The U.S. nutraceuticals market is estimated to observe steady growth during the forecast period of 2017-2025. The growing awareness about the importance of nutraceuticals among numerous individuals in the U.S. is expected to churn considerable growth. Furthermore, the advent of the COVID-19 pandemic has encouraged the consumption of nutraceuticals for maintaining fitness levels. These factors have invited extensive growth prospects for the U.S. nutraceuticals market.

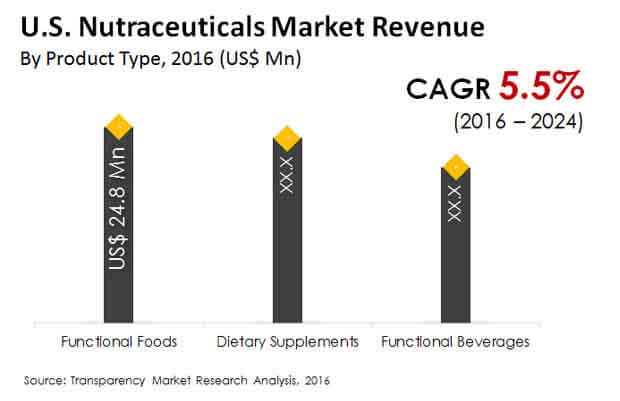

The expanding demand for functional foods and dietary supplements is increasing the growth opportunities across the U.S. nutraceuticals market substantially. In addition, the scope of nutraceuticals in treating cardiovascular diseases is expanding at a rapid rate. These factors have a positive impact on the growth of the nutraceuticals market. Taking all these factors into consideration, the U.S. nutraceuticals market. is estimated to expand at a CAGR of 5.30% during by the end of the forecast period. In 2015, the value of the U.S. U.S. nutraceuticals market stood at US$ 64.8 Bn. The U.S. nutraceuticals market is anticipated to reach a value of US$ 102.6 bn by 2024. With strong investments and increased funding from government and non-government organizations, the U.S. nutraceuticals market is projected to emerge as one of the profitable industries in the coming period.

Nutraceuticals can be consumed in the form of liquid, pills, and powder. Among all the categories, liquid nutraceuticals are gaining extensive popularity among the U.S. population. The liquid nutraceuticals segment was responsible for 34.8% of the market share in 2016 and is estimated to grow at a similar pace between 2017 and 2025. The benefits of liquid nutraceutical consumption are projected to increase the growth prospects.

This nutraceutical type is better as it is easier to consume as compared to pills and powder. Furthermore, consumption of nutraceuticals in the form of pills can block the airways and may choke those in the worst case. These aspects encourage many individuals to opt for liquid nutraceuticals. Many studies have suggested that liquid multivitamin doses have a higher peak concentration than pills. High concentration equals to increased bioavailability. Thus, opting liquid nutraceuticals amounts to optimized effects. These aspects help expand the growth trajectory of the U.S. nutraceuticals market.

As per the Centers for Disease Control and Prevention (CDC), the obesity rate in the U.S. rose from 30.5% in 1999-2000 to 42.4% in 2017-18. These statistics highlight the rising prevalence of obesity among the U.S. population. Many government and non-government organizations are generating awareness about the ill-effects of obesity among the individuals in the U.S. This factor is encouraging many people to use nutraceuticals for weight loss. Many players in the U.S. nutraceuticals market are focusing on developing diet pills that trigger the weight loss process. These factors may propel the growth prospects of the U.S. nutraceuticals market to a great extent.

The COVID-19 outbreak has disturbed the social and economic wellbeing at a global level since its advent in 2020. The U.S. was one of the first countries to be affected by the outbreak. Soon, the U.S. government sprung into action and implemented stay-at-home orders which put restrictions on operation of various establishments, factories, production units, etc. The borders were also closed for travel purposes. The food supply chains were also affected due to the imposition of restrictions. However, some rules were relaxed later seeing the bad impact on the economy. This factor helped the players in the U.S. nutraceuticals market to tap into new revenue streams.

The U.S. U.S. nutraceuticals market is expected to garner considerable growth on the back of the rising awareness among many individuals regarding the importance of high immunity levels and maintenance of fitness levels. The novel coronavirus can prove to be fatal for those with low immunity levels. Obesity also leads to cardiovascular disorders, which is again hazardous. Many studies and findings have shown that COVID-19 can do more damage to people diagnosed with cardiovascular disorders or having low immunity levels.

To stay protected from COVID-19 and for preventing more harm from the deadly virus, many individuals in the U.S. are consuming nutraceuticals to get their daily dose of vitamins and minerals essential for maintaining fitness levels and increasing immunity levels. Many healthcare professionals are recommending consumption of certain nutraceuticals to reduce the damage done by COVID-19 when a person is infected. The transition of nutraceuticals from ‘curative’ to ‘preventive’ will serve as a prominent growth factor. These aspects will present a plethora of opportunities for the growth of the U.S. nutraceuticals market

The U.S. nutraceuticals market is highly competitive. Many players apply different strategies and techniques to increase their revenues. The players are involved in R&D activities for adding new products or updating the existing ones. These activities ultimately contribute to the growth of the U.S. nutraceuticals market in the U.S.

Well-established players lookout for small or medium companies for strategic collaborations. Many players indulge in mergers, acquisitions, joint ventures, and partnerships for expanding their influence across untapped states in the U.S. Furthermore, innovative advertising strategies also play a vital role in increasing the revenues of the players in the U.S. nutraceuticals market.

Some key players into the U.S. U.S. nutraceuticals market are Herbalife International Inc., General Mills Inc., Abbott Laboratories, Groupe Danone, Royal DSM NV, Bayer AG, Chobani LLC, and The Nature’s Bounty Co.

In 2015, U.S. Nutraceuticals Market was valued at US$ 64.8 Bn

U.S. Nutraceuticals Market is expected to reach US$ 102.6 bn by 2024

U.S. Nutraceuticals Market is estimated to rise at a CAGR of 5.5% during forecast period

Expanding demand for functional foods and dietary supplements is expected to drive the U.S. Nutraceuticals Market

Key players of U.S. Nutraceuticals Market are Herbalife International Inc., General Mills Inc., Abbott Laboratories, Groupe Danone, Royal DSM NV, Bayer AG, Chobani LLC, and The Nature’s Bounty Co and others

1. Executive Summary

2. Market Introduction

2.1. Market Definition

2.2. Market Taxonomy

3. Market Dynamics

3.1. Drivers

3.2. Restraints

3.3. Opportunity

3.4. List of Key Participants

4. U.S. Nutraceuticals Market Analysis and Forecast, by Product Type

4.1. Introduction

4.1.1. Basis Point Share (BPS) Analysis by Product Type

4.1.2. Y-o-Y Growth Projections by Product Type

4.2. Market Size Analysis and Forecast by Product Type

4.2.1. Functional Foods

4.2.1.1. Probiotics Fortified Food

4.2.1.2. Omega Fatty Acid Fortified Food

4.2.1.3. Branded Ionized Salt

4.2.1.4. Branded Wheat Flour Market

4.2.1.5. Others

4.2.2. Functional Beverages

4.2.2.1. Energy Drinks

4.2.2.2. Sports Drinks

4.2.2.3. Fortified Juices

4.2.2.4. Fortified Dairy Beverages

4.2.2.5. Others

4.2.3 Dietary Supplements

4.2.3.1. Proteins Supplements

4.2.3.2. Vitamins & Minerals

4.2.3.3. Herbal Supplements (Ayurvedic extracts, plant extracts, algal extracts, phytochemicals)

4.2.3.4. Other (fatty acids, fiber)

4.3. Market Attractiveness Analysis by Product Type

5. U.S. Nutraceuticals Market Analysis and Forecast, By Product Form

5.1 Introduction

5.1.1. Basis Point Share (BPS) Analysis by Product Form

5.1.2. Y-o-Y Growth Projections by Product Form

5.2. Market Size Analysis and Forecast by Product Form

5.2.1. Tablets and Capsules

5.2.2. Powder

5.2.3 Liquid

5.2.4 Solids/Semi-solids

5.3. Market Attractiveness Analysis, By Product Form

6. Competitive Landscape

6.1. Competition Dashboard

6.2. Market Share Analysis

6.3. Company Profiles

6.4. Key Players

6.4.1. General Mills Inc.

Overview

Strategic Overview

Product Offerings

Recent Developments

6.4.2. The Natures Bounty Co. (NBTY)

Overview

Strategic Overview

Product Offerings

Recent Developments

6.4.3. Amway Enterprises

Overview

Strategic Overview

Product Offerings

Recent Developments

6.4.4. Herbalife International, Inc.

Overview

Strategic Overview

Product Offerings

Recent Developments

6.4.5. Royal DSM NV

Overview

Strategic Overview

Product Offerings

Recent Developments

6.4.6. Pepsi Co.

Overview

Strategic Overview

Product Offerings

Recent Developments

6.4.7. Groupe Danone

Overview

Strategic Overview

Product Offerings

Recent Developments

6.4.8. Bayer AG

Overview

Strategic Overview

Product Offerings

Recent Developments

6.4.9. Abbott Laboratories

Overview

Strategic Overview

Product Offerings

Recent Developments

6.4.10. Chobani LLC

Overview

Strategic Overview

Product Offerings

Recent Developments

7. Assumptions & Acronyms Used

8. Research Methodology

List of Tables

Table 1: U.S. Nutraceuticals Market Value (US$ Bn) Forecast, By Product Type, 2016–2024

Table 2: U.S. Nutraceuticals Market Value (US$ Bn) Forecast, By Functional Foods, 2016–2024

Table 3: U.S. Nutraceuticals Market Value (US$ Bn) Forecast, By Functional Beverages, 2016–2024

Table 4: U.S. Nutraceuticals Market Value (US$ Bn) Forecast, By Dietary Supplements, 2016–2024

Table 5: U.S. Nutraceuticals Market Value (US$ Bn) Forecast, By Product Form, 2016–2024

List of Figures

Figure 1: U.S. Nutraceuticals Market Value (US$ Bn) Forecast, 2015–2024

Figure 2: U.S. Nutraceuticals Market Absolute $ Opportunity (US$ Bn), 2015—2024

Figure 3: U.S. Nutraceuticals Market Y-o-Y Growth (%), By Functional Foods, 2016–2024

Figure 4: U.S. Nutraceuticals Market Value (US$ Bn) Share and BPS Analysis, By Functional Foods, 2016 & 2024

Figure 5: U.S. Nutraceuticals Market Absolute $ Opportunity (US$ Bn), by Probiotics Fortified Foods Segment, 2015?2024

Figure 6: U.S. Nutraceuticals Market Absolute $ Opportunity (US$ Bn), by Omega Fatty Acid Fortified Foods Segment, 2015?2024

Figure 7: U.S. Nutraceuticals Market Absolute $ Opportunity (US$ Bn), Iodized salt Segment, 2015?2024

Figure 8: U.S. Nutraceuticals Market Absolute $ Opportunity (US$ Bn), by Branded Wheat Flour Segment, 2015?2024

Figure 9: U.S. Nutraceuticals Market Absolute $ Opportunity (US$ Bn), by Others Segment, 2015?2024

Figure 10: U.S. Nutraceuticals Market Y-o-Y Growth (%), By Functional Beverages, 2016–2024

Figure 11: U.S. Nutraceuticals Market Value (US$ Bn) Share and BPS Analysis, By Functional Beverages, 2016 & 2024

Figure 12: U.S. Nutraceuticals Market Absolute $ Opportunity (US$ Bn), by Energy Drinks Segment, 2015?2024

Figure 13: U.S. Nutraceuticals Market Absolute $ Opportunity (US$ Bn), by Sport Drinks Segment, 2015?2024

Figure 14: U.S. Nutraceuticals Market Absolute $ Opportunity (US$ Bn), by Fortified Juices Segment, 2015?2024

Figure 15: U.S. Nutraceuticals Market Absolute $ Opportunity (US$ Bn), by Fortified Dairy Beverages Segment, 2015?2024

Figure 16: U.S. Nutraceuticals Market Absolute $ Opportunity (US$ Bn), by Others Segment, 2015?2024

Figure 17: U.S. Nutraceuticals Market Y-o-Y Growth (%), By Dietary Supplements, 2016–2024

Figure 18: U.S. Nutraceuticals Market Value (US$ Bn) Share and BPS Analysis, By Dietary Supplements, 2016 & 2024

Figure 19: U.S. Nutraceuticals Market Absolute $ Opportunity (US$ Bn), by Protein Supplements Segment, 2015?2024

Figure 20: U.S. Nutraceuticals Market Absolute $ Opportunity (US$ Bn), by Vitamins and Minerals Segment, 2015?2024

Figure 21: U.S. Nutraceuticals Market Absolute $ Opportunity (US$ Bn), by Herbal Supplements Segment, 2015?2024

Figure 22: U.S. Nutraceuticals Market Absolute $ Opportunity (US$ Bn), by Others Segment, 2015?2024

Figure 23: U.S. Nutraceuticals Market Y-o-Y Growth (%), By Product Form, 2016–2024

Figure 24: U.S. Nutraceuticals Market Value (US$ Bn) Share and BPS Analysis, By Product Form, 2016 & 2024

Figure 25: U.S. Nutraceuticals Market Absolute $ Opportunity (US$ Bn), by Tablets and Capsules Segment, 2015?2024

Figure 26: U.S. Nutraceuticals Market Absolute $ Opportunity (US$ Bn), by Powder Segment, 2015?2024

Figure 27: U.S. Nutraceuticals Market Absolute $ Opportunity (US$ Bn), by Liquid Segment, 2015?2024

Figure 28: U.S. Nutraceuticals Market Absolute $ Opportunity (US$ Bn), by Solids/Semi-solids Segment, 2015?2024

Figure 29: U.S. Nutraceuticals Market Attractiveness Analysis, by Product Type, 2016–2024

Figure 30: U.S. Nutraceuticals Market Attractiveness Analysis, by Product Form, 2016–2024