Analysts’ Viewpoint

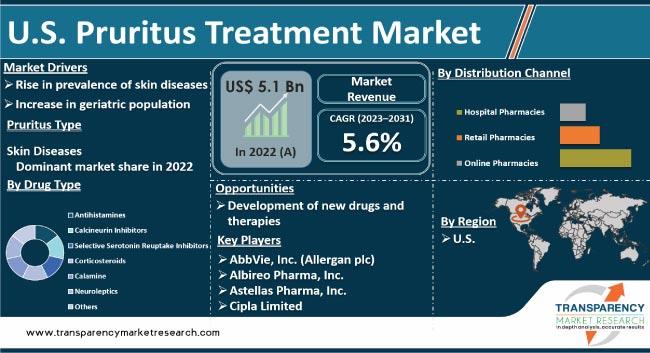

The pruritus treatment market in the U.S. is expected to witness significant growth in the next few years due to rise in prevalence of pruritus among the population. Surge in the geriatric population and increase in incidence of chronic diseases, such as diabetes and kidney diseases, are likely to propel market expansion. Furthermore, increase in awareness about the condition and availability of advanced treatment options, such as topical corticosteroids, antihistamines, and immunosuppressant, are projected to augment U.S. pruritus treatment industry growth in the next few years.

Rise in demand for over-the-counter (OTC) medications and surge in adoption of telemedicine are expected to offer lucrative opportunities to market players. Companies in the market are focusing on developing low cost and efficient OTC medications in order to increase market share and presence.

However, high cost of treatment and side effects associated with certain medications are likely to restrain the market.

Pruritus, commonly known as itching, is a common symptom of various skin conditions such as eczema, psoriasis, and dermatitis. It could also be a side effect of certain medications or a symptom of underlying medical conditions such as liver disease or kidney failure. Various types of pruritus treatment products are available in the market, including topical creams, ointments, lotions, oral medications, and phototherapy. Topical treatments are the most commonly used products for pruritus treatment, as these are easy to apply and provide quick relief. These itchy skin treatment products contain active ingredients such as corticosteroids, antihistamines, and local anesthetics that help to reduce inflammation and itching. However, prolonged use of topical treatments could cause skin thinning and other side effects.

Oral medications such as antihistamines and antidepressants are also used for pruritus treatment. These medications work by blocking the histamine receptors in the body and reducing the sensation of itching. However, these could cause drowsiness and other side effects. Phototherapy, which involves exposing the affected skin to ultraviolet light, is another treatment option for pruritus. It is a safe and effective treatment option; however, it requires specialized equipment and trained professionals to administer the treatment.

The prevalence of skin diseases has been increasing in the U.S. due to factors such as pollution, unhealthy lifestyle habits, and genetic predisposition. According to the American Academy of Dermatology Association (AADA), around 50 million people in the country suffer from acne each year. Moreover, the National Eczema Association states that over 31 million people in the U.S. have some form of eczema.

The rise in the prevalence of skin diseases has led to an increase in demand for pruritus treatment products in the country. Patients suffering from these conditions experience severe itching, which could lead to discomfort and affect the quality of life. Therefore, they seek effective treatments that can provide relief from itching symptoms. Furthermore, advancements in medical technology and research activities focused on developing new itching medicine for treating skin disorders such as pruritus are expected to propel the U.S. pruritus treatment market value.

The geriatric population is growing rapidly across the globe due to increased life expectancy rates and improved healthcare facilities leading to better health outcomes among older adults. According to data published by World Population Review, there were approximately 52 million people aged over 65 years old in the U.S. alone. Older adults are more prone to develop chronic illnesses including various types of skin disorders, such as atopic dermatitis or psoriasis. Hence, they experience pruritus symptoms more frequently than younger individuals.

Aging also causes changes in body physiology resulting in dryness or thinning out layers on the topmost layer i.e., the epidermis, making it more susceptible to itchiness caused by external stimuli such as clothing material. This is driving demand for anti-pruritic medications among elderly patients who require immediate relief from itching symptoms.

In terms of pruritus type, the skin diseases segment accounted for the largest U.S. pruritus treatment market share in 2022. This is ascribed to the high prevalence of skin diseases that cause pruritus among people in the country. According to a report published by the American Academy of Dermatology Association (AADA) in June 2021, around 85 million people in the country are affected by skin diseases every year. This includes conditions such as eczema and psoriasis, which are known to cause pruritus. Hence, the rise in demand for effective treatments for pruritic skin diseases has led to an increase in sales of anti-itch medication.

The surge in awareness about pruritic skin diseases among patients and healthcare professionals is another factor driving the skin diseases segment. Advancements in medical research and technology in the past few years have led to a greater understanding of how certain skin conditions can lead to chronic itching or pruritus. This has resulted in more accurate diagnosis and treatment options being made available, leading to an increase in demand for drugs targeting specific types of pruritus caused by different skin disorders.

Based on drug type, the antihistamines segment dominated the U.S. pruritus treatment market in 2022. Antihistamines are effective against various types of allergy-causing itchiness, such as hives. These drugs work by blocking histamine receptors, thereby reducing inflammation associated with allergic reactions leading to relief from itching sensation. Moreover, antihistamines have fewer side effects compared to other drug classes used for treating itchiness, making it a preferred choice among patients. In May 2021, Pfizer, Inc. announced the launch of Xyzal Allergy 24HR, which is an antihistamine drug used for treating various types of allergies including pruritus caused by allergic reactions.

In terms of dosage form, the oral segment accounted for the largest market share in 2022. This is ascribed to ease of administration and better patient compliance compared with topical dosage forms. Oral medications are usually available in tablet or capsule form, making it easier for patients to take them as prescribed without having to worry about applying creams or ointments topically on affected areas. Furthermore, oral drugs have a longer duration of action compared to topical formulations, leading to sustained relief from itching sensation over a prolonged period. This has led to increase in demand for oral drugs targeting different types of pruritus caused by various underlying conditions.

The U.S. pruritus treatment market report includes vital information about the leading companies operating in the market. Leading players focus on strategies such as product launch, mergers & acquisitions (M&A), partnerships, and divestiture to increase market presence. AbbVie, Inc. (Allergan plc), Albireo Pharma, Inc., Astellas Pharma, Inc., Cipla Limited, Eli Lilly and Company, GSK plc, Merck & Co., Inc., Pfizer, Inc., Teva Pharmaceutical Industries Ltd., and Viatris, Inc. (Mylan N.V.) are the prominent players operating in the market.

Each of these players has been profiled in the report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2022 |

US$ 5.1 Bn |

|

Forecast (Value) in 2031 |

More than US$ 8.4 Bn |

|

Compound Annual Growth Rate (CAGR) |

5.6% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis and qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The industry was valued at US$ 5.1 Bn in 2022

It is projected to reach more than US$ 8.4 Bn by 2031

It is anticipated to grow at a CAGR of 5.6% from 2023 to 2031

Rise in prevalence of skin diseases and increase in geriatric population are driving the market in the country

The skin diseases segment accounted for the largest share of the industry in 2022

AbbVie, Inc. (Allergan plc), Albireo Pharma, Inc., Astellas Pharma, Inc., Cipla Limited, Eli Lilly and Company, GSK plc, Merck & Co., Inc., Pfizer, Inc., Teva Pharmaceutical Industries Ltd., and Viatris, Inc. (Mylan N.V.)

1. Preface

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: U.S. Pruritus Treatment Market

4. Market Overview

4.1. Overview

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. U.S. Pruritus Treatment Market Analysis and Forecast, 2017-2031

4.3.1. Market Revenue Projections (US$ Mn)

4.3.2. Market Volume Projections (Thousand Units)

5. Key Insights

5.1. Porter’s Five Forces Analysis

5.2. Disease Prevalence & Incidence Rate

5.3. Pricing Analysis

5.4. Overview and Application of OTC Products in Treatment of Pruritus

5.5. COVID-19 Impact Analysis

6. U.S. Pruritus Treatment Market Analysis and Forecast, by Pruritus Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Pruritus Type, 2017-2031

6.3.1. Systemic Diseases

6.3.1.1. Cancer

6.3.1.2. Liver Disease

6.3.1.3. Kidney Disease

6.3.1.4. Others

6.3.2. Skin Diseases

6.3.2.1. Eczema

6.3.2.2. Atopic Dermatitis

6.3.2.3. Others

6.3.3. Neurologic Diseases

6.3.3.1. Shingles

6.3.3.2. Multiple Sclerosis

6.3.3.3. Others

6.3.4. Nocturnal Pruritus

6.3.5. Pruritus Ani

6.3.6. Others

6.4. Market Attractiveness Analysis, by Pruritus Type

7. U.S. Pruritus Treatment Market Analysis and Forecast, by Drug Type

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value & Volume Forecast, by Drug Type, 2017-2031

7.3.1. Antihistamines

7.3.2. Calcineurin Inhibitors

7.3.3. Selective Serotonin Reuptake Inhibitors

7.3.4. Corticosteroids

7.3.5. Calamine

7.3.6. Neuroleptics

7.3.7. Others

7.4. Market Attractiveness Analysis, by Drug Type

8. U.S. Pruritus Treatment Market Analysis and Forecast, by Sales Type

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value & Volume Forecast, by Sales Type, 2017 - 2031

8.3.1. Rx Sales

8.3.2. OTC Sales

8.4. Market Attractiveness Analysis, by Sales Type

9. U.S. Pruritus Treatment Market Analysis and Forecast, by Dosage Form

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value & Volume Forecast, by Dosage Form, 2017-2031

9.3.1. Topical

9.3.2. Oral

9.4. Market Attractiveness Analysis, by Dosages Form

10. U.S. Pruritus Treatment Market Analysis and Forecast, by Distribution Channel

10.1. Introduction & Definition

10.2. Key Findings/Developments

10.3. Market Value Forecast, by Distribution Channel, 2017-2031

10.3.1. Hospital Pharmacies

10.3.2. Retail Pharmacies

10.3.3. Online Pharmacies

10.4. Market Attractiveness Analysis, by Distribution Channel

11. Competition Landscape

11.1. Market Player - Competition Matrix (by tier and size of companies)

11.2. Market Share Analysis, by Company, 2021

11.3. Company Profiles

11.3.1. AbbVie, Inc. (Allergan plc)

11.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.1.2. Test Type Portfolio

11.3.1.3. Financial Overview

11.3.1.4. SWOT Analysis

11.3.1.5. Strategic Overview

11.3.2. Albireo Pharma, Inc.

11.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.2.2. Test Type Portfolio

11.3.2.3. Financial Overview

11.3.2.4. SWOT Analysis

11.3.2.5. Strategic Overview

11.3.3. Astellas Pharma, Inc.

11.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.3.2. Test Type Portfolio

11.3.3.3. Financial Overview

11.3.3.4. SWOT Analysis

11.3.3.5. Strategic Overview

11.3.4. Cipla Limited

11.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.4.2. Test Type Portfolio

11.3.4.3. Financial Overview

11.3.4.4. SWOT Analysis

11.3.4.5. Strategic Overview

11.3.5. Eli Lilly and Company

11.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.5.2. Test Type Portfolio

11.3.5.3. Financial Overview

11.3.5.4. SWOT Analysis

11.3.5.5. Strategic Overview

11.3.6. GSK plc

11.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.6.2. Test Type Portfolio

11.3.6.3. Financial Overview

11.3.6.4. SWOT Analysis

11.3.6.5. Strategic Overview

11.3.7. Merck & Co., Inc.

11.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.7.2. Test Type Portfolio

11.3.7.3. Financial Overview

11.3.7.4. SWOT Analysis

11.3.7.5. Strategic Overview

11.3.8. Pfizer, Inc.

11.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.8.2. Test Type Portfolio

11.3.8.3. Financial Overview

11.3.8.4. SWOT Analysis

11.3.8.5. Strategic Overview

11.3.9. Teva Pharmaceutical Industries Ltd.

11.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.9.2. Test Type Portfolio

11.3.9.3. Financial Overview

11.3.9.4. SWOT Analysis

11.3.9.5. Strategic Overview

11.3.10. Viatris Inc. (Mylan N.V.)

11.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.10.2. Test Type Portfolio

11.3.10.3. Financial Overview

11.3.10.4. SWOT Analysis

11.3.10.5. Strategic Overview

List of Tables

Table 01: U.S. Pruritus Treatment Market Value (US$ Mn) Forecast, by Pruritus Type, 2017-2031

Table 02: U.S. Pruritus Treatment Market Value (US$ Mn) Forecast, by Systemic Diseases, 2017-2031

Table 03: U.S. Pruritus Treatment Market Value (US$ Mn) Forecast, by Skin Diseases, 2017-2031

Table 04: U.S. Pruritus Treatment Market Value (US$ Mn) Forecast, by Neurologic Diseases, 2017-2031

Table 05: U.S. Pruritus Treatment Market Value (US$ Mn) Forecast, by Drug Type, 2017-2031

Table 06: U.S. Pruritus Treatment Market Volume (Thousand Units) Forecast, by Drug Type, 2017-2031

Table 07: U.S. Pruritus Treatment Market Value (US$ Mn) Forecast, by Sales Type, 2017-2031

Table 08: U.S. Pruritus Treatment Market Volume (Thousand Units) Forecast, by Sales Type, 2017-2031

Table 09: U.S. Pruritus Treatment Market Value (US$ Mn) Forecast, by Dosage Form, 2017-2031

Table 10: U.S. Pruritus Treatment Market Volume (Thousand Units) Forecast, by Dosage Form, 2017-2031

Table 11: U.S. Pruritus Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

List of Figures

Figure 01: U.S. Pruritus Treatment Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: U.S. Pruritus Treatment Market Volume (Thousand Units) Forecast, 2017-2031

Figure 03: U.S. Pruritus Treatment Market Value Share, by Pruritus Type, 2022

Figure 04: U.S. Pruritus Treatment Market Value Share, by Drug Type, 2022

Figure 05: U.S. Pruritus Treatment Market Value Share, by Sales Type, 2022

Figure 06: U.S. Pruritus Treatment Market Value Share, by Dosage Form, 2022

Figure 07: U.S. Pruritus Treatment Market Value Share, by Distribution Channel, 2022

Figure 08: U.S. Pruritus Treatment Market Value Share Analysis, by Pruritus Type, 2022 and 2031

Figure 09: U.S. Pruritus Treatment Market Attractiveness Analysis, by Pruritus Type, 2023-2031

Figure 10: U.S. Pruritus Treatment Market (US$ Mn), by Systemic Diseases, 2017-2031

Figure 11: U.S. Pruritus Treatment Market (US$ Mn), by Skin Diseases, 2017-2031

Figure 12: U.S. Pruritus Treatment Market (US$ Mn), by Neurologic Diseases, 2017-2031

Figure 13: U.S. Pruritus Treatment Market (US$ Mn), by Nocturnal Pruritus, 2017-2031

Figure 14: U.S. Pruritus Treatment Market (US$ Mn), by Pruritus Ani, 2017-2031

Figure 15: U.S. Pruritus Treatment Market (US$ Mn), by Nocturnal Pruritus, 2017-2031

Figure 16: U.S. Pruritus Treatment Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 17: U.S. Pruritus Treatment Market Attractiveness Analysis, by Drug Type, 2023-2031

Figure 18: U.S. Pruritus Treatment Market (US$ Mn), by Antihistamines, 2017-2031

Figure 19: U.S. Pruritus Treatment Market (US$ Mn), by Calcineurin Inhibitors, 2017-2031

Figure 20: U.S. Pruritus Treatment Market (US$ Mn), by Selective Serotonin Reuptake Inhibitors, 2017-2031

Figure 21: U.S. Pruritus Treatment Market (US$ Mn), by Corticosteroids, 2017-2031

Figure 22: U.S. Pruritus Treatment Market (US$ Mn), by Calamine, 2017-2031

Figure 23: U.S. Pruritus Treatment Market (US$ Mn), by Corticosteroids, 2017-2031

Figure 24: U.S. Pruritus Treatment Market (US$ Mn), by Others, 2017-2031

Figure 25: U.S. Pruritus Treatment Market Value Share Analysis, by Sales Type, 2022 and 2031

Figure 26: U.S. Pruritus Treatment Market Attractiveness Analysis, by Sales Type, 2023-2031

Figure 27: U.S. Pruritus Treatment Market (US$ Mn), by Rx Sales, 2017-2031

Figure 28: U.S. Pruritus Treatment Market (US$ Mn), by OTC Sales, 2017-2031

Figure 29: U.S. Pruritus Treatment Market Value Share Analysis, by Dosage Form, 2022 and 2031

Figure 30: U.S. Pruritus Treatment Market Attractiveness Analysis, by Dosage Form, 2023-2031

Figure 31: U.S. Pruritus Treatment Market (US$ Mn), by Topical, 2017-2031

Figure 32: U.S. Pruritus Treatment Market (US$ Mn), by Oral, 2017-2031

Figure 33: U.S. Pruritus Treatment Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 34: U.S. Pruritus Treatment Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 35: U.S. Pruritus Treatment Market (US$ Mn), by Hospital Pharmacies, 2017-2031

Figure 36: U.S. Pruritus Treatment Market (US$ Mn), by Retail Pharmacies, 2017-2031

Figure 37: U.S. Pruritus Treatment Market (US$ Mn), by Online Pharmacies, 2017-2031

Figure 38: U.S. Pruritus Treatment Market Share Analysis, by Company, 2022