Companies in the U.S. resistance welding products market are closely monitoring the situation regarding the coronavirus outbreak. For instance, Superior Joining Technologies, Inc. - a provider of highly technical and precise welding services in Illinois, the U.S., is ensuring business continuity for essential industries such as food & beverages (F&B), construction, and steel. However, the automotive industry and other industries involving heavy-duty manufacturing have affected the revenue flow in the U.S. resistance welding products market.

Other essential sectors in the U.S. involve the Defense Priorities and Allocations System (DPAS) and the Women-Owned Small Business (WOSB) that are helping to keep economies running for resistance welding products. The DPAS plays an important role in establishing timely availability of industrial resources that meet national defense and emergency preparedness requirements.

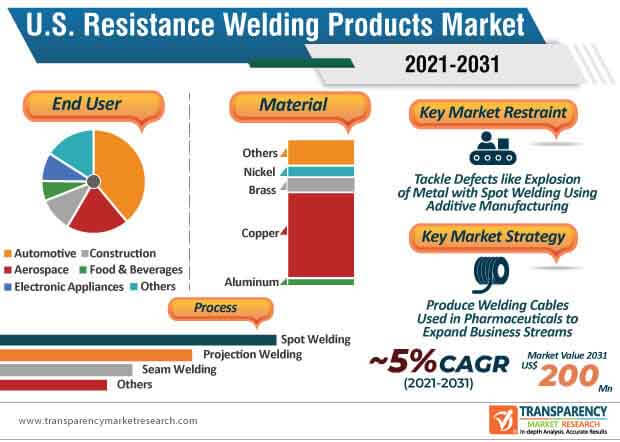

Resistance spot welding is being used for joining plates of fuel tanks, railway tracks, and domestic radiators, among others. This is evident since spot welding is estimated to hold the highest revenue share among all process types in the U.S. resistance welding products market. However, shortcomings of resistance spot welding involve low strength in the case of discontinuous welds and high equipment cost. As such, advantages including easy automation, low fumes, and no requirement for filler materials tend to offset its disadvantages.

The ever-increasing demand for lighter, economical, and low-cost vehicles is estimated to create long-term revenue opportunities pertaining to resistance spot welding.

The U.S. resistance welding products market is projected to reach ~US$ 200 Mn by 2031. Manufacturers are increasing their output capacities to produce electrodes, coils, rods, and the likes to broaden their income streams. This can be attributed to the increasing number of car builders that are fueling the demand for highly standardized plates, flat bars, and other special profiles that comply with the ISO standards and reflect the unified numbering system (UNS).

Manufacturers in the U.S. resistance welding products market are increasing their focus in research & development (R&D) programs launched in partnership with specific automotive manufacturers. This has led to the trend of setting up dedicated, exclusive, and patented manufacturing processes for electrodes. They are increasing the availability of revolutionary electrodes that avoid the striking effect and offer high resistance to softening.

Apart from automobiles and the F&B sector, companies in the U.S. resistance welding products market are expanding their business streams for welding cables in pharmaceuticals, white goods, and electronics industries. In order to gain prominence in non-automotive industries, manufacturers are joining hands with leading manufacturers to provide collaborative and light duty robotics solutions. This is signaling a transformation of the U.S. industrial robotics and the automation industry.

Glass, FMCG (Fast Moving Consumer Goods), packaging, and palletizing applications are generating incremental opportunities for manufacturers in the U.S. resistance welding products market producing welding cables. Manufacturers are improving their casting, machining, and non-destructive testing to produce alloys within their plant in order to offer customized resistance welding products.

Companies in the U.S. resistance welding products market are unlocking incremental opportunities in high volume manufacturing applications. AWL-Techniek Holding B.V. - a specialist in automotive, construction, and packaging capabilities is offering fast, reliable, and automated resistance welding for clients in high volume manufacturing industries. Such companies are triggering the demand for robust resistance welding products.

Resistance welding techniques pertaining to robotic spot welding, as in building machines for projection welding and other diverse applications, are translating into value-grab opportunities for stakeholders in the U.S. resistance welding products market. Spot welding of aluminum has led to new adaptive controls being developed in resistance welding products that are combined with force sensors.

Analysts’ Viewpoint

Even though the automotive industry is starving in terms of incremental opportunities due to the COVID-19 crisis, long-term growth opportunities lie in producing electrodes, round bars, and welding wheels, among others. The automotive industry is supported by the use of high strength steel sheet combinations, chemical compositions, and thickness using spot welding. The U.S. resistance welding products market is projected to advance at a modest CAGR of ~5% during the forecast period. Spot welding is challenged with possible defects such as the explosion of metal near weld site and asymmetrical spot weld marks. Hence, stakeholders should increase awareness about resistance spot welding using additive manufacturing in zinc-coated steel sheets for the automotive industry instead of conventional resistance spot welding methods and other examples to offset disadvantages.

U.S. Resistance Welding Products Market: Overview

Increase in Demand for Automobiles: Key Driver of U.S. Resistance Welding Products Market

Expansion of Consumer Electronics Industry to Boost U.S. Resistance Welding Products Market

U.S. Resistance Welding Products Market: Competition Landscape

U.S. Resistance Welding Products Market: Major Developments

1. Executive Summary

1.1. Market Outlook

1.2. Key Facts and Figures

1.3. Key Trends

2. Market Overview

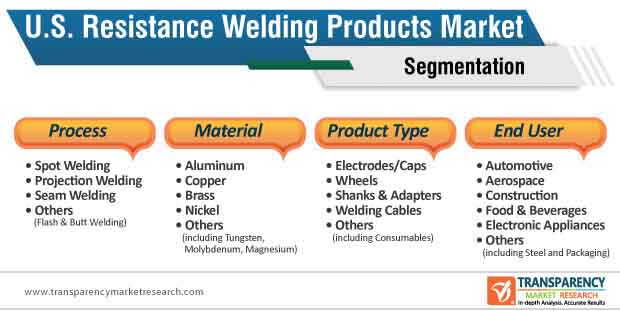

2.1. Market Segmentation

2.2. Market Indicators

3. Market Dynamics

3.1. Drivers and Restraints Snapshot Analysis

3.1.1.1. Drivers

3.1.1.2. Restraints

3.1.1.3. Opportunities

3.2. Porter’s Five Forces Analysis

3.2.1. Threat of Substitutes

3.2.2. Bargaining Power of Buyers

3.2.3. Bargaining Power of Suppliers

3.2.4. Threat of New Entrants

3.2.5. Degree of Competition

3.3. Regulatory Scenario

3.4. Value Chain Analysis

4. COVID-19 Impact Analysis

5. Price Trend Analysis

6. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Analysis, by Process

6.1. Key Findings and Introduction

6.1.1. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Spot Welding, 2020–2031

6.1.2. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Projection Welding, 2020–2031

6.1.3. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Seam Welding, 2020–2031

6.1.4. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Others, 2020–2031

6.2. U.S. Resistance Welding Products Market Attractiveness Analysis, by Process

7. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Analysis, by Material

7.1. Key Findings and Introduction

7.2. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2020–2031

7.2.1. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Aluminum, 2020–2031

7.2.2. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Copper, 2020–2031

7.2.3. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Brass, 2020–2031

7.2.4. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Nickel, 2020–2031

7.2.5. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Others, 2020–2031

7.3. U.S. Resistance Welding Products Market Attractiveness Analysis, by Material

8. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Analysis, by Product Type

8.1. Key Findings and Introduction

8.2. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

8.2.1. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Electrodes/Caps, 2020–2031

8.2.2. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Wheels, 2020–2031

8.2.3. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Shanks & Adapters, 2020–2031

8.2.4. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Welding Cables, 2020–2031

8.2.5. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Others, 2020–2031

8.3. U.S. Resistance Welding Products Market Attractiveness Analysis, by Product Type

9. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Analysis, by End-user

9.1. Key Findings and Introduction

9.2. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

9.2.1. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Automotive, 2020–2031

9.2.2. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Aerospace, 2020–2031

9.2.3. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Construction, 2020–2031

9.2.4. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Food & Beverages, 2020–2031

9.2.5. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Electronic Appliances, 2020–2031

9.2.6. U.S. Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Forecast, by Others, 2020–2031

10. U.S. Resistance Welding Products Market Attractiveness Analysis, by End-user

11. Competition Landscape

11.1. Competition Matrix

11.2. U.S. Resistance Welding Products Market Share Analysis, by Company (2020)

11.3. Market Footprint Analysis

11.4. Company Profiles

11.4.1. Spotwelding Products, Inc.

11.4.1.1. Company Details

11.4.1.2. Company Description

11.4.1.3. Business Overview

11.4.2. Tuffaloy Products, Inc.

11.4.2.1. Company Details

11.4.2.2. Company Description

11.4.2.3. Business Overview

11.4.3. CenterLine Holdings Inc.

11.4.3.1. Company Details

11.4.3.2. Company Description

11.4.3.3. Business Overview

11.4.4. T. J. Snow, Co.

11.4.4.1. Company Details

11.4.4.2. Company Description

11.4.4.3. Business Overview

11.4.5. Cal Manufacturing Inc.

11.4.5.1. Company Details

11.4.5.2. Company Description

11.4.5.3. Business Overview

11.4.6. Weld Systems Integrators (WSI)

11.4.6.1. Company Details

11.4.6.2. Company Description

11.4.6.3. Business Overview

11.4.7. Spotco

11.4.7.1. Company Details

11.4.7.2. Company Description

11.4.7.3. Business Overview

11.4.8. Resistance Welding Machine & Accessory

11.4.8.1. Company Details

11.4.8.2. Company Description

11.4.8.3. Business Overview

11.4.9. Milco Manufacturing.

11.4.9.1. Company Details

11.4.9.2. Company Description

11.4.9.3. Business Overview

11.4.10. AMADA WELD TECH

11.4.10.1. Company Details

11.4.10.2. Company Description

11.4.10.3. Business Overview

12. Primary Research – Key Insights

13. Appendix

13.1. Research Methodology and Assumptions

List of Tables

Table 01: Global Resistance Welding Products Market Volume (Tons) and Value (US$ Mn) Forecast, 2020–2031

Table 02: U.S. Resistance Welding Products Market Volume (Tons) Forecast, by Process, 2020–2031

Table 03: U.S. Resistance Welding Products Market Value (US$ Mn) Forecast, by Process, 2020–2031

Table 04: U.S. Resistance Welding Products Market Volume (Tons) Forecast, by Product Type, 2020–2031

Table 05: U.S. Resistance Welding Products Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 06: U.S. Resistance Welding Products Market Volume (Tons) Forecast, by End-user, 2020–2031

Table 07: U.S. Resistance Welding Products Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 08: U.S. Resistance Welding Products Market Volume (Tons) Forecast, by Material, 2020–2031

Table 09: U.S. Resistance Welding Products Market Value (US$ Mn) Forecast, by Material, 2020–2031

List of Figures

Figure 01: U.S. Resistance Welding Products Market Share Analysis, by Process

Figure 02: U.S. Resistance Welding Products Market Attractiveness Analysis, by Process

Figure 03: U.S. Resistance Welding Products Market Share Analysis, by Product Type

Figure 04: U.S. Resistance Welding Products Market Attractiveness Analysis, by Product Type

Figure 05: U.S. Resistance Welding Products Market Share Analysis, by End-user

Figure 06: U.S. Resistance Welding Products Market Attractiveness Analysis, by End-user

Figure 07: U.S. Resistance Welding Products Market Share Analysis, by Material

Figure 08: U.S. Resistance Welding Products Market Attractiveness Analysis, by Material