Analysts’ Viewpoint on Ultra-low Temperature Freezers Market Scenario

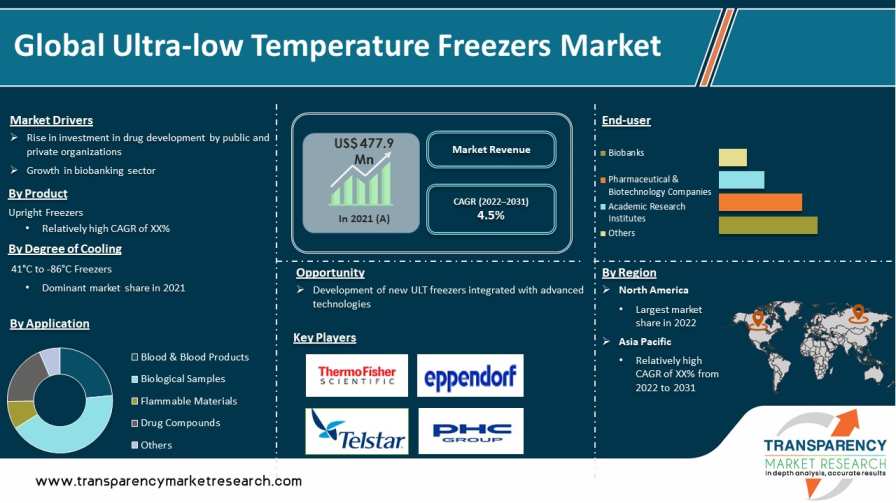

Rise in investment in drug development is expected to drive the global ultra-low temperature freezers market during the forecast period. Ultra-low temperature freezers play an important role in storing samples at specific temperature ranges. Increase in advancements in drug discovery and clinical testing; and growth in incidence of cancer and other infectious diseases are propelling the market. Vaccine storage capacity has increased significantly due to the availability of ultra-low temperature freezers. Growth in ultra-cold chain capabilities is also augmenting the shipment of vaccines across the globe. Players operating in the market are launching new products to enhance their ultra-low temperature freezers market share.

Ultra-low Temperature (ULT) freezers, also referred to as -80 freezers, are used in the life sciences industry to store biomolecules for protracted periods. They typically provide a temperature range of -40°C to -86°C or -40°F to -123°F in order to prevent heat-induced denaturation of biomolecules such as oligonucleotides and proteins. ULT freezers have two doors to maintain a constant temperature, with the inner door limiting the entry of unwanted heat into the freezer interior. An exterior knob and silicone gasket seal the line around the doors' edges to close them tightly. Additionally, the polyurethane walls of ULT freezers offer robust heat insulation from the outside environment.

Blood banks collect, preserve, and distribute rare and valuable biological samples to public and private sectors for scientific research. Public and private sectors are increasingly investing in development of new therapies in order to help bridge the unmet healthcare needs.

The biobanking sector is anticipated to grow significantly in developing regions such as Asia Pacific and Africa due to genetic diversity and biodiversity of these regions. Rise in investment in R&D activities in chronic epidemics is also expected to contribute to the expansion of the biobanking sector in these regions. Majority of biobanks are public; however, the number of private biobanks is increasing due to the rise in demand for preservation of cord blood stem cells, gamete cells such as sperms and eggs, and other tissues.

Increase in cases of organ failure in patients suffering from chronic diseases has led to a rise in demand for organ donation. According to the Health Resources and Services Administration, 105,924 men, women, and children are on the national transplant waiting list, and 17 people die each day while waiting for an organ transplant. According to the U.S. Department of Health and Human Services, approximately 122,913 patients in the U.S. were waiting for organ transplants in 2019.

Donated organs must be stored and preserved at extremely low temperatures. This is expected to boost the demand for ultra-low temperature freezers. Rise in accident and trauma cases is also likely to augment the demand for organ transplantation. Scarcity of donated organs combined with increase in number of people on the waiting list is driving the need for advanced organ preservation techniques and government funding for research in cryopreservation of certain organs.

Internet-of-Things (IoT), remote monitoring, barcode tracking, and other technologies are increasingly being integrated into laboratory devices. Manufacturers are developing integrated ULT freezers. Lack of skilled labor, rise in demand for safe handling of samples, and increase in laboratory workload are driving the development of fully automated freezers. Industry players are collaborating for the R&D of advanced ULT freezers. In 2016, Helmer Scientific collaborated with Terso Solution to offer RFID-enabled ULT freezers. Similarly, key players have introduced several device networking solutions for ULT freezers. In July 2021, Eppendorf launched the redesigned 400 L ULT freezer class. The ULT freezer is completely equipped with green cooling liquids and green insulation foam. The series can be connected to VisioNize Lab Suite for monitoring via VisioNize box.

In terms of product, the global ultra-low temperature freezers market has been classified into upright freezers and chest freezers. The upright freezers segment is projected to grow at a rapid pace during the forecast period. Upright ULT freezers offer a larger storage capacity compared to chest ULT freezers. Upright freezers store biological drugs, enzymes, chemicals, viruses, bacteria, cell preparations, and tissue samples at temperatures ranging from -40°C to -86°C. Adoption of upright ULT freezers leads to a lower carbon footprint than that of chest freezers. Upright ULT freezers offer ease of access to stored samples due to adjustable shelf placement. They are preferred for storing regularly used samples. Around 85% to 90% of ULT freezers available in the market are of upright design.

Based on degree of cooling, the global ultra-low temperature freezers market has been bifurcated into -41°C to -86°C freezers and -87°C to -150°C freezers. The -41°C to -86°C freezers segment held prominent share of the global market in 2021. Most of the laboratory samples, such as biological samples, tissues, blood & blood products, plant tissues, proteins, and DNA, are kept in -41°C to -86°C freezers for long-term storage.

In terms of application, the global ultra-low temperature freezers market has been segmented into blood & blood products, biological samples, flammable materials, drug compounds, and others. The drug compounds segment is expected to grow at a high CAGR during the forecast period. Rise in investment in R&D of advanced therapeutics, including biologicals, peptides, and molecular entities, is projected to drive the drug compounds segment during the forecast period.

Based on end-user, the global ultra-low temperature freezers market has been classified into biobanks, pharmaceutical & biotechnology companies, academic research institutes, and others. The pharmaceutical & biotechnology companies segment recorded the fastest growth in the global market in 2021. Pharmaceutical & biotechnology companies use ultra-low temperature freezers to store biological samples and drug compounds. These companies are significantly investing in R&D activities to enhance their revenue streams. This is anticipated to boost the demand for ultra-low temperature freezers.

North America accounted for major share of around 40.0% of the global ultra-low temperature freezers market in 2021. Rise in adoption of advanced ultra-low temperature freezers and increase in launch of new products are fueling the market in the region. In May 2020, Thermo Fisher Scientific, a biotechnology company headquartered in the U.S., introduced a new service that gathers and monitors critical performance information from the connected TSX Series ULT freezers to guarantee the security of samples and goods. The user can thoroughly inspect the connected TSX Series ULT freezers due to Thermo Scientific's intelligent connected systems function, which keeps track of 37 different types of alarms and 26 operational metrics.

Increase in R&D of COVID-19 vaccines is also anticipated to propel the market in North America during the forecast period. Scientists are relying on BINDER CO2 freezers and incubators for the development of vaccines. These freezers can reach -80°C and thus are used to store coronavirus samples over the long term.

Asia Pacific has a large and diverse population with high unmet needs in medical and life sciences sectors. Increase in purchasing power in emerging markets such as China, India, and South East Asia is encouraging international pharmaceutical & biotechnology and biobanking companies to establish their operations in the region. Rise in need for skilled workforce and increase in public and private funding are leading to an increase in number of academic institutes, thus propelling the market in Asia Pacific.

The global ultra-low temperature freezers market is consolidated, with the presence of a small number of leading players. Most of the companies are investing significantly in R&D activities, primarily to introduce advanced ultra-cold freezers. Strategic alliances among key players to increase revenue and share are augmenting the global market. Furthermore, diversification of product portfolios and mergers & acquisitions are key strategies adopted by leading players. Thermo Fisher Scientific, Inc., Eppendorf AG, PHC Holdings Corporation (Panasonic Healthcare), Azbil Telstar, S.L., Arctiko A/S, Labcold Ltd., Bionics Scientific Technologies (P) Ltd., Haier Biomedical, Global Cooling Inc., and Helmer Scientific are prominent players operating in the global ultra-low temperature freezers market.

Market players are designing ultra-low freezers to store COVID-19 vaccinations. In January 2021, Telstar designed Boreas ultra-low-temperature freezers to store COVID-19 vaccinations at -86°C. Vacuum panels provide excellent insulation, allowing the freezer to maintain a temperature of -80°C in surroundings that record temperatures as high as 28°C.

Each of these players has been profiled in the global ultra-low temperature freezers market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 477.9 Mn |

|

Market Forecast Value in 2031 |

More than US$ 738.6 Mn |

|

Growth Rate (CAGR) |

4.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global ultra-low temperature freezers market was valued at US$ 477.9 Mn in 2021.

The global ultra-low temperature freezers market is projected to reach more than US$ 738.6 Mn by 2031.

The global ultra-low temperature freezers market is anticipated to grow at a CAGR of 4.5% from 2022 to 2031.

Rise in investment in drug development by public and private organizations and expansion in biobanking sector are major trend affecting market growth.

The upright freezers segment held more than 47% share of the global ultra-low temperature freezers market in 2021.

Thermo Fisher Scientific, Inc., Eppendorf AG, PHC Holdings Corporation (Panasonic Healthcare), Azbil Telstar, S.L., Arctiko A/S, Labcold Ltd., Bionics Scientific Technologies (P) Ltd., Haier Biomedical, Global Cooling Inc. and Helmer Scientific.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Ultra-low Temperature Freezers Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution /Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Ultra-low Temperature Freezers Market Analysis and Forecasts, 2017 - 2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Key Industry Development

5.3. COVID-19 Impact Analysis

5.4. Porter’s Five Forces Analysis

5.5. Pricing Analysis

6. Global Ultra-low Temperature Freezers Market Analysis and Forecasts, By Product

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Upright Freezers

6.3.1.1. Floorstanding

6.3.1.2. Benchtop/Undercounter

6.3.2. Chest Freezers

6.4. Market Attractiveness Analysis, by Product

7. Global Ultra-low Temperature Freezers Market Analysis and Forecasts, By Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast By Application, 2017 - 2031

7.3.1. Blood & Blood Products

7.3.2. Biological Samples

7.3.3. Flammable Materials

7.3.4. Drug Compounds

7.3.5. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Ultra-low Temperature Freezers Market Analysis and Forecast, by Degree of Cooling

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Application, 2017–2031

8.3.1. -41°C to -86°C Freezers

8.3.2. -87°C to -140°C Freezers

8.4. Market Attractiveness Analysis, by Degree of Cooling

9. Global Ultra-low Temperature Freezers Market Analysis and Forecasts, By End-user

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value Forecast By Application, 2017 - 2031

9.3.1. Biobanks

9.3.2. Pharmaceutical & Biotechnology Companies

9.3.3. Academic Research Institutes

9.3.4. Others

9.4. Market Attractiveness By End-user

10. Global Ultra-low Temperature Freezers Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Region

11. North America Ultra-low Temperature Freezers Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Product, 2017 - 2031

11.2.1. Upright Freezers

11.2.1.1. Floorstanding

11.2.1.2. Benchtop/Undercounter

11.2.2. Chest Freezers

11.3. Market Value Forecast By Application, 2017 - 2031

11.3.1. Blood & Blood Products

11.3.2. Biological Samples

11.3.3. Flammable Materials

11.3.4. Drug Compounds

11.3.5. Others

11.4. Market Value Forecast By Degree of Cooling, 2017 - 2031

11.4.1. -41°Cto -86°C Freezers

11.4.2. -87°C to -140°C Freezers

11.5. Market Value Forecast By End-user, 2017 - 2031

11.5.1. Biobanks

11.5.2. Pharmaceutical & Biotechnology Companies

11.5.3. Academic Research Institutes

11.5.4. Others

11.6. Market Value Forecast By Country, 2017 - 2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Product

11.7.2. By Application

11.7.3. By Degree of Cooling

11.7.4. By End-user

11.7.5. By Country

12. Europe Ultra-low Temperature Freezers Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Product, 2017 - 2031

12.2.1. Upright Freezers

12.2.1.1. Floorstanding

12.2.1.2. Benchtop/Undercounter

12.2.2. Chest Freezers

12.3. Market Value Forecast By Application, 2017 - 2031

12.3.1. Blood & Blood Products

12.3.2. Biological Samples

12.3.3. Flammable Materials

12.3.4. Drug Compounds

12.3.5. Others

12.4. Market Value Forecast By Degree of Cooling, 2017 - 2031

12.4.1. -41°Cto -86°C Freezers

12.4.2. -87°C to -140°C Freezers

12.5. Market Value Forecast By End-user, 2017 - 2031

12.5.1. Biobanks

12.5.2. Pharmaceutical & Biotechnology Companies

12.5.3. Academic Research Institutes

12.5.4. Others

12.6. Market Value Forecast By Country, 2017 - 2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Product

12.7.2. By Application

12.7.3. By Degree of Cooling

12.7.4. By End-user

12.7.5. By Country

13. Latin America Ultra-low Temperature Freezers Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Product, 2017 - 2031

13.2.1. Upright Freezers

13.2.1.1. Floorstanding

13.2.1.2. Benchtop/Undercounter

13.2.2. Chest Freezers

13.3. Market Value Forecast by Application, 2017 - 2031

13.3.1. Blood & Blood Products

13.3.2. Biological Samples

13.3.3. Flammable Materials

13.3.4. Drug Compounds

13.3.5. Others

13.4. Market Value Forecast by Degree of Cooling, 2017 - 2031

13.4.1. -41°Cto -86°C Freezers

13.4.2. -87°C to -140°C Freezers

13.5. Market Value Forecast by End-user, 2017 - 2031

13.5.1. Biobanks

13.5.2. Pharmaceutical & Biotechnology Companies

13.5.3. Academic Research Institutes

13.5.4. Others

13.6. Market Value Forecast By Country, 2017 - 2031

13.6.1. Brazil

13.6.2. Mexico

13.6.3. Rest of Latin America

13.7. Market Attractiveness Analysis

13.7.1. By Product

13.7.2. By Application

13.7.3. By Degree of Cooling

13.7.4. By End-user

13.7.5. By Country

14. Middle East & Africa Ultra-low Temperature Freezers Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Product, 2017 - 2031

14.2.1. Upright Freezers

14.2.1.1. Floorstanding

14.2.1.2. Benchtop/Undercounter

14.2.2. Chest Freezers

14.3. Market Value Forecast by Application, 2017 - 2031

14.3.1. Blood & Blood Products

14.3.2. Biological Samples

14.3.3. Flammable Materials

14.3.4. Drug Compounds

14.3.5. Others

14.4. Market Value Forecast by Degree of Cooling, 2017 - 2031

14.4.1. -41°Cto -86°C Freezers

14.4.2. -87°C to -140°C Freezers

14.5. Market Value Forecast by End-user, 2017 - 2031

14.5.1. Biobanks

14.5.2. Pharmaceutical & Biotechnology Companies

14.5.3. Academic Research Institutes

14.5.4. Others

14.6. Market Value Forecast by Country, 2017 - 2031

14.6.1. GCC Countries

14.6.2. South Africa

14.6.3. Rest of Middle East & Africa

14.7. Market Attractiveness Analysis

14.7.1. By Product

14.7.2. By Application

14.7.3. By Degree of Cooling

14.7.4. By End-user

14.7.5. By Country

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2018)

15.3. Company Profiles

15.3.1. Thermo Fisher Scientific, Inc.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Company Financials

15.3.1.3. Growth Strategies

15.3.1.4. SWOT Analysis

15.3.2. Eppendorf AG

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Company Financials

15.3.2.3. Growth Strategies

15.3.2.4. SWOT Analysis

15.3.3. PHC Holdings Corporation (Panasonic Healthcare)

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Company Financials

15.3.3.3. Growth Strategies

15.3.3.4. SWOT Analysis

15.3.4. Azbil Telstar, S.L.

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Company Financials

15.3.4.3. Growth Strategies

15.3.4.4. SWOT Analysis

15.3.5. Arctiko A/S

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Company Financials

15.3.5.3. Growth Strategies

15.3.5.4. SWOT Analysis

15.3.6. Labcold Ltd.

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Company Financials

15.3.6.3. Growth Strategies

15.3.6.4. SWOT Analysis

15.3.7. Bionics Scientific Technologies (P) Ltd.

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Company Financials

15.3.7.3. Growth Strategies

15.3.7.4. SWOT Analysis

15.3.8. Haier Biomedical

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Company Financials

15.3.8.3. Growth Strategies

15.3.8.4. SWOT Analysis

15.3.9. Global Cooling Inc.

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Company Financials

15.3.9.3. Growth Strategies

15.3.9.4. SWOT Analysis

15.3.10. Helmer Scientific

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Company Financials

15.3.10.3. Growth Strategies

15.3.10.4. SWOT Analysis

List of Tables

Table 01: Global Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Upright Freezers, 2017–2031

Table 03: Global Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 04: Global Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 05: Global Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Degree of Cooling, 2017‒2031

Table 06: North America Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 07: North America Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 08: North America Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Upright Freezers, 2017–2031

Table 09: North America Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 10: North America Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 11: Europe Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 12: Europe Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Europe Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 14: Europe Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Upright Freezers, 2017–2031

Table 15: Global Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 16: Europe Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 17: Europe Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 18: Europe Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Degree of Cooling, 2017–2031

Table 19: Europe Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 20: Asia Pacific Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 21: Asia Pacific Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 22: Asia Pacific Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 23: Global Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 24: Asia Pacific Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Upright Freezers, 2017–2031

Table 25: Asia Pacific Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 26: Asia Pacific Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 27: Asia Pacific Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Degree of Cooling, 2017–2031

Table 28: Asia Pacific Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 29: Latin America Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 30: Latin America Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 31: Latin America Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Upright Freezers, 2017–2031

Table 32: North America Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Degree of Cooling, 2017–2031

Table 33: Latin America Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 34: North America Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 35: Latin America Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 36: Latin America Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 37: Latin America Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 38: Middle East & Africa Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 39: Middle East & Africa Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 40: Middle East & Africa Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Upright Freezers, 2017–2031

Table 41: Middle East & Africa Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 42: Middle East & Africa Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 43: Middle East & Africa Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by Degree of Cooling, 2017–2031

Table 44: Middle East & Africa Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Ultra-low Temperature Freezers Market, by Product, 2021 and 2031

Figure 03: Global Ultra-low Temperature Freezers Market Attractiveness Analysis, by Product, 2022–2031

Figure 04: Ultra-low Temperature Freezers Market (US$ Mn), by Upright Freezers, 2017–2031

Figure 06: Global Ultra-low Temperature Freezers Market, by Application, 2021 and 2031

Figure 07: Global Ultra-low Temperature Freezers Market Attractiveness Analysis, by Application, 2022–2031

Figure 08: Global Ultra-low Temperature Freezers Market (US$ Mn), by Blood & Blood Products, 2017–2031

Figure 09: Global Ultra-low Temperature Freezers Market (US$ Mn), by Biological Samples, 2017–2031

Figure 10: Global Ultra-low Temperature Freezers Market (US$ Mn), by Flammable Materials, 2017–2031

Figure 11: Global Ultra-low Temperature Freezers Market (US$ Mn), by Drug Compounds, 2017–2031

Figure 12: Global Ultra-low Temperature Freezers Market (US$ Mn), by Others, 2017–2031

Figure 13: Global Ultra-low Temperature Freezers Market, by Degree of Cooling, 2021 and 2031

Figure 14: Global Ultra-low Temperature Freezers Market Attractiveness Analysis, Degree of Cooling, 2022–2031

Figure 15: Global Ultra-low Temperature Freezers Market (US$ Mn), by -41°C to -86°C Freezers, 2017–2031

Figure 16: Global Ultra-low Temperature Freezers Market (US$ Mn), by -87°C to -150°C Freezers, 2017–2031

Figure 17: Global Ultra-low Temperature Freezers Market, by End-user 2021 and 2031

Figure 18: Global Ultra-low Temperature Freezers Market Attractiveness Analysis, End-user, 2022–2031

Figure 20: Ultra-low Temperature Freezers Market (US$ Mn), by Biobanks, 2017–2031

Figure 21: Global Ultra-low Temperature Freezers Market (US$ Mn), by Pharmaceutical & Biotechnology Companies, 2017–2031

Figure 22: Ultra-low Temperature Freezers Market (US$ Mn), by Academic Research Institutes, 2017–2031

Figure 23: Global Ultra-low Temperature Freezers Market (US$ Mn), by Others, 2017–2031

Figure 24: Global Ultra-low Temperature Freezers Market Value Share Analysis, by Region, 2021 and 2031

Figure 25: Global Ultra-low Temperature Freezers Market Attractiveness Analysis, by Region, 2022–2031

Figure 27: North America Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, 2017–2031

Figure 28: North America Ultra-low Temperature Freezers Market Value Share Analysis, by Country, 2021 and 2031

Figure 29: North America Ultra-low Temperature Freezers Market, by Product, 2021 and 2031

Figure 30: North America Ultra-low Temperature Freezers Market Attractiveness Analysis, by Product, 2022–2031

Figure 31: North America Ultra-low Temperature Freezers Market, by Application, 2021 and 2031

Figure 32: North America Ultra-low Temperature Freezers Market Attractiveness Analysis, by Application, 2022–2031

Figure 33: North America Ultra-low Temperature Freezers Market, by Degree of Cooling, 2021 and 2031

Figure 34: North America Ultra-low Temperature Freezers Market Attractiveness Analysis, by Degree of Cooling, 2022–2031

Figure 35: Europe Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, 2017–2031

Figure 36: Europe Ultra-low Temperature Freezers Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 37: Europe Ultra-low Temperature Freezers Market Attractiveness Analysis, by Country, 2022–2031

Figure 38: Europe Ultra-low Temperature Freezers Market, by Product, 2021 and 2031

Figure 39: North America Ultra-low Temperature Freezers Market Attractiveness Analysis, by Country, 2022–2031

Figure 40: North America Ultra-low Temperature Freezers Market Attractiveness Analysis, by End-user, 2022–2031

Figure 41: Europe Ultra-low Temperature Freezers Market Attractiveness Analysis, by Product, 2022–2031

Figure 42: North America Ultra-low Temperature Freezers Market, by End-user, 2021 and 2031

Figure 43: Europe Ultra-low Temperature Freezers Market, by Application, 2021 and 2031

Figure 44: Europe Ultra-low Temperature Freezers Market, by Degree of Cooling, 2021 and 2031

Figure 45: Europe Ultra-low Temperature Freezers Market Attractiveness Analysis, by Degree of Cooling, 2022–2031

Figure 46: Europe Ultra-low Temperature Freezers Market, by End-user, 2021 and 2031

Figure 47: Europe Ultra-low Temperature Freezers Market Attractiveness Analysis, by End-user, 2022–2031

Figure 48: Asia Pacific Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, 2017–2031

Figure 49: Asia Pacific Ultra-low Temperature Freezers Market Value Share Analysis, by Country, 2021 and 2031

Figure 50: Global Ultra-low Temperature Freezers Market (US$ Mn), by Chest Freezers, 2017–2031

Figure 51: Asia Pacific Ultra-low Temperature Freezers Market Attractiveness Analysis, by Country, 2022–2031

Figure 52: Asia Pacific Ultra-low Temperature Freezers Market, by Product, 2021 and 2031

Figure 53: Asia Pacific Ultra-low Temperature Freezers Market Attractiveness Analysis, by Product, 2022–2031

Figure 54: Asia Pacific Ultra-low Temperature Freezers Market, by Application, 2021 and 2031

Figure 55: Asia Pacific Ultra-low Temperature Freezers Market Attractiveness Analysis, by Application, 2022–2031

Figure 56: Asia Pacific Ultra-low Temperature Freezers Market, by Degree of Cooling, 2021 and 2031

Figure 57: Asia Pacific Ultra-low Temperature Freezers Market Attractiveness Analysis, by Degree of Cooling, 2022–2031

Figure 58: Asia Pacific Ultra-low Temperature Freezers Market, by End-user, 2021 and 2031

Figure 59: Asia Pacific Ultra-low Temperature Freezers Market Attractiveness Analysis, by End-user, 2022–2031

Figure 60: Latin America Ultra-low Temperature Freezers Market Value (US$ Mn) Forecast, 2017–2031

Figure 61: Latin America Ultra-low Temperature Freezers Market Value Share Analysis, by Country, 2021 and 2031

Figure 62: Latin America Ultra-low Temperature Freezers Market Attractiveness Analysis, by Country, 2022–2031

Figure 63: Latin America Ultra-low Temperature Freezers Market, by Product, 2021 and 2031