Analysts’ Viewpoint

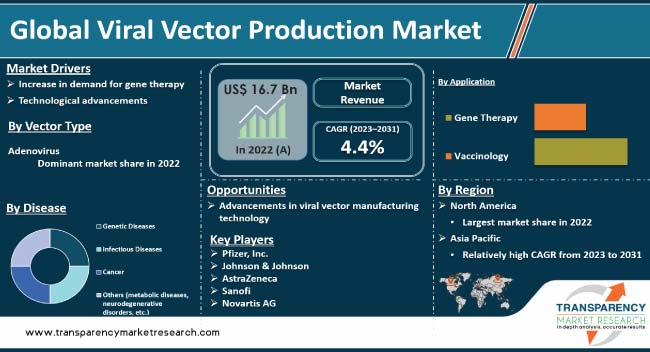

The global viral vector production industry is expected to witness significant growth in the next few years, driven by increase in demand for gene therapy and rise in prevalence of genetic disorders. Development of advanced technologies for viral vector production is expected to propel global viral vector production market growth. Furthermore, increase in demand for gene therapy is likely to accelerate market expansion in the next few years.

Development of advanced technologies for viral vector production is projected to offer lucrative opportunities to market players. Leading players are focusing on development of safe, efficacious, and scalable viral vector production methods in order to increase market share and revenue.

However, high cost of viral vector production and stringent regulatory requirements for gene therapy products are likely to restrain the global market in the next few years.

Viral vector production has been gaining significant attention in the past few years due to its potential applications in gene therapy, vaccine development, and other medical research areas. Viral vectors are modified viruses that are used to deliver genetic material into cells, allowing for the manipulation of gene expression and correction of genetic disorders.

Several types of viral vectors are available in the market, including retroviral vectors, lentiviral vectors, adenoviral vectors, and adeno-associated viral vectors. Each type of vector has its own advantages and disadvantages, depending on the specific application. Retroviral vectors, for example, are commonly used in gene therapy due to their ability to integrate into the host genome, while adenoviral vectors are preferred for vaccine development due to their ability to induce strong immune responses.

Despite their potential benefits, viral vectors pose certain challenges and limitations. One major concern is the risk of immune responses or adverse reactions in patients receiving viral vector-based therapies. Additionally, the production of viral vectors can be complex and expensive, requiring specialized facilities and equipment. Hence, ongoing research and development efforts are focused on improving the safety, efficacy, and scalability of viral vector production methods, with the ultimate goal of bringing these innovative therapies to patients in need.

Gene therapy is a promising treatment option for various genetic disorders, including cancer, inherited diseases, and viral infections. The usage of viral vectors in gene therapy has gained significant attention due to their ability to deliver therapeutic genes into target cells efficiently. Hence, the global viral vector production market is expected to witness robust growth in the next few years. The rise in the prevalence of genetic disorders and chronic diseases, such as cancer, has led to increasing in demand for gene therapies across the world.

According to the World Health Organization (WHO), cancer is one of the leading causes of death globally, with around 9.6 million deaths reported in 2018 alone. Moreover, advancements in biotechnology have enabled researchers to develop new gene therapies that can treat previously untreatable conditions.

Governments of several countries are investing significantly in research & development activities related to gene therapy. For instance, the U.S. Government's National Institutes of Health (NIH) invested over US$ 2 Bn in gene therapy research between 2010 and 2020. Similarly, China's government launched its "Healthy China 2030" initiative aimed at promoting healthcare services and developing innovative treatments such as gene therapies.

Technological advancements have played a crucial role in driving innovation in the global viral vector production market. Significant improvements have been made to enhance efficiency while reducing costs associated with producing high-quality vectors used for various applications such as vaccines or cell-based therapeutics.

CRISPR-Cas9 technology is one major technological advancement that has revolutionized the global market which allows scientists greater precision when editing DNA sequences by cutting out specific sections from genomes without damaging surrounding areas, making it easier to create custom-made viruses tailored specifically toward individual needs.

The development of new viral vector production techniques, such as suspension cell culture systems and transient transfection methods, has enabled researchers to produce high-quality vectors at a lower cost. These advancements have also led to an increase in the scalability of viral vector production, allowing for larger quantities of vectors to be produced in a shorter time.

Additionally, automation technologies have been developed that can streamline the entire process from start to finish. This includes automated bioreactors that can monitor and control various parameters such as temperature, pH levels, and oxygenation rates during cell growth and virus production stages. Such automation not only reduces human error but also increases efficiency while reducing costs associated with manual labor.

In terms of disease, the infectious diseases segment accounted for the largest global viral vector production market share in 2022. This is ascribed to the high prevalence and increase in incidence rates of infectious diseases.

The rise in the need for effective treatments against viral infections is another factor propelling the segment. Viral infections such as HIV/AIDS and hepatitis C are major global health concerns that require effective treatment options. Gene therapy using viral vectors has shown promising results in preclinical studies for treating these diseases.

Another factor contributing to growth in the segment is the development of vaccines against infectious diseases. Vaccines based on viral vectors have been successful in providing protection against various viruses such as influenza and Ebola. These vaccines work by delivering a piece of viral DNA into cells, which then triggers an immune response against that particular virus.

Based on application, the vaccinology segment dominated the global viral vector production market size owing to a wide range of applications, including prevention from life-threatening diseases such as cancer or COVID-19. An increase in demand for new vaccine development due to emerging infectious diseases, such as COVID-19, is a major factor driving the vaccinology segment. Viral vector-based vaccines have emerged as a potential solution due to their ability to induce strong immune responses while being safe. For instance, Oxford-AstraZeneca's COVID-19 vaccine uses an adenoviral vector platform, which has shown an efficacy rate of up to 90% during clinical trials.

Ongoing research activities for developing vaccines against various diseases such as cancer and HIV/AIDS are another factor augmenting the vaccinology segment. Viral vector-based vaccines have shown promising results in preclinical studies for treating these diseases.

In terms of vector type, the adenovirus segment held the largest share of the global market in 2022. This is ascribed to high transduction efficiency and broad host range. Widespread use in gene therapy is one of the major factors bolstering the adenovirus segment. Gene therapy involves introducing genetic material into a patient's cells to treat or prevent disease. Adenoviral vectors are commonly used for this procedure due to their ability to efficiently deliver genes into target cells. Adenoviral vectors have been shown to be safe and effective in clinical trials for various diseases such as cystic fibrosis and hemophilia.

The rise in the usage of adenoviral vectors in vaccine development is also driving the segment. Vaccines based on adenoviral vectors have shown promising results against infectious diseases such as Ebola and Zika viruses. These vaccines work by delivering a piece of viral DNA into cells which then triggers an immune response against that particular virus.

Furthermore, advancements in technology have led to improvements in adenoviral vector production methods. For instance, companies such as Lonza Group AG have developed new viral vector manufacturing processes that allow for large-scale production of high-quality adenoviral vectors at a lower cost.

As per global viral vector production market trends, North America accounted for a major share of the global industry in 2022. The region has a well-established healthcare infrastructure that supports research & development activities related to gene therapy. The U.S. dominated the market in the region owing to the presence of pharmaceutical companies involved in the development of innovative therapies using viral vectors. Furthermore, favorable government initiatives, such as funding support for R&D activities, are propelling the industry in North America.

Asia Pacific is projected to be the fastest-growing region during the forecast period. This can be ascribed to factors such as an increase in disposable income, a rise in awareness about advanced therapies such as gene therapy & cell-based immunotherapy, and a surge in investments by key players in emerging economies such as China and India. Furthermore, countries such as Japan are contributing to the growth of the market in the region due to technological advancements and a supportive regulatory environment. Several local players are entering into partnerships with international firms or acquiring them, which will help them expand their product portfolio while offering cost-effective solutions.

The report includes vital information about the key companies operating in the viral vector production market. Companies focus on strategies such as product launches, divestiture, mergers & acquisitions (M&A), and partnerships to strengthen their position in the market. Pfizer, Inc., Johnson & Johnson, AstraZeneca, Sanofi, Novartis AG, Spark Therapeutics, Inc. (F. Hoffmann-La Roche Ltd.), GlaxoSmithKline plc, Merck KGaA (Merck & Co., Inc.), Lonza, FUJIFILM Diosynth Biotechnologies, Inc., Oxford Biomedica plc, Amgen, Inc., Ferring B.V., uniQure N.V., bluebird bio, Inc., GenScript ProBio, Thermo Fisher Scientific, Inc., and Gamaleya Research Institute Industries are prominent players operating in the market.

Each of these players in the market has been profiled in the report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Size Value in 2022 |

US$ 16.7 Bn |

|

Forecast (Value) in 2031 |

More than US$ 17.3 Bn |

|

Compound Annual Growth Rate (CAGR) |

4.4% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 16.7 Bn in 2022

It is projected to reach more than US$ 17.3 Bn by 2031

The market is anticipated to grow at a CAGR of 4.4% from 2023 to 2031

Increase in demand for gene therapy and technological advancements are driving the global market

The infectious diseases segment held the largest market share in 2022

North America is expected to account for major share of the global market during the forecast period

Pfizer, Inc., Johnson & Johnson, AstraZeneca, Sanofi, Novartis AG, Spark Therapeutics, Inc. (F. Hoffmann-La Roche Ltd.), GlaxoSmithKline plc, Merck KGaA (Merck & Co., Inc.), Lonza, FUJIFILM Diosynth Biotechnologies, Inc., Oxford Biomedica plc, Amgen, Inc., Ferring B.V., uniQure N.V., bluebird bio, Inc., GenScript ProBio, Thermo Fisher Scientific, Inc., and Gamaleya Research Institute are the prominent players in the market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Viral Vector Production Market

4. Market Overview

4.1. Introduction

4.1.1. Vector Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Viral Vector Production Market Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Evolution of Gene Therapy

5.2. Pipeline Analysis

5.3. Regulatory Scenario, by Region/Globally

5.4. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

6. Global Viral Vector Production Market Analysis and Forecast, by Vector Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Vector Type, 2017-2031

6.3.1. Adenovirus

6.3.2. Adeno-associated virus

6.3.3. Retroviruses

6.3.4. Others (baculoviruses, lentivirus, etc.)

6.4. Market Attractiveness Analysis, by Vector Type

7. Global Viral Vector Production Market Analysis and Forecast, by Disease

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Disease, 2017-2031

7.3.1. Genetic Diseases

7.3.2. Infectious Diseases

7.3.3. Cancer

7.3.4. Others (metabolic diseases, neurodegenerative disorders, etc.)

7.4. Market Attractiveness Analysis, by Disease

8. Global Viral Vector Production Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Application, 2017-2031

8.3.1. Gene Therapy

8.3.2. Vaccinology

8.4. Market Attractiveness Analysis, by Application

9. Global Viral Vector Production Market Analysis and Forecast, by Mode

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by Mode, 2017-2031

9.3.1. Transient Transfection

9.3.2. Stable Producer Cell Lines

9.4. Market Attractiveness Analysis, by Mode

10. Global Viral Vector Production Market Analysis and Forecast, by End-user

10.1. Introduction & Definition

10.2. Key Findings / Developments

10.3. Market Value Forecast, by End-user, 2017-2031

10.3.1. Pharmaceutical & Biotechnology Companies

10.3.2. Academic & Research Institutes

10.3.3. CROs & CDMOs

10.4. Market Attractiveness Analysis, by End-user

11. Global Viral Vector Production Market Analysis and Forecast, by Region

11.1. Key Findings

11.2. Market Value Forecast, by Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Market Attractiveness Analysis, by Region

12. North America Viral Vector Production Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Vector Type, 2017-2031

12.2.1. Adenovirus

12.2.2. Adeno-associated virus

12.2.3. Retroviruses

12.2.4. Others (baculoviruses, lentivirus, etc.)

12.3. Market Value Forecast, by Disease, 2017-2031

12.3.1. Genetic Diseases

12.3.2. Infectious Diseases

12.3.3. Cancer

12.3.4. Others (metabolic diseases, neurodegenerative disorders, etc.)

12.4. Market Value Forecast, by Application, 2017-2031

12.4.1. Gene Therapy

12.4.2. Vaccinology

12.5. Market Value Forecast, by Mode, 2017-2031

12.5.1. Transient Transfection

12.5.2. Stable Producer Cell Lines

12.6. Market Value Forecast, by End-user, 2017-2031

12.6.1. Pharmaceutical & Biotechnology Companies

12.6.2. Academic & Research Institutes

12.6.3. CROs & CDMOs

12.7. Market Value Forecast, by Country, 2017-2031

12.7.1. U.S.

12.7.2. Canada

12.8. Market Attractiveness Analysis

12.8.1. By Vector Type

12.8.2. By Disease

12.8.3. By Application

12.8.4. By Mode

12.8.5. By End-user

12.8.6. By Country

13. Europe Viral Vector Production Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Vector Type, 2017-2031

13.2.1. Adenovirus

13.2.2. Adeno-associated virus

13.2.3. Retroviruses

13.2.4. Others (baculoviruses, lentivirus, etc.)

13.3. Market Value Forecast, by Disease, 2017-2031

13.3.1. Genetic Diseases

13.3.2. Infectious Diseases

13.3.3. Cancer

13.3.4. Others (metabolic diseases, neurodegenerative disorders, etc.)

13.4. Market Value Forecast, by Application, 2017-2031

13.4.1. Gene Therapy

13.4.2. Vaccinology

13.5. Market Value Forecast, by Mode, 2017-2031

13.5.1. Transient Transfection

13.5.2. Stable Producer Cell Lines

13.6. Market Value Forecast, by End-user, 2017-2031

13.6.1. Pharmaceutical & Biotechnology Companies

13.6.2. Academic & Research Institutes

13.6.3. CROs & CDMOs

13.7. Market Value Forecast, by Country/Sub-region, 2017-2031

13.7.1. Germany

13.7.2. U.K.

13.7.3. France

13.7.4. Spain

13.7.5. Italy

13.7.6. Rest of Europe

13.8. Market Attractiveness Analysis

13.8.1. By Vector Type

13.8.2. By Disease

13.8.3. By Application

13.8.4. By Mode

13.8.5. By End-user

13.8.6. By Country/Sub-region

14. Asia Pacific Viral Vector Production Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Vector Type, 2017-2031

14.2.1. Adenovirus

14.2.2. Adeno-associated virus

14.2.3. Retroviruses

14.2.4. Others (baculoviruses, lentivirus, etc.)

14.3. Market Value Forecast, by Diseases, 2017-2031

14.3.1. Genetic Diseases

14.3.2. Infectious Diseases

14.3.3. Cancer

14.3.4. Others (metabolic diseases, neurodegenerative disorders, etc.)

14.4. Market Value Forecast, by Application, 2017-2031

14.4.1. Gene Therapy

14.4.2. Vaccinology

14.5. Market Value Forecast, by Mode, 2017-2031

14.5.1. Transient Transfection

14.5.2. Stable Producer Cell Lines

14.6. Market Value Forecast, by End-user, 2017-2031

14.6.1. Pharmaceutical & Biotechnology Companies

14.6.2. Academic & Research Institutes

14.6.3. CROs & CDMOs

14.7. Market Value Forecast, by Country/Sub-region, 2017-2031

14.7.1. China

14.7.2. Japan

14.7.3. India

14.7.4. Australia & New Zealand

14.7.5. Rest of Asia Pacific

14.8. Market Attractiveness Analysis

14.8.1. By Vector Type

14.8.2. By Disease

14.8.3. By Application

14.8.4. By Mode

14.8.5. By End-user

14.8.6. By Country/Sub-region

15. Latin America Viral Vector Production Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Vector Type, 2017-2031

15.2.1. Adenovirus

15.2.2. Adeno-associated virus

15.2.3. Retroviruses

15.2.4. Others (baculoviruses, lentivirus, etc.)

15.3. Market Value Forecast, by Disease, 2017-2031

15.3.1. Genetic Diseases

15.3.2. Infectious Diseases

15.3.3. Cancer

15.3.4. Others (metabolic diseases, neurodegenerative disorders, etc.)

15.4. Market Value Forecast, by Application, 2017-2031

15.4.1. Gene Therapy

15.4.2. Vaccinology

15.5. Market Value Forecast, by Mode, 2017-2031

15.5.1. Transient Transfection

15.5.2. Stable Producer Cell Lines

15.6. Market Value Forecast, by End-user, 2017-2031

15.6.1. Pharmaceutical & Biotechnology Companies

15.6.2. Academic & Research Institutes

15.6.3. CROs & CDMOs

15.7. Market Value Forecast, by Country/Sub-region, 2017-2031

15.7.1. Brazil

15.7.2. Mexico

15.7.3. Rest of Latin America

15.8. Market Attractiveness Analysis

15.8.1. By Vector Type

15.8.2. By Disease

15.8.3. By Application

15.8.4. By Mode

15.8.5. By End-user

15.8.6. By Country/Sub-region

16. Middle East & Africa Viral Vector Production Market Analysis and Forecast

16.1. Introduction

16.1.1. Key Findings

16.2. Market Value Forecast, by Vector Type, 2017-2031

16.2.1. Adenovirus

16.2.2. Adeno-associated virus

16.2.3. Retroviruses

16.2.4. Others (baculoviruses, lentivirus, etc.)

16.3. Market Value Forecast, by Disease, 2017-2031

16.3.1. Genetic Diseases

16.3.2. Infectious Diseases

16.3.3. Cancer

16.3.4. Others (metabolic diseases, neurodegenerative disorders, etc.)

16.4. Market Value Forecast, by Application, 2017-2031

16.4.1. Gene Therapy

16.4.2. Vaccinology

16.5. Market Value Forecast, by Mode, 2017-2031

16.5.1. Transient Transfection

16.5.2. Stable Producer Cell Lines

16.6. Market Value Forecast, by End-user, 2017-2031

16.6.1. Pharmaceutical & Biotechnology Companies

16.6.2. Academic & Research Institutes

16.6.3. CROs & CDMOs

16.7. Market Value Forecast, by Country/Sub-region, 2017-2031

16.7.1. GCC Countries

16.7.2. South Africa

16.7.3. Rest of Middle East & Africa

16.8. Market Attractiveness Analysis

16.8.1. By Vector Type

16.8.2. By Disease

16.8.3. By Application

16.8.4. By Mode

16.8.5. By End-user

16.8.6. By Country/Sub-region

17. Competition Landscape

17.1. Market Player - Competition Matrix (By Tier and Size of companies)

17.2. Market Share Analysis By Company (2021)

17.3. Company Profiles

17.3.1. Pfizer, Inc.

17.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.1.2. Test Type Portfolio

17.3.1.3. Financial Overview

17.3.1.4. SWOT Analysis

17.3.1.5. Strategic Overview

17.3.2. Johnson & Johnson

17.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.2.2. Test Type Portfolio

17.3.2.3. Financial Overview

17.3.2.4. SWOT Analysis

17.3.2.5. Strategic Overview

17.3.3. AstraZeneca

17.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.3.2. Test Type Portfolio

17.3.3.3. Financial Overview

17.3.3.4. SWOT Analysis

17.3.3.5. Strategic Overview

17.3.4. Sanofi

17.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.4.2. Test Type Portfolio

17.3.4.3. Financial Overview

17.3.4.4. SWOT Analysis

17.3.4.5. Strategic Overview

17.3.5. Novartis AG

17.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.5.2. Test Type Portfolio

17.3.5.3. Financial Overview

17.3.5.4. SWOT Analysis

17.3.5.5. Strategic Overview

17.3.6. Spark Therapeutics, Inc. (F. Hoffmann-La Roche Ltd.)

17.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.6.2. Test Type Portfolio

17.3.6.3. Financial Overview

17.3.6.4. SWOT Analysis

17.3.6.5. Strategic Overview

17.3.7. GlaxoSmithKline plc

17.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.7.2. Test Type Portfolio

17.3.7.3. Financial Overview

17.3.7.4. SWOT Analysis

17.3.7.5. Strategic Overview

17.3.8. Merck KGaA (Merck & Co., Inc.)

17.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.8.2. Test Type Portfolio

17.3.8.3. Financial Overview

17.3.8.4. SWOT Analysis

17.3.8.5. Strategic Overview

17.3.9. Lonza

17.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.9.2. Test Type Portfolio

17.3.9.3. Financial Overview

17.3.9.4. SWOT Analysis

17.3.9.5. Strategic Overview

17.3.10. FUJIFILM Diosynth Biotechnologies Inc.

17.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.10.2. Test Type Portfolio

17.3.10.3. Financial Overview

17.3.10.4. SWOT Analysis

17.3.10.5. Strategic Overview

17.3.11. Oxford Biomedica plc

17.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.11.2. Test Type Portfolio

17.3.11.3. Financial Overview

17.3.11.4. SWOT Analysis

17.3.11.5. Strategic Overview

17.3.12. Amgen Inc.

17.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.12.2. Test Type Portfolio

17.3.12.3. Financial Overview

17.3.12.4. SWOT Analysis

17.3.12.5. Strategic Overview

17.3.13. Ferring B.V.

17.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.13.2. Test Type Portfolio

17.3.13.3. Financial Overview

17.3.13.4. SWOT Analysis

17.3.13.5. Strategic Overview

17.3.14. uniQure N.V.

17.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.14.2. Test Type Portfolio

17.3.14.3. Financial Overview

17.3.14.4. SWOT Analysis

17.3.14.5. Strategic Overview

17.3.15. bluebird bio, Inc.

17.3.15.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.15.2. Test Type Portfolio

17.3.15.3. Financial Overview

17.3.15.4. SWOT Analysis

17.3.15.5. Strategic Overview

17.3.16. GenScript ProBio

17.3.16.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.16.2. Test Type Portfolio

17.3.16.3. Financial Overview

17.3.16.4. SWOT Analysis

17.3.16.5. Strategic Overview

17.3.17. Thermo Fisher Scientific, Inc.

17.3.17.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.17.2. Test Type Portfolio

17.3.17.3. Financial Overview

17.3.17.4. SWOT Analysis

17.3.17.5. Strategic Overview

17.3.18. Gamaleya Research Institute

17.3.18.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.18.2. Test Type Portfolio

17.3.18.3. Financial Overview

17.3.18.4. SWOT Analysis

17.3.18.5. Strategic Overview

List of Tables

Table 01: Global Viral Vector Production Market Value (US$ Mn) Forecast, by Vector Type, 2017-2032

Table 02: Global Viral Vector Production Market Value (US$ Mn) Forecast, by Disease, 2017-2032

Table 03: Global Viral Vector Production Market Value (US$ Mn) Forecast, by Application, 2017-2032

Table 04: Global Viral Vector Production Market Value (US$ Mn) Forecast, by Mode, 2017-2032

Table 05: Global Viral Vector Production Market Value (US$ Mn) Forecast, by End-user, 2017-2032

Table 06: Global Viral Vector Production Market Value (US$ Mn) Forecast, by Region, 2017-2032

Table 07: North America Viral Vector Production Market Value (US$ Mn) Forecast, by Country, 2017-2032

Table 08: North America Viral Vector Production Market Value (US$ Mn) Forecast, by Vector Type, 2017-2032

Table 09: North America Viral Vector Production Market Value (US$ Mn) Forecast, by Disease, 2017-2032

Table 10: North America Viral Vector Production Market Value (US$ Mn) Forecast, by Application, 2017-2032

Table 11: North America Viral Vector Production Market Value (US$ Mn) Forecast, by Mode, 2017-2032

Table 12: North America Viral Vector Production Market Value (US$ Mn) Forecast, by End-user, 2017-2032

Table 13: Europe Viral Vector Production Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2032

Table 14: Europe Viral Vector Production Market Value (US$ Mn) Forecast, by Vector Type, 2017-2032

Table 15: Europe Viral Vector Production Market Value (US$ Mn) Forecast, by Disease, 2017-2032

Table 16: Europe Viral Vector Production Market Value (US$ Mn) Forecast, by Application, 2017-2032

Table 17: Europe Viral Vector Production Market Value (US$ Mn) Forecast, by Mode, 2017-2032

Table 18: Europe Viral Vector Production Market Value (US$ Mn) Forecast, by End-user, 2017-2032

Table 19: Asia Pacific Viral Vector Production Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2032

Table 20: Asia Pacific Viral Vector Production Market Value (US$ Mn) Forecast, by Vector Type, 2017-2032

Table 21: Asia Pacific Viral Vector Production Market Value (US$ Mn) Forecast, by Disease, 2017-2032

Table 22: Asia Pacific Viral Vector Production Market Value (US$ Mn) Forecast, by Application, 2017-2032

Table 23: Asia Pacific Viral Vector Production Market Value (US$ Mn) Forecast, by Mode, 2017-2032

Table 24: Asia Pacific Viral Vector Production Market Value (US$ Mn) Forecast, by End-user, 2017-2032

Table 25: Latin America Viral Vector Production Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2032

Table 26: Latin America Viral Vector Production Market Value (US$ Mn) Forecast, by Vector Type, 2017-2032

Table 27: Latin America Viral Vector Production Market Value (US$ Mn) Forecast, by Disease, 2017-2032

Table 28: Latin America Viral Vector Production Market Value (US$ Mn) Forecast, by Application, 2017-2032

Table 29: Latin America Viral Vector Production Market Value (US$ Mn) Forecast, by Mode, 2017-2032

Table 30: Latin America Viral Vector Production Market Value (US$ Mn) Forecast, by End-user, 2017-2032

Table 31: Middle East & Africa Viral Vector Production Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2032

Table 32: Middle East & Africa Viral Vector Production Market Value (US$ Mn) Forecast, by Vector Type, 2017-2032

Table 33: Middle East & Africa Viral Vector Production Market Value (US$ Mn) Forecast, by Disease, 2017-2032

Table 34: Middle East & Africa Viral Vector Production Market Value (US$ Mn) Forecast, by Application, 2017-2032

Table 35: Middle East & Africa Viral Vector Production Market Value (US$ Mn) Forecast, by Mode, 2017-2032

Table 36: Middle East & Africa Viral Vector Production Market Value (US$ Mn) Forecast, by End-user, 2017-2032

List of Figures

Figure 01: Global Viral Vector Production Market Value (US$ Mn) Forecast, 2017-2032

Figure 02: Global Viral Vector Production Market Value Share, by Vector Type, 2022

Figure 03: Global Viral Vector Production Market Value Share, by Disease, 2022

Figure 04: Global Viral Vector Production Market Value Share, by Application, 2022

Figure 05: Global Viral Vector Production Market Value Share, by Mode, 2022

Figure 06: Global Viral Vector Production Market Value Share, by End-user, 2022

Figure 07: Global Viral Vector Production Market Value Share, by Region, 2022

Figure 08: Global Viral Vector Production Market Value Share Analysis, by Vector Type, 2022 and 2032

Figure 09: Global Viral Vector Production Market Attractiveness Analysis, by Vector Type, 2023-2031

Figure 10: Global Viral Vector Production Market (US$ Mn), by Adenovirus, 2017-2032

Figure 11 Global Viral Vector Production Market (US$ Mn), by Adeno-associated Virus, 2017-2031

Figure 12: Global Viral Vector Production Market (US$ Mn), by Retroviruses, 2017-2032

Figure 13: Global Viral Vector Production Market (US$ Mn), by Others, 2017-2032

Figure 14: Global Viral Vector Production Market Value Share Analysis, by Disease, 2022 and 2032

Figure 15: Global Viral Vector Production Market Attractiveness Analysis, by Disease, 2023-2031

Figure 16: Global Viral Vector Production Market (US$ Mn), by Genetic Diseases, 2017-2032

Figure 17: Global Viral Vector Production Market (US$ Mn), by Infectious Diseases, 2017-2032

Figure 18: Global Viral Vector Production Market (US$ Mn), by Cancer, 2017-2032

Figure 19: Global Viral Vector Production Market (US$ Mn), by Others, 2017-2032

Figure 20: Global Viral Vector Production Market Value Share Analysis, by Application, 2022 and 2032

Figure 21: Global Viral Vector Production Market Attractiveness Analysis, by Application, 2023-2032

Figure 22: Global Viral Vector Production Market (US$ Mn), by Gene therapy, 2017-2032

Figure 23: Global Viral Vector Production Market (US$ Mn), by Vaccinology, 2017-2032

Figure 24: Global Viral Vector Production Market Value Share Analysis, by Mode, 2022 and 2032

Figure 25: Global Viral Vector Production Market Attractiveness Analysis, by Mode, 2023-2032

Figure 26: Global Viral Vector Production Market (US$ Mn), by Transient Transfection, 2017-2032

Figure 27: Global Viral Vector Production Market (US$ Mn), by Stable Producer Cell Lines, 2017-2032

Figure 28: Global Viral Vector Production Market Value Share Analysis, by End-user, 2022 and 2032

Figure 29: Global Viral Vector Production Market Attractiveness Analysis, by End-user, 2023-2032

Figure 30: Global Viral Vector Production Market (US$ Mn), by Pharmaceutical & Biotechnology Companies, 2017-2032

Figure 31: Global Viral Vector Production Market (US$ Mn), by Academic & Research Institutes, 2017-2032

Figure 32: Global Viral Vector Production Market Value Share Analysis, by Region, 2022 and 2032

Figure 33: Global Viral Vector Production Market Attractiveness Analysis, by Region, 2023-2032

Figure 34: North America Viral Vector Production Market Value (US$ Mn) Forecast, 2017-2032

Figure 35: North America Viral Vector Production Market Value Share Analysis, by Country, 2022 and 2032

Figure 36: North America Viral Vector Production Market Attractiveness Analysis, by Country, 2023-2032

Figure 37: North America Viral Vector Production Market Value Share Analysis, by Vector Type, 2022 and 2032

Figure 38: North America Viral Vector Production Market Attractiveness Analysis, by Vector Type, 2023-2032

Figure 39: North America Viral Vector Production Market Value Share Analysis, by Disease, 2022 and 2032

Figure 40: North America Viral Vector Production Market Attractiveness Analysis, by Disease, 2023-2032

Figure 41: North America Viral Vector Production Market Value Share Analysis, by Application, 2022 and 2032

Figure 42: North America Viral Vector Production Market Attractiveness Analysis, by Application, 2023-2032

Figure 43: North America Viral Vector Production Market Value Share Analysis, by Mode, 2022 and 2032

Figure 44: North America Viral Vector Production Market Attractiveness Analysis, by Mode, 2023-2032

Figure 45: North America Viral Vector Production Market Value Share Analysis, by End-user, 2022 and 2032

Figure 46: North America Viral Vector Production Market Attractiveness Analysis, by End-user, 2023-2032

Figure 47: Europe Viral Vector Production Market Value (US$ Mn) Forecast, 2017-2032

Figure 48: Europe Viral Vector Production Market Value Share Analysis, by Country/Sub-region, 2022 and 2032

Figure 49: Europe Viral Vector Production Market Attractiveness Analysis, by Country/Sub-region, 2023-2032

Figure 50: Europe Viral Vector Production Market Value Share Analysis, by Vector Type, 2022 and 2032

Figure 51: Europe Viral Vector Production Market Attractiveness Analysis, by Vector Type, 2023-2032

Figure 52: Europe Viral Vector Production Market Value Share Analysis, by Disease, 2022 and 2032

Figure 53: Europe Viral Vector Production Market Attractiveness Analysis, by Disease, 2023-2032

Figure 54: Europe Viral Vector Production Market Value Share Analysis, by Application, 2022 and 2032

Figure 55: Europe Viral Vector Production Market Attractiveness Analysis, by Application, 2023-2032

Figure 56: Europe Viral Vector Production Market Value Share Analysis, by Mode, 2022 and 2032

Figure 57: Europe Viral Vector Production Market Attractiveness Analysis, by Mode, 2023-2032

Figure 58: Europe Viral Vector Production Market Value Share Analysis, by End-user, 2022 and 2032

Figure 59: Europe Viral Vector Production Market Attractiveness Analysis, by End-user, 2023-2032

Figure 60: Asia Pacific Viral Vector Production Market Value (US$ Mn) Forecast, 2017-2032

Figure 61: Asia Pacific Viral Vector Production Market Value Share Analysis, by Country/Sub-region, 2022 and 2032

Figure 62: Asia Pacific Viral Vector Production Market Attractiveness Analysis, by Country/Sub-region, 2023-2032

Figure 63: Asia Pacific Viral Vector Production Market Value Share Analysis, by Vector Type, 2022 and 2032

Figure 64: Asia Pacific Viral Vector Production Market Attractiveness Analysis, by Vector Type, 2023-032

Figure 65: Asia Pacific Viral Vector Production Market Value Share Analysis, by Disease, 2022 and 2032

Figure 66: Asia Pacific Viral Vector Production Market Attractiveness Analysis, by Disease, 2023-2032

Figure 67: Asia Pacific Viral Vector Production Market Value Share Analysis, by Application, 2022 and 2032

Figure 68: Asia Pacific Viral Vector Production Market Attractiveness Analysis, by Application, 2023-2032

Figure 69: Asia Pacific Viral Vector Production Market Value Share Analysis, by Mode, 2022 and 2032

Figure 70: Asia Pacific Viral Vector Production Market Attractiveness Analysis, by Mode, 2023-2032

Figure 71: Asia Pacific Viral Vector Production Market Value Share Analysis, by End-user, 2022 and 2032

Figure 72: Asia Pacific Viral Vector Production Market Attractiveness Analysis, by End-user, 2023-2032

Figure 73: Latin America Viral Vector Production Market Value (US$ Mn) Forecast, 2017-2032

Figure 74: Latin America Viral Vector Production Market Value Share Analysis, by Country/Sub-region, 2022 and 2032

Figure 75: Latin America Viral Vector Production Market Attractiveness Analysis, by Country/Sub-region, 2023-2032

Figure 76: Latin America Viral Vector Production Market Value Share Analysis, by Vector Type, 2022 and 2032

Figure 77: Latin America Viral Vector Production Market Attractiveness Analysis, by Vector Type, 2023-2032

Figure 78: Latin America Viral Vector Production Market Value Share Analysis, by Disease, 2022 and 2032

Figure 79: Latin America Viral Vector Production Market Attractiveness Analysis, by Disease, 2023-2032

Figure 80: Latin America Viral Vector Production Market Value Share Analysis, by Application, 2022 and 2032

Figure 81: Latin America Viral Vector Production Market Attractiveness Analysis, by Application, 2023-2032

Figure 82: Latin America Viral Vector Production Market Value Share Analysis, by Mode, 2022 and 2032

Figure 83: Latin America Viral Vector Production Market Attractiveness Analysis, by Mode, 2023-2032

Figure 84: Latin America Viral Vector Production Market Value Share Analysis, by End-user, 2022 and 2032

Figure 85: Latin America Viral Vector Production Market Attractiveness Analysis, by End-user, 2023-2032

Figure 86: Middle East & Africa Viral Vector Production Market Value (US$ Mn) Forecast, 2017-2032

Figure 87: Middle East & Africa Viral Vector Production Market Value Share Analysis, by Country/Sub-region, 2022 and 2032

Figure 88: Middle East & Africa Viral Vector Production Market Attractiveness Analysis, by Country/Sub-region, 2023-2032

Figure 89: Middle East & Africa Viral Vector Production Market Value Share Analysis, by Vector Type, 2022 and 2032

Figure 90: Middle East & Africa Viral Vector Production Market Attractiveness Analysis, by Vector Type, 2023-2032

Figure 91: Middle East & Africa Viral Vector Production Market Value Share Analysis, by Disease, 2022 and 2032

Figure 92: Middle East & Africa Viral Vector Production Market Attractiveness Analysis, by Disease, 2023-2032

Figure 93: Middle East & Africa Viral Vector Production Market Value Share Analysis, by Application, 2022 and 2032

Figure 94: Middle East & Africa Viral Vector Production Market Attractiveness Analysis, by Application, 2023-2032

Figure 95: Middle East & Africa Viral Vector Production Market Value Share Analysis, by Mode, 2022 and 2032

Figure 96: Middle East & Africa Viral Vector Production Market Attractiveness Analysis, by Mode, 2023-2032

Figure 97: Middle East & Africa Viral Vector Production Market Value Share Analysis, by End-user, 2022 and 2032

Figure 98: Middle East & Africa Viral Vector Production Market Attractiveness Analysis, by End-user, 2023-2032

Figure 99: Global Viral Vector Production Market Share, by Company, 2022