Analysts’ Viewpoint on Venous Diseases Treatment Market Scenario

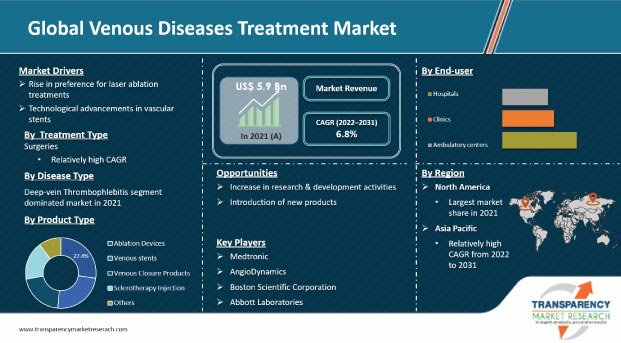

Surge in geriatric population, availability of innovative devices for the treatment of venous diseases, occupations that increase the need for venous therapy, and global technical breakthroughs are driving the venous diseases treatment market. Additionally, rise in awareness about venous diseases and their treatments is propelling the global market. Growth in number of treatment centers with private recovery facilities is resulting in treatment access to a larger population. Furthermore, increase in angioplasty operations, rise in burden of vascular illnesses, and surge in demand for minimally invasive procedures are augmenting the global market. Manufacturers should tap into incremental opportunities by focusing on technologically advanced devices for the treatment of venous diseases in order to broaden their revenue streams.

Venous disorders are diseases that affect the veins in the body. Damaged vein walls obstruct the circulatory system, enabling the blood to collect and flow backward when the muscles relax. This causes an unusually high buildup of pressure in the veins. The accumulation causes stretching and twisting of the veins, increased swelling, valve incompetence, sluggish blood flow, and formation of blood clots. This condition can eventually lead to various disorders known as venous disease. Varicose veins, also known as varicoses or varicosities, are enlarged, twisted veins that can occur anywhere in the body, but are more common in the legs. Varicose veins is one of the most common diseases caused due to damaged vein walls and valves. Rise in prevalence of varicose veins is anticipated to drive the global venous diseases treatment market. According to an article published in the Journal of the American Heart Association, around 23% of adults in the U.S. have varicose veins. Annually, organizations such as the British Association of Sclerotherapies (BAS) launch initiatives to raise awareness and encourage the use of various venous disease treatments. Rise in awareness about deep vein thrombosis treatment, chronic venous occlusions treatment, venous insufficiency treatment, and leg ulcer treatment; and growth in number of product approvals are driving the market. For instance, in November 2020, Vascular Barcelona Devices (VB Devices) received the CE mark approval for Varixio Pod Air, as a Class 1s medical device intended for automated foam preparation for varicose veins sclerotherapy.

Laser ablation treatment does not require lengthy hospital stays. It also does not cause discomfort during the recovery process. Adoption of lasers in varicose vein treatment has increased due to the development of novel technologies and advancements in research activities by key players in the market. Doctors are using laser ablation technology to close smaller varicose and spider veins. This treatment involves directing intense bursts of light at the affected veins, causing them to fade or disappear. The usage of laser treatment is increasing in developed countries due to the rise in healthcare costs and growth in preference for non-invasive procedures.

According to a study published in the British Journal of Surgery in May 2022 titled, "Compression following treatment of superficial venous incompetence: systematic review," laser ablation therapy was cost-effective and the preferred initial treatment for symptomatic venous diseases with a diameter of at least 3 mm and evidence of saphenous vein reflux.

Technological advancements in vascular stents, increase in demand for minimally invasive procedures, and rise in geriatric population are some of the factors driving the global market. Companies are expanding their product portfolio to offer the best services for venous diseases. For instance, in March 2022, Cordis, a global cardiovascular technology company, announced that the FDA approved the S.M.A.R.T. RADIANZ Vascular Stent System, a self-expanding stent designed specifically for radial peripheral procedures. The S.M.A.R.T. RADIANZ Vascular Stent System enables accurate and efficient placement of a stent in the iliac and superficial femoral (SFA) arteries.

In December 2021, Royal Philips, a global leader in health technology, announced that it had agreed to acquire Vesper Medical Inc., a medical technology company based in the U.S., which develops minimally invasive peripheral vascular devices. Vesper Medical would add an advanced venous stent portfolio for the treatment of deep venous disease to Philips' portfolio of diagnostic and therapeutic devices.

In terms of treatment type, the surgeries segment is projected to dominate the global market with 57% share by 2031. Vascular surgery is a surgical subspecialty that treats diseases of the vascular system, which includes arteries, veins, and lymphatic circulation, through medical therapy, minimally invasive catheter procedures, and surgical reconstruction. Vascular diseases are treated using both open surgery and endovascular techniques. Rise in prevalence of varicose veins due to obesity, phlebitis, congenital abnormalities in veins, and blood clots is driving the demand for new treatments. Therefore, companies are offering innovative products, which in turn is propelling the market.

Based on disease type, the varicose veins segment dominated the global market with around 24% share in 2021. Rise in prevalence of small and greater saphenous vein, reticular varicose vein, and genital area varicose veins have prompted people to be more aware and educated about varicose vein warning signals and the importance of a prompt response. In July 2019, India Medtronic Private Limited, a subsidiary of Medtronic plc, launched VenaSeal Closure System in India. This led to an improvement in the quality of life of patients living with varicose veins.

In terms of product type, the ablation devices segment led the global market with around 27% share in 2021. Ablation devices are medical devices used in minimally invasive procedures to remove or excise abnormal body tissues for therapeutic purposes. These systems use the heat generated by radio frequency, energy, extreme cold, or a laser to cause small burns. Rise in adoption of robotic technologies for product application expansion and integration of cutting-edge technologies in ablation devices to improve patient safety and procedural efficiency are expected to drive the segment. Increase in adoption of ablation devices is creating lucrative opportunities for manufacturers in the global venous diseases treatment market.

In terms of end-user, the hospitals segment is projected to dominate the global market with 43% share by 2031. Several hospitals provide treatments for venous diseases. These treatments include endovenous ablation or endovenous laser ablation, radiofrequency ablation, and stripping or surgical ligation. Most surgeons adopt traditional approaches due to high success rates and increase in number of patients preferring traditional approaches. Surge in number of hospitals across the globe along with comparatively higher performance and adoption of minimally invasive surgeries (MISs) in these settings is driving the hospitals segment.

North America dominated the global venous diseases treatment market in 2021. The market in the region is anticipated to grow at a CAGR of 6.8% from 2022 to 2031. It is expected to witness strong growth due to various strategies adopted by key players for market expansion such as product launches, mergers and acquisitions, and collaborations. For instance, in April 2021, Medtronic began an Investigation Device Exemption (IDE) study to determine the efficacy and safety of the Abre venous self-expanding stent device, which is used to treat deep venous disorders.

According to a study titled "Risk assessment for varicose veins among city Police-A cross-sectional study" that was published in Clinical Epidemiology and Global Health in December 2021, in the U.S., around 23% of adults have varicose veins. The prevalence increases to 80% in males and 85% in women when spider telangiectasias and reticular veins are considered. Thus, rise in prevalence of varicose veins among the population of the U.S. is projected to augment the venous diseases treatment market in North America during the forecast period.

The global venous diseases treatment market report concludes with the company profiles section, which includes information about key players in the global venous diseases treatment market. Leading players analyzed in the report are Medtronic, AngioDynamics, Alma Lasers, biolitec AG Untere Viaduktgasse, Becton Dickinson and Company, Boston Scientific Corporation, Abbott Laboratories, B. Braun Melsungen Ag, Teleflex Incorporated, Lumenis, and Philips.

Each of these players has been profiled in the global venous diseases treatment market report based on parameters such as company overview, financial overview, business strategies, application portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 5.9 Bn |

|

Market Forecast Value in 2031 |

More than US$ 11.3 Bn |

|

Growth Rate (CAGR) |

6.8% |

|

Forecast Period |

2022-2031 |

|

Historical Data Available for |

2017-2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global venous diseases treatment market was valued at US$ 5.9 Bn in 2021.

The global venous diseases treatment market is projected to reach more than US$ 11.3 Bn by 2031.

The global venous diseases treatment market is anticipated to grow at a CAGR of 6.8% from 2022 to 2031.

New product launches and rise in awareness about the benefits of venous diseases treatment are driving the global market.

The surgeries segment held over 57% share of the global venous diseases treatment market in 2021.

North America is expected to account for major share of the global venous diseases treatment market during the forecast period.

Medtronic, AngioDynamics, Alma Lasers, Biolitec AG Untere Viaduktgasse, Becton, Dickinson and Company, Boston Scientific Corporation, Abbott Laboratories, B. Braun Melsungen Ag, Teleflex Incorporated, Lumenis, and Philips.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Venous Diseases Treatment Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Porter’s Five Force Analysis

5. Key Insights

5.1. Regulatory Scenario by Region/globally

5.2. Technological Advancements

5.3. Pipeline Analysis

5.4. Key Mergers & Acquisitions

5.5. Disease Prevalence & Incidence Rate globally with key countries

5.6. Reimbursement Scenario by Region/globally

6. Global Venous Diseases Treatment Analysis and Forecast, by Treatment Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Treatment, 2017–2031

6.3.1. Surgeries

6.3.1.1. Angioplasty or Stenting

6.3.1.2. Vein Ligation and Stripping

6.3.1.3. Vena Cava Filter

6.3.1.4. Ambulatory Phlebectomy

6.3.1.5. Others

6.3.2. Therapies

6.3.2.1. Sclerotherapy

6.3.2.2. Radiofrequency Ablation Therapy

6.3.2.3. Laser Treatment

6.4. Market Attractiveness Analysis, by Treatment

7. Global Venous Diseases Treatment Analysis and Forecast, by Disease Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Disease Type, 2017–2031

7.3.1. Deep-vein Thrombophlebitis

7.3.2. Varicose Veins

7.3.3. Superficial Thrombophlebitis

7.3.4. Chronic Venous Insufficiency

7.3.5. Venous Ulcers

7.3.6. Others

7.4. Market Attractiveness Analysis, by Disease Type

8. Global Venous Diseases Treatment Analysis and Forecast, by Product Type

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Product Type, 2017–2031

8.3.1. Ablation Devices

8.3.2. Venous Stents

8.3.3. Venous Closure Treatments

8.3.4. Sclerotherapy Injection

8.3.5. Others

8.4. Market Attractiveness Analysis, by Product Type

9. Global Venous Diseases Treatment Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Hospitals

9.3.2. Clinics

9.3.3. Ambulatory centers

9.4. Market Attractiveness Analysis, by End-user

10. Global Venous Diseases Treatment Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Region

11. North America Venous Diseases Treatment Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Treatment, 2017–2031

11.2.1. Surgeries

11.2.1.1. Angioplasty or Stenting

11.2.1.2. Vein Ligation and Stripping

11.2.1.3. Vena Cava Filter

11.2.1.4. Ambulatory Phlebectomy

11.2.1.5. Others

11.2.2. Therapies

11.2.2.1. Sclerotherapy

11.2.2.2. Radiofrequency Ablation Therapy

11.2.2.3. Laser Treatment

11.3. Market Value Forecast, by Disease Type, 2017–2031

11.3.1. Deep-vein Thrombophlebitis

11.3.2. Varicose Veins

11.3.3. Superficial Thrombophlebitis

11.3.4. Chronic Venous Insufficiency

11.3.5. Venous Ulcers

11.3.6. Others

11.4. Market Value Forecast, by Product Type, 2017–2031

11.4.1. Ablation Devices

11.4.2. Venous Stents

11.4.3. Venous Closure Treatments

11.4.4. Sclerotherapy Injection

11.4.5. Others

11.5. Market Value Forecast, by End-user, 2017–2031

11.5.1. Hospitals

11.5.2. Clinics

11.5.3. Ambulatory centers

11.6. Market Value Forecast, by Country/Sub-region, 2017–2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Treatment

11.7.2. By Disease Type

11.7.3. By Product Type

11.7.4. By End-user

11.7.5. By Country/Sub-region

12. Europe Venous Diseases Treatment Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Treatment, 2017–2031

12.2.1. Surgeries

12.2.1.1. Angioplasty or Stenting

12.2.1.2. Vein Ligation and Stripping

12.2.1.3. VeEnd Use Cava Filter

12.2.1.4. Ambulatory Phlebectomy

12.2.1.5. Others

12.2.2. Therapies

12.2.2.1. Sclerotherapy

12.2.2.2. Radiofrequency Ablation Therapy

12.2.2.3. Laser Treatment

12.3. Market Value Forecast, by Disease Type, 2017–2031

12.3.1. Deep-vein Thrombophlebitis

12.3.2. Varicose Veins

12.3.3. Superficial Thrombophlebitis

12.3.4. Chronic Venous Insufficiency

12.3.5. Venous Ulcers

12.3.6. Others

12.4. Market Value Forecast, by Product Type, 2017–2031

12.4.1. Ablation Devices

12.4.2. Venous Stents

12.4.3. Venous Closure Treatments

12.4.4. Sclerotherapy Injection

12.4.5. Others

12.5. Market Value Forecast, by End-user, 2017–2031

12.5.1. Hospitals

12.5.2. Clinics

12.5.3. Ambulatory centers

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.7. Market Attractiveness Analysis

12.7.1. By Treatment

12.7.2. By Disease Type

12.7.3. By Product Type

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Venous Diseases Treatment Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Treatment, 2017–2031

13.2.1. Surgeries

13.2.1.1. Angioplasty or Stenting

13.2.1.2. Vein Ligation and Stripping

13.2.1.3. VeEnd Use Cava Filter

13.2.1.4. Ambulatory Phlebectomy

13.2.1.5. Others

13.2.2. Therapies

13.2.2.1. Sclerotherapy

13.2.2.2. Radiofrequency Ablation Therapy

13.2.2.3. Laser Treatment

13.3. Market Value Forecast, by Disease Type, 2017–2031

13.3.1. Deep-vein Thrombophlebitis

13.3.2. Varicose Veins

13.3.3. Superficial Thrombophlebitis

13.3.4. Chronic Venous Insufficiency

13.3.5. Venous Ulcers

13.3.6. Others

13.4. Market Value Forecast, by Product Type, 2017–2031

13.4.1. Ablation Devices

13.4.2. Venous Stents

13.4.3. Venous Closure Treatments

13.4.4. Sclerotherapy Injection

13.4.5. Others

13.5. Market Value Forecast, by End-user, 2017–2031

13.5.1. Hospitals

13.5.2. Clinics

13.5.3. Ambulatory centers

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Treatment

13.7.2. By Disease Type

13.7.3. By Product Type

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Venous Diseases Treatment Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Treatment, 2017–2031

14.2.1. Surgeries

14.2.1.1. Angioplasty or Stenting

14.2.1.2. Vein Ligation and Stripping

14.2.1.3. VeEnd Use Cava Filter

14.2.1.4. Ambulatory Phlebectomy

14.2.1.5. Others

14.2.2. Therapies

14.2.2.1. Sclerotherapy

14.2.2.2. Radiofrequency Ablation Therapy

14.2.2.3. Laser Treatment

14.3. Market Value Forecast, by Disease Type, 2017–2031

14.3.1. Deep-vein Thrombophlebitis

14.3.2. Varicose Veins

14.3.3. Superficial Thrombophlebitis

14.3.4. Chronic Venous Insufficiency

14.3.5. Venous Ulcers

14.3.6. Others

14.4. Market Value Forecast, by Product Type, 2017–2031

14.4.1. Ablation Devices

14.4.2. Venous Stents

14.4.3. Venous Closure Treatments

14.4.4. Sclerotherapy Injection

14.4.5. Others

14.5. Market Value Forecast, by End-user, 2017–2031

14.5.1. Hospitals

14.5.2. Clinics

14.5.3. Ambulatory centers

14.6. Market Value Forecast, by Country/Sub-region, 2017 – 2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Treatment

14.7.2. By Disease Type

14.7.3. By Product Type

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Venous Diseases Treatment Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Treatment, 2017–2031

15.2.1. Surgeries

15.2.1.1. Angioplasty or Stenting

15.2.1.2. Vein Ligation and Stripping

15.2.1.3. VeEnd Use Cava Filter

15.2.1.4. Ambulatory Phlebectomy

15.2.1.5. Others

15.2.2. Therapies

15.2.2.1. Sclerotherapy

15.2.2.2. Radiofrequency Ablation Therapy

15.2.2.3. Laser Treatment

15.3. Market Value Forecast, by Disease Type, 2017–2031

15.3.1. Deep-vein Thrombophlebitis

15.3.2. Varicose Veins

15.3.3. Superficial Thrombophlebitis

15.3.4. Chronic Venous Insufficiency

15.3.5. Venous Ulcers

15.3.6. Others

15.4. Market Value Forecast, by Product Type, 2017–2031

15.4.1. Ablation Devices

15.4.2. Venous Stents

15.4.3. Venous Closure Treatments

15.4.4. Sclerotherapy Injection

15.4.5. Others

15.5. Market Value Forecast, by End-user, 2017–2031

15.5.1. Hospitals

15.5.2. Clinics

15.5.3. Ambulatory centers

15.6. Market Value Forecast, by Country/Sub-region, 2017–2031

16. Competitive Landscape

16.1. Market Player - Competition Matrix (by tier and size of companies)

16.2. Market Share Analysis, by Company, 2021

16.3. Company Profiles

16.3.1. Zimmer Biomet Holdings, Inc.

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Company Financials

16.3.1.3. Growth Strategies

16.3.1.4. SWOT Analysis

16.3.2. Medtronic

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Company Financials

16.3.2.3. Growth Strategies

16.3.2.4. SWOT Analysis

16.3.3. AngioDynamics

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Company Financials

16.3.3.3. Growth Strategies

16.3.3.4. SWOT Analysis

16.3.4. Alma Lasers

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Company Financials

16.3.4.3. Growth Strategies

16.3.4.4. SWOT Analysis

16.3.5. Biolitec AG Untere Viaduktgasse

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Company Financials

16.3.5.3. Growth Strategies

16.3.5.4. SWOT Analysis

16.3.6. Becton, Dickinson and Company

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Company Financials

16.3.6.3. Growth Strategies

16.3.6.4. SWOT Analysis

16.3.7. Boston Scientific Corporation

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Company Financials

16.3.7.3. Growth Strategies

16.3.7.4. SWOT Analysis

16.3.8. Abbott Laboratories

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Company Financials

16.3.8.3. Growth Strategies

16.3.8.4. SWOT Analysis

16.3.9. B. Braun Melsungen AG

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Company Financials

16.3.9.3. Growth Strategies

16.3.9.4. SWOT Analysis

16.3.10. Teleflex Incorporated

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Company Financials

16.3.10.3. Growth Strategies

16.3.10.4. SWOT Analysis

16.3.11. Lumenis

16.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.11.2. Company Financials

16.3.11.3. Growth Strategies

16.3.11.4. SWOT Analysis

16.3.12. Philips

16.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.12.2. Company Financials

16.3.12.3. Growth Strategies

16.3.12.4. SWOT Analysis

List of Tables

Table 01: Global Venous Diseases Treatment Revenue (US$ Bn) Forecast, by Treatment Type, 2017–2031

Table 02: Global Venous Diseases Treatment Value (US$ Bn) Forecast, by Disease Type, 2017‒2031

Table 03: Global Venous Diseases Treatment Revenue (US$ Bn) Forecast, by Product Type, 2017–2031

Table 04: Global Venous Diseases Treatment Value (US$ Bn) Forecast, by End-use, 2017‒2031

Table 05: Global Venous Diseases Treatment Value (US$ Bn) Forecast, by Region, 2017–2031

Table 06: North America Venous Diseases Treatment Value (US$ Bn) Forecast, by Country, 2017–2031

Table 07: North America Venous Diseases Treatment Revenue (US$ Bn) Forecast, by Treatment Type, 2017–2031

Table 08: North America Venous Diseases Treatment Value (US$ Bn) Forecast, by Disease Type, 2017‒2031

Table 09: North America Venous Diseases Treatment Revenue (US$ Bn) Forecast, by Product Type, 2017–2031

Table 10: North America Venous Diseases Treatment Value (US$ Bn) Forecast, by End-use, 2017‒2031

Table 11: Europe Venous Diseases Treatment Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2031

Table 12: Europe Venous Diseases Treatment Revenue (US$ Bn) Forecast, by Treatment Type, 2017–2031

Table 13: Europe Venous Diseases Treatment Value (US$ Bn) Forecast, by Disease Type, 2017‒2031

Table 14: Europe Venous Diseases Treatment Revenue (US$ Bn) Forecast, by Product Type, 2017–2031

Table 15: Europe Venous Diseases Treatment Value (US$ Bn) Forecast, by End-use, 2017‒2031

Table 16: Asia Pacific Venous Diseases Treatment Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Asia Pacific Venous Diseases Treatment Revenue (US$ Bn) Forecast, by Treatment Type, 2017–2031

Table 18: Asia Pacific Venous Diseases Treatment Value (US$ Bn) Forecast, by Disease Type, 2017‒2031

Table 19: Asia Pacific Venous Diseases Treatment Revenue (US$ Bn) Forecast, by Product Type, 2017–2031

Table 20: Asia Pacific Venous Diseases Treatment Value (US$ Bn) Forecast, by End-use, 2017‒2031

Table 21: India Venous Diseases Treatment Revenue (US$ Bn) Forecast, by Treatment Type, 2017–2031

Table 22: India Venous Diseases Treatment Value (US$ Bn) Forecast, by Disease Type, 2017‒2031

Table 23: India Venous Diseases Treatment Revenue (US$ Bn) Forecast, by Product Type, 2017–2031

Table 24: India Venous Diseases Treatment Value (US$ Bn) Forecast, by End-use, 2017‒2031

Table 25: Latin America Venous Diseases Treatment Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2031

Table 26: Latin America Venous Diseases Treatment Revenue (US$ Bn) Forecast, by Treatment Type, 2017–2031

Table 27: Latin America Venous Diseases Treatment Value (US$ Bn) Forecast, by Disease Type, 2017‒2031

Table 28: Latin America Venous Diseases Treatment Revenue (US$ Bn) Forecast, by Product Type, 2017–2031

Table 29: Latin America Venous Diseases Treatment Value (US$ Bn) Forecast, by End-use, 2017‒2031

Table 30: Middle East & Africa Venous Diseases Treatment Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2031

Table 31: Middle East & Africa Venous Diseases Treatment Revenue (US$ Bn) Forecast, by Treatment Type, 2017–2031

Table 32: Middle East & Africa Venous Diseases Treatment Value (US$ Bn) Forecast, by Disease Type, 2017‒2031

Table 33: Middle East & Africa Venous Diseases Treatment Revenue (US$ Bn) Forecast, by Product Type, 2017–2031

Table 34: Middle East & Africa Venous Diseases Treatment Value (US$ Bn) Forecast, by End-use, 2017‒2031

List of Figures

Figure 01: Global Venous Diseases Treatment Value Share Analysis, by Treatment Type, 2021 and 2031

Figure 02: Global Venous Diseases Treatment Attractiveness Analysis, by Treatment Type, 2022–2031

Figure 03: Global Venous Diseases Treatment Revenue (US$ Bn), by Surgeries, 2017–2031

Figure 04: Global Venous Diseases Treatment Revenue (US$ Bn), by Therapies, 2017–2031

Figure 05: Global Venous Diseases Treatment Value (US$ Bn) Forecast, by Disease Type, 2017–2031

Figure 06: Global Venous Diseases Treatment Value (US$ Bn) Forecast, by Product Type, 2017–2031

Figure 07: Global Venous Diseases Treatment Value Share Analysis, by End-use, 2021 and 2031

Figure 08: Global Venous Diseases Treatment Attractiveness Analysis, by Angioplasty or Stenting, 2022–2031

Figure 09: Global Venous Diseases Treatment Value (US$ Bn) Forecast, by Vein Ligation and stripping, 2017–2031

Figure 10: Global Venous Diseases Treatment Value (US$ Bn) Forecast, by Vena Cava Filter, 2017–2031

Figure 11: Global Venous Diseases Treatment Value Share Analysis, by Ambulatory Phlebectomy Type, 2021 and 2031

Figure 12: Global Venous Diseases Treatment Attractiveness Analysis, by Others, 2022–2031

Figure 13: Global Venous Diseases Treatment Revenue (US$ Bn), by Sclerotherapy, 2017–2031

Figure 14: Global Venous Diseases Treatment Revenue (US$ Bn), by Laser treatment, 2017–2031

Figure 15: Global Venous Diseases Treatment Value (US$ Bn) Forecast, by Radiofrequency ablation therapy, 2017–2031

Figure 16: Global Venous Diseases Treatment Value (US$ Bn) Forecast, by Varicose Veins 2017–2031

Figure 17: Global Venous Diseases Treatment Value Share Analysis, by Superficial Thrombophlebitis, 2021 and 2031

Figure 18: Global Venous Diseases Treatment Attractiveness Analysis, by Deep-vein Thrombophlebitis, 2022–2031

Figure 19: Global Venous Diseases Treatment Value (US$ Bn) Forecast, by Chronic Venous Insufficiency, 2017–2031

Figure 20: Global Venous Diseases Treatment Value (US$ Bn) Forecast, by Venous ulcers, 2017–2031

Figure 21: Global Venous Diseases Treatment Value (US$ Bn) Forecast, by Others, 2017–2031

Figure 22: Global Venous Diseases Treatment Value (US$ Bn) Forecast, by Ablation Devices, 2017–2031

Figure 23: Global Venous Diseases Treatment Value (US$ Bn) Forecast, by Sclerotherapy Injection, 2017–2031

Figure 24: Global Venous Diseases Treatment Attractiveness Analysis, by Venous Closure Treatments, 2022–2031

Figure 25: Global Venous Diseases Treatment Value (US$ Bn) Forecast, by Venous stents

Figure 26: Global Venous Diseases Treatment Value (US$ Bn) Forecast, by Others, 2017–2031

Figure 27: Global Venous Diseases Treatment Value (US$ Bn) Forecast, by Hospitals, 2017–2031

Figure 28: Global Venous Diseases Treatment Value (US$ Bn) Forecast, by Clinics, 2017–2031

Figure 29: Global Venous Diseases Treatment Value (US$ Bn) Forecast, by Ambulatory centers, 2017–2031

Figure 30: Global Venous Diseases Treatment Value Share Analysis, by Region, 2021 and 2031

Figure 31: Global Venous Diseases Treatment Attractiveness Analysis, by Region, 2022-2031

Figure 32: North America Venous Diseases Treatment Value (US$ Bn) Forecast, 2017–2031

Figure 33: North America Venous Diseases Treatment Value Share Analysis, by Country, 2021 and 2031

Figure 34: North America Venous Diseases Treatment Attractiveness Analysis, by Country, 2022–2031

Figure 35: North America Venous Diseases Treatment Value Share Analysis, by Treatment Type, 2021 and 2031

Figure 36: North America Venous Diseases Treatment Attractiveness Analysis, by Treatment Type, 2022–2031

Figure 37: North America Venous Diseases Treatment Value Share Analysis, by Disease Type, 2021 and 2031

Figure 38: North America Venous Diseases Treatment Attractiveness Analysis, by Disease Type, 2022–2031

Figure 39: North America Venous Diseases Treatment Value Share Analysis, by Product Type, 2021 and 2031

Figure 40: North America Venous Diseases Treatment Attractiveness Analysis, by Product Type, 2022–2031

Figure 41: North America Venous Diseases Treatment Value Share Analysis, by End-use, 2021 and 2031

Figure 36: North America Venous Diseases Treatment Attractiveness Analysis, by End-use, 2022–2031

Figure 37: Europe Venous Diseases Treatment Value (US$ Bn) Forecast, 2017–2031

Figure 38: Europe Venous Diseases Treatment Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 39: Europe Venous Diseases Treatment Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 40: Europe Venous Diseases Treatment Value Share Analysis, by Treatment Type, 2021 and 2031

Figure 41: Europe Venous Diseases Treatment Attractiveness Analysis, by Treatment Type, 2022–2031

Figure 42: Europe Venous Diseases Treatment Value Share Analysis, by Disease Type, 2021 and 2031

Figure 43: Europe Venous Diseases Treatment Attractiveness Analysis, by Disease Type, 2022–2031

Figure 44: Europe Venous Diseases Treatment Value Share Analysis, by Product Type, 2021 and 2031

Figure 45: Europe Venous Diseases Treatment Attractiveness Analysis, by Product Type, 2022–2031

Figure 46: Europe Venous Diseases Treatment Value Share Analysis, by End-use, 2021 and 2031

Figure 47: Europe Venous Diseases Treatment Attractiveness Analysis, by End-use, 2022–2031

Figure 48: Asia Pacific Venous Diseases Treatment Value (US$ Bn) Forecast, 2017–2031

Figure 49: Asia Pacific Venous Diseases Treatment Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 50: Asia Pacific Venous Diseases Treatment Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 51: Asia Pacific Venous Diseases Treatment Value Share Analysis, by Treatment Type, 2021 and 2031

Figure 52: Asia Pacific Venous Diseases Treatment Attractiveness Analysis, by Treatment Type, 2022–2031

Figure 53: Asia Pacific Venous Diseases Treatment Value Share Analysis, by Disease Type, 2021 and 2031

Figure 54: Asia Pacific Venous Diseases Treatment Attractiveness Analysis, by Disease Type, 2022–2031

Figure 55: Asia Pacific Venous Diseases Treatment Value Share Analysis, by Product Type, 2021 and 2031

Figure 56: Asia Pacific Venous Diseases Treatment Attractiveness Analysis, by Product Type, 2022–2031

Figure 57: Asia Pacific Venous Diseases Treatment Value Share Analysis, by End-use, 2021 and 2031

Figure 58: Asia Pacific Venous Diseases Treatment Attractiveness Analysis, by End-use, 2022–2031

Figure 59: Latin America Venous Diseases Treatment Value (US$ Bn) Forecast, 2017–2031

Figure 60: Latin America Venous Diseases Treatment Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 61: Latin America Venous Diseases Treatment Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 62: Latin America Venous Diseases Treatment Value Share Analysis, by Treatment Type, 2021 and 2031

Figure 63: Latin America Venous Diseases Treatment Attractiveness Analysis, by Treatment Type, 2022–2031

Figure 64: Latin America Venous Diseases Treatment Value Share Analysis, by Disease Type, 2021 and 2031

Figure 65: Latin America Venous Diseases Treatment Attractiveness Analysis, by Disease Type, 2022–2031

Figure 66: Latin America Venous Diseases Treatment Value Share Analysis, by Product Type, 2021 and 2031

Figure 67: Latin America Venous Diseases Treatment Attractiveness Analysis, by Product Type, 2022–2031

Figure 68: Latin America Venous Diseases Treatment Value Share Analysis, by End-use, 2021 and 2031

Figure 69: Latin America Venous Diseases Treatment Attractiveness Analysis, by End-use, 2022–2031

Figure 70: Middle East & Africa Venous Diseases Treatment Value (US$ Bn) Forecast, 2017–2031

Figure 71: Middle East & Africa Venous Diseases Treatment Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 72: Middle East & Africa Venous Diseases Treatment Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 73: Middle East & Africa Venous Diseases Treatment Value Share Analysis, by Treatment Type, 2021 and 2031

Figure 74: Middle East & Africa Venous Diseases Treatment Attractiveness Analysis, by Treatment Type, 2022–2031

Figure 75: Middle East & Africa Venous Diseases Treatment Value Share Analysis, by Disease Type, 2021 and 2031

Figure 76: Middle East & Africa Venous Diseases Treatment Attractiveness Analysis, by Disease Type, 2022–2031

Figure 77: Middle East & Africa Venous Diseases Treatment Value Share Analysis, by Product Type, 2021 and 2031

Figure 78: Middle East & Africa Venous Diseases Treatment Attractiveness Analysis, by Product Type, 2022–2031

Figure 79: Middle East & Africa Venous Diseases Treatment Value Share Analysis, by End-use, 2021 and 2031

Figure 80: Middle East & Africa Venous Diseases Treatment Attractiveness Analysis, by End-use, 2022–2031

Figure 81: Company Market Share Analysis, 2021