Global Umbilical Cord Blood Banking Market - Overview

Cord blood banking or umbilical cord blood banking is the technique of preserving blood from the mother’s umbilical cord for potential future use. Such preserved blood from the umbilical cord has its applications in medical therapies of similar approach to that of preserving of stem cells. The preserving of cord blood or simply umbilical blood banking is done for being able to use the cord blood stem cells in future for medicinal purpose or for re-populating blood and providing treatment for wide range of medical conditions. The blood from umbilical cord is known to be a possible source of progenitor cells. These cells are used for tissue reconstruction, reconstruction of organ and other operational areas.

It was in the year 1988 when the first successful umbilical cord blood transplantation procedure was performed successfully. Since then several thousands of transplants of unrelated donor cord blood have taken place across the globe. The umbilical cord blood transplantation is being suggested for the treatment of wide range of diseases that include different conditions such as lymphoma, immunity related conditions, leukemia, sarcoma, and even some metabolic diseases. The first ever umbilical cord blood banking institute was set up in 1991. In the same decade since then, several private as well as public umbilical blood banks became operational across the globe.

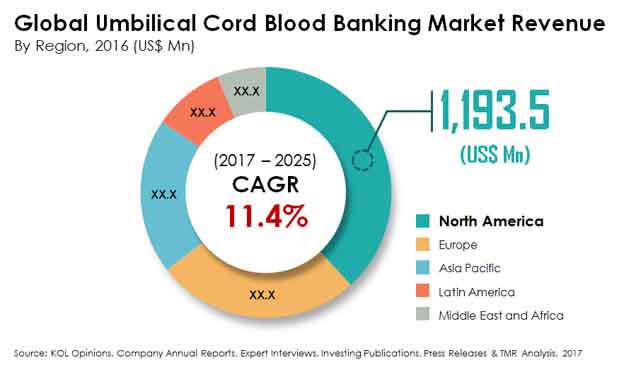

Transparency Market Research has now come up with a new research report that provides a detailed information about the overall working dynamics of the global umbilical cord blood banking market. As per the findings of the research report, the global market was initially valued at US$3,124.4 Mn in 2016. The market is projected to showcase a highly promising CAGR of 11.4% over the given period of forecast ranging from 2017 to 2025. Given this rate of development, the valuation of the umbilical cord blood banking market is expected to rise up to US$8,178.1 Mn by the fall of 2025.

In terms of type of storage, the global market for umbilical cord blood banking was primarily dominated by the segment of private cord blood banks. The segment nearly accounted for 65% of the overall market share in 2016. The segment of private cord blood banks provides storage of cord blood for the personal use of the donor’s family and charges for the storage. Typically, the average cost of processing, testing, and storing umbilical cord blood in these private banks is approximately US$1,500 with an additional US$150 charge per year for continuation of storage.

Private Cord Blood Banks Have Huge Advantage

In spite of such huge costs, this segment of private cord blood banks has been dominant in the global market and are projected to remain so in the coming years of the forecast period. The segment is projected to witness an eye-catching CAGR of 12.5% for the given period of assessment. There is a wide range of factors that is helping to drive the growth of the segment. Some of the key driving factors are complete rights of ownership are with the donor, flexible sites for collection, and secured and assured access to one’s cells. Such factors provide significant advantage and glamor to the segment due to which more and more people are getting interested in donating umbilical cord blood in such institutes over public banks.

Based on application, the global market for umbilical cord blood banking is being segmented into osteoporosis, immune disorders, metabolic disorders, blood disorders, and cancers. Of these, the segment of cancers and blood disorders are projected to have a highly promising growth in the coming years of the forecast period. With increasing research on oncology and treatment of cancer, study umbilical cord blood is expected to hold key for the future. Naturally, the segment of cancer is expected to have a strong development rate in the near future. Furthermore, with prevalence of blood disorders and the properties of cord blood to tackle the same is expected to help the development of the blood diseases segment.

In terms of end user, the global umbilical cord blood banking is segmented into hospitals, pharmaceutical research, and research institutes.

North America to Remain Dominant Market

Based on the geographical segmentation, the global umbilical cord blood banking market is segmented into five key regions. These regions are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America. Of these, currently, the global market is being dominated by the regional segment of North America. The regional segment accounted for nearly 38.2% of the overall market share in 2016. The North America market is projected to witness a constant growth curve in the coming years of the forecast period. This growth of the market is mainly due to the growing demand for preserving cord blood for research and studies. The US market alone accounts for nearly 83.8% share of the entire North America market in 2016 then followed by Canada. Presence of a highly developed and well settled healthcare infrastructure is key for the market growth in the US.

On the other hand, the regional segment of Asia Pacific is expected to witness a promising rate of growth in the coming years of the forecast period with increasing demand from emerging economies. Increasing awareness, busting of long-held taboo, and overhaul of medical infrastructures in these countries are some of the key factors in driving regional growth.

Some of the leading players operating in the global umbilical cord blood banking market are CBR Systems, Inc., ViaCord Inc., China Cord Blood Corporation, Cord Blood America, Inc., Cryo-Cell International, Inc., Cryo-Save AG, Cordlife Group Ltd., Vita 34 AG, LifeCell, and StemCyte Inc.

The global umbilical cord blood banking market was worth US$3,124.4 Mn and is projected to reach a value of US$8,178.1 Mn by the end of 2025

Umbilical cord blood banking market is anticipated to grow at a CAGR of 11.4% during the forecast period

North America accounted for a major share of the global umbilical cord blood banking market

Umbilical cord blood banking market is driven by increasing awareness about its benefits across the globe and increasing demand for umbilical cord blood for stem cell research

Key players in the global umbilical cord blood banking market include CBR Systems, Inc., ViaCord Inc., China Cord Blood Corporation, Cord Blood America, Inc., Cryo-Cell International, Inc., Cryo-Save AG, Cordlife Group Ltd., Vita 34 AG, LifeCell, and StemCyte Inc.

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions

2.2. Acronyms Used

2.3. Research Methodology

3. Executive Summary

3.1. Global Umbilical Cord Blood Banking Market Snapshot

4. Market Overview

4.1. Product Overview

4.2. Key Industry Events

4.3. Global Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, 2015-2025

4.4. Market Opportunity Map

4.5. Global Umbilical Cord Blood Banking Market Outlook

4.6. Porter's Five Forces

5. Market Dynamics

5.1. Drivers and Restraints Snapshot Analysis

5.2. Drivers

5.2.1. Rise in hematopoietic stem cell transplantation rates drives the demand for umbilical cord blood banking

5.2.2. Advancement in cord blood processing and storage Type of Storage

5.2.3. Rise in awareness about stem cell therapy along with adoption of cord blood banking

5.2.4. Increase in applications of cord blood cells in treatment of various disease therapies

5.2.5. Favorable reimbursement policies and rise in funding for stem cell research

5.3. Restraints

5.3.1. High cost associated with umbilical blood processing and storage hampers the growth of the market

5.3.2. Stringent rules and regulations

5.3.3. Lack of umbilical cord blood units

5.4. Opportunities

5.4.1. Investment inflow and mergers and acquisitions

5.4.2. High potential market opportunity in emerging countries

6. Regulatory Status for Using Cord Blood Banking

6.1. American Association of Blood Banks (AABB)

6.2. American Association of Tissue Banks (AATB)

6.3. Clinical Laboratory Improvement Amendments (CLIA)

6.4. Foundation for the Accreditation of Cellular Therapy (FACT)

6.5. FDA Biologics License Application (FDA BLA)

6.6. Human Tissue Authority (HTA) – UK

6.7. International Organization for Standardization (ISO)

6.8. Joint Accreditation Committee - ISCT – EBMT (JACIE)

6.9. NetCord

7. Global Umbilical Cord Blood Banking Market Analysis, by Type of Storage

7.1. Key Findings

7.2. Introduction

7.3. Global Umbilical Cord Blood Banking Market Value Share Analysis, by Type of Storage, 2017 -2025

7.3.1. Private Cord Blood Banks

7.3.2. Public Cord Blood Banks

7.4. Umbilical Cord Blood Banking Market Attractiveness Analysis, by Type of Storage, 2015-2025

8. Global Umbilical Cord Blood Banking Market Analysis, by Application

8.1. Key Findings

8.2. Introduction

8.3. Global Umbilical Cord Blood Banking Market Value Share Analysis, by Application, 2017 -2025

8.3.1. Cancers

8.3.2. Blood Disorders

8.3.3. Metabolic Disorders

8.3.4. Immune Disorders

8.3.5. Osteopetrosis

8.3.6. Others

8.4. Umbilical Cord Blood Banking Market Attractiveness Analysis, by Application, 2015-2025

9. Global Umbilical Cord Blood Banking Market Analysis, by End-user

9.1. Key Findings

9.2. Introduction

9.3. Global Umbilical Cord Blood Banking Market Value Share Analysis, by End-user, 2017 -2025

9.3.1. Hospitals (medical applications)

9.3.2. Pharmaceutical Research (drug discovery)

9.3.3. Research Institutes (scientific research)

9.4. Umbilical Cord Blood Banking Market Attractiveness Analysis, by End-user, 2015-2025

10. Global Umbilical Cord Blood Banking Market Analysis, by Region

10.1. Global Market Scenario by Country

10.2. Global Umbilical Cord Blood Banking Market Value Share Analysis, by Region, 2016 and 2025

11. North America Umbilical Cord Blood Banking Market Analysis

11.1. Key Findings

11.2. Market Overview

11.3. North America Umbilical Cord Blood Banking Market Value Share Analysis, by Country

11.4. North America Umbilical Cord Blood Banking Market Value Share Analysis, by Type of Storage

11.5. North America Umbilical Cord Blood Banking Market Value Share Analysis, by Application

11.6. North America Umbilical Cord Blood Banking Market Value Share Analysis, by End-user

11.7. North America Umbilical Cord Blood Banking Market Attractiveness Analysis

11.8. North America Umbilical Cord Blood Banking Market Trends

12. Europe Umbilical Cord Blood Banking Market Analysis

12.1. Key Findings

12.2. Market Overview

12.3. Europe Umbilical Cord Blood Banking Market Value Share Analysis, by Country

12.4. Europe Umbilical Cord Blood Banking Market Value Share Analysis, by Type of Storage

12.5. Europe Umbilical Cord Blood Banking Market Value Share Analysis, by Application

12.6. Europe Umbilical Cord Blood Banking Market Value Share Analysis, by End-user

12.7. Europe Umbilical Cord Blood Banking Market Attractiveness Analysis

12.8. Europe Umbilical Cord Blood Banking Market Trends

13. Asia Pacific Umbilical Cord Blood Banking Market Analysis

13.1. Key Findings

13.2. Market Overview

13.3. Asia Pacific Umbilical Cord Blood Banking Market Value Share Analysis, by Country

13.4. Asia Pacific Umbilical Cord Blood Banking Market Value Share Analysis, by Type of Storage

13.5. Asia Pacific Umbilical Cord Blood Banking Market Value Share Analysis, by Application

13.6. Asia Pacific Umbilical Cord Blood Banking Market Value Share Analysis, by End-user

13.7. Asia Pacific Umbilical Cord Blood Banking Market Attractiveness Analysis

13.8. Asia Pacific Umbilical Cord Blood Banking Market Trends

14. Latin America Umbilical Cord Blood Banking Market Analysis

14.1. Key Findings

14.2. Market Overview

14.3. Latin America Umbilical Cord Blood Banking Market Value Share Analysis, by Country

14.4. Latin America Umbilical Cord Blood Banking Market Value Share Analysis, by Type of Storage

14.5. Latin America Umbilical Cord Blood Banking Market Value Share Analysis, by Application

14.6. Latin America Umbilical Cord Blood Banking Market Value Share Analysis, by End-user

14.7. Latin America Umbilical Cord Blood Banking Market Attractiveness Analysis

14.8. Latin America Umbilical Cord Blood Banking Market Trends

15. Middle East & Africa Umbilical Cord Blood Banking Market Analysis

15.1. Key Findings

15.2. Market Overview

15.3. Middle East & Africa Umbilical Cord Blood Banking Market Value Share Analysis, by Country

15.4. Middle East & Africa Umbilical Cord Blood Banking Market Value Share Analysis, by Product Type

15.5. Middle East & Africa Umbilical Cord Blood Banking Market Value Share Analysis, by Usage

15.6. Middle East & Africa Umbilical Cord Blood Banking Market Value Share Analysis, by Distribution Channel

15.7. Middle East & Africa Umbilical Cord Blood Banking Market Attractiveness Analysis

15.8. Middle East & Africa Umbilical Cord Blood Banking Market Trends

16. Competition Landscape

16.1. Umbilical Cord Blood Banking Market Share Analysis By Company, 2015

16.2. Competition Matrix

16.3. Company Profiles

16.3.1. CBR Systems, Inc.

16.3.1.1. Company Details

16.3.1.2. Business Overview

16.3.1.3. Financial Overview

16.3.1.4. Strategic Overview

16.3.1.5. SWOT Analysis

16.3.2. ViaCord Inc.

16.3.2.1. Company Details

16.3.2.2. Business Overview

16.3.2.3. Financial Overview

16.3.2.4. Strategic Overview

16.3.2.5. SWOT Analysis

16.3.3. China Cord Blood Corporation

16.3.3.1. Company Details

16.3.3.2. Business Overview

16.3.3.3. Financial Overview

16.3.3.4. Strategic Overview

16.3.3.5. SWOT Analysis

16.3.4. Cord Blood America, Inc.

16.3.4.1. Company Details

16.3.4.2. Business Overview

16.3.4.3. Financial Overview

16.3.4.4. Strategic Overview

16.3.4.5. SWOT Analysis

16.3.5. Cryo-Cell International, Inc.

16.3.5.1. Company Details

16.3.5.2. Business Overview

16.3.5.3. Financial Overview

16.3.5.4. Strategic Overview

16.3.5.5. SWOT Analysis

16.3.6. Cryo-Save AG

16.3.6.1. Company Details

16.3.6.2. Business Overview

16.3.6.3. Financial Overview

16.3.6.4. Strategic Overview

16.3.6.5. SWOT Analysis

16.3.7. Cordlife Group Ltd.

16.3.7.1. Company Details

16.3.7.2. Business Overview

16.3.7.3. Financial Overview

16.3.7.4. Strategic Overview

16.3.7.5. SWOT Analysis

16.3.8. Vita 34 AG

16.3.8.1. Company Details

16.3.8.2. Business Overview

16.3.8.3. Financial Overview

16.3.8.4. Strategic Overview

16.3.8.5. SWOT Analysis

16.3.9. LifeCell

16.3.9.1. Company Details

16.3.9.2. Business Overview

16.3.9.3. Financial Overview

16.3.9.4. Strategic Overview

16.3.9.5. SWOT Analysis

16.3.10. StemCyte Inc.

16.3.10.1. Company Details

16.3.10.2. Business Overview

16.3.10.3. Financial Overview

16.3.10.4. Strategic Overview

16.3.10.5. SWOT Analysis

16.3.11. List of Cord Blood Bank in Key Countries

List of Tables

TABLE 1 Global Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, by Type of Storage, 2015–2025

TABLE 2 Global Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, by Application, 2015–2025

TABLE 3 Global Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, by End-user, 2015–2025

TABLE 4 Global Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, by Region, 2015–2025

TABLE 5 North America Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, by Country, 2015–2025

TABLE 6 North America Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, by Type of Storage, 2015–2025

TABLE 7 North America Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, by Application, 2015–2025

TABLE 8 North America Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, by End-user, 2015–2025

TABLE 9 Europe Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, by Country, 2015–2025

TABLE 10 Europe Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, by Type of Storage, 2015–2025

TABLE 11 Europe Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, by Application, 2015–2025

TABLE 12 Europe Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, by End-user, 2015–2025

TABLE 13 Asia Pacific Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, by Country, 2015–2025

TABLE 14 Asia Pacific Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, by Type of Storage, 2015–2025

TABLE 15 Asia Pacific Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, by Application, 2015–2025

TABLE 16 Asia Pacific Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, by End-user, 2015–2025

TABLE 17 Latin America Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, by Country, 2015–2025

TABLE 18 Latin America Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, by Type of Storage, 2015–2025

TABLE 19 Latin America Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, by Application, 2015–2025

TABLE 20 Latin America Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, by End-user, 2015–2025

TABLE 21 Middle East & Africa Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, by Country, 2015–2025

TABLE 22 Middle East & Africa Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, by Type of Storage, 2015–2025

TABLE 23 Middle East & Africa Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, by Application,

TABLE 24 Middle East & Africa Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, by End-user, 2015–2025

List of Figures

FIG. 1 Global Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast, 2015–2025

FIG. 2 Market Value Share, by Type of Storage (2016)

FIG. 3 Market Value Share, by Applications (2016)

FIG. 4 Market Value Share, by End-user (2016)

FIG. 5 Market Value Share, by Region (2016)

FIG. 6 Global Umbilical Cord Blood Banking Market Value Share Analysis, by Type of Storage, 2016 and 2025

FIG. 7 Global Umbilical Cord Blood Banking Market - Private Cord Blood Banks Revenue (US$ Mn), 2015–2025

FIG. 8 Global Umbilical Cord Blood Banking Market - Private Cord Blood Banks Revenue (US$ Mn), 2015–2025

FIG. 9 Global Umbilical Cord Blood Banking Market Attractiveness Analysis, by Type of Storage, 2015–2025

FIG. 10 Global Umbilical Cord Blood Banking Market Value Share Analysis, by Application, 2016 and 2025

FIG. 11 Global Umbilical Cord Blood Banking Market Revenue (US$ Mn), by Cancers, 2015–2025

FIG. 12 Global Umbilical Cord Blood Banking Market Revenue (US$ Mn), by Blood Disorders, 2015–2025

FIG. 13 Global Umbilical Cord Blood Banking Market Revenue (US$ Mn), by Metabolic Disorders, 2015–2025

FIG. 14 Global Umbilical Cord Blood Banking Market Revenue (US$ Mn), by Immune Disorders, 2015–2025

FIG. 15 Global Umbilical Cord Blood Banking Market Revenue (US$ Mn), by Osteopetrosis, 2015–2025

FIG. 16 Global Umbilical Cord Blood Banking Market Revenue (US$ Mn), by Other Applications, 2015–2025

FIG. 17 Global Umbilical Cord Blood Banking Market Attractiveness Analysis, by Application, 2015–2025

FIG. 18 Global Umbilical Cord Blood Banking Market Value Share Analysis, by End-user, 2016 and 2025

FIG. 19 Global Hospitals (medical applications) Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2025

FIG. 20 Global Pharmaceutical Research (drug discovery) Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2025

FIG. 21 Global Research Institutes (scientific research) Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2025

FIG. 22 Umbilical Cord Blood Banking Market Attractiveness Analysis, by End-user, 2015–2025

FIG. 23 Global Umbilical Cord Blood Banking Market Value Share Analysis, by Region, 2016 and 2025

FIG. 24 Global Umbilical Cord Blood Banking Market Attractiveness Analysis, by Region, 2015–2025

FIG. 25 North America Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2015–2025

FIG. 26 North America Umbilical Cord Blood Banking Market Attractiveness Analysis, by Country, 2017–2025

FIG. 27 North America Umbilical Cord Blood Banking Market Value Share Analysis, by Country, 2016 and 2025

FIG. 28 North America Umbilical Cord Blood Banking Market Value Share Analysis, by Type of Storage, 2016 and 2025

FIG. 29 North America Umbilical Cord Blood Banking Market Value Share Analysis, by Application, 2016 and 2025

FIG. 30 North America Umbilical Cord Blood Banking Market Value Share Analysis, by End-user, 2016 and 2025

FIG. 31 North America Umbilical Cord Blood Banking Market Attractiveness Analysis, by Type of Storage, 2017–2025

FIG. 32 North America Umbilical Cord Blood Banking Market Attractiveness Analysis, by Application, 2017–2025

FIG. 33 North America Umbilical Cord Blood Banking Market Attractiveness Analysis, by End-user, 2017–2025

FIG. 34 Europe Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2015–2025

FIG. 35 Europe Umbilical Cord Blood Banking Market Attractiveness Analysis, by Country, 2017–2025

FIG. 36 Europe Umbilical Cord Blood Banking Market Value Share Analysis, by Country, 2016 and 2025

FIG. 37 Europe Umbilical Cord Blood Banking Market Value Share Analysis, by Type of Storage, 2016 and 2025

FIG. 38 Europe Umbilical Cord Blood Banking Market Value Share Analysis, by Application, 2016 and 2025

FIG. 39 Europe Umbilical Cord Blood Banking Market Value Share Analysis, by End-user, 2016 and 2025

FIG. 40 Europe Umbilical Cord Blood Banking Market Attractiveness Analysis, by Type of Storage, 2017–2025

FIG. 41 Europe Umbilical Cord Blood Banking Market Attractiveness Analysis, by Application, 2017–2025

FIG. 42 Europe Umbilical Cord Blood Banking Market Attractiveness Analysis, by End-user, 2017–2025

FIG. 43 Asia Pacific Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2015–2025

FIG. 44 Asia Pacific Umbilical Cord Blood Banking Market Attractiveness Analysis, by Country, 2017–2025

FIG. 45 Asia Pacific Umbilical Cord Blood Banking Market Value Share Analysis, by Country, 2016 and 2025

FIG. 46 Asia Pacific Umbilical Cord Blood Banking Market Value Share Analysis, by Type of Storage, 2016 and 2025

FIG. 47 Asia Pacific Umbilical Cord Blood Banking Market Value Share Analysis, by Application, 2016 and 2025

FIG. 48 Asia Pacific Umbilical Cord Blood Banking Market Value Share Analysis, by End-user, 2016 and 2025

FIG. 49 Asia Pacific Umbilical Cord Blood Banking Market Attractiveness Analysis, by Type of Storage, 2017–2025

FIG. 50 Asia Pacific Umbilical Cord Blood Banking Market Attractiveness Analysis, by Application, 2017–2025

FIG. 51 Asia Pacific Umbilical Cord Blood Banking Market Attractiveness Analysis, by End-user, 2017–2025

FIG. 52 Latin America Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2015–2025

FIG. 53 Latin America Umbilical Cord Blood Banking Market Attractiveness Analysis, by Country, 2017–2025

FIG. 54 Latin America Umbilical Cord Blood Banking Market Value Share Analysis, by Country, 2016 and 2025

FIG. 55 Latin America Umbilical Cord Blood Banking Market Value Share Analysis, by Type of Storage, 2016 and 2025

FIG. 56 Latin America Umbilical Cord Blood Banking Market Value Share Analysis, by Application, 2016 and 2025

FIG. 57 Latin America Umbilical Cord Blood Banking Market Value Share Analysis, by End-user, 2016 and 2025

FIG. 58 Latin America Umbilical Cord Blood Banking Market Attractiveness Analysis, by Type of Storage, 2017–2025

FIG. 59 Latin America Umbilical Cord Blood Banking Market Attractiveness Analysis, by Application, 2017–2025

FIG. 60 Latin America Umbilical Cord Blood Banking Market Attractiveness Analysis, by End-user, 2017–2025

FIG. 61 Middle East & Africa Umbilical Cord Blood Banking Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2015–2025

FIG. 62 Middle East & Africa Umbilical Cord Blood Banking Market Attractiveness Analysis, by Country, 2017–2025

FIG. 63 Middle East & Africa Umbilical Cord Blood Banking Market Value Share Analysis, by Country, 2016 and 2025

FIG. 64 Middle East & Africa Umbilical Cord Blood Banking Market Value Share Analysis, by Type of Storage, 2016 and 2025

FIG. 65 Middle East & Africa Umbilical Cord Blood Banking Market Value Share Analysis, by Application, 2016 and 2025

FIG. 66 Middle East & Africa Umbilical Cord Blood Banking Market Value Share Analysis, by End-user, 2016 and 2025

FIG. 67 Middle East & Africa Umbilical Cord Blood Banking Market Attractiveness Analysis, by Type of Storage, 2017–2025

FIG. 68 Middle East & Africa Umbilical Cord Blood Banking Market Attractiveness Analysis, by Application, 2017–2025

FIG. 69 Middle East & Africa Umbilical Cord Blood Banking Market Attractiveness Analysis, by End-user, 2017–2025

FIG. 70 Global Umbilical Cord Blood Banking Market Share Analysis, by Company, 2016 (Estimated)