidiaries or Distributors

17.2.5. Strategy and Recent Developments

17.2.6. Key Financials

17.3. Coresix Precision Glass, Inc.

17.3.1. Overview

17.3.2. Product Portfolio

17.3.3. Sales Footprint

17.3.4. Key Subsidiaries or Distributors

17.3.5. Strategy and Recent Developments

17.3.6. Key Financials

17.4. Corning Incorporated

17.4.1. Overview

17.4.2. Product Portfolio

17.4.3. Sales Footprint

17.4.4. Key Subsidiaries or Distributors

17.4.5. Strategy and Recent Developments

17.4.6. Key Financials

17.5. Nippon Electric Glass

17.5.1. Overview

17.5.2. Product Portfolio

17.5.3. Sales Footprint

17.5.4. Key Subsidiaries or Distributors

17.5.5. Strategy and Recent Developments

17.5.6. Key Financials

17.6. Plan Optik AG

17.6.1. Overview

17.6.2. Product Portfolio

17.6.3. Sales Footprint

17.6.4. Key Subsidiaries or Distributors

17.6.5. Strategy and Recent Developments

17.6.6. Key Financials

17.7. Samtec, Inc.

17.7.1. Overview

17.7.2. Product Portfolio

17.7.3. Sales Footprint

17.7.4. Key Subsidiaries or Distributors

17.7.5. Strategy and Recent Developments

17.7.6. Key Financials

17.8. SCHOTT AG

17.8.1. Overview

17.8.2. Product Portfolio

17.8.3. Sales Footprint

17.8.4. Key Subsidiaries or Distributors

17.8.5. Strategy and Recent Developments

17.8.6. Key Financials

17.9. Shin-Etsu Chemical Co., Ltd

17.9.1. Overview

17.9.2. Product Portfolio

17.9.3. Sales Footprint

17.9.4. Key Subsidiaries or Distributors

17.9.5. Strategy and Recent Developments

17.9.6. Key Financials

17.10. Swift glass

17.10.1. Overview

17.10.2. Product Portfolio

17.10.3. Sales Footprint

17.10.4. Key Subsidiaries or Distributors

17.10.5. Strategy and Recent Developments

17.10.6. Key Financials

18. Recommendation

18.1. Opportunity Assessment

18.1.1. By Wafer Type

18.1.2. By Wafer Diameter

18.1.3. By Application

18.1.4. By End-use

18.1.5. By Industry Vertical

18.1.6. By Region

List of Tables

Table 01: Global Wafer Glass Market Size & Forecast, by Wafer Type, Value (US$ Mn), 2017-2031

Table 02: Global Wafer Glass Market Size & Forecast, by Wafer Type, Volume (Thousand Units), 2017-2031

Table 03: Global Wafer Glass Market Size & Forecast, by Wafer Diameter, Value (US$ Mn), 2017-2031

Table 04: Global Wafer Glass Market Size & Forecast, by Wafer Diameter, Volume (Thousand Units), 2017-2031

Table 05: Global Wafer Glass Market Size & Forecast, by Application, Value (US$ Mn), 2017-2031

Table 06: Global Wafer Glass Market Size & Forecast, by End-use, Value (US$ Mn), 2017-2031

Table 07: Global Wafer Glass Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2017-2031

Table 08: Global Wafer Glass Market Size & Forecast, by Region, Value (US$ Mn), 2017-2031

Table 09: Global Wafer Glass Market Size & Forecast, by Region, Volume (Thousand Units), 2017-2031

Table 10: North America Wafer Glass Market Size & Forecast, by Wafer Type, Value (US$ Mn), 2017-2031

Table 11: North America Wafer Glass Market Size & Forecast, by Wafer Type, Volume (Thousand Units), 2017-2031

Table 12: North America Wafer Glass Market Size & Forecast, by Wafer Diameter, Value (US$ Mn), 2017-2031

Table 13: North America Wafer Glass Market Size & Forecast, by Wafer Diameter, Volume (Thousand Units), 2017-2031

Table 14: North America Wafer Glass Market Size & Forecast, by Application, Value (US$ Mn), 2017-2031

Table 15: North America Wafer Glass Market Size & Forecast, by End-use, Value (US$ Mn), 2017-2031

Table 16: North America Wafer Glass Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2017-2031

Table 17: North America Wafer Glass Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Table 18: North America Wafer Glass Market Size & Forecast, by Country, Volume (Thousand Units), 2017-2031

Table 19: Europe Wafer Glass Market Size & Forecast, by Wafer Type, Value (US$ Mn), 2017-2031

Table 20: Europe Wafer Glass Market Size & Forecast, by Wafer Type, Volume (Thousand Units), 2017-2031

Table 21: Europe Wafer Glass Market Size & Forecast, by Wafer Diameter, Value (US$ Mn), 2017-2031

Table 22: Europe Wafer Glass Market Size & Forecast, by Wafer Diameter, Volume (Thousand Units), 2017-2031

Table 23: Europe Wafer Glass Market Size & Forecast, by Application, Value (US$ Mn), 2017-2031

Table 24: Europe Wafer Glass Market Size & Forecast, by End-use, Value (US$ Mn), 2017-2031

Table 25: Europe Wafer Glass Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2017-2031

Table 26: Europe Wafer Glass Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Table 27: Europe Wafer Glass Market Size & Forecast, by Country, Volume (Thousand Units), 2017-2031

Table 28: Asia Pacific Wafer Glass Market Size & Forecast, by Wafer Type, Value (US$ Mn), 2017-2031

Table 29: Asia Pacific Wafer Glass Market Size & Forecast, by Wafer Type, Volume (Thousand Units), 2017-2031

Table 30: Asia Pacific Wafer Glass Market Size & Forecast, by Wafer Diameter, Value (US$ Mn), 2017-2031

Table 31: Asia Pacific Wafer Glass Market Size & Forecast, by Wafer Diameter, Volume (Thousand Units), 2017-2031

Table 32: Asia Pacific Wafer Glass Market Size & Forecast, by Application, Value (US$ Mn), 2017-2031

Table 33: Asia Pacific Wafer Glass Market Size & Forecast, by End-use, Value (US$ Mn), 2017-2031

Table 34: Asia Pacific Wafer Glass Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2017-2031

Table 35: Asia Pacific Wafer Glass Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Table 36: Asia Pacific Wafer Glass Market Size & Forecast, by Country, Volume (Thousand Units), 2017-2031

Table 37: Middle East & Africa Wafer Glass Market Size & Forecast, by Wafer Type, Value (US$ Mn), 2017-2031

Table 38: Middle East & Africa Wafer Glass Market Size & Forecast, by Wafer Type, Volume (Thousand Units), 2017-2031

Table 39: Middle East & Africa Wafer Glass Market Size & Forecast, by Wafer Diameter, Value (US$ Mn), 2017-2031

Table 40: Middle East & Africa Wafer Glass Market Size & Forecast, by Wafer Diameter, Volume (Thousand Units), 2017-2031

Table 41: Middle East & Africa Wafer Glass Market Size & Forecast, by Application, Value (US$ Mn), 2017-2031

Table 42: Middle East & Africa Wafer Glass Market Size & Forecast, by End-use, Value (US$ Mn), 2017-2031

Table 43: Middle East & Africa Wafer Glass Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2017-2031

Table 44: Middle East & Africa Wafer Glass Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Table 45: Middle East & Africa Wafer Glass Market Size & Forecast, by Country, Volume (Thousand Units), 2017-2031

Table 46: South America Wafer Glass Market Size & Forecast, by Wafer Type, Value (US$ Mn), 2017-2031

Table 47: South America Wafer Glass Market Size & Forecast, by Wafer Type, Volume (Thousand Units), 2017-2031

Table 48: South America Wafer Glass Market Size & Forecast, by Wafer Diameter, Value (US$ Mn), 2017-2031

Table 49: South America Wafer Glass Market Size & Forecast, by Wafer Diameter, Volume (Thousand Units), 2017-2031

Table 50: South America Wafer Glass Market Size & Forecast, by Application, Value (US$ Mn), 2017-2031

Table 51: South America Wafer Glass Market Size & Forecast, by End-use, Value (US$ Mn), 2017-2031

Table 52: South America Wafer Glass Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2017-2031

Table 53: South America Wafer Glass Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Table 54: South America Wafer Glass Market Size & Forecast, by Country, Volume (Thousand Units), 2017-2031

List of Figures

Figure 01: Global Wafer Glass Price Trend Analysis (Average Price per Product, Thousand US$)

Figure 02: Global Wafer Glass Market, Value (US$ Mn), 2017-2031

Figure 03: Global Wafer Glass Market, Volume (Thousand Units), 2017-2031

Figure 04: Global Wafer Glass Market Size & Forecast, by Wafer Type, Revenue (US$ Mn), 2017-2031

Figure 05: Global Wafer Glass Market Share Analysis, by Wafer Type, 2022 and 2031

Figure 06: Global Wafer Glass Market Attractiveness, By Wafer Type, Value (US$ Mn), 2022-2031

Figure 07: Global Wafer Glass Market Size & Forecast, by Wafer Diameter, Revenue (US$ Mn), 2017-2031

Figure 08: Global Wafer Glass Market Share Analysis, by Wafer Diameter, 2022 and 2031

Figure 09: Global Wafer Glass Market Attractiveness, By Wafer Diameter, Value (US$ Mn), 2022-2031

Figure 10: Global Wafer Glass Market Size & Forecast, by Application, Revenue (US$ Mn), 2017-2031

Figure 11: Global Wafer Glass Market Share Analysis, by Application, 2022 and 2031

Figure 12: Global Wafer Glass Market Attractiveness, By Application, Value (US$ Mn), 2022-2031

Figure 13: Global Wafer Glass Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017-2031

Figure 14: Global Wafer Glass Market Share Analysis, by End-use, 2022 and 2031

Figure 15: Global Wafer Glass Market Attractiveness, By End-use, Value (US$ Mn), 2022-2031

Figure 16: Global Wafer Glass Market Size & Forecast, by Industry Vertical, Revenue (US$ Mn), 2017-2031

Figure 17: Global Wafer Glass Market Share Analysis, by Industry Vertical, 2022 and 2031

Figure 18: Global Wafer Glass Market Attractiveness, By Industry Vertical, Value (US$ Mn), 2022-2031

Figure 19: Global Wafer Glass Market Size & Forecast, by Region, Revenue (US$ Mn), 2017-2031

Figure 20: Global Wafer Glass Market Share Analysis, by Region, 2022 and 2031

Figure 21: Global Wafer Glass Market Attractiveness, By Region, Value (US$ Mn), 2022-2031

Figure 22: North America Wafer Glass Market, Value (US$ Mn), 2017-2031

Figure 23: North America Wafer Glass Market, Volume (Thousand Units), 2017-2031

Figure 24: North America Wafer Glass Market Size & Forecast, by Wafer Type, Revenue (US$ Mn), 2017-2031

Figure 25: North America Wafer Glass Market Share Analysis, by Wafer Type, 2022 and 2031

Figure 26: North America Wafer Glass Market Attractiveness, By Wafer Type, Value (US$ Mn), 2022-2031

Figure 27: North America Wafer Glass Market Size & Forecast, by Wafer Diameter, Revenue (US$ Mn), 2017-2031

Figure 28: North America Wafer Glass Market Share Analysis, by Wafer Diameter, 2022 and 2031

Figure 29: North America Wafer Glass Market Attractiveness, By Wafer Diameter, Value (US$ Mn), 2022-2031

Figure 30: North America Wafer Glass Market Size & Forecast, by Application, Revenue (US$ Mn), 2017-2031

Figure 31: North America Wafer Glass Market Share Analysis, by Application, 2022 and 2031

Figure 32: North America Wafer Glass Market Attractiveness, By Application, Value (US$ Mn), 2022-2031

Figure 33: North America Wafer Glass Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017-2031

Figure 34: North America Wafer Glass Market Share Analysis, by End-use, 2022 and 2031

Figure 35: North America Wafer Glass Market Attractiveness, By End-use, Value (US$ Mn), 2022-2031

Figure 36: North America Wafer Glass Market Size & Forecast, by Industry Vertical, Revenue (US$ Mn), 2017-2031

Figure 37: North America Wafer Glass Market Share Analysis, by Industry Vertical, 2022 and 2031

Figure 38: North America Wafer Glass Market Attractiveness, By Industry Vertical, Value (US$ Mn), 2022-2031

Figure 39: North America Wafer Glass Market Size & Forecast, by Country, Revenue (US$ Mn), 2017-2031

Figure 40: North America Wafer Glass Market Share Analysis, by Country, 2022 and 2031

Figure 41: North America Wafer Glass Market Attractiveness, By Country, Value (US$ Mn), 2022-2031

Figure 42: Europe Wafer Glass Market, Value (US$ Mn), 2017-2031

Figure 43: Europe Wafer Glass Market, Volume (Thousand Units), 2017-2031

Figure 44: Europe Wafer Glass Market Size & Forecast, by Wafer Type, Revenue (US$ Mn), 2017-2031

Figure 45: Europe Wafer Glass Market Share Analysis, by Wafer Type, 2022 and 2031

Figure 46: Europe Wafer Glass Market Attractiveness, By Wafer Type, Value (US$ Mn), 2022-2031

Figure 47: Europe Wafer Glass Market Size & Forecast, by Wafer Diameter, Revenue (US$ Mn), 2017-2031

Figure 48: Europe Wafer Glass Market Share Analysis, by Wafer Diameter, 2022 and 2031

Figure 49: Europe Wafer Glass Market Attractiveness, By Wafer Diameter, Value (US$ Mn), 2022-2031

Figure 50: Europe Wafer Glass Market Size & Forecast, by Application, Revenue (US$ Mn), 2017-2031

Figure 51: Europe Wafer Glass Market Share Analysis, by Application, 2022 and 2031

Figure 52: Europe Wafer Glass Market Attractiveness, By Application, Value (US$ Mn), 2022-2031

Figure 53: Europe Wafer Glass Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017-2031

Figure 54: Europe Wafer Glass Market Share Analysis, by End-use, 2022 and 2031

Figure 55: Europe Wafer Glass Market Attractiveness, By End-use, Value (US$ Mn), 2022-2031

Figure 56: Europe Wafer Glass Market Size & Forecast, by Industry Vertical, Revenue (US$ Mn), 2017-2031

Figure 57: Europe Wafer Glass Market Share Analysis, by Industry Vertical, 2022 and 2031

Figure 58: Europe Wafer Glass Market Attractiveness, By Industry Vertical, Value (US$ Mn), 2022-2031

Figure 59: Europe Wafer Glass Market Size & Forecast, by Country, Revenue (US$ Mn), 2017-2031

Figure 60: Europe Wafer Glass Market Share Analysis, by Country, 2022 and 2031

Figure 61: Europe Wafer Glass Market Attractiveness, By Country, Value (US$ Mn), 2022-2031

Figure 62: Asia Pacific Wafer Glass Market, Value (US$ Mn), 2017-2031

Figure 63: Asia Pacific Wafer Glass Market, Volume (Thousand Units), 2017-2031

Figure 64: Asia Pacific Wafer Glass Market Size & Forecast, by Wafer Type, Revenue (US$ Mn), 2017-2031

Figure 65: Asia Pacific Wafer Glass Market Share Analysis, by Wafer Type, 2022 and 2031

Figure 66: Asia Pacific Wafer Glass Market Attractiveness, By Wafer Type, Value (US$ Mn), 2022-2031

Figure 67: Asia Pacific Wafer Glass Market Size & Forecast, by Wafer Diameter, Revenue (US$ Mn), 2017-2031

Figure 68: Asia Pacific Wafer Glass Market Share Analysis, by Wafer Diameter, 2022 and 2031

Figure 69: Asia Pacific Wafer Glass Market Attractiveness, By Wafer Diameter, Value (US$ Mn), 2022-2031

Figure 70: Asia Pacific Wafer Glass Market Size & Forecast, by Application, Revenue (US$ Mn), 2017-2031

Figure 71: Asia Pacific Wafer Glass Market Share Analysis, by Application, 2022 and 2031

Figure 72: Asia Pacific Wafer Glass Market Attractiveness, By Application, Value (US$ Mn), 2022-2031

Figure 73: Asia Pacific Wafer Glass Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017-2031

Figure 74: Asia Pacific Wafer Glass Market Share Analysis, by End-use, 2022 and 2031

Figure 75: Asia Pacific Wafer Glass Market Attractiveness, By End-use, Value (US$ Mn), 2022-2031

Figure 76: Asia Pacific Wafer Glass Market Size & Forecast, by Industry Vertical, Revenue (US$ Mn), 2017-2031

Figure 77: Asia Pacific Wafer Glass Market Share Analysis, by Industry Vertical, 2022 and 2031

Figure 78: Asia Pacific Wafer Glass Market Attractiveness, By Industry Vertical, Value (US$ Mn), 2022-2031

Figure 79: Asia Pacific Wafer Glass Market Size & Forecast, by Country, Revenue (US$ Mn), 2017-2031

Figure 80: Asia Pacific Wafer Glass Market Share Analysis, by Country, 2022 and 2031

Figure 81: Asia Pacific Wafer Glass Market Attractiveness, By Country, Value (US$ Mn), 2022-2031

Figure 82: Middle East & Africa Wafer Glass Market, Value (US$ Mn), 2017-2031

Figure 83: Middle East & Africa Wafer Glass Market, Volume (Thousand Units), 2017-2031

Figure 84: Middle East & Africa Wafer Glass Market Size & Forecast, by Wafer Type, Revenue (US$ Mn), 2017-2031

Figure 85: Middle East & Africa Wafer Glass Market Share Analysis, by Wafer Type, 2022 and 2031

Figure 86: Middle East & Africa Wafer Glass Market Attractiveness, By Wafer Type, Value (US$ Mn), 2022-2031

Figure 87: Middle East & Africa Wafer Glass Market Size & Forecast, by Wafer Diameter, Revenue (US$ Mn), 2017-2031

Figure 88: Middle East & Africa Wafer Glass Market Share Analysis, by Wafer Diameter, 2022 and 2031

Figure 89: Middle East & Africa Wafer Glass Market Attractiveness, By Wafer Diameter, Value (US$ Mn), 2022-2031

Figure 90: Middle East & Africa Wafer Glass Market Size & Forecast, by Application, Revenue (US$ Mn), 2017-2031

Figure 91: Middle East & Africa Wafer Glass Market Share Analysis, by Application, 2022 and 2031

Figure 92: Middle East & Africa Wafer Glass Market Attractiveness, By Application, Value (US$ Mn), 2022-2031

Figure 93: Middle East & Africa Wafer Glass Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017-2031

Figure 94: Middle East & Africa Wafer Glass Market Share Analysis, by End-use, 2022 and 2031

Figure 95: Middle East & Africa Wafer Glass Market Attractiveness, By End-use, Value (US$ Mn), 2022-2031

Figure 96: Middle East & Africa Wafer Glass Market Size & Forecast, by Industry Vertical, Revenue (US$ Mn), 2017-2031

Figure 97: Middle East & Africa Wafer Glass Market Share Analysis, by Industry Vertical, 2022 and 2031

Figure 98: Middle East & Africa Wafer Glass Market Attractiveness, By Industry Vertical, Value (US$ Mn), 2022-2031

Figure 99: Middle East & Africa Wafer Glass Market Size & Forecast, by Country, Revenue (US$ Mn), 2017-2031

Figure 100: Middle East & Africa Wafer Glass Market Share Analysis, by Country, 2022 and 2031

Figure 101: Middle East & Africa Wafer Glass Market Attractiveness, By Country, Value (US$ Mn), 2022-2031

Figure 102: South America Wafer Glass Market, Value (US$ Mn), 2017-2031

Figure 103: South America Wafer Glass Market, Volume (Thousand Units), 2017-2031

Figure 104: South America Wafer Glass Market Size & Forecast, by Wafer Type, Revenue (US$ Mn), 2017-2031

Figure 105: South America Wafer Glass Market Share Analysis, by Wafer Type, 2022 and 2031

Figure 106: South America Wafer Glass Market Attractiveness, By Wafer Type, Value (US$ Mn), 2022-2031

Figure 107: South America Wafer Glass Market Size & Forecast, by Wafer Diameter, Revenue (US$ Mn), 2017-2031

Figure 108: South America Wafer Glass Market Share Analysis, by Wafer Diameter, 2022 and 2031

Figure 109: South America Wafer Glass Market Attractiveness, By Wafer Diameter, Value (US$ Mn), 2022-2031

Figure 110: South America Wafer Glass Market Size & Forecast, by Application, Revenue (US$ Mn), 2017-2031

Figure 111: South America Wafer Glass Market Share Analysis, by Application, 2022 and 2031

Figure 112: South America Wafer Glass Market Attractiveness, By Application, Value (US$ Mn), 2022-2031

Figure 113: South America Wafer Glass Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017-2031

Figure 114: South America Wafer Glass Market Share Analysis, by End-use, 2022 and 2031

Figure 115: South America Wafer Glass Market Attractiveness, By End-use, Value (US$ Mn), 2022-2031

Figure 116: South America Wafer Glass Market Size & Forecast, by Industry Vertical, Revenue (US$ Mn), 2017-2031

Figure 117: South America Wafer Glass Market Share Analysis, by Industry Vertical, 2022 and 2031

Figure 118: South America Wafer Glass Market Attractiveness, By Industry Vertical, Value (US$ Mn), 2022-2031

Figure 119: South America Wafer Glass Market Size & Forecast, by Country, Revenue (US$ Mn), 2017-2031

Figure 120: South America Wafer Glass Market Share Analysis, by Country, 2022 and 2031

Figure 121: South America Wafer Glass Market Attractiveness, By Country, Value (US$ Mn), 2022-2031