Analysts’ Viewpoint on Urinary Incontinence Treatment Devices Market Scenario

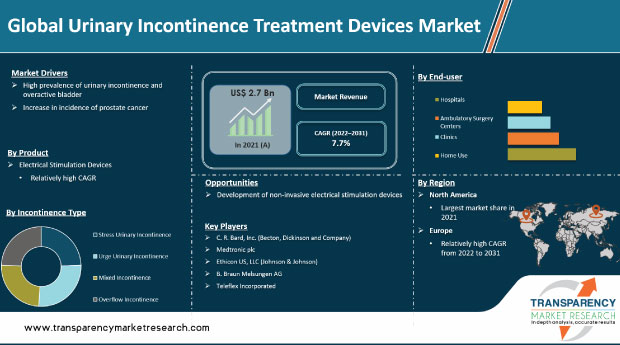

The number of people with urinary incontinence is increasing globally. According to a study, more than 60% women have some type of urinary incontinence. Companies are investing significantly in the development and introduction of new urinary incontinence treatment devices in order to provide the best treatment options to patients. Several market players are engaged in the development and launch of new electrical stimulation devices, such as Medtronic plc’s NURO System, for percutaneous tibial nerve stimulation for the treatment of overactive bladder. Numerous companies are offering non-invasive, over-the-counter electrical stimulation devices for incontinence. Therefore, the global urinary incontinence treatment devices market is projected to present significant opportunities for leading players in the next few years. Usage of electrical stimulation devices is increasing, as they are effective for relieving symptoms of all types of urinary incontinence, and the devices are gaining popularity as these are considered safe and effective. Therefore, new developments and technological advancements are expected to drive the global urinary incontinence treatment devices market during the forecast period.

Urinary incontinence is defined as involuntary release of urine due to loss of bladder control. Urinary incontinence devices are used for the treatment of urinary incontinence. Over 500 million people across the globe are affected by the condition and its incidence increases with age. Several factors such as urinary tract infection, weakening of pelvic floor muscles & urethral sphincters, menopause, pregnancy & childbirth, and post radical prostatectomy surgery in men lead to the development of urinary incontinence symptoms.

The global urinary incontinence treatment devices market size is likely to grow at a rapid pace during the forecast period. High prevalence of urinary incontinence and overactive bladder across the globe and technological advancements, such as non-implantable electrical stimulation devices, are projected to propel the global market during the forecast period.

Urinary incontinence is one of the highly prevalent and largely underreported and under diagnosed urological disorders in the world, affecting millions of people. It has a severe effect on physical, psychological, and emotional health of patients. Women are affected twice as much as men, and the incidence increases with age. Several factors such as weak pelvic floor muscles, urethral sphincters, obesity, pregnancy & childbirth, urinary tract infection, and neurological disorders cause urinary incontinence. Around 200 million people are affected by some form of urinary incontinence or bladder problems. Urinary incontinence and stress urinary incontinence are the most common forms affecting millions of people globally. Therefore, a large patient pool with stress urinary incontinence and overactive bladder symptoms is expected to augment the global urinary incontinence treatment devices market during the forecast period.

Patients undergoing radical prostectomy surgery are at a high risk of developing post prostatectomy urinary incontinence. Radical prostectomy surgery, either through radiation or surgical dissection, affects the bladder’s capacity to hold urine or causes spasms that force urine out. Additionally, radical prostectomy surgery adversely affects the nerves that control bladder function, resulting in urinary incontinence. Prostate cancer is the fourth-leading cancer affecting both men and women, and it is the second most common cancer in men followed by lung cancer. Studies have shown that the rate of stress urinary incontinence among men ranges from 2% to 69% after undergoing prostate surgery. This factor is likely to drive the global urinary incontinence treatment devices market during the forecast period.

In terms of product, the global urinary incontinence treatment devices market has been classified into urethral slings, electrical stimulation devices, artificial urinary sphincters, and catheters. The urethral slings segment has been bifurcated into female slings and male slings. The electrical stimulation devices segment has been spilt into implantable and non-implantable.

The electrical stimulation devices segment dominated the global urinary incontinence treatment devices market, with a share of around 42% in 2021. The trend is expected to continue during the forecast period. The electrical stimulation devices segment is propelled by rise in the demand for minimally invasive/wearable and non-implantable electrical stimulation devices to strengthen the pelvic floor muscles, high success rates with electrical stimulation devices, and favorable medical reimbursement policies in developed countries for implantable electrical stimulation devices.

Based on incontinence type, the global urinary incontinence treatment devices market has been segregated into stress urinary incontinence, urge urinary incontinence, mixed incontinence, and overflow incontinence. The urge incontinence segment held major share of around 40% of the global market in 2021. The trend is likely to continue during the forecast period. Growth of the segment can be attributed to higher cost of treatment devices, especially implantable electrical stimulation devices, than other treatment devices/methods such as indwelling Foley catheters. Furthermore, analysis of global urinary incontinence treatment devices market trends revealed an increase in incidence of urge incontinence, rise in adoption of electrical stimulation devices for overactive bladder treatment, and new product launches are likely to propel the segment during the forecast period.

In terms of end-user, the global urinary incontinence treatment devices market has been divided into hospitals, ambulatory surgery centers, clinics, and home use. The hospitals segment held major share of around 60% of the global market in 2021. Growth of the segment can be attributed to increase in the number of surgical procedures for the treatment of all types of urinary incontinence and favorable reimbursement policies for medical devices in most of the developed and developing countries.

North America accounted for the largest global urinary incontinence treatment devices market share of around 42% in 2021. Early adoption of technologies, large patient pool of urinary incontinence, and easy availability & lucrative medical reimbursement policies in the U.S. and Canada are attributed to North America’s prominent market share in 2021.

Europe held around 32% share of the global market in 2021. The market in the region grew at a faster growth rate in 2021 owing to high prevalence and increase in incidence of urinary incontinence, surge in adoption of technologically advanced products, large base of medical device companies, and high number of products in pipeline for the treatment of urinary incontinence.

Asia Pacific held larger share of the global urinary incontinence treatment devices market than Latin America and Middle East & Africa. However, the market in Latin America is likely to grow at a faster pace than in Middle East & Africa.

The urinary incontinence treatment devices market report concludes with the company profiles section, which includes key information about major players in the global urinary incontinence treatment devices market. Leading players in the global urinary incontinence treatment devices market include C. R. Bard, Inc. (Becton, Dickinson and Company), Coloplast Group, Promedon Group, A.M.I. GmbH, Ethicon US, LLC. (Johnson & Johnson), ZSI Surgical Implants S.R.L., Medtronic plc, InControl Medical LLC, Hollister Incorporated, Atlantic Therapeutics Group Ltd., B. Braun Melsungen AG, and Teleflex Incorporated.

Each of these players has been profiled in the urinary incontinence treatment devices market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 2.7 Bn |

|

Market Forecast Value in 2031 |

More than US$ 5.5 Bn |

|

Growth Rate (CAGR) for 2022-2031 |

7.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global urinary incontinence treatment devices market was valued at US$ 2.7 Bn in 2021.

The global urinary incontinence treatment devices market is projected to reach more than US$ 5.5 Bn by 2031.

The global urinary incontinence treatment devices market is anticipated to grow at a CAGR of 7.7% from 2022 to 2031.

The electrical stimulation devices segment held around 42% share of the global urinary incontinence treatment devices market in 2021.

North America is expected to account for major share of the global market during the forecast period.

C. R. Bard, Inc. (Becton, Dickinson and Company), Coloplast Group, Promedon Group, A.M.I. GmbH, Ethicon US, LLC. (Johnson & Johnson), ZSI Surgical Implants S.R.L., Medtronic plc, InControl Medical LLC, Hollister Incorporated, Atlantic Therapeutics Group Ltd., B. Braun Melsungen AG, and Teleflex Incorporated.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Urinary Incontinence Treatment Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Urinary Incontinence Treatment Devices Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Prevalence of Urinary Incontinence, by Key Region

5.3. Regulatory & Reimbursement Scenario, by Country/Region

5.4. COVID-19 Impact Analysis

6. Global Urinary Incontinence Treatment Devices Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Urethral Slings

6.3.1.1. Female Slings

6.3.1.2. Male Slings

6.3.2. Electrical Stimulation Devices

6.3.2.1. Implantable

6.3.2.2. Non-implantable

6.3.3. Artificial Urinary Sphincters

6.3.4. Catheters

6.4. Market Attractiveness Analysis, by Product

7. Global Urinary Incontinence Treatment Devices Market Analysis and Forecast, by Incontinence Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Incontinence Type, 2017–2031

7.3.1. Stress Urinary Incontinence

7.3.2. Urge Urinary Incontinence

7.3.3. Mixed Incontinence

7.3.4. Overflow Incontinence

7.4. Market Attractiveness Analysis, by Incontinence Type

8. Global Urinary Incontinence Treatment Devices Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Ambulatory Surgery Centers

8.3.3. Clinics

8.3.4. Home Use

8.4. Market Attractiveness Analysis, by End-user

9. Global Urinary Incontinence Treatment Devices Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Urinary Incontinence Treatment Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2031

10.2.1. Urethral Slings

10.2.1.1. Female Slings

10.2.1.2. Male Slings

10.2.2. Electrical Stimulation Devices

10.2.2.1. Implantable

10.2.2.2. Non-implantable

10.2.3. Artificial Urinary Sphincters

10.2.4. Catheters

10.3. Market Value Forecast, by Incontinence Type, 2017–2031

10.3.1. Stress Urinary Incontinence

10.3.2. Urge Urinary Incontinence

10.3.3. Mixed Incontinence

10.3.4. Overflow Incontinence

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Ambulatory Surgery Centers

10.4.3. Clinics

10.4.4. Home Use

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Incontinence Type

10.6.3. By End-user

10.6.4. By Country

11. Europe Urinary Incontinence Treatment Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Urethral Slings

11.2.1.1. Female Slings

11.2.1.2. Male Slings

11.2.2. Electrical Stimulation Devices

11.2.2.1. Implantable

11.2.2.2. Non-implantable

11.2.3. Artificial Urinary Sphincters

11.2.4. Catheters

11.3. Market Value Forecast, by Incontinence Type, 2017–2031

11.3.1. Stress Urinary Incontinence

11.3.2. Urge Urinary Incontinence

11.3.3. Mixed Incontinence

11.3.4. Overflow Incontinence

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Ambulatory Surgery Centers

11.4.3. Clinics

11.4.4. Home Use

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Incontinence Type

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Urinary Incontinence Treatment Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Urethral Slings

12.2.1.1. Female Slings

12.2.1.2. Male Slings

12.2.2. Electrical Stimulation Devices

12.2.2.1. Implantable

12.2.2.2. Non-implantable

12.2.3. Artificial Urinary Sphincters

12.2.4. Catheters

12.3. Market Value Forecast, by Incontinence Type, 2017–2031

12.3.1. Stress Urinary Incontinence

12.3.2. Urge Urinary Incontinence

12.3.3. Mixed Incontinence

12.3.4. Overflow Incontinence

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Ambulatory Surgery Centers

12.4.3. Clinics

12.4.4. Home Use

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Incontinence Type

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Urinary Incontinence Treatment Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Urethral Slings

13.2.1.1. Female Slings

13.2.1.2. Male Slings

13.2.2. Electrical Stimulation Devices

13.2.2.1. Implantable

13.2.2.2. Non-implantable

13.2.3. Artificial Urinary Sphincters

13.2.4. Catheters

13.3. Market Value Forecast, by Incontinence Type, 2017–2031

13.3.1. Stress Urinary Incontinence

13.3.2. Urge Urinary Incontinence

13.3.3. Mixed Incontinence

13.3.4. Overflow Incontinence

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Ambulatory Surgery Centers

13.4.3. Clinics

13.4.4. Home Use

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Incontinence Type

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Urinary Incontinence Treatment Devices Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017–2031

14.2.1. Urethral Slings

14.2.1.1. Female Slings

14.2.1.2. Male Slings

14.2.2. Electrical Stimulation Devices

14.2.2.1. Implantable

14.2.2.2. Non-implantable

14.2.3. Artificial Urinary Sphincters

14.2.4. Catheters

14.3. Market Value Forecast, by Incontinence Type, 2017–2031

14.3.1. Stress Urinary Incontinence

14.3.2. Urge Urinary Incontinence

14.3.3. Mixed Incontinence

14.3.4. Overflow Incontinence

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals

14.4.2. Ambulatory Surgery Centers

14.4.3. Clinics

14.4.4. Home Use

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Incontinence Type

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. C. R. Bard, Inc. (Becton, Dickinson and Company)

15.3.1.1. Company Description

15.3.1.2. Business Overview

15.3.1.3. Financial Overview

15.3.1.4. Strategic Overview

15.3.1.5. SWOT Analysis

15.3.2. Coloplast Group

15.3.2.1. Company Description

15.3.2.2. Business Overview

15.3.2.3. Financial Overview

15.3.2.4. Strategic Overview

15.3.2.5. SWOT Analysis

15.3.3. Promedon Group

15.3.3.1. Company Description

15.3.3.2. Business Overview

15.3.3.3. Financial Overview

15.3.3.4. Strategic Overview

15.3.3.5. SWOT Analysis

15.3.4. A.M.I. GmbH

15.3.4.1. Company Description

15.3.4.2. Business Overview

15.3.4.3. Financial Overview

15.3.4.4. Strategic Overview

15.3.4.5. SWOT Analysis

15.3.5. Ethicon US, LLC. (Johnson & Johnson)

15.3.5.1. Company Description

15.3.5.2. Business Overview

15.3.5.3. Financial Overview

15.3.5.4. Strategic Overview

15.3.5.5. SWOT Analysis

15.3.6. ZSI Surgical Implants S.R.L.

15.3.6.1. Company Description

15.3.6.2. Business Overview

15.3.6.3. Financial Overview

15.3.6.4. Strategic Overview

15.3.6.5. SWOT Analysis

15.3.7. Medtronic plc

15.3.7.1. Company Description

15.3.7.2. Business Overview

15.3.7.3. Financial Overview

15.3.7.4. Strategic Overview

15.3.7.5. SWOT Analysis

15.3.8. InControl Medical LLC

15.3.8.1. Company Description

15.3.8.2. Business Overview

15.3.8.3. Financial Overview

15.3.8.4. Strategic Overview

15.3.8.5. SWOT Analysis

15.3.9. Hollister Incorporated

15.3.9.1. Company Description

15.3.9.2. Business Overview

15.3.9.3. Financial Overview

15.3.9.4. Strategic Overview

15.3.9.5. SWOT Analysis

15.3.10. Atlantic Therapeutics Group Ltd.

15.3.10.1. Company Description

15.3.10.2. Business Overview

15.3.10.3. Financial Overview

15.3.10.4. Strategic Overview

15.3.10.5. SWOT Analysis

15.3.11. B. Braun Melsungen AG

15.3.11.1. Company Description

15.3.11.2. Business Overview

15.3.11.3. Financial Overview

15.3.11.4. Strategic Overview

15.3.11.5. SWOT Analysis

15.3.12. Teleflex Incorporated

15.3.12.1. Company Description

15.3.12.2. Business Overview

15.3.12.3. Financial Overview

15.3.12.4. Strategic Overview

15.3.12.5. SWOT Analysis

List of Tables

Table 01: Global Urinary Incontinence Treatment Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Urinary Incontinence Treatment Devices Market Value (US$ Mn) Forecast, by Incontinence Type, 2017–2031

Table 03: Global Urinary Incontinence Treatment Devices Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 04: Global Urinary Incontinence Treatment Devices Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Urinary Incontinence Treatment Devices Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Urinary Incontinence Treatment Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 07: North America Urinary Incontinence Treatment Devices Market Value (US$ Mn) Forecast, by Incontinence Type, 2017–2031

Table 08: North America Urinary Incontinence Treatment Devices Market (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Urinary Incontinence Treatment Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Urinary Incontinence Treatment Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 11: Europe Urinary Incontinence Treatment Devices Market Value (US$ Mn) Forecast, by Incontinence Type, 2017–2031

Table 12: Europe Urinary Incontinence Treatment Devices Market (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Asia Pacific Urinary Incontinence Treatment Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Urinary Incontinence Treatment Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 15: Asia Pacific Urinary Incontinence Treatment Devices Market Value (US$ Mn) Forecast, by Incontinence Type, 2017–2031

Table 16: Asia Pacific Urinary Incontinence Treatment Devices Market (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Latin America Urinary Incontinence Treatment Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America Urinary Incontinence Treatment Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 19: Latin America Urinary Incontinence Treatment Devices Market Value (US$ Mn) Forecast, by Incontinence Type, 2017–2031

Table 20: Latin America Urinary Incontinence Treatment Devices Market (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Middle East & Africa Urinary Incontinence Treatment Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa Urinary Incontinence Treatment Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 23: Middle East & Africa Urinary Incontinence Treatment Devices Market Value (US$ Mn) Forecast, by Incontinence Type, 2017–2031

Table 24: Middle East & Africa Urinary Incontinence Treatment Devices Market (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Urinary Incontinence Treatment Devices Market, by Product, 2021 and 2031

Figure 02: Global Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 03: Global Urinary Incontinence Treatment Devices Market (US$ Mn), by Urethral Slings, 2017–2031

Figure 04: Global Urinary Incontinence Treatment Devices Market (US$ Mn), by Electrical Stimulation Devices, 2017–2031

Figure 05: Global Urinary Incontinence Treatment Devices Market (US$ Mn), by Artificial Urinary Sphincters, 2017–2031

Figure 06: Global Urinary Incontinence Treatment Devices Market (US$ Mn), by Catheters, 2017–2031

Figure 07: Global Urinary Incontinence Treatment Devices Market, by Incontinence Type, 2021 and 2031

Figure 08: Global Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Incontinence Type, 2022–2031

Figure 09: Global Urinary Incontinence Treatment Devices Market (US$ Mn), by Stress Urinary Incontinence, 2017–2031

Figure 10: Global Urinary Incontinence Treatment Devices Market (US$ Mn), by Urge Urinary Incontinence, 2017–2031

Figure 11: Global Urinary Incontinence Treatment Devices Market (US$ Mn), by Mixed Incontinence, 2017–2031

Figure 12: Global Urinary Incontinence Treatment Devices Market (US$ Mn), by Overflow Incontinence, 2017–2031

Figure 13: Global Urinary Incontinence Treatment Devices Market, by End-user, 2021 and 2031

Figure 14: Global Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 15: Global Urinary Incontinence Treatment Devices Market (US$ Mn), by Hospitals, 2017–2031

Figure 16: Global Urinary Incontinence Treatment Devices Market (US$ Mn), by Ambulatory Surgery Centers, 2017–2031

Figure 17: Global Urinary Incontinence Treatment Devices Market (US$ Mn), by Clinics, 2017–2031

Figure 18: Global Urinary Incontinence Treatment Devices Market (US$ Mn), by Home Use, 2017–2031

Figure 19: Global Urinary Incontinence Treatment Devices Market Value Share Analysis, by Region, 2021 and 2031

Figure 20: Global Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Region, 2022–2031

Figure 21: North America Urinary Incontinence Treatment Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 22: North America Urinary Incontinence Treatment Devices Market Value Share Analysis, by Country, 2021 and 2031

Figure 23: North America Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Country, 2022–2031

Figure 24: North America Urinary Incontinence Treatment Devices Market, by Product, 2021 and 2031

Figure 25: North America Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 26: North America Urinary Incontinence Treatment Devices Market, by Incontinence Type, 2021 and 2031

Figure 27: North America Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Incontinence Type, 2022–2031

Figure 28: North America Urinary Incontinence Treatment Devices Market, by End-user, 2021 and 2031

Figure 29: North America Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 30: Europe Urinary Incontinence Treatment Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 31: Europe Urinary Incontinence Treatment Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 32: Europe Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 33: Europe Urinary Incontinence Treatment Devices Market, by Product, 2021 and 2031

Figure 34: Europe Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 35: Europe Urinary Incontinence Treatment Devices Market, by Incontinence Type, 2021 and 2031

Figure 36: Europe Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Incontinence Type, 2022–2031

Figure 37: Europe Urinary Incontinence Treatment Devices Market, by End-user, 2021 and 2031

Figure 38: Europe Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 39: Asia Pacific Urinary Incontinence Treatment Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 40: Asia Pacific Urinary Incontinence Treatment Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 41: Asia Pacific Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 42: Asia Pacific Urinary Incontinence Treatment Devices Market, by Product, 2021 and 2031

Figure 43: Asia Pacific Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 44: Asia Pacific Urinary Incontinence Treatment Devices Market, by Incontinence Type, 2021 and 2031

Figure 45: Asia Pacific Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Incontinence Type, 2022–2031

Figure 46: Asia Pacific Urinary Incontinence Treatment Devices Market, by End-user, 2021 and 2031

Figure 47: Asia Pacific Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 48: Latin America Urinary Incontinence Treatment Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 49: Latin America Urinary Incontinence Treatment Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 50: Latin America Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 51: Latin America Urinary Incontinence Treatment Devices Market, by Product, 2021 and 2031

Figure 52: Latin America Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 53: Latin America Urinary Incontinence Treatment Devices Market, by Incontinence Type, 2021 and 2031

Figure 54: Latin America Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Incontinence Type, 2022–2031

Figure 55: Latin America Urinary Incontinence Treatment Devices Market, by End-user, 2021 and 2031

Figure 56: Latin America Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 57: Middle East & Africa Urinary Incontinence Treatment Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 58: Middle East & Africa Urinary Incontinence Treatment Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 59: Middle East & Africa Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 60: Middle East & Africa Urinary Incontinence Treatment Devices Market, by Product, 2021 and 2031

Figure 61: Middle East & Africa Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Product, 2022–2031

Figure 62: Middle East & Africa Urinary Incontinence Treatment Devices Market, by Incontinence Type, 2021 and 2031

Figure 63: Middle East & Africa Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Incontinence Type, 2022–2031

Figure 64: Middle East & Africa Urinary Incontinence Treatment Devices Market, by End-user, 2021 and 2031

Figure 65: Middle East & Africa Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by End-user, 2022–2031