Analysts’ Viewpoint on Vehicle-to-Grid Technology Market Scenario

The automotive industry is witnessing rapid technological transformations and developments in emerging EV markets. One such development is vehicle-to-grid technology, which is gaining traction among automakers. Rise in demand for natural resources to power electric vehicles, stringent emission regulations in most of the developed and developing countries, implementation of zero emission technology, and increase in government funding and tax benefits to improve awareness about electric vehicles among the public are a few key factors that are driving the vehicle-to-grid technology market. Moreover, surge in production and sales of electric vehicles across the globe is a major factor that has contributed to the V2G market growth. Major challenges facing the market include a lack of infrastructure development and high initial cost of technology integration. However, a rise in the demand for fast charging or turbo charging stations, globally, is expected to boost the vehicle-to-grid technology market in the future. V2G technology is still in the very early stages; however, the advantages of this technology are significant and would become obvious as electric vehicles become more common.

Vehicle to grid, or V2G technology, is similar to solar panels that generate power on their own. Likewise, an electric vehicle can redistribute, stock, or even generate power with the help of the vehicle-to-grid technology. Parked electric vehicles are ideal, which only consume power, thus vehicle to grid system helps in feeding back electricity that is contained in a parked electric car’s batteries into the electrical grid. The smart grid endorses data sharing among consumers and suppliers and experiences a major issue of energy storage, as storage of large quantities of electricity is very difficult. However, the generated electricity in a vehicle is excessive or not enough to power the network and therefore, most of the output gets wasted. Here, car to grid technology, manages the electricity by balancing it out in real-time, and further adjusts the flow of electricity.

An in-depth analysis of the vehicle-to-grid technology market trends reveal that the market is likely advance significantly due to the rapid increase and development of electrification trend in the global automobile industry. Stringent government regulations associated with the electric vehicle battery cells, onboard chargers, designs of the battery pack, and thermal propagation are anticipated to offer the significant growth opportunity for the vehicle-to-grid technology market.

A vehicle-to-grid technology battery is considered as a bi-directional charging battery that can provide power to the vehicle’s electric grid and can also charge the vehicle battery. Such V2G technology is gaining traction among manufacturers of electric vehicles due to its advantages of bi-directional charging. Shortage of renewable energy sources for power generation and a scarcity of power for electric vehicles further makes the network unstable and propels the demand for more energy storage in a vehicle. However, increased power storage capacity is made available using V2G technology, which can absorb unused energy and prevent it from wastage.

Furthermore, it is also assumed that V2G technology can be utilized as an alternative energy source for domestic use, where an electric vehicle owner can supply power to his home, which is drawn by V2G battery. Such technology is still in the nascent phase, and it’s expected to create opportunities for the vehicle-to-grid technology market during the forecast period.

Government schemes and benefits across the globe, which include Zero-Emission Vehicle Program of California, U.S., European Green Cars Initiative of European Union, and Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme of India, provide incentives and tax benefits to consumers and manufacturers and further boost the demand and adoption of electric vehicles.

According to the European Environment Agency report, 2018, the air quality across Europe deteriorated due to rising vehicle emissions, which further caused rise in healthcare cost to approximately US$ 80 Bn. However, such rise in healthcare cost due to vehicle pollution further leads to enactment of government norms in order to curb vehicle emissions. Thus, rising government regulations and investments is driving the vehicle-to-grid technology market.

Based on component, the vehicle-to-grid technology market has been classified into electric vehicle supply equipment, home energy management, smart meters, and software. The electric vehicle supply equipment (EVSE) segment held a dominant share for the vehicle-to-grid technology market in 2021, owing to its increased usage for connecting electric vehicles to the grid. The EVSE is one of the key components that connects the electric vehicle and helps charge and supply energy back to the vehicle’s electric grid. Increase in trend of smart and renewable energy generation boosts the demand for EVSE, which is extensively utilized in the supply of power to grid and battery.

Based on vehicle type, the vehicle-to-grid technology market has been split into battery electric vehicles, plug-in hybrid electric vehicles, and fuel cell vehicles. The battery electric vehicles segment holds a major share of the global market in 2021 due to early implementation of vehicle-to-grid technology in battery electric vehicles. Moreover, demand for plug-in hybrid electric vehicles (PHEVs) is anticipated to rise at a rapid pace during the forecast period due to high power return capacity and large battery size of PHEVs. Furthermore, rise in demand for vehicle to everything, or V2X communication module, in new electric vehicle models also propels the market.

Analysis of the global vehicle-to-grid technology market status and challenges reveals that Europe held a dominant share of the global market, in terms of revenue, in 2021. The vehicle to grid technology in the U.K., witnessed investment by several manufacturers in the design and development of certain technologies in electric mobility and the smart energy management segment, which have led to the development of reversible charging solutions. Moreover, Groupe Renault has deployed bi-directional chargers, Renault Z.E Smart Charge, across Europe, which offer sensible and smart energy consumption. Europe has more number of on-road electric vehicles and electric vehicle manufacturers, which also boosts the vehicle-to-grid technology market. Furthermore, stringent vehicle emission norms and tax benefits and incentives provided by the governments across Europe for the adoption of electric vehicles have augmented the vehicle-to-grid market size of the region.

Asia Pacific is likely to be the second-most lucrative region of the global V2G market. Companies in Asia Pacific are creating V2G charging networks in addition to charging infrastructure. In September 2020, Nuvve Corporation stated that it would supply the essential technology for a Japan-based vehicle-to-grid (V2G) project that sought to commercialize electricity supply-demand management by 2021. Furthermore, China has taken the initiative to upgrade charging infrastructure across its states to make the transition to electric vehicles simpler. In India, according to the Automotive Research Association of India (ARAI) more than 200 EV charging stations are expected to be installed nationwide. Additionally, Tata Power, an India-based electric utility system provider, supports the National Electric Mobility Mission of the Government of India, and it has developed the country's first set of EV charging stations in Mumbai (India), which makes it simple for customers to access energy-efficient solutions.

North America also held a significant share of the global vehicle-to-grid technology market, in terms of revenue, in 2021. Additionally, v2g compatible cars of 2022, in the U.S. include Nissan LEAF, Nissan e-NV200, and Mitsubishi Outlander PHEV, are CHAdeMo, which are compatible with V2G technology. Such vehicle-to-grid solutions offer several benefits and prompt numerous other manufacturers to enter vehicle-to-grid compatible market.

The global market is split with more number of vehicle-to-grid companies controlling the market share and key companies holding the potential to drive the market, by adopting newer and advanced technologies and by making consistent changes in their charging solutions. However, mergers and acquisitions and expansion of product portfolios are major strategies that are adopted by key players. Some of the manufacturers identified in the vehicle-to-grid technology market across the globe are Energie Baden Wuerttemberg AG (EnBW), Endesa SA, NextEra Energy, Inc. (NEE), PG&E Corporation, NUVVE LTD, AC Battery Type Inc., Denso Corporation, EnerDel Inc., Coritech Services Inc., Engie Group, EV Grid, Hitachi Ltd., Nissan Motor Company Ltd., NRG Energy Inc., OVO Energy Ltd., AC Battery Type, Mitsubishi Motors Corporation.

Key players have been profiled in the vehicle-to-grid technology market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 2.78 Bn |

|

Market Forecast Value in 2031 |

US$ 20.06 Bn |

|

Growth Rate (CAGR) |

21.40% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

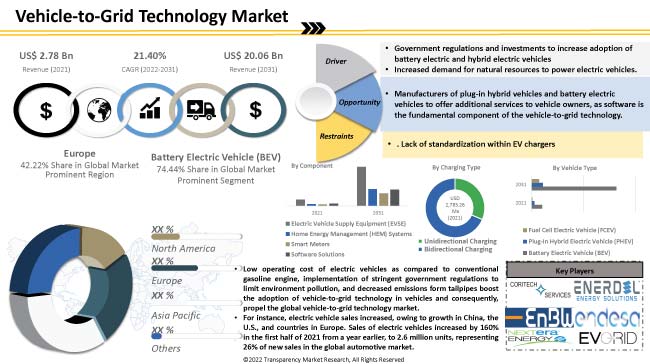

The vehicle-to-grid technology market is valued at US$ 2.78 Bn in 2021

The vehicle-to-grid technology market is expected to advance at a CAGR of 21.40% by 2031

The vehicle-to-grid technology market would be worth US$ 20.06 Bn in 2031

Increased demand for natural resources to power electric vehicles and government regulations and investments to increase adoption of battery electric and hybrid electric vehicles

In terms of component, electric vehicle supply equipment and based on vehicle type, battery electric vehicles segment dominate the vehicle-to-grid technology market

Europe is anticipated to be the highly lucrative region of the global vehicle-to-grid technology market

Energie Baden Wuerttemberg AG (EnBW), Endesa SA, NextEra Energy, Inc. (NEE), PG&E Corporation, NUVVE LTD, AC Battery Type Inc., Denso Corporation, EnerDel Inc., Coritech Services Inc., Engie Group, EV Grid, Hitachi Ltd., Nissan Motor Company Ltd., NRG Energy Inc., OVO Energy Ltd., AC Battery Type, Mitsubishi Motors Corporation.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Mn, 2017-2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage / Taxonomy

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.4.3. Value Chain Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

3. Industry Ecosystem Analysis

3.1. Value Chain Analysis

3.2. Gross Margin Analysis

4. COVID-19 Impact Analysis – Vehicle-to-Grid Technology Market

5. Business Case Study

6. Pricing Analysis

6.1. Cost Structure Analysis

6.2. Profit Margin Analysis

7. Global Vehicle-to-Grid Technology Market, by Component

7.1. Market Snapshot

7.1.1. Introduction,

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Component

7.2.1. Electric Vehicle Supply Equipment (EVSE)

7.2.2. Home Energy Management (HEM) Systems

7.2.3. Smart Meters

7.2.4. Software Solutions

8. Global Vehicle-to-Grid Technology Market, by Charging Type

8.1. Market Snapshot

8.1.1. Introduction,

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Charging Type

8.2.1. Unidirectional Charging

8.2.2. Bidirectional Charging

9. Global Vehicle-to-Grid Technology Market, by Battery Type

9.1. Market Snapshot

9.1.1. Introduction,

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Battery

9.2.1. By Battery Type

9.2.1.1. lithium-ion

9.2.1.2. Nickel-Metal Hydride

9.2.1.3. Lead-acid

9.2.1.4. Ultra-capacitors

9.2.2. By Battery Capacity

9.2.2.1. 20-40kWh

9.2.2.2. 41-70kWh

9.2.2.3. 71-100kWh

9.2.2.4. Above 100kWh

10. Global Vehicle-to-Grid Technology Market, by Vehicle Type

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

10.2.1. Battery Electric Vehicle (BEV)

10.2.2. Plug-In Hybrid Electric Vehicle (PHEV)

10.2.3. Fuel Cell Electric Vehicle (FCEV)

11. Global Vehicle-to-Grid Technology Market, by Application

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Application

11.2.1. Domestic

11.2.2. Commercial

12. Global Vehicle-to-Grid Technology Market, by Region

12.1. Market Snapshot

12.1.1. Introduction, Definition, and Key Findings

12.1.2. Market Growth & Y-o-Y Projections

12.1.3. Base Point Share Analysis

12.2. Global Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Region

12.2.1. North America

12.2.2. Europe

12.2.3. Asia Pacific

12.2.4. Middle East & Africa

12.2.5. South America

13. North America Vehicle-to-Grid Technology Market

13.1. Market Snapshot

13.2. North America Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Component

13.2.1. Electric Vehicle Supply Equipment (EVSE)

13.2.2. Home Energy Management (HEM) Systems

13.2.3. Smart Meters

13.2.4. Software Solutions

13.3. North America Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Charging Type

13.3.1. Unidirectional Charging

13.3.2. Bidirectional Charging

13.4. North America Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Battery

13.4.1. By Battery Type

13.4.1.1. lithium-ion

13.4.1.2. Nickel-Metal Hydride

13.4.1.3. Lead-acid

13.4.1.4. Ultra-capacitors

13.4.2. By Battery Capacity

13.4.2.1. 20-40kWh

13.4.2.2. 41-70kWh

13.4.2.3. 71-100kWh

13.4.2.4. Above 100kWh

13.5. North America Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

13.5.1. Battery Electric Vehicle (BEV)

13.5.2. Plug-In Hybrid Electric Vehicle (PHEV)

13.5.3. Fuel Cell Electric Vehicle (FCEV)

13.6. North America Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Application

13.6.1. Domestic

13.6.2. Commercial

13.7. Key Country Analysis – North America Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031

13.7.1. U.S.

13.7.2. Canada

13.7.3. Mexico

14. Europe Vehicle-to-Grid Technology Market

14.1. Market Snapshot

14.2. Europe Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Component

14.2.1. Electric Vehicle Supply Equipment (EVSE)

14.2.2. Home Energy Management (HEM) Systems

14.2.3. Smart Meters

14.2.4. Software Solutions

14.3. Europe Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Charging Type

14.3.1. Unidirectional Charging

14.3.2. Bidirectional Charging

14.4. Europe Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Battery

14.4.1. By Battery Type

14.4.1.1. lithium-ion

14.4.1.2. Nickel-Metal Hydride

14.4.1.3. Lead-acid

14.4.1.4. Ultra-capacitors

14.4.2. By Battery Capacity

14.4.2.1. 20-40kWh

14.4.2.2. 41-70kWh

14.4.2.3. 71-100kWh

14.4.2.4. Above 100kWh

14.5. Europe Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

14.5.1. Battery Electric Vehicle (BEV)

14.5.2. Plug-In Hybrid Electric Vehicle (PHEV)

14.5.3. Fuel Cell Electric Vehicle (FCEV)

14.6. Europe Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Application

14.6.1. Domestic

14.6.2. Commercial

14.7. Key Country Analysis – Europe Vehicle-to- Grid Technology Market Size Analysis & Forecast, 2017-2031

14.7.1. Germany

14.7.2. U. K.

14.7.3. France

14.7.4. Italy

14.7.5. Spain

14.7.6. Nordic Countries

14.7.7. Russia & CIS

14.7.8. Rest of Europe

15. Asia Pacific Vehicle-to-Grid Technology Market

15.1. Market Snapshot

15.2. Asia Pacific Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Component

15.2.1. Electric Vehicle Supply Equipment (EVSE)

15.2.2. Home Energy Management (HEM) Systems

15.2.3. Smart Meters

15.2.4. Software Solutions

15.3. Asia Pacific Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Charging Type

15.3.1. Unidirectional Charging

15.3.2. Bidirectional Charging

15.4. Asia Pacific Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Battery

15.4.1. By Battery Type

15.4.1.1. lithium-ion

15.4.1.2. Nickel-Metal Hydride

15.4.1.3. Lead-acid

15.4.1.4. Ultra-capacitors

15.4.2. By Battery Capacity

15.4.2.1. 20-40kWh

15.4.2.2. 41-70kWh

15.4.2.3. 71-100kWh

15.4.2.4. Above 100kWh

15.5. Asia Pacific Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

15.5.1. Battery Electric Vehicle (BEV)

15.5.2. Plug-In Hybrid Electric Vehicle (PHEV)

15.5.3. Fuel Cell Electric Vehicle (FCEV)

15.6. Asia Pacific Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Application

15.6.1. Domestic

15.6.2. Commercial

15.7. Key Country Analysis – Asia Pacific Vehicle- to-Grid Technology Market Size Analysis & Forecast, 2017-2031

15.7.1. China

15.7.2. India

15.7.3. Japan

15.7.4. ASEAN Countries

15.7.5. South Korea

15.7.6. ANZ

15.7.7. Rest of Asia Pacific

16. Middle East & Africa Vehicle-to-Grid Technology Market

16.1. Market Snapshot

16.2. Middle East & Africa Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Component

16.2.1. Electric Vehicle Supply Equipment (EVSE)

16.2.2. Home Energy Management (HEM) Systems

16.2.3. Smart Meters

16.2.4. Software Solutions

16.3. Middle East & Africa Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Charging Type

16.3.1. Unidirectional Charging

16.3.2. Bidirectional Charging

16.4. Middle East & Africa Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Battery

16.4.1. By Battery Type

16.4.1.1. lithium-ion

16.4.1.2. Nickel-Metal Hydride

16.4.1.3. Lead-acid

16.4.1.4. Ultra-capacitors

16.4.2. By Battery Capacity

16.4.2.1. 20-40kWh

16.4.2.2. 41-70kWh

16.4.2.3. 71-100kWh

16.4.2.4. Above 100kWh

16.5. Middle East & Africa Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

16.5.1. Battery Electric Vehicle (BEV)

16.5.2. Plug-In

16.5.3. Fuel Cell Electric Vehicle (FCEV)

16.6. Middle East & Africa Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Application

16.6.1. Domestic

16.6.2. Commercial

16.7. Key Country Analysis – Middle East & Africa Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031

16.7.1. GCC

16.7.2. South Africa

16.7.3. Turkey

16.7.4. Rest of Middle East & Africa

17. South America Vehicle-to-Grid Technology Market

17.1. Market Snapshot

17.2. South America Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Component

17.2.1. Electric Vehicle Supply Equipment (EVSE)

17.2.2. Home Energy Management (HEM) Systems

17.2.3. Smart Meters

17.2.4. Software Solutions

17.3. South America Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Charging Type

17.3.1. Unidirectional Charging

17.3.2. Bidirectional Charging

17.4. South America Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Battery

17.4.1. By Battery Type

17.4.1.1. lithium-ion

17.4.1.2. Nickel-Metal Hydride

17.4.1.3. Lead-acid

17.4.1.4. Ultra-capacitors

17.4.2. By Battery Capacity

17.4.2.1. 20-40kWh

17.4.2.2. 41-70kWh

17.4.2.3. 71-100kWh

17.4.2.4. Above 100kWh

17.5. South America Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

17.5.1. Battery Electric Vehicle (BEV)

17.5.2. Plug-In Hybrid Electric Vehicle (PHEV)

17.5.3. Fuel Cell Electric Vehicle (FCEV)

17.6. South America Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031, by Application

17.6.1. Domestic

17.6.2. Commercial

17.7. Key Country Analysis – South America Vehicle-to-Grid Technology Market Size Analysis & Forecast, 2017-2031

17.7.1. Brazil

17.7.2. Argentina

17.7.3. Rest of South America

18. Competitive Landscape

18.1. Company Share Analysis/ Brand Share Analysis, 2021

18.2. Pricing comparison among key players

18.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

19. Company Profile/ Key Players

19.1. Energie Baden Wuerttemberg AG (EnBW)

19.1.1. Company Overview

19.1.2. Company Footprints

19.1.3. Production Locations

19.1.4. Product Portfolio

19.1.5. Competitors & Customers

19.1.6. Subsidiaries & Parent Organization

19.1.7. Recent Developments

19.1.8. Financial Analysis

19.1.9. Profitability

19.1.10. Revenue Share

19.2. Endesa SA

19.2.1. Company Overview

19.2.2. Company Footprints

19.2.3. Production Locations

19.2.4. Product Portfolio

19.2.5. Competitors & Customers

19.2.6. Subsidiaries & Parent Organization

19.2.7. Recent Developments

19.2.8. Financial Analysis

19.2.9. Profitability

19.2.10. Revenue Share

19.3. NextEra Energy, Inc. (NEE)

19.3.1. Company Overview

19.3.2. Company Footprints

19.3.3. Production Locations

19.3.4. Product Portfolio

19.3.5. Competitors & Customers

19.3.6. Subsidiaries & Parent Organization

19.3.7. Recent Developments

19.3.8. Financial Analysis

19.3.9. Profitability

19.3.10. Revenue Share

19.4. PG&E Corporation

19.4.1. Company Overview

19.4.2. Company Footprints

19.4.3. Production Locations

19.4.4. Product Portfolio

19.4.5. Competitors & Customers

19.4.6. Subsidiaries & Parent Organization

19.4.7. Recent Developments

19.4.8. Financial Analysis

19.4.9. Profitability

19.4.10. Revenue Share

19.5. NUVVE LTD

19.5.1. Company Overview

19.5.2. Company Footprints

19.5.3. Production Locations

19.5.4. Product Portfolio

19.5.5. Competitors & Customers

19.5.6. Subsidiaries & Parent Organization

19.5.7. Recent Developments

19.5.8. Financial Analysis

19.5.9. Profitability

19.5.10. Revenue Share

19.6. AC Battery Type Inc.

19.6.1. Company Overview

19.6.2. Company Footprints

19.6.3. Production Locations

19.6.4. Product Portfolio

19.6.5. Competitors & Customers

19.6.6. Subsidiaries & Parent Organization

19.6.7. Recent Developments

19.6.8. Financial Analysis

19.6.9. Profitability

19.6.10. Revenue Share

19.7. DENSO Corporation

19.7.1. Company Overview

19.7.2. Company Footprints

19.7.3. Production Locations

19.7.4. Product Portfolio

19.7.5. Competitors & Customers

19.7.6. Subsidiaries & Parent Organization

19.7.7. Recent Developments

19.7.8. Financial Analysis

19.7.9. Profitability

19.7.10. Revenue Share

19.8. EnerDel Inc.

19.8.1. Company Overview

19.8.2. Company Footprints

19.8.3. Production Locations

19.8.4. Product Portfolio

19.8.5. Competitors & Customers

19.8.6. Subsidiaries & Parent Organization

19.8.7. Recent Developments

19.8.8. Financial Analysis

19.8.9. Profitability

19.8.10. Revenue Share

19.9. Coritech Services Inc.

19.9.1. Company Overview

19.9.2. Company Footprints

19.9.3. Production Locations

19.9.4. Product Portfolio

19.9.5. Competitors & Customers

19.9.6. Subsidiaries & Parent Organization

19.9.7. Recent Developments

19.9.8. Financial Analysis

19.9.9. Profitability

19.9.10. Revenue Share

19.10. Engie Group

19.10.1. Company Overview

19.10.2. Company Footprints

19.10.3. Production Locations

19.10.4. Product Portfolio

19.10.5. Competitors & Customers

19.10.6. Subsidiaries & Parent Organization

19.10.7. Recent Developments

19.10.8. Financial Analysis

19.10.9. Profitability

19.10.10. Revenue Share

19.11. EV Grid

19.11.1. Company Overview

19.11.2. Company Footprints

19.11.3. Production Locations

19.11.4. Product Portfolio

19.11.5. Competitors & Customers

19.11.6. Subsidiaries & Parent Organization

19.11.7. Recent Developments

19.11.8. Financial Analysis

19.11.9. Profitability

19.11.10. Revenue Share

19.12. Hitachi Ltd.

19.12.1. Company Overview

19.12.2. Company Footprints

19.12.3. Production Locations

19.12.4. Product Portfolio

19.12.5. Competitors & Customers

19.12.6. Subsidiaries & Parent Organization

19.12.7. Recent Developments

19.12.8. Financial Analysis

19.12.9. Profitability

19.12.10. Revenue Share

19.13. Nissan Motor Company Ltd.

19.13.1. Company Overview

19.13.2. Company Footprints

19.13.3. Production Locations

19.13.4. Product Portfolio

19.13.5. Competitors & Customers

19.13.6. Subsidiaries & Parent Organization

19.13.7. Recent Developments

19.13.8. Financial Analysis

19.13.9. Profitability

19.13.10. Revenue Share

19.14. NRG Energy Inc.

19.14.1. Company Overview

19.14.2. Company Footprints

19.14.3. Production Locations

19.14.4. Product Portfolio

19.14.5. Competitors & Customers

19.14.6. Subsidiaries & Parent Organization

19.14.7. Recent Developments

19.14.8. Financial Analysis

19.14.9. Profitability

19.14.10. Revenue Share

19.15. OVO Energy Ltd.

19.15.1. Company Overview

19.15.2. Company Footprints

19.15.3. Production Locations

19.15.4. Product Portfolio

19.15.5. Competitors & Customers

19.15.6. Subsidiaries & Parent Organization

19.15.7. Recent Developments

19.15.8. Financial Analysis

19.15.9. Profitability

19.15.10. Revenue Share

19.16. AC Battery Type

19.16.1. Company Overview

19.16.2. Company Footprints

19.16.3. Production Locations

19.16.4. Product Portfolio

19.16.5. Competitors & Customers

19.16.6. Subsidiaries & Parent Organization

19.16.7. Recent Developments

19.16.8. Financial Analysis

19.16.9. Profitability

19.16.10. Revenue Share

19.17. Mitsubishi Motors Corporation

19.17.1. Company Overview

19.17.2. Company Footprints

19.17.3. Production Locations

19.17.4. Product Portfolio

19.17.5. Competitors & Customers

19.17.6. Subsidiaries & Parent Organization

19.17.7. Recent Developments

19.17.8. Financial Analysis

19.17.9. Profitability

19.17.10. Revenue Share

19.18. Other Key Players

List of Tables

Table 1: Global Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Component, 2017-2031

Table 2: Global Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Charging Type, 2017-2031

Table 3: Global Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Battery, 2017-2031

Table 4: Global Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 5: Global Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 6: Global Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 7: North America Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Component, 2017-2031

Table 8: North America Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Charging Type, 2017-2031

Table 9: North America Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Battery, 2017-2031

Table 10: North America Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 11: North America Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 12: North America Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 13: Europe Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Component, 2017-2031

Table 14: Europe Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Charging Type, 2017-2031

Table 15: Europe Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Battery, 2017-2031

Table 16: Europe Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 17: Europe Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 18: Europe Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

Table 19: Asia Pacific Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Component, 2017-2031

Table 20: Asia Pacific Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Charging Type, 2017-2031

Table 21: Asia Pacific Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Battery, 2017-2031

Table 22: Asia Pacific Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 23: Asia Pacific Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 24: Asia Pacific Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

Table 25: Middle East & Africa Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Component, 2017-2031

Table 26: Middle East & Africa Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Charging Type, 2017-2031

Table 27: Middle East & Africa Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Battery, 2017-2031

Table 28: Middle East & Africa Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 29: Middle East & Africa Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 30: Middle East & Africa Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

Table 31: South America Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Component, 2017-2031

Table 32: South America Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Charging Type, 2017-2031

Table 33: South America Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Battery, 2017-2031

Table 34: South America Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 35: South America Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 36: South America Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

List of Figures

Figure 1: Global Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Component, 2017-2031

Figure 2: Global Vehicle-to-Grid Technology Market, Incremental Opportunity, by Component, Value (US$ Mn), 2022-2031

Figure 3: Global Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Charging Type, 2017-2031

Figure 4: Global Vehicle-to-Grid Technology Market, Incremental Opportunity, by Charging Type, Value (US$ Mn), 2022-2031

Figure 5: Global Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Battery, 2017-2031

Figure 6: Global Vehicle-to-Grid Technology Market, Incremental Opportunity, by Battery, Value (US$ Mn), 2022-2031

Figure 7: Global Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 8: Global Vehicle-to-Grid Technology Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022-2031

Figure 9: Global Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 10: Global Vehicle-to-Grid Technology Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 11: Global Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Region, 2017-2031

Figure 12: Global Vehicle-to-Grid Technology Market, Incremental Opportunity, by Region, Value (US$ Mn), 2022-2031

Figure 13: North America Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Component, 2017-2031

Figure 14: North America Vehicle-to-Grid Technology Market, Incremental Opportunity, by Component, Value (US$ Mn), 2022-2031

Figure 15: North America Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Charging Type, 2017-2031

Figure 16: North America Vehicle-to-Grid Technology Market, Incremental Opportunity, by Charging Type, Value (US$ Mn), 2022-2031

Figure 17: North America Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Battery, 2017-2031

Figure 18: North America Vehicle-to-Grid Technology Market, Incremental Opportunity, by Battery, Value (US$ Mn), 2022-2031

Figure 19: North America Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 20: North America Vehicle-to-Grid Technology Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022-2031

Figure 21: North America Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 22: North America Vehicle-to-Grid Technology Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 23: North America Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 24: North America Vehicle-to-Grid Technology Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022-2031

Figure 25: Europe Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Component, 2017-2031

Figure 26: Europe Vehicle-to-Grid Technology Market, Incremental Opportunity, by Component, Value (US$ Mn), 2022-2031

Figure 27: Europe Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Charging Type, 2017-2031

Figure 28: Europe Vehicle-to-Grid Technology Market, Incremental Opportunity, by Charging Type, Value (US$ Mn), 2022-2031

Figure 29: Europe Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Battery, 2017-2031

Figure 30: Europe Vehicle-to-Grid Technology Market, Incremental Opportunity, by Battery, Value (US$ Mn), 2022-2031

Figure 31: Europe Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 32: Europe Vehicle-to-Grid Technology Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022-2031

Figure 33: Europe Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 34: Europe Vehicle-to-Grid Technology Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 35: Europe Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

Figure 36: Europe Vehicle-to-Grid Technology Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Mn), 2022-2031

Figure 37: Asia Pacific Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Component, 2017-2031

Figure 38: Asia Pacific Vehicle-to-Grid Technology Market, Incremental Opportunity, by Component, Value (US$ Mn), 2022-2031

Figure 39: Asia Pacific Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Charging Type, 2017-2031

Figure 40: Asia Pacific Vehicle-to-Grid Technology Market, Incremental Opportunity, by Charging Type, Value (US$ Mn), 2022-2031

Figure 41: Asia Pacific Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Battery, 2017-2031

Figure 42: Asia Pacific Vehicle-to-Grid Technology Market, Incremental Opportunity, by Battery, Value (US$ Mn), 2022-2031

Figure 43: Asia Pacific Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 44: Asia Pacific Vehicle-to-Grid Technology Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022-2031

Figure 45: Asia Pacific Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 46: Asia Pacific Vehicle-to-Grid Technology Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 47: Asia Pacific Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

Figure 48: Asia Pacific Vehicle-to-Grid Technology Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Mn), 2022-2031

Figure 49: Middle East & Africa Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Component, 2017-2031

Figure 50: Middle East & Africa Vehicle-to-Grid Technology Market, Incremental Opportunity, by Component, Value (US$ Mn), 2022-2031

Figure 51: Middle East & Africa Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Charging Type, 2017-2031

Figure 52: Middle East & Africa Vehicle-to-Grid Technology Market, Incremental Opportunity, by Charging Type, Value (US$ Mn), 2022-2031

Figure 53: Middle East & Africa Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Battery, 2017-2031

Figure 54: Middle East & Africa Vehicle-to-Grid Technology Market, Incremental Opportunity, by Battery, Value (US$ Mn), 2022-2031

Figure 55: Middle East & Africa Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 56: Middle East & Africa Vehicle-to-Grid Technology Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022-2031

Figure 57: Middle East & Africa Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 58: Middle East & Africa Vehicle-to-Grid Technology Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 59: Middle East & Africa Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

Figure 60: Middle East & Africa Vehicle-to-Grid Technology Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Mn), 2022-2031

Figure 61: South America Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Component, 2017-2031

Figure 62: South America Vehicle-to-Grid Technology Market, Incremental Opportunity, by Component, Value (US$ Mn), 2022-2031

Figure 63: South America Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Charging Type, 2017-2031

Figure 64: South America Vehicle-to-Grid Technology Market, Incremental Opportunity, by Charging Type, Value (US$ Mn), 2022-2031

Figure 65: South America Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Battery, 2017-2031

Figure 66: South America Vehicle-to-Grid Technology Market, Incremental Opportunity, by Battery, Value (US$ Mn), 2022-2031

Figure 67: South America Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 68: South America Vehicle-to-Grid Technology Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022-2031

Figure 69: South America Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 70: South America Vehicle-to-Grid Technology Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 71: South America Vehicle-to-Grid Technology Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

Figure 72: South America Vehicle-to-Grid Technology Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Mn), 2022-2031