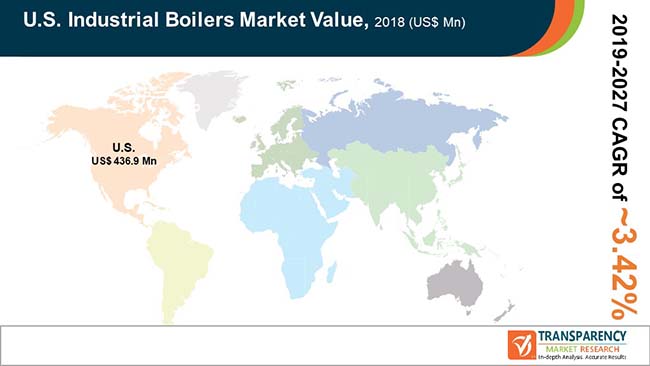

The increasing pressure on the chemical, metal, food, and several other manufacturing companies to reduce their carbon footprint is creating a lucrative growth opportunity for the industrial boilers market in the U.S. The recently stated guidelines by the Environmental Protection Agency (EPA) pertaining to air pollution levels from institutional, commercial, and industrial boilers is expected to lead to an investment in energy-efficient boilers. This supportive groundwork is also expected to push the opportunity of the industrial boilers market.

In terms of regions, the East North Central region witnessed a surge in the number of industrial boiler installations in 2018. In the same year, the region accounted for about 30% of the total market. In the coming few years, this regional market is expected to experience tremendous rise in manufacturing activities and industrial growth. Citing these reasons, the East North Central region will see the highest demand of industrial boilers in the forecast period. The strong presence of metal, chemical, and food companies in Michigan and Illinois will also present ample of growth opportunities to the industrial boilers market in the U.S.

The next big geographical segment in the U.S. industrial boilers market is the West South Central. As of 2018, this region held around 18% share in the total market. Researchers predict that the rise of this regional segment will be due to the growth of fabricated metal and petroleum industries in Oklahoma. Studies also point out that the maximum installed industrial boilers are of 300 BHP capacity due to the presence of primary metals, food processing, and petroleum industries.

The South Atlantic region of the U.S. industrial boiler market was registered as the third largest key contributor to the revenues of the overall market. As of 2018, this region held a share of around 15% in the overall market. The burgeoning chemical and paper industries of South Atlantic are expected to drive this market in the coming years.

The industrial boilers market in the U.S. will also be driven by the rising fuel costs that account for about 85% of the total cost of operations of boilers. In wake of exorbitantly rising fuel costs, the preference of end-user industries is likely to shift towards energy and fuel-efficient boilers. The modern boilers are known to bring down emissions of harmful gases such as CO, CO2, VOC, and NOX. The economic recovery of the U.S. and the rising capital investments are also expected to propel this market.

Some of the leading players operating in the U.S. industrial boilers market are

The competitive landscape in the U.S. industrial boilers market is fragmented with players trying to secure a larger consumer base through strategic alliances. However, companies are increasingly working on technological innovation and establishing product differentiation to create a niche.

1. Executive Summary: US Industrial Boilers Market

2. Market Overview

2.1. Market Segmentation

2.2. Market Definitions

2.3. Market Trends

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.6. Value Chain Analysis

2.7. Regulatory Landscape

3. US Industrial Boilers Market Analysis and Forecast, by Capacity

3.1. Key Findings

3.2. Market Definitions

3.3. US Industrial Boilers Market Value (US$ Mn), by Capacity, 2018–2027

3.3.1. Up to 300 BHP

3.3.1.1. 10-150 BHP

3.3.1.2. 151-300 BHP

3.3.2. 300–600 BHP

3.4. US Industrial Boilers Market Attractiveness Analysis, by Capacity

4. US Industrial Boilers Market Analysis and Forecast, by Region

4.1. Key Findings

4.2. US Industrial Boilers Market Value (US$ Mn), by Region, 2018–2027

4.2.1. South Atlantic

4.2.1.1. Up to 300 BHP

4.2.1.1.1. 10-150 BHP

4.2.1.1.2. 151-300 BHP

4.2.1.2. 300–600 BHP

4.2.2. West North Central

4.2.2.1. Up to 300 BHP

4.2.2.1.1. 10-150 BHP

4.2.2.1.2. 151-300 BHP

4.2.2.2. 300–600 BHP

4.2.3. West South Central

4.2.3.1. Up to 300 BHP

4.2.3.1.1. 10-150 BHP

4.2.3.1.2. 151-300 BHP

4.2.3.2. 300–600 BHP

4.2.4. Pacific States

4.2.4.1. Up to 300 BHP

4.2.4.1.1. 10-150 BHP

4.2.4.1.2. 151-300 BHP

4.2.4.2. 300–600 BHP

4.2.5. Mountain States

4.2.5.1. Up to 300 BHP

4.2.5.1.1. 10-150 BHP

4.2.5.1.2. 151-300 BHP

4.2.5.2. 300–600 BHP

4.2.6. North East

4.2.6.1. Up to 300 BHP

4.2.6.1.1. 10-150 BHP

4.2.6.1.2. 151-300 BHP

4.2.6.2. 300–600 BHP

4.2.7. East North Central

4.2.7.1. Up to 300 BHP

4.2.7.1.1. 10-150 BHP

4.2.7.1.2. 151-300 BHP

4.2.7.2. 300–600 BHP

4.2.8. East South Central

4.2.8.1. Up to 300 BHP

4.2.8.1.1. 10-150 BHP

4.2.8.1.2. 151-300 BHP

4.2.8.2. 300–600 BHP

4.3. US Industrial Boilers Market Attractiveness Analysis, by Region

5. Competition Landscape

5.1. Competition Matrix, by Key Players

5.2. US Industrial Boilers Market Share Analysis, by Company, 2018

5.3. Product Mapping

5.4. Company Profiles

5.4.1. Johnston Boiler Company

5.4.1.1. Company overview

5.4.1.2. Product portfolio

5.4.1.3. Financial overview

5.4.1.4. Business strategy

5.4.1.5. Recent developments

5.4.2. Fulton Boiler Works, Inc.

5.4.2.1. Company overview

5.4.2.2. Product portfolio

5.4.2.3. Financial overview

5.4.2.4. Business strategy

5.4.2.5. Recent developments

5.4.3. Columbia Boiler Company

5.4.3.1. Company overview

5.4.3.2. Product portfolio

5.4.3.3. Financial overview

5.4.3.4. Business strategy

5.4.3.5. Recent developments

5.4.4. Clayton Industries Inc.

5.4.4.1. Company overview

5.4.4.2. Product portfolio

5.4.4.3. Financial overview

5.4.4.4. Business strategy

5.4.4.5. Recent developments

5.4.5. Hurst Boiler & Welding Company, Inc.

5.4.5.1. Company overview

5.4.5.2. Product portfolio

5.4.5.3. Financial overview

5.4.5.4. Business strategy

5.4.5.5. Recent developments

5.4.6. M. Lattner Manufacturing Company

5.4.6.1. Company overview

5.4.6.2. Product portfolio

5.4.6.3. Financial overview

5.4.6.4. Business strategy

5.4.6.5. Recent developments

5.4.7. Le Groupe Simoneau Inc.

5.4.7.1. Company overview

5.4.7.2. Product portfolio

5.4.7.3. Financial overview

5.4.7.4. Business strategy

5.4.7.5. Recent developments

5.4.8. Williams & Davis Boilers, Inc.

5.4.8.1. Company overview

5.4.8.2. Product portfolio

5.4.8.3. Financial overview

5.4.8.4. Business strategy

5.4.8.5. Recent developments

5.4.9. Calderas Powermaster

5.4.9.1. Company overview

5.4.9.2. Product portfolio

5.4.9.3. Financial overview

5.4.9.4. Business strategy

5.4.9.5. Recent developments

5.4.10. PARKER BOILER COMPANY

5.4.10.1. Company overview

5.4.10.2. Product portfolio

5.4.10.3. Financial overview

5.4.10.4. Business strategy

5.4.10.5. Recent developments

5.4.11. Sioux Corporation

5.4.11.1. Company overview

5.4.11.2. Product portfolio

5.4.11.3. Financial overview

5.4.11.4. Business strategy

5.4.11.5. Recent developments

5.4.12. Acme Engineering Prod. Ltd.

5.4.12.1. Company overview

5.4.12.2. Product portfolio

5.4.12.3. Financial overview

5.4.12.4. Business strategy

5.4.12.5. Recent developments

5.4.13. Easco Boiler Corp.

5.4.13.1. Company overview

5.4.13.2. Product portfolio

5.4.13.3. Financial overview

5.4.13.4. Business strategy

5.4.13.5. Recent developments

5.4.14. Cleaver-Brooks, Inc.

5.4.14.1. Company overview

5.4.14.2. Product portfolio

5.4.14.3. Financial overview

5.4.14.4. Business strategy

5.4.14.5. Recent developments

5.4.15. Superior Boiler Works, Inc.

5.4.15.1. Company overview

5.4.15.2. Product portfolio

5.4.15.3. Financial overview

5.4.15.4. Business strategy

5.4.15.5. Recent developments

5.4.16. Unilux Advanced Manufacturing LLC

5.4.16.1. Company overview

5.4.16.2. Product portfolio

5.4.16.3. Financial overview

5.4.16.4. Business strategy

5.4.16.5. Recent developments

5.4.17. Bryan Steam LLC

5.4.17.1. Company overview

5.4.17.2. Product portfolio

5.4.17.3. Financial overview

5.4.17.4. Business strategy

5.4.17.5. Recent developments

5.4.18. York-Shipley U.S

5.4.18.1. Company overview

5.4.18.2. Product portfolio

5.4.18.3. Financial overview

5.4.18.4. Business strategy

5.4.18.5. Recent developments

5.4.19. Vapor Power International, LLC

5.4.19.1. Company overview

5.4.19.2. Product portfolio

5.4.19.3. Financial overview

5.4.19.4. Business strategy

5.4.19.5. Recent developments

6. Primary Research - Key Insights

7. Appendix

7.1. Research Methodology and Assumptions

List of Tables

Table 1 Industrial Boiler Market, by East South Central, 2018-2027 (Revenue US$ Mn)

Table 2 Industrial Boiler Market (300 BHP), by East South Central, 2018-2027 (Revenue US$ Mn)

Table 3 Industrial Boiler Market, by Pacific States, 2018-2027 (Revenue US$ Mn)

Table 4 Industrial Boiler Market (300 BHP), by Pacific States, 2018-2027 (Revenue US$ Mn)

Table 5 Industrial Boiler Market, by South Atlantic, 2018-2027 (Revenue US$ Mn)

Table 6 Industrial Boiler Market (300 BHP), by South Atlantic, 2018-2027 (Revenue US$ Mn)

Table 7 Industrial Boiler Market, by East North Central, 2018-2027 (Revenue US$ Mn)

Table 8 Industrial Boiler Market (300 BHP), by East North Central, 2018-2027 (Revenue US$ Mn)

Table 9 Industrial Boiler Market, by Mountain States, 2018-2027 (Revenue US$ Mn)

Table 10 Industrial Boiler Market (300BHP), by Mountain States, 2018-2027 (Revenue US$ Mn)

Table 11 Industrial Boiler Market, by North East, 2018-2027 (Revenue US$ Mn)

Table 12 Industrial Boiler Market (300BHP), by North East, 2018-2027 (Revenue US$ Mn)

Table 13 Industrial Boiler Market, by West South Central, 2018-2027 (Revenue US$ Mn)

Table 14 Industrial Boiler Market (300 BHP), by West South Central, 2018-2027 (Revenue US$ Mn)

Table 15 Industrial Boiler Market, by West North Central, 2018-2027 (Revenue US$ Mn)

Table 16 Industrial Boiler Market (300 BHP), by West North Central, 2018-2027 (Revenue US$ Mn)

List of Figures

Figure 1 Company Market Share, Industrial Boilers Market (%)

Figure 2 Market Attractiveness, By Region (2018)

Figure 3 East South Central by State, by Revenue (US$ Mn), 2018

Figure 4 East South Central, by State, by Revenue (US$ Mn), 2027

Figure 5 East South Central, by Capacity, by Revenue (US$ Mn), 2018

Figure 6 East South Central, by Capacity, by Revenue (US$ Mn), 2027

Figure 7 Pacific States, by State, by Revenue (US$ Mn), 2018

Figure 8 Pacific States, by State, by Revenue (US$ Mn), 2027

Figure 9 Pacific States, by Capacity, by Revenue (US$ Mn), 2018

Figure 10 Pacific States, by Capacity, by Revenue (US$ Mn), 2027

Figure 11 East North Central, by State, by Revenue (US$ Mn), 2018

Figure 12 East North Central, by State, by Revenue (US$ Mn), 2027

Figure 13 East North Central, by Capacity, by Revenue (US$ Mn), 2018

Figure 14 East North Central, by Capacity, by Revenue (US$ Mn), 2027

Figure 15 Mountain States, by State, by Revenue (US$ Mn), 2018

Figure 16 Mountain States, by State, by Revenue (US$ Mn), 2027

Figure 17 Mountain States, by Capacity, by Revenue (US$ Mn), 2018

Figure 18 Mountain States, by Capacity, by Revenue (US$ Mn), 2027

Figure 19 South Atlantic, by State, by Revenue (US$ Mn), 2018

Figure 20 South Atlantic, by State, by Revenue (US$ Mn), 2027

Figure 21 South Atlantic, by Capacity, by Revenue (US$ Mn), 2018

Figure 22 South Atlantic, by Capacity, by Revenue (US$ Mn), 2027

Figure 23 North East Region, by State, by Revenue (US$ Mn), 2018

Figure 24 North East Region, by State, by Revenue (US$ Mn), 2027

Figure 25 North East Region, by Capacity, by Revenue (US$ Mn), 2018

Figure 26 North East Region, by Capacity, by Revenue (US$ Mn), 2027

Figure 27 West South Central, by State, by Revenue (US$ Mn), 2018

Figure 28 West South Central, by State, by Revenue (US$ Mn), 2027

Figure 29 West South Central, by Capacity, by Revenue (US$ Mn), 2018

Figure 30 West South Central, by Capacity, by Revenue (US$ Mn), 2027

Figure 31 West North Central, by State, by Revenue (US$ Mn), 2018

Figure 32 West North Central, by State, by Revenue (US$ Mn), 2027

Figure 33 West North Central, by Capacity, by Revenue (US$ Mn), 2018

Figure 34 West North Central, by Capacity, by Revenue (US$ Mn), 2027