Analysts’ Viewpoint

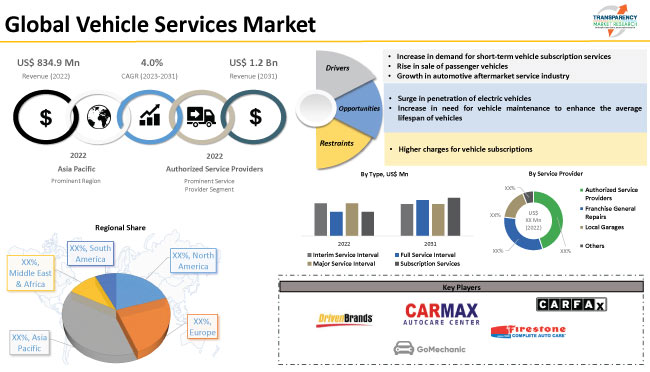

Rise in demand for passenger vehicles and growth in automotive aftermarket service industry are anticipated to drive the vehicle services market share during the forecast period. Surge in penetration of electric vehicles across the globe is also contributing to market expansion. Furthermore, increase in demand for short-term vehicle subscriptions and rise in concern regarding automotive carbon emissions are boosting vehicle services industry growth.

Authorized vehicle service centers are offering annual subscription plans along with various exciting discounts and rewards to attract customers. This is creating lucrative opportunities for raw material suppliers catering to the vehicle services market. Leading players are launching new service facilities and innovative products with advanced technologies to enhance their market share.

Repair and maintenance work carried out at a vehicle service center helps improve the performance of the vehicle. This, in turn, increases the average lifespan of the vehicle. Vehicle servicing is primarily carried out at company specified/authorized service centers as well as local garages.

Vehicle services primarily include changing of engine oil and several other components that are in continuous operation. It also comprises filter replacement, and checking of tires & lights and operations of steering & brakes. Servicing needs to be performed at regular intervals, since vehicle components are susceptible to wear and tear, and require adequate maintenance.

Growth in demand for shared mobility is boosting the demand for vehicle maintenance services. Furthermore, rise in demand for passenger vehicles, issues in spare parts, and surge in need for technologically advanced components in vehicles are key factors driving market growth.

Service centers are attracting customers through strategies such as discounts and rewards on annual services and maintenance of vehicles. This is creating lucrative vehicle services market opportunities for industry players. Increase in automotive sales and implementation of stringent government regulations to upgrade or replace damaged components are the key factors that are positively impacting the vehicle services market value. However, rise in raw material prices and high monthly charges for short-term subscription plans are likely to hamper market statistics in the next few years.

Increase in trend of customization of vehicles, rise in automotive safety norms, growth in disposable income, and surge in demand for advanced features in vehicles are creating value-grab market opportunities for key players. Authorized service providers are offering quick and reliable services for vehicles that are less than three years old.

Vehicle service market demand is rising consistently due to the increase in number of on-road vehicles across the globe. Each vehicle has to undergo servicing after a specific time interval to enhance efficiency.

Vehicle owners have higher level of trust in authorized service centers, owing to the usage of proper materials and components along with surety of quick and efficient service. They tend to visit authorized dealers for maintenance work, until the end of the vehicle warranty period. Several customers also prefer to extend warranties for hassle-free vehicle operation.

Growth in the automotive industry, rise in penetration of connected cars and electric vehicles, and increase in transportation activities across the globe are fueling the demand for vehicle repair & maintenance services. The automobile sector is particularly promising in developing countries such as India, China, and Brazil.

According to Tata Motors, sales of domestic passenger vehicles rose by 47.0% in February 2022. Additionally, passenger automobile registrations in the European Union surged by around 10.0% in June 2021 compared to that in the previous year. These indicate the steep growth of the automobile sector across the globe.

Demand for high-end utility vehicles is rising due to the increase in tour and leisure activities. In December 2022, Maruti Suzuki and Mahindra and Mahindra, prominent automobile manufacturers based in India, recorded 22.3% and 62.2% rise in sales of automobiles, respectively.

According to the vehicle services industry research report, Asia Pacific is projected to dominate the global market during the forecast period. The region comprises major developing countries with significant population such as India and China. Demand for vehicle services is rising in Asia Pacific due the increase in vehicle production, development of road connectivity & infrastructure, and lucrative presence of key manufacturers.

Increase in demand for passenger vehicles and rise in per capita income in emerging economies are also contributing to market growth in Asia Pacific. For instance, there were 22 cars per 1000 people in India in 2022. This is anticipated to bolster vehicle services market development in the region.

North America and Europe are also expected to account for significant share during the forecast period. Vehicle owners in these regions are aware of the importance of vehicle maintenance services. For instance, the average age of vehicles rose to 12.1 years in these regions in 2021 vis-à-vis 11.9 years in 2020.

The global market is fragmented; it is controlled by established companies. According to the vehicle services market forecast report, companies are developing supply chain networks to enhance their revenue. New entrants are expected to record substantial profit margins in the next few years. Key players are strengthening their market position through strategies such as partnerships, mergers, acquisitions, and development of product portfolios.

Arnold Clark Automobiles Limited, Carfax Car Care, Carmax Autocare Center, Conroe's Choice Automotive, Driven Brands, Inc., Firestone Complete Auto Care, Gomechanic, Halfords Group Plc., Jiffy Lube International, Inc., Lookers Group, Monro Muffler Brake, and Pendragon Vehicle Management are some of the prominent vehicle services market players across the globe.

Prominent players have been profiled in the vehicle services market report based on parameters such as financial overview, company overview, business strategies, business segments, recent developments, and product portfolio.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 834.9 Mn |

|

Market Forecast Value in 2031 |

US$ 1.2 Bn |

|

Growth Rate (CAGR) |

4.0% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Mn/Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 834.9 Mn in 2022.

It is expected to grow at a CAGR of 4.0% by 2031.

It would be worth US$ 1.2 Bn in 2031.

Increase in demand for short-term vehicle subscription services, rise in sale of passenger vehicles, and growth in automotive aftermarket services.

In terms of service provider, the authorized service providers segment is likely to account for major share during the forecast period.

Asia Pacific is anticipated to be a highly lucrative region for vendors.

Arnold Clark Automobiles Limited, Carfax Car Care, Carmax Autocare Center, Conroe's Choice Automotive, Driven Brands, Inc., Firestone Complete Auto Care, Gomechanic, Halfords Group Plc., Jiffy Lube International, Inc., Lookers Group, Monro Muffler Brake, and Pendragon Vehicle Management.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Value US$ Mn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. COVID-19 Impact Analysis – Vehicle Services Market

4. Global Vehicle Services Market, By Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Vehicle Services Market Size & Forecast, 2017-2031, By Type

4.2.1. Interim Service Interval

4.2.2. Full Service Interval

4.2.3. Major Service Interval

4.2.4. Subscription Services

5. Global Vehicle Services Market, By Service Provider

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Vehicle Services Market Size & Forecast, 2017-2031, By Service Provider

5.2.1. Authorized Service Providers

5.2.2. Franchise General Repairs

5.2.3. Local Garages

5.2.4. Others

6. Global Vehicle Services Market, By Vehicle Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Vehicle Services Market Size & Forecast, 2017-2031, By Vehicle Type

6.2.1. 2-Wheelers & 3-Wheelers

6.2.2. Passenger Cars

6.2.2.1. Hatchbacks

6.2.2.2. Sedans

6.2.2.3. Utility Vehicles

6.2.3. Light Commercial Vehicles

6.2.4. Heavy-duty Trucks

6.2.5. Buses & Coaches

7. Global Vehicle Services Market, By Propulsion

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Vehicle Services Market Size & Forecast, 2017-2031, By Propulsion

7.2.1. IC Engine

7.2.1.1. Diesel

7.2.1.2. Gasoline

7.2.2. Electric

8. Global Vehicle Services Market, by Region

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Vehicle Services Market Size & Forecast, 2017-2031, By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Vehicle Services Market

9.1. Market Snapshot

9.2. North America Vehicle Services Market Size & Forecast, 2017-2031, By Type

9.2.1. Interim Service Interval

9.2.2. Full Service Interval

9.2.3. Major Service Interval

9.2.4. Subscription Services

9.3. North America Vehicle Services Market Size & Forecast, 2017-2031, By Service Provider

9.3.1. Authorized Service Providers

9.3.2. Franchise General Repairs

9.3.3. Local Garages

9.3.4. Others

9.4. North America Vehicle Services Market Size & Forecast, 2017-2031, By Vehicle Type

9.4.1. 2-Wheelers & 3-Wheelers

9.4.2. Passenger Cars

9.4.2.1. Hatchbacks

9.4.2.2. Sedans

9.4.2.3. Utility Vehicles

9.4.3. Light Commercial Vehicles

9.4.4. Heavy-duty Trucks

9.4.5. Buses & Coaches

9.5. North America Vehicle Services Market Size & Forecast, 2017-2031, By Propulsion

9.5.1. IC Engine

9.5.1.1. Diesel

9.5.1.2. Gasoline

9.5.2. Electric

9.6. North America Vehicle Services Market Size & Forecast, 2017-2031, By Country

9.6.1. The U. S.

9.6.2. Canada

9.6.3. Mexico

10. Europe Vehicle Services Market

10.1. Market Snapshot

10.2. Europe Vehicle Services Market Size & Forecast, 2017-2031, By Type

10.2.1. Interim Service Interval

10.2.2. Full Service Interval

10.2.3. Major Service Interval

10.2.4. Subscription Services

10.3. Europe Vehicle Services Market Size & Forecast, 2017-2031, By Service Provider

10.3.1. Authorized Service Providers

10.3.2. Franchise General Repairs

10.3.3. Local Garages

10.3.4. Others

10.4. Europe Vehicle Services Market Size & Forecast, 2017-2031, By Vehicle Type

10.4.1. 2-Wheelers & 3-Wheelers

10.4.2. Passenger Cars

10.4.2.1. Hatchbacks

10.4.2.2. Sedans

10.4.2.3. Utility Vehicles

10.4.3. Light Commercial Vehicles

10.4.4. Heavy-duty Trucks

10.4.5. Buses & Coaches

10.5. Europe Vehicle Services Market Size & Forecast, 2017-2031, By Propulsion

10.5.1. IC Engine

10.5.1.1. Diesel

10.5.1.2. Gasoline

10.5.2. Electric

10.6. Europe Vehicle Services Market Size & Forecast, 2017-2031, By Country

10.6.1. Germany

10.6.2. U. K.

10.6.3. France

10.6.4. Italy

10.6.5. Spain

10.6.6. Nordic Countries

10.6.7. Russia & CIS

10.6.8. Rest of Europe

11. Asia Pacific Vehicle Services Market

11.1. Market Snapshot

11.2. Asia Pacific Vehicle Services Market Size & Forecast, 2017-2031, By Type

11.2.1. Interim Service Interval

11.2.2. Full Service Interval

11.2.3. Major Service Interval

11.2.4. Subscription Services

11.3. Asia Pacific Vehicle Services Market Size & Forecast, 2017-2031, By Service Provider

11.3.1. Authorized Service Providers

11.3.2. Franchise General Repairs

11.3.3. Local Garages

11.3.4. Others

11.4. Asia Pacific Vehicle Services Market Size & Forecast, 2017-2031, By Vehicle Type

11.4.1. 2-Wheelers & 3-Wheelers

11.4.2. Passenger Cars

11.4.2.1. Hatchbacks

11.4.2.2. Sedans

11.4.2.3. Utility Vehicles

11.4.3. Light Commercial Vehicles

11.4.4. Heavy-duty Trucks

11.4.5. Buses & Coaches

11.5. Asia Pacific Vehicle Services Market Size & Forecast, 2017-2031, By Propulsion

11.5.1. IC Engine

11.5.1.1. Diesel

11.5.1.2. Gasoline

11.5.2. Electric

11.6. Asia Pacific Vehicle Services Market Size & Forecast, 2017-2031, By Country

11.6.1. China

11.6.2. India

11.6.3. Japan

11.6.4. ASEAN Countries

11.6.5. South Korea

11.6.6. ANZ

11.6.7. Rest of Asia Pacific

12. Middle East & Africa Vehicle Services Market

12.1. Market Snapshot

12.2. Middle East & Africa Vehicle Services Market Size & Forecast, 2017-2031, By Type

12.2.1. Interim Service Interval

12.2.2. Full Service Interval

12.2.3. Major Service Interval

12.2.4. Subscription Services

12.3. Middle East & Africa Vehicle Services Market Size & Forecast, 2017-2031, By Service Provider

12.3.1. Authorized Service Providers

12.3.2. Franchise General Repairs

12.3.3. Local Garages

12.3.4. Others

12.4. Middle East & Africa Vehicle Services Market Size & Forecast, 2017-2031, By Vehicle Type

12.4.1. 2-Wheelers & 3-Wheelers

12.4.2. Passenger Cars

12.4.2.1. Hatchbacks

12.4.2.2. Sedans

12.4.2.3. Utility Vehicles

12.4.3. Light Commercial Vehicles

12.4.4. Heavy-duty Trucks

12.4.5. Buses & Coaches

12.5. Middle East & Africa Vehicle Services Market Size & Forecast, 2017-2031, By Propulsion

12.5.1. IC Engine

12.5.1.1. Diesel

12.5.1.2. Gasoline

12.5.2. Electric

12.6. Middle East & Africa Vehicle Services Market Size & Forecast, 2017-2031, By Country

12.6.1. GCC

12.6.2. South Africa

12.6.3. Turkey

12.6.4. Rest of Middle East & Africa

13. South America Vehicle Services Market

13.1. Market Snapshot

13.2. South America Vehicle Services Market Size & Forecast, 2017-2031, By Type

13.2.1. Interim Service Interval

13.2.2. Full Service Interval

13.2.3. Major Service Interval

13.2.4. Subscription Services

13.3. South America Vehicle Services Market Size & Forecast, 2017-2031, By Service Provider

13.3.1. Authorized Service Providers

13.3.2. Franchise General Repairs

13.3.3. Local Garages

13.3.4. Others

13.4. South America Vehicle Services Market Size & Forecast, 2017-2031, By Vehicle Type

13.4.1. 2-Wheelers & 3-Wheelers

13.4.2. Passenger Cars

13.4.2.1. Hatchbacks

13.4.2.2. Sedans

13.4.2.3. Utility Vehicles

13.4.3. Light Commercial Vehicles

13.4.4. Heavy-duty Trucks

13.4.5. Buses & Coaches

13.5. South America Vehicle Services Market Size & Forecast, 2017-2031, By Propulsion

13.5.1. IC Engine

13.5.1.1. Diesel

13.5.1.2. Gasoline

13.5.2. Electric

13.6. South America Vehicle Services Market Size & Forecast, 2017-2031, By Country

13.6.1. Brazil

13.6.2. Argentina

13.6.3. Rest of South America

14. Competitive Landscape

14.1. Company Share Analysis/ Brand Share Analysis, 2022

14.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

15. Company Profile/ Key Players

15.1. Arnold Clark Automobiles Limited

15.1.1. Company Overview

15.1.2. Company Footprints

15.1.3. Production Locations

15.1.4. Product Portfolio

15.1.5. Competitors & Customers

15.1.6. Subsidiaries & Parent Organization

15.1.7. Recent Developments

15.1.8. Financial Analysis

15.1.9. Profitability

15.1.10. Revenue Share

15.2. Carfax Car Care

15.2.1. Company Overview

15.2.2. Company Footprints

15.2.3. Production Locations

15.2.4. Product Portfolio

15.2.5. Competitors & Customers

15.2.6. Subsidiaries & Parent Organization

15.2.7. Recent Developments

15.2.8. Financial Analysis

15.2.9. Profitability

15.2.10. Revenue Share

15.3. Carmax Autocare Center

15.3.1. Company Overview

15.3.2. Company Footprints

15.3.3. Production Locations

15.3.4. Product Portfolio

15.3.5. Competitors & Customers

15.3.6. Subsidiaries & Parent Organization

15.3.7. Recent Developments

15.3.8. Financial Analysis

15.3.9. Profitability

15.3.10. Revenue Share

15.4. Conroe's Choice Automotive

15.4.1. Company Overview

15.4.2. Company Footprints

15.4.3. Production Locations

15.4.4. Product Portfolio

15.4.5. Competitors & Customers

15.4.6. Subsidiaries & Parent Organization

15.4.7. Recent Developments

15.4.8. Financial Analysis

15.4.9. Profitability

15.4.10. Revenue Share

15.5. Driven Brands, Inc.

15.5.1. Company Overview

15.5.2. Company Footprints

15.5.3. Production Locations

15.5.4. Product Portfolio

15.5.5. Competitors & Customers

15.5.6. Subsidiaries & Parent Organization

15.5.7. Recent Developments

15.5.8. Financial Analysis

15.5.9. Profitability

15.5.10. Revenue Share

15.6. Firestone Complete Auto Care

15.6.1. Company Overview

15.6.2. Company Footprints

15.6.3. Production Locations

15.6.4. Product Portfolio

15.6.5. Competitors & Customers

15.6.6. Subsidiaries & Parent Organization

15.6.7. Recent Developments

15.6.8. Financial Analysis

15.6.9. Profitability

15.6.10. Revenue Share

15.7. Gomechanic

15.7.1. Company Overview

15.7.2. Company Footprints

15.7.3. Production Locations

15.7.4. Product Portfolio

15.7.5. Competitors & Customers

15.7.6. Subsidiaries & Parent Organization

15.7.7. Recent Developments

15.7.8. Financial Analysis

15.7.9. Profitability

15.7.10. Revenue Share

15.8. Halfords Group Plc.

15.8.1. Company Overview

15.8.2. Company Footprints

15.8.3. Production Locations

15.8.4. Product Portfolio

15.8.5. Competitors & Customers

15.8.6. Subsidiaries & Parent Organization

15.8.7. Recent Developments

15.8.8. Financial Analysis

15.8.9. Profitability

15.8.10. Revenue Share

15.9. Jiffy Lube International, Inc.

15.9.1. Company Overview

15.9.2. Company Footprints

15.9.3. Production Locations

15.9.4. Product Portfolio

15.9.5. Competitors & Customers

15.9.6. Subsidiaries & Parent Organization

15.9.7. Recent Developments

15.9.8. Financial Analysis

15.9.9. Profitability

15.9.10. Revenue Share

15.10. Lookers Group

15.10.1. Company Overview

15.10.2. Company Footprints

15.10.3. Production Locations

15.10.4. Product Portfolio

15.10.5. Competitors & Customers

15.10.6. Subsidiaries & Parent Organization

15.10.7. Recent Developments

15.10.8. Financial Analysis

15.10.9. Profitability

15.10.10. Revenue Share

15.11. Monro Muffler Brake

15.11.1. Company Overview

15.11.2. Company Footprints

15.11.3. Production Locations

15.11.4. Product Portfolio

15.11.5. Competitors & Customers

15.11.6. Subsidiaries & Parent Organization

15.11.7. Recent Developments

15.11.8. Financial Analysis

15.11.9. Profitability

15.11.10. Revenue Share

15.12. Pendragon Vehicle Management

15.12.1. Company Overview

15.12.2. Company Footprints

15.12.3. Production Locations

15.12.4. Product Portfolio

15.12.5. Competitors & Customers

15.12.6. Subsidiaries & Parent Organization

15.12.7. Recent Developments

15.12.8. Financial Analysis

15.12.9. Profitability

15.12.10. Revenue Share

15.13. Other Key Players

15.13.1. Company Overview

15.13.2. Company Footprints

15.13.3. Production Locations

15.13.4. Product Portfolio

15.13.5. Competitors & Customers

15.13.6. Subsidiaries & Parent Organization

15.13.7. Recent Developments

15.13.8. Financial Analysis

15.13.9. Profitability

15.13.10. Revenue Share

List of Tables

Table 1: Global Vehicle Services Market Revenue (US$ Mn) Forecast, by Type, 2017-2031

Table 2: Global Vehicle Services Market Revenue (US$ Mn) Forecast, by Service Provider, 2017-2031

Table 3: Global Vehicle Services Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 4: Global Vehicle Services Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 5: Global Vehicle Services Market Revenue (US$ Mn) Forecast, by Region, 2017-2031

Table 6: North America Vehicle Services Market Revenue (US$ Mn) Forecast, by Type, 2017-2031

Table 7: North America Vehicle Services Market Revenue (US$ Mn) Forecast, by Service Provider, 2017-2031

Table 8: North America Vehicle Services Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 9: North America Vehicle Services Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 10: North America Vehicle Services Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Table 11: Europe Vehicle Services Market Revenue (US$ Mn) Forecast, by Type, 2017-2031

Table 12: Europe Vehicle Services Market Revenue (US$ Mn) Forecast, by Service Provider, 2017-2031

Table 13: Europe Vehicle Services Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 14: Europe Vehicle Services Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 15: Europe Vehicle Services Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Table 16: Asia Pacific Vehicle Services Market Revenue (US$ Mn) Forecast, by Type, 2017-2031

Table 17: Asia Pacific Vehicle Services Market Revenue (US$ Mn) Forecast, by Service Provider, 2017-2031

Table 18: Asia Pacific Vehicle Services Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 19: Asia Pacific Vehicle Services Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 20: Asia Pacific Vehicle Services Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Table 21: Middle East & Africa Vehicle Services Market Revenue (US$ Mn) Forecast, by Type, 2017-2031

Table 22: Middle East & Africa Vehicle Services Market Revenue (US$ Mn) Forecast, by Service Provider, 2017-2031

Table 23: Middle East & Africa Vehicle Services Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 24: Middle East & Africa Vehicle Services Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 25: Middle East & Africa Vehicle Services Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Table 26: South America Vehicle Services Market Revenue (US$ Mn) Forecast, by Type, 2017-2031

Table 27: South America Vehicle Services Market Revenue (US$ Mn) Forecast, by Service Provider, 2017-2031

Table 28: South America Vehicle Services Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 29: South America Vehicle Services Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 30: South America Vehicle Services Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Vehicle Services Market Revenue (US$ Mn) Forecast, by Type, 2017-2031

Figure 2: Global Vehicle Services Market, Incremental Opportunity, by Type, Value (US$ Mn), 2022-2031

Figure 3: Global Vehicle Services Market Revenue (US$ Mn) Forecast, by Service Provider, 2017-2031

Figure 4: Global Vehicle Services Market, Incremental Opportunity, by Service Provider, Value (US$ Mn), 2022-2031

Figure 5: Global Vehicle Services Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 6: Global Vehicle Services Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022-2031

Figure 7: Global Vehicle Services Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 8: Global Vehicle Services Market, Incremental Opportunity, by Propulsion, Value (US$ Mn), 2022-2031

Figure 9: Global Vehicle Services Market Revenue (US$ Mn) Forecast, by Region, 2017-2031

Figure 10: Global Vehicle Services Market, Incremental Opportunity, by Region, Value (US$ Mn), 2022-2031

Figure 11: North America Vehicle Services Market Revenue (US$ Mn) Forecast, by Type, 2017-2031

Figure 12: North America Vehicle Services Market, Incremental Opportunity, by Type, Value (US$ Mn), 2022-2031

Figure 13: North America Vehicle Services Market Revenue (US$ Mn) Forecast, by Service Provider, 2017-2031

Figure 14: North America Vehicle Services Market, Incremental Opportunity, by Service Provider, Value (US$ Mn), 2022-2031

Figure 15: North America Vehicle Services Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 16: North America Vehicle Services Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022-2031

Figure 17: North America Vehicle Services Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 18: North America Vehicle Services Market, Incremental Opportunity, by Propulsion, Value (US$ Mn), 2022-2031

Figure 19: North America Vehicle Services Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 20: North America Vehicle Services Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022-2031

Figure 21: Europe Vehicle Services Market Revenue (US$ Mn) Forecast, by Type, 2017-2031

Figure 22: Europe Vehicle Services Market, Incremental Opportunity, by Type, Value (US$ Mn), 2022-2031

Figure 23: Europe Vehicle Services Market Revenue (US$ Mn) Forecast, by Service Provider, 2017-2031

Figure 24: Europe Vehicle Services Market, Incremental Opportunity, by Service Provider, Value (US$ Mn), 2022-2031

Figure 25: Europe Vehicle Services Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 26: Europe Vehicle Services Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022-2031

Figure 27: Europe Vehicle Services Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 28: Europe Vehicle Services Market, Incremental Opportunity, by Propulsion, Value (US$ Mn), 2022-2031

Figure 29: Europe Vehicle Services Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 30: Europe Vehicle Services Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022-2031

Figure 31: Asia Pacific Vehicle Services Market Revenue (US$ Mn) Forecast, by Type, 2017-2031

Figure 32: Asia Pacific Vehicle Services Market, Incremental Opportunity, by Type, Value (US$ Mn), 2022-2031

Figure 33: Asia Pacific Vehicle Services Market Revenue (US$ Mn) Forecast, by Service Provider, 2017-2031

Figure 34: Asia Pacific Vehicle Services Market, Incremental Opportunity, by Service Provider, Value (US$ Mn), 2022-2031

Figure 35: Asia Pacific Vehicle Services Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 36: Asia Pacific Vehicle Services Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022-2031

Figure 37: Asia Pacific Vehicle Services Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 38: Asia Pacific Vehicle Services Market, Incremental Opportunity, by Propulsion, Value (US$ Mn), 2022-2031

Figure 39: Asia Pacific Vehicle Services Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 40: Asia Pacific Vehicle Services Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022-2031

Figure 41: Middle East & Africa Vehicle Services Market Revenue (US$ Mn) Forecast, by Type, 2017-2031

Figure 42: Middle East & Africa Vehicle Services Market, Incremental Opportunity, by Type, Value (US$ Mn), 2022-2031

Figure 43: Middle East & Africa Vehicle Services Market Revenue (US$ Mn) Forecast, by Service Provider, 2017-2031

Figure 44: Middle East & Africa Vehicle Services Market, Incremental Opportunity, by Service Provider, Value (US$ Mn), 2022-2031

Figure 45: Middle East & Africa Vehicle Services Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 46: Middle East & Africa Vehicle Services Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022-2031

Figure 47: Middle East & Africa Vehicle Services Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 48: Middle East & Africa Vehicle Services Market, Incremental Opportunity, by Propulsion, Value (US$ Mn), 2022-2031

Figure 49: Middle East & Africa Vehicle Services Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 50: Middle East & Africa Vehicle Services Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022-2031

Figure 51: South America Vehicle Services Market Revenue (US$ Mn) Forecast, by Type, 2017-2031

Figure 52: South America Vehicle Services Market, Incremental Opportunity, by Type, Value (US$ Mn), 2022-2031

Figure 53: South America Vehicle Services Market Revenue (US$ Mn) Forecast, by Service Provider, 2017-2031

Figure 54: South America Vehicle Services Market, Incremental Opportunity, by Service Provider, Value (US$ Mn), 2022-2031

Figure 55: South America Vehicle Services Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 56: South America Vehicle Services Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022-2031

Figure 57: South America Vehicle Services Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 58: South America Vehicle Services Market, Incremental Opportunity, by Propulsion, Value (US$ Mn), 2022-2031

Figure 59: South America Vehicle Services Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 60: South America Vehicle Services Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022-2031