Analysts’ Viewpoint

Usage of vascular grafts is rising at a rapid pace owing to an increase in incidence of health conditions such as chronic kidney and cardiovascular diseases.

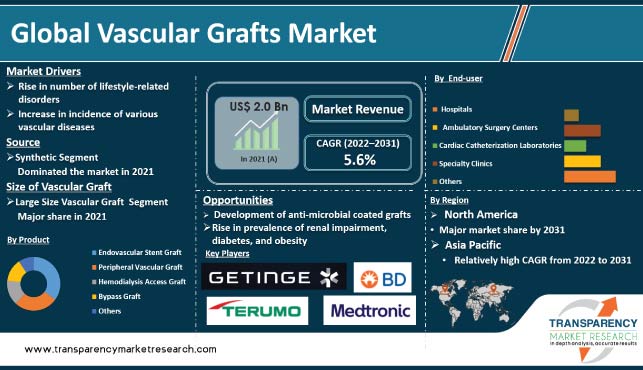

Rise in the number of lifestyle-related disorders, surge in the geriatric population, increase in health care expenditure, and improvement in healthcare infrastructure are driving the demand for vascular graft surgeries or procedures.

Government and regulatory bodies of various countries are adopting cost-containment measures to reduce the health care burden, especially in developed economies. This shift from volume- to value-based system is driven by various measures taken by governments, health care providers, insurance payers, and life sciences companies.

Leading vascular graft companies, including Terumo Corporation and Vascular Graft Solutions, play a crucial role in the development of these grafts.

Vascular surgery involves rerouting blocked or narrowed artery in order to restore the blood flow to a specific organ (heart, brain, leg, etc.). Surgeons use a synthetic or natural graft to connect to a healthy artery to the narrowed artery beyond the blocked point in order to create another path for the blood flow. Different types of vascular bypass graft surgeries can be performed depending on the location of the blockage.

Vascular bypass graft surgery is an inpatient procedure performed by a cardiothoracic surgeon, neurosurgeon, or vascular surgeon in hospital setting. Bypass surgeries are mostly scheduled in advance. For each bypass surgery, a graft must be chosen to create a new route around the blocked section of the artery.

The graft could be taken from a vein or artery, or it can be synthetic. Objective vascular bypass surgery is performed to bypass the blocked or narrow artery and restore the blood flow. The most common bypass surgeries are coronary artery bypass grafting/surgery, cerebral artery bypass surgery, renal artery bypass surgery, aortoiliac or aortofemoral bypass surgery, and peripheral bypass surgery.

Chronic kidney disease (CKD), also known as chronic kidney failure, is one of the major risk factors for diabetes, hypertension, cardiovascular diseases, and others diseases. It involves a gradual loss of the kidney function. Advanced chronic kidney disease can lead to dangerous levels of fluids, electrolytes, and waste build up in the body.

According to the National Institute of Diabetes & Digestive & Kidney Diseases, more than 37 million adults in the U.S. have CKD. According to the Centers for Disease Control and Prevention, diabetes and high blood pressure are the leading causes of kidney failure in the country, accounting for three out of four new cases.

Consumption of alcohol & tobacco and hereditary factors increase the number of cardiovascular disorders. According to the WHO, cardiovascular diseases (CVDs) accounted for an estimated 17.9 million deaths in 2019, representing 32% of all global deaths. Of these, around 85% were due to heart attack and stroke. Moreover, rise in the number of cancer cases increases the demand for central venous catheters and implantable ports & grafts for the administration of chemotherapy medications and blood transfusion.

Incidence of lifestyle-related disorders such as diabetes, blood pressure, and obesity has increased due to unhealthy lifestyle & diet and lack of exercise. According to the International Diabetes Federation (IDF), around 527 million adults across the world were living with diabetes in 2021, and the number is expected to rise to 643 million by 2030 and 783 million by 2045. Hypertension, or elevated blood pressure, is another disorder caused by unhealthy diet or excessive salt consumption, physical inactivity, or overweight/obesity.

According to the WHO, globally, an estimated 1.28 billion adults aged 30 years to 79 years have hypertension, especially people living in low and middle income countries. Hence, increase in the incidence of lifestyle-related disorders among the global population propels the need for hospitalization, which in turn augments the global demand.

In terms of product, the global vascular grafts market has been classified into endovascular stent graft, peripheral vascular graft, hemodialysis access graft, bypass graft, and others. The endovascular stent grafts segment dominated the global industry in terms of share in 2021. This stent graft usually supports the weak areas of the aorta. It is a non-invasive surgical procedure used to treat abdominal aortic aneurysm.

Based on source, the global vascular grafts market has been segregated into biological, synthetic, and biosynthetic. The synthetic segment accounted for major share in 2021. Synthetic vascular grafts are non-toxic, non-allergenic grafts made of materials such as Teflon, glass, or lead. These have the ability to re-adjust the wall configuration to form a good mechanical fit, while making an opening in blood vessels or diverging them.

In terms of size of vascular graft, the global vascular grafts business has been bifurcated into large size vascular grafts and small size vascular grafts. Large size vascular grafts accounted for major share of the market demand in 2021. Advantages such as wide availability, high patency rate, and constant flow of blood are driving the large size vascular grafts segment.

Based on application, the global vascular grafts market has been divided into coronary artery bypass, aneurysm, vascular occlusion, renal failure, critical limb ischemia, and others.

The coronary artery bypass segment held a dominant share in 2021 due to increase in the incidence of cardiovascular diseases and rise in demand for treatment procedures. According to the WHO, about 17.9 million people succumb to cardiovascular diseases every year, which is 32% of total global deaths.

In terms of end-user, the market segmentation comprises hospitals, ambulatory surgical centers, cardiac catheterization laboratories, specialty clinics, and others. The hospitals segment held the largest market share in 2021. Hospitals are the most preferred choice and highly favorable settings for procedures requiring vascular access, ranging from cardiovascular to dialysis. Therefore, the segment is expected to grow at a rapid pace during the forecast period.

North America accounted for major share of the global vascular grafts market in 2021. The U.S. dominated the region due to large patient pool, high prevalence of heart diseases, advancements in clinical trials for various vascular disorders & diseases, and surge in demand among vascular surgeons for the development of new products. According to the Centers for Disease Control and Prevention, about 697,000 people in the U.S. succumbed to heart disease in 2020 i.e., 1 in every 5 deaths; one person dies every 34 seconds in the country from cardiovascular disease.

Asia Pacific is expected to be the fastest growing region during the forecast period. According to the America College of Cardiology, in 2019, CVD accounted for 9.6 million deaths among men and 8.9 million deaths among women. Furthermore, over 6 million of these deaths occurred in people aged between 30 and 70. The highest number of CVD deaths occurred in China, followed by India, Russia and Indonesia. Moreover, demand for vascular graft modification among surgeons is increasing owing to rise in the number of awareness programs by vascular associations across Asia Pacific. Surge in the incidence of coronary artery disease is likely to drive market expansion in the region.

The global industry is consolidated, with the presence of a small number of large companies. Majority of these players are investing significantly in research & development to develop advanced vascular grafts.

Expansion of product portfolio and mergers & acquisitions are prominent strategies adopted by key players. Prominent players in the industry are B. Braun SE, Becton, Dickinson and Company, Cook Medical, Inc., CryoLife, Inc., Getinge AB, Heart Medical, Junken Medical Co., Ltd., LeMaitre Vascular, Inc., Medtronic, Vascular Graft Solutions, and W. L. Gore & Associates, Inc.

Leading players in the industry have been profiled in the report based on parameters such as company overview, financial standing, strategies, portfolio, segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2021 |

US$ 2.0 Bn |

|

Forecast Value in 2031 |

US$ 3.7 Bn |

|

Growth Rate (CAGR) |

5.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 2.0 Bn in 2021

It is projected to reach a value of more than US$ 3.7 Bn by 2031

The CAGR contracted at 1.7% from 2017 to 2021

The market is anticipated to grow at a CAGR of 5.6% from 2022 to 2031

Increase in the incidence of target diseases and rise in the number of lifestyle-related disorders.

North America is expected to account for the largest share.

Braun SE, BD, Cook Medical, Inc., CryoLife, Inc., Getinge AB, Heart Medical, Junken Medical Co., Ltd., LeMaitre Vascular, Inc., Medtronic, Vascular Graft Solutions, and W. L. Gore & Associates, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Vascular Grafts Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Vascular Grafts Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Pipeline Analysis

5.2. Global Prevalence of Chronic Kidney Diseases

5.3. Global Prevalence of Cardiovascular Diseases

5.4. Covid-19 Pandemic Impact on the Industry

6. Global Vascular Grafts Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Endovascular Stent Graft

6.3.2. Peripheral Vascular Graft

6.3.3. Hemodialysis Access Graft

6.3.4. Bypass Graft

6.3.5. Others

6.4. Market Attractiveness Analysis, by Product

7. Global Vascular Grafts Market Analysis and Forecast, by Size of Vascular Graft

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Size of Vascular Graft, 2017–2031

7.3.1. Large Size Vascular Graft

7.3.2. Small Size Vascular Graft

7.4. Market Attractiveness Analysis, by Size of Vascular Graft

8. Global Vascular Grafts Market Analysis and Forecast, by Source

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Source, 2017–2031

8.3.1. Synthetic

8.3.1.1. Polytetrafluethylene (PTFE)

8.3.1.2. Polyurethane (PU)

8.3.1.3. Dacron

8.3.1.4. Others

8.3.2. Biological

8.3.2.1. Bovine Vein

8.3.2.2. Saphenous Vein

8.3.2.3. Others

8.3.3. Biosynthetic

8.3.3.1. Ovine Collagen with Polyester

8.3.3.2. Others

8.4. Market Attractiveness Analysis, by Source

9. Global Vascular Grafts Market Analysis and Forecast, by Application

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by Application, 2017–2031

9.3.1. Coronary Artery Bypass

9.3.2. Aneurysm

9.3.3. Vascular Occlusion

9.3.4. Critical Limb Ischemia

9.3.5. Renal Failure

9.3.6. Others

9.4. Market Attractiveness Analysis, by Application

10. Global Vascular Grafts Market Analysis and Forecast, by End-user

10.1. Introduction & Definition

10.2. Key Findings / Developments

10.3. Market Value Forecast, by End-user, 2017–2031

10.3.1. Hospitals

10.3.2. Ambulatory Surgery Centers

10.3.3. Cardiac Catheterization Laboratories

10.3.4. Specialty Clinics

10.3.5. Others

10.4. Market Attractiveness Analysis, by End-user

11. Global Vascular Grafts Market Analysis and Forecast, by Region

11.1. Key Findings

11.2. Market Value Forecast, by Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Market Attractiveness Analysis, by Region

12. North America Vascular Grafts Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Endovascular Stent Graft

12.2.2. Peripheral Vascular Graft

12.2.3. Hemodialysis Access Graft

12.2.4. Bypass Graft

12.2.5. Others

12.3. Market Value Forecast, by Size of Vascular Graft, 2017–2031

12.3.1. Large Size Vascular Graft

12.3.2. Small Size Vascular Graft

12.4. Market Value Forecast, by Source, 2017–2031

12.4.1. Synthetic

12.4.1.1. Polytetrafluethylene (PTFE)

12.4.1.2. Polyurethane (PU)

12.4.1.3. Dacron

12.4.1.4. Others

12.4.2. Biological

12.4.2.1. Bovine Vein

12.4.2.2. Saphenous Vein

12.4.2.3. Others

12.4.3. Biosynthetic

12.4.3.1. Ovine Collagen with Polyester

12.4.3.2. Others

12.5. Market Value Forecast, by Application , 2017–2031

12.5.1. Coronary Artery Bypass

12.5.2. Aneurysm

12.5.3. Vascular Occlusion

12.5.4. Critical Limb Ischemia

12.5.5. Renal Failure

12.5.6. Others

12.6. Market Value Forecast, by End-user, 2017–2031

12.6.1. Hospitals

12.6.2. Ambulatory Surgery Centers

12.6.3. Cardiac Catheterization Laboratories

12.6.4. Specialty Clinics

12.6.5. Others

12.7. Market Value Forecast, by Country, 2017–2031

12.7.1. U.S.

12.7.2. Canada

12.8. Market Attractiveness Analysis

12.8.1. By Product

12.8.2. By Size of Vascular Graft

12.8.3. By Source

12.8.4. By Application

12.8.5. By End-user

12.8.6. By Country

13. Europe Vascular Grafts Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Endovascular Stent Graft

13.2.2. Peripheral Vascular Graft

13.2.3. Hemodialysis Access Graft

13.2.4. Bypass Graft

13.2.5. Others

13.3. Market Value Forecast, by Size of Vascular Graft, 2017–2031

13.3.1. Large Size Vascular Graft

13.3.2. Small Size Vascular Graft

13.4. Market Value Forecast, by Source, 2017–2031

13.4.1. Synthetic

13.4.1.1. Polytetrafluethylene (PTFE)

13.4.1.2. Polyurethane (PU)

13.4.1.3. Dacron

13.4.1.4. Others

13.4.2. Biological

13.4.2.1. Bovine Vein

13.4.2.2. Saphenous Vein

13.4.2.3. Others

13.4.3. Biosynthetic

13.4.3.1. Ovine Collagen with Polyester

13.4.3.2. Others

13.5. Market Value Forecast, by Application, 2017–2031

13.5.1. Coronary Artery Bypass

13.5.2. Aneurysm

13.5.3. Vascular Occlusion

13.5.4. Critical Limb Ischemia

13.5.5. Renal Failure

13.5.6. Others

13.6. Market Value Forecast, by End-user, 2017–2031

13.6.1. Hospitals

13.6.2. Ambulatory Surgery Centers

13.6.3. Cardiac Catheterization Laboratories

13.6.4. Specialty Clinics

13.6.5. Others

13.7. Market Value Forecast, by Country/Sub-region, 2017–2031

13.7.1. Germany

13.7.2. U.K.

13.7.3. France

13.7.4. Italy

13.7.5. Spain

13.7.6. Rest of Europe

13.8. Market Attractiveness Analysis

13.8.1. By Product

13.8.2. By Size of Vascular Graft

13.8.3. By Source

13.8.4. By Application

13.8.5. By End-user

13.8.6. By Country/Sub-region

14. Asia Pacific Vascular Grafts Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017–2031

14.2.1. Endovascular Stent Graft

14.2.2. Peripheral Vascular Graft

14.2.3. Hemodialysis Access Graft

14.2.4. Bypass Graft

14.2.5. Others

14.3. Market Value Forecast, by Size of Vascular Graft, 2017–2031

14.3.1. Large Size Vascular Graft

14.3.2. Small Size Vascular Graft

14.4. Market Value Forecast, by Source, 2017–2031

14.4.1. Synthetic

14.4.1.1. Polytetrafluethylene (PTFE)

14.4.1.2. Polyurethane (PU)

14.4.1.3. Dacron

14.4.1.4. Others

14.4.2. Biological

14.4.2.1. Bovine Vein

14.4.2.2. Saphenous Vein

14.4.2.3. Others

14.4.3. Biosynthetic

14.4.3.1. Ovine Collagen with Polyester

14.4.3.2. Others

14.5. Market Value Forecast, by Application, 2017–2031

14.5.1. Coronary Artery Bypass

14.5.2. Aneurysm

14.5.3. Vascular Occlusion

14.5.4. Critical Limb Ischemia

14.5.5. Renal Failure

14.5.6. Others

14.6. Market Value Forecast, by End-user, 2017–2031

14.6.1. Hospitals

14.6.2. Ambulatory Surgery Centers

14.6.3. Cardiac Catheterization Laboratories

14.6.4. Specialty Clinics

14.6.5. Others

14.7. Market Value Forecast, by Country/Sub-region, 2017–2031

14.7.1. China

14.7.2. Japan

14.7.3. India

14.7.4. Australia & New Zealand

14.7.5. Rest of Asia Pacific

14.8. Market Attractiveness Analysis

14.8.1. By Product

14.8.2. By Size of Vascular Graft

14.8.3. By Source

14.8.4. By Application

14.8.5. By End-user

14.8.6. By Country/Sub-region

15. Latin America Vascular Grafts Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Product, 2017–2031

15.2.1. Endovascular Stent Graft

15.2.2. Peripheral Vascular Graft

15.2.3. Hemodialysis Access Graft

15.2.4. Bypass Graft

15.2.5. Others

15.3. Market Value Forecast, by Size of Vascular Graft, 2017–2031

15.3.1. Large Size Vascular Graft

15.3.2. Small Size Vascular Graft

15.4. Market Value Forecast, by Source, 2017–2031

15.4.1. Synthetic

15.4.1.1. Polytetrafluethylene (PTFE)

15.4.1.2. Polyurethane (PU)

15.4.1.3. Dacron

15.4.1.4. Others

15.4.2. Biological

15.4.2.1. Bovine Vein

15.4.2.2. Saphenous Vein

15.4.2.3. Others

15.4.3. Biosynthetic

15.4.3.1. Ovine Collagen with Polyester

15.4.3.2. Others

15.5. Market Value Forecast, by Application , 2017–2031

15.5.1. Coronary Artery Bypass

15.5.2. Aneurysm

15.5.3. Vascular Occlusion

15.5.4. Critical Limb Ischemia

15.5.5. Renal Failure

15.5.6. Others

15.6. Market Value Forecast, by End-user, 2017–2031

15.6.1. Hospitals

15.6.2. Ambulatory Surgery Centers

15.6.3. Cardiac Catheterization Laboratories

15.6.4. Specialty Clinics

15.6.5. Others

15.7. Market Value Forecast, by Country/Sub-region, 2017–2031

15.7.1. Brazil

15.7.2. Mexico

15.7.3. Rest of Latin America

15.8. Market Attractiveness Analysis

15.8.1. By Product

15.8.2. By Size of Vascular Graft

15.8.3. By Source

15.8.4. By Application

15.8.5. By End-user

15.8.6. By Country/Sub-region

16. Middle East & Africa Vascular Grafts Market Analysis and Forecast

16.1. Introduction

16.1.1. Key Findings

16.2. Market Value Forecast, by Product, 2017–2031

16.2.1. Endovascular Stent Graft

16.2.2. Peripheral Vascular Graft

16.2.3. Hemodialysis Access Graft

16.2.4. Bypass Graft

16.2.5. Others

16.3. Market Value Forecast, by Size of Vascular Graft, 2017–2031

16.3.1. Large Size Vascular Graft

16.3.2. Small Size Vascular Graft

16.4. Market Value Forecast, by Source, 2017–2031

16.4.1. Synthetic

16.4.1.1. Polytetrafluethylene (PTFE)

16.4.1.2. Polyurethane (PU)

16.4.1.3. Dacron

16.4.1.4. Others

16.4.2. Biological

16.4.2.1. Bovine Vein

16.4.2.2. Saphenous Vein

16.4.2.3. Others

16.4.3. Biosynthetic

16.4.3.1. Ovine Collagen with Polyester

16.4.3.2. Others

16.5. Market Value Forecast, by Application, 2017–2031

16.5.1. Coronary Artery Bypass

16.5.2. Aneurysm

16.5.3. Vascular Occlusion

16.5.4. Critical Limb Ischemia

16.5.5. Renal Failure

16.5.6. Others

16.6. Market Value Forecast, by End-user, 2017–2031

16.6.1. Hospitals

16.6.2. Ambulatory Surgery Centers

16.6.3. Cardiac Catheterization Laboratories

16.6.4. Specialty Clinics

16.6.5. Others

16.7. Market Value Forecast, by Country/Sub-region, 2017–2031

16.7.1. GCC Countries

16.7.2. South Africa

16.7.3. Rest of Middle East & Africa

16.8. Market Attractiveness Analysis

16.8.1. By Product

16.8.2. By Size of Vascular Graft

16.8.3. By Source

16.8.4. By Application

16.8.5. By End-user

16.8.6. By Country/Sub-region

17. Competition Landscape

17.1. Market Player - Competition Matrix (by tier and size of companies)

17.2. Market Share Analysis, by Company, 2021

17.3. Company Profiles

17.3.1. B. Braun SE

17.3.1.1. Company Overview

17.3.1.2. Product Portfolio

17.3.1.3. SWOT Analysis

17.3.1.4. Strategic Overview

17.3.2. BD

17.3.2.1. Company Overview

17.3.2.2. Product Portfolio

17.3.2.3. SWOT Analysis

17.3.2.4. Strategic Overview

17.3.3. Cook Medical, Inc.

17.3.3.1. Company Overview

17.3.3.2. Product Portfolio

17.3.3.3. SWOT Analysis

17.3.3.4. Strategic Overview

17.3.4. CryoLife, Inc.

17.3.4.1. Company Overview

17.3.4.2. Product Portfolio

17.3.4.3. SWOT Analysis

17.3.4.4. Strategic Overview

17.3.5. Getinge AB

17.3.5.1. Company Overview

17.3.5.2. Product Portfolio

17.3.5.3. SWOT Analysis

17.3.5.4. Strategic Overview

17.3.6. Heart Medical

17.3.6.1. Company Overview

17.3.6.2. Product Portfolio

17.3.6.3. SWOT Analysis

17.3.6.4. Strategic Overview

17.3.7. JUNKEN MEDICAL Co., Ltd.

17.3.7.1. Company Overview

17.3.7.2. Product Portfolio

17.3.7.3. SWOT Analysis

17.3.7.4. Strategic Overview

17.3.8. LeMaitre Vascular, Inc.

17.3.8.1. Company Overview

17.3.8.2. Product Portfolio

17.3.8.3. SWOT Analysis

17.3.8.4. Strategic Overview

17.3.9. Medtronic

17.3.9.1. Company Overview

17.3.9.2. Product Portfolio

17.3.9.3. SWOT Analysis

17.3.9.4. Strategic Overview

17.3.10. Terumo Corporation

17.3.10.1. Company Overview

17.3.10.2. Product Portfolio

17.3.10.3. SWOT Analysis

17.3.10.4. Strategic Overview

17.3.11. Vascular Graft Solutions

17.3.11.1. Company Overview

17.3.11.2. Product Portfolio

17.3.11.3. SWOT Analysis

17.3.11.4. Strategic Overview

17.3.12. W. L. Gore & Associates, Inc.

17.3.12.1. Company Overview

17.3.12.2. Product Portfolio

17.3.12.3. SWOT Analysis

17.3.12.4. Strategic Overview

List of Tables

Table 01: Global Vascular Graft Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 02: Global Vascular Graft Market Value (US$ Mn) Forecast, by Source, 2017‒2031

Table 03: Global Vascular Graft Market Value (US$ Mn) Forecast, by Synthetic Source, 2017‒2031

Table 04: Global Vascular Graft Market Value (US$ Mn) Forecast, by Biological Source, 2017‒2031

Table 05: Global Vascular Graft Market Value (US$ Mn) Forecast, by Biosynthetic Source, 2017‒2031

Table 06: Global Vascular Graft Market Value (US$ Mn) Forecast, by Size of Vascular Graft, 2017‒2031

Table 07: Global Vascular Graft Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 08: Global Vascular Graft Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 09: Global Vascular Graft Market Value (US$ Mn) Forecast, by Region, 2017‒2031

Table 10: North America Vascular Graft Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 11: North America Vascular Graft Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 12: North America Vascular Graft Market Value (US$ Mn) Forecast, by Source, 2017‒2031

Table 13: North America Vascular Graft Market Value (US$ Mn) Forecast, by Synthetic, 2017‒2031

Table 14: North America Vascular Graft Market Value (US$ Mn) Forecast, by Biological, 2017‒2031

Table 15: North America Vascular Graft Market Value (US$ Mn) Forecast, by Biosynthetic, 2017‒2031

Table 16: North America Vascular Graft Market Value (US$ Mn) Forecast, by Size of Vascular Graft, 2017‒2031

Table 17: North America Vascular Graft Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 18: North America Vascular Graft Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 19: Europe Vascular Graft Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017‒2031

Table 20: Europe Vascular Graft Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 21: Europe Vascular Graft Market Value (US$ Mn) Forecast, by Source, 2017‒2031

Table 22: Europe Vascular Graft Market Value (US$ Mn) Forecast, by Synthetic, 2017‒2031

Table 23: Europe Vascular Graft Market Value (US$ Mn) Forecast, by Biological, 2017‒2031

Table 24: Europe Vascular Graft Market Value (US$ Mn) Forecast, by Biosynthetic, 2017‒2031

Table 25: Europe Vascular Graft Market Value (US$ Mn) Forecast, by Size of Vascular Graft, 2017‒2031

Table 26: Europe Vascular Graft Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 27: Europe Vascular Graft Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 28: Asia Pacific Vascular Graft Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017‒2031

Table 29: Asia Pacific Vascular Graft Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 30: Asia Pacific Vascular Graft Market Value (US$ Mn) Forecast, by Source, 2017‒2031

Table 31: Asia Pacific Vascular Graft Market Value (US$ Mn) Forecast, by Synthetic, 2017‒2031

Table 32: Asia Pacific Vascular Graft Market Value (US$ Mn) Forecast, by Biological, 2017‒2031

Table 33: Asia Pacific Vascular Graft Market Value (US$ Mn) Forecast, by Biosynthetic, 2017‒2031

Table 34: Asia Pacific Vascular Graft Market Value (US$ Mn) Forecast, by Size of Vascular Graft, 2017‒2031

Table 35: Asia Pacific Vascular Graft Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 36: Asia Pacific Vascular Graft Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 37: Latin America Vascular Graft Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017‒2031

Table 38: Latin America Vascular Graft Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 39: Latin America Vascular Graft Market Value (US$ Mn) Forecast, by Source, 2017‒2031

Table 40: Latin America Vascular Graft Market Value (US$ Mn) Forecast, by Synthetic, 2017‒2031

Table 41: Latin America Vascular Graft Market Value (US$ Mn) Forecast, by Biological, 2017‒2031

Table 42: Latin America Vascular Graft Market Value (US$ Mn) Forecast, by Biosynthetic Source, 2017‒2031

List of Figures

Figure 01: Global Vascular Grafts Market Value (US$ Bn) Forecast, 2017–2031

Figure 02: Global Vascular Grafts Market Value Share, by Product, 2021

Figure 03: Global Vascular Grafts Market Value Share, by Size of Vascular Graft, 2021

Figure 04: Global Vascular Grafts Market Value Share, by Source, 2021

Figure 04: Global Vascular Grafts Market Value Share, by Application, 2021

Figure 04: Global Vascular Grafts Market Value Share, by End-user, 2021

Figure 05: Global Vascular Grafts Market Value Share Analysis, by Product, 2021 and 2031

Figure 06: Global Vascular Grafts Market Attractiveness Analysis, by Product, 2022–2031

Figure 09: Global Vascular Grafts Market Value Share Analysis, by Size of Vascular Graft, 2021 and 2031

Figure 10: Global Vascular Grafts Market Attractiveness Analysis, by Size of Vascular Graft, 2022–2031

Figure 11: Global Vascular Grafts Market Value Share Analysis, by Source, 2021 and 2031

Figure 12: Global Vascular Grafts Market Attractiveness Analysis, by Source, 2022–2031

Figure 13: Global Vascular Grafts Market Value Share Analysis, by Application, 2021 and 2031

Figure 14: Global Vascular Grafts Market Attractiveness Analysis, by Application, 2022–2031

Figure 15: Global Vascular Grafts Market Value Share Analysis, by End-user, 2021 and 2031

Figure 16: Global Vascular Grafts Market Attractiveness Analysis, by End-user, 2022–2031

Figure 17: Global Vascular Grafts Market Value Share Analysis, by Region, 2021 and 2031

Figure 18: Global Vascular Grafts Market Attractiveness Analysis, by Region, 2022–2031

Figure 19: North America Vascular Grafts Market Value (US$ Bn) Forecast, 2017–2031

Figure 20: North America Vascular Grafts Market Value Share Analysis, by Country, 2021 and 2031

Figure 21: North America Vascular Grafts Market Attractiveness Analysis, by Country, 2022–2031

Figure 22: North America Vascular Grafts Market Value Share Analysis, by Product, 2021 and 2031

Figure 23: North America Vascular Grafts Market Attractiveness Analysis, by Product, 2022–2031

Figure 24: North America Vascular Grafts Market Value Share Analysis, by Size of Vascular Graft, 2021 and 2031

Figure 25: North America Vascular Grafts Market Attractiveness Analysis, by Size of Vascular Graft, 2022–2031

Figure 26: North America Vascular Grafts Market Value Share Analysis, by Source, 2021 and 2031

Figure 27: North America Vascular Grafts Market Attractiveness Analysis, by Source, 2022–2031

Figure 28: North America Vascular Grafts Market Value Share Analysis, by Application, 2021 and 2031

Figure 29: North America Vascular Grafts Market Attractiveness Analysis, by Application, 2022–2031

Figure 30: North America Vascular Grafts Market Value Share Analysis, by End-user, 2021 and 2031

Figure 31: North America Vascular Grafts Market Attractiveness Analysis, by End-user, 2022–2031

Figure 32: Europe Vascular Grafts Market Value (US$ Bn) Forecast, 2017–2031

Figure 33: Europe Vascular Grafts Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 34: Europe Vascular Grafts Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 35: Europe Vascular Grafts Market Value Share Analysis, by Product, 2021 and 2031

Figure 36: Europe Vascular Grafts Market Attractiveness Analysis, by Product, 2022–2031

Figure 37: Europe Vascular Grafts Market Value Share Analysis, by Size of Vascular Graft, 2021 and 2031

Figure 38: Europe Vascular Grafts Market Attractiveness Analysis, by Size of Vascular Graft, 2022–2031

Figure 39: Europe Vascular Grafts Market Value Share Analysis, by Source, 2021 and 2031

Figure 40: Europe Vascular Grafts Market Attractiveness Analysis, by Source, 2022–2031

Figure 41: Europe Vascular Grafts Market Value Share Analysis, by Application, 2021 and 2031

Figure 42: Europe Vascular Grafts Market Attractiveness Analysis, by Application, 2022–2031

Figure 43: Europe Vascular Grafts Market Value Share Analysis, by End-user, 2021 and 2031

Figure 44: Europe Vascular Grafts Market Attractiveness Analysis, by End-user, 2022–2031

Figure 45: Asia Pacific Vascular Grafts Market Value (US$ Bn) Forecast, 2017–2031

Figure 46: Asia Pacific Vascular Grafts Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 47: Asia Pacific Vascular Grafts Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 48: Asia Pacific Vascular Grafts Market Value Share Analysis, by Product, 2021 and 2031

Figure 49: Asia Pacific Vascular Grafts Market Attractiveness Analysis, by Product, 2022–2031

Figure 50: Asia Pacific Vascular Grafts Market Value Share Analysis, by Size of Vascular Graft, 2021 and 2031

Figure 51: Asia Pacific Vascular Grafts Market Attractiveness Analysis, by Size of Vascular Graft, 2022–2031

Figure 52: Asia Pacific Vascular Grafts Market Value Share Analysis, by Source, 2021 and 2031

Figure 53: Asia Pacific Vascular Grafts Market Attractiveness Analysis, by Source, 2022–2031

Figure 54: Asia Pacific Vascular Grafts Market Value Share Analysis, by Application, 2021 and 2031

Figure 55: Asia Pacific Vascular Grafts Market Attractiveness Analysis, by Application, 2022–2031

Figure 56: Asia Pacific Vascular Grafts Market Value Share Analysis, by End-user, 2021 and 2031

Figure 57: Asia Pacific Vascular Grafts Market Attractiveness Analysis, by End-user, 2022–2031

Figure 58: Latin America Vascular Grafts Market Value (US$ Bn) Forecast, 2017–2031

Figure 59: Latin America Vascular Grafts Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 60: Latin America Vascular Grafts Market Attractiveness Analysis, by Country/Sub-region, 2021-2031

Figure 61: Latin America Vascular Grafts Market Value Share Analysis, by Product, 2021 and 2031

Figure 62: Latin America Vascular Grafts Market Attractiveness Analysis, by Product, 2022–2031

Figure 63: Latin America Vascular Grafts Market Value Share Analysis, by Size of Vascular Graft, 2021 and 2031

Figure 64: Latin America Vascular Grafts Market Attractiveness Analysis, by Size of Vascular Graft, 2022–2031

Figure 65: Latin America Vascular Grafts Market Value Share Analysis, by Source, 2021 and 2031

Figure 66: Latin America Vascular Grafts Market Attractiveness Analysis, by Source, 2022–2031

Figure 67: Latin America Vascular Grafts Market Value Share Analysis, by Application, 2021 and 2031

Figure 68: Latin America Vascular Grafts Market Attractiveness Analysis, by Application, 2022–2031

Figure 69: Latin America Vascular Grafts Market Value Share Analysis, by End-user, 2021 and 2031

Figure 70: Latin America Vascular Grafts Market Attractiveness Analysis, by End-user, 2022–2031

Figure 71: Middle East & Africa Vascular Grafts Market Value (US$ Bn) Forecast, 2017–2031

Figure 72: Middle East & Africa Vascular Grafts Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 73: Middle East & Africa Vascular Grafts Market Attractiveness Analysis, by Country/Sub-region, 2021-2031

Figure 74: Middle East & Africa Vascular Grafts Market Value Share Analysis, by Product, 2021 and 2031

Figure 75: Middle East & Africa Vascular Grafts Market Attractiveness Analysis, by Product, 2022–2031

Figure 76: Middle East & Africa Vascular Grafts Market Value Share Analysis, by Size of Vascular Graft, 2021 and 2031

Figure 77: Middle East & Africa Vascular Grafts Market Attractiveness Analysis, by Size of Vascular Graft, 2022–2031

Figure 78: Middle East & Africa Vascular Grafts Market Value Share Analysis, by Source, 2021 and 2031

Figure 79: Middle East & Africa Vascular Grafts Market Attractiveness Analysis, by Source, 2022–2031

Figure 80: Middle East & Africa Vascular Grafts Market Value Share Analysis, by Application, 2021 and 2031

Figure 81: Middle East & Africa Vascular Grafts Market Attractiveness Analysis, by Application, 2022–2031

Figure 82: Middle East & Africa Vascular Grafts Market Value Share Analysis, by End-user, 2021 and 2031

Figure 83: Middle East & Africa Vascular Grafts Market Attractiveness Analysis, by End-user, 2022–2031

Figure 84: Company Share Analysis, 2021