The global urinary incontinence treatment devices market is driven by high prevalence and rapidly increasing incidence of urinary incontinence across the globe. The global market was valued at US$ 2.21 Bn in 2018 and is projected to expand at a CAGR of 7.5% from 2019 to 2027 to reach US$ 4.20 Bn by 2027. High growth of the market is attributed to increase in adoption, easy availability of electrical vaginal stimulation devices, and rise in demand for minimally invasive or non-surgical products across the globe.

Urinary incontinence is defined as involuntary release of urine due to loss of bladder control. Millions of people across the world are affected by urinary incontinence and women are more likely to be affected than men. Urinary incontinence is highly underreported primarily due to embarrassment to speak about it. Over 500 million people across the globe are affected by the condition and its incidence increases with age. Several factors such as urinary tract infection, weakening of pelvic floor muscles & urethral sphincters, menopause, pregnancy & childbirth, and post radical prostatectomy surgery in men lead to the development of urinary incontinence symptoms. According to the International Continence Society, around 12% (both men and women) of the global geriatric population is affected by overactive bladder and its incidence increases with age. In the past few years, various treatment devices such as urethral slings, electrical stimulation devices, artificial urinary sphincters, and catheters have been developed and are increasingly used for effective management of urinary incontinence. Rise in demand for minimally invasive surgery and non-invasive treatment devices and new product launches in the electrical stimulation devices segment are projected to accelerate the growth of the global urinary incontinence treatment devices market during the forecast period.

The global urinary incontinence treatment devices market has been segmented based on product, incontinence type, end-user, and region. In terms of product, the market has been classified into urethral slings, electrical stimulation devices, artificial urinary sphincters, and catheters. The urethral slings segment has been bifurcated into female slings and male slings. The female slings sub-segment dominated the urethral slings segment in 2018. The sub-segment is projected to gain market share from 2019 to 2027. The electrical stimulation devices segment has been categorized into implantable and non-implantable. Medtronic plc’s InterStim device is the only implantable electrical simulation device available in the market for the treatment of overactive bladder symptoms. Vaginal electrical stimulation devices are widely used and demand for these devices is increasing significantly across the globe. Urinary catheters such as Foley catheters, intermittent catheters, and external catheters dominated the global urinary incontinence treatment devices market. High adoption of Foley catheters and intermittent catheters for emptying the bladder, technologically advanced products to prevent infection, and ease of use of intermittent catheters are attributed to the large market share of the catheters segment. Based on incontinence type, the global urinary incontinence treatment devices market has been divided into stress urinary incontinence, urge urinary incontinence, mixed incontinence, and overflow incontinence. The urge incontinence segment dominated the global market in 2018. The segment is anticipated grow at a rapid pace during the forecast period.

In terms of end-user, the global urinary incontinence treatment devices market has been classified into hospitals, ambulatory surgery centers, clinics, and home use. The hospitals segment accounted for major share of the global market in 2018, followed by the ambulatory surgery centers segment. Increase in the number of multinational hospitals with advanced sling surgery techniques such TVT & TOT and adoption of mini slings are expected to boost the growth of the hospitals and ambulatory surgery centers segments during the forecast period.

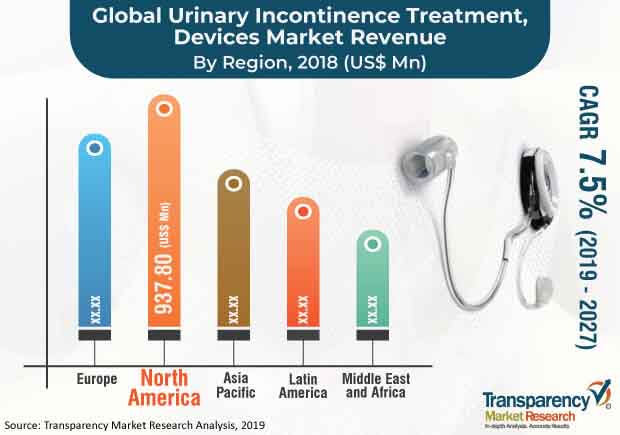

Geographically, the global urinary incontinence treatment devices market has been segmented into five major regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America accounted for the largest share of the global market in 2018, followed by Europe. Well-established health care facilities, favorable reimbursement policies, and early adoption of technologically advanced products for the management of urinary incontinence have contributed to North America’s large market share. Europe is projected to be the most attractive market for urinary incontinence treatment devices from 2019 to 2027. The market in the region is anticipated to expand at the highest CAGR during the forecast period due to high prevalence and increase in incidence of urinary incontinence in the region, recent launch of wearable electrical stimulation devices, and high per capita health care expenditure.

The global urinary incontinence treatment devices market is consolidated, with small number of companies accounting for majority market share. Key players operating in the global market include Boston Scientific Corporation, C. R. Bard, Inc. (Becton, Dickinson and Company), Coloplast Group, Promedon Group, Medtronic plc, and Ethicon US, LLC. (Johnson & Johnson). These players exhibit significant geographical outreach, with presence in multiple urinary incontinence treatment devices segments. Manufacturers are adopting acquisition & collaboration and new product development strategies to tap the unmet needs of a large proportion of urinary incontinence patient pool. Other prominent players in the global urinary incontinence treatment devices market include ZSI Surgical Implants S.R.L., InControl Medical LLC, Hollister Incorporated, Atlantic Therapeutics Group Ltd., B. Braun Melsungen AG, A.M.I. GmbH, and Teleflex Incorporated.

Increasing Awareness About Health Burden to Spur Urinary Incontinence Treatment Devices Market Growth

A variety of mechanical devices for managing urinary incontinence treatment (UTI) have made commercial launches over the past few years. New designs have come especially targeting women population, and over the years established themselves as a popular alternative to surgery. The substantial health burden UTI carries for both men and women is a key aspect driving the evolution of the urinary incontinence treatment (UTI) devices market. The current demography is a vital factor in driving the development of new devices in the healthcare industry. A growing body of incontinence research has in only in recent years have come to recognize the health-related impact of UTI on sufferers. Thus, policy makers and medical professionals have been supporting funding in the UTI devices market. Particularly, the general public has woken up to the misconception that UTI may just be a normal part of the aging process, or that these effect women in only certain clinical conditions. The changing perception has also encouraged device makers to take interest in the UTI devices market.

Interestingly, developed nations a number of prevalence studies have propelled the prospects of the UTI devices market. Europe, Asia Pacific, and North America have been at the forefront of such studies. The growing demand for devices for controlling adult female urinary incontinence is one of the trends that have kept the UTI devices market lucrative.

The currently emerging Covid-19 has caused wide repercussions on the manufacturing sector across industries. One of the most severely impacted is the medical devices manufacturing. The pandemic-led disruptions in economic activities have been largely responsible for lack of quality clinical data to assess the effectiveness of new devices in the UTI devices market. On the other hand, pharmaceutical industry has in recent months faced some of the severe budget constraints of the decade. This has also shaped the investment priorities of the medical technology companies operating in the UTI devices market. Further, decline in people seeking hospital care has also restrained the potential prospects of the UTI devices market.

Urinary incontinence treatment devices market to reach US$ 4.20 Bn by 2027

Urinary incontinence treatment devices market is projected to expand at a CAGR of 7.5% from 2019 to 2027

Urinary incontinence treatment devices market is driven by high prevalence and rapidly increasing incidence of urinary incontinence across the globe

The urge urinary incontinence segment is projected to dominate the global urinary incontinence treatment market during the forecast period

Key players in the global urinary incontinence treatment devices market include Boston Scientific Corporation, C. R. Bard, Inc. (Becton, Dickinson and Company), Coloplast Group, Promedon Group, Medtronic plc

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Urinary Incontinence Treatment Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Urinary Incontinence Treatment Devices Market Analysis and Forecast, 2017–2027

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Prevalence of Urinary Incontinence, by Key Region

5.2. Technological Advancements

5.3. Regulatory & Reimbursement Scenario, by Country/Region

5.4. Pricing Analysis, by Electrical Simulation Devices, by Country

5.5. Key Mergers and Acquisitions

5.6. New Product Launch & Approvals

5.7. Guidelines for Managing Urinary Incontinence

5.8. New Approaches and Developments in Urinary Incontinence Treatment Devices

6. Global Urinary Incontinence Treatment Devices Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2027

6.3.1. Urethral Slings

6.3.1.1. Female Slings

6.3.1.2. Male Slings

6.3.2. Electrical Stimulation Devices

6.3.2.1. Implantable

6.3.2.2. Non-implantable

6.3.3. Artificial Urinary Sphincters

6.3.4. Catheters

6.4. Market Attractiveness, by Product

7. Global Urinary Incontinence Treatment Devices Market Analysis and Forecast, by Incontinence Type

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Incontinence Type, 2017–2027

7.3.1. Stress Urinary Incontinence

7.3.2. Urge Urinary Incontinence

7.3.3. Mixed Incontinence

7.3.4. Overflow Incontinence

7.4. Market Attractiveness, by Incontinence Type

8. Global Urinary Incontinence Treatment Devices Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2027

8.3.1. Hospitals

8.3.2. Ambulatory Surgery Centers

8.3.3. Clinics

8.3.4. Home Use

8.4. Market Attractiveness, by End-user

9. Global Urinary Incontinence Treatment Devices Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness, by Country/Region

10. North America Urinary Incontinence Treatment Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2027

10.2.1. Urethral Slings

10.2.1.1. Female Slings

10.2.1.2. Male Slings

10.2.2. Electrical Stimulation Devices

10.2.2.1. Implantable

10.2.2.2. Non-implantable

10.2.3. Artificial Urinary Sphincters

10.2.4. Catheters

10.3. Market Value Forecast, by Incontinence Type, 2017–2027

10.3.1. Stress Urinary Incontinence

10.3.2. Urge Urinary Incontinence

10.3.3. Mixed Incontinence

10.3.4. Overflow Incontinence

10.4. Market Value Forecast, by End-user, 2017–2027

10.4.1. Hospitals

10.4.2. Ambulatory Surgery Centers

10.4.3. Clinics

10.4.4. Home Use

10.5. Market Value Forecast, by Country, 2017–2027

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Incontinence Type

10.6.3. By End-user

10.6.4. By Country

11. Europe Urinary Incontinence Treatment Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2027

11.2.1. Urethral Slings

11.2.1.1. Female Slings

11.2.1.2. Male Slings

11.2.2. Electrical Stimulation Devices

11.2.2.1. Implantable

11.2.2.2. Non-implantable

11.2.3. Artificial Urinary Sphincters

11.2.4. Catheters

11.3. Market Value Forecast, by Incontinence Type, 2017–2027

11.3.1. Stress Urinary Incontinence

11.3.2. Urge Urinary Incontinence

11.3.3. Mixed Incontinence

11.3.4. Overflow Incontinence

11.4. Market Value Forecast, by End-user, 2017–2027

11.4.1. Hospitals

11.4.2. Ambulatory Surgery Centers

11.4.3. Clinics

11.4.4. Home Use

11.5. Market Value Forecast, by Country/Sub-region, 2017–2027

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Incontinence Type

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Urinary Incontinence Treatment Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2027

12.2.1. Urethral Slings

12.2.1.1. Female Slings

12.2.1.2. Male Slings

12.2.2. Electrical Stimulation Devices

12.2.2.1. Implantable

12.2.2.2. Non-implantable

12.2.3. Artificial Urinary Sphincters

12.2.4. Catheters

12.3. Market Value Forecast, by Incontinence Type, 2017–2027

12.3.1. Stress Urinary Incontinence

12.3.2. Urge Urinary Incontinence

12.3.3. Mixed Incontinence

12.3.4. Overflow Incontinence

12.4. Market Value Forecast, by End-user, 2017–2027

12.4.1. Hospitals

12.4.2. Ambulatory Surgery Centers

12.4.3. Clinics

12.4.4. Home Use

12.5. Market Value Forecast, by Country/Sub-region, 2017–2027

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Incontinence Type

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Urinary Incontinence Treatment Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2027

13.2.1. Urethral Slings

13.2.1.1. Female Slings

13.2.1.2. Male Slings

13.2.2. Electrical Stimulation Devices

13.2.2.1. Implantable

13.2.2.2. Non-implantable

13.2.3. Artificial Urinary Sphincters

13.2.4. Catheters

13.3. Market Value Forecast, by Incontinence Type, 2017–2027

13.3.1. Stress Urinary Incontinence

13.3.2. Urge Urinary Incontinence

13.3.3. Mixed Incontinence

13.3.4. Overflow Incontinence

13.4. Market Value Forecast, by End-user, 2017–2027

13.4.1. Hospitals

13.4.2. Ambulatory Surgery Centers

13.4.3. Clinics

13.4.4. Home Use

13.5. Market Value Forecast, by Country/Sub-region, 2017–2027

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Incontinence Type

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Urinary Incontinence Treatment Devices Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017–2027

14.2.1. Urethral Slings

14.2.1.1. Female Slings

14.2.1.2. Male Slings

14.2.2. Electrical Stimulation Devices

14.2.2.1. Implantable

14.2.2.2. Non-implantable

14.2.3. Artificial Urinary Sphincters

14.2.4. Catheters

14.3. Market Value Forecast, by Incontinence Type, 2017–2027

14.3.1. Stress Urinary Incontinence

14.3.2. Urge Urinary Incontinence

14.3.3. Mixed Incontinence

14.3.4. Overflow Incontinence

14.4. Market Value Forecast, by End-user, 2017–2027

14.4.1. Hospitals

14.4.2. Ambulatory Surgery Centers

14.4.3. Clinics

14.4.4. Home Use

14.5. Market Value Forecast, by Country/Sub-region, 2017–2027

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Incontinence Type

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (By Tier and Size of companies)

15.2. Company Profiles

15.2.1. Boston Scientific Corporation

15.2.2. C. R. Bard, Inc. (Becton, Dickinson and Company)

15.2.3. Coloplast Group

15.2.4. Promedon Group

15.2.5. A.M.I. GmbH

15.2.6. Ethicon US, LLC. (Johnson & Johnson)

15.2.7. ZSI Surgical Implants S.R.L.

15.2.8. Medtronic plc

15.2.9. InControl Medical LLC

15.2.10. Hollister Incorporated

15.2.11. Atlantic Therapeutics Group Ltd.

15.2.12. B. Braun Melsungen AG

15.2.13. Teleflex Incorporate

Table 01: Global Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by Product, 2017–2027

Table 02: Global Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by Urethral Slings, 2017–2027

Table 03: Global Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by Electrical Stimulation Devices, 2017–2027

Table 04: Global Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by Incontinence Type, 2017–2027

Table 05: Global Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by End-user, 2017–2027

Table 06: Global Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by Region, 2017–2027

Table 07: North America Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by Country, 2017–2027

Table 08: North America Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by Product, 2017–2027

Table 09: North America Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by Urethral Slings, 2017–2027

Table 10: North America Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by Electrical Stimulation Devices, 2017–2027

Table 11: North America Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by Incontinence Type, 2017–2027

Table 12: North America Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by End-user, 2017–2027

Table 13: Europe Urinary Incontinence Treatment Devices Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 14: Europe Urinary Incontinence Treatment Devices Market Revenue (US$ Mn) Forecast, by Product, 2017–2027

Table 15: Europe Urinary Incontinence Treatment Devices Market Revenue (US$ Mn) Forecast, by Urethral Slings, 2017–2027

Table 16: Europe Urinary Incontinence Treatment Devices Market Revenue (US$ Mn) Forecast, by Electrical Stimulation Devices, 2017–2027

Table 17: Europe Urinary Incontinence Treatment Devices Market Revenue (US$ Mn) Forecast, by Incontinence Type, 2017–2027

Table 18: Europe Urinary Incontinence Treatment Devices Market Revenue (US$ Mn) Forecast, by End-user, 2017–2027

Table 19: Asia Pacific Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 20: Asia Pacific Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by Product, 2017–2027

Table 21: Asia Pacific Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by Urethral Slings, 2017–2027

Table 22: Asia Pacific Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by Electrical Stimulation Devices, 2017–2027

Table 23: Asia Pacific Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by Incontinence Type, 2017–2027

Table 24: Asia Pacific Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by End-user, 2017–2027

Table 25: Latin America Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 26: Latin America Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by Product, 2017–2027

Table 27: Latin America Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by Urethral Slings, 2017–2027

Table 28: Latin America Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by Electrical Stimulation Devices, 2017–2027

Table 29: Latin America Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by Incontinence Type, 2017–2027

Table 30: Latin America Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by End-user, 2017–2027

Table 31: Middle East & Africa Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 32: Middle East & Africa Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by Product, 2017–2027

Table 33: Middle East & Africa Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by Urethral Slings, 2017–2027

Table 34: Middle East & Africa Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by Electrical Stimulation Devices, 2017–2027

Table 35: Middle East & Africa Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by Incontinence Type, 2017–2027

Table 36: Middle East & Africa Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, by End-user, 2017–2027

Figure 01: Global Urinary Incontinence Treatment Devices Market Size (US$ Mn) Forecast, 2017–2027

Figure 02: Market Value Share, by Product, 2018

Figure 03: Market Value Share, by Incontinence Type, 2018

Figure 04: Market Value Share, by End-user, 2018

Figure 05: Market Value Share, by Region, 2018

Figure 06: Global Urinary Incontinence Treatment Devices Market Value Share Analysis, by Product, 2018 and 2027

Figure 07: Global Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Product, 2019–2027

Figure 08: Global Urinary Incontinence Treatment Devices Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%), by Urethral Slings, 2017–2027

Figure 09: Global Urinary Incontinence Treatment Devices Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%), by Electrical Stimulation Devices, 2017–2027

Figure 10: Global Urinary Incontinence Treatment Devices Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%), by Artificial Urinary Sphincters, 2017–2027

Figure 11: Global Urinary Incontinence Treatment Devices Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%), by Catheters, 2017–2027

Figure 12: Global Urinary Incontinence Treatment Devices Market Value Share Analysis, by Incontinence Type, 2018 and 2027

Figure 13: Global Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Incontinence Type, 2019–2027

Figure 14: Global Urinary Incontinence Treatment Devices Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%), by Stress Urinary Incontinence, 2017–2027

Figure 15: Global Urinary Incontinence Treatment Devices Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%), by Urge Urinary Incontinence, 2017–2027

Figure 16: Global Urinary Incontinence Treatment Devices Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%), by Mixed Incontinence, 2017–2027

Figure 17: Global Urinary Incontinence Treatment Devices Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%), by Overflow Incontinence, 2017–2027

Figure 18: Global Urinary Incontinence Treatment Devices Market Value Share Analysis, by End-user, 2018 and 2027

Figure 19: Global Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by End-user, 2019–2027

Figure 20: Global Urinary Incontinence Treatment Devices Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%), by Hospitals, 2017–2027

Figure 21: Global Urinary Incontinence Treatment Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%), by Ambulatory Surgery Centers, 2017–2027

Figure 22: Global Urinary Incontinence Treatment Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%), by Clinics, 2017–2027

Figure 23: Global Urinary Incontinence Treatment Devices Revenue (US$ Mn) Forecast and Y-o-Y Growth (%), by Home Use, 2017–2027

Figure 24: Global Urinary Incontinence Treatment Devices Market Value Share, by Region, 2018 and 2027

Figure 25: Global Urinary Incontinence Treatment Devices Market Attractiveness, by Region, 2019–2027

Figure 26: North America Urinary Incontinence Treatment Devices Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 27: North America Urinary Incontinence Treatment Devices Market Value Share Analysis, by Country, 2018 and 2027

Figure 28: North America Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Country, 2018-2026

Figure 29: North America Urinary Incontinence Treatment Devices Market Value Share Analysis, by Product, 2018 and 2027

Figure 30: North America Urinary Incontinence Treatment Devices Market Value Share Analysis, by Incontinence Type, 2018 and 2027

Figure 31: North America Urinary Incontinence Treatment Devices Market Value Share Analysis, by End-user, 2018 and 2027

Figure 32: North America Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Product, 2019–2027

Figure 33: North America Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Incontinence Type, 2019–2027

Figure 34: North America Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by End-user, 2019–2027

Figure 35: Europe Urinary Incontinence Treatment Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 36: Europe Urinary Incontinence Treatment Devices Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 37: Europe Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 38: Europe Urinary Incontinence Treatment Devices Market Value Share Analysis, by Product, 2018 and 2027

Figure 39: Europe Urinary Incontinence Treatment Devices Market Value Share Analysis, by Incontinence Type, 2018 and 2027

Figure 40: Europe Urinary Incontinence Treatment Devices Market Value Share Analysis, by End-user, 2018 and 2027

Figure 41: Europe Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Product, 2019–2027

Figure 42: Europe Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Incontinence Type, 2019–2027

Figure 43: Europe Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by End-user, 2019–2027

Figure 44: Asia Pacific Urinary Incontinence Treatment Devices Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 45: Asia Pacific Urinary Incontinence Treatment Devices Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 46: Asia Pacific Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Country/Sub-region, 2018-2026

Figure 47: Asia Pacific Urinary Incontinence Treatment Devices Market Value Share Analysis, by Product, 2018 and 2027

Figure 48: Asia Pacific Urinary Incontinence Treatment Devices Market Value Share Analysis, by Incontinence Type, 2018 and 2027

Figure 49: Asia Pacific Urinary Incontinence Treatment Devices Market Value Share Analysis, by End-user, 2018 and 2027

Figure 50: Asia Pacific Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Product, 2019–2027

Figure 51: Asia Pacific Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Incontinence Type, 2019–2027

Figure 52: Asia Pacific Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by End-user, 2019–2027

Figure 53: Latin America Urinary Incontinence Treatment Devices Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 54: Latin America Urinary Incontinence Treatment Devices Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 55: Latin America Urinary Incontinence Treatment Devices Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 56: Latin America Urinary Incontinence Treatment Devices Market Value Share, by Product, 2018 and 2027

Figure 57: Latin America Urinary Incontinence Treatment Devices Market Value Share, by Incontinence Type, 2018 and 2027

Figure 58: Latin America Urinary Incontinence Treatment Devices Market Value Share, by End-user, 2018 and 2027

Figure 59: Latin America Urinary Incontinence Treatment Devices Market Attractiveness, by Product, 2019–2027

Figure 60: Latin America Urinary Incontinence Treatment Devices Market Attractiveness, by Incontinence Type, 2019–2027

Figure 61: Latin America Urinary Incontinence Treatment Devices Market Attractiveness, by End-user, 2019–2027

Figure 62: Middle East & Africa Urinary Incontinence Treatment Devices Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 63: Middle East & Africa Urinary Incontinence Treatment Devices Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 64: Middle East & Africa Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 65: Middle East & Africa Urinary Incontinence Treatment Devices Market Value Share Analysis, by Product, 2018 and 2027

Figure 66: Middle East & Africa Urinary Incontinence Treatment Devices Market Value Share Analysis, by Incontinence Type, 2018 and 2027

Figure 67: Middle East & Africa Urinary Incontinence Treatment Devices Market Value Share Analysis, by End-user, 2018 and 2027

Figure 68: Middle East & Africa Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Product, 2019–2027

Figure 69: Middle East & Africa Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by Incontinence Type, 2019–2027

Figure 70: Middle East & Africa Urinary Incontinence Treatment Devices Market Attractiveness Analysis, by End-user, 2019–2027