Analyst Viewpoint

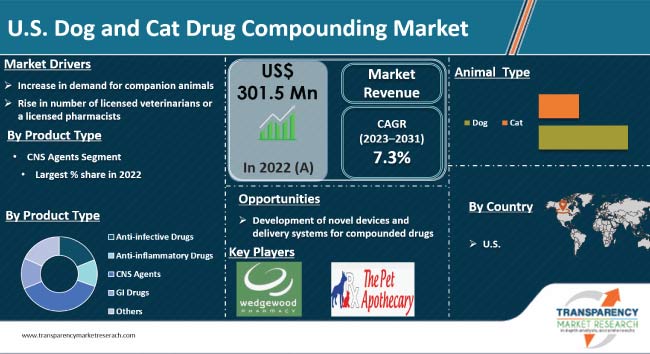

Increase in awareness among large number of people about the importance of improving the health of animals, such as cat and dog, is driving U.S. market. Dog and cat medicine compounding is essential for bridging the gap between the limited supply of licensed drugs for dog and cat medication and alternative veterinary treatment options. Rise in demand for companion animals is another major factor driving market expansion. Furthermore, increase in owner approval of the practice in the past few years is expected to bolster the global U.S. dog and cat drug compounding market size during the forecast period.

Advancements in the manufacturing and pharmaceutical industries offers lucrative opportunities to market players. Companies are focusing on improving dog &cat welfare initiatives, increasing availability & use of health insurance, and better understanding of the therapeutic indications for various drugs.

Compounding drugs is the process of combining, mixing, or modifying ingredients to create a medication tailored to the needs of a single animal or a small group of animals. These drugs can be extremely useful in veterinary medicine.

Typically, compounded dog and cat drugs are prepared by pharmacists or veterinarians. Compounding drugs is permitted under the Federal Food, Drug, and Cosmetic Act (FD&C Act) when the active ingredient is derived from a finished FDA-approved drug rather than a bulk drug substance.

Animal (dog and cat) drug compounding companies are increasing their efforts to keep a full line of chemicals and supplies to support veterinary compounding. Letco Medical, a pharmaceutical ingredient supplier, is gaining recognition for maintaining a formula database that assists in finding the right mixture for any animal.

Dog and cat drug compounding companies collaborate with ingredient suppliers for APIs, bases, flavors, and formulas for veterinary compounding. These players are focusing on quality assurance and adherence to stringent standards in order to increase market credibility. Companies are expanding their compounding capabilities for horses, birds, and other exotic animals that swim and fly, in addition to dogs and cats. These factors are likely to fuel U.S. dog and cat drug compounding market growth in the near future.

The number of companion animals has increased across the U.S. According to the American Veterinary Medical Association (2017-2018 - U.S. Pet Ownership & Demographics Sourcebook), the percentage of households owning dogs and cats are 38.4% and 25.4%, respectively.

People in the U.S. spent over US$ 75.5 Bn on their pets in 2016, with an average total household spend of US$ 892 on pet food, veterinary services, supplies, and other services. The median lifetime expenditures for medicines are US$ 5,154 for a dog and US$ 5,325 for a cat. According to the North American Pet Health Insurance Association, NAPHIA, more number of dogs are insured compared to cats in the U.S.

According to the American Pet Products Association’s 2023-2024 National Pet Owners Survey, almost 65.1 million U.S. households have at least one dog and 46.5 million U.S. families own a cat. In 2022, dogs were found to be owned by 44.5% of households in the U.S., while cats were owned by 29% of households.

The number of pet dogs was estimated to be around 70 million in the 2021-2022 study, which showed a slight decrease in 2023. According to the American Society for the Prevention of Cruelty to Animals, approximately 1 in 5 U.S. households acquired a dog or cat from March 2020 to May 2021.

Animals cannot be always treated with the same medicines that are used for humans. This is where compounded drugs are used for specific animals, as these drugs can be tailored according to every individual animal needs. Compounding medications with flavors and colors makes them more palatable, a service which is especially useful for pets. Thus, increase in demand for companion animals is projected to propel the U.S. dog and cat drug compounding market growth in the next few years.

In terms of product, the CNS agents segment accounted for the largest U.S. dog and cat drug compounding market share in 2022. Attention deficit hyperactivity disorder-like (ADHD-like) behaviors or attention deficit disorder is quite common in dogs.

According to a study (study name: Demographics and comorbidity of behavior problems in dogs) published in Journal of Veterinary Behavior (2019), around 12% to 15% dogs exhibit hyperactivity and impulsivity and 20% exhibit inattention in the U.S. This is driving the CNS agents.

However, as per U.S. dog and cat drug compounding market forecast, the anti-infectives segment is expected to grow at a rapid pace during the forecast period. Thus, compounding oral antibiotics, such as erythromycin, for skin infections, including staph bacterial skin infection, is driving the segment.

Based on dosage form, the solution segment dominated the U.S. dog and cat drug compounding market statistics in 2022. Solutions are liquid formulations that can be easily administered to animals through various routes such as oral. This is a key factor driving the segment.

Compared to tablets or powders, which may require additional steps, such as crushing or mixing, solutions can be directly administered without the need for further preparation, making the process simpler and more convenient for both the animals (dog & cat) and the caregiver.

In terms of administration, the oral segment led the U.S. dog and cat drug compounding market demand in 2022. The oral route of administration is frequently used for companion animals. Compared to other routes of administration such as injections, which may require more skill and care, oral administration is generally easier and less stressful for both the animal and the caregiver. Thus, high preference for oral route of administration is fueling the segment.

The U.S. dog and cat drug compounding market is consolidated, with the presence of leading players. Expansion of product portfolio and mergers & acquisitions are the key strategies adopted by the leading players in the market.

Animal Pharm, LLC, BEST PET RX, Central Compounding Center South, Custom Med Compounding Pharmacy, Davis Islands Pharmacy, Millers Pharmacy, Mixlab, Inc., PetMed Express, Inc., PetScripts Pharmacy, Precision Compounding Pharmacy, The Compounding Pharmacy of America, The Pet Apothecary, Triangle Compounding Pharmacy, and Wedgewood Pharmacy are the prominent players in the market.

Each of these players has been profiled in the U.S. dog and cat drug compounding market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 301.5 Mn |

| Forecast (Value) in 2031 | More than US$ 573.0 Mn |

| Growth Rate (CAGR) | 7.3% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Mn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 301.5 Mn in 2022

It is projected to reach more than US$ 573.0 Mn by 2031

It is anticipated to grow at a CAGR of 7.3% from 2023 to 2031

Significant investments for effective & efficient treatment through drug compounding

Animal Pharm, LLC, BEST PET RX, Central Compounding Center South, Custom Med Compounding Pharmacy, Davis Islands Pharmacy, Millers Pharmacy, Mixlab, Inc., PetMed Express, Inc., PetScripts Pharmacy, Precision Compounding Pharmacy, The Compounding Pharmacy of America, The Pet Apothecary, Triangle Compounding Pharmacy and Wedgewood Pharmacy.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: U.S. Dog and Cat Drug Compounding Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

5. Key Insights

5.1. Overview: Global Animal Drug Compounding Market

5.2. U.S. Animal Compounding Market Value (US$), 2026, 2027 and 2031

5.3. U.S. Animal Drug Compounding Prescription Volume, 2026, 2027 and 2031

5.4. U.S. Dogs and Cats Drug Compounding Prescription Volume, 2026, 2027 and 2031

5.5. Prescription Volume Share Compounded in Veterinarian Office Vs. Third Party Pharmacy

5.6. U.S. Dogs and Cats Prescription Compounding Market Value (US$), 2026, 2027 and 2031

5.7. % Distribution of Compounded Prescriptions (for Dogs and Cats) by Dosage Form (oral solutions/suspensions, tablets/capsules, topicals, injectables, others) and 5-year Trend in Shifting Dosage Forms for Compounding

5.8. Technological Advancements

5.9. Regulatory Scenario

5.10. Top 10 Animal Prescription Compounding Pharmacies in the U.S.

5.11. Key Mergers & Acquisitions

5.12. COVID-19 Pandemic Impact on Industry

6. U.S. Dog and Cat Drug Compounding Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2023–2031

6.3.1. Anti-infective Drugs

6.3.2. Anti-inflammatory Drugs

6.3.3. CNS Agents

6.3.4. GI Drugs

6.3.5. Others (hormonal drugs, etc.)

6.4. Market Attractiveness Analysis, by Product

7. U.S. Dog and Cat Drug Compounding Market Analysis and Forecast, by Dosage Form

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Dosage Form, 2023–2031

7.3.1. Tablets & Capsules

7.3.2. Powder

7.3.3. Solution

7.3.4. Others (suspension, etc.)

8. U.S. Dog and Cat Drug Compounding Market Analysis and Forecast, by Route of Administration

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Route of Administration, 2023–2031

8.3.1. Oral

8.3.2. Injectable

8.3.3. Topical

8.3.4. Others (ocular, rectal, etc.)

8.4. Market Attractiveness Analysis, by Route of Administration

9. U.S. Dog and Cat Drug Compounding Market Analysis and Forecast, by Animal

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value Forecast, by Animal, 2023–2031

9.3.1. Dog

9.3.2. Cat

9.4. Market Attractiveness Analysis, by Animal

10. Competition Landscape

10.1. U.S. Dog and Cat Drug Compounding Market Strategy Analysis, by Company 2022

10.2. Company Profiles

10.2.1. Animal Pharm, LLC,

10.2.1.1. Company Overview

10.2.1.2. Product Portfolio

10.2.1.3. Financial Overview

10.2.1.4. SWOT Analysis

10.2.2. BEST PET RX

10.2.2.1. Company Overview

10.2.2.2. Product Portfolio

10.2.2.3. Financial Overview

10.2.2.4. SWOT Analysis

10.2.3. Central Compounding Center South

10.2.3.1. Company Overview

10.2.3.2. Product Portfolio

10.2.3.3. Financial Overview

10.2.3.4. SWOT Analysis

10.2.4. Custom Med Compounding Pharmacy

10.2.4.1. Company Overview

10.2.4.2. Product Portfolio

10.2.4.3. Financial Overview

10.2.4.4. SWOT Analysis

10.2.5. Davis Islands Pharmacy

10.2.5.1. Company Overview

10.2.5.2. Product Portfolio

10.2.5.3. Financial Overview

10.2.5.4. SWOT Analysis

10.2.6. Millers Pharmacy

10.2.6.1. Company Overview

10.2.6.2. Product Portfolio

10.2.6.3. Financial Overview

10.2.6.4. SWOT Analysis

10.2.7. Mixlab, Inc.

10.2.7.1. Company Overview

10.2.7.2. Product Portfolio

10.2.7.3. Financial Overview

10.2.7.4. SWOT Analysis

10.2.8. PetMed Express, Inc.

10.2.8.1. Company Overview

10.2.8.2. Product Portfolio

10.2.8.3. Financial Overview

10.2.8.4. SWOT Analysis

10.2.9. PetScripts Pharmacy

10.2.9.1. Company Overview

10.2.9.2. Product Portfolio

10.2.9.3. Financial Overview

10.2.9.4. SWOT Analysis

10.2.10. Precision Compounding Pharmacy

10.2.10.1. Company Overview

10.2.10.2. Product Portfolio

10.2.10.3. Financial Overview

10.2.10.4. SWOT Analysis

10.2.11. The Compounding Pharmacy of America

10.2.11.1. Company Overview

10.2.11.2. Product Portfolio

10.2.11.3. Financial Overview

10.2.11.4. SWOT Analysis

10.2.12. The Pet Apothecary

10.2.12.1. Company Overview

10.2.12.2. Product Portfolio

10.2.12.3. Financial Overview

10.2.12.4. SWOT Analysis

10.2.13. Triangle Compounding Pharmacy

10.2.13.1. Company Overview

10.2.13.2. Product Portfolio

10.2.13.3. Financial Overview

10.2.13.4. SWOT Analysis

10.2.14. Wedgewood Pharmacy

10.2.14.1. Company Overview

10.2.14.2. Product Portfolio

10.2.14.3. Financial Overview

10.2.14.4. SWOT Analysis

List of Tables

Table 01: U.S. Dog and Cat Drug Compounding Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 02: U.S. Dog and Cat Drug Compounding Market Value (US$ Mn) Forecast, by Dosage Form, 2023-2031

Table 03: U.S. Dog and Cat Drug Compounding Market Value (US$ Mn) Forecast, by Route of Administration, 2023-2031

Table 04: U.S. Dog and Cat Drug Compounding Market Value (US$ Mn) Forecast, by Animals, 2023-2031

List of Figures

Figure 1 : U.S. Dog and Cat Drug Compounding Market Size, by Product, 2022

Figure 2 : U.S. Dog and Cat Drug Compounding Market Share (%), by Product, 2022

Figure 3 : U.S. Dog and Cat Drug Compounding Market Size, by Dosage Form, 2022

Figure 4 : U.S. Dog and Cat Drug Compounding Market Share (%), by Dosage Form, 2022

Figure 5 : U.S. Dog and Cat Drug Compounding Market Size, by Route of Administration, 2022

Figure 6 : U.S. Dog and Cat Drug Compounding Market Share (%), by Route of Administration, 2022

Figure 7 : U.S. Dog and Cat Drug Compounding Market Size, by Animal, 2022

Figure 8 : U.S. Dog and Cat Drug Compounding Market Share (%), by Animal, 2022

Figure 9 : U.S. Dog and Cat Drug Compounding Market Value (US$ Mn) Share Analysis, by Product, 2022 and 2031

Figure 10: U.S. Dog and Cat Drug Compounding Market Value (US$ Mn) Share Analysis, by Product, 2022

Figure 11: U.S. Dog and Cat Drug Compounding Market Value (US$ Mn) Share Analysis, by Product, 2031

Figure 12: U.S. Dog and Cat Drug Compounding Market Attractiveness Analysis, by Product, 2023–2031

Figure 13: U.S. Dog and Cat Drug Compounding Market Value (US$ Mn) Share Analysis, by Dosage Form, 2022 and 2031

Figure 14: U.S. Dog and Cat Drug Compounding Market Value (US$ Mn) Share Analysis, by Dosage Form, 2022

Figure 15: U.S. Dog and Cat Drug Compounding Market Value (US$ Mn) Share Analysis, by Dosage Form, 2031

Figure 16: U.S. Dog and Cat Drug Compounding Market Attractiveness Analysis, by Dosage Form, 2023–2031

Figure 17: U.S. Dog and Cat Drug Compounding Market Value (US$ Mn) Share Analysis, by Route of Administration, 2022 and 2031

Figure 18: U.S. Dog and Cat Drug Compounding Market Value (US$ Mn) Share Analysis, by Route of Administration, 2022

Figure 19: U.S. Dog and Cat Drug Compounding Market Value (US$ Mn) Share Analysis, by Route of Administration, 2031

Figure 20: U.S. Dog and Cat Drug Compounding Market Attractiveness Analysis, by Route of Administration, 2023–2031

Figure 21: U.S. Dog and Cat Drug Compounding Market Value (US$ Mn) Share Analysis, by Animal, 2022 and 2031

Figure 22: U.S. Dog and Cat Drug Compounding Market Value (US$ Mn) Share Analysis, by Animal, 2022

Figure 23: U.S. Dog and Cat Drug Compounding Market Value (US$ Mn) Share Analysis, by Animal, 2031

Figure 24: U.S. Dog and Cat Drug Compounding Market Attractiveness Analysis, by Animal, 2023–2031