Analysts’ Viewpoint on Market Scenario

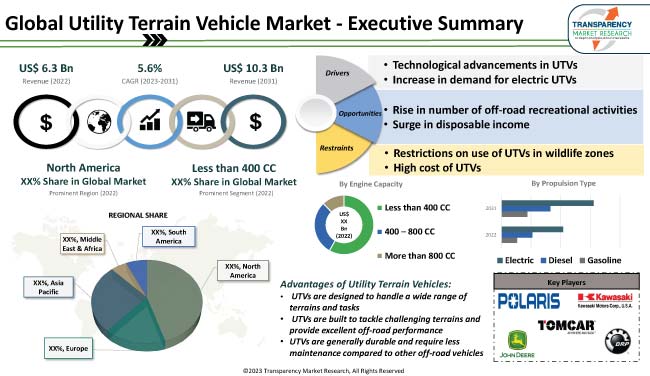

Technological advancements in UTVs are expected to fuel the utility terrain vehicle market size during the forecast period. All-terrain utility vehicles are popular for their versatility, off-road capabilities, and applications across various industries. Rise in interest in outdoor activities, recreational off-roading, and utility tasks is projected to fuel market expansion in the near future.

UTVs appeal to diverse consumers, including recreational enthusiasts, farmers, construction workers, and public service agencies. Vendors in the global utility terrain vehicle industry are collaborating with other UTV manufacturers to expand their product portfolio. They are also focusing on continuous product improvement, customization, competitive pricing, and offering consumers a wide range of choices to increase their utility terrain vehicle market share.

Utility Terrain Vehicle (UTV) is a type of off-road vehicle that is designed for multiple purposes, including work, recreation, and transportation in various terrains. UTVs typically have a higher seating capacity than All-Terrain Vehicles (ATVs) and are equipped with a cargo bed or hauling capacity to carry equipment, tools, supplies, or passengers.

UTVs provide a more stable and comfortable ride compared to ATVs due to their larger size and seating configuration. They typically offer seating for two to six passengers, depending on the model, allowing for group activities, work teams, or recreational outings.

UTVs find applications in a wide range of industries, including agriculture, construction, mining, forestry, and tourism. Surge in need for versatile off-road vehicles that can handle rugged terrains and perform various tasks is projected to spur the utility terrain vehicle market growth in the near future. The UTV industry is expanding both in terms of geographic reach and consumer segments. UTVs are gaining traction in traditional markets, such as North America and Europe, as well as emerging regions such as Asia Pacific and South America.

Technological advancements have led to improvements in UTV performance, including increased power, better acceleration, and improved handling. Utility terrain vehicle manufacturers are continually developing engines that are more efficient and provide better off-road capabilities and higher speeds.

UTVs are equipped with suspension systems that help absorb shocks and vibrations while traversing rough terrains. Technological advancements have led to the development of sophisticated suspension systems, including independent suspension systems, adjustable shocks, and electronic stability control. These advancements improve ride comfort, stability, and handling, making UTVs more appealing to consumers. This, in turn, is propelling the utility terrain vehicle market statistics.

Many UTV models now come equipped with connectivity options and infotainment systems. These features allow users to connect their smartphones, access GPS navigation, stream music, and even integrate with other smart devices. Connectivity and infotainment systems enhance user experience and provide convenience during off-road adventures.

Growth in awareness about environmental issues and a shift toward sustainable practices are leading to high demand for electric vehicles across various industries. Electric UTVs offer lower or zero emissions compared to their gasoline-powered counterparts, making them an attractive choice for environmentally conscious consumers and businesses. Thus, surge in focus on reducing carbon footprints and increase in adoption of eco-friendly modes of transportation are driving the utility terrain vehicle market revenue.

Governments and regulatory bodies around the world are implementing stringent emissions regulations and promoting the adoption of electric vehicles. They are offering various incentives, subsidies, and tax benefits to boost the usage of electric UTVs. These supportive policies and regulations are projected to contribute to the growth of the utility terrain vehicle industry in the next few years.

Electric UTVs can offer long-term cost savings in terms of lower fuel costs and reduced maintenance requirements. Electricity tends to be cheaper than gasoline or diesel, resulting in lower operational costs for electric UTVs. Additionally, electric UTVs have fewer moving parts and require less maintenance than internal combustion engine vehicles, leading to potential savings in servicing and repair expenses.

Electric UTVs produce minimal noise compared to traditional gasoline-powered UTVs. This feature is particularly beneficial for applications such as hunting, nature conservation, and outdoor recreation, where noise pollution is a concern. The quiet operation of electric UTVs enables users to enjoy their activities without disturbing wildlife or other visitors.

According to the latest utility terrain vehicle market trends, the less than 400 CC engine capacity segment accounted for major share of 58.1% in 2022. UTVs with smaller engine capacities generally consume less fuel, resulting in improved fuel efficiency. This makes them attractive to consumers who prioritize cost savings on fuel expenses and who have applications or usage patterns that do not require excessive power. Additionally, lower fuel consumption contributes to a smaller environmental footprint, aligning with growth in interest in sustainable and eco-friendly options.

In many regions, there are specific regulations and licensing requirements for off-road vehicles based on their engine capacities. UTVs with engine capacities below 400 cc often fall into a category that is exempt from certain regulations or less restricted in terms of licensing and registration. This can make them more appealing to consumers who want a versatile off-road vehicle without having to comply with more stringent requirements.

According to the latest utility terrain vehicle market analysis, the sports application segment held major share of 38.5% in 2022. Sport UTVs are specifically designed for performance and speed, offering an exhilarating off-road experience. They are equipped with powerful engines, advanced suspension systems, and other performance-enhancing features that allow for faster acceleration, higher top speeds, and superior handling.

Sport UTVs offer a wide range of customization options, allowing owners to personalize their vehicles according to their preferences and performance requirements. Owners can modify their sports UTVs with aftermarket accessories such as performance upgrades, specialized tires, suspension enhancements, and appearance modifications. The ability to customize and tailor the vehicle to their specific needs is further driving the demand for sports demand for utility terrain vehicles.

According to the latest utility terrain vehicle market forecast, North America is anticipated to hold largest share from 2023 to 2031. Presence of a strong outdoor recreation culture including off-roading, trail riding, hunting, camping, and exploring rugged terrains is fueling market dynamics in the region. UTVs are well suited for these activities, offering a thrilling and versatile means of transportation in various environments. The vast landscapes, diverse terrain, and availability of off-road trails in North America contribute to the popularity of UTVs for recreational purposes.

North America, particularly the U.S., has an extensive network of public lands, including national parks, national forests, and off-road recreational areas. UTV enthusiasts can explore these lands and utilize UTVs for recreational activities. The availability of public lands, along with regulations that allow for off-road vehicle usage in designated areas, is contributing to market progress in the region.

North America’s large consumer base, coupled with the demand for innovative and high-performance vehicles, makes it an attractive market for manufacturers to invest in and promote their UTVs. Continuous product innovation and marketing efforts are also boosting market development in North America.

The global industry is consolidated, with the presence of several companies. Most companies are expanding their supply chain networks and adopting collaboration, partnership, and M&A strategies to expand their customer base.

Honda Motor Company, Arctic Cat Inc., BRP, CFMOTO USA, Deere & Company, Hisun Motors, Kawasaki Motors, Ltd., Kubota Corporation., Polaris Inc., Suzuki Motor Corporation, TOMCAR, Inc., and Yamaha Motor Co., Ltd. are key players in the UTV market.

Each of these players has been profiled in the utility terrain vehicle market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 6.3 Bn |

|

Market Forecast Value in 2031 |

US$ 10.3 Bn |

|

Growth Rate (CAGR) |

5.6% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 6.3 Bn in 2022

It is projected to grow at a CAGR of 5.6% from 2023 to 2031

It is estimated to reach US$ 10.3 Bn by the end of 2031

Technological advancements in UTVs and increase in demand for electric UTVs

The less than 400 CC engine capacity segment accounted for major share of 58.1% in 2022

North America is expected to record the highest demand during the forecast period

Honda Motor Company, Arctic Cat Inc., BRP, CFMOTO USA, Deere & Company, Hisun Motors, Kawasaki Motors, Ltd., Kubota Corporation., Polaris Inc., Suzuki Motor Corporation, TOMCAR, Inc., and Yamaha Motor Co., Ltd.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value, Thousand Units, US$ Bn, 2017-2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage / Taxonomy

2.3. Market Definition / Scope / Limitations

2.4. Macro-Economic Factors

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunity

2.6. Market Factor Analysis

2.6.1. Porter’s Five Force Analysis

2.6.2. SWOT Analysis

2.7. Regulatory Scenario

2.8. Key Trend Analysis

2.9. Value Chain Analysis

2.10. Gross Margin Analysis

3. Global Utility Terrain Vehicle Market, By Drive Type

3.1. Market Snapshot

3.1.1. Introduction, Definition, and Key Findings

3.1.2. Market Growth & Y-o-Y Projections

3.1.3. Base Point Share Analysis

3.2. Global Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Drive Type

3.2.1. 2WD

3.2.2. 4WD

3.2.3. AWD

4. Global Utility Terrain Vehicle Market, By Engine Capacity

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Engine Capacity

4.2.1. Less than 400 CC

4.2.2. 400 - 800 CC

4.2.3. More than 800 CC

5. Global Utility Terrain Vehicle Market, By Propulsion Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Propulsion Type

5.2.1. Gasoline

5.2.2. Diesel

5.2.3. Electric

6. Global Utility Terrain Vehicle Market, By Vehicle Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

6.2.1. Car

6.2.2. Pick-up

7. Global Utility Terrain Vehicle Market, By Application

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Application

7.2.1. Sports

7.2.2. Recreation

7.2.3. Military & Defense

7.2.4. Utility Work

7.2.5. Entertainment

7.2.6. Agriculture

7.2.7. Others

8. Global Utility Terrain Vehicle Market, By Region

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Utility Terrain Vehicle Market

9.1. Market Snapshot

9.2. North America Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Drive Type

9.2.1. 2WD

9.2.2. 4WD

9.2.3. AWD

9.3. North America Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Engine Capacity

9.3.1. Less than 400 CC

9.3.2. 400 - 800 CC

9.3.3. More than 800 CC

9.4. North America Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Propulsion Type

9.4.1. Gasoline

9.4.2. Diesel

9.4.3. Electric

9.5. North America Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

9.5.1. Car

9.5.2. Pick-up

9.6. North America Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Application

9.6.1. Sports

9.6.2. Recreation

9.6.3. Military & Defense

9.6.4. Utility Work

9.6.5. Entertainment

9.6.6. Agriculture

9.6.7. Others

9.7. Key Country Analysis - North America Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031

9.7.1. U.S.

9.7.2. Canada

9.7.3. Mexico

10. Europe Utility Terrain Vehicle Market

10.1. Market Snapshot

10.2. Europe Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Drive Type

10.2.1. 2WD

10.2.2. 4WD

10.2.3. AWD

10.3. Europe Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Engine Capacity

10.3.1. Less than 400 CC

10.3.2. 400 - 800 CC

10.3.3. More than 800 CC

10.4. Europe Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Propulsion Type

10.4.1. Gasoline

10.4.2. Diesel

10.4.3. Electric

10.5. Europe Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

10.5.1. Car

10.5.2. Pick-up

10.6. North America Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Application

10.6.1. Sports

10.6.2. Recreation

10.6.3. Military & Defense

10.6.4. Utility Work

10.6.5. Entertainment

10.6.6. Agriculture

10.6.7. Others

10.7. Key Country Analysis - Europe Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031

10.7.1. Germany

10.7.2. U.K.

10.7.3. France

10.7.4. Italy

10.7.5. Spain

10.7.6. Nordic Countries

10.7.7. Russia & CIS

10.7.8. Rest of Europe

11. Asia Pacific Utility Terrain Vehicle Market

11.1. Market Snapshot

11.2. Asia Pacific Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Drive Type

11.2.1. 2WD

11.2.2. 4WD

11.2.3. AWD

11.3. Asia Pacific Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Engine Capacity

11.3.1. Less than 400 CC

11.3.2. 400 - 800 CC

11.3.3. More than 800 CC

11.4. Asia Pacific Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Propulsion Type

11.4.1. Gasoline

11.4.2. Diesel

11.4.3. Electric

11.5. Asia Pacific Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

11.5.1. Car

11.5.2. Pick-up

11.6. Asia Pacific Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Application

11.6.1. Sports

11.6.2. Recreation

11.6.3. Military & Defense

11.6.4. Utility Work

11.6.5. Entertainment

11.6.6. Agriculture

11.6.7. Others

11.7. Key Country Analysis - Asia Pacific Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031

11.7.1. China

11.7.2. India

11.7.3. Japan

11.7.4. ASEAN Countries

11.7.5. South Korea

11.7.6. ANZ

11.7.7. Rest of Asia Pacific

12. Middle East & Africa Utility Terrain Vehicle Market

12.1. Market Snapshot

12.2. Middle East & Africa Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Drive Type

12.2.1. 2WD

12.2.2. 4WD

12.2.3. AWD

12.3. Middle East & Africa Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Engine Capacity

12.3.1. Less than 400 CC

12.3.2. 400 - 800 CC

12.3.3. More than 800 CC

12.4. Middle East & Africa Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Propulsion Type

12.4.1. Gasoline

12.4.2. Diesel

12.4.3. Electric

12.5. Middle East & Africa Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

12.5.1. Car

12.5.2. Pick-up

12.6. Middle East & Africa Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Application

12.6.1. Sports

12.6.2. Recreation

12.6.3. Military & Defense

12.6.4. Utility Work

12.6.5. Entertainment

12.6.6. Agriculture

12.6.7. Others

12.7. Key Country Analysis - Middle East & Africa Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031

12.7.1. GCC

12.7.2. South Africa

12.7.3. Turkey

12.7.4. Rest of Middle East & Africa

13. South America Utility Terrain Vehicle Market

13.1. Market Snapshot

13.2. South America Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Drive Type

13.2.1. 2WD

13.2.2. 4WD

13.2.3. AWD

13.3. South America Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Engine Capacity

13.3.1. Less than 400 CC

13.3.2. 400 - 800 CC

13.3.3. More than 800 CC

13.4. South America Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Propulsion Type

13.4.1. Gasoline

13.4.2. Diesel

13.4.3. Electric

13.5. South America Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

13.5.1. Car

13.5.2. Pick-up

13.6. South America Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031, By Application

13.6.1. Sports

13.6.2. Recreation

13.6.3. Military & Defense

13.6.4. Utility Work

13.6.5. Entertainment

13.6.6. Agriculture

13.6.7. Others

13.7. Key Country Analysis - South America Utility Terrain Vehicle Market Size Analysis & Forecast, 2017-2031

13.7.1. Brazil

13.7.2. Argentina

13.7.3. Rest of South America

14. Competitive Landscape

14.1. Company Share Analysis/ Brand Share Analysis, 2022

14.2. Pricing Comparison Among Key Players

14.3. Company Analysis for Each Player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

15. Company Profiles/ Key Players

15.1. Honda Motor Company

15.1.1. Company Overview

15.1.2. Company Footprints

15.1.3. Production Locations

15.1.4. Product Portfolio

15.1.5. Competitors & Customers

15.1.6. Subsidiaries & Parent Organization

15.1.7. Recent Developments

15.1.8. Financial Analysis

15.1.9. Profitability

15.1.10. Revenue Share

15.2. Arctic Cat Inc.

15.2.1. Company Overview

15.2.2. Company Footprints

15.2.3. Production Locations

15.2.4. Product Portfolio

15.2.5. Competitors & Customers

15.2.6. Subsidiaries & Parent Organization

15.2.7. Recent Developments

15.2.8. Financial Analysis

15.2.9. Profitability

15.2.10. Revenue Share

15.3. BRP

15.3.1. Company Overview

15.3.2. Company Footprints

15.3.3. Production Locations

15.3.4. Product Portfolio

15.3.5. Competitors & Customers

15.3.6. Subsidiaries & Parent Organization

15.3.7. Recent Developments

15.3.8. Financial Analysis

15.3.9. Profitability

15.3.10. Revenue Share

15.4. CFMOTO USA

15.4.1. Company Overview

15.4.2. Company Footprints

15.4.3. Production Locations

15.4.4. Product Portfolio

15.4.5. Competitors & Customers

15.4.6. Subsidiaries & Parent Organization

15.4.7. Recent Developments

15.4.8. Financial Analysis

15.4.9. Profitability

15.4.10. Revenue Share

15.5. Deere & Company

15.5.1. Company Overview

15.5.2. Company Footprints

15.5.3. Production Locations

15.5.4. Product Portfolio

15.5.5. Competitors & Customers

15.5.6. Subsidiaries & Parent Organization

15.5.7. Recent Developments

15.5.8. Financial Analysis

15.5.9. Profitability

15.5.10. Revenue Share

15.6. Hisun Motors

15.6.1. Company Overview

15.6.2. Company Footprints

15.6.3. Production Locations

15.6.4. Product Portfolio

15.6.5. Competitors & Customers

15.6.6. Subsidiaries & Parent Organization

15.6.7. Recent Developments

15.6.8. Financial Analysis

15.6.9. Profitability

15.6.10. Revenue Share

15.7. Kawasaki Motors, Ltd.

15.7.1. Company Overview

15.7.2. Company Footprints

15.7.3. Production Locations

15.7.4. Product Portfolio

15.7.5. Competitors & Customers

15.7.6. Subsidiaries & Parent Organization

15.7.7. Recent Developments

15.7.8. Financial Analysis

15.7.9. Profitability

15.7.10. Revenue Share

15.8. Kubota Corporation

15.8.1. Company Overview

15.8.2. Company Footprints

15.8.3. Production Locations

15.8.4. Product Portfolio

15.8.5. Competitors & Customers

15.8.6. Subsidiaries & Parent Organization

15.8.7. Recent Developments

15.8.8. Financial Analysis

15.8.9. Profitability

15.8.10. Revenue Share

15.9. Polaris Inc.

15.9.1. Company Overview

15.9.2. Company Footprints

15.9.3. Production Locations

15.9.4. Product Portfolio

15.9.5. Competitors & Customers

15.9.6. Subsidiaries & Parent Organization

15.9.7. Recent Developments

15.9.8. Financial Analysis

15.9.9. Profitability

15.9.10. Revenue Share

15.10. Suzuki Motor Corporation

15.10.1. Company Overview

15.10.2. Company Footprints

15.10.3. Production Locations

15.10.4. Product Portfolio

15.10.5. Competitors & Customers

15.10.6. Subsidiaries & Parent Organization

15.10.7. Recent Developments

15.10.8. Financial Analysis

15.10.9. Profitability

15.10.10. Revenue Share

15.11. TOMCAR, Inc.

15.11.1. Company Overview

15.11.2. Company Footprints

15.11.3. Production Locations

15.11.4. Product Portfolio

15.11.5. Competitors & Customers

15.11.6. Subsidiaries & Parent Organization

15.11.7. Recent Developments

15.11.8. Financial Analysis

15.11.9. Profitability

15.11.10. Revenue Share

15.12. Yamaha Motor Co., Ltd.

15.12.1. Company Overview

15.12.2. Company Footprints

15.12.3. Production Locations

15.12.4. Product Portfolio

15.12.5. Competitors & Customers

15.12.6. Subsidiaries & Parent Organization

15.12.7. Recent Developments

15.12.8. Financial Analysis

15.12.9. Profitability

15.12.10. Revenue Share

15.13. Other Key Players

15.13.1. Company Overview

15.13.2. Company Footprints

15.13.3. Production Locations

15.13.4. Product Portfolio

15.13.5. Competitors & Customers

15.13.6. Subsidiaries & Parent Organization

15.13.7. Recent Developments

15.13.8. Financial Analysis

15.13.9. Profitability

15.13.10. Revenue Share

List of Tables

Table 1: Global Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Drive Type, 2017-2031

Table 2: Global Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Table 3: Global Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Table 4: Global Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Engine Capacity, 2017-2031

Table 5: Global Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Propulsion Type, 2017-2031

Table 6: Global Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Table 7: Global Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 8: Global Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 9: Global Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 10: Global Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 11: Global Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 12: Global Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 13: North America Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Drive Type, 2017-2031

Table 14: North America Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Table 15: North America Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Table 16: North America Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Engine Capacity, 2017-2031

Table 17: North America Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Propulsion Type, 2017-2031

Table 18: North America Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Table 19: North America Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 20: North America Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 21: North America Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 22: North America Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 23: North America Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 24: North America Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 25: Europe Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Drive Type, 2017-2031

Table 26: Europe Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Table 27: Europe Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Table 28: Europe Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Engine Capacity, 2017-2031

Table 29: Europe Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Propulsion Type, 2017-2031

Table 30: Europe Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Table 31: Europe Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 32: Europe Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 33: Europe Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 34: Europe Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 35: Europe Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 36: Europe Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 37: Asia Pacific Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Drive Type, 2017-2031

Table 38: Asia Pacific Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Table 39: Asia Pacific Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Table 40: Asia Pacific Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Engine Capacity, 2017-2031

Table 41: Asia Pacific Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Propulsion Type, 2017-2031

Table 42: Asia Pacific Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Table 43: Asia Pacific Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 44: Asia Pacific Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 45: Asia Pacific Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 46: Asia Pacific Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 47: Asia Pacific Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 48: Asia Pacific Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 49: Middle East & Africa Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Drive Type, 2017-2031

Table 50: Middle East & Africa Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Table 51: Middle East & Africa Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Table 52: Middle East & Africa Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Engine Capacity, 2017-2031

Table 53: Middle East & Africa Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Propulsion Type, 2017-2031

Table 54: Middle East & Africa Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Table 55: Middle East & Africa Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 56: Middle East & Africa Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 57: Middle East & Africa Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 58: Middle East & Africa Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 59: Middle East & Africa Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 60: Middle East & Africa Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 61: South America Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Drive Type, 2017-2031

Table 62: South America Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Table 63: South America Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Table 64: South America Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Engine Capacity, 2017-2031

Table 65: South America Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Propulsion Type, 2017-2031

Table 66: South America Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Table 67: South America Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 68: South America Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 69: South America Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 70: South America Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 71: South America Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 72: South America Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Drive Type, 2017-2031

Figure 2: Global Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Figure 3: Global Utility Terrain Vehicle Market, Incremental Opportunity, by Drive Type, Value (US$ Bn), 2022-2031

Figure 4: Global Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Figure 5: Global Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Engine Capacity, 2017-2031

Figure 6: Global Utility Terrain Vehicle Market, Incremental Opportunity, by Engine Capacity, Value (US$ Bn), 2022-2031

Figure 7: Global Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Propulsion Type, 2017-2031

Figure 8: Global Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 9: Global Utility Terrain Vehicle Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2022-2031

Figure 10: Global Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 11: Global Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 12: Global Utility Terrain Vehicle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 13: Global Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 14: Global Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 15: Global Utility Terrain Vehicle Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 16: Global Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 17: Global Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 18: Global Utility Terrain Vehicle Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 19: North America Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Drive Type, 2017-2031

Figure 20: North America Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Figure 21: North America Utility Terrain Vehicle Market, Incremental Opportunity, by Drive Type, Value (US$ Bn), 2022-2031

Figure 22: North America Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Figure 23: North America Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Engine Capacity, 2017-2031

Figure 24: North America Utility Terrain Vehicle Market, Incremental Opportunity, by Engine Capacity, Value (US$ Bn), 2022-2031

Figure 25: North America Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Propulsion Type, 2017-2031

Figure 26: North America Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 27: North America Utility Terrain Vehicle Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2022-2031

Figure 28: North America Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 29: North America Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 30: North America Utility Terrain Vehicle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 31: North America Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 32: North America Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 33: North America Utility Terrain Vehicle Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 34: North America Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 35: North America Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: North America Utility Terrain Vehicle Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 37: Europe Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Drive Type, 2017-2031

Figure 38: Europe Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Figure 39: Europe Utility Terrain Vehicle Market, Incremental Opportunity, by Drive Type, Value (US$ Bn), 2022-2031

Figure 40: Europe Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Figure 41: Europe Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Engine Capacity, 2017-2031

Figure 42: Europe Utility Terrain Vehicle Market, Incremental Opportunity, by Engine Capacity, Value (US$ Bn), 2022-2031

Figure 43: Europe Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Propulsion Type, 2017-2031

Figure 44: Europe Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 45: Europe Utility Terrain Vehicle Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2022-2031

Figure 46: Europe Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 47: Europe Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 48: Europe Utility Terrain Vehicle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 49: Europe Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 50: Europe Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 51: Europe Utility Terrain Vehicle Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 52: Europe Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 53: Europe Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 54: Europe Utility Terrain Vehicle Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 55: Asia Pacific Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Drive Type, 2017-2031

Figure 56: Asia Pacific Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Figure 57: Asia Pacific Utility Terrain Vehicle Market, Incremental Opportunity, by Drive Type, Value (US$ Bn), 2022-2031

Figure 58: Asia Pacific Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Figure 59: Asia Pacific Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Engine Capacity, 2017-2031

Figure 60: Asia Pacific Utility Terrain Vehicle Market, Incremental Opportunity, by Engine Capacity, Value (US$ Bn), 2022-2031

Figure 61: Asia Pacific Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Propulsion Type, 2017-2031

Figure 62: Asia Pacific Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 63: Asia Pacific Utility Terrain Vehicle Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2022-2031

Figure 64: Asia Pacific Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 65: Asia Pacific Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 66: Asia Pacific Utility Terrain Vehicle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 67: Asia Pacific Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 68: Asia Pacific Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 69: Asia Pacific Utility Terrain Vehicle Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 70: Asia Pacific Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 71: Asia Pacific Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: Asia Pacific Utility Terrain Vehicle Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 73: Middle East & Africa Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Drive Type, 2017-2031

Figure 74: Middle East & Africa Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Figure 75: Middle East & Africa Utility Terrain Vehicle Market, Incremental Opportunity, by Drive Type, Value (US$ Bn), 2022-2031

Figure 76: Middle East & Africa Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Figure 77: Middle East & Africa Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Engine Capacity, 2017-2031

Figure 78: Middle East & Africa Utility Terrain Vehicle Market, Incremental Opportunity, by Engine Capacity, Value (US$ Bn), 2022-2031

Figure 79: Middle East & Africa Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Propulsion Type, 2017-2031

Figure 80: Middle East & Africa Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 81: Middle East & Africa Utility Terrain Vehicle Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2022-2031

Figure 82: Middle East & Africa Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 83: Middle East & Africa Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 84: Middle East & Africa Utility Terrain Vehicle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 85: Middle East & Africa Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 86: Middle East & Africa Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 87: Middle East & Africa Utility Terrain Vehicle Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 88: Middle East & Africa Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 89: Middle East & Africa Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: Middle East & Africa Utility Terrain Vehicle Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 91: South America Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Drive Type, 2017-2031

Figure 92: South America Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Figure 93: South America Utility Terrain Vehicle Market, Incremental Opportunity, by Drive Type, Value (US$ Bn), 2022-2031

Figure 94: South America Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Engine Capacity, 2017-2031

Figure 95: South America Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Engine Capacity, 2017-2031

Figure 96: South America Utility Terrain Vehicle Market, Incremental Opportunity, by Engine Capacity, Value (US$ Bn), 2022-2031

Figure 97: South America Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Propulsion Type, 2017-2031

Figure 98: South America Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 99: South America Utility Terrain Vehicle Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2022-2031

Figure 100: South America Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 101: South America Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 102: South America Utility Terrain Vehicle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 103: South America Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 104: South America Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 105: South America Utility Terrain Vehicle Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 106: South America Utility Terrain Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 107: South America Utility Terrain Vehicle Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 108: South America Utility Terrain Vehicle Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031