Analysts’ Viewpoint on Market Scenario

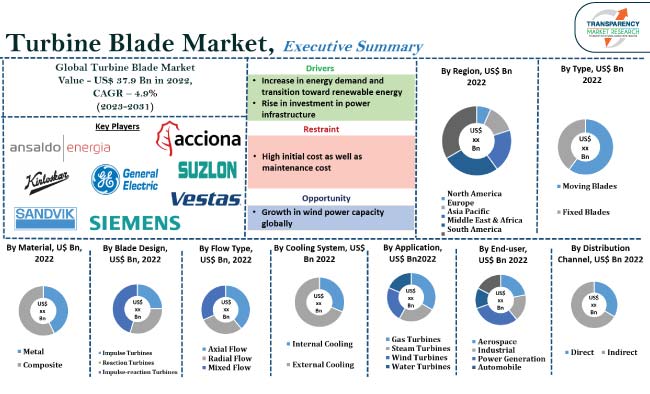

Rapid industrialization and investment in power infrastructure, surge in energy demand, and transition toward renewable energy are key factors driving the turbine blade market. The growth in demand for turbines to generate power from gas, steam, wind, and water for aviation and industrial applications is driving turbine blade market size.

Key players are focusing on offering bigger turbine blade lengths with customization as well as providing specific turbine blades with respect to blade design and flow type, thus boosting the turbine blade market value.

Furthermore, leading manufacturers are innovating in terms of turbine blade design and turbine blade material properties. Key turbine blade market players collaborate with different companies to expand their product offerings and global reach to keep their businesses growing across regions.

A turbine blade is a key component of a turbine that converts the energy from steam, gas, or wind through rotational motion. It is designed to efficiently extract energy from the source and convert it into mechanical energy to drive a generator, a compressor, or other mechanical equipment. Turbine fan blades are typically made of durable materials and composites such as steel, titanium, cobalt, carbon, and glass that can withstand high temperatures, pressures, and rotational speeds. Turbine fins are designed with specific aerodynamic outlines to optimize energy capture and minimize loss due to drag or turbulence. Turbine blade designs may vary depending on the type of turbine such as steam turbine, gas turbine, or wind turbine and its specific operating condition.

Global energy demand is continuously increasing due to population growth, urbanization, and industrialization. The need for efficient and reliable power generation systems have increased, where different types of turbine blades such as steam turbine blades, gas turbines, and wind turbines, enable the conversion of energy from different sources into electricity. Wind turbine blades are constantly being improved to enhance energy efficiency and optimize power generation. Furthermore, research and development efforts in turbine blade technology are driving innovation and improving product performance. Advanced materials, such as composite materials and coatings, are used to enhance the strength, durability, and efficiency of turbine blades.

The global shift toward renewable energy sources, driven by concerns over climate change and greenhouse gas emissions, is a significant factor fueling market progress. Wind turbine rotors, in particular, have experienced remarkable growth as wind power has become one of the fastest growing renewable energy sectors worldwide. Turbine blades are vital components of wind turbines, harnessing the kinetic energy of the wind and converting it into electricity.

Turbine blades are also used in hydroelectric power plants, where the kinetic energy of flowing water is converted into mechanical energy. As the demand for renewable energy continues to grow, the development of small and micro-hydroelectric power projects is also increasing and driving the demand for turbine blades. These are significant turbine blade market trends for the upcoming years.

In recent years, investment in power infrastructure has increased globally to expand power generation capacity and meet the rising energy demand. As new power plants are constructed or existing ones are upgraded, the demand for turbine blades increases as these blades are one of the essential components in various power generation technologies, including steam turbines and gas turbines.

Additionally, investment in renewable energy projects, such as wind farms and solar power plants, drives the demand for turbine blades for wind turbines and concentrated solar power systems, leading to turbine blade market development. Power infrastructure investment includes the expansion and strengthening of electricity transmission and distribution networks that enable the efficient transfer of electricity from power generation facilities to end-users, utilizing turbine blades. Governments worldwide are implementing supportive policies and offering incentives to promote renewable energy adoption such as initiatives to encourage investment in renewable energy projects, offering lucrative market expansion opportunities for turbine blades.

The turbine blade market segmentation based on blade design includes impulse turbines, reaction turbines, and impulse-reaction turbines.

Impulse-reaction turbines are highly versatile and used in various applications, including power generation, industrial processes, and marine propulsion systems. Impulse-reaction turbines blades are suitable for both high-pressure and low-pressure steam conditions, making them adaptable to different operating environments. Impulse reaction turbines have a more compact design compared to traditional turbines, enabling easier installation in various settings, including power plants with limited space availability, as the combination of impulse and reaction in turbines offers improved rotor stability and reduced vibration. These characteristics result in enhanced reliability and reduced maintenance requirements, thus driving the overall turbine blade market growth.

In terms of region, Asia Pacific holds major turbine blade market share in the global landscape, owing to rise in industrialization, rapid urbanization, and growth in energy demand. China and India are witnessing significant investments in power generation infrastructure. The wind energy sector is particularly vibrant in China, which has a large number of wind farms. Japan and South Korea also contribute to the market with their advanced turbine blade manufacturing process capabilities.

According to the turbine blade market forecast, North America and Europe are emerging markets. Established manufacturing industries, such as aerospace, power generation, and wind energy across the regions help in the turbine blade industry growth.

Detailed profiles of companies in the global turbine blade market research are provided to evaluate their financials, key product offerings, recent developments, and strategies. Majority of companies are spending significantly on comprehensive R&D activities, primarily to develop innovative products. Expansion of product portfolios and mergers & acquisitions are the key strategies followed by manufacturers.

Acciona S.A., Ansaldo Energia S.p.A., General Electric Company, Kirloskar Brothers Limited, PBS Group a. s., Sandvik AB, Siemens AG, Suzlon Energy Limited, Turbocam Inc., and Vestas Wind Systems A/S are the prominent companies operating in the global turbine blade industry.

Each of these players has been profiled in the global turbine blade market report based on parameters such as company overview, financial overview, business strategies, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

USD 37.9 Bn |

|

Market Forecast Value in 2031 |

USD 57.6 Bn |

|

Growth Rate (CAGR) |

4.9% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

Market Share Analysis by Company (2022) Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, COVID-19 Response, Strategy & Business Overview) |

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 37.9 Bn in 2022

It is expected to reach US$ 57.6 Bn by the end of 2031

The CAGR is anticipated to be 4.9% during 2023-2031

Increase in energy demand & transition toward renewable energy, and rise in investment in power infrastructure

Impulse-reaction turbines is the prominent segment

Asia Pacific is highly lucrative for turbine blades

Acciona S.A., Ansaldo Energia S.p.A., General Electric Company, Kirloskar Brothers Limited, PBS Group a. s., Sandvik AB, Siemens AG, Suzlon Energy Limited, Turbocam Inc., and Vestas Wind Systems A/S.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. Overall Turbine Industry Overview

5.5. Porter’s Five Forces Analysis

5.6. Industry SWOT Analysis

5.7. Value Chain Analysis

5.8. Raw Material Analysis

5.9. Technological Overview Analysis

5.10. Regularity Framework

5.11. Global Turbine Blade Market Analysis and Forecast, 2017 - 2031

5.11.1. Market Value Projections (US$ Bn)

5.11.2. Market Volume Projections (Thousand Units)

6. Global Turbine Blade Market Analysis and Forecast, By Type

6.1. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

6.1.1. Moving Blades

6.1.2. Fixed Blades

6.2. Incremental Opportunity, By Type

7. Global Turbine Blade Market Analysis and Forecast, By Material

7.1. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Material, 2017 - 2031

7.1.1. Metal

7.1.1.1. Steel

7.1.1.2. Titanium

7.1.1.3. Cobalt

7.1.1.4. Rhenium

7.1.1.5. Nickel-based Alloys

7.1.2. Composite

7.1.2.1. Carbon

7.1.2.2. Glass

7.1.2.3. Polyester

7.1.2.4. Glass Fiber Reinforced Plastics (GRP)

7.2. Incremental Opportunity, By Material

8. Global Turbine Blade Market Analysis and Forecast, By Blade Design

8.1. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Blade Design, 2017 - 2031

8.1.1. Impulse Turbines

8.1.2. Reaction Turbines

8.1.3. Impulse-reaction Turbines

8.2. Incremental Opportunity, By Blade Design

9. Global Turbine Blade Market Analysis and Forecast, By Flow Type

9.1. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Flow Type,2017 - 2031

9.1.1. Axial Flow

9.1.2. Radial Flow

9.1.3. Mixed Flow

9.2. Incremental Opportunity, By Flow Type

10. Global Turbine Blade Market Analysis and Forecast, By Cooling System

10.1. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Cooling System,2017 - 2031

10.1.1. Internal Cooling

10.1.2. External Cooling

10.2. Incremental Opportunity, By Cooling System

11. Global Turbine Blade Market Analysis and Forecast, By Application

11.1. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Application,2017 - 2031

11.1.1. Gas Turbines

11.1.2. Steam Turbines

11.1.3. Wind Turbines

11.1.4. Water Turbines

11.2. Incremental Opportunity, By Application

12. Global Turbine Blade Market Analysis and Forecast, By End-user

12.1. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By End-user,2017 - 2031

12.1.1. Aerospace

12.1.2. Industrial

12.1.3. Power Generation

12.1.4. Automobile

12.1.5. Others

12.2. Incremental Opportunity, By End-user

13. Global Turbine Blade Market Analysis and Forecast, By Distribution Channel

13.1. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

13.1.1. Direct

13.1.2. Indirect

13.2. Incremental Opportunity, By Distribution Channel

14. Global Turbine Blade Market Analysis and Forecast, By Region

14.1. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Region, 2017 - 2031

14.1.1. North America

14.1.2. Europe

14.1.3. Asia Pacific

14.1.4. Middle East & Africa

14.1.5. South America

14.2. Incremental Opportunity, By Region

15. North America Turbine Blade Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Trends Analysis

15.2.1. Demand Side

15.2.2. Supplier Side

15.3. Key Supplier Analysis

15.4. Price Trend Analysis

15.4.1. Weighted Average Selling Cooling System

15.5. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Type,2017 - 2031

15.5.1. Moving Blades

15.5.2. Fixed Blades

15.6. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Material, 2017 - 2031

15.6.1. Metal

15.6.1.1. Steel

15.6.1.2. Titanium

15.6.1.3. Cobalt

15.6.1.4. Rhenium

15.6.1.5. Nickel-based Alloys

15.6.2. Composite

15.6.2.1. Carbon

15.6.2.2. Glass

15.6.2.3. Polyester

15.6.2.4. Glass Fiber Reinforced Plastics (GRP)

15.7. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Blade Design, 2017 - 2031

15.7.1. Impulse Turbines

15.7.2. Reaction Turbines

15.7.3. Impulse-reaction Turbines

15.8. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Flow Type,2017 - 2031

15.8.1. Axial Flow

15.8.2. Radial Flow

15.8.3. Mixed Flow

15.9. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Cooling System,2017 - 2031

15.9.1. Internal Cooling

15.9.2. External Cooling

15.10. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Application,2017 - 2031

15.10.1. Gas Turbines

15.10.2. Steam Turbines

15.10.3. Wind Turbines

15.10.4. Water Turbines

15.11. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By End-user,2017 - 2031

15.11.1. Aerospace

15.11.2. Industrial

15.11.3. Power Generation

15.11.4. Automobile

15.11.5. Others

15.12. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

15.12.1. Direct

15.12.2. Indirect

15.13. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

15.13.1. U.S

15.13.2. Canada

15.13.3. Rest of North America

15.14. Incremental Opportunity Analysis

16. Europe Turbine Blade Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Trends Analysis

16.2.1. Demand Side

16.2.2. Supplier Side

16.3. Key Supplier Analysis

16.4. Price Trend Analysis

16.4.1. Weighted Average Selling Cooling System

16.5. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Type,2017 - 2031

16.5.1. Moving Blades

16.5.2. Fixed Blades

16.6. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Material, 2017 - 2031

16.6.1. Metal

16.6.1.1. Steel

16.6.1.2. Titanium

16.6.1.3. Cobalt

16.6.1.4. Rhenium

16.6.1.5. Nickel-based Alloys

16.6.2. Composite

16.6.2.1. Carbon

16.6.2.2. Glass

16.6.2.3. Polyester

16.6.2.4. Glass Fiber Reinforced Plastics (GRP)

16.7. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Blade Design, 2017 - 2031

16.7.1. Impulse Turbines

16.7.2. Reaction Turbines

16.7.3. Impulse-reaction Turbines

16.8. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Flow Type,2017 - 2031

16.8.1. Axial Flow

16.8.2. Radial Flow

16.8.3. Mixed Flow

16.9. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Cooling System,2017 - 2031

16.9.1. Internal Cooling

16.9.2. External Cooling

16.10. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Application,2017 - 2031

16.10.1. Gas Turbines

16.10.2. Steam Turbines

16.10.3. Wind Turbines

16.10.4. Water Turbines

16.11. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By End-user,2017 - 2031

16.11.1. Aerospace

16.11.2. Industrial

16.11.3. Power Generation

16.11.4. Automobile

16.11.5. Others

16.12. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

16.12.1. Direct

16.12.2. Indirect

16.13. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

16.13.1. U.K

16.13.2. Germany

16.13.3. France

16.13.4. Rest of Europe

16.14. Incremental Opportunity Analysis

17. Asia Pacific Turbine Blade Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Key Trends Analysis

17.2.1. Demand Side

17.2.2. Supplier Side

17.3. Key Supplier Analysis

17.4. Price Trend Analysis

17.4.1. Weighted Average Selling Cooling System

17.5. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

17.5.1. Moving Blades

17.5.2. Fixed Blades

17.6. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Material, 2017 - 2031

17.6.1. Metal

17.6.1.1. Steel

17.6.1.2. Titanium

17.6.1.3. Cobalt

17.6.1.4. Rhenium

17.6.1.5. Nickel-based Alloys

17.6.2. Composite

17.6.2.1. Carbon

17.6.2.2. Glass

17.6.2.3. Polyester

17.6.2.4. Glass Fiber Reinforced Plastics (GRP)

17.7. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Blade Design, 2017 - 2031

17.7.1. Impulse Turbines

17.7.2. Reaction Turbines

17.7.3. Impulse-reaction Turbines

17.8. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Flow Type,2017 - 2031

17.8.1. Axial Flow

17.8.2. Radial Flow

17.8.3. Mixed Flow

17.9. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Cooling System,2017 - 2031

17.9.1. Internal Cooling

17.9.2. External Cooling

17.10. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Application,2017 - 2031

17.10.1. Gas Turbines

17.10.2. Steam Turbines

17.10.3. Wind Turbines

17.10.4. Water Turbines

17.11. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By End-user,2017 - 2031

17.11.1. Aerospace

17.11.2. Industrial

17.11.3. Power Generation

17.11.4. Automobile

17.11.5. Others

17.12. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

17.12.1. Direct

17.12.2. Indirect

17.13. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

17.13.1. India

17.13.2. China

17.13.3. Japan

17.13.4. Rest of Asia Pacific

17.14. Incremental Opportunity Analysis

18. Middle East & South Africa Turbine Blade Market Analysis and Forecast

18.1. Regional Snapshot

18.2. Key Trends Analysis

18.2.1. Demand Side

18.2.2. Supplier Side

18.3. Key Supplier Analysis

18.4. Price Trend Analysis

18.4.1. Weighted Average Selling Cooling System

18.5. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

18.5.1. Moving Blades

18.5.2. Fixed Blades

18.6. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Material, 2017 - 2031

18.6.1. Metal

18.6.1.1. Steel

18.6.1.2. Titanium

18.6.1.3. Cobalt

18.6.1.4. Rhenium

18.6.1.5. Nickel-based Alloys

18.6.2. Composite

18.6.2.1. Carbon

18.6.2.2. Glass

18.6.2.3. Polyester

18.6.2.4. Glass Fiber Reinforced Plastics (GRP)

18.7. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Blade Design, 2017 - 2031

18.7.1. Impulse Turbines

18.7.2. Reaction Turbines

18.7.3. Impulse-reaction Turbines

18.8. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Flow Type,2017 - 2031

18.8.1. Axial Flow

18.8.2. Radial Flow

18.8.3. Mixed Flow

18.9. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Cooling System,2017 - 2031

18.9.1. Internal Cooling

18.9.2. External Cooling

18.10. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Application,2017 - 2031

18.10.1. Gas Turbines

18.10.2. Steam Turbines

18.10.3. Wind Turbines

18.10.4. Water Turbines

18.11. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By End-user,2017 - 2031

18.11.1. Aerospace

18.11.2. Industrial

18.11.3. Power Generation

18.11.4. Automobile

18.11.5. Others

18.12. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

18.12.1. Direct

18.12.2. Indirect

18.13. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

18.13.1. GCC

18.13.2. Rest of MEA

18.14. Incremental Opportunity Analysis

19. South America Turbine Blade Market Analysis and Forecast

19.1. Regional Snapshot

19.2. Key Trends Analysis

19.2.1. Demand Side

19.2.2. Supplier Side

19.3. Key Supplier Analysis

19.4. Price Trend Analysis

19.4.1. Weighted Average Selling Cooling System

19.5. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

19.5.1. Moving Blades

19.5.2. Fixed Blades

19.6. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Material, 2017 - 2031

19.6.1. Metal

19.6.1.1. Steel

19.6.1.2. Titanium

19.6.1.3. Cobalt

19.6.1.4. Rhenium

19.6.1.5. Nickel-based Alloys

19.6.2. Composite

19.6.2.1. Carbon

19.6.2.2. Glass

19.6.2.3. Polyester

19.6.2.4. Glass Fiber Reinforced Plastics (GRP)

19.7. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Blade Design, 2017 - 2031

19.7.1. Impulse Turbines

19.7.2. Reaction Turbines

19.7.3. Impulse-reaction Turbines

19.8. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Flow Type,2017 - 2031

19.8.1. Axial Flow

19.8.2. Radial Flow

19.8.3. Mixed Flow

19.9. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Cooling System,2017 - 2031

19.9.1. Internal Cooling

19.9.2. External Cooling

19.10. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Application,2017 - 2031

19.10.1. Gas Turbines

19.10.2. Steam Turbines

19.10.3. Wind Turbines

19.10.4. Water Turbines

19.11. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By End-user,2017 - 2031

19.11.1. Aerospace

19.11.2. Industrial

19.11.3. Power Generation

19.11.4. Automobile

19.11.5. Others

19.12. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

19.12.1. Direct

19.12.2. Indirect

19.13. Turbine Blade Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

19.13.1. Brazil

19.13.2. Rest of South America

19.14. Incremental Opportunity Analysis

20. Competition Landscape

20.1. Market Player - Competition Dashboard

20.2. Market Share Analysis (%), by Company, (2022)

20.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

20.3.1. Acciona S.A.

20.3.1.1. Company Overview

20.3.1.2. Sales Area/Geographical Presence

20.3.1.3. Revenue

20.3.1.4. Strategy & Business Overview

20.3.2. Ansaldo Energia S.p.A.

20.3.2.1. Company Overview

20.3.2.2. Sales Area/Geographical Presence

20.3.2.3. Revenue

20.3.2.4. Strategy & Business Overview

20.3.3. General Electric Company

20.3.3.1. Company Overview

20.3.3.2. Sales Area/Geographical Presence

20.3.3.3. Revenue

20.3.3.4. Strategy & Business Overview

20.3.4. Kirloskar Brothers Limited

20.3.4.1. Company Overview

20.3.4.2. Sales Area/Geographical Presence

20.3.4.3. Revenue

20.3.4.4. Strategy & Business Overview

20.3.5. PBS Group a. s.

20.3.5.1. Company Overview

20.3.5.2. Sales Area/Geographical Presence

20.3.5.3. Revenue

20.3.5.4. Strategy & Business Overview

20.3.6. Sandvik AB

20.3.6.1. Company Overview

20.3.6.2. Sales Area/Geographical Presence

20.3.6.3. Revenue

20.3.6.4. Strategy & Business Overview

20.3.7. Siemens AG

20.3.7.1. Company Overview

20.3.7.2. Sales Area/Geographical Presence

20.3.7.3. Revenue

20.3.7.4. Strategy & Business Overview

20.3.8. Suzlon Energy Limited

20.3.8.1. Company Overview

20.3.8.2. Sales Area/Geographical Presence

20.3.8.3. Revenue

20.3.8.4. Strategy & Business Overview

20.3.9. Turbocam Inc.

20.3.9.1. Company Overview

20.3.9.2. Sales Area/Geographical Presence

20.3.9.3. Revenue

20.3.9.4. Strategy & Business Overview

20.3.10. Vestas Wind Systems A/S

20.3.10.1. Company Overview

20.3.10.2. Sales Area/Geographical Presence

20.3.10.3. Revenue

20.3.10.4. Strategy & Business Overview

20.3.11. Among Others

20.3.11.1. Company Overview

20.3.11.2. Sales Area/Geographical Presence

20.3.11.3. Revenue

20.3.11.4. Strategy & Business Overview

21. Go To Market Strategy

21.1. Identification of Potential Market Spaces

21.2. Prevailing Market Risks

21.3. Understanding the Buying Process of Customers

21.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Turbine Blade Market Volume (Thousand Units) Share, by Type, 2017-2031

Table 2: Global Turbine Blade Market Value (US$ Bn) Share, by Type, 2017-2031

Table 3: Global Turbine Blade Market Volume (Thousand Units) Share, by Material, 2017-2031

Table 4: Global Turbine Blade Market Value (US$ Bn) Share, by Material, 2017-2031

Table 5: Global Turbine Blade Market Volume (Thousand Units) Share, by Blade Design, 2017-2031

Table 6: Global Turbine Blade Market Value (US$ Bn) Share, by Blade Design, 2017-2031

Table 7: Global Turbine Blade Market Volume (Thousand Units) Share, by Flow Type, 2017-2031

Table 8: Global Turbine Blade Market Value (US$ Bn) Share, by Flow Type, 2017-2031

Table 9: Global Turbine Blade Market Volume (Thousand Units) Share, by Cooling System, 2017-2031

Table 10: Global Turbine Blade Market Value (US$ Bn) Share, by Cooling System, 2017-2031

Table 11: Global Turbine Blade Market Volume (Thousand Units) Share, by Application, 2017-2031

Table 12: Global Turbine Blade Market Value (US$ Bn) Share, by Application, 2017-2031

Table 13: Global Turbine Blade Market Value (US$ Bn) Share, by End-user, 2017-2031

Table 14: Global Turbine Blade Market Value (US$ Bn) Share, by End-user, 2017-2031

Table 15: Global Turbine Blade Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Table 16: Global Turbine Blade Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Table 17: Global Turbine Blade Market Volume (Thousand Units) Share, by Region, 2017-2031

Table 18: Global Turbine Blade Market Value (US$ Bn) Share, by Region, 2017-2031

Table 19: North America Turbine Blade Market Volume (Thousand Units) Share, by Type, 2017-2031

Table 20: North America Turbine Blade Market Value (US$ Bn) Share, by Type, 2017-2031

Table 21: North America Turbine Blade Market Volume (Thousand Units) Share, by Material, 2017-2031

Table 22: North America Turbine Blade Market Value (US$ Bn) Share, by Material, 2017-2031

Table 23: North America Turbine Blade Market Volume (Thousand Units) Share, by Blade Design, 2017-2031

Table 24: North America Turbine Blade Market Value (US$ Bn) Share, by Blade Design, 2017-2031

Table 25: North America Turbine Blade Market Volume (Thousand Units) Share, by Flow Type, 2017-2031

Table 26: North America Turbine Blade Market Value (US$ Bn) Share, by Flow Type, 2017-2031

Table 27: North America Turbine Blade Market Volume (Thousand Units) Share, by Cooling System, 2017-2031

Table 28: North America Turbine Blade Market Value (US$ Bn) Share, by Cooling System, 2017-2031

Table 29: North America Turbine Blade Market Volume (Thousand Units) Share, by Application, 2017-2031

Table 30: North America Turbine Blade Market Value (US$ Bn) Share, by Application, 2017-2031

Table 31: North America Turbine Blade Market Value (US$ Bn) Share, by End-user, 2017-2031

Table 32: North America Turbine Blade Market Value (US$ Bn) Share, by End-user, 2017-2031

Table 33: North America Turbine Blade Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Table 34: North America Turbine Blade Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Table 35: North America Turbine Blade Market Volume (Thousand Units) Share, by Country, 2017-2031

Table 36: North America Turbine Blade Market Value (US$ Bn) Share, by Country, 2017-2031

Table 37: Europe Turbine Blade Market Volume (Thousand Units) Share, by Type, 2017-2031

Table 38: Europe Turbine Blade Market Value (US$ Bn) Share, by Type, 2017-2031

Table 39: Europe Turbine Blade Market Volume (Thousand Units) Share, by Material, 2017-2031

Table 40: Europe Turbine Blade Market Value (US$ Bn) Share, by Material, 2017-2031

Table 41: Europe Turbine Blade Market Volume (Thousand Units) Share, by Blade Design, 2017-2031

Table 42: Europe Turbine Blade Market Value (US$ Bn) Share, by Blade Design, 2017-2031

Table 43: Europe Turbine Blade Market Volume (Thousand Units) Share, by Flow Type, 2017-2031

Table 44: Europe Turbine Blade Market Value (US$ Bn) Share, by Flow Type, 2017-2031

Table 45: Europe Turbine Blade Market Volume (Thousand Units) Share, by Cooling System, 2017-2031

Table 46: Europe Turbine Blade Market Value (US$ Bn) Share, by Cooling System, 2017-2031

Table 47: Europe Turbine Blade Market Volume (Thousand Units) Share, by Application, 2017-2031

Table 48: Europe Turbine Blade Market Value (US$ Bn) Share, by Application, 2017-2031

Table 49: Europe Turbine Blade Market Value (US$ Bn) Share, by End-user, 2017-2031

Table 50: Europe Turbine Blade Market Value (US$ Bn) Share, by End-user, 2017-2031

Table 51: Europe Turbine Blade Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Table 52: Europe Turbine Blade Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Table 53: Europe Turbine Blade Market Volume (Thousand Units) Share, by Country, 2017-2031

Table 54: Europe Turbine Blade Market Value (US$ Bn) Share, by Country, 2017-2031

Table 55: Asia Pacific Turbine Blade Market Volume (Thousand Units) Share, by Type, 2017-2031

Table 56: Asia Pacific Turbine Blade Market Value (US$ Bn) Share, by Type, 2017-2031

Table 57: Asia Pacific Turbine Blade Market Volume (Thousand Units) Share, by Material, 2017-2031

Table 58: Asia Pacific Turbine Blade Market Value (US$ Bn) Share, by Material, 2017-2031

Table 59: Asia Pacific Turbine Blade Market Volume (Thousand Units) Share, by Blade Design, 2017-2031

Table 60: Asia Pacific Turbine Blade Market Value (US$ Bn) Share, by Blade Design, 2017-2031

Table 61: Asia Pacific Turbine Blade Market Volume (Thousand Units) Share, by Flow Type, 2017-2031

Table 62: Asia Pacific Turbine Blade Market Value (US$ Bn) Share, by Flow Type, 2017-2031

Table 63: Asia Pacific Turbine Blade Market Volume (Thousand Units) Share, by Cooling System, 2017-2031

Table 64: Asia Pacific Turbine Blade Market Value (US$ Bn) Share, by Cooling System, 2017-2031

Table 65: Asia Pacific Turbine Blade Market Volume (Thousand Units) Share, by Application, 2017-2031

Table 66: Asia Pacific Turbine Blade Market Value (US$ Bn) Share, by Application, 2017-2031

Table 67: Asia Pacific Turbine Blade Market Value (US$ Bn) Share, by End-user, 2017-2031

Table 68: Asia Pacific Turbine Blade Market Value (US$ Bn) Share, by End-user, 2017-2031

Table 69: Asia Pacific Turbine Blade Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Table 70: Asia Pacific Turbine Blade Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Table 71: Asia Pacific Turbine Blade Market Volume (Thousand Units) Share, by Country, 2017-2031

Table 72: Asia Pacific Turbine Blade Market Value (US$ Bn) Share, by Country, 2017-2031

Table 73: Middle East & Africa Turbine Blade Market Volume (Thousand Units) Share, by Type, 2017-2031

Table 74: Middle East & Africa Turbine Blade Market Value (US$ Bn) Share, by Type, 2017-2031

Table 75: Middle East & Africa Turbine Blade Market Volume (Thousand Units) Share, by Material, 2017-2031

Table 76: Middle East & Africa Turbine Blade Market Value (US$ Bn) Share, by Material, 2017-2031

Table 77: Middle East & Africa Turbine Blade Market Volume (Thousand Units) Share, by Blade Design, 2017-2031

Table 78: Middle East & Africa Turbine Blade Market Value (US$ Bn) Share, by Blade Design, 2017-2031

Table 79: Middle East & Africa Turbine Blade Market Volume (Thousand Units) Share, by Flow Type, 2017-2031

Table 80: Middle East & Africa Turbine Blade Market Value (US$ Bn) Share, by Flow Type, 2017-2031

Table 81: Middle East & Africa Turbine Blade Market Volume (Thousand Units) Share, by Cooling System, 2017-2031

Table 82: Middle East & Africa Turbine Blade Market Value (US$ Bn) Share, by Cooling System, 2017-2031

Table 83: Middle East & Africa Turbine Blade Market Volume (Thousand Units) Share, by Application, 2017-2031

Table 84: Middle East & Africa Turbine Blade Market Value (US$ Bn) Share, by Application, 2017-2031

Table 85: Middle East & Africa Turbine Blade Market Value (US$ Bn) Share, by End-user, 2017-2031

Table 86: Middle East & Africa Turbine Blade Market Value (US$ Bn) Share, by End-user, 2017-2031

Table 87: Middle East & Africa Turbine Blade Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Table 88: Middle East & Africa Turbine Blade Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Table 89: Middle East & Africa Turbine Blade Market Volume (Thousand Units) Share, by Country, 2017-2031

Table 90: Middle East & Africa Turbine Blade Market Value (US$ Bn) Share, by Country, 2017-2031

Table 91: South America Turbine Blade Market Volume (Thousand Units) Share, by Type, 2017-2031

Table 92: South America Turbine Blade Market Value (US$ Bn) Share, by Type, 2017-2031

Table 93: South America Turbine Blade Market Volume (Thousand Units) Share, by Material, 2017-2031

Table 94: South America Turbine Blade Market Value (US$ Bn) Share, by Material, 2017-2031

Table 95: South America Turbine Blade Market Volume (Thousand Units) Share, by Blade Design, 2017-2031

Table 96: South America Turbine Blade Market Value (US$ Bn) Share, by Blade Design, 2017-2031

Table 97: South America Turbine Blade Market Volume (Thousand Units) Share, by Flow Type, 2017-2031

Table 98: South America Turbine Blade Market Value (US$ Bn) Share, by Flow Type, 2017-2031

Table 99: South America Turbine Blade Market Volume (Thousand Units) Share, by Cooling System, 2017-2031

Table 100: South America Turbine Blade Market Value (US$ Bn) Share, by Cooling System, 2017-2031

Table 101: South America Turbine Blade Market Volume (Thousand Units) Share, by Application, 2017-2031

Table 102: South America Turbine Blade Market Value (US$ Bn) Share, by Application, 2017-2031

Table 103: South America Turbine Blade Market Value (US$ Bn) Share, by End-user, 2017-2031

Table 104: South America Turbine Blade Market Value (US$ Bn) Share, by End-user, 2017-2031

Table 105: South America Turbine Blade Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Table 106: South America Turbine Blade Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Table 107: South America Turbine Blade Market Volume (Thousand Units) Share, by Country, 2017-2031

Table 108: South America Turbine Blade Market Value (US$ Bn) Share, by Country, 2017-2031

List of Figures

Figure 1: Global Turbine Blade Market Volume (Thousand Units) Share, by Type, 2017-2031

Figure 2: Global Turbine Blade Market Value (US$ Bn) Share, by Type, 2017-2031

Figure 3: Global Turbine Blade Market Incremental Opportunity (US$ Bn), by Type, 2017-2031

Figure 4: Global Turbine Blade Market Volume (Thousand Units) Share, by Material, 2017-2031

Figure 5: Global Turbine Blade Market Value (US$ Bn) Share, by Material, 2017-2031

Figure 6: Global Turbine Blade Market Incremental Opportunity (US$ Bn), by Material, 2017-2031

Figure 7: Global Turbine Blade Market Volume (Thousand Units) Share, by Blade Design, 2017-2031

Figure 8: Global Turbine Blade Market Value (US$ Bn) Share, by Blade Design, 2017-2031

Figure 9: Global Turbine Blade Market Incremental Opportunity (US$ Bn), by Blade Design, 2017-2031

Figure 10: Global Turbine Blade Market Volume (Thousand Units) Share, by Flow Type, 2017-2031

Figure 11: Global Turbine Blade Market Value (US$ Bn) Share, by Flow Type, 2017-2031

Figure 12: Global Turbine Blade Market Incremental Opportunity (US$ Bn), by Flow Type, 2017-2031

Figure 13: Global Turbine Blade Market Volume (Thousand Units) Share, by Cooling System, 2017-2031

Figure 14: Global Turbine Blade Market Value (US$ Bn) Share, by Cooling System, 2017-2031

Figure 15: Global Turbine Blade Market Incremental Opportunity (US$ Bn), by Cooling System, 2017-2031

Figure 16: Global Turbine Blade Market Volume (Thousand Units) Share, by Application, 2017-2031

Figure 17: Global Turbine Blade Market Value (US$ Bn) Share, by Application, 2017-2031

Figure 18: Global Turbine Blade Market Incremental Opportunity (US$ Bn), by Application, 2017-2031

Figure 19: Global Turbine Blade Market Volume (Thousand Units) Share, by End-user, 2017-2031

Figure 20: Global Turbine Blade Market Value (US$ Bn) Share, by End-user, 2017-2031

Figure 21: Global Turbine Blade Market Incremental Opportunity (US$ Bn), by End-user, 2017-2031

Figure 22: Global Turbine Blade Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Figure 23: Global Turbine Blade Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Figure 24: Global Turbine Blade Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figure 25: Global Turbine Blade Market Volume (Thousand Units) Share, by Region, 2017-2031

Figure 26: Global Turbine Blade Market Value (US$ Bn) Share, by Region, 2017-2031

Figure 27: Global Turbine Blade Market Incremental Opportunity (US$ Bn), by Region, 2017-2031

Figure 28: North America Turbine Blade Market Volume (Thousand Units) Share, by Type, 2017-2031

Figure 29: North America Turbine Blade Market Value (US$ Bn) Share, by Type, 2017-2031

Figure 30: North America Turbine Blade Market Incremental Opportunity (US$ Bn), by Type, 2017-2031

Figure 31: North America Turbine Blade Market Volume (Thousand Units) Share, by Material, 2017-2031

Figure 32: North America Turbine Blade Market Value (US$ Bn) Share, by Material, 2017-2031

Figure 33: North America Turbine Blade Market Incremental Opportunity (US$ Bn), by Material, 2017-2031

Figure 34: North America Turbine Blade Market Volume (Thousand Units) Share, by Blade Design, 2017-2031

Figure 35: North America Turbine Blade Market Value (US$ Bn) Share, by Blade Design, 2017-2031

Figure 36: North America Turbine Blade Market Incremental Opportunity (US$ Bn), by Blade Design, 2017-2031

Figure 37: North America Turbine Blade Market Volume (Thousand Units) Share, by Flow Type, 2017-2031

Figure 38: North America Turbine Blade Market Value (US$ Bn) Share, by Flow Type, 2017-2031

Figure 39: North America Turbine Blade Market Incremental Opportunity (US$ Bn), by Flow Type, 2017-2031

Figure 40: North America Turbine Blade Market Volume (Thousand Units) Share, by Cooling System, 2017-2031

Figure 41: North America Turbine Blade Market Value (US$ Bn) Share, by Cooling System, 2017-2031

Figure 42: North America Turbine Blade Market Incremental Opportunity (US$ Bn), by Cooling System, 2017-2031

Figure 43: North America Turbine Blade Market Volume (Thousand Units) Share, by Application, 2017-2031

Figure 44: North America Turbine Blade Market Value (US$ Bn) Share, by Application, 2017-2031

Figure 45: North America Turbine Blade Market Incremental Opportunity (US$ Bn), by Application, 2017-2031

Figure 46: North America Turbine Blade Market Volume (Thousand Units) Share, by End-user, 2017-2031

Figure 47: North America Turbine Blade Market Value (US$ Bn) Share, by End-user, 2017-2031

Figure 48: North America Turbine Blade Market Incremental Opportunity (US$ Bn), by End-user, 2017-2031

Figure 49: North America Turbine Blade Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Figure 50: North America Turbine Blade Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Figure 51: North America Turbine Blade Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figure 52: North America Turbine Blade Market Volume (Thousand Units) Share, by Country, 2017-2031

Figure 53: North America Turbine Blade Market Value (US$ Bn) Share, by Country, 2017-2031

Figure 54: North America Turbine Blade Market Incremental Opportunity (US$ Bn), by Country, 2017-2031

Figure 55: Europe Turbine Blade Market Volume (Thousand Units) Share, by Type, 2017-2031

Figure 56: Europe Turbine Blade Market Value (US$ Bn) Share, by Type, 2017-2031

Figure 57: Europe Turbine Blade Market Incremental Opportunity (US$ Bn), by Type, 2017-2031

Figure 58: Europe Turbine Blade Market Volume (Thousand Units) Share, by Material, 2017-2031

Figure 59: Europe Turbine Blade Market Value (US$ Bn) Share, by Material, 2017-2031

Figure 60: Europe Turbine Blade Market Incremental Opportunity (US$ Bn), by Material, 2017-2031

Figure 61: Europe Turbine Blade Market Volume (Thousand Units) Share, by Blade Design, 2017-2031

Figure 62: Europe Turbine Blade Market Value (US$ Bn) Share, by Blade Design, 2017-2031

Figure 63: Europe Turbine Blade Market Incremental Opportunity (US$ Bn), by Blade Design, 2017-2031

Figure 64: Europe Turbine Blade Market Volume (Thousand Units) Share, by Flow Type, 2017-2031

Figure 65: Europe Turbine Blade Market Value (US$ Bn) Share, by Flow Type, 2017-2031

Figure 66: Europe Turbine Blade Market Incremental Opportunity (US$ Bn), by Flow Type, 2017-2031

Figure 67: Europe Turbine Blade Market Volume (Thousand Units) Share, by Cooling System, 2017-2031

Figure 68: Europe Turbine Blade Market Value (US$ Bn) Share, by Cooling System, 2017-2031

Figure 69: Europe Turbine Blade Market Incremental Opportunity (US$ Bn), by Cooling System, 2017-2031

Figure 70: Europe Turbine Blade Market Volume (Thousand Units) Share, by Application, 2017-2031

Figure 71: Europe Turbine Blade Market Value (US$ Bn) Share, by Application, 2017-2031

Figure 72: Europe Turbine Blade Market Incremental Opportunity (US$ Bn), by Application, 2017-2031

Figure 73: Europe Turbine Blade Market Volume (Thousand Units) Share, by End-user, 2017-2031

Figure 74: Europe Turbine Blade Market Value (US$ Bn) Share, by End-user, 2017-2031

Figure 75: Europe Turbine Blade Market Incremental Opportunity (US$ Bn), by End-user, 2017-2031

Figure 76: Europe Turbine Blade Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Figure 77: Europe Turbine Blade Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Figure 78: Europe Turbine Blade Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figure 79: Europe Turbine Blade Market Volume (Thousand Units) Share, by Country, 2017-2031

Figure 80: Europe Turbine Blade Market Value (US$ Bn) Share, by Country, 2017-2031

Figure 81: Europe Turbine Blade Market Incremental Opportunity (US$ Bn), by Country, 2017-2031

Figure 82: Asia Pacific Turbine Blade Market Volume (Thousand Units) Share, by Type, 2017-2031

Figure 83: Asia Pacific Turbine Blade Market Value (US$ Bn) Share, by Type, 2017-2031

Figure 84: Asia Pacific Turbine Blade Market Incremental Opportunity (US$ Bn), by Type, 2017-2031

Figure 85: Asia Pacific Turbine Blade Market Volume (Thousand Units) Share, by Material, 2017-2031

Figure 86: Asia Pacific Turbine Blade Market Value (US$ Bn) Share, by Material, 2017-2031

Figure 87: Asia Pacific Turbine Blade Market Incremental Opportunity (US$ Bn), by Material, 2017-2031

Figure 88: Asia Pacific Turbine Blade Market Volume (Thousand Units) Share, by Blade Design, 2017-2031

Figure 89: Asia Pacific Turbine Blade Market Value (US$ Bn) Share, by Blade Design, 2017-2031

Figure 90: Asia Pacific Turbine Blade Market Incremental Opportunity (US$ Bn), by Blade Design, 2017-2031

Figure 91: Asia Pacific Turbine Blade Market Volume (Thousand Units) Share, by Flow Type, 2017-2031

Figure 92: Asia Pacific Turbine Blade Market Value (US$ Bn) Share, by Flow Type, 2017-2031

Figure 93: Asia Pacific Turbine Blade Market Incremental Opportunity (US$ Bn), by Flow Type, 2017-2031

Figure 94: Asia Pacific Turbine Blade Market Volume (Thousand Units) Share, by Cooling System, 2017-2031

Figure 95: Asia Pacific Turbine Blade Market Value (US$ Bn) Share, by Cooling System, 2017-2031

Figure 96: Asia Pacific Turbine Blade Market Incremental Opportunity (US$ Bn), by Cooling System, 2017-2031

Figure 97: Asia Pacific Turbine Blade Market Volume (Thousand Units) Share, by Application, 2017-2031

Figure 98: Asia Pacific Turbine Blade Market Value (US$ Bn) Share, by Application, 2017-2031

Figure 99: Asia Pacific Turbine Blade Market Incremental Opportunity (US$ Bn), by Application, 2017-2031

Figure 100: Asia Pacific Turbine Blade Market Volume (Thousand Units) Share, by End-user, 2017-2031

Figure 101: Asia Pacific Turbine Blade Market Value (US$ Bn) Share, by End-user, 2017-2031

Figure 102: Asia Pacific Turbine Blade Market Incremental Opportunity (US$ Bn), by End-user, 2017-2031

Figure 103: Asia Pacific Turbine Blade Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Figure 104: Asia Pacific Turbine Blade Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Figure 105: Asia Pacific Turbine Blade Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figure 106: Asia Pacific Turbine Blade Market Volume (Thousand Units) Share, by Country, 2017-2031

Figure 107: Asia Pacific Turbine Blade Market Value (US$ Bn) Share, by Country, 2017-2031

Figure 108: Asia Pacific Turbine Blade Market Incremental Opportunity (US$ Bn), by Country, 2017-2031

Figure 109: Middle East & Africa Turbine Blade Market Volume (Thousand Units) Share, by Type, 2017-2031

Figure 110: Middle East & Africa Turbine Blade Market Value (US$ Bn) Share, by Type, 2017-2031

Figure 111: Middle East & Africa Turbine Blade Market Incremental Opportunity (US$ Bn), by Type, 2017-2031

Figure 112: Middle East & Africa Turbine Blade Market Volume (Thousand Units) Share, by Material, 2017-2031

Figure 113: Middle East & Africa Turbine Blade Market Value (US$ Bn) Share, by Material, 2017-2031

Figure 114: Middle East & Africa Turbine Blade Market Incremental Opportunity (US$ Bn), by Material, 2017-2031

Figure 115: Middle East & Africa Turbine Blade Market Volume (Thousand Units) Share, by Blade Design, 2017-2031

Figure 116: Middle East & Africa Turbine Blade Market Value (US$ Bn) Share, by Blade Design, 2017-2031

Figure 117: Middle East & Africa Turbine Blade Market Incremental Opportunity (US$ Bn), by Blade Design, 2017-2031

Figure 118: Middle East & Africa Turbine Blade Market Volume (Thousand Units) Share, by Flow Type, 2017-2031

Figure 119: Middle East & Africa Turbine Blade Market Value (US$ Bn) Share, by Flow Type, 2017-2031

Figure 120: Middle East & Africa Turbine Blade Market Incremental Opportunity (US$ Bn), by Flow Type, 2017-2031

Figure 121: Middle East & Africa Turbine Blade Market Volume (Thousand Units) Share, by Cooling System, 2017-2031

Figure 122: Middle East & Africa Turbine Blade Market Value (US$ Bn) Share, by Cooling System, 2017-2031

Figure 123: Middle East & Africa Turbine Blade Market Incremental Opportunity (US$ Bn), by Cooling System, 2017-2031

Figure 124: Middle East & Africa Turbine Blade Market Volume (Thousand Units) Share, by Application, 2017-2031

Figure 125: Middle East & Africa Turbine Blade Market Value (US$ Bn) Share, by Application, 2017-2031

Figure 126: Middle East & Africa Turbine Blade Market Incremental Opportunity (US$ Bn), by Application, 2017-2031

Figure 127: Middle East & Africa Turbine Blade Market Volume (Thousand Units) Share, by End-user, 2017-2031

Figure 128: Middle East & Africa Turbine Blade Market Value (US$ Bn) Share, by End-user, 2017-2031

Figure 129: Middle East & Africa Turbine Blade Market Incremental Opportunity (US$ Bn), by End-user, 2017-2031

Figure 130: Middle East & Africa Turbine Blade Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Figure 131: Middle East & Africa Turbine Blade Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Figure 132: Middle East & Africa Turbine Blade Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figure 133: Middle East & Africa Turbine Blade Market Volume (Thousand Units) Share, by Country, 2017-2031

Figure 134: Middle East & Africa Turbine Blade Market Value (US$ Bn) Share, by Country, 2017-2031

Figure 135: Middle East & Africa Turbine Blade Market Incremental Opportunity (US$ Bn), by Country, 2017-2031

Figure 136: South America Turbine Blade Market Volume (Thousand Units) Share, by Type, 2017-2031

Figure 137: South America Turbine Blade Market Value (US$ Bn) Share, by Type, 2017-2031

Figure 138: South America Turbine Blade Market Incremental Opportunity (US$ Bn), by Type, 2017-2031

Figure 139: South America Turbine Blade Market Volume (Thousand Units) Share, by Material, 2017-2031

Figure 140: South America Turbine Blade Market Value (US$ Bn) Share, by Material, 2017-2031

Figure 141: South America Turbine Blade Market Incremental Opportunity (US$ Bn), by Material, 2017-2031

Figure 142: South America Turbine Blade Market Volume (Thousand Units) Share, by Blade Design, 2017-2031

Figure 143: South America Turbine Blade Market Value (US$ Bn) Share, by Blade Design, 2017-2031

Figure 144: South America Turbine Blade Market Incremental Opportunity (US$ Bn), by Blade Design, 2017-2031

Figure 145: South America Turbine Blade Market Volume (Thousand Units) Share, by Flow Type, 2017-2031

Figure 146: South America Turbine Blade Market Value (US$ Bn) Share, by Flow Type, 2017-2031

Figure 147: South America Turbine Blade Market Incremental Opportunity (US$ Bn), by Flow Type, 2017-2031

Figure 148: South America Turbine Blade Market Volume (Thousand Units) Share, by Cooling System, 2017-2031

Figure 149: South America Turbine Blade Market Value (US$ Bn) Share, by Cooling System, 2017-2031

Figure 150: South America Turbine Blade Market Incremental Opportunity (US$ Bn), by Cooling System, 2017-2031

Figure 151: South America Turbine Blade Market Volume (Thousand Units) Share, by Application, 2017-2031

Figure 152: South America Turbine Blade Market Value (US$ Bn) Share, by Application, 2017-2031

Figure 153: South America Turbine Blade Market Incremental Opportunity (US$ Bn), by Application, 2017-2031

Figure 154: South America Turbine Blade Market Volume (Thousand Units) Share, by End-user, 2017-2031

Figure 155: South America Turbine Blade Market Value (US$ Bn) Share, by End-user, 2017-2031

Figure 156: South America Turbine Blade Market Incremental Opportunity (US$ Bn), by End-user, 2017-2031

Figure 157: South America Turbine Blade Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Figure 158: South America Turbine Blade Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Figure 159: South America Turbine Blade Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figure 160: South America Turbine Blade Market Volume (Thousand Units) Share, by Country, 2017-2031

Figure 161: South America Turbine Blade Market Value (US$ Bn) Share, by Country, 2017-2031

Figure 162: South America Turbine Blade Market Incremental Opportunity (US$ Bn), by Country, 2017-2031