Global Viral Inactivation Market: Snapshot

A popular strategy with savvy players in the global market for viral inactivation trying to bolster their positions is the thrust on acquisitions. Besides, they are also investing heavily in research and development to come up with new products in response to various requirements for treating diseases. A dominant players in the market, namely Merck & Co., Inc., is seen to have a stronghold across nations worldwide.

At the forefront of driving growth in the global market for viral inactivation is the rising approvals of new drugs, rules pertaining to viral safety of biologics, and the proliferation of the biologics and biosimilars industry. Besides, the growing instances of various infectious diseases and growing application of biosimilars therapeutic treatment for a range of diseases are also positively impacting the market.

Proving counterproductive to the market, on the downside, is the high costs involved in developing and manufacturing biologics and biosimilars products and also the high price of equipment for viral inactivation. However, new types of viruses needing vaccinations to be developed against them spells new opportunities for the market.

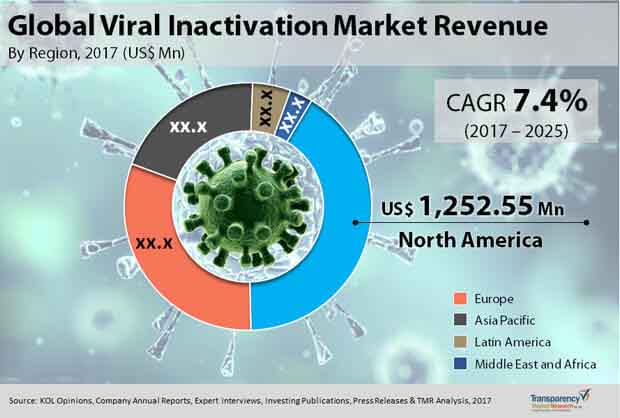

A report by Transparency Market Research predicts the global viral inactivation market to expand at a healthy 7.4% CAGR from 2017 to 2025 to become worth US$5.736 bn by 2025 from US$3.05 bn in 2016.

Effectiveness of Chemical Method Drives it to Fore Vis-à-vis Market Share

Depending upon the type of method, the global viral inactivation market can be divided segmented into chemical, radiation, and others such as pasteurization and dry and moist heat treatment. Of them, the chemical method leads the market with maximum share as it is a robust and effective method of inactivation of different types of viruses. It is also cost-effective, safe, and brings about a high degree of purity of sample. The chemical method is further sub-segmented into solvent detergent method, use of alkylating agent method, and pH concentration method. The solvent detergent method, among them, is projected to account for largest market share by the end of 2025.

In terms of growth rate, however, the radiation method for viral inactivation is expected to outpace all others on account of the rising adoption of the method in blood centers in developed nations. The UV radiation method has been tested and developed for viral inactivation of blood and blood components at blood centers and at commercial manufacturing facilities.

Robust Biopharmaceutical Industry Makes North America Dominant Region

From a geographical standpoint, North America currently holds a sway over the global market on account of a robust biopharmaceutical industry, swift uptake of newer viral inactivation methodologies, rising demand for blood and blood components for transfusion therapy, and strict regulatory guidelines for the viral safety of biologics products. By growing at a CAGR of 7.2% in the forecast period, the market will likely become worth US$2.31 bn by 2025.

However, North America is slated to lose some of its market share to Asia Pacific, which is predicted to expand at maximum pace. The report by TMR projects the viral inactivation market in the region to clock a CAGR of 7.9% from 2017 to 2025. The region’s growth will be primarily powered by countries of South Korea, Japan, and Australia which have strict rules in place for purity of biologics and biosimilars products and also by China, India, and Malaysia having a booming biopharmaceutical industry.

Some of the dominant players in the global market for viral inactivation are Shandong Weigao Group Medical Polymer Company Limited, Sartorius AG, Cerus Corporation, Macopharma SA, and Terumo BCT, Inc.

Global Viral Inactivation Market to Grow with Advancements in Research Related to COVID-19

As the name suggests, viral inactivation is an important process for ensuring that the patients are not exposed to secondary infections or diseases. The occurrence or birth of a virus inside the human body can magnify into a major problem if it is not heeded to at the right time. Therefore, the medical industry is making ardent efforts to ensure that viruses contracted by the human and animal bodies are controlled with adequate procedures. In addition to this, the importance of treating viral infections with palpable ease has also created new opportunities for growth and advancement across the global viral inactivation market. Over the course of the next decade, the use of viral infections and therapies shall increase by leaps and bounds.

Chapter 1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

Chapter 2. Assumptions and Research Methodology

Chapter 3. Executive Summary: Global Viral Inactivation market

Chapter 4. Market Overview

4.1. Introduction

4.1.1. Viral Inactivation Method Introduction

4.1.2. Industry Evolution / Developments

Chapter 5. Market Dynamics

5.1. Drivers

5.2. Restraints

5.3. Opportunities

5.4. Trends

5.5. Viral Inactivation market Analysis and Forecast, 2017 – 2025

5.5.1. Market Revenue Projections (US$ Mn), 2017-2025

5.6. Porter’s five forces analysis

5.7. Market Outlook

Chapter 6. Global Viral Inactivation market Analysis and Forecasts, by Method

6.1. Key Findings

6.2. Introduction

6.3. Market size (US$ Mn) Forecast, by Method, 2017-2025

6.3.1. Chemical method

6.3.1.1. Solvent & Detergents

6.3.1.2. Alkylating Agents

6.3.1.3. pH Concentration

6.3.2. Radiation Method

6.3.3. Other Methods

6.4. Market Attractiveness Analysis, by Method

6.5. Key Trends

Chapter 7. Global Viral Inactivation market Analysis and Forecasts, by Application

7.1. Key Findings

7.2. Introduction

7.3. Market size (US$ Mn) Forecast, by Application, 2017-2025

7.3.1. Blood and Blood Products

7.3.2. Vaccines

7.3.3. Cell and Tissue Culture

7.4. Market Attractiveness, by Application

Chapter 8. Global Viral Inactivation market Analysis and Forecasts, by End-user

8.1. Key Findings

8.2. Introduction

8.3. Market size (US$ Mn) Forecast by End-user, 2017-2025

8.3.1. Pharmaceutical and Biotechnology Companies

8.3.2. Blood banks and Hospitals

8.3.3. Contract Research Organizations

8.3.4. Others

8.4. Market Attractiveness by End-user

Chapter 9. Global Viral Inactivation market Analysis and Forecasts, by Region

9.1. Key Findings

9.2. Global Market Scenario

9.3. Market Value (US$ Mn) Forecast, by Region, 2017-2025

9.3.1. North America

9.3.2. Europe

9.3.3. Asia Pacific

9.3.4. Latin America

9.3.5. Middle East & Africa

9.4. Market Attractiveness, by Region

Chapter 10. North America Viral Inactivation market Analysis and Forecast

10.1. Key Findings

10.2. Market Overview

10.3. Market Value (US$ Mn) Forecast, by Country, 2017-2025

10.3.1. U.S.

10.3.2. Canada

10.4. Market size (US$ Mn) Forecast, by Method, 2017-2025

10.4.1. Chemical method

10.4.1.1. Solvent & Detergents

10.4.1.2. Alkylating Agents

10.4.1.3. pH Concentration

10.4.2. Radiation Method

10.4.3. Other Methods

10.5. Market size (US$ Mn) Forecast, by Application, 2017-2025

10.5.1. Blood and Blood Products

10.5.2. Vaccines

10.5.3. Cell and Tissue Culture

10.6. Market size (US$ Mn) Forecast by End-user, 2017-2025

10.6.1. Pharmaceutical and Biotechnology Companies

10.6.2. Blood banks and Hospitals

10.6.3. Contract Research Organizations

10.6.4. Others

10.7. Market Attractiveness Analysis

10.7.1. By Country

10.7.2. By Method

10.7.3. By Application

10.7.4. By End-user

10.8. Key Trends

Chapter 11. Europe Viral Inactivation market Analysis and Forecast

11.1. Key Findings

11.2. Market Overview

11.3. Market size (US$ Mn) Forecast By Country, 2017-2025

11.3.1. Germany

11.3.2. U.K.

11.3.3. France

11.3.4. Spain

11.3.5. Italy

11.3.6. Rest of Europe

11.4. Market size (US$ Mn) Forecast, by Method, 2017-2025

11.4.1. Chemical method

11.4.1.1. Solvent & Detergents

11.4.1.2. Alkylating Agents

11.4.1.3. pH Concentration

11.4.2. Radiation Method

11.4.3. Other Methods

11.5. Market size (US$ Mn) Forecast, by Application, 2017-2025

11.5.1. Blood and Blood Products

11.5.2. Vaccines

11.5.3. Cell and Tissue Culture

11.6. Market size (US$ Mn) Forecast by End-user, 2017-2025

11.6.1. Pharmaceutical and Biotechnology Companies

11.6.2. Blood banks and Hospitals

11.6.3. Contract Research Organizations

11.6.4. Others

11.7. Market Attractiveness Analysis

11.7.1. By Country

11.7.2. By Method

11.7.3. By Application

11.7.4. By End-user

11.8. Key Trends

Chapter 12. Asia Pacific Viral Inactivation market Analysis and Forecast

12.1. Key Findings / Developments

12.2. Market Overview

12.3. Market size (US$ Mn) Forecast, by Country, 2017-2025

12.3.1. China

12.3.2. India

12.3.3. Japan

12.3.4. Australia & New Zealand

12.3.5. Rest of Asia Pacific

12.4. Market size (US$ Mn) Forecast, by Method, 2017-2025

12.4.1. Chemical method

12.4.1.1. Solvent & Detergents

12.4.1.2. Alkylating Agents

12.4.1.3. pH Concentration

12.4.2. Radiation Method

12.4.3. Other Methods

12.5. Market size (US$ Mn) Forecast, by Application, 2017-2025

12.5.1. Blood and Blood Products

12.5.2. Vaccines

12.5.3. Cell and Tissue Culture

12.6. Market size (US$ Mn) Forecast by End-user, 2017-2025

12.6.1. Pharmaceutical and Biotechnology Companies

12.6.2. Blood banks and Hospitals

12.6.3. Contract Research Organizations

12.6.4. Others

12.7. Market Attractiveness Analysis

12.7.1. By Country

12.7.2. By Method

12.7.3. By Application

12.7.4. By End-user

12.8. Key Trends

Chapter 13. Latin America Viral Inactivation market Analysis and Forecast

13.1. Key Findings / Developments

13.2. Market Overview

13.3. Market Size (US$ Mn) Forecast, by Country, 2017-2025

13.3.1. Brazil

13.3.2. Mexico

13.3.3. Rest of Latin America

13.4. Market size (US$ Mn) Forecast, by Method, 2017-2025

13.4.1. Chemical method

13.4.1.1. Solvent & Detergents

13.4.1.2. Alkylating Agents

13.4.1.3. pH Concentration

13.4.2. Radiation Method

13.4.3. Other Methods

13.5. Market size (US$ Mn) Forecast, by Application, 2017-2025

13.5.1. Blood and Blood Products

13.5.2. Vaccines

13.5.3. Cell and Tissue Culture

13.6. Market size (US$ Mn) Forecast by End-user, 2017-2025

13.6.1. Pharmaceutical and Biotechnology Companies

13.6.2. Blood banks and Hospitals

13.6.3. Contract Research Organizations

13.6.4. Others

13.7. Market Attractiveness Analysis

13.7.1. By Country

13.7.2. By Method

13.7.3. By Application

13.7.4. By End-user

13.8. Key Trends

Chapter 14. Middle East and Africa Viral Inactivation market Analysis and Forecast

14.1. Key Findings / Developments

14.2. Market Overview

14.3. Market size (US$ Mn) Forecast, by Country, 2017-2025

14.3.1. GCC Countries

14.3.2. South Africa

14.3.3. Rest of Middle East and Africa

14.4. Market size (US$ Mn) Forecast, by Method, 2017-2025

14.4.1. Chemical method

14.4.1.1. Solvent & Detergents

14.4.1.2. Alkylating Agents

14.4.1.3. pH Concentration

14.4.2. Radiation Method

14.4.3. Other Methods

14.5. Market size (US$ Mn) Forecast, by Application, 2017-2025

14.5.1. Blood and Blood Products

14.5.2. Vaccines

14.5.3. Cell and Tissue Culture

14.6. Market size (US$ Mn) Forecast by End-user, 2017-2025

14.6.1. Pharmaceutical and Biotechnology Companies

14.6.2. Blood banks and Hospitals

14.6.3. Contract Research Organizations

14.6.4. Others

14.7. Market Attractiveness Analysis

14.7.1. By Country

14.7.2. By Method

14.7.3. By Application

14.7.4. By End-user

14.8. Key Trends

Chapter 15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

15.2.1. Parker Hannifin Corporation

15.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.1.2. Product Portfolio

15.2.1.3. SWOT Analysis

15.2.1.4. Strategic Overview

15.2.2. Merck & Co., Inc.

15.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.2.2. Product Portfolio

15.2.2.3. SWOT Analysis

15.2.2.4. Strategic Overview

15.2.3. Shandong Weigao Group Medical Polymer Company Limited

15.2.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.3.2. Product Portfolio

15.2.3.3. SWOT Analysis

15.2.3.4. Financial Overview

15.2.3.5. Strategic Overview

15.2.4. Sartorius AG

15.2.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.4.2. Product Portfolio

15.2.4.3. SWOT Analysis

15.2.4.4. Financial Overview

15.2.4.5. Strategic Overview

15.2.5. Cerus Corporation

15.2.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.5.2. Product Portfolio

15.2.5.3. SWOT Analysis

15.2.5.4. Financial Overview

15.2.5.5. Strategic Overview

15.2.6. Macopharma SA

15.2.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.6.2. Product Portfolio

15.2.6.3. SWOT Analysis

15.2.6.4. Financial Overview

15.2.6.5. Strategic Overview

15.2.7. Terumo BCT, Inc.

15.2.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.7.2. Product Portfolio

15.2.7.3. SWOT Analysis

15.2.7.4. Financial Overview

15.2.7.5. Strategic Overview

15.2.8. Thermo Fisher Scientific Inc.

15.2.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.8.2. Product Portfolio

15.2.8.3. SWOT Analysis

15.2.8.4. Financial Overview

15.2.8.5. Strategic Overview

15.2.9. V.I.P.S. SA

15.2.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.9.2. Product Portfolio

15.2.9.3. SWOT Analysis

15.2.9.4. Financial Overview

15.2.9.5. Strategic Overview

List of Tables

Table 01: Global Viral Inactivation Market Size (US$ Mn) Forecast, by Method, 2015–2025

Table 02: Global Market Size (US$ Mn) Forecast, Chemical Method, 2015–2025

Table 03: Global Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 04: Global Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 05: Global Market Size (US$ Mn) Forecast, by Region, 2015–2025

Table 06: North America Viral Inactivation Market Size (US$ Mn) Forecast, by Country/ Sub-region, 2015–2025

Table 07: North America Market Size (US$ Mn) Forecast, by Method, 2015–2025

Table 08: North America Market Size (US$ Mn) Forecast, by Chemical method, 2015–2025

Table 09: North America Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 10: North America Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 11: Europe Viral Inactivation Market Value (US$ Mn) Forecast, by Country / Sub-region, 2015–2025

Table 12: Europe Market Value (US$ Mn) Forecast, by Method, 2015–2025

Table 13: Europe Market Size (US$ Mn) Forecast, by Chemical Method, 2015–2025

Table 14: Europe Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 15: Europe Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 16: Asia Pacific Viral Inactivation Market Value (US$ Mn) Forecast, by Country/ Sub-region, 2015–2025

Table 17: Asia Pacific Market Value (US$ Mn) Forecast, by Method, 2015–2025

Table 18: Asia Pacific Market Size (US$ Mn) Forecast, by Chemical Method, 2015–2025

Table 19: Asia Pacific Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 20: Asia Pacific Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 21: Latin America Viral Inactivation Market Size (US$ Mn) Forecast, by Country/ Sub-region, 2015–2025

Table 22: Latin America Market Size (US$ Mn) Forecast, by Method, 2015–2025

Table 23: Latin America Market Size (US$ Mn) Forecast, by Chemical Method, 2015–2025

Table 24: Latin America Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 25: Latin America Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 26: Middle East & Africa Viral Inactivation Market Size (US$ Mn) Forecast, by Country/ Sub-region, 2015–2025

Table 27: Middle East & Africa Market Size (US$ Mn) Forecast, by Method, 2015–2025

Table 28: Middle East & Africa Market Size (US$ Mn) Forecast, by Chemical Method, 2015–2025

Table 29: Middle East & Africa Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 30: Middle East & Africa Market Size (US$ Mn) Forecast, by End-user, 2015–2025

List of Figures

Figure 01: Global Viral Inactivation Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2025

Figure 02: Global Market Value Share, by Method (2016)

Figure 03: Global Market Value Share, by Application (2016)

Figure 04: Global Market Value Share, by End-user (2016)

Figure 05: Global Market Value Share, by Region (2016)

Figure 06: Global Market Value Share Analysis, by Method, 2016 and 2025

Figure 07: Global Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Chemical Method, 2016–2025

Figure 08: Global Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Radiation Method, 2016–2025

Figure 09: Global Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Other Methods, 2016–2025

Figure 10: Global Market Attractiveness Analysis, by Method, 2017–2025

Figure 11: Global Market Value Share Analysis, by Application, 2016 and 2025

Figure 12: Global Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Blood and Blood Products, 2017–2025

Figure 13: Global Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Vaccines, 2017–2025

Figure 14: Global Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Cell & Tissue Culture, 2017–2025

Figure 15: Global Market Attractiveness Analysis, by Application, 2017–2025

Figure 16: Global Market Value Share Analysis, by End-user, 2016 and 2025

Figure 17: Global Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Pharmaceutical and Biotechnology companies, 2016–2025

Figure 18: Global Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Blood Banks and Hospitals, 2016–2025

Figure 19: Global Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Contract Research Organizations, 2016–2025

Figure 20: Global Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2016–2025

Figure 21: Global Market Attractiveness

Figure 22: Global Market Value Share Analysis, by Region, 2016 and 2025

Figure 23: Global Market Attractiveness Analysis, by Region, 2017–2025

Figure 24: North America Viral Inactivation Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2016–2025

Figure 25: North America Market Attractiveness Analysis, by Country/Sub-region, 2017–2025

Figure 26: North America Market Value Share Analysis, by Country/ Sub-region, 2016 and 2025

Figure 27: North America Market Value Share Analysis, by Method, 2016 and 2025

Figure 28: North America Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Chemical method, 2016–2025

Figure 29: North America Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Radiation method, 2016–2025

Figure 30: North America Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Other Methods, 2016–2025

Figure 31: North America Market Value Share Analysis, by Application, 2016 and 2025

Figure 32: North America Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Blood and Blood Products, 2016–2025

Figure 33: North America Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Vaccines, 2016–2025

Figure 34: North America Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Cell & Tissue Culture, 2016–2025

Figure 35: North America Market Value Share Analysis, by End-user, 2016 and 2025

Figure 36: North America Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Pharmaceutical and Biotechnology Companies, 2016–2025

Figure 37: North America Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Blood Banks and Hospitals, 2016–2025

Figure 38: North America Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Contract Research Organizations, 2016–2025

Figure 39: North America Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2016–2025

Figure 40: North America Market Attractiveness Analysis, by Method, 2017–2025

Figure 41: North America Market Attractiveness Analysis, by Application, 2017–2025

Figure 42: North America Market Attractiveness Analysis, by End-user, 2017-2025

Figure 43: Europe Viral Inactivation Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2016–2025

Figure 44: Europe Market Attractiveness Analysis, by Country / Sub-region, 2017–2025

Figure 45: Europe Market Value Share Analysis, by Country / Sub-region, 2016 and 2025

Figure 46: Europe Market Value Share Analysis, by Method, 2016 and 2025

Figure 47: Europe Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Chemical, 2016–2025

Figure 48: Europe Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Radiation Method, 2016–2025

Figure 49: Europe Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Other Methods, 2016–2025

Figure 50: Europe Market Value Share Analysis (US$ Mn), by Application, 2016 and 2025

Figure 51: Europe Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Blood & Blood Products, 2016–2025

Figure 52: Europe Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Vaccines, 2016–2025

Figure 53: Europe Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Cell & Tissue Culture, 2016–2025

Figure 54: Europe Market Value share Analysis, by End-user, 2016 and 2025

Figure 55: Europe Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Pharmaceutical & Biotechnology Companies, 2016–2025

Figure 56: Europe Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Blood Banks & Hospitals, 2016–2025

Figure 57: Europe Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Contract Research Organization, 2016–2025

Figure 58: Europe Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2016–2025

Figure 59: Europe Market Attractiveness Analysis, by Method, 2017–2025

Figure 60: Europe Market Attractiveness Analysis, by Application, 2017–2025

Figure 61: Europe Market Attractiveness Analysis, by End-user, 2017–2025

Figure 62: Asia Pacific Viral Inactivation Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2016–2025

Figure 63: Asia Pacific Market Attractiveness Analysis, by Country/Sub-region, 2017–2025

Figure 64: Asia Pacific Market Value Share Analysis, by Country/Sub-region, 2016 and 2025

Figure 65: Asia Pacific Market Value Share Analysis, by Method, 2016 and 2025

Figure 66: Asia Pacific Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Chemical Method, 2016–2025

Figure 67: Asia Pacific Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Radiation Method, 2016–2025

Figure 68: Asia Pacific Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Other Methods, 2016–2025

Figure 69: Asia Pacific Market Value Share Analysis, by Application, 2016 and 2025

Figure 70: Asia Pacific Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Blood & Blood Products, 2016–2025

Figure 71: Asia Pacific Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Vaccines, 2016–2025

Figure 72: Asia Pacific Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Cell & Tissue Culture, 2016–2025

Figure 73: Asia Pacific Market Value share Analysis, by End-user, 2016 and 2025

Figure 74: Asia Pacific Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Pharmaceutical & Biotechnology Companies, 2016–2025

Figure 75: Asia Pacific Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Blood Banks & Hospitals, 2016–2025

Figure 76: Asia Pacific Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Contract Research Organizations, 2016–2025

Figure 77: Asia Pacific Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2016–2025

Figure 78: Asia PacificMarket Attractiveness Analysis, by Method, 2017–2025

Figure 79: Asia Pacific Market Attractiveness Analysis, by Application, 2017–2025

Figure 80: Asia Pacific Market Attractiveness Analysis, by End-user, 2017–2025

Figure 81: Latin America Viral Inactivation Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2016–2025

Figure 82: Latin America Market Attractiveness Analysis, by Country/Sub-region, 2017-2025

Figure 83: Latin America Market Value Share Analysis, by Country/Sub-region, 2016 and 2025

Figure 84: Latin America Market Value Share Analysis, by Method, 2016 and 2025

Figure 85: Latin America Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Chemical Method, 2016–2025

Figure 86: Latin America Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Radiation method, 2016–2025

Figure 87: Latin America Market Revenue (US$ Mn) and Y-o-Y Growth (%), by other methods 2016–2025

Figure 88: Latin America Market Value Share Analysis, by Application, 2016 and 2025

Figure 89: Latin America Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Blood and Blood Products 2016–2025

Figure 90: Latin America Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Vaccines, 2016–2025

Figure 91: Latin America Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Cell and Tissue Culture, 2016–2025

Figure 92: Latin America Market Value Share Analysis, by End-user, 2016 and 2025

Figure 93: Latin America Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Pharmaceutical and Biotechnology companies, 2016–2025

Figure 94: Latin America Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Blood Banks and Hospitals, 2016–2025

Figure 95: Latin America Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Contract Research Organizations 2016–2025

Figure 96: Latin America Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2016–2025

Figure 97: Latin America Market Attractiveness Analysis, by Method, 2017–2025

Figure 98: Latin America arket Attractiveness Analysis, by Application, 2017–2025

Figure 99: Latin America Market Attractiveness Analysis, by End-user, 2017-2025

Figure 100: Middle East & Africa Viral Inactivation Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2016–2025

Figure 101: Middle East & Africa Market Attractiveness Analysis, by Country/Sub-region, 2017-2025

Figure 102: Middle East & Africa Market Value Share Analysis, by Country/Sub-region, 2016 and 2025

Figure 103: Middle East & Africa Market Value Share Analysis, by Method, 2016 and 2025

Figure 104: Middle East & Africa Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Chemical Method, 2016–2025

Figure 105: Middle East & Africa Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Radiation method, 2016–2025

Figure 106: Middle East & Africa Market Revenue (US$ Mn) and Y-o-Y Growth (%), by other methods, 2016–2025

Figure 107: Middle East & Africa Market Value Share Analysis, by Application, 2016 and 2025

Figure 108: Middle East & Africa Blood and Blood Products Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2025

Figure 109: Middle East & Africa Vaccines Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2025

Figure 110: Middle East & Africa Cell Culture Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2025

Figure 111: Middle East & Africa Market Value Share Analysis, by End-user, 2016 and 2025

Figure 112: Middle East & Africa Pharmaceutical and Biotechnology companies Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2025

Figure 113: Middle East & Africa Blood Banks and Hospitals Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2025

Figure 114: Middle East & Africa Contract Research Organizations Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2025

Figure 115: Middle East & Africa Others Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2025

Figure 116: Middle East & Africa Market Attractiveness Analysis, by Method, 2017–2025

Figure 117: Middle East & Africa Market Attractiveness Analysis, by Application, 2017–2025

Figure 118: Middle East & Africa Market Attractiveness Analysis, by End-user, 2017–2025