U.S. RFID Tags Market: Snapshot

Radio-frequency identification (RFID) technology enhances and revolutionize the way the companies do business by improving efficiency of operations, improving asset traceability and visibility, deceasing pressure on manual processes, reducing costs and improving reliability. RFID tags are small in size and they require very less power and don’t need a battery to store and exchange information or data with readers. This makes it cheap and easy to apply tags to all kind of objects that people would like to track or identify.

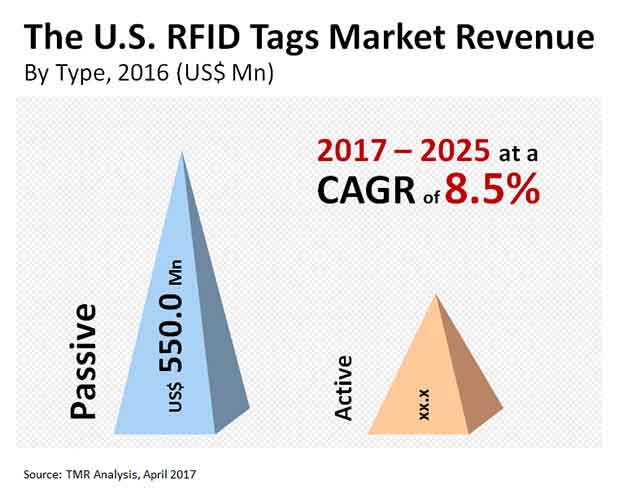

The increase in use of RFID technology in retail sector has been identified as one of the key driving factors for the U.S. RFID Tags Market. In 2016, the U.S. RFID Tags market was valued at US$809.4 mn and is expected to reach US$1,672.5 mn by 2025, expanding at a CAGR of 8.5% during the forecast period. Though already installed base of barcode systems may act as a restrain for RFID tags market. Nonetheless, the increasing focus on enhancing security system has provided opportunity for the usage of RFID chips in passports and visas.

Passive Tag Segment Emerges as High-revenue Earning Segment

Based on type of tags, the U.S. RFID Tags market has been segmented into active and passive tags segments. The passive tags segment held the largest market share in 2016 of the total market revenue share. The passive tag segment is expected to increase at a CAGR of 8.9% during the forecast period from 2017 to 2025. On the other hand, active tags segment is projected to grow significantly throughout the forecast period mainly in surveillance and security sector. These tags are used for tracking containers and pallets as well as large military assets. These tags are also used in tracking ocean containers and land, vehicles, logistics and other high and large value assets.

Based on product type, the U.S. RFID tags market is segmented into healthcare tags, commercial tags, correctional tags and others. In 2016, the largest market share of is accumulated by commercial tags segment and is expected to rise at a CAGR of 8.9% during the forecast period. Healthcare tags are also estimated to support the growth of the RFID tags market. These tags are mainly used for medical devices tracking purpose. Proactive initiative of healthcare RFID tags implementation for managing medical device threat, streamlining processes, automating billing and reporting has been beneficial to hospitals.

Logistics and Transportation to Make Maximum Use of RFID Tags Over Forecast Period

In terms of end-user industry, the market has been classified into healthcare, retail, automotive, logistics and transportation, surveillance and security and others such as sports, wildlife, livestock, and IT amongst others. In 2016, the largest market share is accumulated by logistics and transportation industry and is expected to grow considerably during the forecast period. In this sector, RFID-based technologies are extensively implemented to improve transportation security and safety, thus increasing the efficiency of the transportation system and improving the way of living of the citizens. In 2025, the logistics and transportation segment is projected to dominate the market revenue share followed by retail and healthcare sector.

Some of the leading players operating in the U.S. RFID tags market are AMS AG, Atmel Corporation, Impinj Inc., Alien Technology, Confidex LTD., HID USA Corporation, Invengo Information Technology Co., Ltd., Omni- ID Ltd., NXP Semiconductors N.V., and RF Code Inc.

1.Preface

1.1.Market Definition and Scope

1.2.Market Segmentation

1.3.Key Research Objectives

1.4.Research Highlights

2.Assumptions and Research Methodology

3.Executive Summary: THE U.S. RFID Tags Market

4.Market Overview

4.1.Introduction

4.2.Market Dynamics

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.The U.S. RFID Tags Market Analysis and Forecasts, 2015 - 2025

4.3.1.Market Revenue Projections (US$ Mn)

4.4.Porter’s Five Force Analysis

4.5.Value Chain Analysis

4.6.Market Outlook

5.The U.S. RFID Tags Market Analysis and Forecasts, By Type

5.1.Overview & Definition

5.2.Key Trends

5.3.RFID Tags Market Size, (US$ Mn) Forecast By Type, 2015 – 2025

5.3.1.Active RFID

5.3.2.Passive RFID

5.4.Type Comparison Matrix

5.5.Market Attractiveness By Type

6.The U.S. RFID Tags Market Analysis and Forecasts, By Product Type

6.1.Overview & Definition

6.2.Key Trends

6.3.RFID Tags Market Size, (US$ Mn) Forecast By Product Type, 2015 – 2025

6.3.1.Healthcare Tags

6.3.2.Commercial Tags

6.3.3.Correctional Tags

6.3.4.Others

6.4.Product Type Comparison Matrix

6.5.Market Attractiveness By Product Type

7.The U.S. RFID Tags Market Analysis and Forecasts, By End Use Industry

7.1.Overview & Definition

7.2.Key Trends

7.3.RFID Tags Market Size (US$ Mn) Forecast By End use Industry, 2015 - 2025

7.3.1.Healthcare

7.3.2.Retail

7.3.3.Automotive

7.3.4.Logistics and Transportation

7.3.5.Surveillance and Security

7.3.6.Others (Sports, Wildlife, Livestock, IT)

7.4.End use Industry Comparison Matrix

7.5.Market Attractiveness By End use Industry

8.Competition Landscape

8.1.The U.S. RFID Type Market Share Analysis By Company (2016)

8.1.1. Active RFID (US$ Mn & Thousand Units)

8.1.2. Passive RFID (US$ Mn & Thousand Units)

8.2.Market Player – Competition Matrix

8.3.The U.S. Market Share Analysis By Company (2016)

8.4.Company Profiles

8.4.1.AMS AG

8.4.1.1. Company Detail

8.4.1.2. Company Description

8.4.1.3. Financial Overview

8.4.1.4. SWOT Analysis

8.4.1.5. Strategic Overview

8.4.2.Atmel Corp

8.4.2.1. Company Detail

8.4.2.2. Company Description

8.4.2.3. Financial Overview

8.4.2.4. SWOT Analysis

8.4.2.5. Strategic Overview

8.4.3.Impinj Inc

8.4.3.1. Company Detail

8.4.3.2. Company Description

8.4.3.3. Financial Overview

8.4.3.4. SWOT Analysis

8.4.3.5. Strategic Overview

8.4.4.Alien Technology

8.4.4.1. Company Detail

8.4.4.2. Company Description

8.4.4.3. Financial Overview

8.4.4.4. SWOT Analysis

8.4.4.5. Strategic Overview

8.4.5.Confidex Ltd.

8.4.5.1. Company Detail

8.4.5.2. Company Description

8.4.5.3. Financial Overview

8.4.5.4. SWOT Analysis

8.4.5.5. Strategic Overview

8.4.6.HID USA Corporation

8.4.6.1. Company Detail

8.4.6.2. Company Description

8.4.6.3. Financial Overview

8.4.6.4. SWOT Analysis

8.4.6.5. Strategic Overview

8.4.7.Invengo Information Technology Co., Ltd.

8.4.7.1. Company Detail

8.4.7.2. Company Description

8.4.7.3. Financial Overview

8.4.7.4. SWOT Analysis

8.4.7.5. Strategic Overview

8.4.8.NXP Semiconductors N.V.

8.4.8.1. Company Detail

8.4.8.2. Company Description

8.4.8.3. Financial Overview

8.4.8.4. SWOT Analysis

8.4.8.5. Strategic Overview

8.4.9.Omni- ID Ltd.

8.4.9.1. Company Detail

8.4.9.2. Company Description

8.4.9.3. Financial Overview

8.4.9.4. SWOT Analysis

8.4.9.5. Strategic Overview

8.4.10. RF Code

8.4.10.1. Company Detail

8.4.10.2. Company Description

8.4.10.3. Financial Overview

8.4.10.4. SWOT Analysis

8.4.10.5. Strategic Overview

9. Key Takeaways

List of Tables

Table 1: The U.S. RFID Tags Market Forecast, By Type, 2015–2025 (US$ Mn)

Table 2: The U.S. RFID Tags Market Forecast, By Type, 2015–2025 (Mn Units)

Table 3: The U.S. RFID Tags Market Forecast, By Product Type, 2015–2025 (US$ Mn)

Table 4: The U.S. RFID Tags Market Forecast, By End-Use Industry, 2015–2025 (US$ Mn)

Table 5: Active RFID (US$ Mn & Thousand Units)

Table 6: Active RFID (US$ Mn & Thousand Units)

Table 7: Passive RFID (US$ Mn & Thousand Units)

Table 8: Passive RFID (US$ Mn & Thousand Units)

List of Figures

Figure 1: The U.S. RFID Tags Market Revenue Projections, 2015 - 2025 (US$ Mn)

Figure 2: The U.S. RFID Tags Market – Porter’s Five Forces Analysis

Figure 3: The U.S. RFID Tags Market – Porter’s Five Forces Analysis

Figure 4: The U.S. Market Value Share (Revenue) By Type (2017)

Figure 5: The U.S. Market Value Share (Revenue) By Product Type (2017)

Figure 6: The U.S. Market Value Share (Revenue) By End-use Industry (2017)

Figure 7: The U.S. RFID Tags Market Value Share Analysis, By Type, 2017 and 2025

Figure 8: The U.S. RFID Tags Market Revenue, By Type, Active

Figure 9: The U.S. RFID Tags Market Revenue, By Type, Passive

Figure 10: The U.S. RFID Tags Comparison Matrix, By Type

Figure 11: The U.S. RFID Tags Market Attractiveness Analysis, By Type

Figure 12: The U.S. RFID Tags Market Value Share Analysis, By Product Type, 2017 and 2025

Figure 13: The U.S. RFID Tags Market Revenue, By Product Type, Healthcare Tags

Figure 14: The U.S. RFID Tags Market Revenue, By Product Type, Commercial Tags

Figure 15: The U.S. RFID Tags Market Revenue, By Product Type, Correctional Tags

Figure 16: The U.S. RFID Tags Market Revenue, By Product Type, Others

Figure 17: The U.S. RFID Tags Comparison Matrix, By Product Type

Figure 18: The U.S. RFID Tags Market Attractiveness Analysis, By Product Type

Figure 19: The U.S. RFID Tags Market Value Share Analysis, By End-Use Industry, 2017 and 2025

Figure 20: The U.S. RFID Tags Market Revenue, By End-Use Industry, Healthcare

Figure 21: The U.S. RFID Tags Market Revenue, By End-Use Industry, Retail

Figure 22: The U.S. RFID Tags Market Revenue, By End-Use Industry, Automotive

Figure 23: The U.S. RFID Tags Market Revenue, By End-Use Industry, Logistics and Transportation

Figure 24: The U.S. RFID Tags Market Revenue, By End-Use Industry, Surveillance and Security

Figure 25: The U.S. RFID Tags Market Revenue, By End-Use Industry, Others

Figure 26: The U.S. RFID Tags Comparison Matrix, By End-Use Industry

Figure 27: The U.S. RFID Tags Market Attractiveness Analysis, By End-Use Industry

Figure 28: The U.S. RFID Tags Market Share Analysis (2016)