Analysts’ Viewpoint on Vitamin D Testing Scenario

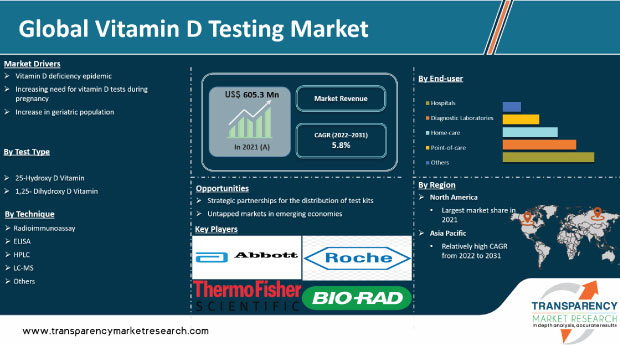

Vitamin D testing market is anticipated to grow at a steady pace during the forecast period owing to a rise in prevalence of vitamin D deficiency across the globe. 25-hydroxy D vitamin test is the most commonly performed test for the estimation of vitamin D levels in the serum plasma owing to the ease of identification of this molecule in the sample. North America dominated the global market, while Asia Pacific offers significant opportunity in the near future. Rise in number of patients suffering from vitamin D deficiency is boosting the demand for vitamin D testing and consequently, driving the market for vitamin D testing. Furthermore, significant product launches and strategic partnerships are notable strategies employed by key players to enhance their market presence. This is anticipated to fuel the global market. For instance, in 2019, Thorne launched five new at-home health tests, including vitamin D test, heart health, weight management, testosterone test, and menopause test.

Rise in awareness about the consequences of nutritional deficiencies, increase in the geriatric population, and rise in cases of chronic illnesses in both young and old populations have driven the global market revenue in the last few years. Vitamin D is one of the vital nutrients required by the human body for good health, cell growth, and stronger teeth. Based on the source, it is classified into two types - Vitamin D2, which is manmade and added to food, and Vitamin D3, which is synthesized in the human skin and can also be found in animal-based food. The incidence of vitamin D deficiency is increasing due to minimizing exposure to sunlight, low intake of vitamin D, poor absorption of food, and changes in lifestyles. Furthermore, the introduction of at-home testing kits and intravenous administration for quick results, combined with a rise in expenditure in the healthcare industry in various developing countries are expected to drive the vitamin D testing market size. The ability of vitamin D testing to identify bone malformations, bone softness, and weakness is also expected to increase the demand for testing, which is expected to have a positive impact on the market.

According to the National Center for Biotechnology Information (NCBI), Vitamin D deficiency is a global public health issue. Approximately one billion people worldwide have vitamin D deficiency, while 50% of the population has vitamin D insufficiency. The prevalence of patients with vitamin D deficiency is highest in the elderly, obese patients, nursing home residents, and hospitalized patients.

In the U.S., around 50% to 60% of nursing home residents and hospitalized patients had vitamin D deficiency. Vitamin D deficiency is known to be common in northern Europe, majorly in women with pigmented skin. The deficiency is reported to be three times more common in winter months as compared to that in other months in the U.K.

In the U.S., 47% of African-American infants and 56% of Caucasian infants have vitamin D deficiency, while over 90% of infants in Iran, Turkey, and India have vitamin D deficiency. In the adult population, 35% of adults in the U.S. are vitamin D deficient, while over 80% of adults in India and Bangladesh are Vitamin D deficient. In the U.S., 61% of the geriatric population is vitamin D deficient, whereas 90% in Turkey, 96% in India, and 67% in Iran were vitamin D deficient.

The rise in the prevalence of vitamin D and an increase in focus on its importance contribute to the rise in screening for vitamin D serum levels, thereby boosting the vitamin D testing business.

According to data published by the United Nations Department of Economics and Social Affairs, the geriatric population is expected to double to nearly 2.1 billion by 2050. The geriatric population is prone to deficiency of vitamin D. Chronic diseases affecting skin integrity such as peripheral vascular diseases (arterial insufficiency & venous hypertension) and diabetes is becoming increasingly common with the rise in the geriatric population. Frequent consequences include skin breakdown with ulcers and chronic wound formation. An increase in the geriatric population is likely to triple or quintuple the demand for medical services and trigger the growth of non-communicable diseases (heart, cancer, and diabetes), which account for about 87% of the health issues faced by the aged population in low, middle, and high-income countries. This situation also needs surgical interventions, consequently driving the global market for vitamin D testing. An increase in the geriatric population and a rise in vitamin D deficiency among this population is likely to boost the vitamin D testing market.

The 25-hydroxy vitamin D segment dominated the market and accounted for a notable market share in 2021. The segment is anticipated to expand at a high CAGR during the forecast period. This segment is expected to remain dominant during the forecast period, both in terms of revenues and market share.

Expansion of the segment can be attributed to an increase in the number of tests being performed globally, ease of identification, and estimation of 25-hydroxy D vitamin levels in the plasma serum owing to its longer half-life, even though it is present in smaller volumes. Furthermore, its ability to identify a range of bone disorders owing to the lack of recommended levels of vitamin D propels the segment.

The ELISA segment dominated the market and held a prominent share of the global market in 2021. The growth of the segment is attributed to the rapid automation of systems due to an increase in vitamin D tests. ELISA is a completely automated technique for vitamin D tests.

Vitamin D deficiency (VDD) is a common health issue in women during the early stage of pregnancy. Various clinical trials using ELISA have been carried out to measure the concentrations of 25-hydroxy vitamin D. It has been proven that women usually suffer from vitamin D deficiency during early pregnancy. Thus, stakeholders in the vitamin D testing landscape need to innovate and develop preventive techniques and ways of early detection of VDD during early pregnancy.

North America held a major share of the global market for vitamin D testing, in terms of revenue, in 2021. The region is projected to dominate the global market during the forecast period. The rise in the prevalence of vitamin D deficiency, the increase in prescriptions of vitamin D blood tests, the surge in the aging population, and the rise in the prevalence of vitamin D deficiency among the adult population boost the market in North America.

Europe is anticipated to be the second-largest market in terms of share and revenue during the forecast period. Vitamin D deficiency is a public health issue in Germany. It is significantly prevalent in the adult as well as the younger population. Moreover, various studies conducted in Germany indicate that the average intake of vitamin D does not meet the recommended daily intake levels. These factors increase the number of vitamin D blood tests performed in the country; consequently, fueling the market.

The vitamin D testing market in the Asia Pacific is expected to expand at a notable CAGR of 6.5% during the forecast period. Growth of the market in the region is attributed to an increase in the geriatric population, a rise in the prevalence of vitamin D deficiency, changing reimbursement scenario for these tests, and an increase in the focus of market players on strengthening their presence in emerging economies.

Key manufacturers operating in the global vitamin D testing business are gaining a competitive edge in the market by emphasizing mergers and tie-ups. Presently, the market is highly competitive, as a large number of companies are aiming to capitalize on the expansion of the market. The global vitamin D testing market is fragmented, with the presence of a large number of players. These include Bio-Rad Laboratories, Inc., Abbott Laboratories, F. Hoffmann-La Roche AG, Thermo Fisher Scientific, DiaSys Diagnostic Systems GmbH, DiaSorin, bioMérieux, Siemens AG, Quest Diagnostics, Danaher Corporation, and OmegaQuant.

Each of these players has been profiled in the vitamin D testing industry report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 605.3 Mn |

|

Market Forecast Value in 2031 |

More than US$ 1.06 Bn |

|

Growth Rate (CAGR) for 2022-2031 |

5.8% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn/Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market for vitamin D testing was valued at US$ 605.3 Mn in 2021

The global vitamin D testing market is projected to reach more than US$ 1.06 Bn by 2031

The global market is anticipated to expand at a CAGR of 5.8% from 2022 to 2031

The vitamin D deficiency epidemic is driving the global market for vitamin D testing.

Bio-Rad Laboratories, Inc., Abbott Laboratories, F. Hoffmann-La Roche AG, Thermo Fisher Scientific, DiaSys Diagnostic Systems GmbH, DiaSorin, bioMérieux, Siemens AG, Quest Diagnostics, and Danaher Corporation.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Vitamin D Testing Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Vitamin D Testing Market Analysis and Forecast, 2017 - 2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Key Industry Developments

5.2. Vitamin D Deficiency Prevalence

5.3. Healthcare Industry Overview

5.4. Vitamin D Tests – Product Life Cycle

5.5. Covid 19 Impact Analysis

6. Global Vitamin D Testing Market Analysis and Forecast, by Test Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Test Type, 2017 - 2031

6.3.1. 25-Hydroxy D Vitamin

6.3.2. 1,25- Dihydroxy D Vitamin

6.4. Market Attractiveness, by Test Type

7. Global Vitamin D Testing Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by End-user, 2017 - 2031

7.3.1. Hospitals

7.3.2. Diagnostic Laboratories

7.3.3. Home-care

7.3.4. Point-of-care

7.3.5. Others

7.4. Market Attractiveness, by End-user

8. Global Vitamin D Testing Market Analysis and Forecast, by Technique

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Technique, 2017 - 2031

8.3.1. Radioimmunoassay

8.3.2. ELISA

8.3.3. HPLC

8.3.4. LC-MS

8.3.5. Others

8.4. Market Attractiveness, by Technique

9. Global Vitamin D Testing Market Analysis and Forecast, by Patient Type

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by Patient Type, 2017 - 2031

9.3.1. Adult

9.3.2. Pediatric

9.4. Market Attractiveness, by Patient Type

10. Global Vitamin D Testing Market Analysis and Forecast, by Indication

10.1. Introduction & Definition

10.2. Key Findings / Developments

10.3. Market Value Forecast, by Indication, 2017 - 2031

10.3.1. Osteoporosis

10.3.2. Rickets

10.3.3. Thyroid disorders

10.3.4. Malabsorption

10.3.5. Vitamin D Deficiency

10.3.6. Others

10.4. Market Attractiveness, by Indication

11. Global Vitamin D Testing Market Analysis and Forecast, by Region

11.1. Key Findings

11.2. Market Value Forecast, by Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Market Attractiveness, by Country/Region

12. North America Vitamin D Testing Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Test Type, 2017 - 2031

12.2.1. 25-Hydroxy D Vitamin

12.2.2. 1,25- Dihydroxy D Vitamin

12.3. Market Value Forecast, by End-user, 2017 - 2031

12.3.1. Hospitals

12.3.2. Diagnostic Laboratories

12.3.3. Home-care

12.3.4. Point-of-care

12.3.5. Others

12.4. Market Value Forecast, by Technique, 2017 - 2031

12.4.1. Radioimmunoassay

12.4.2. ELISA

12.4.3. HPLC

12.4.4. LC-MS

12.4.5. Others

12.5. Market Value Forecast, by Patient Type, 2017 - 2031

12.5.1. Adult

12.5.2. Pediatric

12.6. Market Value Forecast, by Indication, 2017 - 2031

12.6.1. Osteoporosis

12.6.2. Rickets

12.6.3. Thyroid disorders

12.6.4. Malabsorption

12.6.5. Vitamin D Deficiency

12.6.6. Others

12.7. Market Value Forecast, by Country, 2017 - 2031

12.7.1. U.S.

12.7.2. Canada

12.8. Market Attractiveness Analysis

12.8.1. By Test Type

12.8.2. By End-user

12.8.3. By Technique

12.8.4. By Patient Type

12.8.5. By Indication

12.8.6. By Country

13. Europe Vitamin D Testing Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Test Type, 2017 - 2031

13.2.1. 25-Hydroxy D Vitamin

13.2.2. 1,25- Dihydroxy D Vitamin

13.3. Market Value Forecast, by End-user, 2017 - 2031

13.3.1. Hospitals

13.3.2. Diagnostic Laboratories

13.3.3. Home-care

13.3.4. Point-of-care

13.3.5. Others

13.4. Market Value Forecast, by Technique, 2017 - 2031

13.4.1. Radioimmunoassay

13.4.2. ELISA

13.4.3. HPLC

13.4.4. LC-MS

13.4.5. Others

13.5. Market Value Forecast, by Patient Type, 2017 - 2031

13.5.1. Adult

13.5.2. Pediatric

13.6. Market Value Forecast, by Indication, 2017 - 2031

13.6.1. Osteoporosis

13.6.2. Rickets

13.6.3. Thyroid disorders

13.6.4. Malabsorption

13.6.5. Vitamin D Deficiency

13.6.6. Others

13.7. Market Value Forecast, by Country/Sub-region, 2017 - 2031

13.7.1. Germany

13.7.2. U.K.

13.7.3. France

13.7.4. Spain

13.7.5. Italy

13.7.6. Rest of Europe

13.8. Market Attractiveness Analysis

13.8.1. By Test Type

13.8.2. By End-user

13.8.3. By Technique

13.8.4. By Patient Type

13.8.5. By Indication

13.8.6. By Country/Sub-region

14. Asia Pacific Vitamin D Testing Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Test Type, 2017 - 2031

14.2.1. 25-Hydroxy D Vitamin

14.2.2. 1,25- Dihydroxy D Vitamin

14.3. Market Value Forecast, by End-user, 2017 - 2031

14.3.1. Hospitals

14.3.2. Diagnostic Laboratories

14.3.3. Home-care

14.3.4. Point-of-care

14.3.5. Others

14.4. Market Value Forecast, by Technique, 2017 - 2031

14.4.1. Radioimmunoassay

14.4.2. ELISA

14.4.3. HPLC

14.4.4. LC-MS

14.4.5. Others

14.5. Market Value Forecast, by Patient Type, 2017 - 2031

14.5.1. Adult

14.5.2. Pediatric

14.6. Market Value Forecast, by Indication, 2017 - 2031

14.6.1. Osteoporosis

14.6.2. Rickets

14.6.3. Thyroid disorders

14.6.4. Malabsorption

14.6.5. Vitamin D Deficiency

14.6.6. Others

14.7. Market Value Forecast, by Country/Sub-region, 2017 - 2031

14.7.1. China

14.7.2. Japan

14.7.3. India

14.7.4. Australia & New Zealand

14.7.5. Rest of Asia Pacific

14.8. Market Attractiveness Analysis

14.8.1. By Test Type

14.8.2. By End-user

14.8.3. By Technique

14.8.4. By Patient Type

14.8.5. By Indication

14.8.6. By Country/Sub-region

15. Latin America Vitamin D Testing Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Test Type, 2017 - 2031

15.2.1. 25-Hydroxy D Vitamin

15.2.2. 1,25- Dihydroxy D Vitamin

15.3. Market Value Forecast, by End-user, 2017 - 2031

15.3.1. Hospitals

15.3.2. Diagnostic Laboratories

15.3.3. Home-care

15.3.4. Point-of-care

15.3.5. Others

15.4. Market Value Forecast, by Technique, 2017 - 2031

15.4.1. Radioimmunoassay

15.4.2. ELISA

15.4.3. HPLC

15.4.4. LC-MS

15.4.5. Others

15.5. Market Value Forecast, by Patient Type, 2017 - 2031

15.5.1. Adult

15.5.2. Pediatric

15.6. Market Value Forecast, by Indication, 2017 - 2031

15.6.1. Osteoporosis

15.6.2. Rickets

15.6.3. Thyroid disorders

15.6.4. Malabsorption

15.6.5. Vitamin D Deficiency

15.6.6. Others

15.7. Market Value Forecast, by Country/Sub-region, 2017 - 2031

15.7.1. Brazil

15.7.2. Mexico

15.7.3. Rest of Latin America

15.8. Market Attractiveness Analysis

15.8.1. By Test Type

15.8.2. By End-user

15.8.3. By Technique

15.8.4. By Patient Type

15.8.5. By Indication

15.8.6. By Country/Sub-region

16. Middle East & Africa Vitamin D Testing Market Analysis and Forecast

16.1. Introduction

16.1.1. Key Findings

16.2. Market Value Forecast, by Test Type, 2017 - 2031

16.2.1. 25-Hydroxy D Vitamin

16.2.2. 1,25- Dihydroxy D Vitamin

16.3. Market Value Forecast, by End-user, 2017 - 2031

16.3.1. Hospitals

16.3.2. Diagnostic Laboratories

16.3.3. Home-care

16.3.4. Point-of-care

16.3.5. Others

16.4. Market Value Forecast, by Technique, 2017 - 2031

16.4.1. Radioimmunoassay

16.4.2. ELISA

16.4.3. HPLC

16.4.4. LC-MS

16.4.5. Others

16.5. Market Value Forecast, by Patient Type, 2017 - 2031

16.5.1. Adult

16.5.2. Pediatric

16.6. Market Value Forecast, by Indication, 2017 - 2031

16.6.1. Osteoporosis

16.6.2. Rickets

16.6.3. Thyroid disorders

16.6.4. Malabsorption

16.6.5. Vitamin D Deficiency

16.6.6. Others

16.7. Market Value Forecast, by Country/Sub-region, 2017 - 2031

16.7.1. GCC Countries

16.7.2. South Africa

16.7.3. Rest of Middle East & Africa

16.8. Market Attractiveness Analysis

16.8.1. By Test Type

16.8.2. By End-user

16.8.3. By Technique

16.8.4. By Patient Type

16.8.5. By Indication

16.8.6. By Country/Sub-region

17. Competition Landscape

17.1. Market Player – Competition Matrix (By Tier and Size of companies)

17.2. Market Share Analysis, by Company (2021)

17.3. Company Profiles

17.3.1. DiaSorin S.p.A.

17.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.1.2. Financial Analysis

17.3.1.3. Growth Strategies

17.3.1.4. SWOT Analysis

17.3.2. DiaSys Diagnostic Systems GmbH

17.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.2.2. Financial Analysis

17.3.2.3. Growth Strategies

17.3.2.4. SWOT Analysis

17.3.3. bioMérieux SA

17.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.3.2. Financial Analysis

17.3.3.3. Growth Strategies

17.3.3.4. SWOT Analysis

17.3.4. Bio-Rad Laboratories

17.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.4.2. Financial Analysis

17.3.4.3. Growth Strategies

17.3.4.4. SWOT Analysis

17.3.5. Abbott Laboratories

17.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.5.2. Financial Analysis

17.3.5.3. Growth Strategies

17.3.5.4. SWOT Analysis

17.3.6. Siemens Healthineers

17.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.6.2. Financial Analysis

17.3.6.3. Growth Strategies

17.3.6.4. SWOT Analysis

17.3.7. F. Hoffmann-La Roche Ltd

17.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.7.2. Financial Analysis

17.3.7.3. Growth Strategies

17.3.7.4. SWOT Analysis

17.3.8. Thermo Fisher Scientific, Inc.

17.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.8.2. Financial Analysis

17.3.8.3. Growth Strategies

17.3.8.4. SWOT Analysis

17.3.9. Quest Diagnostics Incorporated

17.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.9.2. Financial Analysis

17.3.9.3. Growth Strategies

17.3.9.4. SWOT Analysis

17.3.10. Danaher Corporation

17.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.10.2. Financial Analysis

17.3.10.3. Growth Strategies

17.3.10.4. SWOT Analysis

List of Tables

Table 01: Global Vitamin D Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 02: Global Vitamin D Testing Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 03: Global Vitamin D Testing Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 04: Global Vitamin D Testing Market Value (US$ Mn) Forecast, by Patient Type, 2017–2031

Table 05: Global Vitamin D Testing Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 06: Global Vitamin D Testing Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 07: North America Vitamin D Testing Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 08: North America Vitamin D Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 09: North America Vitamin D Testing Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 10: North America Vitamin D Testing Market Value (US$ Mn) Forecast, by Patient Type, 2017–2031

Table 11: North America Vitamin D Testing Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 12: North America Vitamin D Testing Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Europe Vitamin D Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Europe Vitamin D Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 15: Europe Vitamin D Testing Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 16: Europe Vitamin D Testing Market Value (US$ Mn) Forecast, by Patient Type, 2017–2031

Table 17: Europe Vitamin D Testing Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 18: Europe Vitamin D Testing Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 19: Asia Pacific Vitamin D Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 20: Asia Pacific Vitamin D Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 21: Asia Pacific Vitamin D Testing Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 22: Asia Pacific Vitamin D Testing Market Value (US$ Mn) Forecast, by Patient Type, 2017–2031

Table 23: Asia Pacific Vitamin D Testing Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 24: Asia Pacific Vitamin D Testing Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 25: Latin America Vitamin D Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 26: Latin America Vitamin D Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 27: Latin America Vitamin D Testing Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 28: Latin America Vitamin D Testing Market Value (US$ Mn) Forecast, by Patient Type, 2017–2031

Table 29: Latin America Vitamin D Testing Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 30: Latin America Vitamin D Testing Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 31: Middle East & Africa Vitamin D Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 32: Middle East & Africa Vitamin D Testing Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 33: Middle East & Africa Vitamin D Testing Market Value (US$ Mn) Forecast, by Technique, 2017–2031

Table 34: Middle East & Africa Vitamin D Testing Market Value (US$ Mn) Forecast, by Patient Type, 2017–2031

Table 35: Middle East & Africa Vitamin D Testing Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 36: Middle East & Africa Vitamin D Testing Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Vitamin D Testing Market Snapshot

Figure 02: Global Vitamin D Testing Market Value (US$ Mn) and Distribution (%), by Region, 2021 and 2031

Figure 03: Global Vitamin D Testing Market Value (US$ Mn) Forecast, 2017–2031

Figure 04: Global Vitamin D Testing Market Value Share (%), by Test Type, 2021

Figure 05: Global Vitamin D Testing Market Value Share (%), by Technique, 2021

Figure 06: Global Vitamin D Testing Market Value Share (%), by Indication, 2021

Figure 07: Global Vitamin D Testing Market Value Share (%), by Patient Type, 2021

Figure 08: Global Vitamin D Testing Market Value Share (%), by End-user, 2021

Figure 09: Global Vitamin D Testing Market Value Share (%), by Region, 2021

Figure 10: Vitamin D Tests - Product Life Cycle

Figure 11: Vitamin D Testing Market - Key Industry Developments

Figure 12: Vitamin D Deficiency - Prevalence

Figure 13: Global Vitamin D Testing Market Value Share Analysis, by Test Type, 2021 and 2027

Figure 14: Global Vitamin D Testing Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by 25-Hydroxy D Vitamin, 2017–2031

Figure 15: Global Vitamin D Testing Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by 1,25-ihydroxy D Vitamin, 2017–2031

Figure 16: Global Vitamin D Testing Market Attractiveness, by Test Type, 2022‒2031

Figure 17: Key Trends - Global Vitamin D Testing Market, by Test Type

Figure 18: Global Vitamin D Testing Market Value Share Analysis, by Technique, 2021 and 2027

Figure 19: Global Vitamin D Testing Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Radioimmunoassay, 2017–2031

Figure 20: Global Vitamin D Testing Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by ELISA, 2017–2031

Figure 21: Global Vitamin D Testing Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by HPLC, 2017–2031

Figure 22: Global Vitamin D Testing Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by LC-MS, 2017–2031

Figure 23: Global Vitamin D Testing Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Others, 2017–2031

Figure 24: Global Vitamin D Testing Market Attractiveness, by Technique, 2022‒2031

Figure 25: Key Trends - Global Vitamin D Testing Market, by Technique

Figure 26: Global Vitamin D Testing Market Value Share Analysis, by Indication, 2021 and 2031

Figure 27: Global Vitamin D Testing Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Osteoporosis, 2017–2031

Figure 28: Global Vitamin D Testing Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Rickets, 2017–2031

Figure 29: Global Vitamin D Testing Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Thyroid

Disorders, 2017–2031

Figure 30: Global Vitamin D Testing Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Malabsorption, 2017–2031

Figure 31: Global Vitamin D Testing Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Vitamin D Deficiency, 2017–2031

Figure 32: Global Vitamin D Testing Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Others, 2017–2031

Figure 33: Global Vitamin D Testing Market Attractiveness, by Indication, 2022‒2031

Figure 34: Key Trends - Global Vitamin D Testing Market, by Indication

Figure 35: Global Vitamin D Testing Market Value Share Analysis, by Patient Type, 2021 and 2031

Figure 36: Global Vitamin D Testing Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Adult, 2017–2031

Figure 37: Global Vitamin D Testing Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Pediatric, 2017–2031

Figure 38: Global Vitamin D Testing Market Attractiveness, by Patient Type, 2022‒2031

Figure 39: Key Trends - Global Vitamin D Testing Market, by Patient Type

Figure 40: Global Vitamin D Testing Market Value Share Analysis, by End-user, 2021 and 2031

Figure 41: Global Vitamin D Testing Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Hospitals, 2017–2031

Figure 42: Global Vitamin D Testing Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Diagnostic Laboratories, 2017–2031

Figure 43: Global Vitamin D Testing Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Home Care, 2017–2031

Figure 44: Global Vitamin D Testing Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Point-of-care, 2017–2031

Figure 45: Global Vitamin D Testing Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Others, 2017–2031

Figure 46: Global Vitamin D Testing Market Attractiveness, by End-user, 2022‒2031

Figure 47: Key Trends - Global Vitamin D Testing Market, by End-user

Figure 48: Vitamin D Testing Market: Regional Outlook

Figure 49: Global Vitamin D Testing Market Value (US$ Mn) Forecast, 2017–2031

Figure 50: Global Vitamin D Testing Market Value Share Analysis, by Region, 2021 and 2031

Figure 51: Global Vitamin D Testing Market Attractiveness, by Region, 2022-2031

Figure 52: North America Vitamin D Testing Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2031

Figure 53: North America Vitamin D Testing Market Attractiveness Analysis, by Country, 2022–2031

Figure 54: North America Vitamin D Testing Market Value Share Analysis, by Country, 2021 and 2031

Figure 55: North America Vitamin D Testing Market Value Share Analysis, by Test Type, 2021 and 2031

Figure 56: North America Vitamin D Testing Market Value Share Analysis, by Technique, 2021 and 2031

Figure 57: North America Vitamin D Testing Market Value Share Analysis, by Patient Type, 2021 and 2031

Figure 58: North America Vitamin D Testing Market Value Share Analysis, by Indication, 2021 and 2031

Figure 59: North America Vitamin D Testing Market Value Share Analysis, by End-user, 2021 and 2031

Figure 60: North America Vitamin D Testing Market Attractiveness, by Test Type, 2022‒2031

Figure 61: North America Vitamin D Testing Market Attractiveness, by Technique, 2022‒2031

Figure 62: North America Vitamin D Testing Market Attractiveness, by Patient Type, 2022‒2031

Figure 63: North America Vitamin D Testing Market Attractiveness, by Indication, 2022‒2031

Figure 64: North America Vitamin D Testing Market Attractiveness, by End-user, 2022‒2031

Figure 65: Europe Vitamin D Testing Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2031

Figure 66: Europe Vitamin D Testing Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 67: Europe Vitamin D Testing Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 68: Europe Vitamin D Testing Market Value Share Analysis, by Test Type, 2021 and 2031

Figure 69: Europe Vitamin D Testing Market Value Share Analysis, by Technique, 2021 and 2031

Figure 70: Europe Vitamin D Testing Market Value Share Analysis, by Patient Type, 2021 and 2031

Figure 71: Europe Vitamin D Testing Market Value Share Analysis, by Indication, 2021 and 2031

Figure 72: Europe Vitamin D Testing Market Value Share Analysis, by End-user, 2021 and 2031

Figure 73: Europe Vitamin D Testing Market Attractiveness, by Test Type, 2022‒2031

Figure 74: Europe Vitamin D Testing Market Attractiveness, by Technique, 2022‒2031

Figure 75: Europe Vitamin D Testing Market Attractiveness, by Patient Type, 2022‒2031

Figure 76: Europe Vitamin D Testing Market Attractiveness, by Indication, 2022‒2031

Figure 77: Europe Vitamin D Testing Market Attractiveness, by End-user, 2022‒2031

Figure 78: Asia Pacific Vitamin D Testing Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2031

Figure 79: Asia Pacific Vitamin D Testing Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 80: Asia Pacific Vitamin D Testing Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 81: Asia Pacific Vitamin D Testing Market Value Share Analysis, by Test Type, 2021 and 2031

Figure 82: Asia Pacific Vitamin D Testing Market Value Share Analysis, by Technique, 2021 and 2031

Figure 83: Asia Pacific Vitamin D Testing Market Value Share Analysis, by Patient Type, 2021 and 2031

Figure 84: Asia Pacific Vitamin D Testing Market Value Share Analysis, by Indication, 2021 and 2031

Figure 85: Asia Pacific Vitamin D Testing Market Value Share Analysis, by End-user, 2021 and 2031

Figure 86: Asia Pacific Vitamin D Testing Market Attractiveness, by Test Type, 2022‒2031

Figure 87: Asia Pacific Vitamin D Testing Market Attractiveness, by Technique, 2022‒2031

Figure 88: Asia Pacific Vitamin D Testing Market Attractiveness, by Patient Type, 2022‒2031

Figure 89: Asia Pacific Vitamin D Testing Market Attractiveness, by Indication, 2022‒2031

Figure 90: Asia Pacific Vitamin D Testing Market Attractiveness, by End-user, 2022‒2031

Figure 91: Latin America Vitamin D Testing Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2031

Figure 92: Latin America Vitamin D Testing Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 93: Latin America Vitamin D Testing Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 94: Latin America Vitamin D Testing Market Value Share Analysis, by Test Type, 2021 and 2031

Figure 95: Latin America Vitamin D Testing Market Value Share Analysis, by Technique, 2021 and 2031

Figure 96: Latin America Vitamin D Testing Market Value Share Analysis, by Patient Type, 2021 and 2031

Figure 97: Latin America Vitamin D Testing Market Value Share Analysis, by Indication, 2021 and 2031

Figure 98: Latin America Vitamin D Testing Market Value Share Analysis, by End-user, 2021 and 2031

Figure 99: Latin America Vitamin D Testing Market Attractiveness, by Test Type, 2022‒2031

Figure 100: Latin America Vitamin D Testing Market Attractiveness, by Technique, 2022‒2031

Figure 101: Latin America Vitamin D Testing Market Attractiveness, by Patient Type, 2022‒2031

Figure 102: Latin America Vitamin D Testing Market Attractiveness, by Indication, 2022‒2031

Figure 103: Latin America Vitamin D Testing Market Attractiveness, by End-user, 2022‒2031

Figure 104: Middle East & Africa Vitamin D Testing Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2031

Figure 105: Middle East & Africa Vitamin D Testing Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 106: Middle East & Africa Vitamin D Testing Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 107: Middle East & Africa Vitamin D Testing Market Value Share Analysis, by Test Type, 2021 and 2031

Figure 108: Middle East & Africa Vitamin D Testing Market Value Share Analysis, by Technique, 2021 and 2031

Figure 109: Middle East & Africa Vitamin D Testing Market Value Share Analysis, by Patient Type, 2021 and 2031

Figure 110: Middle East & Africa Vitamin D Testing Market Value Share Analysis, by Indication, 2021 and 2031

Figure 111: Middle East & Africa Vitamin D Testing Market Value Share Analysis, by End-user, 2021 and 2031

Figure 112: Middle East & Africa Vitamin D Testing Market Attractiveness, by Test Type, 2022‒2031

Figure 113: Middle East & Africa Vitamin D Testing Market Attractiveness, by Technique, 2022‒2031

Figure 114: Middle East & Africa Vitamin D Testing Market Attractiveness, by Patient Type, 2022‒2031

Figure 115: Middle East & Africa Vitamin D Testing Market Attractiveness, by Indication, 2022‒2031

Figure 116: Middle East & Africa Vitamin D Testing Market Attractiveness, by End-user, 2022‒2031