The world of athletics is very diverse with many different types of sports being played on the different types of surfaces used for each sport. All sports are physically demanding for athletes and like any physical activity, injuries are always a concern. One of the most effective ways to prevent sports injuries is to ensure that athletes are playing on the right type of sports flooring and surfaces both indoors and outdoors. Sports flooring types are made with special care to provide shock absorption as well as a suitable surface for each sport. The growing awareness for such potential incidence is expected to driving the sports flooring market in the U.S.

Sports flooring are made from the substance such as vinyl, linoleum, rubber, polymer, and wood. These flooring materials are fit for both indoor and outdoor activities. Usually, they are in sheet form with a foam lining that produces an elastic or mixed elastic floor point. Additionally, most consumers prefer flooring with the capacity for shock absorption, withstanding the rolling load, and resist slipping. The flooring materials cover all the things, making themselves a sustainable choice leading to the surge in demand in various applications. They are highly utilized in residential and commercial buildings in the U.S. This factor is expected to drive the U.S. sports flooring market.

As the coronavirus spread in the U.S. and other parts of the world, various measures were implemented in the sports industry to protect the health of athletes, spectators, and all others involved. Due to the ongoing pandemic, a rising number of major sporting events and matches have been suspended or canceled. Every element of sport has been affected, from sports activities to sporting goods, flooring, sports retail, hospitality, and media coverage. Companies operating in the sports flooring market saw their market valuations fall in the early months of the pandemic. However, they managed to outperform the wider market as the year progressed, with sports equipment makers doing especially well.

Manufacturers in the sports flooring market were impacted with varying degrees depending on how accessible they were in the lockdown environment. Outdoor individual sports flooring and indoor courts both saw decreased participation. They struggled due to the postponement or cancellation of major sporting events. However, to win in the new environment, the industry needs to adapt both its customer proposition and its operational capabilities. Moreover, with the trending Tokyo Olympics 2020, participation in sporting activities is expected to rise, proving propitious for the U.S. sports flooring market.

The growing demand for gyms and sports in the U.S. is expected to drive the sports flooring market in the country. In addition, increasing inclination toward outdoor and indoor sports and surge in the number of the health-conscious population are propelling the product demand. Moreover, the introduction of new sports floors with new materials and the rise in the number of sports enthusiasts are anticipated to contribute to the rising demand. Furthermore, growing investments in research and development activities with rising infrastructure development are surging the demand for gymnasiums. Owing to these factors, the market is expected to boost the need for sports flooring and help to improve the demand rate for the sports flooring market during the forecast period.

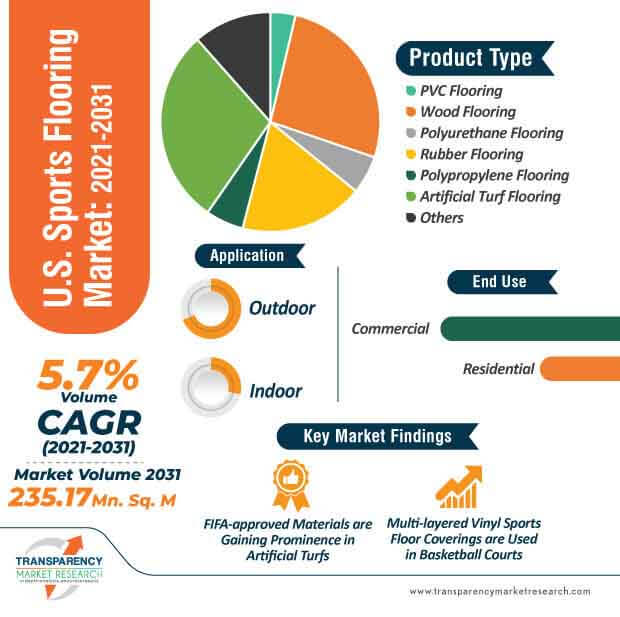

The U.S. sports flooring market is expected to reach the valuation of US$ 5.8 Bn by 2031, expanding at a CAGR of 6% during the forecast period.

Analysts’ Viewpoint

Extreme weather conditions in the U.S. have fueled the demand for sports flooring in the indoor application segment. Government and private sports clubs in the U.S. are investing significantly in indoor sports complexes. Moreover, growth in public awareness about the connection between physical activity and health is majorly contributing to the growth of the sports flooring market in the U.S.

Increase in Number of Gyms, Personal Fitness Centers: Key Driver of U.S. Sports Flooring Market

Growth in Usage of Artificial Turf Flooring in U.S.

Rise in Demand for Sports Flooring in Commercial Set-up

Increase in Usage of Sports Flooring in Outdoor Application

U.S. Sports Flooring Market: Competition Landscape

U.S. Sports Flooring Market is expected to reach US$ 5.8 Bn By 2031

U.S. Sports Flooring Market is estimated to rise at a CAGR of 6% during forecast period

Increase in the demand for sports flooring in the U.S. for use in various applications such as indoor sports, and outdoor sports is anticipated to drive the U.S. sports flooring market

Key players operating in the U.S. sports flooring market are Tarkett, LG Hausys Ltd., Bauwerk Boen Group, Mats Inc., SnapSports Athletic Surfaces, Conica AG, Aacer Flooring, LLC, Kiefer USA, Flexcourt Athletics, KLIKFLEX Flooring, Rephouse Ltd, and Flexcourt Athletics.

Commercial, Residential are the end-use segments in the U.S. Sports Flooring Market

1. Executive Summary

1.1. Sports Flooring Market Snapshot

1.2. Key Market Trends

1.3. Current Market and Future Potential

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Definitions

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.6. Value Chain Analysis

2.6.1. List of Potential Customers

3. COVID-19 Impact Analysis

4. Sports Flooring Market Outlook

5. Sports Flooring Price Trend Analysis, 2020–2031

5.1. By Product Type

5.2. By Application

6. U.S. Sports Flooring Market Analysis and Forecast, by Product Type, 2020–2031

6.1. Introduction and Definitions

6.2. U.S. Sports Flooring Market Volume (Million Square Meters) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

6.2.1. PVC Flooring

6.2.2. Wood Flooring

6.2.3. Polyurethane Flooring

6.2.4. Rubber Flooring

6.2.5. Polypropylene Flooring

6.2.6. Artificial Turf Flooring

6.2.7. Others

6.3. U.S. Sports Flooring Market Attractiveness, by Product Type

7. U.S. Sports Flooring Market Analysis and Forecast, by Application, 2020–2031

7.1. Introduction and Definitions

7.2. U.S. Sports Flooring Market Volume (Million Square Meters) and Value (US$ Mn) Forecast, by Application, 2020–2031

7.2.1. Outdoor

7.2.2. Indoor

7.3. U.S. Sports Flooring Market Attractiveness, by Application

8. U.S. Sports Flooring Market Analysis and Forecast, by End-use, 2020–2031

8.1. Introduction and Definitions

8.2. U.S. Sports Flooring Market Volume (Million Square Meters) and Value (US$ Mn) Forecast, by End-use, 2020–2031

8.2.1. Commercial

8.2.2. Residential

8.3. U.S. Sports Flooring Market Attractiveness, by End-use

9. U.S. Sports Flooring Market Analysis and Forecast, by Sports, 2020–2031

9.1. Introduction and Definitions

9.2. U.S. Sports Flooring Market Volume (Million Square Meters) and Value (US$ Mn) Forecast, by Sports, 2020–2031

9.2.1. Track & Field

9.2.2. Football

9.2.3. Basketball

9.2.4. Volleyball

9.2.5. Badminton

9.2.6. Tennis

9.2.7. Gym, Dance, and Aerobic Studio

9.2.8. Others

9.3. U.S. Sports Flooring Market Attractiveness, by Sports

10. U.S. Sports Flooring Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. U.S. Sports Flooring Market Volume (Million Square Meters) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

10.3. U.S. Sports Flooring Market Volume (Million Square Meters) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4. U.S. Sports Flooring Market Volume (Million Square Meters) and Value (US$ Mn) Forecast, by End-use, 2020–2031

10.5. U.S. Sports Flooring Market Volume (Million Square Meters) and Value (US$ Mn) Forecast, by Sports, 2020–2031

10.6. U.S. Sports Flooring Market Volume (Million Square Meters) and Value (US$ Mn) Forecast, by Country, 2020–2031

11. Competition Landscape

11.1. U.S. Sports Flooring Market Company Market Share Analysis, 2020

11.2. Competition Matrix

11.3. Market Footprint Analysis

11.3.1. By Product Type

11.3.2. By Application

11.3.3. By End-use

11.3.4. By Sports

11.4. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

11.4.1. Tarkett

11.4.1.1. Company Description

11.4.1.2. Business Overview

11.4.2. LG Hausys Ltd.

11.4.2.1. Company Description

11.4.2.2. Business Overview

11.4.3. Bauwerk Boen Group

11.4.3.1. Company Description

11.4.3.2. Business Overview

11.4.4. Mats Inc.

11.4.4.1. Company Description

11.4.4.2. Business Overview

11.4.5. Conica AG

11.4.5.1. Company Description

11.4.5.2. Business Overview

11.4.6. Aacer Flooring

11.4.6.1. Company Description

11.4.6.2. Business Overview

11.4.7. Kiefer USA

11.4.7.1. Company Description

11.4.7.2. Business Overview

11.4.8. Flexcourt Athletics

11.4.8.1. Company Description

11.4.8.2. Business Overview

11.4.9. KLIKFLEX Flooring

11.4.9.1. Company Description

11.4.9.2. Business Overview

11.4.10. Rephouse Ltd

11.4.10.1. Company Description

11.4.10.2. Business Overview

11.4.11. Flexcourt Athletics

11.4.11.1. Company Description

11.4.11.2. Business Overview

12. Primary Research: Key Insights

13. Appendix

List of Tables

Table 01: U.S. Sports Flooring Market Volume (Million Square Meters) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 02: U.S. Sports Flooring Market Volume (Million Square Meters) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 03: U.S. Sports Flooring Market Volume (Million Square Meters) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 04: U.S. Sports Flooring Market Volume (Million Square Meters) and Value (US$ Mn) Forecast, by Sports, 2020–2031

List of Figures

Figure 01: U.S. Sports Flooring Market Value Share Analysis, by Product Type

Figure 02: U.S. Sports Flooring Market Attractiveness Analysis, by Product Type

Figure 03: U.S. Sports Flooring Market Value Share Analysis, by Application

Figure 04: U.S. Sports Flooring Market Attractiveness Analysis, by Application

Figure 05: U.S. Sports Flooring Market Value Share Analysis, by End-use

Figure 06: U.S. Sports Flooring Market Attractiveness Analysis, by End-use

Figure 07: U.S. Sports Flooring Market Value Share Analysis, by Sports

Figure 08: U.S. Sports Flooring Market Attractiveness Analysis, by Sports

Figure 09: U.S. Sports Flooring Market Volume (Million Square Meters) and Value (US$ Mn) Forecast, 2020–2031