The European Parliament recently announced the postponement of the implementation of the new Medical Device Regulation (MDR) by a year, due to the unprecedented COVID-19 (coronavirus) outbreak. This will help medtech companies in the vascular closure devices market to stabilize their operations, owing to the debilitating consequences of the pandemic.

This postponement is to come in practice after individual member states share their approval. However, the COVID-19 crisis has slowed down innovations in the vascular closure devices market and postponement of the regulations is anticipated to affect the growth rate of the market.

Given the current pressure on the national health authorities, popular news outlets state that compliance with new regulations could create a shortage and delay in the supply of medical devices in Europe. Hence, the postponement of the new Medical Device Regulation (MDR) will help medical device manufacturers to meet urgent demands in healthcare facilities caused due to the COVID-19 outbreak.

Specialty-focused solutions are acquiring prominence in the vascular closure devices. For instance, leading supplier of specialty medical devices for critical care and surgery Teleflex, announced to showcase their MANTA® vascular closure device at the 2019 PCR London Valves-a cross-disciplinary course being held in London, U.K. Specialty-focused solutions are helping healthcare providers to improve the health and patient quality of life worldwide.

Companies are increasing efforts to develop products that simplify complex procedures and overcome barriers associated with common procedural challenges.

Novel biomechanical vascular closure devices (VDCs) are boosting the credibility of companies in the market landscape. These devices are being pervasively used by interventionalists worldwide for the closure of large bore femoral arteriotomies.

Companies in the vascular closure devices market are designing products that seal arterial puncture holes post percutaneous coronary intervention (PCI) catheter based vascular procedures. As such, the revenue of peripheral vascular interventions is anticipated for robust growth during the forecast period.

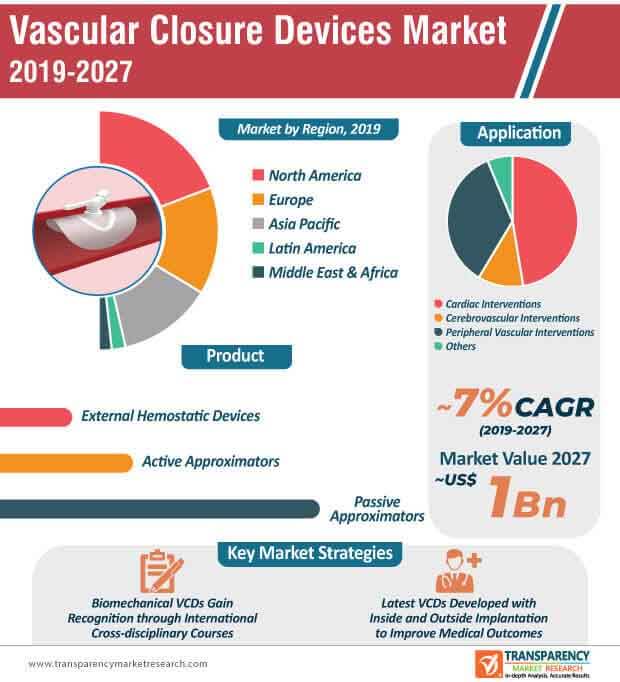

Companies in the vascular closure devices market are investing in capacity additions to manufacture products used to close femoral arteriotomies following intra-arterial procedures. This explains why cardiac interventions dictate the highest revenue among all applications in the vascular closure devices, since these devices are being increasingly used in peripheral and coronary angioplasty, owing to the high prevalence of cardiovascular diseases worldwide. As such, the market is estimated to reach a value of ~US$ 1 Bn by the end of 2027.

Other important applications demanding vascular closure devices are other intra-arterial procedures such as arterial stents, balloon angioplasty, and diagnostic or interventional catheterization procedures.

Hence, companies in the vascular closure devices are increasing their production capabilities to manufacture biocompatible stainless steel implants. They are increasing R&D to design implants that can be applied both inside and outside of the puncture site in the femoral artery.

Suture-based closure devices are being adopted by healthcare professionals for percutaneous closure of large-bore arteriotomies. Such advancements are boosting the growth for the vascular closure devices market, which is predicted to grow at a robust CAGR of ~7% during the forecast period.

However, suture-based closure devices are cumbersome and are experiencing a downtick, owing to their long learning curve and increased risk of complications. Hence, companies in the vascular closure devices are increasing their efforts to design devices that are used in parallel or angulated configuration.

Prominent medical devices and healthcare company Abbott is increasing awareness about Perclose ProGlide-an improved suture-based vascular closure device, which is being frequently used in large-bore vessel closures. Advanced vascular closure devices are performing in challenging procedures such as suture knots that are advanced to the vessel wall for final vascular closures.

Recent trends include single-device deployment in hybrid closure techniques. On the other hand, dedicated large-bore closure devices are overcoming limitations of surgical and suture-based closure techniques.

Analysts’ Viewpoint

Europe dominates the second-highest revenue among all regions in the vascular closure devices market, but is challenged with urgent needs, owing to the COVID-19 pandemic, which is relatively severe in European countries. As such, the postponement of the new EU-MDR will help medtech companies to stabilize their operations over the next few months and prevent shortage of medical devices.

Though suture-based techniques form the current standard of care, these techniques remain technically demanding for inexperienced healthcare operators and are relatively time consuming. Hence, companies should increase the availability of dedicated large-bore devices that overcome the drawbacks associated with suture-based closure devices.

Vascular closure devices is estimated to reach a value of ~US$ 1 Bn by the end of 2027

Vascular closure devices to expand at a CAGR of ~7% from 2019 to 2027

Vascular closure devices is driven by increase in number of surgical procedures

The passive approximators segment dominated the vascular closure devices in 2018 and the trend is projected to continue during the forecast period

Key players in the global vascular closure devices report include Terumo Medical Corporation, Cardinal Health, Abbott, Cardiva Medical, Inc., Medtronic plc

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Vascular Closure Devices Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Vascular Closure Devices Market Analysis and Forecast, 2017–2027

5. Market Outlook

5.1. Technological Advancements

5.2. Epidemiology of Cardiac Diseases

5.3. Regulatory Scenario

5.4. Key Industry Events (Mergers, Acquisitions, New Service Launch, etc.)

6. Global Vascular Closure Devices Market Value and Forecast, by Product

6.1. Introduction

6.2. Global Vascular Closure Devices Market Value Forecast, by Product, 2017–2027

6.2.1. Passive Approximators

6.2.1.1. Collagen Plugs

6.2.1.2. Sealant Or Gel-based Devices

6.2.1.3. Compression-assist Devices

6.2.2. Active Approximators

6.2.2.1. Suture-based Devices

6.2.2.2. Clip-based Devices

6.2.3. External Hemostatic Devices

6.3. Global Vascular Closure Devices Market Attractiveness, by Product

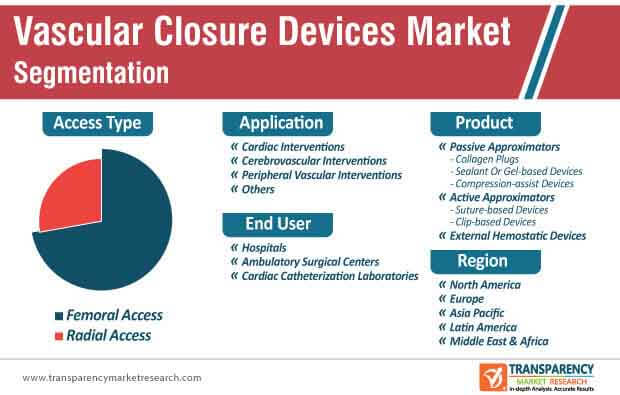

7. Global Vascular Closure Devices Market Value and Forecast, by Access Type

7.1. Introduction

7.2. Global Vascular Closure Devices Market Value Forecast, by Access Type, 2017–2027

7.2.1. Femoral Access

7.2.2. Radial Access

7.3. Global Vascular Closure Devices Market Attractiveness, by Access Type

8. Global Vascular Closure Devices Market Value and Forecast, by Application

8.1. Introduction

8.2. Global Vascular Closure Devices Market Value Forecast, by Application, 2017–2027

8.2.1. Cardiac Interventions

8.2.2. Cerebrovascular Interventions

8.2.3. Peripheral Vascular Interventions

8.2.4. Others

8.3. Global Vascular Closure Devices Market Attractiveness, by Application

9. Global Vascular Closure Devices Market Value and Forecast, by End-user

9.1. Introduction

9.1.1. Global Vascular Closure Devices Market Value Forecast, by End-user, 2017–2027

9.1.2. Hospitals

9.1.3. Ambulatory Surgical Centers

9.1.4. Cardiac Catheterization Laboratories

9.2. Global Vascular Closure Devices Market Attractiveness, by End-user

10. Global Vascular Closure Devices Market Value and Forecast, by Region

10.1. Introduction

10.2 Vascular Closure Devices Market Value Forecast, by Region, 2017–2027

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Latin America

10.1.5. Middle East & Africa

. Global Vascular Closure Devices Market Attractiveness, by Region

11. North America Vascular Closure Devices Market Analysis and Forecast

11.1. Introduction

11.2. North America Vascular Closure Devices Market Value Forecast, by Product, 2017–2027

11.2.1. Passive Approximators

11.2.1.1. Collagen Plugs

11.2.1.2. Sealant Or Gel-based Devices

11.2.1.3. Compression-assist Devices

11.2.2. Active Approximators

11.2.2.1. Suture-based Devices

11.2.2.2. Clip-based Devices

11.2.3. External Hemostatic Devices

11.3. North America Vascular Closure Devices Market Value Forecast, by Access Type, 2017–2027

11.3.1. Femoral Access

11.3.2. Radial Access

11.4. North America Vascular Closure Devices Market Value Forecast, by Application, 2017–2027

11.4.1. Cardiac Interventions

11.4.2. Cerebrovascular Interventions

11.4.3. Peripheral Vascular Interventions

11.4.4. Others

11.5. North America Vascular Closure Devices Market Value Forecast, by End-user, 2017–2027

11.5.1. Hospitals

11.5.2. Ambulatory Surgical Centers

11.5.3. Cardiac Catheterization Laboratories

11.6. North America Vascular Closure Devices Market Value Forecast, by Country, 2017–2027

11.6.1. U.S.

11.6.2. Canada

11.7. North America Vascular Closure Devices Market Attractiveness Analysis

11.7.1. By Product

11.7.2. By Access Type

11.7.3. By Application

11.7.4. By End-user

11.7.5. By Country

12. Europe Vascular Closure Devices Market Analysis and Forecast

12.1. Introduction

12.2. Europe Vascular Closure Devices Market Value Forecast, by Product, 2017–2027

12.2.1. Passive Approximators

12.2.1.1. Collagen Plugs

12.2.1.2. Sealant Or Gel-based Devices

12.2.1.3. Compression-assist Devices

12.2.2. Active Approximators

12.2.2.1. Suture-based Devices

12.2.2.2. Clip-based Devices

12.2.3. External Hemostatic Devices

12.3. Europe Vascular Closure Devices Market Value Forecast, by Access Type, 2017–2027

12.3.1. Femoral Access

12.3.2. Radial Access

12.4. Europe Vascular Closure Devices Market Value Forecast, by Application, 2017–2027

12.4.1. Cardiac Interventions

12.4.2. Cerebrovascular Interventions

12.4.3. Peripheral Vascular Interventions

12.4.4. Others

12.5. Europe Vascular Closure Devices Market Value Forecast, by End-user, 2017–2027

12.5.1. Hospitals

12.5.2. Ambulatory Surgical Centers

12.5.3. Cardiac Catheterization Laboratories

12.6. Europe Vascular Closure Devices Market Value Forecast, by Country/Sub-region, 2017–2027

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Rest of Europe

12.7. Europe Vascular Closure Devices Market Attractiveness Analysis

12.7.1. By Product

12.7.2. By Access Type

12.7.3. By Application

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Vascular Closure Devices Market Analysis and Forecast

13.1. Introduction

13.2. Asia Pacific Vascular Closure Devices Market Value Forecast, by Product, 2017–2027

13.2.1. Passive Approximators

13.2.1.1. Collagen Plugs

13.2.1.2. Sealant Or Gel-based Devices

13.2.1.3. Compression-assist Devices

13.2.2. Active Approximators

13.2.2.1. Suture-based Devices

13.2.2.2. Clip-based Devices

13.2.3. External Hemostatic Devices

13.3. Asia Pacific Vascular Closure Devices Market Value Forecast, by Access Type, 2017–2027

13.3.1. Femoral Access

13.3.2. Radial Access

13.4. Asia Pacific Vascular Closure Devices Market Value Forecast, by Application, 2017–2027

13.4.1. Cardiac Interventions

13.4.2. Cerebrovascular Interventions

13.4.3. Peripheral Vascular Interventions

13.4.4. Others

13.5. Asia Pacific Vascular Closure Devices Market Value Forecast, by End-user, 2017–2027

13.5.1. Hospitals

13.5.2. Ambulatory Surgical Centers

13.5.3. Cardiac Catheterization Laboratories

13.6. Asia Pacific Vascular Closure Devices Market Value Forecast, by Country/Sub-region, 2017–2027

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Asia Pacific Vascular Closure Devices Market Attractiveness Analysis

13.7.1. By Product

13.7.2. By Access Type

13.7.3. By Application

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Vascular Closure Devices Market Analysis and Forecast

14.1. Introduction

14.2. Latin America Vascular Closure Devices Market Value Forecast, by Product, 2017–2027

14.2.1. Passive Approximators

14.2.1.1. Collagen Plugs

14.2.1.2. Sealant Or Gel-based Devices

14.2.1.3. Compression-assist Devices

14.2.2. Active Approximators

14.2.2.1. Suture-based Devices

14.2.2.2. Clip-based Devices

14.2.3. External Hemostatic Devices

14.3. Latin America Vascular Closure Devices Market Value Forecast, by Access Type, 2017–2027

14.3.1. Femoral Access

14.3.2. Radial Access

14.4. Latin America Vascular Closure Devices Market Value Forecast, by Application, 2017–2027

14.4.1. Cardiac Interventions

14.4.2. Cerebrovascular Interventions

14.4.3. Peripheral Vascular Interventions

14.4.4. Others

14.5. Latin America Vascular Closure Devices Market Value Forecast, by End-user, 2017–2027

14.5.1. Hospitals

14.5.2. Ambulatory Surgical Centers

14.5.3. Cardiac Catheterization Laboratories

14.6. Latin America Vascular Closure Devices Market Value Forecast, by Country/Sub-region, 2017–2027

14.6.1. Mexico

14.6.2. Brazil

14.6.3. Rest of Latin America

14.7. Latin America Vascular Closure Devices Market Attractiveness Analysis

14.7.1. By Product

14.7.2. By Access Type

14.7.3. By Application

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Vascular Closure Devices Market Analysis and Forecast

15.1. Introduction

15.2. Middle East & Africa Vascular Closure Devices Market Value Forecast, by Product, 2017–2027

15.2.1. Passive Approximators

15.2.1.1. Collagen Plugs

15.2.1.2. Sealant Or Gel-based Devices

15.2.1.3. Compression-assist Devices

15.2.2. Active Approximators

15.2.2.1. Suture-based Devices

15.2.2.2. Clip-based Devices

15.2.3. External Hemostatic Devices

15.3. Middle East & Africa Vascular Closure Devices Market Value Forecast, by Access Type, 2017–2027

15.3.1. Femoral Access

15.3.2. Radial Access

15.4. Middle East & Africa Vascular Closure Devices Market Value Forecast, by Application, 2017–2027

15.4.1. Cardiac Interventions

15.4.2. Cerebrovascular Interventions

15.4.3. Peripheral Vascular Interventions

15.4.4. Others

15.5. Middle East & Africa Vascular Closure Devices Market Value Forecast, by End-user, 2017–2027

15.5.1. Hospitals

15.5.2. Ambulatory Surgical Centers

15.5.3. Cardiac Catheterization Laboratories

15.6. Middle East & Africa Vascular Closure Devices Market Value Forecast, by Country/Sub-region, 2017–2027

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Middle East & Africa Vascular Closure Devices Market Attractiveness Analysis

15.7.1. By Product

15.7.2. By Access Type

15.7.3. By Application

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix

16.2. Global Vascular Closure Devices Market Position Analysis, by Company, 2018

16.3. Company Profiles

16.3.1. Medtronic plc.

16.3.1.1. Company Description

16.3.1.2. Business Overview

16.3.1.3. Financial Overview

16.3.1.4. Strategic Overview

16.3.1.5. SWOT Analysis

16.3.2. Terumo Medical Corporation

16.3.2.1. Company Description

16.3.2.2. Business Overview

16.3.2.3. Financial Overview

16.3.2.4. Strategic Overview

16.3.2.5. SWOT Analysis

16.3.3. Abbott

16.3.3.1. Company Description

16.3.3.2. Business Overview

16.3.3.3. Financial Overview

16.3.3.4. Strategic Overview

16.3.3.5. SWOT Analysis

16.3.4. BIOTRONIK

16.3.4.1. Company Description

16.3.4.2. Business Overview

16.3.4.3. Financial Overview

16.3.4.4. Strategic Overview

16.3.4.5. SWOT Analysis

16.3.5. Teleflex Incorporated

16.3.5.1. Company Description

16.3.5.2. Business Overview

16.3.5.3. Financial Overview

16.3.5.4. Strategic Overview

16.3.5.5. SWOT Analysis

16.3.6. Merit Medical Systems, Inc.

16.3.6.1. Company Description

16.3.6.2. Business Overview

16.3.6.3. Financial Overview

16.3.6.4. Strategic Overview

16.3.6.5. SWOT Analysis

16.3.7. Cardinal Health

16.3.7.1. Company Description

16.3.7.2. Business Overview

16.3.7.3. Financial Overview

16.3.7.4. Strategic Overview

16.3.7.5. SWOT Analysis

16.3.8. Cardiva Medical, Inc.

16.3.8.1. Company Description

16.3.8.2. Business Overview

16.3.8.3. Strategic Overview

16.3.8.4. SWOT Analysis

16.3.9. Tricol Medical

16.3.9.1. Company Description

16.3.9.2. Business Overview

16.3.9.3. SWOT Analysis

16.3.10. Z-Medica, LLC

16.3.10.1. Company Description

16.3.10.2. Business Overview

16.3.10.3. Strategic Overview

16.3.10.4. SWOT Analysis

List of Tables

Table 01 Global Vascular Closure Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 02 Global Vascular Closure Devices Market Value (US$ Mn) Forecast, by Passive Approximators, 2017–2027

Table 03 Global Vascular Closure Devices Market Value (US$ Mn) Forecast, by Active Approximators, 2017–2027

Table 04 Global Vascular Closure Devices Market Value (US$ Mn) Forecast, by Access Type, 2017–2027

Table 05 Global Vascular Closure Devices Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 06 Global Vascular Closure Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 07 Global Vascular Closure Devices Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 08 North America Vascular Closure Devices Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 09 North America Vascular Closure Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 10 North America Vascular Closure Devices Market Value (US$ Mn) Forecast, by Passive Approximators, 2017–2027

Table 11 North America Vascular Closure Devices Market Value (US$ Mn) Forecast, by Active Approximators, 2017–2027

Table 12 North America Vascular Closure Devices Market Value (US$ Mn) Forecast, by Access Type, 2017–2027

Table 13 North America Vascular Closure Devices Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 14 North America Vascular Closure Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 15 Europe Vascular Closure Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 16 Europe Vascular Closure Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 17 Europe Vascular Closure Devices Market Value (US$ Mn) Forecast, by Passive Approximators, 2017–2027

Table 18 Europe Vascular Closure Devices Market Value (US$ Mn) Forecast, by Active Approximators, 2017–2027

Table 19 Europe Vascular Closure Devices Market Value (US$ Mn) Forecast, by Access Type, 2017–2027

Table 20 Europe Vascular Closure Devices Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 21 Europe Vascular Closure Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 22 Asia Pacific Vascular Closure Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 23 Asia Pacific Vascular Closure Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 24 Asia Pacific Vascular Closure Devices Market Value (US$ Mn) Forecast, by Passive Approximators, 2017–2027

Table 25 Asia Pacific Vascular Closure Devices Market Value (US$ Mn) Forecast, by Active Approximators, 2017–2027

Table 26 Asia Pacific Vascular Closure Devices Market Value (US$ Mn) Forecast, by Access Type, 2017–2027

Table 27 Asia Pacific Vascular Closure Devices Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 28 Asia Pacific Vascular Closure Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 29 Latin America Vascular Closure Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 30 Latin America Vascular Closure Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 31 Latin America Vascular Closure Devices Market Value (US$ Mn) Forecast, by Passive Approximators, 2017–2027

Table 32 Latin America Vascular Closure Devices Market Value (US$ Mn) Forecast, by Active Approximators, 2017–2027

Table 33 Latin America Vascular Closure Devices Market Value (US$ Mn) Forecast, by Access Type, 2017–2027

Table 34 Latin America Vascular Closure Devices Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 35 Latin America Vascular Closure Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 36 Middle East & Africa Vascular Closure Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 37 Middle East & Africa Vascular Closure Devices Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 38 Middle East & Africa Vascular Closure Devices Market Value (US$ Mn) Forecast, by Passive Approximators, 2017–2027

Table 39 Middle East & Africa Vascular Closure Devices Market Value (US$ Mn) Forecast, by Active Approximators, 2017–2027

Table 40 Middle East & Africa Vascular Closure Devices Market Value (US$ Mn) Forecast, by Access Type, 2017–2027

Table 41 Middle East & Africa Vascular Closure Devices Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 42 Middle East & Africa Vascular Closure Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2027

List of Figures

Figure 01 Global Vascular Closure Devices Market Value Share, by Passive Approximators, 2018

Figure 02 Global Vascular Closure Devices Market Value Share, by Active Approximators, 2018

Figure 03 Global Vascular Closure Devices Market Value Share, by Access Type 2018

Figure 04 Global Vascular Closure Devices Market Value Share, by End-user, 2018

Figure 05 Global Vascular Closure Devices Market Value Share Analysis, by Product, 2018 and 2027

Figure 06 Global Vascular Closure Devices Market Attractiveness Analysis, by Product, 2018-2027

Figure 07 Global Vascular Closure Devices Market Revenue (US$ Mn), by Passive Approximators, 2017–2027

Figure 08 Global Vascular Closure Devices Market Revenue (US$ Mn), by Active Approximators, 2017–2027

Figure 09 Global Vascular Closure Devices Market Revenue (US$ Mn), by External Hemostatic Devices, 2017–2027

Figure 10 Global Vascular Closure Devices Market Value Share Analysis, by Access Type, 2018 and 2027

Figure 11 Global Vascular Closure Devices Market Attractiveness Analysis, by Access Type, 2018-2027

Figure 12 Global Vascular Closure Devices Market Revenue (US$ Mn), by Femoral Access, 2017–2027

Figure 13 Global Vascular Closure Devices Market Revenue (US$ Mn), by Radial Access, 2017–2027

Figure 14 Global Vascular Closure Devices Market Value Share Analysis, by Application, 2018 and 2027

Figure 15 Global Vascular Closure Devices Market Attractiveness Analysis, by Application, 2018-2027

Figure 16 Global Vascular Closure Devices Market Revenue (US$ Mn), by Cardiac Interventions, 2017–2027

Figure 17 Global Vascular Closure Devices Market Revenue (US$ Mn), by Cerebrovascular Interventions, 2017–2027

Figure 18 Global Vascular Closure Devices Market Revenue (US$ Mn), by Peripheral Vascular Interventions, 2017–2027

Figure 19 Global Vascular Closure Devices Market Revenue (US$ Mn), by Others, 2017–2027

Figure 20 Global Vascular Closure Devices Market Value Share Analysis, by End-user, 2018 and 2027

Figure 21 Global Vascular Closure Devices Market Attractiveness Analysis, by End-user, 2018-2027

Figure 22 Global Vascular Closure Devices Market Revenue (US$ Mn), by Hospitals, 2017–2027

Figure 23 Global Vascular Closure Devices Market Revenue (US$ Mn), by Ambulatory Surgical Centers, 2017–2027

Figure 24 Global Vascular Closure Devices Market Revenue (US$ Mn), by Cardiac Catheterization Laboratories, 2017–2027

Figure 25 Global Vascular Closure Devices Market Value Share Analysis, by Region, 2018 and 2027

Figure 26 Global Vascular Closure Devices Market Attractiveness Analysis, by Region, 2018-2027

Figure 27 North America Vascular Closure Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 28 North America Vascular Closure Devices Market Value Share (%), by Country, 2018 and 2027

Figure 29 North America Vascular Closure Devices Market Attractiveness, by Country, 2019–2027

Figure 30 North America Vascular Closure Devices Market Value Share (%), by Product, 2018 and 2027

Figure 31 North America Vascular Closure Devices Market Attractiveness, by Product, 2019–2027

Figure 32 North America Vascular Closure Devices Market Value Share (%), by Access Type, 2018 and 2027

Figure 33 North America Vascular Closure Devices Market Attractiveness, by Access Type, 2019–2027

Figure 34 North America Vascular Closure Devices Market Value Share (%), by Application, 2018 and 2027

Figure 35 North America Vascular Closure Devices Market Attractiveness, by Application, 2019–2027

Figure 36 North America Vascular Closure Devices Market Value Share (%), by End-user, 2018 and 2027

Figure 37 North America Vascular Closure Devices Market Attractiveness, by End-user, 2019–2027

Figure 38 Europe Vascular Closure Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 39 Europe Vascular Closure Devices Market Value Share (%), by Country/Sub-region, 2018 and 2027

Figure 40 Europe Vascular Closure Devices Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 41 Europe Vascular Closure Devices Market Value Share (%), by Product, 2018 and 2027

Figure 42 Europe Vascular Closure Devices Market Attractiveness, by Product, 2019–2027

Figure 43 Europe Vascular Closure Devices Market Value Share (%), by Access Type, 2018 and 2027

Figure 44 Europe Vascular Closure Devices Market Attractiveness, by Access Type, 2019–2027

Figure 45 Europe Vascular Closure Devices Market Value Share (%), by Application, 2018 and 2027

Figure 46 Europe Vascular Closure Devices Market Attractiveness, by Application, 2019–2027

Figure 47 Europe Vascular Closure Devices Market Value Share (%), by End-user, 2018 and 2027

Figure 48 Europe Vascular Closure Devices Market Attractiveness, by End-user, 2019–2027

Figure 49 Asia Pacific Vascular Closure Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 50 Asia Pacific Vascular Closure Devices Market Value Share (%), by Country/Sub-region, 2018 and 2027

Figure 51 Asia Pacific Vascular Closure Devices Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 52 Asia Pacific Vascular Closure Devices Market Value Share (%), by Product, 2018 and 2027

Figure 53 Asia Pacific Vascular Closure Devices Market Attractiveness, by Product, 2019–2027

Figure 54 Asia Pacific Vascular Closure Devices Market Value Share (%), by Access Type, 2018 and 2027

Figure 55 Asia Pacific Vascular Closure Devices Market Attractiveness, by Access Type, 2019–2027

Figure 56 Asia Pacific Vascular Closure Devices Market Value Share (%), by Application, 2018 and 2027

Figure 57 Asia Pacific Vascular Closure Devices Market Attractiveness, by Application, 2019–2027

Figure 58 Asia Pacific Vascular Closure Devices Market Value Share (%), by End-user, 2018 and 2027

Figure 59 Asia Pacific Vascular Closure Devices Market Attractiveness, by End-user, 2019–2027

Figure 60 Latin America Vascular Closure Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 61 Latin America Vascular Closure Devices Market Value Share (%), by Country/Sub-region, 2018 and 2027

Figure 62 Latin America Vascular Closure Devices Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 63 Latin America Vascular Closure Devices Market Value Share (%), by Product, 2018 and 2027

Figure 64 Latin America Vascular Closure Devices Market Attractiveness, by Product, 2019–2027

Figure 65 Latin America Vascular Closure Devices Market Value Share (%), by Access Type, 2018 and 2027

Figure 66 Latin America Vascular Closure Devices Market Attractiveness, by Access Type, 2019–2027

Figure 67 Latin America Vascular Closure Devices Market Value Share (%), by Application, 2018 and 2027

Figure 68 Latin America Vascular Closure Devices Market Attractiveness, by Application, 2019–2027

Figure 69 Latin America Vascular Closure Devices Market Value Share (%), by End-user, 2018 and 2027

Figure 70 Latin America Vascular Closure Devices Market Attractiveness, by End-user, 2019–2027

Figure 71 Middle East & Africa Vascular Closure Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 72 Middle East & Africa Vascular Closure Devices Market Value Share (%), by Country/Sub-region, 2018 and 2027

Figure 73 Middle East & Africa Vascular Closure Devices Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 74 Middle East & Africa Vascular Closure Devices Market Value Share (%), by Product, 2018 and 2027

Figure 75 Middle East & Africa Vascular Closure Devices Market Attractiveness, by Product, 2019–2027

Figure 76 Middle East & Africa Vascular Closure Devices Market Value Share (%), by Access Type, 2018 and 2027

Figure 77 Middle East & Africa Vascular Closure Devices Market Attractiveness, by Access Type, 2019–2027

Figure 78 Middle East & Africa Vascular Closure Devices Market Value Share (%), by Application, 2018 and 2027

Figure 79 Middle East & Africa Vascular Closure Devices Market Attractiveness, by Application, 2019–2027

Figure 80 Middle East & Africa Vascular Closure Devices Market Value Share (%), by End-user, 2018 and 2027

Figure 81 Middle East & Africa Vascular Closure Devices Market Attractiveness, by End-user, 2019–2027