As the impacts of COVID-19 ripples across the globe, pipe manufacturers find themselves operating in a fundamentally new reality. In response to supply chain interruptions, companies in the U.K. MDPE pipe market for water supply are either relocating or ramping up the production of critical products for healthcare and residential sectors.

Stakeholders in the U.K. MDPE pipe market for water supply are entering into merger & acquisition (M&A) deals to cater with mission-critical projects in sewage and agricultural applications. Companies are seeking secondary manufacturers who can produce pipes during the ongoing pandemic so that the former can focus on marketing and distribution of pipes. Manufacturers are increasing efforts to understand their competitive cost position and break-even point.

MDPE (Medium-density Polyethylene) pipes are being increasingly used in home installations and commercial establishments. However, the cost of buying MDPE is a little higher as compared to ordinary pipes. As such, the total cost of ownership in the long-run is benefitting customers. Advantages such as high resistance to cracks, changes in temperatures, and easy installations are compensating for its high cost price.

MDPE pipes are emerging as an alternative to galvanized steel pipes, owing to the advantage of easy installation. Manufacturers in the U.K. MDPE pipe market for water supply are increasing the availability of pipes that can withstand any kind of shock, leading to few incidence of cracking.

There is a growing demand for MDPE pipes for connections between the distribution mains to individual properties and for above ground services, if the pipes are installed within protective ducts. Build Plumb Plastics Ltd. - a building materials supplier in England, is recognizing this demand and building a comprehensive product portfolio in MDPE water pipes across various diameters and coil lengths.

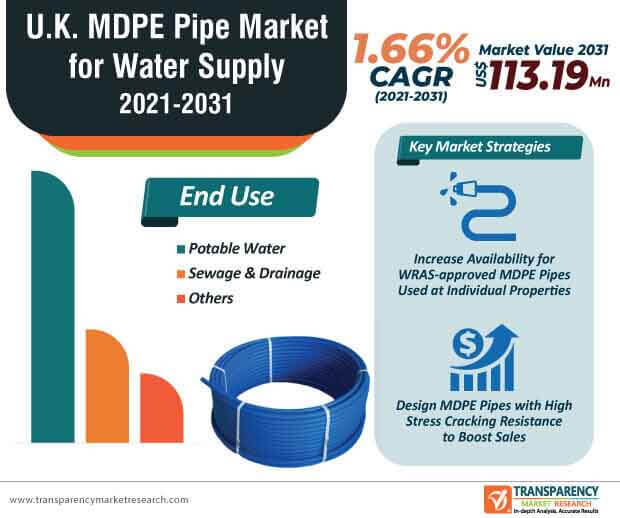

The U.K. MDPE pipe market for water supply is predicted to reach an output of 41,031.49 tons by the end of 2031. Manufacturers are increasing production of pipes that are WRAS (Water Regulations Advisory Scheme) approved and conform to BS EN 12201 specifications.

The U.K. MDPE pipe market for water supply is projected to reach US$ 113.19 Mn by 2031. Weatherproof and long service life features are being preferred in MDPE pipes to achieve high stress cracking resistance. Sewage, seawater, and corporations are catalyzing the demand for these pipes. Manufacturers are increasing their R&D capabilities to produce pipes with best technical and operational characteristics.

Residential colonies and housing societies are creating stable revenue streams for manufacturers in the U.K. MDPE pipe market for water supply. Manufacturers are using special sky blue color in MDPE pipes to indicate that the material does not contain any impurities and is made of 100% virgin material.

The U.K. MDPE pipe market for water supply is slated to register a CAGR of 1.66% during the forecast period. Potentially fragmented nature of the market has led to increased competition and increasing number of supplier leading to accelerated oversupply of pipe products. Hence, stakeholders are anticipated to diversify their production capabilities in other polyethylene pipes to expand revenue streams.

High tensile strength and superior rigidity are being preferred in MDPE pipes. Manufacturers in the U.K. MDPE pipe market for water supply are gaining proficiency in changing the density of polyethylene through copolymerization of ethylene and other comonomer. This change leads to the addition of new cross-linking among polymers, which helps to increase the tensile strength of MDPE pipes.

Analysts’ Viewpoint

Companies in the U.K. MDPE pipe market for water supply are focusing on value creation by establishing customer integration in various end-use applications during the COVID-19 crisis. MDPE pipes are being augmented with special polyethylene additives, which make it immune to harmful UV rays of the sun and make it an ideal choice for over the ground open laying of water pipelines.

Slow crack growth (SCG) remains one of the most common failure modes in long-term loaded plastic structures such as pressure pipe. Hence, manufacturers in the U.K. MDPE pipe market for water supply should use special imported raw materials, which are certified for slow crack resistance.

U.K. MDPE Pipe Market for Water Supply: Overview

Quality of MDPE to Impart Better Properties to Pipes Employed in Various End-use Industries: Key Driver of MDPE Pipe Market for Water Supply

U.K. MDPE Pipe Market for Water Supply: Competition Landscape

U.K. MDPE Pipe Market for Water Supply: Key Developments

U.K. MDPE Pipe Market for Water Supply Snapshot

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

USD 94.78 Million |

|

Market Forecast Value in 2031 |

USD 113.19 Million |

|

Growth Rate (CAGR) |

1.66% |

|

Forecast Period |

2021-2031 |

|

Quantitative Units |

US$ Mn for Value & Tons for Volume |

|

Market Analysis |

It includes analysis of MDPE pipe market for water application w.r.t. its end-use segment for the U.K. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porters Five Forces analysis, value chain analysis, key market indicator, etc. |

|

Competition Landscape |

Company Profiles, Dashboard, Market Share Analysis of Companies, Footprint Analysis |

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

1. Executive Summary

1.1. Market Outlook

1.2. Key Facts and Figures

1.3. Key Trends

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Dynamics

2.4. Drivers and Restraints Snapshot Analysis

2.4.1.1. Drivers

2.4.1.2. Restraints

2.4.1.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.5.1. Threat of Substitutes

2.5.2. Bargaining Power of Buyers

2.5.3. Bargaining Power of Suppliers

2.5.4. Threat of New Entrants

2.5.5. Degree of Competition

2.6. Regulatory Scenario

2.7. Value Chain Analysis

3. COVID-19 Impact Analysis

4. Price Trend Analysis

5. U.K. MDPE Pipe Market for Water Supply Volume (Tons) and Value (US$ Mn) Analysis, by End-use

5.1. Key Findings and Introduction

5.2. U.K. MDPE Pipe Market for Water Supply Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

5.2.1. U.K. MDPE Pipe Market for Water Supply Volume (Tons) and Value (US$ Mn) Forecast, by Potable Water, 2020-2031

5.2.2. U.K. MDPE Pipe Market for Water Supply Volume (Tons) and Value (US$ Mn) Forecast, by Sewage & Drainage, 2020-2031

5.2.3. U.K. MDPE Pipe Market for Water Supply Volume (Tons) and Value (US$ Mn) Forecast, by Others, 2020-2031

5.3. U.K. MDPE Pipe Market for Water Supply Attractive Analysis, by End-use

6. Competition Landscape

6.1. Competition Matrix

6.2. U.K. MDPE Pipe Market for Water Supply Share Analysis, by Company (2020)

6.3. Market Footprint Analysis

6.4. Company Profiles

6.4.1. Borealis AG

6.4.1.1. Company Details

6.4.1.2. Company Description

6.4.1.3. Business Overview

6.4.1.4. Financial Details

6.4.1.5. Strategic Overview

6.4.2. INEOS

6.4.2.1. Company Details

6.4.2.2. Company Description

6.4.2.3. Business Overview

6.4.2.4. Financial Details

6.4.2.5. Strategic Overview

6.4.3. LG Chem

6.4.3.1. Company Details

6.4.3.2. Company Description

6.4.3.3. Business Overview

6.4.3.4. Financial Details

6.4.3.5. Strategic Overview

6.4.4. Dow

6.4.4.1. Company Details

6.4.4.2. Company Description

6.4.4.3. Business Overview

6.4.4.4. Financial Details

6.4.4.5. Strategic Overview

6.4.5. SCG Chemicals Co.

6.4.5.1. Company Details

6.4.5.2. Company Description

6.4.5.3. Business Overview

6.4.5.4. Strategic Overview

6.4.6. NOVA Chemicals Corporate

6.4.6.1. Company Details

6.4.6.2. Company Description

6.4.6.3. Business Overview

6.4.6.4. Financial Details

6.4.6.5. Strategic Overview

6.4.7. Westlake Chemical Corporation

6.4.7.1. Company Details

6.4.7.2. Company Description

6.4.7.3. Business Overview

6.4.7.4. Financial Details

6.4.7.5. Strategic Overview

6.4.8. BASF SE

6.4.8.1. Company Details

6.4.8.2. Company Description

6.4.8.3. Business Overview

6.4.8.4. Financial Details

6.4.8.5. Strategic Overview

6.4.9. LyondellBasell Industries Holdings B.V.

6.4.9.1. Company Details

6.4.9.2. Company Description

6.4.9.3. Business Overview

6.4.9.4. Financial Details

6.4.9.5. Strategic Overview

6.4.10. SABIC

6.4.10.1. Company Details

6.4.10.2. Company Description

6.4.10.3. Business Overview

6.4.10.4. Financial Details

6.4.10.5. Strategic Overview

7. Primary Research – Key Insights

8. Appendix

8.1. Research Methodology and Assumptions

List of Tables

Table 01: U.K. MDPE Pipe Market for Water Supply Volume (Tons) Forecast, by End-use, 2020–2031

Table 02: U.K. MDPE Pipe Market for Water Supply Value (US$ Mn) Forecast, by End-use, 2020–2031

List of Figures

Figure 01: U.K. MDPE Pipe Market for Water Supply Share Analysis, by End-use

Figure 02: U.K. MDPE Pipe Market for Water Supply Attractiveness Analysis, by End-use