Analysts’ Viewpoint on Two-wheeler Services Market Scenario

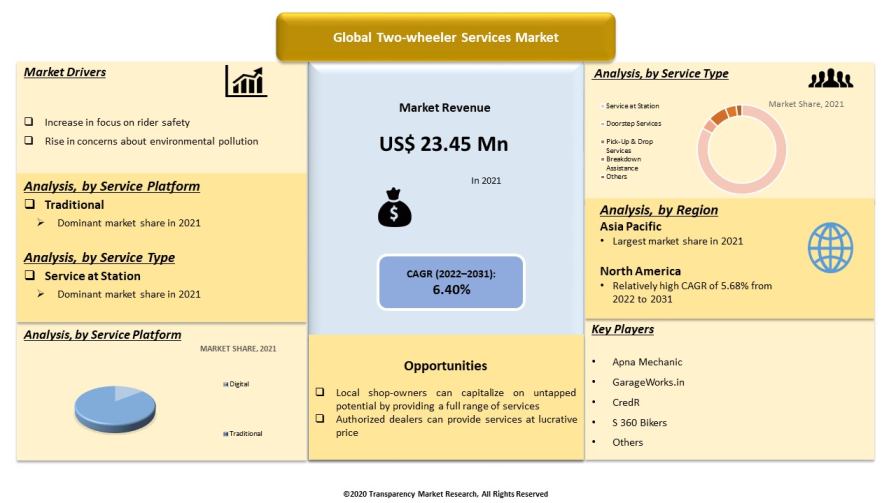

Increase in focus on vehicle safety and growth in the e-commerce sector are expected to propel the global two-wheeler services market during the forecast period. Players in the market are expanding their customer base through two-wheeler dealerships and franchise general repair shops. The COVID-19 pandemic has hampered the market value of the two-wheeler services market, as local garages were shut during the peak of the pandemic. However, companies have come up with innovative strategies, such as launch of app-based services, to broaden their revenue streams. Market players are also providing doorstep services to increase their share in the global two-wheeler services market. Thus, the scope for two-wheeler services market appears positive during the forecast period.

Two-wheeler service is a series of maintenance procedures carried out at a set time interval or after the vehicle has traveled a certain amount of distance. The service intervals are specified by the vehicle manufacturer. Two-wheeler repair services include maintenance and repair of different parts such as the engine, suspension, battery, shock absorbers, and tires. Tire services include tire pressure monitoring and replacement of tires, while battery services comprise replacement of two-wheeler batteries. Vehicle manufacturers, specialty shops, general repairs franchises, and locally-owned repair shops offer two-wheeler repair and maintenance services. Specialty shops are independently-owned shops specializing in doorstep services, breakdown assistance services, pick-up and drop services, and Annual Maintenance Contract (AMC) facilities.

Breakdown of vehicle components often results in road accidents. Therefore, vehicle maintenance and servicing must be carried out regularly to boost vehicle performance. The service life of automotive components is highly dependent on utilization, as components have threshold lifespan. Regular motorcycle repair and services ensure rider safety and reduces air pollution. Thus, increase in focus on rider safety and environmental protection is expected to boost the growth prospects for global two-wheeler services market during the forecast period.

Growth of the e-commerce sector is expected to offer lucrative opportunities for players operating in the market. Competitive pricing is a key benefit of e-commerce websites. Increase in preference for online shopping has led to rapid growth in the last-mile delivery sector. Key delivery and e-commerce startups such as Big-basket, Swiggy, and Flipkart are expanding their regional presence, thereby driving the demand for two-wheelers for delivering goods and services. This, in turn, is fueling the need for periodic repair and maintenance of two-wheelers.

In terms of service platform, the global two-wheeler services market has been bifurcated into digital and traditional. The traditional segment held major share of 85.65% of the global market in 2021. The segment is estimated to maintain its position in the market during the forecast period.

Nearly 70% of the Indian population lives in rural areas. People in the rural areas of the country do not opt for the digital medium to book an appointment for two-wheeler servicing owing to the lack of availability of resources such as fast internet connectivity and digitalized service centers.

Adoption of smartphones and availability of high-speed network connectivity is increasing at a rapid pace in rural areas. This is expected to encourage two-wheeler owners to opt for the digital medium due to the ease and convenience involved. Thus, digital platform is likely to be the fastest growing segment of the two-wheeler services market during the forecast period.

In terms of service type, the global two-wheeler services market has been classified into service at station, doorstep services, pick-up & drop services, breakdown assistance, and others. The service at station segment held major share of 82.90% of the global market in 2021. The segment is estimated to retain its dominance in the market during the forecast period. Lack of digital awareness in rural areas is a key factor driving the service at station segment. Additionally, reliability of service providers is another factor that plays a crucial role in driving the demand for service at station, especially in rural areas, where customers prefer to visit local service providers personally. They can also bargain on the services provided at these centers.

According to the demand analysis of two-wheeler services market, players offering two-wheeler services are witnessing a transformation in demand for services. Rise in adoption of smart gadgets and growth in app-based services are the emerging trends of the two-wheeler services market. Development of mobile applications and their user-friendly interfaces are encouraging people to use services such as doorstep, pick & drop facility, etc. This is creating lucrative opportunities for hi-tech facility enabled service centers.

In terms of revenue, Asia Pacific dominated the global two-wheeler services market in 2021. It is expected to hold more than 37.54% share of the global market by the end of the forecast period. Thus, Asia Pacific is likely to be the fastest growing market for two-wheeler services owing to the presence of a prominent automotive industry in China. Rise in population and urbanization is also a major factor boosting the two-wheeler services market in the region. China’s emergence as a global manufacturing hub has increased the demand for two-wheelers. Availability of low-cost labor and raw materials is boosting the production of aftermarket parts in Asia Pacific. Rise in two-wheeler production, especially electric two-wheelers, is anticipated to augment the two-wheeler services market in the region during the forecast period. Increase in demand for electric two-wheelers and rapid expansion of OEMs in China, India, and South Korea are further fueling the two-wheeler services market in Asia Pacific.

Europe also holds vital share of the global two-wheeler services market owing to the increase in disposable income, competition, and population in the region. Germany accounts for large share of the two-wheeler services market in Europe.

The global two-wheeler services market is fragmented, with large number of manufacturers controlling majority of the share. Key companies are adopting newer technologies and making consistent changes in vehicles to maintain their position in the market. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by the key players. Service providers identified in the global two-wheeler services market are BikeFixo, Garage2Ghar, Go Bumpr, CredR, GarageWorks, Hoopy, myTVS, Ragilly, ServicePlus, and VOC.

Each of these players has been profiled in the two-wheeler services market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 23.45 Bn |

|

Market Forecast Value in 2031 |

US$ 43.61 Bn |

|

Growth Rate (CAGR) |

6.40% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global two-wheeler services market was valued at US$ 23.45 Bn in 2021

The global two-wheeler services market is expected to grow at a CAGR of 6.40% by 2031

The two-wheeler services market is expected to reach US$ 43.61 Bn in 2031

Increase in demand for electric two-wheelers and surge in per capita disposable income

The traditional segment accounted for 85.65% share of the global two-wheeler services market in 2021

Asia Pacific is a highly lucrative region of the global two-wheeler services market

Apna Mechanic, BikeFixo, Bike Doctor, CredR, Garage Works, Garage2Ghar, Gativan, Go Bumpr, Hoopy, Ragilly, S 360 Bikers, Sando Automobiles, ServicePlus, Service Force, and VOC

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Bn, 2017-2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Macro-economic Factors

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.4.3. PESTEL Analysis

2.4.4. Value Chain Analysis

2.4.4.1. Raw Material Supplier

2.4.4.2. Service Providers

2.4.4.3. Applications

2.5. Business Case Study

2.6. Comparison: ICE Vehicle Vs Electric Vehicle

2.7. Comparison: ICE Vehicle Service Provider Vs Electric Vehicle Service Provider

2.8. Regulatory Scenario

2.9. Key Trend Analysis

3. COVID-19 Impact Analysis – Two-wheeler Services Market

4. Global Two-wheeler Services Market, By Service Platform

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Two-wheeler Services Market Size Analysis & Forecast, 2017-2031, By Service Platform

4.2.1. Digital

4.2.2. Traditional

5. Global Two-wheeler Services Market, By Service Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Two-wheeler Services Market Size Analysis & Forecast, 2017-2031, By Service Type

5.2.1. Service at Station

5.2.2. Doorstep Services

5.2.3. Pick-Up & Drop Services

5.2.4. Breakdown Assistance

5.2.5. Others

6. Global Two-wheeler Services Market, By Service Providers

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Two-wheeler Services Market Size Analysis & Forecast, 2017-2031, By Service Providers

6.2.1. Vehicle Manufacturers

6.2.2. Two-wheeler Dealerships

6.2.3. Franchise General Repairs

6.2.4. Locally-owned Repair Shops

6.2.5. Others

7. Global Two-wheeler Services Market, By Vehicle Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Two-wheeler Services Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

7.2.1. IC Engine

7.2.1.1. Motorcycles

7.2.1.2. Mopeds/ Scooters

7.2.2. Electric

7.2.2.1. Motorcycles

7.2.2.2. Mopeds/ Scooters

8. Global Two-wheeler Services Market, by Region

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Two-wheeler Services Market Size Analysis & Forecast, 2017-2031, By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Two-wheeler Services Market

9.1. Market Snapshot

9.2. Two-wheeler Services Market Size Analysis & Forecast, 2017-2031, By Service Platform

9.2.1. Digital

9.2.2. Traditional

9.3. Two-wheeler Services Market Size Analysis & Forecast, 2017-2031, By Service Type

9.3.1. Service at Station

9.3.2. Doorstep Services

9.3.3. Pick-Up & Drop Services

9.3.4. Breakdown Assistance

9.3.5. Others

9.4. Two-wheeler Services Market Size Analysis & Forecast, 2017-2031, By Service Providers

9.4.1. Vehicle Manufacturers

9.4.2. Two-wheeler Dealerships

9.4.3. Franchise General Repairs

9.4.4. Locally-owned Repair Shops

9.4.5. Others

9.5. Two-wheeler Services Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

9.5.1. IC Engine

9.5.1.1. Motorcycles

9.5.1.2. Mopeds/ Scooters

9.5.2. Electric

9.5.2.1. Motorcycles

9.5.2.2. Mopeds/ Scooters

9.6. Key Country Analysis – North America Two-wheeler Services Market Size Analysis & Forecast, 2017-2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Mexico

10. Europe Two-wheeler Services Market

10.1. Market Snapshot

10.2. Two-wheeler Services Market Size Analysis & Forecast, 2017-2031, By Service Platform

10.2.1. Digital

10.2.2. Traditional

10.3. Two-wheeler Services Market Size Analysis & Forecast, 2017-2031, By Service Type

10.3.1. Service at Station

10.3.2. Doorstep Services

10.3.3. Pick-Up & Drop Services

10.3.4. Breakdown Assistance

10.3.5. Others

10.4. Two-wheeler Services Market Size Analysis & Forecast, 2017-2031, By Service Providers

10.4.1. Vehicle Manufacturers

10.4.2. Two-wheeler Dealerships

10.4.3. Franchise General Repairs

10.4.4. Locally-owned Repair Shops

10.4.5. Others

10.5. Two-wheeler Services Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

10.5.1. IC Engine

10.5.1.1. Motorcycles

10.5.1.2. Mopeds/ Scooters

10.5.2. Electric

10.5.2.1. Motorcycles

10.5.2.2. Mopeds/ Scooters

10.6. Key Country Analysis – Europe Two-wheeler Services Market Size Analysis & Forecast, 2017-2031

10.6.1. Germany

10.6.2. U. K.

10.6.3. France

10.6.4. Italy

10.6.5. Spain

10.6.6. Nordic Countries

10.6.7. Russia & CIS

10.6.8. Rest of Europe

11. Asia Pacific Two-wheeler Services Market

11.1. Market Snapshot

11.2. Two-wheeler Services Market Size Analysis & Forecast, 2017-2031, By Service Platform

11.2.1. Digital

11.2.2. Traditional

11.3. Two-wheeler Services Market Size Analysis & Forecast, 2017-2031, By Service Type

11.3.1. Service at Station

11.3.2. Doorstep Services

11.3.3. Pick-Up & Drop Services

11.3.4. Breakdown Assistance

11.3.5. Others

11.4. Two-wheeler Services Market Size Analysis & Forecast, 2017-2031, By Service Providers

11.4.1. Vehicle Manufacturers

11.4.2. Two-wheeler Dealerships

11.4.3. Franchise General Repairs

11.4.4. Locally-owned Repair Shops

11.4.5. Others

11.5. Two-wheeler Services Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

11.5.1. IC Engine

11.5.1.1. Motorcycles

11.5.1.2. Mopeds/ Scooters

11.5.2. Electric

11.5.2.1. Motorcycles

11.5.2.2. Mopeds/ Scooters

11.6. Key Country Analysis – Asia Pacific Two-wheeler Services Market Size Analysis & Forecast, 2017-2031

11.6.1. China

11.6.2. India

11.6.3. Japan

11.6.4. ASEAN Countries

11.6.5. South Korea

11.6.6. ANZ

11.6.7. Rest of Asia Pacific

12. Middle East & Africa Two-wheeler Services Market

12.1. Market Snapshot

12.2. Two-wheeler Services Market Size Analysis & Forecast, 2017-2031, By Service Platform

12.2.1. Digital

12.2.2. Traditional

12.3. Two-wheeler Services Market Size Analysis & Forecast, 2017-2031, By Service Type

12.3.1. Service at Station

12.3.2. Doorstep Services

12.3.3. Pick-Up & Drop Services

12.3.4. Breakdown Assistance

12.3.5. Others

12.4. Two-wheeler Services Market Size Analysis & Forecast, 2017-2031, By Service Providers

12.4.1. Vehicle Manufacturers

12.4.2. Two-wheeler Dealerships

12.4.3. Franchise General Repairs

12.4.4. Locally-owned Repair Shops

12.4.5. Others

12.5. Two-wheeler Services Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

12.5.1. IC Engine

12.5.1.1. Motorcycles

12.5.1.2. Mopeds/ Scooters

12.5.2. Electric

12.5.2.1. Motorcycles

12.5.2.2. Mopeds/ Scooters

12.6. Key Country Analysis – Middle East & Africa Two-wheeler Services Market Size Analysis & Forecast, 2017-2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Turkey

12.6.4. Rest of Middle East & Africa

13. South America Two-wheeler Services Market

13.1. Market Snapshot

13.2. Two-wheeler Services Market Size Analysis & Forecast, 2017-2031, By Service Platform

13.2.1. Digital

13.2.2. Traditional

13.3. Two-wheeler Services Market Size Analysis & Forecast, 2017-2031, By Service Type

13.3.1. Service at Station

13.3.2. Doorstep Services

13.3.3. Pick-Up & Drop Services

13.3.4. Breakdown Assistance

13.3.5. Others

13.4. Two-wheeler Services Market Size Analysis & Forecast, 2017-2031, By Service Providers

13.4.1. Vehicle Manufacturers

13.4.2. Two-wheeler Dealerships

13.4.3. Franchise General Repairs

13.4.4. Locally-owned Repair Shops

13.4.5. Others

13.5. Two-wheeler Services Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

13.5.1. IC Engine

13.5.1.1. Motorcycles

13.5.1.2. Mopeds/ Scooters

13.5.2. Electric

13.5.2.1. Motorcycles

13.5.2.2. Mopeds/ Scooters

13.6. Key Country Analysis – South America Two-wheeler Services Market Size Analysis & Forecast, 2017-2031

13.6.1. Brazil

13.6.2. Mexico

13.6.3. Rest of South America

14. Competitive Landscape

14.1. Company Share Analysis/ Brand Share Analysis, 2021

14.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

14.3. Key Players

14.3.1. Apna Mechanic

14.3.1.1. Company Overview

14.3.1.2. Company Footprints

14.3.1.3. Production Locations

14.3.1.4. Product Portfolio

14.3.1.5. Competitors & Customers

14.3.1.6. Subsidiaries & Parent Organization

14.3.1.7. Recent Developments

14.3.1.8. Financial Analysis

14.3.1.9. Profitability

14.3.1.10. Revenue Share

14.3.2. BikeFixo

14.3.2.1. Company Overview

14.3.2.2. Company Footprints

14.3.2.3. Production Locations

14.3.2.4. Product Portfolio

14.3.2.5. Competitors & Customers

14.3.2.6. Subsidiaries & Parent Organization

14.3.2.7. Recent Developments

14.3.2.8. Financial Analysis

14.3.2.9. Profitability

14.3.2.10. Revenue Share

14.3.3. Bike Doctor

14.3.3.1. Company Overview

14.3.3.2. Company Footprints

14.3.3.3. Production Locations

14.3.3.4. Product Portfolio

14.3.3.5. Competitors & Customers

14.3.3.6. Subsidiaries & Parent Organization

14.3.3.7. Recent Developments

14.3.3.8. Financial Analysis

14.3.3.9. Profitability

14.3.3.10. Revenue Share

14.3.4. CredR

14.3.4.1. Company Overview

14.3.4.2. Company Footprints

14.3.4.3. Production Locations

14.3.4.4. Product Portfolio

14.3.4.5. Competitors & Customers

14.3.4.6. Subsidiaries & Parent Organization

14.3.4.7. Recent Developments

14.3.4.8. Financial Analysis

14.3.4.9. Profitability

14.3.4.10. Revenue Share

14.3.5. Garage Works

14.3.5.1. Company Overview

14.3.5.2. Company Footprints

14.3.5.3. Production Locations

14.3.5.4. Product Portfolio

14.3.5.5. Competitors & Customers

14.3.5.6. Subsidiaries & Parent Organization

14.3.5.7. Recent Developments

14.3.5.8. Financial Analysis

14.3.5.9. Profitability

14.3.5.10. Revenue Share

14.3.6. Garage2Ghar

14.3.6.1. Company Overview

14.3.6.2. Company Footprints

14.3.6.3. Production Locations

14.3.6.4. Product Portfolio

14.3.6.5. Competitors & Customers

14.3.6.6. Subsidiaries & Parent Organization

14.3.6.7. Recent Developments

14.3.6.8. Financial Analysis

14.3.6.9. Profitability

14.3.6.10. Revenue Share

14.3.7. Gativan

14.3.7.1. Company Overview

14.3.7.2. Company Footprints

14.3.7.3. Production Locations

14.3.7.4. Product Portfolio

14.3.7.5. Competitors & Customers

14.3.7.6. Subsidiaries & Parent Organization

14.3.7.7. Recent Developments

14.3.7.8. Financial Analysis

14.3.7.9. Profitability

14.3.7.10. Revenue Share

14.3.8. Go Bumpr

14.3.8.1. Company Overview

14.3.8.2. Company Footprints

14.3.8.3. Production Locations

14.3.8.4. Product Portfolio

14.3.8.5. Competitors & Customers

14.3.8.6. Subsidiaries & Parent Organization

14.3.8.7. Recent Developments

14.3.8.8. Financial Analysis

14.3.8.9. Profitability

14.3.8.10. Revenue Share

14.3.9. Hoopy

14.3.9.1. Company Overview

14.3.9.2. Company Footprints

14.3.9.3. Production Locations

14.3.9.4. Product Portfolio

14.3.9.5. Competitors & Customers

14.3.9.6. Subsidiaries & Parent Organization

14.3.9.7. Recent Developments

14.3.9.8. Financial Analysis

14.3.9.9. Profitability

14.3.9.10. Revenue Share

14.3.10. Ragilly

14.3.10.1. Company Overview

14.3.10.2. Company Footprints

14.3.10.3. Production Locations

14.3.10.4. Product Portfolio

14.3.10.5. Competitors & Customers

14.3.10.6. Subsidiaries & Parent Organization

14.3.10.7. Recent Developments

14.3.10.8. Financial Analysis

14.3.10.9. Profitability

14.3.10.10. Revenue Share

14.3.11. S 360 Bikers

14.3.11.1. Company Overview

14.3.11.2. Company Footprints

14.3.11.3. Production Locations

14.3.11.4. Product Portfolio

14.3.11.5. Competitors & Customers

14.3.11.6. Subsidiaries & Parent Organization

14.3.11.7. Recent Developments

14.3.11.8. Financial Analysis

14.3.11.9. Profitability

14.3.11.10. Revenue Share

14.3.12. Sando Automobiles

14.3.12.1. Company Overview

14.3.12.2. Company Footprints

14.3.12.3. Production Locations

14.3.12.4. Product Portfolio

14.3.12.5. Competitors & Customers

14.3.12.6. Subsidiaries & Parent Organization

14.3.12.7. Recent Developments

14.3.12.8. Financial Analysis

14.3.12.9. Profitability

14.3.12.10. Revenue Share

14.3.13. ServicePlus

14.3.13.1. Company Overview

14.3.13.2. Company Footprints

14.3.13.3. Production Locations

14.3.13.4. Product Portfolio

14.3.13.5. Competitors & Customers

14.3.13.6. Subsidiaries & Parent Organization

14.3.13.7. Recent Developments

14.3.13.8. Financial Analysis

14.3.13.9. Profitability

14.3.13.10. Revenue Share

14.3.14. Service Force

14.3.14.1. Company Overview

14.3.14.2. Company Footprints

14.3.14.3. Production Locations

14.3.14.4. Product Portfolio

14.3.14.5. Competitors & Customers

14.3.14.6. Subsidiaries & Parent Organization

14.3.14.7. Recent Developments

14.3.14.8. Financial Analysis

14.3.14.9. Profitability

14.3.14.10. Revenue Share

14.3.15. VOC

14.3.15.1. Company Overview

14.3.15.2. Company Footprints

14.3.15.3. Production Locations

14.3.15.4. Product Portfolio

14.3.15.5. Competitors & Customers

14.3.15.6. Subsidiaries & Parent Organization

14.3.15.7. Recent Developments

14.3.15.8. Financial Analysis

14.3.15.9. Profitability

14.3.15.10. Revenue Share

14.3.16. Other Key Players

List of Tables

Table 1: Global Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Platform, 2017‒2031

Table 2: Global Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Type, 2017‒2031

Table 3: Global Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Providers, 2017‒2031

Table 4: Global Two-wheeler Services Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 5: Global Two-wheeler Services Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 6: North America Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Platform, 2017‒2031

Table 7: North America Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Type, 2017‒2031

Table 8: North America Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Providers, 2017‒2031

Table 9: North America Two-wheeler Services Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 10: North America Two-wheeler Services Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 11: Europe Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Platform, 2017‒2031

Table 12: Europe Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Type, 2017‒2031

Table 13: Europe Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Providers, 2017‒2031

Table 14: Europe Two-wheeler Services Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 15: Europe Two-wheeler Services Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 16: Asia Pacific Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Platform, 2017‒2031

Table 17: Asia Pacific Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Type, 2017‒2031

Table 18: Asia Pacific Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Providers, 2017‒2031

Table 19: Asia Pacific Two-wheeler Services Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 20: Asia Pacific Two-wheeler Services Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 21: Middle East & Africa Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Platform, 2017‒2031

Table 22: Middle East & Africa Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Type, 2017‒2031

Table 23: Middle East & Africa Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Providers, 2017‒2031

Table 24: Middle East & Africa Two-wheeler Services Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 25: Middle East & Africa Two-wheeler Services Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 26: South America Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Platform, 2017‒2031

Table 27: South America Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Type, 2017‒2031

Table 28: South America Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Providers, 2017‒2031

Table 29: South America Two-wheeler Services Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 30: South America Two-wheeler Services Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Platform, 2017-2031

Figure 2: Global Two-wheeler Services Market, Incremental Opportunity, by Service Platform, Value (US$ Bn), 2022-2031

Figure 3: Global Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Type, 2017-2031

Figure 4: Global Two-wheeler Services Market, Incremental Opportunity, by Service Type, Value (US$ Bn), 2022-2031

Figure 5: Global Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Providers, 2017-2031

Figure 6: Global Two-wheeler Services Market, Incremental Opportunity, by Service Providers, Value (US$ Bn), 2022-2031

Figure 7: Global Two-wheeler Services Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 8: Global Two-wheeler Services Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 9: Global Two-wheeler Services Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 10: Global Two-wheeler Services Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 11: North America Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Platform, 2017-2031

Figure 12: North America Two-wheeler Services Market, Incremental Opportunity, by Service Platform, Value (US$ Bn), 2022-2031

Figure 13: North America Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Type, 2017-2031

Figure 14: North America Two-wheeler Services Market, Incremental Opportunity, by Service Type, Value (US$ Bn), 2022-2031

Figure 15: North America Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Providers, 2017-2031

Figure 16: North America Two-wheeler Services Market, Incremental Opportunity, by Service Providers, Value (US$ Bn), 2022-2031

Figure 17: North America Two-wheeler Services Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 18: North America Two-wheeler Services Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 19: North America Two-wheeler Services Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 20: North America Two-wheeler Services Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 21: Europe Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Platform, 2017-2031

Figure 22: Europe Two-wheeler Services Market, Incremental Opportunity, by Service Platform, Value (US$ Bn), 2022-2031

Figure 23: Europe Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Type, 2017-2031

Figure 24: Europe Two-wheeler Services Market, Incremental Opportunity, by Service Type, Value (US$ Bn), 2022-2031

Figure 25: Europe Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Providers, 2017-2031

Figure 26: Europe Two-wheeler Services Market, Incremental Opportunity, by Service Providers, Value (US$ Bn), 2022-2031

Figure 27: Europe Two-wheeler Services Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 28: Europe Two-wheeler Services Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 29: Europe Two-wheeler Services Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 30: Europe Two-wheeler Services Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 31: Asia Pacific Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Platform, 2017-2031

Figure 32: Asia Pacific Two-wheeler Services Market, Incremental Opportunity, by Service Platform, Value (US$ Bn), 2022-2031

Figure 33: Asia Pacific Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Type, 2017-2031

Figure 34: Asia Pacific Two-wheeler Services Market, Incremental Opportunity, by Service Type, Value (US$ Bn), 2022-2031

Figure 35: Asia Pacific Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Providers, 2017-2031

Figure 36: Asia Pacific Two-wheeler Services Market, Incremental Opportunity, by Service Providers, Value (US$ Bn), 2022-2031

Figure 37: Asia Pacific Two-wheeler Services Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 38: Asia Pacific Two-wheeler Services Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 39: Asia Pacific Two-wheeler Services Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 40: Asia Pacific Two-wheeler Services Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 41: Middle East & Africa Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Platform, 2017-2031

Figure 42: Middle East & Africa Two-wheeler Services Market, Incremental Opportunity, by Service Platform, Value (US$ Bn), 2022-2031

Figure 43: Middle East & Africa Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Type, 2017-2031

Figure 44: Middle East & Africa Two-wheeler Services Market, Incremental Opportunity, by Service Type, Value (US$ Bn), 2022-2031

Figure 45: Middle East & Africa Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Providers, 2017-2031

Figure 46: Middle East & Africa Two-wheeler Services Market, Incremental Opportunity, by Service Providers, Value (US$ Bn), 2022-2031

Figure 47: Middle East & Africa Two-wheeler Services Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 48: Middle East & Africa Two-wheeler Services Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 49: Middle East & Africa Two-wheeler Services Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 50: Middle East & Africa Two-wheeler Services Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 51: South America Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Platform, 2017-2031

Figure 52: South America Two-wheeler Services Market, Incremental Opportunity, by Service Platform, Value (US$ Bn), 2022-2031

Figure 53: South America Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Type, 2017-2031

Figure 54: South America Two-wheeler Services Market, Incremental Opportunity, by Service Type, Value (US$ Bn), 2022-2031

Figure 55: South America Two-wheeler Services Market Value (US$ Bn) Forecast, by Service Providers, 2017-2031

Figure 56: South America Two-wheeler Services Market, Incremental Opportunity, by Service Providers, Value (US$ Bn), 2022-2031

Figure 57: South America Two-wheeler Services Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 58: South America Two-wheeler Services Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 59: South America Two-wheeler Services Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: South America Two-wheeler Services Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031