Analysts’ Viewpoint on Market Scenario

Urology equipment are usually termed as medical devices used for diagnosis and treatment of kidney and urology diseases related to urinary bladder, urethra, ureter, and kidney.

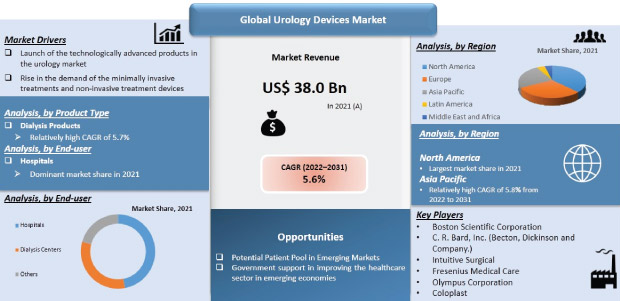

The global urology devices market is experiencing a shift toward less or minimally invasive treatment methods. Launch of technologically advanced products in the urology market and rise in demand for minimally invasive treatments & non-invasive treatment devices are expected to increase the demand for urology equipment during the forecast period. Additionally, rise in prevalence and incidence of various urologic conditions such as chronic kidney diseases, urinary incontinence, end-stage renal diseases, bladder cancer, and prostate cancer is likely to propel the demand for urology instruments during the forecast period. Moreover, patients suffering from COVID-19 are experiencing increased urology conditions such as kidney injuries and chronic kidney disease.

An article published by Johns Hopkins Medicine Organization indicated that people suffering from severe COVID-19 show signs of kidney damage even if they had no underlying kidney problem before they were infected with COVID-19. According to the article, research studies show over 30% of patients hospitalized due to COVID-19 develop kidney injury, and over 50% of patients in the intensive care unit (ICU) with kidney injury may require dialysis.

Due to rising incidence of urologic conditions, medical device manufacturers are increasing their production capabilities to manufacture efficient and safe urological devices. Urinary incontinence is a common yet critical problem of urinary disorder wherein a patient loses control over urine. Besides in the elderly population, women are commonly affected with the medical condition of urinary incontinence. Data published by the urinaryincontinence.com states that one in three women in the U.S. suffers from some form of urinary incontinence.

The urology devices market is expanding due to increase in adoption of minimally invasive procedures and surge in the number of patients suffering from disorders of urinary tract system. High quality urology instruments are being developed by manufacturers for diagnosis and treatment of urological conditions.

Thus, rise in the number of urology disorders such as urological cancer, kidney blockage, prostate cancer, etc. in people is driving the demand for urology devices such as urology catheters, stents, urology guidewires, drainage bags, etc.

The global urology devices industry is significantly driven by the increasing demand for urology devices such as dialysis products, endoscopes, peripheral instruments, etc. from hospitals. Several device manufacturers are focusing on introducing technologically advanced products, including urology lasers and robotic systems for early diagnosis of diseases related to the urinary tract system.

Hospitals and other care centers are making huge investments in procuring advanced endoscopy and laparoscopy devices that can be used in minimally invasive surgeries & treatment procedures of bladder cancer, incontinence, & kidney diseases. This is being carried out to ensure positive patient outcomes.

The onset of the COVID-19 pandemic has evidently increased stress levels in people. Stress urinary incontinence is a commonly prevalent health problem across the world. Stress can trigger acute respiratory distress in patients with severe kidney diseases. This condition can damage the kidney further. Hence, the demand for dialysis procedures at healthcare centers as well as in home care settings surged from patients with urology-related disorders who were infected by the COVID-19 strain. Consequently, companies in the urology devices market have increased the supply of urology equipment to efficiently manage urological emergencies at various care centers.

There is a rise in the number of patients suffering from urological disorders opting for minimally invasive procedures over traditional ones. Minimally invasive surgeries offer benefits such as small incisions, less pain, less healing time, and low risk of bacterial infections. Patients suffering from various urology conditions such as bladder cancer and prostate cancer are preferring minimally invasive surgery. Moreover, foley catheters or indwelling catheters are commonly used to drain the urine from body after a surgical procedure.

With advancements in technology, urologists in developing countries are employing specialized urology diagnosis methods such as the urinalysis & cystoscope, and using advanced urology surgical devices for surgical procedures for the treatment of urology disorders.

These factors are translating into revenue opportunities for med-tech companies in the market.

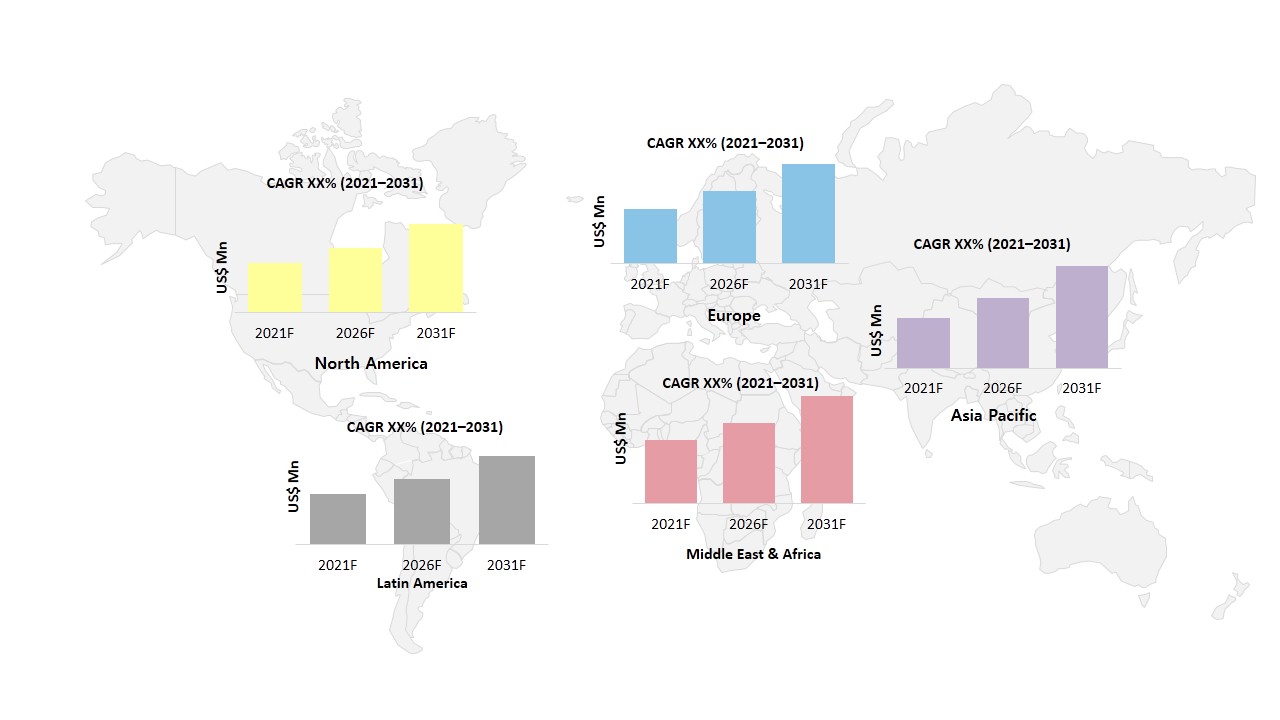

North America is expected to dominate the global urology devices market during the forecast period due to advanced healthcare facilities, technological innovations in medical devices, and rise in the number of patients suffering from kidney disorders in the U.S. & Canada. In addition, increasing government support through favorable reimbursement policies and healthcare insurance is encouraging patients to undergo necessary surgery for the treatment of urological disorders, thus demanding advanced urology instruments. This is a key factor driving the urology devices market in North America.

In addition, lifestyle diseases such as diabetes, high blood pressure, stress, etc. are becoming common in people, thus leading to kidney impairment or CKD. This rise in the number of people suffering from kidney-related disorders is fueling the demand for dialysis equipment, home dialysis machines, and surgical instruments in hospitals & dialysis centers.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 38 Bn |

|

Market Forecast Value in 2031 |

US$ 64 Bn |

|

Growth Rate (CAGR) |

5.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 38 Bn in 2021.

The global market is anticipated to expand at a CAGR of 5.6% from 2022 to 2031.

Increase in patient population with various urology disorders, rise in demand for minimally invasive procedures, and technologically advanced products drive the global market.

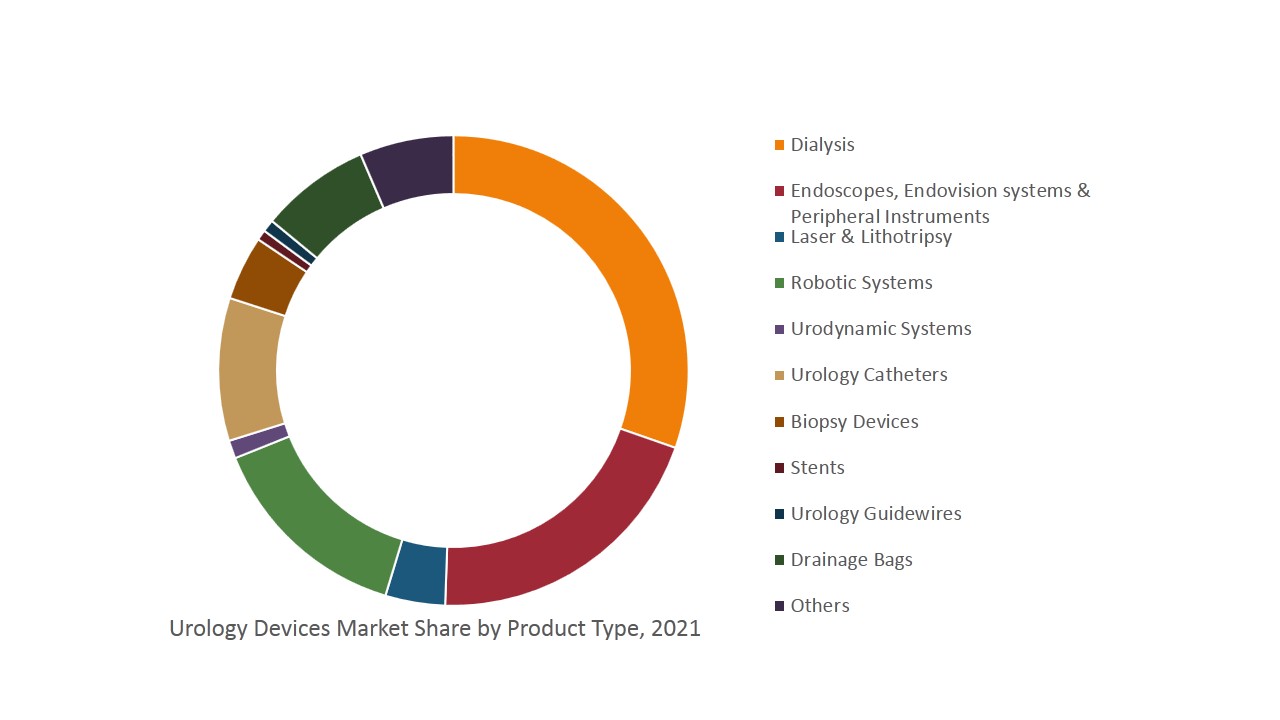

The dialysis products segment held over 40% share of the global market in 2021

North America is expected to be a highly attractive market for vendors during the forecast period.

Key players in the global urology devices market include Boston Scientific Corporation, KARL STORZ SE & Co. KG, C. R. Bard, Inc. (Becton, Dickinson and Company), Richard Wolf GmbH, Intuitive Surgical, Fresenius Medical Care, Olympus Corporation, Coloplast, Medtronic, Siemens Healthineers, Stryker, Cardinal Health, Baxter, HealthTronics, Inc., Johnson & Johnson, and Cook Medical.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Urology Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Urology Devices Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Porter’s Five Force Analysis

5. Market Outlook

5.1. Technological Advancements

5.2. Epidemiological Overview

6. Global Urology Devices Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Global Urology Devices Market Value Forecast, by Product Type, 2017–2031

6.3.1. Dialysis Products

6.3.2. Endoscopes, Endovision Systems & Peripheral Instruments

6.3.3. Laser & Lithotripsy

6.3.4. Robotic Systems

6.3.5. Urodynamic Systems

6.3.6. Urology Catheters

6.3.7. Biopsy Devices

6.3.8. Stents

6.3.9. Urology Guidewires

6.3.10. Drainage Bags

6.3.11. Others

6.4. Global Urology Devices Market Attractiveness Analysis, by Product Type

7. Global Urology Devices Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Global Urology Devices Market Value Forecast, by End-user, 2017–2031

7.3.1. Hospitals

7.3.2. Dialysis Centers

7.3.3. Others

7.4. Global Urology Devices Market Attractiveness Analysis, by End-user

8. Global Urology Devices Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Global Urology Devices Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Global Urology Devices Market Attractiveness Analysis, by Region

9. North America Urology Devices Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. North America Urology Devices Market Value Forecast, by Product Type, 2017–2031

9.2.1. Dialysis Products

9.2.2. Endoscopes, Endovision Systems & Peripheral Instruments

9.2.3. Laser & Lithotripsy

9.2.4. Robotic Systems

9.2.5. Urodynamic Systems

9.2.6. Urology Catheters

9.2.7. Biopsy Devices

9.2.8. Stents

9.2.9. Urology Guidewires

9.2.10. Drainage Bags

9.2.11. Others

9.3. North America Urology Devices Market Value Forecast, by End-user, 2017–2031

9.3.1. Hospitals

9.3.2. Dialysis Centers

9.3.3. Others

9.4. North America Urology Devices Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. North America Urology Devices Market Attractiveness Analysis

9.5.1. By Product Type

9.5.2. By End-user

9.5.3. By Country

10. Europe Urology Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Europe Urology Devices Market Value Forecast, by Product Type, 2017–2031

10.2.1. Dialysis Products

10.2.2. Endoscopes, Endovision Systems & Peripheral Instruments

10.2.3. Laser & Lithotripsy

10.2.4. Robotic Systems

10.2.5. Urodynamic Systems

10.2.6. Urology Catheters

10.2.7. Biopsy Devices

10.2.8. Stents

10.2.9. Urology Guidewires

10.2.10. Drainage Bags

10.2.11. Others

10.3. Europe Urology Devices Market Value Forecast, by End-user, 2017–2031

10.3.1. Hospitals

10.3.2. Dialysis Centers

10.3.3. Others

10.4. Europe Urology Devices Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Spain

10.4.5. Italy

10.4.6. Rest of Europe

10.5. Europe Urology Devices Market Attractiveness Analysis

10.5.1. By Product Type

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Urology Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Asia Pacific Urology Devices Market Value Forecast, by Product Type, 2017–2031

11.2.1. Dialysis Products

11.2.2. Endoscopes, Endovision Systems & Peripheral Instruments

11.2.3. Laser & Lithotripsy

11.2.4. Robotic Systems

11.2.5. Urodynamic Systems

11.2.6. Urology Catheters

11.2.7. Biopsy Devices

11.2.8. Stents

11.2.9. Urology Guidewires

11.2.10. Drainage Bags

11.2.11. Others

11.3. Asia Pacific Urology Devices Market Value Forecast, by End-user, 2017–2031

11.3.1. Hospitals

11.3.2. Dialysis Centers

11.3.3. Others

11.4. Asia Pacific Urology Devices Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Asia Pacific Urology Devices Market Attractiveness Analysis

11.5.1. By Product Type

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Urology Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Latin America Urology Devices Market Value Forecast, by Product Type, 2017–2031

12.2.1. Dialysis Products

12.2.2. Endoscopes, Endovision Systems & Peripheral Instruments

12.2.3. Laser & Lithotripsy

12.2.4. Robotic Systems

12.2.5. Urodynamic Systems

12.2.6. Urology Catheters

12.2.7. Biopsy Devices

12.2.8. Stents

12.2.9. Urology Guidewires

12.2.10. Drainage Bags

12.2.11. Others

12.3. Latin America Urology Devices Market Value Forecast, by End-user, 2017–2031

12.3.1. Hospitals

12.3.2. Dialysis Centers

12.3.3. Others

12.4. Latin America Urology Devices Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Latin America Urology Devices Market Attractiveness Analysis

12.5.1. By Product Type

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Urology Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Middle East & Africa Urology Devices Market Value Forecast, by Product Type, 2017–2031

13.2.1. Dialysis Products

13.2.2. Endoscopes, Endovision Systems & Peripheral Instruments

13.2.3. Laser & Lithotripsy

13.2.4. Robotic Systems

13.2.5. Urodynamic Systems

13.2.6. Urology Catheters

13.2.7. Biopsy Devices

13.2.8. Stents

13.2.9. Urology Guidewires

13.2.10. Drainage Bags

13.2.11. Others

13.3. Middle East & Africa Urology Devices Market Value Forecast, by End-user, 2017–2031

13.3.1. Hospitals

13.3.2. Dialysis Centers

13.3.3. Others

13.4. Middle East & Africa Urology Devices Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Middle East & Africa Urology Devices Market Attractiveness Analysis

13.5.1. By Product Type

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (by tier and size of companies)

14.2. Company Profiles

14.2.1. Medtronic

14.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.1.2. Product Portfolio

14.2.1.3. SWOT Analysis

14.2.1.4. Strategic Overview

14.2.2. Fresenius Medical Care

14.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.2.2. Product Portfolio

14.2.2.3. SWOT Analysis

14.2.2.4. Strategic Overview

14.2.3. Baxter International, Inc.

14.2.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.3.2. Product Portfolio

14.2.3.3. SWOT Analysis

14.2.3.4. Strategic Overview

14.2.4. C. R. Bard, Inc. (Becton, Dickinson and Company.)

14.2.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.4.2. Product Portfolio

14.2.4.3. SWOT Analysis

14.2.4.4. Strategic Overview

14.2.5. Siemens Healthineers (Siemens AG)

14.2.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.5.2. Product Portfolio

14.2.5.3. SWOT Analysis

14.2.5.4. Strategic Overview

14.2.6. Boston Scientific Corporation

14.2.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.6.2. Product Portfolio

14.2.6.3. SWOT Analysis

14.2.6.4. Strategic Overview

14.2.7. Olympus Corporation

14.2.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.7.2. Product Portfolio

14.2.7.3. SWOT Analysis

14.2.7.4. Strategic Overview

14.2.8. Intuitive Surgical

14.2.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.8.2. Product Portfolio

14.2.8.3. SWOT Analysis

14.2.8.4. Strategic Overview

14.2.9. KARL STORZ SE & Co. KG

14.2.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.9.2. Product Portfolio

14.2.9.3. SWOT Analysis

14.2.9.4. Strategic Overview

14.2.10. Richard Wolf GmbH

14.2.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.10.2. Product Portfolio

14.2.10.3. SWOT Analysis

14.2.10.4. Strategic Overview

14.2.11. Cook Medical

14.2.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.11.2. Product Portfolio

14.2.11.3. SWOT Analysis

14.2.11.4. Strategic Overview

List of Tables

Table 01: Global Urology Devices Market Value (US$ Bn) Forecast, by Product Type, 2017–2031

Table 02: Global Urology Devices Market Value (US$ Bn) Forecast, by End-user, 2017–2031

Table 03: Global Urology Devices Market Value (US$ Bn) Forecast, by Region, 2017–2031

Table 04: North America Urology Devices Market Value (US$ Bn) Forecast, by Country, 2017–2031

Table 05: North America Urology Devices Market Value (US$ Bn) Forecast, by Product Type, 2017–2031

Table 06: North America Urology Devices Market Value (US$ Bn) Forecast, by End-user, 2017–2031

Table 07: Europe Urology Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2031

Table 08: Europe Urology Devices Market Value (US$ Bn) Forecast, by Product Type, 2017–2031

Table 09: Europe Urology Devices Market Value (US$ Bn) Forecast, by End-user, 2017–2031

Table 10: Asia Pacific Urology Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2031

Table 11: Asia Pacific Urology Devices Market Value (US$ Bn) Forecast, by Product Type, 2017–2031

Table 12: Asia Pacific Urology Devices Market value (US$ Bn) Forecast, by End-user, 2017–2031

Table 13: Latin America Urology Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Latin America Urology Devices Market Value (US$ Bn) Forecast, by Product Type, 2017–2031

Table 15: Latin America Urology Devices Market Value (US$ Bn) Forecast, by End-user, 2017–2031

Table 16: Middle East & Africa Urology Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Middle East & Africa Urology Devices Market Value (US$ Bn) Forecast, by Product Type, 2017–2031

Table 18: Middle East & Africa Urology Devices Market Value (US$ Bn) Forecast, by End-user, 2017–2031

List of Figures

Figure 1: Global Urology Devices Market Value (US$ Bn) and Distribution by Geography, 2021 and 2031

Figure 2: Global Urology Devices Market Value (US$ Bn), by Product Type, 2021

Figure 3: Global Urology Devices (US$ Bn), by End-user, 2021

Figure 4: Global Urology Devices (US$ Bn), by Key Segment and Market Share (%), 2021

Figure 5: Urology Devices, Market Opportunity Map, by Product Type

Figure 6: Urology Devices, Market Opportunity Map, by End-user

Figure 7: Key Industry Evolution/Developments

Figure 8: Urology Devices Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 9: Opportunity Analysis

Figure 10: Porter’s Five Force Analysis

Figure 11: Value Chain Analysis

Figure 12: Global Urology Devices Market Value Share, by Product Type, 2021

Figure 13: Global Urology Devices Market Value Share, by Region, 2021

Figure 14: Global Urology Devices Market Value Share, by End-user, 2021

Figure 15: Global Urology Devices Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 16: Global Urology Devices Market Value (US$ Bn) and Y-o-Y Growth (%), by Dialysis Products, 2017–2031

Figure 17: Global Urology Devices Market Value (US$ Bn) and Y-o-Y Growth (%), by Endoscopes, Endovision Systems & Peripheral Instruments, 2017–2031

Figure 18: Global Urology Devices Market Value (US$ Bn) and Y-o-Y Growth (%), by Laser & Lithotripsy, 2017–2031

Figure 19: Global Urology Devices Market Value (US$ Bn) and Y-o-Y Growth (%), by Robotic Systems, 2017–2031

Figure 20: Global Urology Devices Market Value (US$ Bn) and Y-o-Y Growth (%), by Urodynamic Systems, 2017–2031

Figure 21: Global Urology Devices Market Value (US$ Bn) and Y-o-Y Growth (%), by Urology Catheters, 2017–2031

Figure 22: Global Urology Devices Market Value (US$ Bn) and Y-o-Y Growth (%), by Biopsy Devices, 2017–2031

Figure 23: Global Urology Devices Market Value (US$ Bn) and Y-o-Y Growth (%), by Stents, 2017–2031

Figure 24: Global Urology Devices Market Value (US$ Bn) and Y-o-Y Growth (%), by Urology Guidewires, 2017–2031

Figure 25: Global Urology Devices Market Value (US$ Bn) and Y-o-Y Growth (%), by Drainage Bags, 2017–2031

Figure 26: Global Urology Devices Market Value (US$ Bn) and Y-o-Y Growth (%), by Others, 2017–2031

Figure 27: Global Urology Devices Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 28: Global Urology Devices Market Value Share, by End-user, 2021 and 2031

Figure 29: Global Urology Devices Market Value (US$ Bn) and Y-o-Y Growth (%), by Hospitals 2017–2031

Figure 30: Global Urology Devices Market Value (US$ Bn) and Y-o-Y Growth (%), by Dialysis Centers, 2017–2031

Figure 31: Global Urology Devices Market Value (US$ Bn) and Y-o-Y Growth (%), by Others, 2017–2031

Figure 32: Global Urology Devices Market Attractiveness Analysis, by End-user, 2022-2031

Figure 33: Global Urology Devices Market Scenario

Figure 34: Global Urology Devices Market Value Share Analysis, by Region, 2021 and 2031

Figure 35: Global Urology Devices Market Attractiveness Analysis, by Region, 2022-2031

Figure 36: North America Urology Devices Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 37: North America Urology Devices Market Value Share, by Country, 2021 and 2031

Figure 38: North America Urology Devices Market Attractiveness Analysis, by Country, 2022-2031

Figure 39: North America Urology Devices Market Value Share, by Product Type, 2021 and 2031

Figure 40: North America Urology Devices Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 41: North America Urology Devices Market Value Share, by End-user, 2021 and 2031

Figure 42: North America Urology Devices Market Attractiveness Analysis, by End-user, 2022-2031

Figure 43: Europe Urology Devices Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 44: Europe Urology Devices Market Value Share, by Country/Sub-region, 2021 and 2031

Figure 45: Europe Urology Devices Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 46: Europe Urology Devices Market Value Share, by Product Type, 2021 and 2031

Figure 47: Europe Urology Devices Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 48: Europe Urology Devices Market Value Share, by End-user, 2021 and 2031

Figure 49: Europe Urology Devices Market Attractiveness Analysis, by End-user, 2022-2031

Figure 50: Asia Pacific Urology Devices Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, 2017‒2031

Figure 51: Asia Pacific Urology Devices Market Value Share, by Country/Sub-region, 2021 and 2031

Figure 52: Asia Pacific Urology Devices Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 53: Asia Pacific Urology Devices Market Value Share, by Product Type, 2021 and 2031

Figure 54: Asia Pacific Urology Devices Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 55: Asia Pacific Urology Devices Market Value Share, by End-user, 2021 and 2026

Figure 56: Asia Pacific Urology Devices Market Attractiveness Analysis, by End-user, 2022-2031

Figure 57: Latin America Urology Devices Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, 2016‒2026

Figure 58: Latin America Urology Devices Market Value Share, by Country/Sub-region, 2021 and 2026

Figure 59: Latin America Urology Devices Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 60: Latin America Urology Devices Market Value Share, by Product Type, 2021 and 2026

Figure 61: Latin America Urology Devices Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 62: Latin America Urology Devices Market Value Share, by End-user, 2021 and 2026

Figure 63: Latin America Urology Devices Market Attractiveness Analysis, by End-user, 2022-2031

Figure 64: Middle East & Africa Urology Devices Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 65: Middle East & Africa Urology Devices Market Value Share, by Country/Sub-region, 2021 and 2026

Figure 66: Middle East & Africa Urology Devices Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 67: Middle East & Africa Urology Devices Market Value Share, by Product Type, 2021 and 2026

Figure 68: Middle East & Africa Urology Devices Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 69: Middle East & Africa Urology Devices Market Value Share, by End-user, 2021 and 2031

Figure 70: Middle East & Africa Urology Devices Market Attractiveness Analysis, by End-user, 2022-2031

Figure 71: Medtronic plc. Revenue (US$ Bn) and Y-o-Y Growth (%), 2017–2021

Figure 72: Medtronic plc. Operating Profit (US$ Bn) and Y-o-Y Growth (%), 2017–2021

Figure 73: Medtronic plc. Gross Profit (US$ Bn) and Y-o-Y Growth (%), 2017–2021

Figure 73: Medtronic plc. Gross Profit (US$ Bn) and Y-o-Y Growth (%), 2017–2021

Figure 75: Medtronic plc. Breakdown of Customers (%), by Segment, 2021

Figure 76: Fresenius SE & Co. KGaA Revenue (US$ Bn) & Y-o-Y Growth (%), 2016–2020

Figure 77: Fresenius SE & Co. KGaA R&D Expenses (US$ Bn) and Y-o-Y Growth (%), 2016–2020

Figure 78: Fresenius SE & Co. KGaA Breakdown of Net Sales, by Business Segment, 2020

Figure 79: Fresenius SE & Co. KGaA Breakdown of Net Sales, by Region, 2020

Figure 80: Fresenius Medical Care Revenue (US$ Bn) & Y-o-Y Growth (%), 2016–2020

Figure 81: Fresenius Medical Care R&D Expenses (US$ Bn) and Y-o-Y Growth (%), 2016–2020

Figure 82: Fresenius Medical Care Breakdown of Net Sales, by Business Segment, 2020

Figure 83: Fresenius Medical Care Breakdown of Net Sales, by Region, 2020

Figure 84: Baxter Revenue (US$ Bn) and Y-o-Y Growth (%), 2017–2021

Figure 85: Baxter R&D Expenses (US$ Bn) and Y-o-Y Growth (%), 2017–2021

Figure 86: Baxter Breakdown of Net Sales, by Region, 2021

Figure 87: Baxter Breakdown of Net Sales (%), by Business Segment, 2021

Figure 88: BD Revenue (US$ Bn) and Y-o-Y Growth (%), 2017–2021

Figure 89: BD R&D Intensity and Sales & Marketing Intensity – Company Level, (US$ Bn), 2017–2021

Figure 90: BD Breakdown of Net Sales, by Region, 2021

Figure 91: BD Breakdown of Net Sales, by Business Segment, 20121

Figure 92: Siemens Healthineers (Siemens AG) Revenue (US$ Bn) and Y-o-Y Growth (%), 2017–2021

Figure 93: Siemens Healthineers (Siemens AG) Research and Development Expenses, 2017–2021

Figure 94: Siemens Healthineers (Siemens AG) Breakdown of Net Sales (% Share), by Business Segment (2021)

Figure 95: Siemens Healthineers (Siemens AG) Breakdown of Net Sales (% Share), by Region (2021)