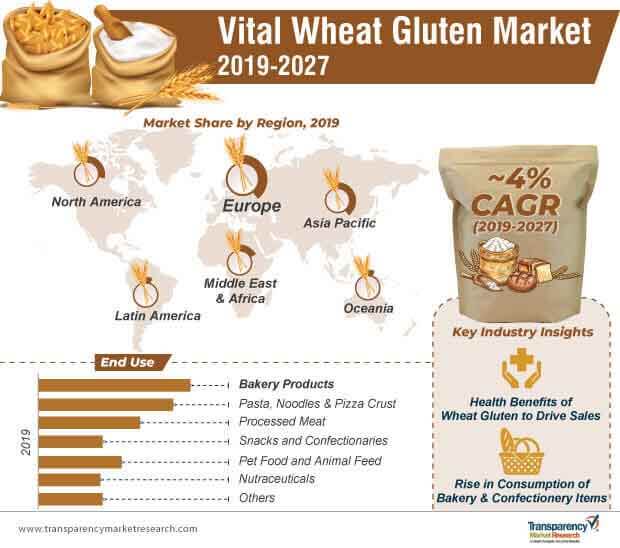

The global vital wheat gluten market will rise from ~US$ 2 Bn in 2019 to ~US$ 2.7 Bn by 2027, as market players mark the rising proclivity of consumers for protein-fortified products. Consumer sentiments oriented towards vegan food will give impetus to the vital wheat gluten market, as plant-based protein is the sole source of protein for the vegan populace.

With health being at the center of innovation, vital wheat gluten has already carved a niche of its own in the bakery industry. Further, the nutraceutical industry is also highly likely to catalyze the revenue of the market, as consumers are seeking nutrition outside their plates. However, an interesting aspect of vital wheat gluten is its penetration in the pet food and animal feed segment. Though currently at a budding stage, this trend is likely to grow in terms of popularity, owing to the rich protein content of vital wheat gluten that is essential for the overall well-being of pets and cattle.

Vital wheat gluten is also gaining a place of prominence in the diets of bodybuilders and athletes who suffer from celiac disease or gastric and bloating problems. With sustained demand for vital wheat gluten ascending from numerous end users, manufacturers are evincing interest in manufacturing clean-label and organic products to improve their sales prospects.

There has been heated debates across the world regarding the risks associated with cultivating and consuming genetically modified foods. Owing to such disparities, regulations regarding testing and approval procedures vary in different countries. As a result, the lack of a standard procedure is likely to limit the exposure of market players in other markets.

In addition, some countries even have a ban in place on the cultivation of GMO crops, which is likely to hamper the production of vital wheat gluten. For instance, in October 2015, a regulation was passed by the European Commission proclaiming that member countries must abstain from the production of GMO crops.

Yet another key impeder to steady market growth is the accelerated movement of the 'entomophagy' culture. As the never-ending quest for protein is drifting manufacturers towards new sources of protein, including even insects. A number of literatures are coming to light that quantify the nutritional value of cricket flour, along with its protein profile, which has instigated a shift towards the newly-discovered protein source, away from vital wheat gluten.

Lucrative opportunities await market players, as consumers seek organic products, not only on their plate but also for entire well-being, and the positive impact of vital wheat gluten is inundating the cosmetics and personal care industry. This has encouraged market players to experiment with formulations and develop skincare and hair care products.

In recent times, vital wheat gluten is witnessing voluminous adoption for the formulation of cosmetic products that improve the quality of the hair and skin. Given the fast-replacement of ingredients in the highly competitive cosmetic industry, market players can collaborate with end users to ensure a streamlined supply of vital wheat gluten.

Analysts’ Viewpoint

Authors of the report opine that, the growth trajectory that of the vital wheat gluten market will be a moderate one, with concerns regarding gluten and GMO-based food products. However, a shift towards veganism and vegetarianism will enable channeled sales opportunities for market players. Analysts also believe that ease of availability will be a crucial key to market success, which can be achieved by entering into partnerships with online as well as offline retailers. Market players can also capitalize on consumer sentiments towards healthy products through effective and clear brand communication. Collaborations and partnerships with end users as well as distributors will remain integral to thrive in the vital wheat gluten market during the forecast period.

Usage of Wheat Protein in Bakery & Confectionery Industry to Create Significant Opportunities

Increasing Demand for Vital Wheat Gluten as a Protein Source

Celiac Disease Triggered by Vital Wheat Gluten to Significantly Hamper Market Growth

Vital Wheat Gluten Market: Competitive Landscape

Key players operating in the vital wheat gluten market, as profiled in the study include

Vital Wheat Gluten Market: Key Developments

1. Global Vital Wheat Gluten Market - Executive Summary

2. Global Vital Wheat Gluten Market Overview

2.1. Introduction

2.1.1. Global Vital Wheat Gluten Market Taxonomy

2.2. Global Vital Wheat Gluten Market Size (US$ Mn & Volume) and Forecast, 2013-2027

2.2.1. Global Vital Wheat Gluten Market Y-o-Y Growth

2.3. Global Vital Wheat Gluten Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.4. Macroeconomic Factors impacting Vital Wheat Gluten Market

2.5. Porter’s Five Forces Analysis

2.6. Pestle Analysis

2.7. Product Lifecycle

2.8. Key Regulatory Framework

2.9. Key Identified Regulations & Guidelines on Food Safety & Labelling

2.10. Label Claims: Overview

2.10.1. Organic Certification

2.10.2. Halal Certification

2.10.3. Kosher Certification

2.10.4. Non-GMO Certification

2.11. Value Chain Analysis

2.11.1. Supply Chain

2.11.2. Operating Margin Analysis

2.11.3. Investment Feasibility Matrix

2.12. Pricing Analysis

2.12.1. Global Vital Wheat Gluten Market Pricing Analysis (US$ per MT), 2018

2.12.2. Factors Influencing Pricing

2.13. Food for Thought

3. Global Vital Wheat Gluten Market Analysis and Forecast 2013-2027

3.1. Global Vital Wheat Gluten Market Size and Forecast By Nature, 2013-2027

3.1.1. Organic Market Size and Forecast, 2013-2027

3.1.1.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.1.1.2. Market Share Comparison, By Region

3.1.1.3. Y-o-Y growth Comparison, By Region

3.1.2. Conventional Market Size and Forecast, 2013-2027

3.1.2.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.1.2.2. Market Share Comparison, By Region

3.1.2.3. Y-o-Y growth Comparison, By Region

3.2. Global Vital Wheat Gluten Market Size and Forecast By End Use, 2013-2027

3.2.1. Bakery Products Market Size and Forecast, 2013-2027

3.2.1.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.2.1.2. Market Share Comparison, By Region

3.2.1.3. Y-o-Y growth Comparison, By Region

3.2.2. Pasta, Noodle & Pizza Crust Market Size and Forecast, 2013-2027

3.2.2.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.2.2.2. Market Share Comparison, By Region

3.2.2.3. Y-o-Y growth Comparison, By Region

3.2.3. Processed Meat Market Size and Forecast, 2013-2027

3.2.3.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.2.3.2. Market Share Comparison, By Region

3.2.4. Y-o-Y growth Comparison, By Region

3.2.5. Snacks and Confectionaries Market Size and Forecast, 2013-2027

3.2.5.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.2.5.2. Market Share Comparison, By Region

3.2.5.3. Y-o-Y growth Comparison, By Region

3.2.6. Pet Food and Animal Feed Market Size and Forecast, 2013-2027

3.2.6.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.2.6.2. Market Share Comparison, By Region

3.2.6.3. Y-o-Y growth Comparison, By Region

3.2.7. Nutraceuticals Market Size and Forecast, 2013-2027

3.2.7.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.2.7.2. Market Share Comparison, By Region

3.2.7.3. Y-o-Y growth Comparison, By Region

3.2.8. Others Market Size and Forecast, 2013-2027

3.2.8.1. Revenue (US$ Mn) & Volume Comparison, By Region

3.2.8.2. Market Share Comparison, By Region

3.2.8.3. Y-o-Y growth Comparison, By Region

4. North America Vital Wheat Gluten Market Size and Forecast, 2013-2027

4.1. Revenue (US$ Mn) & Volume Comparison, By Country

4.1.1. U.S.

4.1.2. Canada

4.2. Revenue (US$ Mn) & Volume Comparison, By Nature

4.3. Revenue (US$ Mn) & Volume Comparison, By End Use

5. Latin America Vital Wheat Gluten Market Size and Forecast, 2013-2027

5.1. Revenue (US$ Mn) & Volume Comparison, By Country

5.1.1. Brazil

5.1.2. Mexico

5.1.3. Chile

5.1.4. Peru

5.1.5. Argentina

5.1.6. Rest of Latin America

5.2. Revenue (US$ Mn) & Volume Comparison, By Nature

5.3. Revenue (US$ Mn) & Volume Comparison, By End Use

6. Europe Vital Wheat Gluten Market Size and Forecast, 2013-2027

6.1. Revenue (US$ Mn) & Volume Comparison, By Country

6.1.1. EU4

6.1.2. U.K.

6.1.3. Benelux

6.1.4. Nordic

6.1.5. Russia

6.1.6. Rest Of Europe

6.2. Revenue (US$ Mn) & Volume Comparison, By Nature

6.3. Revenue (US$ Mn) & Volume Comparison, By End Use

7. Oceania Vital Wheat Gluten Market Size and Forecast, 2013-2027

7.1. Revenue (US$ Mn) & Volume Comparison, By Nature

7.2. Revenue (US$ Mn) & Volume Comparison, By End Use

8. Asia Pacific Vital Wheat Gluten Market Size and Forecast, 2013-2027

8.1. Revenue (US$ Mn) & Volume Comparison, By Country

8.1.1. India

8.1.2. China

8.1.3. ASEAN

8.1.4. South Korea

8.1.5. Japan

8.1.6. Rest of APEJ

8.2. Revenue (US$ Mn) & Volume Comparison, By Nature

8.3. Revenue (US$ Mn) & Volume Comparison, By End Use

9. MEA Vital Wheat Gluten Market Size and Forecast, 2013-2027

9.1. Revenue (US$ Mn) & Volume Comparison, By Country

9.1.1. GCC Countries

9.1.2. South Africa

9.1.3. Turkey

9.1.4. Iran

9.1.5. Israel

9.1.6. Rest of MEA

9.2. Revenue (US$ Mn) & Volume Comparison, By Nature

9.3. Revenue (US$ Mn) & Volume Comparison, By End Use

10. Global Vital Wheat Gluten Market Company Share, Competition Landscape and Company Profiles

10.1. Market Analysis by Tier of Companies

10.2. Market Concentration

10.3. Market Share Analysis of Top Players

10.4. Market Presence Analysis

10.4.1. By Regional Footprint of Players

10.4.2. Product Footprint by Players

10.4.3. Channel Footprint by Players

11. Competition Analysis

11.1. Competition Dashboard

11.2. Pricing Analysis by Competition

11.3. Competition Benchmarking

11.4. Competition Deep Dive (Tentative List)

11.4.1. Blattmann Schweiz AG

11.4.1.1. Overview

11.4.1.2. Product Portfolio

11.4.1.3. Profitability by Market Segments (Product/Channel/Region)

11.4.1.4. Sales Footprint

11.4.1.5. Strategy Overview

11.4.1.5.1. Marketing Strategy

11.4.1.5.2. Product Strategy

11.4.2. Tereos Syral (Tate and Lyle)

11.4.2.1. Overview

11.4.2.2. Product Portfolio

11.4.2.3. Profitability by Market Segments (Product/Channel/Region)

11.4.2.4. Sales Footprint

11.4.2.5. Strategy Overview

11.4.2.5.1. Marketing Strategy

11.4.2.5.2. Product Strategy

11.4.3. Beneo

11.4.3.1. Overview

11.4.3.2. Product Portfolio

11.4.3.3. Profitability by Market Segments (Product/Channel/Region)

11.4.3.4. Sales Footprint

11.4.3.5. Strategy Overview

11.4.3.5.1. Marketing Strategy

11.4.3.5.2. Product Strategy

11.4.4. Crop Energies AG

11.4.4.1. Overview

11.4.4.2. Product Portfolio

11.4.4.3. Profitability by Market Segments (Product/Channel/Region)

11.4.4.4. Sales Footprint

11.4.4.5. Strategy Overview

11.4.4.5.1. Marketing Strategy

11.4.4.5.2. Product Strategy

11.4.5. Bryan W Nash & Sons Ltd.

11.4.5.1. Overview

11.4.5.2. Product Portfolio

11.4.5.3. Profitability by Market Segments (Product/Channel/Region)

11.4.5.4. Sales Footprint

11.4.5.5. Strategy Overview

11.4.5.5.1. Marketing Strategy

11.4.5.5.2. Product Strategy

11.4.6. Roquette Amilina, Ab

11.4.6.1. Overview

11.4.6.2. Product Portfolio

11.4.6.3. Profitability by Market Segments (Product/Channel/Region)

11.4.6.4. Sales Footprint

11.4.6.5. Strategy Overview

11.4.6.5.1. Marketing Strategy

11.4.6.5.2. Product Strategy

11.4.7. Kröner-Stärke GmbH

11.4.7.1. Overview

11.4.7.2. Product Portfolio

11.4.7.3. Profitability by Market Segments (Product/Channel/Region)

11.4.7.4. Sales Footprint

11.4.7.5. Strategy Overview

11.4.7.5.1. Marketing Strategy

11.4.7.5.2. Product Strategy

11.4.8. Pioneer industries Limited

11.4.8.1. Overview

11.4.8.2. Product Portfolio

11.4.8.3. Profitability by Market Segments (Product/Channel/Region)

11.4.8.4. Sales Footprint

11.4.8.5. Strategy Overview

11.4.8.5.1. Marketing Strategy

11.4.8.5.2. Product Strategy

11.4.9. Z&F sungold corporation

11.4.9.1. Overview

11.4.9.2. Product Portfolio

11.4.9.3. Profitability by Market Segments (Product/Channel/Region)

11.4.9.4. Sales Footprint

11.4.9.5. Strategy Overview

11.4.9.5.1. Marketing Strategy

11.4.9.5.2. Product Strategy

11.4.10. Manildra Group

11.4.10.1. Overview

11.4.10.2. Product Portfolio

11.4.10.3. Profitability by Market Segments (Product/Channel/Region)

11.4.10.4. Sales Footprint

11.4.10.5. Strategy Overview

11.4.10.5.1. Marketing Strategy

11.4.10.5.2. Product Strategy

11.4.11. Archer Daniels Midland Company

11.4.11.1. Overview

11.4.11.2. Product Portfolio

11.4.11.3. Profitability by Market Segments (Product/Channel/Region)

11.4.11.4. Sales Footprint

11.4.11.5. Strategy Overview

11.4.11.5.1. Marketing Strategy

11.4.11.5.2. Product Strategy

11.4.12. MGP Ingredients Inc.

11.4.12.1. Overview

11.4.12.2. Product Portfolio

11.4.12.3. Profitability by Market Segments (Product/Channel/Region)

11.4.12.4. Sales Footprint

11.4.12.5. Strategy Overview

11.4.12.5.1. Marketing Strategy

11.4.12.5.2. Product Strategy

11.4.13. Hodgson Mill, Inc.

11.4.13.1. Overview

11.4.13.2. Product Portfolio

11.4.13.3. Profitability by Market Segments (Product/Channel/Region)

11.4.13.4. Sales Footprint

11.4.13.5. Strategy Overview

11.4.13.5.1. Marketing Strategy

11.4.13.5.2. Product Strategy

11.4.14. Bob’s Red Mill Ltd

11.4.14.1. Overview

11.4.14.2. Product Portfolio

11.4.14.3. Profitability by Market Segments (Product/Channel/Region)

11.4.14.4. Sales Footprint

11.4.14.5. Strategy Overview

11.4.14.5.1. Marketing Strategy

11.4.14.5.2. Product Strategy

11.4.15. Others on Additional Request

11.4.15.1. Overview

11.4.15.2. Product Portfolio

11.4.15.3. Profitability by Market Segments (Product/Channel/Region)

11.4.15.4. Sales Footprint

11.4.15.5. Strategy Overview

11.4.15.5.1. Marketing Strategy

11.4.15.5.2. Product Strategy

12. Research Methodology

13. Secondary and Primary Sources

14. Assumptions and Acronyms

15. Disclaimer

List of Tables

TABLE 1 Global Vital Wheat Gluten Market Value (US$ Mn) & Volume, 2013-2018

TABLE 2 Global Vital Wheat Gluten Market Value (US$ Mn) & Volume, 2019-2027

TABLE 3 Global Vital Wheat Gluten Market Value (US$ Mn) & Volume and Y-o-Y, 2018-2027

TABLE 4 Global Organic Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 5 Global Organic Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 6 Global Organic Segment Market Share, By Region 2013-2018

TABLE 7 Global Organic Segment Market Share, By Region 2019-2027

TABLE 8 Global Organic Segment Y-o-Y, By Region 2018-2027

TABLE 9 Global Conventional Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 10 Global Conventional Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 11 Global Conventional Segment Market Share, By Region 2013-2018

TABLE 12 Global Conventional Segment Market Share, By Region 2019-2027

TABLE 13 Global Conventional Segment Y-o-Y, By Region 2018-2027

TABLE 14 Global Bakery Products Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 15 Global Bakery Products Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 16 Global Bakery Products Segment Market Share, By Region 2013-2018

TABLE 17 Global Bakery Products Segment Market Share, By Region 2019-2027

TABLE 18 Global Bakery Products Segment Y-o-Y, By Region 2018-2027

TABLE 19 Global Pasta, Noodle & Pizza Crust Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 20 Global Pasta, Noodle & Pizza Crust Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 21 Global Pasta, Noodle & Pizza Crust Segment Market Share, By Region 2013-2018

TABLE 22 Global Pasta, Noodle & Pizza Crust Segment Market Share, By Region 2019-2027

TABLE 23 Global Pasta, Noodle & Pizza Crust Segment Y-o-Y, By Region 2018-2027

TABLE 24 Global Processed Meat Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 25 Global Processed Meat Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 26 Global Processed Meat Segment Market Share, By Region 2013-2018

TABLE 27 Global Processed Meat Segment Market Share, By Region 2019-2027

TABLE 28 Global Processed Meat Segment Y-o-Y, By Region 2018-2027

TABLE 29 Global Snacks and Confectionaries Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 30 Global Snacks and Confectionaries Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 31 Global Snacks and Confectionaries Segment Market Share, By Region 2013-2018 53

TABLE 32 Global Snacks and Confectionaries Segment Market Share, By Region 2019-2027

TABLE 33 Global Snacks and Confectionaries Segment Y-o-Y, By Region 2018-2027

TABLE 34 Global Pet Food and Animal Feed Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 35 Global Pet Food and Animal Feed Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 36 Global Pet Food and Animal Feed Segment Market Share, By Region 2013-2018

TABLE 37 Global Pet Food and Animal Feed Segment Market Share, By Region 2019-2027

TABLE 38 Global Pet Food and Animal Feed Segment Y-o-Y, By Region 2018-2027

TABLE 39 Global Nutraceuticals Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 40 Global Nutraceuticals Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 41 Global Nutraceuticals Segment Market Share, By Region 2013-2018

TABLE 42 Global Nutraceuticals Segment Market Share, By Region 2019-2027

TABLE 43 Global Nutraceuticals Segment Y-o-Y, By Region 2018-2027

TABLE 44 Global Others Segment Value (US$ Mn) & Volume, By Region 2013-2018

TABLE 45 Global Others Segment Value (US$ Mn) & Volume, By Region 2019-2027

TABLE 46 North America Vital Wheat Gluten Market Value (US$ Mn) & Volume, By Country 2019-2027

TABLE 47 North America Vital Wheat Gluten Market Value (US$ Mn) & Volume, By Nature 2013-2018

TABLE 48 North America Vital Wheat Gluten Market Value (US$ Mn) & Volume, By Nature 2019-2027

TABLE 49 North America Vital Wheat Gluten Market Value (US$ Mn) & Volume, By End Use 2013-2018

TABLE 50 North America Vital Wheat Gluten Market Value (US$ Mn) & Volume, By End Use 2019-2027

TABLE 51 Latin America Vital Wheat Gluten Market Value (US$ Mn) & Volume, By Country 2013-2018

TABLE 52 Latin America Vital Wheat Gluten Market Value (US$ Mn) & Volume, By Country 2019-2027

TABLE 53 Latin America Vital Wheat Gluten Market Value (US$ Mn) & Volume, By Nature 2013-2018

TABLE 54 Latin America Vital Wheat Gluten Market Value (US$ Mn) & Volume, By Nature 2019-2027

TABLE 55 Latin America Vital Wheat Gluten Market Value (US$ Mn) & Volume, By End Use 2013-2018

TABLE 56 Latin America Vital Wheat Gluten Market Value (US$ Mn) & Volume, By End Use 2019-2027

TABLE 57 Europe Vital Wheat Gluten Market Value (US$ Mn) & Volume, By Country 2013-2018

TABLE 58 Europe Vital Wheat Gluten Market Value (US$ Mn) & Volume, By Country 2019-2027

TABLE 59 Europe Vital Wheat Gluten Market Value (US$ Mn) & Volume, By Nature 2013-2018

TABLE 60 Europe Vital Wheat Gluten Market Value (US$ Mn) & Volume, By Nature 2019-2027

TABLE 61 Europe Vital Wheat Gluten Market Value (US$ Mn) & Volume, By End Use 2013-2018

TABLE 62 Europe Vital Wheat Gluten Market Value (US$ Mn) & Volume, By End Use 2019-2027

TABLE 63 Oceania Vital Wheat Gluten Market Value (US$ Mn) & Volume, By Nature 2013-2018

TABLE 64 Oceania Vital Wheat Gluten Market Value (US$ Mn) & Volume, By Nature 2019-2027

TABLE 65 Oceania Vital Wheat Gluten Market Value (US$ Mn) & Volume, By End Use 2013-2018

TABLE 66 Oceania Vital Wheat Gluten Market Value (US$ Mn) & Volume, By End Use 2019-2027

TABLE 67 Asia Pacific Vital Wheat Gluten Market Value (US$ Mn) & Volume, By Country 2013-2018

TABLE 68 Asia Pacific Vital Wheat Gluten Market Value (US$ Mn) & Volume, By Country 2019-2027

TABLE 69 Asia Pacific Vital Wheat Gluten Market Value (US$ Mn) & Volume, By Nature 2013-2018

TABLE 70 Asia Pacific Vital Wheat Gluten Market Value (US$ Mn) & Volume, By Nature 2019-2027

TABLE 71 Asia Pacific Vital Wheat Gluten Market Value (US$ Mn) & Volume, By End Use 2013-2018

TABLE 72 Asia Pacific Vital Wheat Gluten Market Value (US$ Mn) & Volume, By End Use 2019-2027

TABLE 73 MEA Vital Wheat Gluten Market Value (US$ Mn) & Volume, By Country 2013-2018

TABLE 74 MEA Vital Wheat Gluten Market Value (US$ Mn) & Volume, By Country 2019-2027

TABLE 75 MEA Vital Wheat Gluten Market Value (US$ Mn) & Volume, By Nature 2013-2018

TABLE 76 MEA Vital Wheat Gluten Market Value (US$ Mn) & Volume, By Nature 2019-2027

TABLE 77 MEA Vital Wheat Gluten Market Value (US$ Mn) & Volume, By End Use 2013-2018

TABLE 78 MEA Vital Wheat Gluten Market Value (US$ Mn) & Volume, By End Use 2019-2027

List of Figures

FIG. 1 Global Vital Wheat Gluten Market Value (US$ Mn), 2013-2018

FIG. 2 Global Vital Wheat Gluten Market Value (US$ Mn) Forecast, 2019-2027

FIG. 3 Global Vital Wheat Gluten Market Value (US$ Mn) and Y-o-Y, 2018-2027

FIG. 4 Global Organic Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 5 Global Organic Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 6 Global Organic Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 7 Global Conventional Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 8 Global Conventional Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 9 Global Conventional Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 10 Global Bakery Products Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 11 Global Bakery Products Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 12 Global Bakery Products Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 13 Global Pasta, Noodle & Pizza Crust Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 14 Global Pasta, Noodle & Pizza Crust Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 15 Global Pasta, Noodle & Pizza Crust Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 16 Global Processed Meat Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 17 Global Processed Meat Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 18 Global Processed Meat Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 19 Global Snacks and Confectionaries Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 20 Global Snacks and Confectionaries Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 21 Global Snacks and Confectionaries Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 22 Global Pet Food and Animal Feed Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 23 Global Pet Food and Animal Feed Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 24 Global Pet Food and Animal Feed Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 25 Global Nutraceuticals Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 26 Global Nutraceuticals Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 27 Global Nutraceuticals Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 28 Global Others Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 29 Global Others Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 30 North America Vital Wheat Gluten Market Value (US$ Mn) & Volume, By Country 2013-2018

FIG. 31 North America Vital Wheat Gluten Market Value (US$ Mn), By Country 2013-2018

FIG. 32 North America Vital Wheat Gluten Market Value (US$ Mn), By Country 2019-2027

FIG. 33 North America Vital Wheat Gluten Market Value (US$ Mn), By Nature 2013-2018

FIG. 34 North America Vital Wheat Gluten Market Value (US$ Mn), By Nature 2019-2027

FIG. 35 North America Vital Wheat Gluten Market Value (US$ Mn), By End Use 2013-2018

FIG. 36 North America Vital Wheat Gluten Market Value (US$ Mn), By End Use 2019-2027

FIG. 37 Latin America Vital Wheat Gluten Market Value (US$ Mn), By Country 2013-2018

FIG. 38 Latin America Vital Wheat Gluten Market Value (US$ Mn), By Country 2019-2027

FIG. 39 Latin America Vital Wheat Gluten Market Value (US$ Mn), By Nature 2013-2018

FIG. 40 Latin America Vital Wheat Gluten Market Value (US$ Mn), By Nature 2019-2027

FIG. 41 Latin America Vital Wheat Gluten Market Value (US$ Mn), By End Use 2013-2018

FIG. 42 Latin America Vital Wheat Gluten Market Value (US$ Mn), By End Use 2019-2027

FIG. 43 Europe Vital Wheat Gluten Market Value (US$ Mn), By Country 2013-2018

FIG. 44 Europe Vital Wheat Gluten Market Value (US$ Mn), By Country 2019-2027

FIG. 45 Europe Vital Wheat Gluten Market Value (US$ Mn), By Nature 2013-2018

FIG. 46 Europe Vital Wheat Gluten Market Value (US$ Mn), By Nature 2019-2027

FIG. 47 Europe Vital Wheat Gluten Market Value (US$ Mn), By End Use 2013-2018

FIG. 48 Europe Vital Wheat Gluten Market Value (US$ Mn), By End Use 2019-2027

FIG. 49 Oceania Vital Wheat Gluten Market Value (US$ Mn), By Nature 2013-2018

FIG. 50 Oceania Vital Wheat Gluten Market Value (US$ Mn), By Nature 2019-2027

FIG. 51 Oceania Vital Wheat Gluten Market Value (US$ Mn), By 2013-2018

FIG. 52 Oceania Vital Wheat Gluten Market Value (US$ Mn), By End Use 2019-2027

FIG. 53 Asia Pacific Vital Wheat Gluten Market Value (US$ Mn), By Country 2013-2018

FIG. 54 Asia Pacific Vital Wheat Gluten Market Value (US$ Mn), By Country 2019-2027

FIG. 55 Asia Pacific Vital Wheat Gluten Market Value (US$ Mn), By Nature 2013-2018

FIG. 56 Asia Pacific Vital Wheat Gluten Market Value (US$ Mn), By Nature 2019-2027

FIG. 57 Asia Pacific Vital Wheat Gluten Market Value (US$ Mn), By End Use 2013-2018

FIG. 58 Asia Pacific Vital Wheat Gluten Market Value (US$ Mn), By End Use 2019-2027

FIG. 59 MEA Vital Wheat Gluten Market Value (US$ Mn), By Country 2013-2018

FIG. 60 MEA Vital Wheat Gluten Market Value (US$ Mn), By Country 2019-2027

FIG. 61 MEA Vital Wheat Gluten Market Value (US$ Mn), By Nature 2013-2018

FIG. 62 MEA Vital Wheat Gluten Market Value (US$ Mn), By Nature 2019-2027

FIG. 63 MEA Vital Wheat Gluten Market Value (US$ Mn), By End Use 2013-2018

FIG. 64 MEA Vital Wheat Gluten Market Value (US$ Mn), By End Use 2019-2027