Analysts’ Viewpoint on U.S. Roadside Drug Testing Devices Market Scenario

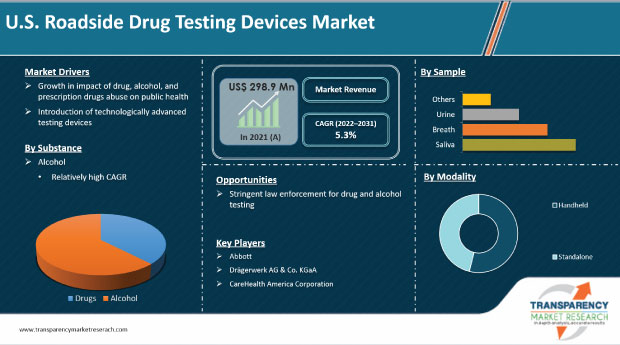

The roadside drug testing devices market in the U.S. has been witnessing strong growth over the last few years due to the increase in consumption of various illicit drugs and alcohol in the country. Currently, cannabis is used in medicines to treat various conditions. This has led to legalization of the drug, which in turn has increased the drug consumption rate. Drug-impaired driving is responsible for a large number of accidents. It has resulted in an increase in demand for roadside drug testing in order to prevent accidents. Manufacturers should focus on developing advanced drug testing devices such as mobile alcohol breathalyzers to increase revenue opportunities.

Roadside drug testing devices are used to identify drugs consumed by an individual while driving. Devices used for drug testing include breathalyzers and drug test kits. It has become mandatory to conduct drug driving testing to prevent accidents and mishaps. In 2020, around 11,654 people died due to alcohol-impaired driving in the U.S., a 14% increase over that in 2019. Increase in the number of drug and alcohol abusers in the U.S. presents significant opportunities for test providers and manufacturers of drug abuse test products in the market.

Substance abuse has a significant effect on the health of individuals and their families. Abuse of prescription drugs or nonmedical use of prescription drugs has become a grave public health concern owing to its high prevalence and mortality rate in the U.S. Several individuals consume such drugs and drive, which leads to major accidents. Hence, roadside drug screening devices are used regularly to test individuals. This, in turn, propels the market in the country.

Rise in prescription drug abuse increases the rate of overdose deaths and emergency room visits. Consumption of non-medical prescription drugs is rising at a rapid pace. According to the National Institute of Drug Abuse (NIDA), around 52 million people have used prescription drugs for non-medical reasons at least once in their lifetime. Vicodin and OxyContin are the most abused prescription drugs among the young population.

Technological advancements related to sample collection and efforts of manufacturers to create easy-to-use disposable test kits are expected to boost the demand for roadside drug testing devices. Manufacturers are focusing on using samples other than urine, such as sweat and hair, which are less embarrassing for individuals tested for drug abuse. They are also focusing on the development of rapid tests that provide faster results; and are easy to use and more affordable than wet tests. For instance, the DDS2 Mobile Test System, designed and manufactured by Alere, Inc. (Abbott), is a next-generation portable drug testing device. It detects if a driver is addicted to cocaine, marijuana, opiates, amphetamines, and methamphetamines in a single oral fluid test within five minutes.

Based on substance, the roadside drug testing devices market in the U.S. has been bifurcated into drugs and alcohol. The drugs segment has been split into tetrahydrocannabinol (THC), cocaine, amphetamine, and others. The alcohol segment dominated the market in the U.S. in 2021, accounting for around 62% share. The segment is likely to grow at a rapid pace during the forecast period. According to CDC, around 10,511 alcohol-impaired driving deaths occurred in the U.S. in 2018. Implementation of strategies to prevent alcohol and drug-impaired driving in the country is propelling the alcohol segment.

Based on sample, the roadside drug testing devices market in the U.S. has been segregated into saliva, breath, urine, and others. The urine segment held major share of around 42% in 2021. The trend is projected to continue during the forecast period. Urine samples are easy to store. Urine tests also give accurate results. These are non-invasive procedures used by professionals to detect illegal consumption of drugs. The breath segment held the second largest share of the market in the country in 2021. The segment is driven by the increase in the number of cases of driving under the influence of alcohol.

In terms of modality, the roadside drug testing devices market in the U.S. has been segregated into handheld and standalone. The handheld segment dominated the roadside drug testing devices market in the country in 2021, accounting for 73% share. The segment is anticipated to grow at the fastest CAGR during the forecast period. This can be attributed to high portability and low cost associated with handheld devices. Increase in sales of these compact roadside drug testing devices can be ascribed to their small size, speed, and reliability.

The roadside drug testing devices market report concludes with the company profiles section, which includes key information about leading players in the roadside drug testing devices market in the U.S. Most of the key players play an active role in the introduction of new mobile devices as well as point-of-care testing devices. Leading players in the roadside drug testing devices market in the country include Abbott, Quest Products, LLC, CareHealth America Corporation, Oranoxis, Inc., Drägerwerk AG & Co. KGaA, BACtrack, and Lifeloc Technologies, Inc.

Each of these players has been profiled in the roadside drug testing devices market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments. The report also focuses on demand analysis of roadside drug testing devices.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 298.9 Mn |

|

Market Forecast Value in 2031 |

US$ 498.8 Mn |

|

Growth Rate (CAGR) |

5.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes cross segment analysis at regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The roadside drug testing devices market in the U.S. was valued at US$ 298.9 Mn in 2021

The roadside drug testing devices market in the country is projected to reach US$ 498.8 Mn by 2031

The alcohol substance segment held more than 60% share of the roadside drug testing devices market in the U.S. in 2021

The roadside drug testing devices market in the U.S. is anticipated to expand at a CAGR of 5.3% from 2022 to 2031

Prominent players in the roadside drug testing devices market in the U.S. include Abbott, Drägerwerk AG & Co. KGaA, and CareHealth America Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: U.S. Roadside Drug Testing Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Substance Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. U.S. Roadside Drug Testing Devices Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Roadside Drug Testing Programs: Overview

5.2. Regulatory Scenario

5.3. Key Industry Events (mergers, acquisitions, partnerships, etc.)

5.4. COVID-19 Pandemics Impact on Industry (value chain and short / mid / long term impact)

6. U.S. Roadside Drug Testing Devices Market Analysis and Forecast, by Substance

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Substance, 2017–2031

6.3.1. Drugs

6.3.1.1. Tetrahydrocannabinol (THC)

6.3.1.2. Cocaine

6.3.1.3. Amphetamine

6.3.1.4. Others

6.3.2. Alcohol

6.4. Market Attractiveness Analysis, by Substance

7. U.S. Roadside Drug Testing Devices Market Analysis and Forecast, by Sample

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Sample, 2017–2031

7.3.1. Saliva

7.3.2. Breath

7.3.3. Urine

7.3.4. Others

7.4. Market Attractiveness Analysis, by Sample

8. U.S. Roadside Drug Testing Devices Market Analysis and Forecast, by Modality

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Modality, 2017–2031

8.3.1. Handheld

8.3.2. Standalone

8.4. Market Attractiveness Analysis, by Modality

9. Competition Landscape

9.1. Market Player - Competition Matrix (by tier and size of companies)

9.2. Market Share Analysis, by Company, 2021

9.3. Company Profiles

9.3.1. Abbott

9.3.1.1. Company overview

9.3.1.2. Financial overview

9.3.1.3. Business strategies

9.3.1.4. SWOT analysis

9.3.1.5. Recent developments

9.3.2. Quest Products, LLC

9.3.2.1. Company overview

9.3.2.2. Financial overview

9.3.2.3. Business strategies

9.3.2.4. SWOT analysis

9.3.2.5. Recent developments

9.3.3. CareHealth America Corporation

9.3.3.1. Company overview

9.3.3.2. Financial overview

9.3.3.3. Business strategies

9.3.3.4. SWOT analysis

9.3.3.5. Recent developments

9.3.4. Oranoxis, Inc.

9.3.4.1. Company overview

9.3.4.2. Financial overview

9.3.4.3. Business strategies

9.3.4.4. SWOT analysis

9.3.4.5. Recent developments

9.3.5. Drägerwerk AG & Co. KGaA

9.3.5.1. Company overview

9.3.5.2. Financial overview

9.3.5.3. Business strategies

9.3.5.4. SWOT analysis

9.3.5.5. Recent developments

9.3.6. BACtrack

9.3.6.1. Company overview

9.3.6.2. Financial overview

9.3.6.3. Business strategies

9.3.6.4. SWOT analysis

9.3.6.5. Recent developments

9.3.7. Lifeloc Technologies, Inc.

9.3.7.1. Company overview

9.3.7.2. Financial overview

9.3.7.3. Business strategies

9.3.7.4. SWOT analysis

9.3.7.5. Recent developments

List of Tables

Table 01: U.S. Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Substance 2017–2031

Table 02: U.S. Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Drugs 2017–2031

Table 03: U.S. Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Sample, 2017–2031

Table 04: U.S. Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Modality, 2017–2031

List of Figures

Figure 01: U.S. Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: U.S. Roadside Drug Testing Devices Market Value Share, by Substance, 2021

Figure 03: U.S. Roadside Drug Testing Devices Market Value Share, by Sample, 2021

Figure 04: U.S. Roadside Drug Testing Devices Market Value Share, by Modality, 2021

Figure 05: U.S. Roadside Drug Testing Devices Market, by Substance, 2021 and 2031

Figure 06: U.S. Roadside Drug Testing Devices Market Attractiveness Analysis, by Substance, 2022–2031

Figure 07: U.S. Roadside Drug Testing Devices Market (US$ Mn), by Drugs, 2017–2031

Figure 08: U.S. Roadside Drug Testing Devices Market (US$ Mn), by Alcohol, 2017–2031

Figure 09: U.S. Roadside Drug Testing Devices Market, by Sample, 2021 and 2031

Figure 10: U.S. Roadside Drug Testing Devices Market Attractiveness Analysis, by Sample, 2022–2031

Figure 11: U.S. Roadside Drug Testing Devices Market (US$ Mn), by Saliva, 2017–2031

Figure 12: U.S. Roadside Drug Testing Devices Market (US$ Mn), by Sweat, 2017–2031

Figure 13: U.S. Roadside Drug Testing Devices Market (US$ Mn), by Urine, 2017–2031

Figure 14: U.S. Roadside Drug Testing Devices Market (US$ Mn), by Others, 2017–2031

Figure 15: U.S. Roadside Drug Testing Devices Market, by Modality, 2021 and 2031

Figure 16: U.S. Roadside Drug Testing Devices Market Attractiveness Analysis, by Modality, 2022–2031

Figure 17: U.S. Roadside Drug Testing Devices Market (US$ Mn), by Handheld, 2017–2031

Figure 18: U.S. Roadside Drug Testing Devices Market (US$ Mn), by Standalone, 2017–2031