Technological advancements continue to play an essential role in the healthcare industry. At present, urologists are increasingly relying on newer technologies to offer safe and effective treatments. Advancements in technology have paved the way for minimally invasive procedures and robots in the healthcare sector. Moreover, imaging in the medical field has improved at a considerable pace primarily driven by innovations and progress in technology. Moreover, focus on research and development is expected to generate significant interest in nanotechnology and tissue engineering marking the start of a new era in the field of urology. Urology imaging equipment and diagnostics continue to evolve at an impressive rate and the uptake of the same is also witnessing substantial growth.

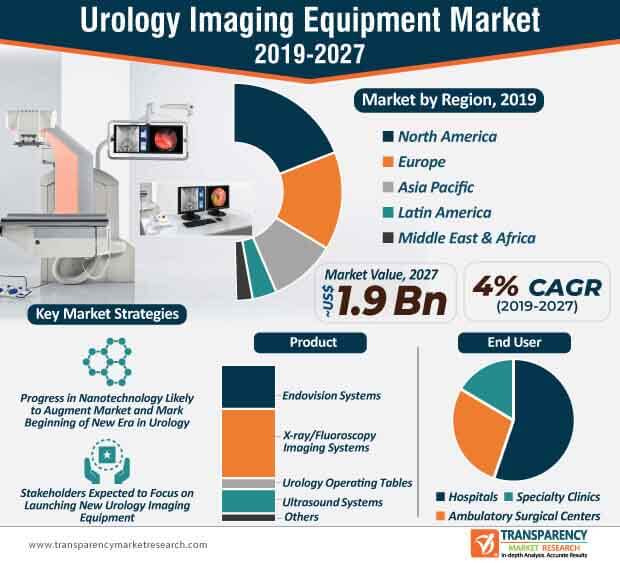

Over the past few years, narrow-band imaging in endoscopy to improve mucosal detail has gained a significant amount of popularity due to a range of factors. In comparison with the existing white-light cystoscopy, the improved ability of narrow-band imaging in the detection of cancerous tissues is a major factor that is projected to increase the prospects of the urology imaging equipment market during the forecast period. Furthermore, the growing adoption of magnetic resonance imaging (MRI) due to progress in nanotechnology will also augment the urology imaging equipment market, which is expected to attain a market value of ~US$ 1.9 Bn by the end of 2027. The launch of state-of-the-art urology imaging equipment, particularly in developed regions including North America and Europe is expected to increase the adoption of urology imaging equipment in the coming years.

With significant rise in the number of chronic kidney diseases, tissue regeneration is expected to gain a notable amount of traction in the coming years. Healthcare experts and researchers are focusing on improving the potential of stem-cell therapies in the urological field by negotiating various challenges, including epigenetic changes and immune reactions. Participants in the current urology imaging equipment market are also expected to explore the potential of nanotechnology in targeted therapies. Studies have revealed that nanoparticles have the ability to improve the chemotherapeutic action of apoptosis in prostate cancer cells. In addition, the uptake of nanoparticles in gene therapy is on the rise, as they are safer and efficient than the other vector alternatives. Apart from targeted therapies, nanotechnology is anticipated to play a major role in the development of next-generation urological imaging equipment. Moreover, nanotechnology has also played a key role in improving MRI scanning– a factor that is expected to boost the growth of the urology imaging equipment market in the upcoming years.

At present, with nanotechnology hovering around the urology imaging equipment market, training of modern-day urologists is imperative. Progress in computing capacity and interactivity will boost the prospects of the urology imaging equipment market during the forecast period.

Over the next few years, urological technology is expected to advance at a steady pace due to which, the growth of the urology imaging equipment market is expected. Participants in the current market landscape are projected to focus on improving the efficiency of urology imaging equipment.

Companies involved in the current urology imaging equipment market are expected to leverage the benefits of new technologies to develop cutting-edge urology imaging systems. The flurry of new urology imaging systems in the upcoming years will continue to drive the market growth. For instance, in 2018, Siemens Healthineers launched the Acuson Sequoia, an advanced ultrasound system to overcome the existing challenges in ultrasound imaging. Additionally, Guerbet launched the L-F Hydra Vision TM Digital Urological Imaging Equipment, which aims to enhance the efficiency of urological imaging and organize workflows. Companies are likely to align their product development strategies in accordance with evolving requirements of modern-day diagnostic imaging. During the forecast period, fluoroscopy imaging systems, endovision systems, and ultrasound systems are likely to gain considerable popularity.

Analysts’ Viewpoint

The global urology imaging equipment market is expected to grow at a CAGR of 4% during the forecast period. Some of the leading factors that will contribute to market growth include advancements in medical imaging technologies, progress in computing capacity, advent of nanotechnology in urology, and growing demand for minimally invasive procedures. The adoption of multimodality imaging technologies will continue to grow in the coming years, due to which the demand for urology imaging equipment is projected to rise. Companies in the urology imaging equipment market should focus on launching new imaging systems with improved efficiency and capabilities to gain an edge over their competitors.

Urology imaging equipment market To Reach Valuation Of ~US$ 1.9 Bn By 2027

Urology imaging equipment market is projected to expand at a CAGR of 4% from 2019 to 2027

Urology imaging equipment market is driven by increase in demand for early diagnosis

The x-ray/fluoroscopy imaging systems segment accounted for a major share of the global urology imaging equipment market

Key players in the global urology imaging equipment market include Stryker, Olympus Corporation, Guerbet, GE Healthcare (General Electric Company), KARL STORZ

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Urology Imaging Equipment Market

4. Market Overview

4.1. Introduction

4.1.1. Product/Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Urology Imaging Equipment Market Analysis and Forecast, 2017–2027

5. Market Outlook

5.1. Disease Epidemiology

5.2. Technological Advancements

5.3. Regulatory Scenario by Region/Globally

6. Global Urology Imaging Equipment Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Global Urology Imaging Equipment Market Value Forecast, by Product, 2017–2027

6.3.1. Endovision Systems

6.3.2. X-ray/Fluoroscopy Imaging Systems

6.3.3. Urology Operating Tables

6.3.4. Ultrasound Systems

6.3.5. Others

6.4. Global Urology Imaging Equipment Market Attractiveness, by Product

7. Global Urology Imaging Equipment Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Global Urology Imaging Equipment Market Value Forecast, by Application, 2017–2027

7.3.1. Diagnostics

7.3.2. Interventional

7.4. Global Urology Imaging Equipment Market Attractiveness, by Application

8. Global Urology Imaging Equipment Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Global Urology Imaging Equipment Market Value Forecast, by End-user, 2017–2027

8.3.1. Hospitals

8.3.2. Ambulatory Surgical Centers

8.3.3. Specialty Clinics

8.4. Global Urology Imaging Equipment Market Attractiveness, by End-user

9. Global Urology Imaging Equipment Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Global Urology Imaging Equipment Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Urology Imaging Equipment Market Attractiveness, by Region

10. North America Urology Imaging Equipment Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. North America Urology Imaging Equipment Market Value Forecast, by Product, 2017–2027

10.2.1. Endovision Systems

10.2.2. X-ray/Fluoroscopy Imaging Systems

10.2.3. Urology Operating Tables

10.2.4. Ultrasound Systems

10.2.5. Others

10.3. North America Urology Imaging Equipment Market Value Forecast, by Application, 2017–2027

10.3.1. Diagnostics

10.3.2. Interventional

10.4. North America Urology Imaging Equipment Market Value Forecast, by End-user, 2017–2027

10.4.1. Hospitals

10.4.2. Ambulatory Surgical Centers

10.4.3. Specialty Clinics

10.5. North America Urology Imaging Equipment Market Value Forecast, by Country, 2017–2027

10.5.1. U.S.

10.5.2. Canada

10.6. North America Urology Imaging Equipment Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Urology Imaging Equipment Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Europe Urology Imaging Equipment Market Value Forecast, by Product, 2017–2027

11.2.1. Endovision Systems

11.2.2. X-ray/Fluoroscopy Imaging Systems

11.2.3. Urology Operating Tables

11.2.4. Ultrasound Systems

11.2.5. Others

11.3. Europe Urology Imaging Equipment Market Value Forecast, by Application, 2017–2027

11.3.1. Diagnostics

11.3.2. Interventional

11.4. Europe Urology Imaging Equipment Market Value Forecast, by End-user, 2017–2027

11.4.1. Hospitals

11.4.2. Ambulatory Surgical Centers

11.4.3. Specialty Clinics

11.5. Europe Urology Imaging Equipment Market Value Forecast, by Country/Sub-region, 2017–2027

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Europe Urology Imaging Equipment Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Urology Imaging Equipment Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Asia Pacific Urology Imaging Equipment Market Value Forecast, by Product, 2017–2027

12.2.1. Endovision Systems

12.2.2. X-ray/Fluoroscopy Imaging Systems

12.2.3. Urology Operating Tables

12.2.4. Ultrasound Systems

12.2.5. Others

12.3. Asia Pacific Urology Imaging Equipment Market Value Forecast, by Application, 2017–2027

12.3.1. Diagnostics

12.3.2. Interventional

12.4. Asia Pacific Urology Imaging Equipment Market Value Forecast, by End-user, 2017–2027

12.4.1. Hospitals

12.4.2. Ambulatory Surgical Centers

12.4.3. Specialty Clinics

12.5. Asia Pacific Urology Imaging Equipment Market Value Forecast, by Country/Sub-region, 2017–2027

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Asia Pacific Urology Imaging Equipment Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Urology Imaging Equipment Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Latin America Urology Imaging Equipment Market Value Forecast, by Product, 2017–2027

13.2.1. Endovision Systems

13.2.2. X-ray/Fluoroscopy Imaging Systems

13.2.3. Urology Operating Tables

13.2.4. Ultrasound Systems

13.2.5. Others

13.3. Latin America Urology Imaging Equipment Market Value Forecast, by Application, 2017–2027

13.3.1. Diagnostics

13.3.2. Interventional

13.4. Latin America Urology Imaging Equipment Market Value Forecast, by End-user, 2017–2027

13.4.1. Hospitals

13.4.2. Ambulatory Surgical Centers

13.4.3. Specialty Clinics

13.5. Latin America Urology Imaging Equipment Market Value Forecast, by Country/Sub-region, 2017–2027

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Latin America Urology Imaging Equipment Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Urology Imaging Equipment Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Middle East & Africa Urology Imaging Equipment Market Value Forecast, by Product, 2017–2027

14.2.1. Endovision Systems

14.2.2. X-ray/Fluoroscopy Imaging Systems

14.2.3. Urology Operating Tables

14.2.4. Ultrasound Systems

14.2.5. Others

14.3. Middle East & Africa Urology Imaging Equipment Market Value Forecast, by Application, 2017–2027

14.3.1. Diagnostics

14.3.2. Interventional

14.4. Middle East & Africa Urology Imaging Equipment Market Value Forecast, by End-user, 2017–2027

14.4.1. Hospitals

14.4.2. Ambulatory Surgical Centers

14.4.3. Specialty Clinics

14.5. Middle East & Africa Urology Imaging Equipment Market Value Forecast, by Country/Sub-region, 2017–2027

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Middle East & Africa Urology Imaging Equipment Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Company Profiles

15.2.1. Stryker

15.2.1.1. Company Overview

15.2.1.2. Company Financials

15.2.1.3. Growth Strategies

15.2.1.4. SWOT Analysis

15.2.2. Olympus Corporation

15.2.2.1. Company Overview

15.2.2.2. Company Financials

15.2.2.3. Growth Strategies

15.2.2.4. SWOT Analysis

15.2.3. Guerbet

15.2.3.1. Company Overview

15.2.3.2. Company Financials

15.2.3.3. Growth Strategies

15.2.3.4. SWOT Analysis

15.2.4. GE Healthcare (General Electric Company)

15.2.4.1. Company Overview

15.2.4.2. Company Financials

15.2.4.3. Growth Strategies

15.2.4.4. SWOT Analysis

15.2.5. KARL STORZ

15.2.5.1. Company Overview

15.2.5.2. Growth Strategies

15.2.5.3. SWOT Analysis

15.2.6. Siemens Healthineers

15.2.6.1. Company Overview

15.2.6.2. Company Financials

15.2.6.3. Growth Strategies

15.2.6.4. SWOT Analysis

15.2.7. Richard Wolf GmbH

15.2.7.1. Company Overview

15.2.7.2. Growth Strategies

15.2.7.3. SWOT Analysis

15.2.8. CANON MEDICAL SYSTEMS CORPORATION

15.2.8.1. Company Overview

15.2.8.2. Company Financials

15.2.8.3. Growth Strategies

15.2.8.4. SWOT Analysis

15.2.9. Koninklijke Philips N.V.

15.2.9.1. Company Overview

15.2.9.2. Company Financials

15.2.9.3. Growth Strategies

15.2.9.4. SWOT Analysis

15.2.10. Boston Scientific Corporation

15.2.10.1. Company Overview

15.2.10.2. Company Financials

15.2.10.3. Growth Strategies

15.2.10.4. SWOT Analysis

List of Tables

Table 01: Global Urology Imaging Equipment Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 02: Global Urology Imaging Equipment Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 03: Global Urology Imaging Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 04: Global Urology Imaging Equipment Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 05: North America Urology Imaging Equipment Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 06: North America Urology Imaging Equipment Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 07: North America Urology Imaging Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 08: North America Urology Imaging Equipment Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 09: Europe Urology Imaging Equipment Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 10: Europe Urology Imaging Equipment Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 11: Europe Urology Imaging Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 12: Europe Urology Imaging Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 13: Asia Pacific Urology Imaging Equipment Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 14: Asia Pacific Urology Imaging Equipment Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 15: Asia Pacific Urology Imaging Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 16: Asia Pacific Urology Imaging Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 17: Latin America Urology Imaging Equipment Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 18: Latin America Urology Imaging Equipment Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 19: Latin America Urology Imaging Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 20: Latin America Urology Imaging Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 21: Middle East & Africa Urology Imaging Equipment Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 22: Middle East & Africa Urology Imaging Equipment Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 23: Middle East & Africa Urology Imaging Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 24: Middle East & Africa Urology Imaging Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

List of Figures

Figure 01: Global Urology Imaging Equipment Market Value (US$ Mn) and Distribution (%), by Region, 2018 and 2027

Figure 02: Global Urology Imaging Equipment Market Value (US$ Mn), by Product, 2018

Figure 03: Global Urology Imaging Equipment Market Value Share Analysis, by Application, 2018

Figure 04: Market Overview

Figure 05: Global Urology Imaging Equipment Market Value Share, by Product, 2018

Figure 06: Global Urology Imaging Equipment Market Value Share, by Application, 2018

Figure 07: Global Urology Imaging Equipment Market Value Share, by End-user, 2018

Figure 09: Global Urology Imaging Equipment Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 10: Global Urology Imaging Equipment Market Value Share Analysis, by Product, 2018 and 2027

Figure 11: Global Urology Imaging Equipment Market Value (US$ Mn) and Y-o-Y Growth, by Endovision Systems, 2017–2027

Figure 12: Global Urology Imaging Equipment Market Value (US$ Mn) and Y-o-Y Growth, by X-ray/Fluoroscopy Imaging Systems, 2017–2027

Figure 13: Global Urology Imaging Equipment Market Value (US$ Mn) and Y-o-Y Growth, by Urology Operating Tables, 2017–2027

Figure 14: Global Urology Imaging Equipment Market Value (US$ Mn) and Y-o-Y Growth, by Ultrasound Systems, 2017–2027

Figure 15: Global Urology Imaging Equipment Market Value (US$ Mn) and Y-o-Y Growth, by Others, 2017–2027

Figure 16: Global Urology Imaging Equipment Market Attractiveness Analysis, by Product, 2019–2027

Figure 17: Global Urology Imaging Equipment Market Value Share Analysis, by Application, 2018 and 2027

Figure 18: Global Urology Imaging Equipment Market Value (US$ Mn) and Y-o-Y Growth, by Diagnostics, 2017–2027

Figure 19: Global Urology Imaging Equipment Market Value (US$ Mn) and Y-o-Y Growth, by Interventional, 2017–2027

Figure 20: Global Urology Imaging Equipment Market Attractiveness Analysis, by Application, 2019–2027

Figure 21: Global Urology Imaging Equipment Market Value Share Analysis, by End-user, 2018 and 2027

Figure 22: Global Urology Imaging Equipment Market Value (US$ Mn) and Y-o-Y Growth, by Hospitals, 2017–2027

Figure 23: Global Urology Imaging Equipment Market Value (US$ Mn) and Y-o-Y Growth, by Ambulatory Surgical Centers, 2017–2027

Figure 24: Global Urology Imaging Equipment Market Value (US$ Mn) and Y-o-Y Growth, by Specialty Clinics, 2017–2027

Figure 25: Global Urology Imaging Equipment Market Attractiveness Analysis, by End-user, 2019–2027

Figure 26: Global Urology Imaging Equipment Market Value Share Analysis, by Region, 2018 and 2027

Figure 27: Global Urology Imaging Equipment Market Attractiveness Analysis, by Region, 2019–2027

Figure 28: North America Urology Imaging Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 29: North America Urology Imaging Equipment Market Value Share Analysis, by Product, 2018 and 2027

Figure 30: North America Urology Imaging Equipment Market Attractiveness Analysis, by Product, 2019–2027

Figure 31: North America Urology Imaging Equipment Market Value Share Analysis, by Application, 2018 and 2027

Figure 32: North America Urology Imaging Equipment Market Attractiveness Analysis, by Application, 2019–2027

Figure 33: North America Urology Imaging Equipment Market Value Share Analysis, by End-user, 2018 and 2027

Figure 34: North America Urology Imaging Equipment Market Attractiveness Analysis, by End-user, 2019 -2027

Figure 35: North America Urology Imaging Equipment Market Value Share Analysis, by Country, 2018 and 2027

Figure 36: North America Urology Imaging Equipment Market Attractiveness Analysis, by Country, 2019–2027

Figure 37: Europe Urology Imaging Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 38: Europe Urology Imaging Equipment Market Value Share Analysis, by Product, 2018 and 2027

Figure 39: Europe Urology Imaging Equipment Market Attractiveness Analysis, by Product, 2019–2027

Figure 40: Europe Urology Imaging Equipment Market Value Share Analysis, by Application, 2018 and 2027

Figure 41: Europe Urology Imaging Equipment Market Attractiveness Analysis, by Application, 2019–2027

Figure 42: Europe Urology Imaging Equipment Market Value Share Analysis, by End-user, 2018 and 2027

Figure 43: Europe Urology Imaging Equipment Market Attractiveness Analysis, by End-user, 2019 -2027

Figure 44: Europe Urology Imaging Equipment Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 45: Europe Urology Imaging Equipment Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 46: Asia Pacific Urology Imaging Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 47: Asia Pacific Urology Imaging Equipment Market Value Share Analysis, by Product, 2018 and 2027

Figure 48: Asia Pacific Urology Imaging Equipment Market Attractiveness Analysis, by Product, 2019–2027

Figure 49: Asia Pacific Urology Imaging Equipment Market Value Share Analysis, by Application, 2018 and 2027

Figure 50: Asia Pacific Urology Imaging Equipment Market Attractiveness Analysis, by Application, 2019–2027

Figure 51: Asia Pacific Urology Imaging Equipment Market Value Share Analysis, by End-user, 2018 and 2027

Figure 52: Asia Pacific Urology Imaging Equipment Market Attractiveness Analysis, by End-user, 2019–2027

Figure 53: Asia Pacific Urology Imaging Equipment Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 54: Asia Pacific Urology Imaging Equipment Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 55: Latin America Urology Imaging Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 56: Latin America Urology Imaging Equipment Market Value Share Analysis, by Product, 2018 and 2027

Figure 57: Latin America Urology Imaging Equipment Market Attractiveness Analysis, by Product, 2019–2027

Figure 58: Latin America Urology Imaging Equipment Market Value Share Analysis, by Application, 2018 and 2027

Figure 59: Latin America Urology Imaging Equipment Market Attractiveness Analysis, by Application, 2019–2027

Figure 60: Latin America Urology Imaging Equipment Market Value Share Analysis, by End-user, 2018 and 2027

Figure 61: Latin America Urology Imaging Equipment Market Attractiveness Analysis, by End-user, 2019 -2027

Figure 62: Latin America Urology Imaging Equipment Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 63: Latin America Urology Imaging Equipment Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 64: Middle East & Africa Urology Imaging Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 65: Middle East & Africa Urology Imaging Equipment Market Value Share Analysis, by Product, 2018 and 2027

Figure 66: Middle East & Africa Urology Imaging Equipment Market Attractiveness Analysis, by Product, 2019–2027

Figure 67: Middle East & Africa Urology Imaging Equipment Market Value Share Analysis, by Application, 2018 and 2027

Figure 68: Middle East & Africa Urology Imaging Equipment Market Attractiveness Analysis, by Application, 2019–2027

Figure 69: Middle East & Africa Urology Imaging Equipment Market Value Share Analysis, by End-user, 2018 and 2027

Figure 70: Middle East & Africa Urology Imaging Equipment Market Attractiveness Analysis, by End-user, 2019 -2027

Figure 71: Middle East & Africa Urology Imaging Equipment Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 72: Middle East & Africa Urology Imaging Equipment Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 73: Stryker Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 74: Stryker Breakdown of Net Sales (%), by Region/Country, 2018

Figure 75: Stryker Breakdown of Net Sales (%), by Business Segment (MedSurg), 2018

Figure 76: Stryker R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 77: Olympus Corporation Revenue (US$ Mn) and Y-o-Y Growth (%) (Medical Business), 2016–2018

Figure 78: Olympus Corporation Breakdown of Net Sales (%), Medical Segment, by Region/Country, 2018

Figure 79: Olympus Corporation Breakdown of Net Sales (%), by Business Segment, 2018

Figure 80: Olympus Corporation R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 81: Guerbet Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 82: Guerbet Breakdown of Net Sales (%), by Region/Country, 2018

Figure 83: Guerbet Breakdown of Net Sales (%), by Product Range, 2018

Figure 84: Guerbet R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 85: GE Healthcare - Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2018

Figure 86: GE Healthcare - Breakdown of Net Sales (%), by Region/Country, 2018

Figure 87: GE Healthcare - Breakdown of Net Sales (%), by Segment, 2018

Figure 88: GE Healthcare - R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2016–2018

Figure 89: Siemens Healthineers - Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 90: Siemens Healthineers - Breakdown of Net Sales (%), by Region/Country, 2018

Figure 91: Siemens Healthineers - Revenue Breakdown of Net Sales (%), by Medical Device Business Unit, 2018

Figure 92: Siemens Healthineers - R&D Expenses (US$ Mn) and Y-o-Y Growth (%) by Medical Devices, 2017–2018

Figure 93: Medical System Revenue (US$ Mn) and Y-o-Y Growth (%), 2017–2018

Figure 94: Canon Medical Systems Corporation Breakdown of Net Sales (%), by Region/Country, 2018

Figure 95: Canon Medical Systems Corporation Breakdown of Net Sales (%), by Medical Device Business Unit, 2018

Figure 96: Medical Device Business - Operating cost and expenses (US$ Mn) and Y-o-Y Growth (%), 2016–2018

Figure 97: Koninklijke Philips N.V. Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 98: Koninklijke Philips N.V. Breakdown of Net Sales (%), by Region/Country, 2018

Figure 99: Koninklijke Philips N.V. Breakdown of Net Sales (%), by Business Segment, 2018

Figure 100: Koninklijke Philips N.V. R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 101: Boston Scientific Corporation Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 102: Boston Scientific Corporation Breakdown of Net Sales (%), by Region/Country, 2018

Figure 103: Boston Scientific Corporation Breakdown of Net Sales (%), by Business Segment, 2018

Figure 104: Boston Scientific Corporation R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2015–2018