The changing lifestyle and growing preference for packaged food has grown the demand for vacuum packaging. Vacuum packaging helps in providing better shelf life, better flexibility, and portability for the food. Nowadays, more than 20% of the manufacturers have started using vacuum packaging. In addition, the players in the market introduce innovative solutions to meet the functional requirements of various end-user, especially in the food and beverages segment. The rising disposable income and growing preference to spend on hygiene food has also grown the demand for vacuum packaging that will provide a fillip to the market.

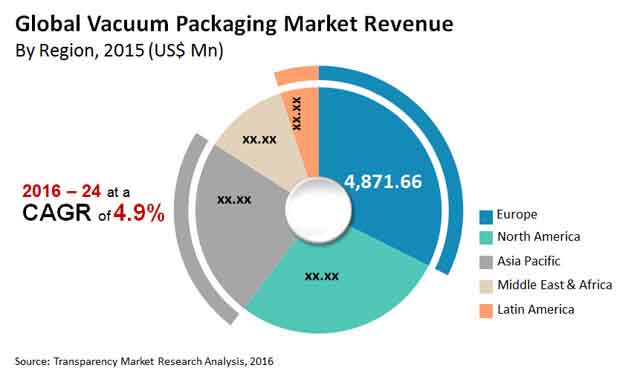

The global vacuum packaging market is prophesied to rise at 4.9% of CAGR during the forecast period between 2016 and 2024. The valuation for the market is expected to reach US$22.8 bn by the end of 2024, progressing from US$15.0 bn as estimated in 2015.

The global vacuum packaging market is categorized on the basis of pack type, material, and application. Based on material, the market is divided into polyvinylidene chloride (PVDC), polyethylene (PE), polypropylene (PP), polyester (PET), polyvinylchloride (PVC), and polyamide (PA). Out of these materials, polyethylene (PE) is likely to dominate the market and held 38% of the complete market in 2016. This segment is expected to rise at 4.6% CAGR over the forecast period and remain the dominant contributor to the revenue of the global market. Moreover, extended shelf life and higher barrier films of polypropylene packaging are the other factors that helps in fueling the market growth.

The application of vacuum packaging is seen in food and beverages, industrial goods, pharmaceuticals, and consumer goods. Of these, the demand for vacuum packaging is high in food and beverages. This segment is likely to dominate the market during the forecast period. Based on pack type, the global vacuum packaging market is divided into rigid packaging, semi-rigid packaging, and flexible packaging. Out of these, the flexible packaging segment is projected to lead during the forecast period as is it used for packaged food.

On the regional front, Europe is projected to lead the global vacuum packaging market and is considered as the most lucrative regional market in terms of revenue generation. In 2016, the market held 32.4% of total market share and expected to do so in the forthcoming years. After Europe, North America and Asia Pacific are favorable markets considered for the growth of the vacuum packaging. The vacuum packaging market in North America is expected to rise at 5.3% CAGR over the forecast period and is likely to create significant demand for vacuum packaging. Moreover, United Sates is the leading country in the region where large number of manufacturers are present and the demand for vacuum packaging is also very high in this country.

Furthermore, the Middle East and Africa are also considered as prominent markets for the vacuum packaging, but is projected to undergo huge losses in terms of incremental opportunities. In contrast, Latin America that accounts for a very small share in the global market is projected to rise at 4.9% of CAGR over the forecast tenure.

The report has elucidated on some of the key players and their contribution to the global vacuum packaging market. To mention some of the leading players in the market are Wipak Group, Amcor Limited, Bemis Company, Sealed Air Corporation, Berry Plastics Inc., and Mondi Group.

Vacuum Packaging Market to See Steady Revenues Coming from Food Industry during Post-pandemic World

Vacuum packaging has been widely used for a wide range of food products. Over the years, the technology has come to be used frequently for industrial goods, pharmaceutical products, and consumer goods. The key proposition of the mass scale adoption of vacuum packaging for food and beverages industry has been increasing the shelf life of the food products. The packaging prevents oxidation reactions, limits aerobic microorganisms, and improve the heat transfer. In meat products, vacuum packaging has been commonly used to restrain the growth of oxygen-breathing microorganisms in meat packaging. Polyethylene (PE) has been used extensively as the packaging material for various end-use industries in the vacuum packaging market. In recent years, the growing use of vacuum packaging for flexible packaging is a key trend spurring lucrative opportunities for packaging companies. Growing use of vacuum packaging for essential products has risen in recent months.

The COVID-19 outbreak brought forth numerous unique challenges for the industries in addition to being a health pandemic across the world. The pandemic saw proliferating demand for essential groceries and medication supply, which to an extent was a favorable trend spurring the utilization of vacuum packaging among food and pharmaceutical industries. On the other hand, the plunge in demand for other e-commerce purchases had severely impacted the profitability of stakeholders in the vacuum packaging market for most part of 2020. With continuous focus of the packaging sector on strategy recalibrations to overcome the fallout of the pandemic, the vacuum packaging manufacturers will see new set of challenges, and hence opportunity in unexplored application areas. Further, businesses will engage in new vendor relationship that might reduce the cost of raw material sourcing. Most of the new business models will see attention of investors in B2B markets. As the supply chains and distribution channels see improvements, vacuum packaging manufacturers will gain to see new avenues from the emerging new demography trends.

1. Executive Summary

2. Assumptions and Acronyms Used

3. Research Methodology

4. Global Vacuum Packaging Market Introduction

4.1. Global Vacuum Packaging Market Definition

4.2. Global Vacuum Packaging Market Taxonomy

4.3. Global Packaging Market Overview

5. Global Vacuum Packaging Market Analysis Scenario

5.1. Global Vacuum Packaging Market (US$ Mn) and Forecast

5.1.1. Global Vacuum Packaging Market and Y-o-Y Growth

5.1.2. Absolute $ Opportunity

5.2. Global Vacuum Packaging Market Overview

5.2.1. Value Chain

5.2.2. Profitability Margins

5.2.3. List of Active Participants

5.2.3.1. Raw Material Suppliers

5.2.3.2. Manufacturer

5.2.3.3. Distributors / Retailers

5.3. Product - Cost Teardown Analysis

6. Global Vacuum Packaging Market Dynamics

6.1. Macro-economic Factors

6.2. Drivers

6.3. Restraints

6.4. Opportunity

6.5. Forecast Factors – Relevance and Impact

7. Global Vacuum Packaging Market Analysis and Forecast, By Material Type

7.1. Introduction

7.1.1. Basis Point Share (BPS) Analysis By Material Type

7.1.2. Y-o-Y Growth Projections By Material Type

7.2. Global Vacuum Packaging Market Value (US$ Mn) Forecast By Material Type

7.2.1. Polyethylene (PE)

7.2.2. Polyvinylidenchloride (PVDC)

7.2.3. Polypropylene (PP)

7.2.4. Polyvinylchloride (PVC)

7.2.5. Polyester (PET)

7.2.6. Polyamide (PA)

7.3. Global Vacuum Packaging Market Attractiveness Analysis By, Material Type

7.4. Prominent Trends

8. Global Vacuum Packaging Market Analysis and Forecast, By Pack Type

8.1. Introduction

8.1.1. Basis Point Share (BPS) Analysis By Pack Type

8.1.2. Y-o-Y Growth Projections By Pack Type

8.2. Global Vacuum Packaging Market Value (US$ Mn) Forecast

8.2.1. Rigid Packaging

8.2.2. Flexible Packaging

8.2.3. Semi-Rigid Packaging

8.3. Global Vacuum Packaging Market Attractiveness Analysis By Pack Type

8.4. Prominent Trends

9. Global Vacuum Packaging Market Analysis and Forecast, By Application Type

9.1. Introduction

9.1.1. Basis Point Share (BPS) Analysis By Application Type

9.1.2. Y-o-Y Growth Projections By Application Type

9.2. Global Vacuum Packaging Market Value (US$ Mn) Forecast By Application Type

9.2.1. Food & Beverage

9.2.2. Pharmaceuticals

9.2.3. Industrial Goods

9.2.4. Consumer Goods

9.2.5. Others

9.3. Global Vacuum Packaging Market Attractiveness Analysis By Application Type

9.4. Prominent Trends

10. Global Vacuum Packaging Market Analysis and Forecast, By Region

10.1. Introduction

10.1.1. Basis Point Share (BPS) Analysis By Region

10.1.2. Y-o-Y Growth Projections By Region

10.2. Global Vacuum Packaging Market Value (US$ Mn) Forecast By Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific (APAC)

10.2.4. Latin America

10.2.5. Middle East and Africa (MEA)

10.3. Global Vacuum Packaging Market Attractiveness Analysis By Region

11. North America Vacuum Packaging Market Analysis and Forecast

11.1. Introduction

11.1.1. Basis Point Share (BPS) Analysis By Country

11.1.2. Y-o-Y Growth Projections By Country

11.2. North America Vacuum Packaging Market Value (US$ Mn) Forecast By Country

11.2.1. U.S.

11.2.2. Canada

11.3. North America Vacuum Packaging Market Value (US$ Mn) Forecast By Material Type

11.3.1. Polyethylene (PE)

11.3.2. Polyvinylidenchloride (PVDC)

11.3.3. Polypropylene (PP)

11.3.4. Polyvinylchloride (PVC)

11.3.5. Polyester (PET)

11.3.6. Polyamide (PA)

11.4. North America Vacuum Packaging Market Value (US$ Mn) Forecast By Pack Type

11.4.1. Rigid Packaging

11.4.2. Flexible Packaging

11.4.3. Semi-Rigid Packaging

11.5. North America Vacuum Packaging Market Value (US$ Mn) Forecast By Application Type

11.5.1. Food & Beverage

11.5.2. Pharmaceuticals

11.5.3. Industrial Goods

11.5.4. Consumer Goods

11.5.5. Others

11.6. North America Vacuum Packaging Market Attractiveness Analysis

11.6.1. By Country

11.6.2. By Material Type

11.6.3. By Pack Type

11.6.4. By Application Type

11.7. Prominent Trends

11.8. Drivers and Restraints: Impact Analysis

12. Europe Vacuum Packaging Market Analysis and Forecast

12.1. Introduction

12.1.1. Basis Point Share (BPS) Analysis By Country

12.1.2. Y-o-Y Growth Projections By Country

12.2. Europe Vacuum Packaging Market Value (US$ Mn) Forecast By Country

12.2.1. Germany

12.2.2. Spain

12.2.3. Italy

12.2.4. France

12.2.5. U.K.

12.2.6. BENELUX

12.2.7. Russia

12.2.8. Rest of Europe

12.3. Europe Vacuum Packaging Market Value (US$ Mn) Forecast By Material Type

12.3.1. Polyethylene (PE)

12.3.2. Polyvinylidenchloride (PVDC)

12.3.3. Polypropylene (PP)

12.3.4. Polyvinylchloride (PVC)

12.3.5. Polyester (PET)

12.3.6. Polyamide (PA)

12.4. Europe Vacuum Packaging Market Value (US$ Mn) Forecast By Pack Type

12.4.1. Rigid Packaging

12.4.2. Flexible Packaging

12.4.3. Semi-Rigid Packaging

12.5. Europe Vacuum Packaging Market Value (US$ Mn) Forecast By Application Type

12.5.1. Food & Beverage

12.5.2. Pharmaceuticals

12.5.3. Industrial Goods

12.5.4. Consumer Goods

12.5.5. Others

12.6. Europe Vacuum Packaging Market Attractiveness Analysis

12.6.1. By Country

12.6.2. By Material Type

12.6.3. By Pack Type

12.6.4. By Application Type

12.7. Prominent Trends

12.8. Drivers and Restraints: Impact Analysis

13. Asia Pacific (APAC) Vacuum Packaging Market Analysis and Forecast

13.1. Introduction

13.1.1. Basis Point Share (BPS) Analysis By Country

13.1.2. Y-o-Y Growth Projections By Country

13.2. Asia Pacific (APAC) Vacuum Packaging Market Value (US$ Mn) Forecast By Country

13.2.1. China

13.2.2. India

13.2.3. Japan

13.2.4. ASEAN

13.2.5. Australia and New Zealand

13.2.6. Rest of APAC

13.3. Asia Pacific (APAC) Vacuum Packaging Market Value (US$ Mn) Forecast By Material Type

13.3.1. Polyethylene (PE)

13.3.2. Polyvinylidenchloride (PVDC)

13.3.3. Polypropylene (PP)

13.3.4. Polyvinylchloride (PVC)

13.3.5. Polyester (PET)

13.3.6. Polyamide (PA)

13.4. Asia Pacific (APAC) Vacuum Packaging Market Value (US$ Mn) Forecast By Pack Type

13.4.1. Rigid Packaging

13.4.2. Flexible Packaging

13.4.3. Semi-Rigid Packaging

13.5. Asia Pacific (APAC) Vacuum Packaging Market Value (US$ Mn) Forecast By Application Type

13.5.1. Food & Beverage

13.5.2. Pharmaceuticals

13.5.3. Industrial Goods

13.5.4. Consumer Goods

13.5.5. Others

13.6. Asia Pacific (APAC) Vacuum Packaging Market Attractiveness Analysis

13.6.1. By Country

13.6.2. By Material Type

13.6.3. By Pack Type

13.6.4. By Application Type

13.7. Prominent Trends

13.8. Drivers and Restraints: Impact Analysis

14. Latin America Vacuum Packaging Market Analysis and Forecast

14.1. Introduction

14.1.1. Basis Point Share (BPS) Analysis By Country

14.1.2. Y-o-Y Growth Projections By Country

14.2. Latin America Vacuum Packaging Market Value (US$ Mn) Forecast By Country

14.2.1. Brazil

14.2.2. Mexico

14.2.3. Rest of Latin America

14.3. Latin America Vacuum Packaging Market Value (US$ Mn) Forecast By Material Type

14.3.1. Polyethylene (PE)

14.3.2. Polyvinylidenchloride (PVDC)

14.3.3. Polypropylene (PP)

14.3.4. Polyvinylchloride (PVC)

14.3.5. Polyester (PET)

14.3.6. Polyamide (PA)

14.4. Latin America Vacuum Packaging Market Value (US$ Mn) Forecast By Pack Type

14.4.1. Rigid Packaging

14.4.2. Flexible Packaging

14.4.3. Semi-Rigid Packaging

14.5. Latin America Vacuum Packaging Market Value (US$ Mn) Forecast By Application Type

14.5.1. Food & Beverage

14.5.2. Pharmaceuticals

14.5.3. Industrial Goods

14.5.4. Consumer Goods

14.5.5. Others

14.6. Latin America Vacuum Packaging Market Attractiveness Analysis

14.6.1. By Country

14.6.2. By Material Type

14.6.3. By Pack Type

14.6.4. By Application Type

14.7. Prominent Trends

14.8. Drivers and Restraints: Impact Analysis

15. Middle East and Africa (MEA) Vacuum Packaging Market Analysis and Forecast

15.1. Introduction

15.1.1. Basis Point Share (BPS) Analysis By Country

15.1.2. Y-o-Y Growth Projections By Country

15.2. Middle East and Africa (MEA) Vacuum Packaging Market Value (US$ Mn) Forecast By Country

15.2.1. North Africa

15.2.2. South Africa

15.2.3. GCC countries

15.2.4. Rest of MEA

15.3. Middle East and Africa (MEA) Vacuum Packaging Market Value (US$ Mn) Forecast By Material Type

15.3.1. Polyethylene (PE)

15.3.2. Polyvinylidenchloride (PVDC)

15.3.3. Polypropylene (PP)

15.3.4. Polyvinylchloride (PVC)

15.3.5. Polyester (PET)

15.3.6. Polyamide (PA)

15.4. Middle East and Africa (MEA) Vacuum Packaging Market Value (US$ Mn) Forecast By Pack Type

15.4.1. Rigid Packaging

15.4.2. Flexible Packaging

15.4.3. Semi-Rigid Packaging

15.5. Middle East and Africa (MEA) Vacuum Packaging Market Value (US$ Mn) Forecast By Application Type

15.5.1. Food & Beverage

15.5.2. Pharmaceuticals

15.5.3. Industrial Goods

15.5.4. Consumer Goods

15.5.5. Others

15.6. Middle East and Africa (MEA) Vacuum Packaging Market Attractiveness Analysis

15.6.1. By Country

15.6.2. By Material Type

15.6.3. By Pack Type

15.6.4. By Application Type

15.7. Prominent Trends

15.8. Drivers and Restraints: Impact Analysis

16. Competition Landscape

16.1. Competition Dashboard

16.2. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT Analysis)

16.3. Market Share Analysis

16.4. Global Players

16.4.1. Amcor Limited

16.4.1.1. Overview

16.4.1.2. Financials

16.4.1.3. Recent Developments

16.4.1.4. SWOT Analysis

16.4.1.5. Strategy

16.4.2. Berry Plastics

16.4.2.1. Overview

16.4.2.2. Financials

16.4.2.3. Recent Developments

16.4.2.4. SWOT Analysis

16.4.2.5. Strategy

16.4.3. Sealed Air Corporation

16.4.3.1. Overview

16.4.3.2. Financials

16.4.3.3. Recent Developments

16.4.3.4. SWOT Analysis

16.4.3.5. Strategy

16.4.4. Bemis Company Inc.

16.4.4.1. Overview

16.4.4.2. Financials

16.4.4.3. Recent Developments

16.4.4.4. SWOT Analysis

16.4.4.5. Strategy

16.4.5. Wipak Group

16.4.5.1. Overview

16.4.5.2. Financials

16.4.5.3. Recent Developments

16.4.5.4. SWOT Analysis

16.4.5.5. Strategy

16.4.6. Mondi Group

16.4.6.1. Overview

16.4.6.2. Financials

16.4.6.3. Recent Developments

16.4.6.4. SWOT Analysis

16.4.6.5. Strategy

List of Tables

Table 01: Global Vacuum Packaging Market Size (US$ Bn) by Material Type, 2015–2024

Table 02: Global Vacuum Packaging Market Size (US$ Bn) by Pack Type, 2015–2024

Table 03: Global Vacuum Packaging Market Size (US$ Bn) by Application, 2015–2024

Table 04: Global Vacuum Packaging Market Size (US$ Bn) by Region, 2015–2024

Table 05: North America Vacuum Packaging Market Size (US$ Bn) by Material Type, 2015–2024

Table 06: North America Flexible Packaging Market Size (US$ Bn) by Pack Type, 2015–2024

Table 07: North America Vacuum Packaging Market Size (US$ Bn) by Application, 2015–2024

Table 08: Latin America Vacuum Packaging Market Size (US$ Bn) by Material Type, 2015–2024

Table 09: Latin America Vacuum Packaging Market Size (US$ Mn) by Product Type, 2015–2024

Table 10: Latin America Vacuum Packaging Market Size (US$ Mn) by Application, 2015–2024

Table 11: Europe Vacuum Packaging Market Size (US$ Bn) by Material Type, 2015–2024

Table 12: Europe Vacuum Packaging Market Size (US$ Bn) by Pack Type, 2015–2024

Table 13: Europe Vacuum Packaging Market Size (US$ Bn) by Application, 2015–2024

Table 14: APAC Vacuum Packaging Market Size (US$ Bn) by Material Type, 2015–2024

Table 15: APAC Vacuum Packaging Market Size (US$ Mn) by Pack Type, 2015–2024

Table 16: APAC Vacuum Packaging Market Size (US$ Bn) by Application, 2015–2024

Table 17: MEA Vacuum Packaging Market Size (US$ Bn) by Material Type, 2015–2024

Table 18: MEA Vacuum Packaging Market Size (US$ Bn) by Pack Type, 2015–2024

Table19: MEA Vacuum Packaging Market Size (US$ Mn) by Application, 2015–2024

List of Figures

Figure 01: Global Vacuum Packaging Market Value (US$ Bn) 2015–2024

Figure 02: Global Vacuum Packaging Market Absolute $ Opportunity (US$ Bn), 2015?2024

Figure 03: Global Vacuum Packaging Market Value Share by Material Type, 2016

Figure 04: Global Vacuum Packaging Market Value Share by Pack Type, 2016

Figure 05: Global Vacuum Packaging Market Value Share by Product Type, 2016

Figure 06: Global Vacuum Packaging Market Value Share by Region, 2016

Figure 07: Global Vacuum Packaging Market Share & BPS Analysis by Material Type, 2016 & 2024

Figure 08: Global Vacuum Packaging Market Revenue Y-o-Y Growth by Material Type, 2015–2024

Figure 09: Global Vacuum Packaging Market Value (US$ Bn) by Material Type, 2014–2024

Figure 10: Global Vacuum Packaging Market Absolute $ Opportunity by Polyethylene (PE), 2016–2024

Figure 11: Global Vacuum Packaging Market Absolute $ Opportunity by Polyvinylidenchloride (PVDC), 2016–2024

Figure 12: Global Vacuum Packaging Market Absolute $ Opportunity by Aluminum Segment, 2016–2024

Figure 13: Global Vacuum Packaging Market Absolute $ Opportunity by Cellulosic Segment, 2016–2024

Figure 14: Global Vacuum Packaging Market Absolute $ Opportunity by Aluminum Segment, 2016–2024

Figure 15: Global Vacuum Packaging Market Absolute $ Opportunity by Cellulosic Segment, 2016–2024

Figure 16: Global Vacuum Packaging Market Attractiveness by Material Type, 2016–2024

Figure 17: Global Vacuum Packaging Market Absolute $ Opportunity by Rigid Packaging Segment, 2016–2024

Figure 18: Global Vacuum Packaging Market Absolute $ Opportunity by Flexible Packaging, 2016–2024

Figure 19: Global Vacuum Packaging Market Absolute $ Opportunity by Semi-Rigid Packaging, 2016–2024

Figure 20: Global Vacuum Packaging Market Share & BPS Analysis by Pack Type, 2016 & 2024

Figure 21: Global Vacuum Packaging Market Revenue Y-o-Y Growth by Pack Type, 2015–2024

Figure 22: Global Vacuum Packaging Market Attractiveness by Pack Type, 2016–2024

Figure 23: Global Vacuum Packaging Market, BPS Analysis by Application, 2016 & 2024

Figure 24: Global Vacuum Packaging Market Revenue Y-o-Y Growth by Application, 2015–2024

Figure 25: Global Vacuum Packaging Market Value (US$ Bn) by Application, 2014–2024

Figure 26: Global Vacuum Packaging Market Absolute $ Opportunity by Consumer Segment, 2016–2024

Figure 27: Global Vacuum Packaging Market Absolute $ Opportunity by Industrial and Institutional Segment, 2016–2024

Figure 28: Global Vacuum Packaging Market Absolute $ Opportunity by Consumer Segment, 2016–2024

Figure 29: Global Vacuum Packaging Market Absolute $ Opportunity by Industrial and Institutional Segment, 2016–2024

Figure 30: Global Vacuum Packaging Market Absolute $ Opportunity by Consumer Segment, 2016–2024

Figure 31: Global Vacuum Packaging Market Attractiveness by Application, 2015–2024

Figure 32: Global Vacuum Packaging Market Share & BPS Analysis by Region, 2016 & 2024

Figure 33: Global Vacuum Packaging Market Revenue Y-o-Y Growth by Region, 2015–2024

Figure 34: Global Vacuum Packaging Market Attractiveness by Region, 2016–2024

Figure 35: North America Flexible Packaging Market Value (US$ Bn) , 2015–2024

Figure 36: North America Flexible Packaging Market Absolute $ Opportunity (US$ Bn), 2015?2024

Figure 37: U.S. Flexible Packaging Market Absolute $ Opportunity, 2015–2024

Figure 38: Canada Flexible Packaging Market Absolute $ Opportunity, 2015–2024

Figure 39: North America Flexible Packaging Market Share & BPS Analysis, by Material Type, 2016 & 2024

Figure 40: North America Flexible Packaging Market Y-o-Y Growth Rate, by Material Type, 2015–2024

Figure 41: North America Vacuum Packaging Market Share & BPS Analysis, by Pack Type, 2016 & 2024

Figure 42: North America Vacuum Packaging Market Attractiveness Analysis by Pack Type, 2016–2024

Figure 43: North America Vacuum Packaging Market Value (US$ Bn) by Application, 2014–2024

Figure 44: North America Vacuum Packaging Market Y-o-Y Growth Rate by Application, 2015–2024

Figure 45: North America Vacuum Packaging Market Share & BPS Analysis, by Application, 2015 & 2024

Figure 46: North America Vacuum Packaging Market Attractiveness Analysis by Application, 2016–2024

Figure 47: Latin America Vacuum Packaging Market Value (US$ Mn), 2015–2024

Figure 48: Latin America Vacuum Packaging Market Absolute $ Opportunity (US$ Mn), 2015?2024

Figure 49: Brazil Vacuum Packaging Market Absolute $ Opportunity, 2015–2024

Figure 50: Argentina Vacuum Packaging Market Absolute $ Opportunity, 2015–2024

Figure 51: Rest of the Latin America Vacuum Packaging Market Absolute $ Opportunity, 2015–2024

Figure 52: Latin America Vacuum Packaging Market Share & BPS Analysis, by Material Type, 2016 & 2024

Figure 53: Latin America Vacuum Packaging Market Y-o-Y Growth Rate, by Material Type, 2015–2024

Figure 54: Latin America Vacuum Packaging Market Share & BPS Analysis, by Pack Type, 2016 & 2024

Figure 55: Latin America Vacuum Packaging Market Y-o-Y Growth Rate, by Pack Type, 2015–2024

Figure 56: Latin America Vacuum Packaging Market Attractiveness Analysis by Pack Type, 2016–2024

Figure 57: Latin America Vacuum Packaging Market Value (US$ Mn) by Application, 2014–2024

Figure 58: Latin America Vacuum Packaging Market Y-o-Y Growth Rate by Application, 2015–2024

Figure 59: Latin America Vacuum Packaging Market Share & BPS Analysis, by Application, 2016 & 2024

Figure 60: Latin America Vacuum Packaging Market Attractiveness Analysis by Application, 2016–2024

Figure 61: Europe Vacuum Packaging Market Value (US$ Bn), 2015–2024

Figure 62: Europe Vacuum Packaging Market Absolute $ Opportunity (US$ Bn), 2015?2024

Figure 63: Germany Vacuum Packaging Market Absolute $ Opportunity, 2015–2024

Figure 64: France Vacuum Packaging Market Absolute $ Opportunity, 2015–2024

Figure 65: U.K. Vacuum Packaging Market Absolute $ Opportunity, 2015–2024

Figure 66: Spain Vacuum Packaging Market Absolute $ Opportunity, 2015–2024

Figure 67: Italy Vacuum Packaging Market Absolute $ Opportunity, 2015–2024

Figure 68: Rest of Europe Vacuum Packaging Market Absolute $ Opportunity, 2015–2024

Figure 69: Europe Vacuum Packaging Market Share & BPS Analysis, by Material Type, 2016 & 2024

Figure 70: Europe Vacuum Packaging Market Y-o-Y Growth Rate, by Material Type, 2015–2024

Figure 71: Europe Vacuum Packaging Market Share & BPS Analysis, by Pack Type, 2016 & 2024

Figure 72: Europe Vacuum Packaging Market Attractiveness Analysis by Pack Type, 2016–2024

Figure 73: Europe Vacuum Packaging Market Value (US$ Bn) by Application, 2014–2024

Figure 74: Europe Vacuum Packaging Market Y-o-Y Growth Rate by Application, 2015–2024

Figure 75: Europe Vacuum Packaging Market Share & BPS Analysis, by Application, 2016 & 2024

Figure 76: Europe Vacuum Packaging Market Attractiveness Analysis by Application, 2016–2024

Figure 77: APAC Vacuum Packaging Market Value (US$ Bn), 2015–2024

Figure 78: APAC Vacuum Packaging Market Absolute $ Opportunity (US$ Bn), 2015?2024

Figure 79: China Vacuum Packaging Market Absolute $ Opportunity, 2015–2024

Figure 80: India Vacuum Packaging Market Absolute $ Opportunity, 2015–2024

Figure 81: Korea Vacuum Packaging Market Absolute $ Opportunity, 2015–2024

Figure 82: Japan Vacuum Packaging Market Absolute $ Opportunity, 2015–2024

Figure 83: ASEAN Vacuum Packaging Market Absolute $ Opportunity, 2015–2024

Figure 84: Rest of APAC Vacuum Packaging Market Absolute $ Opportunity, 2015–2024

Figure 85: APAC Vacuum Packaging Market Share & BPS Analysis, by Material Type, 2016 & 2024

Figure 86: APAC Vacuum Packaging Market Y-o-Y Growth Rate, by Material Type, 2015–2024

Figure 87: APAC Vacuum Packaging Market Share & BPS Analysis, by Pack Type, 2016 & 2024

Figure 88: APAC Vacuum Packaging Market Attractiveness Analysis by Pack Type, 2016–2024

Figure 89: APAC Vacuum Packaging Market Value (US$ Bn) by Application, 2014–2024

Figure 90: APAC Vacuum Packaging Market Y-o-Y Growth Rate by Application, 2015–2024

Figure 91: APAC Vacuum Packaging Market Share & BPS Analysis, Application, 2016 & 2024

Figure 92: APAC Vacuum Packaging Market Attractiveness Analysis by Application, 2016–2024

Figure 93: MEA Vacuum Packaging Market Value (US$ Bn), 2015–2024

Figure 94: MEA Vacuum Packaging Market Absolute $ Opportunity (US$ Bn), 2015?2024

Figure 95: Saudi Arabia Vacuum Packaging Market Absolute $ Opportunity, 2015–2024

Figure 96: South Africa Vacuum Packaging Market Absolute $ Opportunity, 2015–2024

Figure 97: UAE Vacuum Packaging Market Absolute $ Opportunity, 2015–2024

Figure 98: Rest of MEA Countries Vacuum Packaging Market Absolute $ Opportunity, 2015–2024

Figure 99: MEA Vacuum Packaging Market Share & BPS Analysis, by Material Type, 2016 & 2024

Figure 100: MEA Vacuum Packaging Market Y-o-Y Growth Rate, by Material Type, 2015–2024

Figure 101: MEA Vacuum Packaging Market Share & BPS Analysis, by Pack Type, 2016 & 2024

Figure 102: MEA Vacuum Packaging Market Attractiveness Analysis by Pack Type, 2016–2024

Figure 103: MEA Vacuum Packaging Market Value (US$ Mn) by Application, 2014–2024

Figure 104: MEA Vacuum Packaging Market Y-o-Y Growth Rate by Application, 2015–2024

Figure 105: MEA Vacuum Packaging Market Share & BPS Analysis, by Application, 2016 & 2024

Figure 106: MEA Vacuum Packaging Market Attractiveness Analysis by Application, 2016–2024