Vascular diseases have high worldwide mortality, propelling advances in endovascular surgeries. Developing effective and long-term revascularization solutions has gathered immense attention among healthcare providers. Autologous arteries or veins as well as synthetic grafts have gained acceptance in the vascular grafts market. A key aim is to improve patency rates in such procedures. In this light, tissue-engineered vascular grafts are attracting attention and research interest among industry players. Though synthetic vascular prostheses have gained significant acceptance among the patient populations, some glaring limitations have hindered the commercialization scope of respective implant developers. Particularly, the marketplace hasn’t been so promising in regard to developing grafts for small-diameter vessels, which is less than 6 mm.

Autologous arteries or veins have emerged as the gold standards, but the failure rates in the last five years have alarmed researchers and proponents for tissue engineering. This has kicked in demand for in situ tissue engineering approaches. For such approaches to enter mainstream, the regulatory burden for clinical translation should be low. In this regard, cell-free scaffolds are showing some clinical potential. There are, however, several things to keep in focus for an adequate success rate, notably implant materials and subsequently the fabrication methods. Some of the common endpoints are hemocompatibility, an adequate microenvironment for tissue generation, and a good combination of elasticity and strength of the biomaterials. Perhaps the most important endpoint, which many players in the vascular grafts market have been pursuing, is overcoming compliance mismatch. In this regard, electrospinning is one of the widely used techniques of obtaining the graft. Several new approaches will shape the prospects of the market in coming months.

Though the body of research has been hindered by Covid-19 pandemic, which is still emerging, healthcare providers are optimistic of the rise in demand in the next few months. Moreover, several elective endovascular surgeries which might have been postponed might offer momentum in the times when the economies are opening with restrictions. Further, new vascular graft designs are likely to be tested in the market in not-so-distant future.

Vascular grafts are used to redirect blood flow from one part of the body to another by connecting blood vessels. Vascular grafting surgery is performed to treat ischemia caused by atherosclerosis, organ transplantation, or for vascular access in hemodialysis. However, demand for vascular grafts is anticipated to decline during the forecast period owing to increase in adverse effects like decellularized xenogeneic grafts increase the rate of infection, thrombosis, and aneurysms.

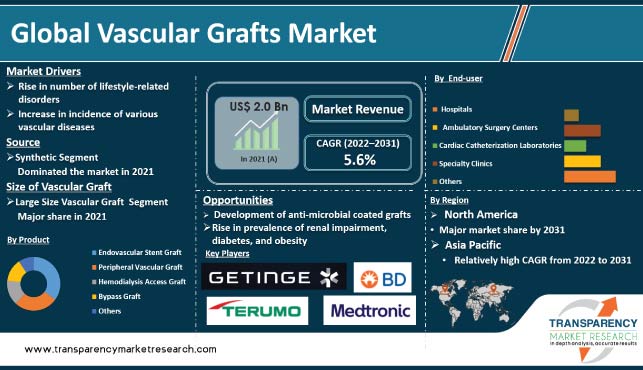

The global vascular grafts market was valued at US$ 2,010.1 Mn in 2017 and is projected to expand at a CAGR of 5.0% from 2018 to 2026 to reach US$ 3,000 Mn by 2026. High incidence rate of cardiovascular diseases, peripheral diseases, and rise in geriatric population are likely to fuel the growth of the global market from 2018 to 2026. Surge in government investment in health care infrastructure and strategic alliances among players to penetrate the emerging markets are expected to propel the global market during the forecast period.

In terms of product, the global vascular grafts market has been segmented into endovascular stent grafts, peripheral vascular grafts, hemodialysis access grafts, bypass grafts, and others. The endovascular stent grafts segment held the largest market share in 2017. Moreover, the segment is anticipated to expand at a high CAGR during the forecast period due to high demand for minimally invasive surgeries and rise in preference for stent grafts to treat atherosclerosis. Based on source, the global market has been classified into synthetic, biological, and biosynthetic. The synthetic segment is projected to dominate the global market during the forecast period owing to its good materialistic properties such as flexibility. In terms of size of vascular graft, the global vascular graft market has been bifurcated into large and small. The small segment is expected to expand at a high CAGR due to increase in focus of major players on the development of small size vascular grafts to treat narrow vascular atherosclerosis. Based on end-user, the global market has been divided into hospitals, ambulatory surgery centers, cardiac catheterization laboratories, specialty clinics, and others. The hospitals segment accounted for the largest market share in 2017. The segment is expected to expand at a significant CAGR during the forecast period.

North America is projected to account for major share of the global vascular grafts market from 2018 to 2026, supported by rise in prevalence of cardiovascular diseases and increase in the number of vascular surgeries. According to the Journal of Vascular Surgery (2012), critical limb ischemia is associated with significant cost to the U.S. health care system and is estimated to exceed US$ 3 Bn annually. According to data provided by the American College of Cardiology, more than 130 million adults in the U.S. are anticipated to have some form of cardiovascular diseases (CVD) by 2035, and the total cost of CVD is expected to reach US$ 1.1 Trn in 2035. The vascular graft market in Asia Pacific is likely to expand at a high CAGR during the forecast period due to increase in focus on development of health care infrastructure by both public and private hospitals and high cardiovascular patient pool in countries such as India and China.

Key companies operating in the global vascular grafts market and profiled in the report include W. L. Gore & Associates, Inc., Maquet Holding B.V. & Co. KG (Getinge Group), BD, LeMaitre Vascular, Inc., B. Braun Melsungen AG, Cook Medical, Medtronic plc, Artegraft, Inc., Vascutek Ltd., Vascular Graft Solution Ltd., Heat Medical Europe BV, and CryoLife, Inc.

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

1.3. Assumptions and Acronyms Used

2. Research Methodology

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Key Industry Evolution/Developments

4.3. Market Dynamics

4.3.1. Drivers

4.3.1.1. Increase in the Incidence of Target Diseases

4.3.1.2. Rise in the Number of Lifestyle-related Disorders

4.3.1.3. Increase in the Geriatric Population

4.3.1.4. Shift toward Value-based Health Care Model

4.3.1.5. Increase in Health Care Spending & Improvement in Health Care Infrastructure

4.3.2. Restraints

4.3.2.1. Stringent Regulatory Guidelines

4.3.2.2. Increase in Adverse Effects

4.3.2.3. Rise in Pricing Pressure

4.3.3. Opportunities

4.3.3.1. Rise in Cases of Renal Impairment, Diabetes, and Obesity

4.3.3.2. Increase in the Number of Potential Markets for Commercializing Vascular Grafts

4.3.3.3. Anti-microbial Coated Grafts

4.4. Global Vascular Market Analysis & Forecast, 2018–2026

4.4.1.1. Market Revenue Projections (US$ Mn)

5. Market Overview

5.1. Global Prevalence of Chronic Kidney Diseases

5.2. Global Prevalence of End-stage Renal Disorders (ESRD)

5.3. Patient Data for Dialysis

5.4. Global Prevalence of Cardiovascular Diseases

5.5. Overview of Cryopreservation Technique

5.6. Pipeline Analysis

6. Global Vascular Grafts Market, by Product

6.1. Introduction and Definitions

6.2. Key Findings

6.3. Global Vascular Grafts Market Analysis, by Product

6.4. Global Vascular Grafts Market Forecast, by Product

6.4.1. Endovascular Stent Grafts

6.4.2. Peripheral Vascular Grafts

6.4.3. Hemodialysis Access Grafts

6.4.4. Bypass Grafts

6.4.5. Others

6.5. Global Vascular Grafts Market Attractiveness Analysis, by Product

7. Global Vascular Grafts Market, by Source

7.1. Introduction and Definitions

7.2. Key Findings

7.3. Global Vascular Grafts Market Analysis, by Source

7.4. Global Vascular Grafts Market Forecast, by Source

7.4.1. Synthetic

7.4.1.1. Polytetrafluethylene (PTFE)

7.4.1.2. Polyurethane (PU)

7.4.1.3. Dacron

7.4.1.4. Others

7.4.2. Biological

7.4.2.1. Bovine Vein

7.4.2.2. Saphenous Vein

7.4.2.3. Others

7.4.3. Biosynthetic

7.4.3.1. Ovine Collagen with Polyester

7.4.3.2. Others

7.5. Global Vascular Grafts Market Attractiveness Analysis, by Source

8. Global Vascular Grafts Market Analysis and Forecast, by Size of Vascular Graft

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Global Vascular Grafts Market Analysis, by Size of Vascular Graft

8.4. Global Vascular Grafts Market Value Forecast, by Size of Vascular Graft, 2016–2026

8.4.1. Large

8.4.2. Small

8.5. Global Vascular Grafts Market Attractiveness Analysis, by Size of Vascular Graft

9. Global Vascular Grafts Market Analysis and Forecast, by Application

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Global Vascular Grafts Market Analysis, by Application

9.4. Global Vascular Grafts Market Value Forecast, by Application, 2016–2026

9.4.1. Coronary Artery Bypass

9.4.2. Aneurysm

9.4.3. Vascular Occlusion

9.4.4. Critical Limb Ischemia

9.4.5. Renal Failure

9.4.6. Others

9.5. Others Global Vascular Grafts Market Attractiveness Analysis, by Application

10. Global Vascular Grafts Market Analysis and Forecast, by End-user

10.1. Introduction & Definition

10.2. Key Findings / Developments

10.3. Global Vascular Grafts Market Analysis, by End-user

10.4. Global Vascular Grafts Market Value Forecast, by End-user, 2016–2026

10.4.1. Hospitals

10.4.2. Ambulatory Surgical Centers

10.4.3. Cardiac Catheterization Laboratories

10.4.4. Specialty Clinics

10.4.5. Others

10.4.6. Others Global Vascular Grafts Market Attractiveness Analysis, by End-user

11. Global Vascular Grafts Market Analysis and Forecast, by Region

11.1. Introduction & Definition

11.2. Key Findings / Developments

11.3. Market Value Forecast, by Region, 2016–2026

11.3.1. North America

11.3.2. Europe

11.3.3. Asia Pacific

11.3.4. Latin America

11.3.5. Middle East & Africa

11.4. Global Vascular Grafts Attractiveness Analysis, by Region

12. North America Vascular Grafts Market Analysis and Forecast, by Region

12.1. Key Findings

12.2. North America Vascular Grafts Market Overview

12.3. North America Vascular Grafts Market Value Share Analysis, by Country

12.4. North America Vascular Grafts Market Size and Forecast, by Country

12.4.1. U.S.

12.4.2. Canada

12.5. North America Vascular Grafts Market Value Share Analysis, by Product

12.6. North America Vascular Grafts Market Size and Forecast, by Product

12.6.1. Endovascular Stent Grafts

12.6.2. Peripheral Vascular Grafts

12.6.3. Hemodialysis Access Grafts

12.6.4. Bypass Grafts

12.6.5. Others

12.7. North America Vascular Grafts Market Value Share Analysis, by Source

12.8. North America Vascular Grafts Market Size and Forecast, by Source

12.8.1. Synthetic

12.8.1.1. Polytetrafluethylene (PTFE)

12.8.1.2. Polyurethane (PU)

12.8.1.3. Dacron

12.8.1.4. Others

12.8.2. Biological

12.8.2.1. Bovine Vein

12.8.2.2. Saphenous Vein

12.8.2.3. Others

12.8.3. Biosynthetic

12.8.3.1. Ovine Collagen with Polyester

12.8.3.2. Others

12.9. North America Vascular Grafts Market Value Share Analysis, by Size of Vascular Graft

12.10. North America Vascular Grafts Market Size and Forecast, by Size of Vascular Graft

12.10.1. Large

12.10.2. Small

12.11. North America Vascular Grafts Market Value Share Analysis, by Application

12.12. North America Vascular Grafts Market Size and Forecast, by Application

12.12.1. Coronary Artery Bypass

12.12.2. Aneurysm

12.12.3. Vascular Occlusion

12.12.4. Critical Limb Ischemia

12.12.5. Renal Failure

12.12.6. Others

12.13. North America Vascular Grafts Market Value Share Analysis, by End-User

12.14. North America Vascular Grafts Market Size and Forecast, by End-user

12.14.1. Hospitals

12.14.2. Ambulatory Surgical Centers

12.14.3. Cardiac Catheterization Laboratories

12.14.4. Specialty Clinics

12.14.5. Others

12.15. North America Vascular Grafts Market Size and Forecast, by Market Attractiveness

12.15.1. Product

12.15.2. Source

12.15.3. Size of Vascular Graft

12.15.4. Application

12.15.5. End-user

12.15.6. Country

13. Europe Vascular Grafts Market Analysis and Forecast, by Region

13.1. Key Findings

13.2. Europe Vascular Grafts Market Overview

13.3. Europe Vascular Grafts Market Value Share Analysis, by Country/Sub-region

13.4. Europe Vascular Grafts Market Size and Forecast, by Country/Sub-region

13.4.1. Germany

13.4.2. France

13.4.3. U.K.

13.4.4. Spain

13.4.5. Italy

13.4.6. Rest of Europe

13.5. Europe Vascular Grafts Market Value Share Analysis, by Product

13.6. Europe Vascular Grafts Market Size and Forecast, by Product

13.6.1. Endovascular Stent Grafts

13.6.2. Peripheral Vascular Grafts

13.6.3. Hemodialysis Access Grafts

13.6.4. Bypass Grafts

13.6.5. Others

13.7. Europe Vascular Grafts Market Value Share Analysis, by Source

13.8. Europe Vascular Grafts Market Size and Forecast, by Source

13.8.1. Synthetic

13.8.1.1. Polytetrafluethylene (PTFE)

13.8.1.2. Polyurethane (PU)

13.8.1.3. Dacron

13.8.1.4. Others

13.8.2. Biological

13.8.2.1. Bovine Vein

13.8.2.2. Saphenous Vein

13.8.2.3. Others

13.8.3. Biosynthetic

13.8.3.1. Ovine Collagen with Polyester

13.8.3.2. Others

13.9. Europe Vascular Grafts Market Value Share Analysis, by Size of Vascular Graft

13.10. Europe Vascular Grafts Market Size and Forecast, by Size of Vascular Graft

13.10.1. Large

13.10.2. Small

13.11. Europe Vascular Grafts Market Value Share Analysis, by Application

13.12. Europe Vascular Grafts Market Size and Forecast, by Application

13.12.1. Coronary Artery Bypass

13.12.2. Aneurysm

13.12.3. Vascular Occlusion

13.12.4. Critical Limb Ischemia

13.12.5. Renal Failure

13.12.6. Others

13.13. Europe Vascular Grafts Market Value Share Analysis, by End-User

13.14. Europe Vascular Grafts Market Size and Forecast, by End-user

13.14.1. Hospitals

13.14.2. Ambulatory Surgical Centers

13.14.3. Cardiac Catheterization Laboratories

13.14.4. Specialty Clinics

13.14.5. Others

13.15. Europe Vascular Grafts Market Size and Forecast, by Market Attractiveness

13.15.1. Product

13.15.2. Source

13.15.3. Size of Vascular Graft

13.15.4. Application

13.15.5. End-user

13.15.6. Country

14. Asia Pacific Vascular Grafts Market Analysis and Forecast, by Region

14.1. Key Findings

14.2. Asia Pacific Vascular Grafts Market Overview

14.3. Asia Pacific Vascular Grafts Market Value Share Analysis, by Country/Sub-region

14.4. Asia Pacific Vascular Grafts Market Size and Forecast, by Country/Sub-region

14.4.1. China

14.4.2. Japan

14.4.3. India

14.4.4. Australia & New Zealand

14.4.5. Rest of Asia Pacific

14.5. Asia Pacific Vascular Grafts Market Value Share Analysis, by Product

14.6. Asia Pacific Vascular Grafts Market Size and Forecast, by Product

14.6.1. Endovascular Stent Grafts

14.6.2. Peripheral Vascular Grafts

14.6.3. Hemodialysis Access Grafts

14.6.4. Bypass Grafts

14.6.5. Others

14.7. Asia Pacific Vascular Grafts Market Value Share Analysis, by Source

14.8. Asia Pacific Vascular Grafts Market Size and Forecast, by Source

14.8.1. Synthetic

14.8.1.1. Polytetrafluethylene (PTFE)

14.8.1.2. Polyurethane (PU)

14.8.1.3. Dacron

14.8.1.4. Others

14.8.2. Biological

14.8.2.1. Bovine Vein

14.8.2.2. Saphenous Vein

14.8.2.3. Others

14.8.3. Biosynthetic

14.8.3.1. Ovine Collagen with Polyester

14.8.3.2. Others

14.9. Asia Pacific Vascular Grafts Market Value Share Analysis, by Size of Vascular Graft

14.10. Asia Pacific Vascular Grafts Market Size and Forecast, by Size of Vascular Graft

14.10.1. Large

14.10.2. Small

14.11. Asia Pacific Vascular Grafts Market Value Share Analysis, by Application

14.12. Asia Pacific Vascular Grafts Market Size and Forecast, by Application

14.12.1. Coronary Artery Bypass

14.12.2. Aneurysm

14.12.3. Vascular Occlusion

14.12.4. Critical Limb Ischemia

14.12.5. Renal Failure

14.12.6. Others

14.13. Asia Pacific Vascular Grafts Market Value Share Analysis, by Application

14.14. Asia Pacific Vascular Grafts Market Size and Forecast, by Application

14.14.1. Hospitals

14.14.2. Ambulatory Surgical Centers

14.14.3. Cardiac Catheterization Laboratories

14.14.4. Specialty Clinics

14.14.5. Others

14.15. Asia Pacific Vascular Grafts Market Size and Forecast, by Market Attractiveness

14.15.1. Product

14.15.2. Source

14.15.3. Size of Vascular Graft

14.15.4. Application

14.15.5. End-user

14.15.6. Country/Sub-region

15. Latin America Vascular Grafts Market Analysis and Forecast, by Region

15.1. Key Findings

15.2. Latin America Vascular Grafts Market Overview

15.3. Latin America Vascular Grafts Market Value Share Analysis, by Country/Sub-region

15.4. Latin America Vascular Grafts Market Size and Forecast, by Country/Sub-region

15.4.1. Brazil

15.4.2. Mexico

15.4.3. Rest of Latin America

15.5. Latin America Vascular Grafts Market Value Share Analysis, by Product

15.6. Latin America Vascular Grafts Market Size and Forecast, by Product

15.6.1. Endovascular Stent Grafts

15.6.2. Peripheral Vascular Grafts

15.6.3. Hemodialysis Access Grafts

15.6.4. Bypass Grafts

15.6.5. Others

15.7. Latin America Vascular Grafts Market Value Share Analysis, by Source

15.8. Latin America Vascular Grafts Market Size and Forecast, by Source

15.8.1. Synthetic

15.8.1.1. Polytetrafluethylene (PTFE)

15.8.1.2. Polyurethane (PU)

15.8.1.3. Dacron

15.8.1.4. Others

15.8.2. Biological

15.8.2.1. Bovine Vein

15.8.2.2. Saphenous Vein

15.8.2.3. Others

15.8.3. Biosynthetic

15.8.3.1. Ovine Collagen with Polyester

15.8.3.2. Others

15.9. Latin America Vascular Grafts Market Value Share Analysis, by Size of Vascular Graft

15.10. Latin America Vascular Grafts Market Size and Forecast, by Size of Vascular Graft

15.10.1. Large

15.10.2. Small

15.11. Latin America Vascular Grafts Market Value Share Analysis, by Application

15.12. Latin America Vascular Grafts Market Size and Forecast, by Application

15.12.1. Coronary Artery Bypass

15.12.2. Aneurysm

15.12.3. Vascular Occlusion

15.12.4. Critical Limb Ischemia

15.12.5. Renal Failure

15.12.6. Others

15.13. Latin America Vascular Grafts Market Value Share Analysis, by End-user

15.14. Latin America Vascular Grafts Market Size and Forecast, by End-user

15.14.1. Hospitals

15.14.2. Ambulatory Surgical Centers

15.14.3. Cardiac Catheterization Laboratories

15.14.4. Specialty Clinics

15.14.5. Others

15.15. Latin America Vascular Grafts Market Size and Forecast, by Market Attractiveness

15.15.1. Product

15.15.2. Source

15.15.3. Size of Vascular Graft

15.15.4. Application

15.15.5. End-user

15.15.6. Country/Sub-region

16. Middle East & Africa Vascular Grafts Market Analysis and Forecast, by Region

16.1. Key Findings

16.2. Middle East & Africa Vascular Grafts Market Overview

16.3. Middle East & Africa Vascular Grafts Market Value Share Analysis, by Country/Sub-region

16.4. Middle East & Africa Vascular Grafts Market Size and Forecast, by Country/Sub-region

16.4.1. GCC Countries

16.4.2. South Africa

16.4.3. Rest of Middle East & Africa

16.5. Middle East & Africa Vascular Grafts Market Value Share Analysis, by Product

16.6. Middle East & Africa Vascular Grafts Market Size and Forecast, by Product

16.6.1. Endovascular Stent Grafts

16.6.2. Peripheral Vascular Grafts

16.6.3. Hemodialysis Access Grafts

16.6.4. Bypass Grafts

16.6.5. Others

16.7. Middle East & Africa Vascular Grafts Market Value Share Analysis, by Source

16.8. Middle East & Africa Vascular Grafts Market Size and Forecast, by Source

16.8.1. Synthetic

16.8.1.1. Polytetrafluethylene (PTFE)

16.8.1.2. Polyurethane (PU)

16.8.1.3. Dacron

16.8.1.4. Others

16.8.2. Biological

16.8.2.1. Bovine Vein

16.8.2.2. Saphenous Vein

16.8.2.3. Others

16.8.3. Biosynthetic

16.8.3.1. Ovine Collagen with Polyester

16.8.3.2. Others

16.9. Middle East & Africa Vascular Grafts Market Value Share Analysis, by Size of Vascular Graft

16.10. Middle East & Africa Vascular Grafts Market Size and Forecast, by Size of Vascular Graft

16.10.1. Large

16.10.2. Small

16.11. Middle East & Africa Vascular Grafts Market Value Share Analysis, by Application

16.12. Middle East & Africa Vascular Grafts Market Size and Forecast, by Application

16.12.1. Coronary Artery Bypass

16.12.2. Aneurysm

16.12.3. Vascular Occlusion

16.12.4. Critical Limb Ischemia

16.12.5. Renal Failure

16.12.6. Others

16.13. Middle East & Africa Vascular Grafts Market Value Share Analysis, by End-user

16.14. Middle East & Africa Vascular Grafts Market Size and Forecast, by End-user

16.14.1. Hospitals

16.14.2. Ambulatory Surgical Centers

16.14.3. Cardiac Catheterization Laboratories

16.14.4. Specialty Clinics

16.14.5. Others

16.15. Middle East & Africa Vascular Grafts Market Size and Forecast, by Market Attractiveness

16.15.1. Product

16.15.2. Source

16.15.3. Size of Vascular Graft

16.15.4. Application

16.15.5. End-user

16.15.6. Country/Sub-region

17. Competitive Landscape

17.1. Company Analysis

17.2. Competition Matrix

17.3. Company Profiles

17.3.1. LaMaitre Vascular, Inc.

17.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.1.2. Financial Overview

17.3.1.3. Product Portfolio

17.3.1.4. SWOT Analysis

17.3.1.5. Strategic Overview

17.3.2. B. Braun Melsungen AG

17.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.2.2. Financial Overview

17.3.2.3. Product Portfolio

17.3.2.4. SWOT Analysis

17.3.2.5. Strategic Overview

17.3.3. C. R. Bard, Inc.

17.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.3.2. Financial Overview

17.3.3.3. Product Portfolio

17.3.3.4. SWOT Analysis

17.3.3.5. Strategic Overview

17.3.4. Cook Medical

17.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.4.2. Financial Overview

17.3.4.3. Product Portfolio

17.3.4.4. SWOT Analysis

17.3.4.5. Strategic Overview

17.3.5. Medtronic plc

17.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.5.2. Financial Overview

17.3.5.3. Product Portfolio

17.3.5.4. SWOT Analysis

17.3.5.5. Strategic Overview

17.3.6. ArteGrafts, Inc.

17.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.6.2. Financial Overview

17.3.6.3. Product Portfolio

17.3.6.4. SWOT Analysis

17.3.6.5. Strategic Overview

17.3.7. Vascutek Ltd.

17.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.7.2. Financial Overview

17.3.7.3. Product Portfolio

17.3.7.4. SWOT Analysis

17.3.7.5. Strategic Overview

17.3.8. Vascular Grafts Solution Ltd.

17.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.8.2. Financial Overview

17.3.8.3. Product Portfolio

17.3.8.4. SWOT Analysis

17.3.8.5. Strategic Overview

17.3.9. Heart Medical Europe BV

17.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.9.2. Financial Overview

17.3.9.3. Product Portfolio

17.3.9.4. SWOT Analysis

17.3.9.5. Strategic Overview

17.3.10. W. L. Gore & Associates, Inc.

17.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.10.2. Financial Overview

17.3.10.3. Product Portfolio

17.3.10.4. SWOT Analysis

17.3.10.5. Strategic Overview

17.3.11. CryoLife, Inc.

17.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.11.2. Financial Overview

17.3.11.3. Product Portfolio

17.3.11.4. SWOT Analysis

17.3.11.5. Strategic Overview

17.3.12. Maquet Holding B.V. & Co. KG

17.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.12.2. Financial Overview

17.3.12.3. Product Portfolio

17.3.12.4. SWOT Analysis

17.3.12.5. Strategic Overview

List of Tables

Table 01: Global Vascular Grafts Market Size (US$ Mn) Forecast, by Product, 2016–2026

Table 02: Global Vascular Grafts Market Size (US$ Mn) Forecast, by Source, 2016–2026

Table 03: Global Vascular Grafts Market Size (US$ Mn) Forecast, by Synthetic, 2016–2026

Table 04: Global Vascular Grafts Market Size (US$ Mn) Forecast, by Biological, 2016–2026

Table 05: Global Vascular Grafts Market Size (US$ Mn) Forecast, by Biosynthetic, 2016–2026

Table 06: Global Vascular Grafts Market Size (US$ Mn) Forecast, by Size of Vascular Graft, 2016–2026

Table 07: Global Vascular Grafts Market Size (US$ Mn) Forecast, by Application, 2016–2026

Table 08: Global Vascular Grafts Market Size (US$ Mn) Forecast, by End-user, 2016–2026

Table 09: Global Vascular Grafts Market Size (US$ Mn) Forecast, by Region, 2016–2026

Table 10: North America Vascular Grafts Market Value (US$ Mn) Forecast, by Country, 2016–2026

Table 11: North America Vascular Grafts Market Value (US$ Mn) Forecast, by Product, 2016–2026

Table 12: North America Vascular Grafts Market Value (US$ Mn) Forecast, by Source, 2016–2026

Table 13: North America Vascular Grafts Market Value (US$ Mn) Forecast, by Synthetic, 2016–2026

Table 14: North America Vascular Grafts Market Value (US$ Mn) Forecast, by Biological, 2016–2026

Table 15: North America Vascular Grafts Market Value (US$ Mn) Forecast, by Biosynthetic, 2016–2026

Table 16: North America Vascular Grafts Market Value (US$ Mn) Forecast, by Size of Vascular Graft, 2016–2026

Table 17: North America Vascular Grafts Market Value (US$ Mn) Forecast, by Application, 2016–2026

Table 18: North America Vascular Grafts Market Value (US$ Mn) Forecast, by End-user, 2016–2026

Table 19: Europe Vascular Grafts Market Value (US$ Mn) Forecast, by Country/Sub-region, 2016–2026

Table 20: Europe Vascular Grafts Market Value (US$ Mn) Forecast, by Product, 2016–2026

Table 21: Europe Vascular Grafts Market Value (US$ Mn) Forecast, by Source, 2016–2026

Table 22: Europe Vascular Grafts Market Value (US$ Mn) Forecast, by Synthetic, 2016–2026

Table 23: Europe Vascular Grafts Market Value (US$ Mn) Forecast, by Biological, 2016–2026

Table 24: Europe Vascular Grafts Market Value (US$ Mn) Forecast, by Biosynthetic, 2016–2026

Table 25: Europe Vascular Grafts Market Value (US$ Mn) Forecast, by Size of Vascular Graft, 2016–2026

Table 26: Europe Vascular Grafts Market Size (US$ Mn) Forecast, by Application, 2016–2026

Table 27: Europe Vascular Grafts Market Size (US$ Mn) Forecast, by End-user, 2016–2026

Table 28: Asia Pacific Vascular Grafts Market Value (US$ Mn) Forecast, by Country/Sub-region, 2016–2026

Table 29: Asia Pacific Vascular Grafts Market Value (US$ Mn) Forecast, by Product, 2016–2026

Table 30: Asia Pacific Vascular Grafts Market Value (US$ Mn) Forecast, by Source, 2016–2026

Table 31: Asia Pacific Vascular Grafts Market Value (US$ Mn) Forecast, by Synthetic, 2016–2026

Table 32: Asia Pacific Vascular Grafts Market Value (US$ Mn) Forecast, by Biological, 2016–2026

Table 33: Asia Pacific Vascular Grafts Market Value (US$ Mn) Forecast, by Biosynthetic, 2016–2026

Table 34: Asia Pacific Vascular Grafts Market Value (US$ Mn) Forecast, by Size of Vascular Graft, 2016–2026

Table 35: Asia Pacific Vascular Grafts Market Value (US$ Mn) Forecast, by Application, 2016–2026

Table 36: Asia Pacific Vascular Grafts Market Value (US$ Mn) Forecast, by End-user, 2016–2026

Table 37: Latin America Vascular Grafts Market Value (US$ Mn) Forecast, by Country/Sub-region, 2016–2026

Table 38: Latin America Vascular Grafts Market Value (US$ Mn) Forecast, by Product, 2016–2026

Table 39: Latin America Vascular Grafts Market Value (US$ Mn) Forecast, by Source, 2016–2026

Table 40: Latin America Vascular Grafts Market Value (US$ Mn) Forecast, by Synthetic, 2016–2026

Table 41: Latin America Vascular Grafts Market Value (US$ Mn) Forecast, by Biological, 2016–2026

Table 42: Latin America Vascular Grafts Market Value (US$ Mn) Forecast, by Biosynthetic Source, 2016–2026

Table 43: Latin America Vascular Grafts Market Value (US$ Mn) Forecast, by Size of Vascular Graft, 2016–2026

Table 44: Latin America Vascular Grafts Market Value (US$ Mn) Forecast, by Application, 2016–2026

Table 45: Latin America Vascular Grafts Market Value (US$ Mn) Forecast, by End-user, 2016–2026

Table 46: Middle East & Africa Vascular Grafts Market Value (US$ Mn) Forecast, by Country/Sub-region, 2016–2026

Table 47: Middle East & Africa Vascular Grafts Market Value (US$ Mn) Forecast, by Product, 2016–2026

Table 48: Middle East & Africa Vascular Grafts Market Value (US$ Mn) Forecast, by Source, 2016–2026

Table 49: Middle East & Africa Vascular Grafts Market Value (US$ Mn) Forecast, by Synthetic, 2016–2026

Table 50: Middle East & Africa Vascular Grafts Market Value (US$ Mn) Forecast, by Biological, 2016–2026

Table 51: Middle East & Africa Vascular Grafts Market Value (US$ Mn) Forecast, by Biosynthetic, 2016–2026

Table 52: Middle East & Africa Vascular Grafts Market Value (US$ Mn) Forecast, by Size of Vascular Graft, 2016–2026

Table 53: Middle East & Africa Vascular Grafts Market Value (US$ Mn) Forecast, by Application, 2016–2026

Table 54: Middle East & Africa Vascular Grafts Market Value (US$ Mn) Forecast, by End-user, 2016–2026

List of Figures

Figure 01: Global Vascular Grafts Market Value (US$ Mn) and Distribution, by Region, 2017 and 2026

Figure 02: Market Snapshot of Global Vascular Grafts Market

Figure 03: Market Opportunity Map, Revenue Share, by Product

Figure 04: Market Opportunity Map, Revenue Share, by Source

Figure 05: Market Opportunity Map, Revenue Share, by Size of Vascular Graft

Figure 06: Market Opportunity Map, Revenue Share, by Application

Figure 07: Market Opportunity Map, Revenue Share, by End-user

Figure 08: Global Vascular Grafts Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2016–2026

Figure 09: Vascular Grafts Market Value Share, by Product, 2017

Figure 10: Vascular Grafts Market Value Share, by Application, 2017

Figure 11: Vascular Grafts Market Value Share, by End-user, 2017

Figure 12: Vascular Grafts Market Value Share, by Source, 2017

Figure 13: Vascular Grafts Market Value Share, by Size of Vascular Graft, 2017

Figure 14: Vascular Grafts Market Value Share, by Region, 2017

Figure 15: Global Vascular Grafts Market Value Share, by Product, 2017 and 2026

Figure 16: Global Vascular Grafts Market Attractiveness, by Product, 2018–2026

Figure 17: Global Vascular Grafts Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Endovascular Stent Grafts, 2016–2026

Figure 18: Global Vascular Grafts Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Peripheral Vascular Grafts, 2016–2026

Figure 19: Global Vascular Grafts Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Hemodialysis Access Grafts, 2016–2026

Figure 20: Global Vascular Grafts Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Bypass Grafts, 2016–2026

Figure 21: Global Vascular Grafts Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Others, 2016–2026

Figure 22: Global Vascular Grafts Market Value Share, by Source, 2017 and 2026

Figure 23: Global Vascular Grafts Market Attractiveness, by Source, 2018–2026

Figure 24: Global Vascular Grafts Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Synthetic, 2016–2026

Figure 25: Global Vascular Grafts Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Biological, 2016–2026

Figure 26: Global Vascular Grafts Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Biosynthetic, 2016–2026

Figure 27: Global Vascular Grafts Market Value Share, by Size of Vascular Graft, 2017 and 2026

Figure 28: Global Vascular Grafts Market Attractiveness, by Size of Vascular Graft, 2018–2026

Figure 29: Global Vascular Grafts Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Large, 2016–2026

Figure 30: Global Vascular Grafts Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Small, 2016–2026

Figure 31: Global Vascular Grafts Market Value Share, by Application, 2017 and 2026

Figure 32: Global Vascular Grafts Market Attractiveness, by Application, 2018–2026

Figure 33: Global Vascular Grafts Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Coronary Artery Bypass, 2016–2026

Figure 34: Global Vascular Grafts Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Aneurysm, 2016–2026

Figure 35: Global Vascular Grafts Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Vascular Occlusion, 2016–2026

Figure 36: Global Vascular Grafts Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Renal Failure, 2016–2026

Figure 37: Global Vascular Grafts Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Critical Limb Ischemia, 2016–2026

Figure 38: Global Vascular Grafts Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Others, 2016–2026

Figure 39: Global Vascular Grafts Market Value Share, by End-user, 2017 and 2026

Figure 40: Global Vascular Grafts Market Attractiveness, by End-user, 2018–2026

Figure 41: Global Vascular Grafts Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Hospital, 2016–2026

Figure 42: Global Vascular Grafts Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Ambulatory Surgical Centers, 2016–2026

Figure 43: Global Vascular Grafts Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Cardiac Catheterization Laboratories, 2016–2026

Figure 44: Global Vascular Grafts Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Specialty Clinics, 2016–2026

Figure 45: Global Vascular Grafts Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Others, 2016–2026

Figure 46: Global Vascular Grafts Market Value Share, by Region, 2017 and 2026

Figure 47: Global Vascular Grafts Market Attractiveness, by Region, 2018–2026

Figure 48: North America Vascular Grafts Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2016–2026

Figure 49: North America Vascular Grafts Market Attractiveness, by Country, 2018–2026

Figure 50: North America Vascular Grafts Market Value Share, by Country, 2017 and 2026

Figure 51: North America Vascular Grafts Market Value Share, by Product, 2017 and 2026

Figure 52: North America Vascular Grafts Market Attractiveness, by Product, 2018–2026

Figure 53: North America Vascular Grafts Market Value Share Analysis, by Source, 2017 and 2026

Figure 54: North America Vascular Grafts Market Attractiveness, by Source, 2018–2026

Figure 55: North America Vascular Grafts Market Value Share Analysis, by Size of Vascular Graft, 2017 and 2026

Figure 56: North America Vascular Grafts Market Attractiveness, by Size of Vascular Graft, 2018–2026

Figure 57: North America Vascular Grafts Market Value Share, by Application, 2017 and 2026

Figure 58: North America Vascular Grafts Market Attractiveness, by Application, 2018–2026

Figure 59: North America Vascular Grafts Market Value Share, by End-user, 2017 and 2026

Figure 60: North America Vascular Grafts Market Attractiveness, by End-user, 2018–2026

Figure 61: Europe Vascular Grafts Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2016–2026

Figure 62: Europe Vascular Grafts Market Value Share (%), by Country/Sub-region, 2017 and 2026

Figure 63: Europe Vascular Grafts Market Attractiveness, by Country/Sub-region, 2018–2026

Figure 64: Europe Vascular Grafts Market Value Share, by Product, 2017 and 2026

Figure 65: Europe Vascular Grafts Market Attractiveness, by Product, 2018–2026

Figure 66: Europe Vascular Grafts Market Value Share Analysis, by Source, 2017 and 2026

Figure 67: Europe Vascular Grafts Market Attractiveness, by Source, 2018–2026

Figure 68: Europe Vascular Grafts Market Value Share Analysis, by Size of Vascular Graft, 2017 and 2026

Figure 69: Europe Vascular Grafts Market Attractiveness, by Size of Vascular Graft, 2018–2026

Figure 70: Europe Vascular Grafts Market Value Share, by Application, 2017 and 2026

Figure 71: Europe Vascular Grafts Market Attractiveness, by Application, 2018–2026

Figure 72: Europe Vascular Grafts Market Value Share, by End-user, 2017 and 2026

Figure 73: Europe Vascular Grafts Market Attractiveness, by End-user, 2018–2026

Figure 74: Asia Pacific Vascular Grafts Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2016–2026

Figure 75: Asia Pacific Vascular Grafts Market Attractiveness, by Country/Sub-region, 2018–2026

Figure 76: Asia Pacific Vascular Grafts Market Value Share, by Country/Sub-region, 2017 and 2026

Figure 77: Asia Pacific Vascular Grafts Market Value Share, by Product, 2017 and 2026

Figure 78: Asia Pacific Vascular Grafts Market Attractiveness,

Figure 79: Asia Pacific Vascular Grafts Market Value Share Analysis, by Source, 2017 and 2026

Figure 80: Asia Pacific Vascular Grafts Market Attractiveness, by Source, 2018–2026

Figure 81: Asia Pacific Vascular Grafts Market Value Share Analysis, by Size of Vascular Graft, 2017 and 2026

Figure 82: Asia Pacific Vascular Grafts Market Attractiveness, by Size of Vascular Graft, 2018–2026

Figure 83: Asia Pacific Vascular Grafts Market Value Share, by Application, 2017 and 2026

Figure 84: Asia Pacific Vascular Grafts Market Attractiveness, by Application, 2018–2026

Figure 85: Asia Pacific Vascular Grafts Market Value Share, by End-user, 2017 and 2026

Figure 86: Asia Pacific Vascular Grafts Market Attractiveness, by End-user, 2018–2026

Figure 87: Latin America Vascular Grafts Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2016–2026

Figure 88: Latin America Vascular Grafts Market Value Share, by Country/Sub-region, 2017 and 2026

Figure 89: Latin America Vascular Grafts Market Attractiveness, by Country/Sub-region, 2018–2026

Figure 90: Latin America Vascular Grafts Market Value Share, by Product, 2017 and 2026

Figure 91: Latin America Vascular Grafts Market Attractiveness,

Figure 92: Latin America Vascular Grafts Market Value Share, by Source, 2017 and 2026

Figure 93: Latin America Vascular Grafts Market Attractiveness, by Source, 2018–2026

Figure 94: Latin America Vascular Grafts Market Value Share Analysis, by Size of Vascular Graft, 2017 and 2026

Figure 95: Latin America Vascular Grafts Market Attractiveness, by Size of Vascular Graft, 2018–2026

Figure 96: Latin America Vascular Grafts Market Value Share, by Application, 2017 and 2026

Figure 97: Latin America Vascular Grafts Market Attractiveness, by Application, 2018–2026

Figure 98: Latin America Vascular Grafts Market Value Share, by End-user, 2017 and 2026

Figure 99: Latin America Vascular Grafts Market Attractiveness, by End-user, 2018–2026

Figure 100: Middle East & Africa Vascular Grafts Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2016–2026

Figure 101: Middle East & Africa Vascular Grafts Market Value Share, by Country/Sub-region, 2017 and 2026

Figure 102: Middle East & Africa Vascular Grafts Market Attractiveness, by Country/Sub-region, 2018–2026

Figure 103: Middle East & Africa Vascular Grafts Market Value Share, by Product, 2017 and 2026

Figure 104: Middle East & Africa Vascular Grafts Market Attractiveness, by Product, 2018–2026

Figure 105: Middle East & Africa Vascular Grafts Market Value Share, by Source, 2017 and 2026

Figure 106: Middle East & Africa Vascular Grafts Market Attractiveness, by Source, 2018–2026

Figure 107: Middle East & Africa Vascular Grafts Market Value Share Analysis, by Size of Vascular Graft, 2017 and 2026

Figure 108: Middle East & Africa Vascular Grafts Market Attractiveness, by Size of Vascular Graft, 2018–2026

Figure 109: Middle East & Africa Vascular Grafts Market Value Share, by Application, 2017 and 2026

Figure 110: Middle East & Africa Vascular Grafts Market Attractiveness, by Application, 2018–2026

Figure 111: Middle East & Africa Vascular Grafts Market Value Share, by End-user, 2017 and 2026

Figure 112: Middle East & Africa Vascular Grafts Market Attractiveness, by End-user, 2018–2026