The most challenging vascular injuries involve trauma caused to the abdomen, pelvis, and retroperitoneal structures of the body. Complications such as difficulty in acquiring immediate proximal control & appropriate exposure, treatment of injury in face of contamination, and provisions for prolonged surveillance & follow-up have increased the need for vascular injury treatment.

Vascular injuries can occur in civilian as well as military setting. Traumatic vascular injury caused due to explosions and projectiles such as bullets and shrapnel severely affect the arteries and veins of the limbs, and trigger excessive blood loss and ischemia. Thus, there is the constant need for instant relief and effective treatment solutions for vascular injuries in military and emergency cases.

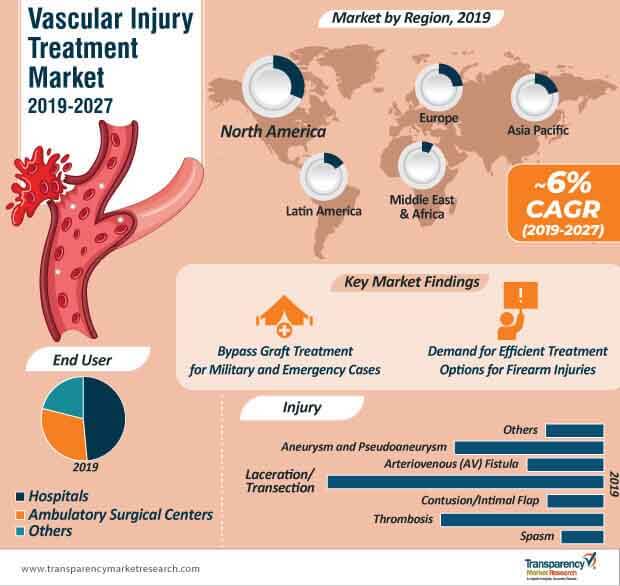

As such, healthcare providers in the vascular injury treatment landscape are adopting the extra-anatomical aortic bypass graft to solve grave vascular injuries in military and emergency cases. Adequately-sized interposition grafts help in the successful management and repair of damaged tissues and other serious vascular injuries.

Growing incidences of anticancer drug induced arterial injuries are surfacing in the vascular injury treatment ecosystem. The side effects of chemotherapeutic drugs and anti-tumor medicines complicate treatment cycles. These side effects are some of the causes for the increase in non-cancer-related mortality rates, and affect the quality of life of cancer survivors. Growing incidences of arterial thromboembolic events (ATEE) are also associated with the consumption of anti-cancer drugs.

As such, stakeholders need to develop treatment solutions to assess the high risks of vascular complications, and innovate on antithrombotic therapies that keep a tab on thromboembolic and bleeding risks. Preventive measures and individualized chemotherapy serve as viable treatment steps to reduce the incidences of anti-tumor treatment-related vascular events. As such, ongoing research and development is being carried out to address ATEE risk stratification, which helps in early prediction and reduced complications in cancer survivors.

A recent study on vascular injury treatment, conducted by researchers from the Boston University School of Medicine (BUSM), stated that, individuals who suffered firearm injuries and underwent surgical repair of major blood vessels were more susceptible to the high injury severity score (a scale made to predict in-hospital deaths).

In many cases, individuals that suffer firearm injuries due to gunshots undergo vascular injury treatment to repair the damage caused by bullets to major blood vessels. After several cross-validations, it found that, individuals who underwent surgical repair of their major blood vessels accounted for a high injury severity score as compared to those who didn’t undergo surgical repair treatment. Further studies showed that, the risk of death increased by five times, and complications increased three times, due to surgical repair treatment.

Complications such as venous thromboembolism, kidney failure, sepsis, and heart and neurologic-related complexes were greater in patients who underwent repair of their major blood vessels. Thus, stakeholders in the vascular injury treatment landscape need to carry out clinical trials to better understand firearm injuries and the impact of surgical repair on major blood vessels. Improvements in trauma care can help emergency medicine physicians and vascular injury treatment surgeons develop efficient treatment solutions for gun violence survivors.

Analysts’ Viewpoint

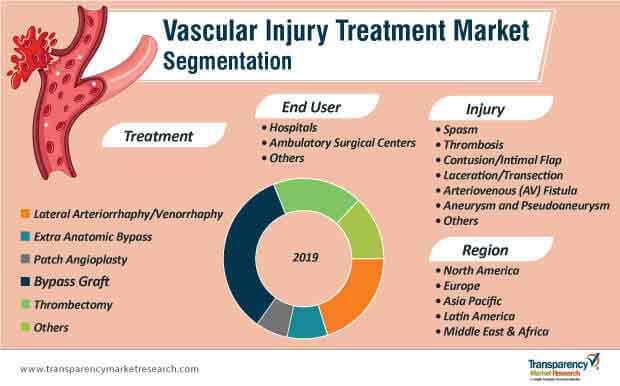

Analysts of the vascular injury treatment market have a promising outlook for its growth potential during the forecast period of 2019-2027. Stakeholders in the landscape are developing innovative offerings for bypass graft and lateral arteriorrhaphy treatment solutions. Increasing incidences of firearm injuries and arterial thromboembolic events in cancer patients have influenced the need for efficacious vascular injury treatment solutions. However, there is the need to improvise on the surgical repair treatment of major blood vessels for firearm injuries to avoid complications. Stakeholders in the vascular injury treatment landscape are developing preventive measures to reduce incidences of arterial thromboembolic events and improving trauma care for firearm injuries. Since bypass graft treatment accounts for a market share of ~34% in the vascular injury treatment landscape, stakeholders need to innovate on allograft repair treatment, as adequate frequency of follow-ups have resulted in excellent outcomes for patients.

Vascular Injury Treatment Market: Overview

Rise in Prevalence of Vascular Injuries: Key Driver of Vascular Injury Treatment Market

Focus on Collaborations, Agreements, Partnerships, and Technological Advancements

Vascular Injury Treatment Market: High Cost of Treatment

Global Vascular Injury Treatment Market: Competitive Landscape

Global Vascular Injury Treatment Market: Key Developments

Key manufacturers in the global vascular injury treatment market are strengthening their overseas sales structure by expanding their production capacities. Other developments in the global vascular injury treatment market are listed below.

Vascular injury treatment market to reach a value of ~US$ 4.8 Bn by 2027

Vascular injury treatment market is anticipated to expand at a CAGR of ~6% from 2019 to 2027

Vascular injury treatment market is driven by rise in the prevalence of vascular injuries

The laceration/transection segment dominated the global urinary incontinence treatment market during the forecast period

Key players in the global vascular injury treatment market include Cleveland Clinic, Apollo Hospitals Enterprise Ltd., Massachusetts General Hospital, Heidelberg University Hospital, Royal Berkshire NHS Foundation Trust

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Vascular Injury Treatment Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Vascular Injury Treatment Market Analysis and Forecast, 2017–2027

4.4.1. Market Revenue Projections (US$ Mn)

5. Market Outlook

5.1. Reimbursement Scenario

5.2. Regulatory Scenario

5.3. Technological Advancements

5.4. Number of Vascular Injury Incidences, by Region, (2018)

5.4.1. Penetrating Wounds

5.4.2. Blunt Trauma

5.4.3. Invasive Procedures

6. Global Vascular Injury Treatment Market Analysis and Forecast, by Injury

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Injury, 2017–2027

6.3.1. Spasm

6.3.2. Thrombosis

6.3.3. Contusion/Intimal Flap

6.3.4. Laceration/Transection

6.3.5. Arteriovenous (AV) Fistula

6.3.6. Aneurysm and Pseudoaneurysm

6.3.7. Others

6.4. Market Attractiveness, by Injury

7. Global Vascular Injury Treatment Market Analysis and Forecast, by Treatment

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Treatment, 2017–2027

7.3.1. Lateral Arteriorrhaphy/ Venorrhaphy

7.3.2. Patch Angioplasty

7.3.3. Bypass Graft

7.3.4. Extraanatomic Bypass

7.3.5. Thrombectomy

7.3.6. Others

7.4. Market Attractiveness, by Treatment

8. Global Vascular Injury Treatment Market Analysis and Forecast, by End User

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End User, 2017–2027

8.3.1. Hospitals

8.3.2. Ambulatory Surgical Centers

8.3.3. Others

8.4. Market Attractiveness, by End User

9. Global Vascular Injury Treatment Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness, by Country/Region

10. North America Vascular Injury Treatment Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Injury, 2017–2027

10.2.1. Spasm

10.2.2. Thrombosis

10.2.3. Contusion/Intimal Flap

10.2.4. Laceration/Transection

10.2.5. Arteriovenous (AV) Fistula

10.2.6. Aneurysm and Pseudoaneurysm

10.2.7. Others

10.3. Market Value Forecast, by Treatment, 2017–2027

10.3.1. Lateral Arteriorrhaphy/ Venorrhaphy

10.3.2. Patch Angioplasty

10.3.3. Bypass Graft

10.3.4. Extraanatomic Bypass

10.3.5. Thrombectomy

10.3.6. Others

10.4. Market Value Forecast, by End User, 2017–2027

10.4.1. Hospitals

10.4.2. Ambulatory Surgical Centers

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2027

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Injury

10.6.2. By Treatment

10.6.3. By End User

10.6.4. By Country

11. Europe Vascular Injury Treatment Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Injury, 2017–2027

11.2.1. Spasm

11.2.2. Thrombosis

11.2.3. Contusion/Intimal Flap

11.2.4. Laceration/Transection

11.2.5. Arteriovenous (AV) Fistula

11.2.6. Aneurysm and Pseudoaneurysm

11.2.7. Others

11.3. Market Value Forecast, by Treatment, 2017–2027

11.3.1. Lateral Arteriorrhaphy/ Venorrhaphy

11.3.2. Patch Angioplasty

11.3.3. Bypass Graft

11.3.4. Extraanatomic Bypass

11.3.5. Thrombectomy

11.3.6. Others

11.4. Market Value Forecast, by End User, 2017–2027

11.4.1. Hospitals

11.4.2. Ambulatory Surgical Centers

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2027

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Injury

11.6.2. By Treatment

11.6.3. By End User

11.6.4. By Country/Sub-region

12. Asia Pacific Vascular Injury Treatment Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Injury, 2017–2027

12.2.1. Spasm

12.2.2. Thrombosis

12.2.3. Contusion/Intimal Flap

12.2.4. Laceration/Transection

12.2.5. Arteriovenous (AV) Fistula

12.2.6. Aneurysm and Pseudoaneurysm

12.2.7. Others

12.3. Market Value Forecast, by Treatment, 2017–2027

12.3.1. Lateral Arteriorrhaphy/ Venorrhaphy

12.3.2. Patch Angioplasty

12.3.3. Bypass Graft

12.3.4. Extraanatomic Bypass

12.3.5. Thrombectomy

12.3.6. Others

12.4. Market Value Forecast, by End User, 2017–2027

12.4.1. Hospitals

12.4.2. Ambulatory Surgical Centers

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2027

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Injury

12.6.2. By Treatment

12.6.3. By End User

12.6.4. By Country/Sub-region

13. Latin America Vascular Injury Treatment Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Injury, 2017–2027

13.2.1. Spasm

13.2.2. Thrombosis

13.2.3. Contusion/Intimal Flap

13.2.4. Laceration/Transection

13.2.5. Arteriovenous (AV) Fistula

13.2.6. Aneurysm and Pseudoaneurysm

13.2.7. Others

13.3. Market Value Forecast, by Treatment, 2017–2027

13.3.1. Lateral Arteriorrhaphy/ Venorrhaphy

13.3.2. Patch Angioplasty

13.3.3. Bypass Graft

13.3.4. Extraanatomic Bypass

13.3.5. Thrombectomy

13.3.6. Others

13.4. Market Value Forecast, by End User, 2017–2027

13.4.1. Hospitals

13.4.2. Ambulatory Surgical Centers

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2027

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Injury

13.6.2. By Treatment

13.6.3. By End User

13.6.4. By Country/Sub-region

14. Middle East & Africa Vascular Injury Treatment Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Injury, 2017–2027

14.2.1. Spasm

14.2.2. Thrombosis

14.2.3. Contusion/Intimal Flap

14.2.4. Laceration/Transection

14.2.5. Arteriovenous (AV) Fistula

14.2.6. Aneurysm and Pseudoaneurysm

14.2.7. Others

14.3. Market Value Forecast, by Treatment, 2017–2027

14.3.1. Lateral Arteriorrhaphy/ Venorrhaphy

14.3.2. Patch Angioplasty

14.3.3. Bypass Graft

14.3.4. Extraanatomic Bypass

14.3.5. Thrombectomy

14.3.6. Others

14.4. Market Value Forecast, by End User, 2017–2027

14.4.1. Hospitals

14.4.2. Ambulatory Surgical Centers

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2027

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Injury

14.6.2. By Treatment

14.6.3. By End User

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Company Profiles

15.1.1. Cleveland Clinic

15.1.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.1.2. Company Financials

15.1.1.3. Growth Strategies

15.1.1.4. SWOT Analysis

15.1.2. Apollo Hospitals Enterprise Ltd.

15.1.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.2.2. Company Financials

15.1.2.3. Growth Strategies

15.1.2.4. SWOT Analysis

15.1.3. Massachusetts General Hospital

15.1.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.3.2. Company Financials

15.1.3.3. Growth Strategies

15.1.3.4. SWOT Analysis

15.1.4. Heidelberg University Hospital

15.1.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.4.2. Company Financials

15.1.4.3. Growth Strategies

15.1.4.4. SWOT Analysis

15.1.5. Royal Berkshire NHS Foundation Trust

15.1.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.5.2. Company Financials

15.1.5.3. Growth Strategies

15.1.5.4. SWOT Analysis

15.1.6. Universal Health Services, Inc.

15.1.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.6.2. Company Financials

15.1.6.3. Growth Strategies

15.1.6.4. SWOT Analysis

15.1.7. Tenet Healthcare

15.1.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.7.2. Company Financials

15.1.7.3. Growth Strategies

15.1.7.4. SWOT Analysis

15.1.8. Mayo Clinic Health System

15.1.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.8.2. Company Financials

15.1.8.3. Growth Strategies

15.1.8.4. SWOT Analysis

15.1.9. Mediclinic International

15.1.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.9.2. Company Financials

15.1.9.3. Growth Strategies

15.1.9.4. SWOT Analysis

15.1.10. CHSPSC, LLC

15.1.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.10.2. Company Financials

15.1.10.3. Growth Strategies

15.1.10.4. SWOT Analysis

15.1.11. IHH Healthcare Berhad

15.1.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.11.2. Company Financials

15.1.11.3. Growth Strategies

15.1.11.4. SWOT Analysis

*Note: Financial details for companies that do not report this information in public domain might not be captured

List of Tables

Table 01: Number of Vascular Injury Incidences, by Region, 2018

Table 02: North America Number of Vascular Injury Incidences, 2018

Table 03: Europe America Number of Vascular Injury Incidences, 2018

Table 04: Asia Pacific Number of Vascular Injury Incidences, 2018

Table 05: Latin America Number of Vascular Injury Incidences, 2018

Table 06: Middle East & Africa Number of Vascular Injury Incidences, 2018

Table 07: Global Vascular Injury Treatment Market Value (US$ Mn) Forecast, by Injury, 2017–2027

Table 08: Global Vascular Injury Treatment Market Value (US$ Mn) Forecast, by Treatment, 2017–2027

Table 09: Global Vascular Injury Treatment Market Value (US$ Mn) Forecast, by End User, 2017–2027

Table 10: Global Vascular Injury Treatment Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 11: North America Vascular Injury Treatment Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 12: North America Vascular Injury Treatment Market Value (US$ Mn) Forecast, by Injury, 2017–2027

Table 13: North America Vascular Injury Treatment Market Value (US$ Mn) Forecast, by Treatment, 2017–2027

Table 14: North America Vascular Injury Treatment Market Value (US$ Mn) Forecast, by End User, 2017?2027

Table 15: Europe Vascular Injury Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 16: Europe Vascular Injury Treatment Market Value (US$ Mn) Forecast, by Injury, 2017–2027

Table 17: Europe Vascular Injury Treatment Market Value (US$ Mn) Forecast, by Treatment, 2017–2027

Table 18: Europe Vascular Injury Treatment Market Value (US$ Mn) Forecast, by End User, 2017?2027

Table 19: Asia Pacific Vascular Injury Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2027

Table 20: Asia Pacific Vascular Injury Treatment Market Value (US$ Mn) Forecast, by Injury, 2017–2027

Table 21: Asia Pacific Vascular Injury Treatment Market Value (US$ Mn) Forecast, by Treatment, 2017–2027

Table 22: Asia Pacific Vascular Injury Treatment Market Value (US$ Mn) Forecast, by End User, 2017?2027

Table 23: Latin America Vascular Injury Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 24: Latin America Vascular Injury Treatment Market Value (US$ Mn) Forecast, by Injury, 2017–2027

Table 25: Latin America Vascular Injury Treatment Market Value (US$ Mn) Forecast, by Treatment, 2017–2027

Table 26: Latin America Vascular Injury Treatment Market Value (US$ Mn) Forecast, by End User, 2017?2027

Table 27: Middle East & Africa Vascular Injury Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2027

Table 28: Middle East & Africa Vascular Injury Treatment Market Value (US$ Mn) Forecast, by Injury, 2017–2027

Table 29: Middle East & Africa Vascular Injury Treatment Market Value (US$ Mn) Forecast, by Treatment, 2017–2027

Table 30: Middle East & Africa Vascular Injury Treatment Market Value (US$ Mn) Forecast, by End User, 2017?2027

List of Figures

Figure 01: Global Vascular Injury Treatment Market Value (US$ Mn) and Distribution (%), by Region, 2019 and 2027

Figure 02: Global Vascular Injury Treatment Market Value (US$ Mn) Forecast, 2017–2027

Figure 03: Global Vascular Injury Treatment Market Value Share (%), by Injury, 2018

Figure 04: Global Vascular Injury Treatment Market Value Share (%), by Treatment, 2018

Figure 05: Global Vascular Injury Treatment Market Value Share (%), by End User, 2018

Figure 06: Global Vascular Injury Treatment Market Value Share (%), by Region, 2018

Figure 07: Global Vascular Injury Treatment Market Value Share (%), by Injury, 2018 and 2027

Figure 08: Global Vascular Injury Treatment Market Value (US$ Mn), by Spasm, 2017–2027

Figure 09: Global Vascular Injury Treatment Market Value (US$ Mn), by Thrombosis, 2017–2027

Figure 10: Global Vascular Injury Treatment Market Value (US$ Mn), by Contusion/Intimal Flap, 2017–2027

Figure 11: Global Vascular Injury Treatment Market Value (US$ Mn), by Laceration/Transection, 2017–2027

Figure 12: Global Vascular Injury Treatment Market Value (US$ Mn), by Arteriovenous (AV) Fistula, 2017–2027

Figure 13: Global Vascular Injury Treatment Market Value (US$ Mn), by Aneurysm & Pseudoaneurysm, 2017–2027

Figure 14: Global Vascular Injury Treatment Market Value (US$ Mn), by Others, 2017–2027

Figure 15: Global Vascular Injury Treatment Market Attractiveness, by Injury, 2019?2027

Figure 16: Global Vascular Injury Treatment Market Value Share (%), by Treatment, 2018 and 2027

Figure 17: Global Vascular Injury Treatment Market Attractiveness, by Treatment, 2019–2027

Figure 18: Global Vascular Injury Treatment Market Value (US$ Mn), by Lateral Arteriorrhaphy/Venorrhaphy, 2017–2027

Figure 19: Global Vascular Injury Treatment Market Value (US$ Mn), by Patch Angioplasty, 2017–2027

Figure 20: Global Vascular Injury Treatment Market Value (US$ Mn), by Bypass Graft, 2017–2027

Figure 21: Global Vascular Injury Treatment Market Value (US$ Mn), by Extraanatomic Bypass, 2017–2027

Figure 22: Global Vascular Injury Treatment Market Value (US$ Mn), by Thrombectomy, 2017–2027

Figure 23: Global Vascular Injury Treatment Market Value (US$ Mn), by Others, 2017–2027

Figure 24: Global Vascular Injury Treatment Market Value Share (%), by End User, 2018 and 2027

Figure 25: Global Vascular Injury Treatment Market Attractiveness, by End User, 2019–2027

Figure 26: Global Vascular Injury Treatment Market Value (US$ Mn), by Hospitals, 2017–2027

Figure 27: Global Vascular Injury Treatment Market Value (US$ Mn), by Ambulatory Surgical Centers, 2017–2027

Figure 28: Global Vascular Injury Treatment Market Value (US$ Mn), by Others, 2017–2027

Figure 29: Global Vascular Injury Treatment Market Value Share Analysis, by Region, 2018 and 2027

Figure 30: Global Vascular Injury Treatment Market Attractiveness Analysis, by Region, 2019–2027

Figure 31: North America Vascular Injury Treatment Market Value (US$ Mn), 2017–2027

Figure 32: North America Vascular Injury Treatment Market Value Share Analysis, by Country, 2018 and 2027

Figure 33: North America Vascular Injury Treatment Market Attractiveness Analysis, by Country, 2019–2027

Figure 34: North America Vascular Injury Treatment Market Value Share (%), by Injury, 2018 and 2027

Figure 35: North America Vascular Injury Treatment Market Attractiveness, by Injury, 2019–2027

Figure 36: North America Vascular Injury Treatment Market Value Share Analysis, by Treatment, 2018 and 2027

Figure 37: North America Vascular Injury Treatment Market Attractiveness Analysis, by Treatment, 2019–2027

Figure 38: North America Vascular Injury Treatment Market Value Share (%), by End User, 2018 and 2027

Figure 39: North America Vascular Injury Treatment Market Attractiveness, by End User, 2019–2027

Figure 40: Europe Vascular Injury Treatment Market Value (US$ Mn) Forecast, 2017–2027

Figure 41: Europe Vascular Injury Treatment Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 42: Europe Vascular Injury Treatment Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 43: Europe Vascular Injury Treatment Market Value Share (%), by Injury, 2018 and 2027

Figure 44: Europe Vascular Injury Treatment Market Attractiveness, by Injury, 2019–2027

Figure 45: Europe Vascular Injury Treatment Market Value Share Analysis, by Treatment, 2018 and 2027

Figure 46: Europe Vascular Injury Treatment Market Attractiveness Analysis, by Treatment, 2019–2027

Figure 47: Europe Vascular Injury Treatment Market Value Share (%), by End User, 2018 and 2027

Figure 48: Europe Vascular Injury Treatment Market Attractiveness, by End User, 2019–2027

Figure 49: Asia Pacific Vascular Injury Treatment Market Value (US$ Mn), 2017–2027

Figure 50: Asia Pacific Vascular Injury Treatment Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 51: Asia Pacific Vascular Injury Treatment Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 52: Asia Pacific Vascular Injury Treatment Market Value Share (%), by Injury, 2018 and 2027

Figure 53: Asia Pacific Vascular Injury Treatment Market Attractiveness, by Injury, 2019–2027

Figure 54: Asia Pacific Vascular Injury Treatment Market Value Share Analysis, by Treatment, 2018 and 2027

Figure 55: Asia Pacific Vascular Injury Treatment Market Attractiveness Analysis, by Treatment, 2019–2027

Figure 56: Asia Pacific Vascular Injury Treatment Market Value Share (%), by End User, 2018 and 2027

Figure 57: Asia Pacific Vascular Injury Treatment Market Attractiveness, by End User, 2019–2027

Figure 58: Latin America Vascular Injury Treatment Market Value (US$ Mn), 2017–2027

Figure 59: Latin America Vascular Injury Treatment Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 60: Latin America Vascular Injury Treatment Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 61: Latin America Vascular Injury Treatment Market Value Share (%), by Injury, 2018 and 2027

Figure 62: Latin America Vascular Injury Treatment Market Attractiveness, by Injury, 2019–2027

Figure 63: Latin America Vascular Injury Treatment Market Value Share Analysis, by Treatment, 2018 and 2027

Figure 64: Latin America Vascular Injury Treatment Market Attractiveness Analysis, by Treatment, 2019–2027

Figure 65: Latin America Vascular Injury Treatment Market Value Share (%), by End User, 2018 and 2027

Figure 66: Latin America Vascular Injury Treatment Market Attractiveness, by End User, 2019–2027

Figure 67: Middle East & Africa Vascular Injury Treatment Market Value (US$ Mn), 2017–2027

Figure 68: Middle East & Africa Vascular Injury Treatment Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 69: Middle East & Africa Vascular Injury Treatment Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 70: Middle East & Africa Vascular Injury Treatment Market Value Share (%), by Injury, 2018 and 2027

Figure 71: Middle East & Africa Vascular Injury Treatment Market Attractiveness, by Injury, 2019–2027

Figure 72: Middle East & Africa Vascular Injury Treatment Market Value Share Analysis, by Treatment, 2018 and 2027

Figure 73: Middle East & Africa Vascular Injury Treatment Market Attractiveness Analysis, by Treatment, 2019–2027

Figure 74: Middle East & Africa Vascular Injury Treatment Market Value Share (%), by End User, 2018 and 2027

Figure 75: Middle East & Africa Vascular Injury Treatment Market Attractiveness, by End User, 2019–2027