Analyst Viewpoint

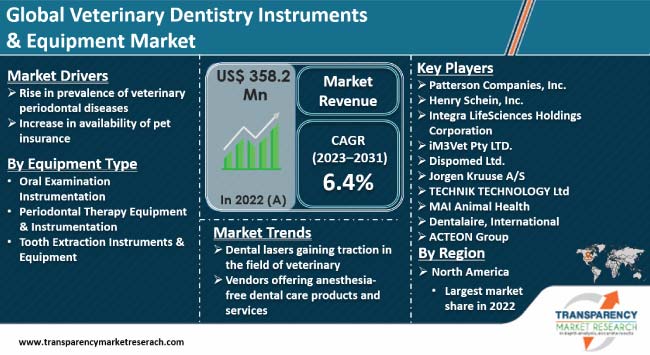

Rise in prevalence of veterinary periodontal diseases and increase in availability of pet insurance are propelling the veterinary dentistry instruments & equipment market size. Increase in humanization of pets is also boosting the demand for veterinary dentistry instruments & equipment.

Dental lasers are gaining traction in the field of veterinary as they allow for precise cutting and tissue ablation, minimizing damage to surrounding healthy tissue. Non-traditional dental care providers are increasingly adopting diode laser technology for a variety of soft tissue procedures including gingivectomy and frenectomy. Vendors in the global veterinary dentistry instruments & equipment industry are offering anesthesia-free dental care products and services to expand their customer base.

Veterinary dentistry is similar to dental care for humans. Animals require routine dental check-ups, cleanings, and general care. This guarantees the best possible dental health for the animal. It prevents unwanted discomfort brought on by inadequate oral hygiene. The field of veterinary dentistry requires various tools and equipment.

A variety of appropriate veterinary dental instruments are necessary for providing effective dental treatment. For a complete oral surgery suite, various sizes of dental luxations, elevators, periosteal elevators, scalers, curettes, and mechanical scaler inserts are used. These tools increase comfort, diagnostic accuracy, and efficacy.

Pets frequently have dental illnesses, which can have major health consequences if neglected. According to the American Veterinary Dental Society, periodontal disease is the most common dental issue in dogs and cats aged 3 years old. Dogs with periodontal disease exhibit gingivitis symptoms in stage 1. Approximately 25% of the teeth detach from the gums in stage 2, and the gum tissue recedes and reveals the teeth's roots in later stages 3 and 4. Thus, surge in incidence of dental disorders in animals is driving the veterinary dentistry instruments & equipment market revenue.

85% of pet owners reported that they viewed their pets as family members when asked about their relationship with their pets. Hence, increase in humanization of pets is projected to spur the veterinary dentistry instruments & equipment market growth in the near future.

Dental treatment is one of the many expensive medical bills that pet insurance policies cover. As a result, pet owners are opting for preventive dental treatment and routine dental check-ups. According to a report released in 2022 by the North American Pet Health Insurance Association (NAPHIA), 4.41 million pets were insured in North America by the end of 2021.

Technological advancements in veterinary dentistry are fueling the veterinary dentistry instruments & equipment market landscape. Dental lasers are gaining popularity in the field of veterinary. Non-traditional dental care providers are increasingly adopting diode laser technology. Anesthesia-free dental care is also gaining traction for dogs and cats. In July 2023, BIOLASE, Inc. announced an arrangement with Pet Dental Services to integrate BIOLASE's diode laser technology.

According to the latest veterinary dentistry instruments & equipment market trends, North America held largest share in 2022. Rise in availability of veterinary dentistry services and increase in prevalence of periodontal diseases in pets are fueling the market dynamics of the region. Surge in number of companion animals is also propelling the market statistics in North America.

According to the American Pet Products Association (APPA), 70% of U.S. households-or 90.5 million homes-owned a pet in 2021-2022. Moreover, around 5.3 million families in the country possessed cats and 69 million households owned dogs in 2019-20.

Key players are investing in the R&D of new products to expand their product portfolio and increase their veterinary dentistry instruments & equipment market share. They are also launching portable dental units for veterinary clinics.

Patterson Companies, Inc., Henry Schein, Inc., Integra LifeSciences Holdings Corporation, iM3Vet Pty LTD., Dispomed Ltd., Jorgen Kruuse A/S, TECHNIK TECHNOLOGY Ltd., MAI Animal Health, Dentalaire, International, and ACTEON Group are key players operating in this market.

Each of these companies has been profiled in the veterinary dentistry instruments & equipment market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 358.2 Mn |

| Market Forecast (Value) in 2031 | US$ 615.3 Mn |

| Growth Rate (CAGR) | 6.4% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Mn for Value |

| Market Analysis | It includes segment analysis as well as regional-level analysis. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 358.2 Mn in 2022

It is anticipated to grow at a CAGR of 6.4% from 2023 to 2031

Rise in prevalence of veterinary periodontal diseases and increase in availability of pet insurance

North America was the most lucrative region in 2022

Patterson Companies, Inc., Henry Schein, Inc., Integra LifeSciences Holdings Corporation, iM3Vet Pty LTD., Dispomed Ltd., Jorgen Kruuse A/S, TECHNIK TECHNOLOGY Ltd., MAI Animal Health, Dentalaire, International, and ACTEON Group

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Veterinary Dentistry Instruments & Equipment Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definitions

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Veterinary Dentistry Instruments & Equipment Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Key Equipment Type/Brand Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry

6. Global Veterinary Dentistry Instruments & Equipment Market Analysis and Forecast, by Equipment Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Equipment Type, 2017–2031

6.3.1. Oral Examination Instrumentation

6.3.1.1. Periodontal Probes

6.3.1.2. Dental Explorers

6.3.1.3. Mouth Gags

6.3.1.4. Dental Mirrors

6.3.2. Periodontal Therapy Equipment & Instrumentation

6.3.2.1. Scaling Equipment

6.3.2.1.1. Hand Instruments

6.3.2.1.2. Powered Equipment

6.3.2.2. Polishing Equipment

6.3.3. Tooth Extraction Instruments & Equipment’s

6.3.3.1. Hand Instruments

6.3.3.1.1. Luxators

6.3.3.1.2. Elevators

6.3.3.1.3. Extraction Forceps

6.3.3.1.4. Root-tip Picks

6.3.3.1.5. Minnesota Retractors

6.3.3.1.6. Scalpel Blades

6.3.3.1.7. Others

6.3.3.2. Powered Equipment

6.3.3.2.1. Micromotor Units

6.3.3.2.2. Compressed air-driven Units

6.3.3.2.3. Burs

6.3.3.3. Ancillary Equipment

6.3.3.3.1. Magnifying Loupes

6.3.3.3.2. Dentistry Tablets

6.4. Market Attractiveness Analysis, by Equipment Type

7. Global Veterinary Dentistry Instruments & Equipment Market Analysis and Forecast, by Region

7.1. Key Findings

7.2. Market Value Forecast, by Region, 2017–2031

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Latin America

7.2.5. Middle East & Africa

7.3. Market Attractiveness Analysis, by Region

8. North America Veterinary Dentistry Instruments & Equipment Market Analysis and Forecast

8.1. Introduction

8.1.1. Key Findings

8.2. Market Value Forecast, by Equipment Type, 2017–2031

8.2.1. Oral Examination Instrumentation

8.2.1.1. Periodontal Probes

8.2.1.2. Dental Explorers

8.2.1.3. Mouth Gags

8.2.1.4. Dental Mirrors

8.2.2. Periodontal Therapy Equipment & Instrumentation

8.2.2.1. Scaling Equipment

8.2.2.1.1. Hand Instruments

8.2.2.1.2. Powered Equipment

8.2.2.2. Polishing Equipment

8.2.3. Tooth Extraction Instruments & Equipment’s

8.2.3.1. Hand Instruments

8.2.3.1.1. Luxators

8.2.3.1.2. Elevators

8.2.3.1.3. Extraction Forceps

8.2.3.1.4. Root-tip Picks

8.2.3.1.5. Minnesota Retractors

8.2.3.1.6. Scalpel Blades

8.2.3.1.7. Others

8.2.3.2. Powered Equipment

8.2.3.2.1. Micromotor Units

8.2.3.2.2. Compressed air-driven Units

8.2.3.2.3. Burs

8.2.3.3. Ancillary Equipment

8.2.3.3.1. Magnifying Loupes

8.2.3.3.2. Dentistry Tablets

8.3. Market Value Forecast, by Country, 2017–2031

8.3.1. U.S.

8.3.2. Canada

8.4. Market Attractiveness Analysis

8.5. By Equipment Type

8.5.1. By Country

9. Europe Veterinary Dentistry Instruments & Equipment Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Equipment Type, 2017–2031

9.2.1. Oral Examination Instrumentation

9.2.1.1. Periodontal Probes

9.2.1.2. Dental Explorers

9.2.1.3. Mouth Gags

9.2.1.4. Dental Mirrors

9.2.2. Periodontal Therapy Equipment & Instrumentation

9.2.2.1. Scaling Equipment

9.2.2.1.1. Hand Instruments

9.2.2.1.2. Powered Equipment

9.2.2.2. Polishing Equipment

9.2.3. Tooth Extraction Instruments & Equipment’s

9.2.3.1. Hand Instruments

9.2.3.1.1. Luxators

9.2.3.1.2. Elevators

9.2.3.1.3. Extraction Forceps

9.2.3.1.4. Root-tip Picks

9.2.3.1.5. Minnesota Retractors

9.2.3.1.6. Scalpel Blades

9.2.3.1.7. Others

9.2.3.2. Powered Equipment

9.2.3.2.1. Micromotor Units

9.2.3.2.2. Compressed air-driven Units

9.2.3.2.3. Burs

9.2.3.3. Ancillary Equipment

9.2.3.3.1. Magnifying Loupes

9.2.3.3.2. Dentistry Tablets

9.3. Market Value Forecast, by Country/Sub-region, 2017–2031

9.3.1. Germany

9.3.2. U.K.

9.3.3. France

9.3.4. Italy

9.3.5. Spain

9.3.6. Rest of Europe

9.4. Market Attractiveness Analysis

9.4.1. By Equipment Type

9.4.2. By Country/Sub-region

10. Asia Pacific Veterinary Dentistry Instruments & Equipment Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Equipment Type, 2017–2031

10.2.1. Oral Examination Instrumentation

10.2.1.1. Periodontal Probes

10.2.1.2. Dental Explorers

10.2.1.3. Mouth Gags

10.2.1.4. Dental Mirrors

10.2.2. Periodontal Therapy Equipment & Instrumentation

10.2.2.1. Scaling Equipment

10.2.2.1.1. Hand Instruments

10.2.2.1.2. Powered Equipment

10.2.2.2. Polishing Equipment

10.2.3. Tooth Extraction Instruments & Equipment’s

10.2.3.1. Hand Instruments

10.2.3.1.1. Luxators

10.2.3.1.2. Elevators

10.2.3.1.3. Extraction Forceps

10.2.3.1.4. Root-tip Picks

10.2.3.1.5. Minnesota Retractors

10.2.3.1.6. Scalpel Blades

10.2.3.1.7. Others

10.2.3.2. Powered Equipment

10.2.3.2.1. Micromotor Units

10.2.3.2.2. Compressed air-driven Units

10.2.3.2.3. Burs

10.2.3.3. Ancillary Equipment

10.2.3.3.1. Magnifying Loupes

10.2.3.3.2. Dentistry Tablets

10.3. Market Value Forecast, by Country/Sub-region, 2017–2031

10.3.1. China

10.3.2. Japan

10.3.3. India

10.3.4. Australia & New Zealand

10.3.5. Rest of Asia Pacific

10.4. Market Attractiveness Analysis

10.4.1. By Equipment Type

10.4.2. By Country/Sub-region

11. Latin America Veterinary Dentistry Instruments & Equipment Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Equipment Type, 2017–2031

11.2.1. Oral Examination Instrumentation

11.2.1.1. Periodontal Probes

11.2.1.2. Dental Explorers

11.2.1.3. Mouth Gags

11.2.1.4. Dental Mirrors

11.2.2. Periodontal Therapy Equipment & Instrumentation

11.2.2.1. Scaling Equipment

11.2.2.1.1. Hand Instruments

11.2.2.1.2. Powered Equipment

11.2.2.2. Polishing Equipment

11.2.3. Tooth Extraction Instruments & Equipment’s

11.2.3.1. Hand Instruments

11.2.3.1.1. Luxators

11.2.3.1.2. Elevators

11.2.3.1.3. Extraction Forceps

11.2.3.1.4. Root-tip Picks

11.2.3.1.5. Minnesota Retractors

11.2.3.1.6. Scalpel Blades

11.2.3.1.7. Others

11.2.3.2. Powered Equipment

11.2.3.2.1. Micromotor Units

11.2.3.2.2. Compressed air-driven Units

11.2.3.2.3. Burs

11.2.3.3. Ancillary Equipment

11.2.3.3.1. Magnifying Loupes

11.2.3.3.2. Dentistry Tablets

11.3. Market Value Forecast, by Country/Sub-region, 2017–2031

11.3.1. Brazil

11.3.2. Mexico

11.3.3. Rest of Latin America

11.4. Market Attractiveness Analysis

11.4.1. By Equipment Type

11.4.2. By Country/Sub-region

12. Middle East & Africa Veterinary Dentistry Instruments & Equipment Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Equipment Type, 2017–2031

12.2.1. Oral Examination Instrumentation

12.2.1.1. Periodontal Probes

12.2.1.2. Dental Explorers

12.2.1.3. Mouth Gags

12.2.1.4. Dental Mirrors

12.2.2. Periodontal Therapy Equipment & Instrumentation

12.2.2.1. Scaling Equipment

12.2.2.1.1. Hand Instruments

12.2.2.1.2. Powered Equipment

12.2.2.2. Polishing Equipment

12.2.3. Tooth Extraction Instruments & Equipment’s

12.2.3.1. Hand Instruments

12.2.3.1.1. Luxators

12.2.3.1.2. Elevators

12.2.3.1.3. Extraction Forceps

12.2.3.1.4. Root-tip Picks

12.2.3.1.5. Minnesota Retractors

12.2.3.1.6. Scalpel Blades

12.2.3.1.7. Others

12.2.3.2. Powered Equipment

12.2.3.2.1. Micromotor Units

12.2.3.2.2. Compressed air-driven Units

12.2.3.2.3. Burs

12.2.3.3. Ancillary Equipment

12.2.3.3.1. Magnifying Loupes

12.2.3.3.2. Dentistry Tablets

12.3. Market Value Forecast, by Country/Sub-region, 2017–2031

12.3.1. GCC Countries

12.3.2. South Africa

12.3.3. Rest of Middle East & Africa

12.4. Market Attractiveness Analysis

12.4.1. By Equipment Type

12.4.2. By Country/Sub-region

13. Competition Landscape

13.1. Market Player - Competitive Matrix (by Tier and Size of Companies)

13.2. Market Share Analysis, by Company (2022)

13.3. Company Profiles

13.3.1. Parrerson Companies, Inc.

13.3.1.1. Company Overview

13.3.1.2. Equipment Type Portfolio

13.3.1.3. SWOT Analysis

13.3.1.4. Financial Overview

13.3.1.5. Strategic Overview

13.3.2. Henry Schine, Inc.

13.3.2.1. Company Overview

13.3.2.2. Equipment Type Portfolio

13.3.2.3. SWOT Analysis

13.3.2.4. Financial Overview

13.3.2.5. Strategic Overview

13.3.3. Intergra LifeSciences Holdings Corporation

13.3.3.1. Company Overview

13.3.3.2. Equipment Type Portfolio

13.3.3.3. SWOT Analysis

13.3.3.4. Financial Overview

13.3.3.5. Strategic Overview

13.3.4. iM3Vet Pty LTD.

13.3.4.1. Company Overview

13.3.4.2. Equipment Type Portfolio

13.3.4.3. SWOT Analysis

13.3.4.4. Financial Overview

13.3.4.5. Strategic Overview

13.3.5. Dispomed Ltd.

13.3.5.1. Company Overview

13.3.5.2. Equipment Type Portfolio

13.3.5.3. SWOT Analysis

13.3.5.4. Financial Overview

13.3.5.5. Strategic Overview

13.3.6. Jorgen Kruuse A/S

13.3.6.1. Company Overview

13.3.6.2. Equipment Type Portfolio

13.3.6.3. SWOT Analysis

13.3.6.4. Financial Overview

13.3.6.5. Strategic Overview

13.3.7. TECHNIK TECHNOLOGY Ltd.

13.3.7.1. Company Overview

13.3.7.2. Equipment Type Portfolio

13.3.7.3. SWOT Analysis

13.3.7.4. Financial Overview

13.3.7.5. Strategic Overview

13.3.8. MAI Animal Health

13.3.8.1. Company Overview

13.3.8.2. Product Portfolio

13.3.8.3. SWOT Analysis

13.3.8.4. Financial Overview

13.3.8.5. Strategic Overview

13.3.9. Dentalaire, International

13.3.9.1. Company Overview

13.3.9.2. Product Portfolio

13.3.9.3. SWOT Analysis

13.3.9.4. Financial Overview

13.3.9.5. Strategic Overview

13.3.10. ACTEON Group

13.3.10.1. Company Overview

13.3.10.2. Product Portfolio

13.3.10.3. SWOT Analysis

13.3.10.4. Financial Overview

13.3.10.5. Strategic Overview

List of Tables

Table 01: Global Veterinary Dentistry Instruments & Equipment Market Size (US$ Mn) Forecast, by Equipment Type, 2017–2031

Table 02: Global Veterinary Dentistry Instruments & Equipment Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 03: North America Veterinary Dentistry Instruments & Equipment Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 04: North America Veterinary Dentistry Instruments & Equipment Market Size (US$ Mn) Forecast, by Equipment Type, 2017–2031

Table 05: Europe Veterinary Dentistry Instruments & Equipment Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 06: Europe Veterinary Dentistry Instruments & Equipment Market Size (US$ Mn) Forecast, by Equipment Type, 2017–2031

Table 07: Asia Pacific Veterinary Dentistry Instruments & Equipment Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 08: Asia Pacific Veterinary Dentistry Instruments & Equipment Market Size (US$ Mn) Forecast, by Equipment Type, 2017–2031

Table 09: Latin America Veterinary Dentistry Instruments & Equipment Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Latin America Veterinary Dentistry Instruments & Equipment Market Size (US$ Mn) Forecast, by Equipment Type, 2017–2031

Table 11: Middle East & Africa Veterinary Dentistry Instruments & Equipment Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 12: Middle East & Africa Veterinary Dentistry Instruments & Equipment Market Size (US$ Mn) Forecast, by Equipment Type, 2017–2031

List of Figures

Figure 01: Global Veterinary Dentistry Instruments & Equipment Market Size (US$ Mn) and Distribution (%), by Region, 2017 and 2031

Figure 02: Global Veterinary Dentistry Instruments & Equipment Market Revenue (US$ Mn), by Equipment Type, 2022

Figure 03: Global Veterinary Dentistry Instruments & Equipment Market Value Share, by Equipment Type, 2022

Figure 04: Global Veterinary Dentistry Instruments & Equipment Market Value Share, by Region, 2022

Figure 05: Global Veterinary Dentistry Instruments & Equipment Market Value (US$ Mn) Forecast, 2017–2031

Figure 06: Global Veterinary Dentistry Instruments & Equipment Market Value Share Analysis, by Equipment Type, 2022 and 2031

Figure 07: Global Veterinary Dentistry Instruments & Equipment Market Attractiveness Analysis, by Equipment Type, 2023-2031

Figure 08: Global Veterinary Dentistry Instruments & Equipment Market Value Share Analysis, by Region, 2022 and 2031

Figure 09: Global Veterinary Dentistry Instruments & Equipment Market Attractiveness Analysis, by Region, 2023-2031

Figure 10: North America Veterinary Dentistry Instruments & Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 11: North America Veterinary Dentistry Instruments & Equipment Market Attractiveness Analysis, by Country, 2017–2031

Figure 12: North America Veterinary Dentistry Instruments & Equipment Market Value Share Analysis, by Country, 2022 and 2031

Figure 13: North America Veterinary Dentistry Instruments & Equipment Market Value Share Analysis, by Equipment Type, 2022 and 2031

Figure 14: North America Veterinary Dentistry Instruments & Equipment Market Attractiveness Analysis, by Equipment Type, 2023–2031

Figure 15: Europe Veterinary Dentistry Instruments & Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 16: Europe Veterinary Dentistry Instruments & Equipment Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 17: Europe Veterinary Dentistry Instruments & Equipment Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 18: Europe Veterinary Dentistry Instruments & Equipment Market Value Share Analysis, by Equipment Type, 2022 and 2031

Figure 19: Europe Veterinary Dentistry Instruments & Equipment Market Attractiveness Analysis, by Equipment Type, 2023–2031

Figure 20: Asia Pacific Veterinary Dentistry Instruments & Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 21: Asia Pacific Veterinary Dentistry Instruments & Equipment Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 22: Asia Pacific Veterinary Dentistry Instruments & Equipment Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 23: Asia Pacific Veterinary Dentistry Instruments & Equipment Market Value Share Analysis, by Equipment Type, 2022 and 2031

Figure 24: Asia Pacific Veterinary Dentistry Instruments & Equipment Market Attractiveness Analysis, by Equipment Type, 2023–2031

Figure 25: Latin America Veterinary Dentistry Instruments & Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 26: Latin America Veterinary Dentistry Instruments & Equipment Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 27: Latin America Veterinary Dentistry Instruments & Equipment Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 28: Latin America Veterinary Dentistry Instruments & Equipment Market Value Share Analysis, by Equipment Type, 2022 and 2031

Figure 29: Latin America Veterinary Dentistry Instruments & Equipment Market Attractiveness Analysis, by Equipment Type, 2023–2031

Figure 30: Middle East & Africa Veterinary Dentistry Instruments & Equipment Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 31: Middle East & Africa Veterinary Dentistry Instruments & Equipment Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 32: Middle East & Africa Veterinary Dentistry Instruments & Equipment Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 33: Middle East & Africa Veterinary Dentistry Instruments & Equipment Market Value Share Analysis, by Equipment Type, 2022 and 2031

Figure 34: Middle East & Africa Veterinary Dentistry Instruments & Equipment Market Attractiveness Analysis, by Equipment Type, 2023–2031