Analysts’ Viewpoint

Surge in online shopping and the need for efficient last-mile delivery have led the e-commerce industry to rely heavily on truck rentals. Rise of online marketplaces, same-day or next-day delivery expectations, and expansion of urban logistics have fueled the growing demand for rented trucks. The vehicle rental market has witnessed the entry of new players, including both traditional rental companies and startups, leading to increased competition. This has resulted in more options for customers, better service quality, and competitive pricing.

The global truck rental industry caters to various industries such as logistics, e-commerce, construction, and moving services, which require transportation on-demand. Renting eco-friendly trucks, such as electric or hybrid vehicles, enables companies to reduce their carbon footprint and comply with sustainability goals. Moreover, truck rental companies have formed strategic alliances with other stakeholders in the logistics and transportation industry. Collaborations with logistics providers, warehouses, and e-commerce platforms create synergies and offer integrated solutions to customers.

Truck rental service provides individuals and businesses with the opportunity to rent trucks for various transportation needs. Renting a truck can be a cost-effective and convenient solution, whether it be moving to a new home, transporting goods for business, or undertaking a large project that requires heavy-duty hauling.

Truck rental companies typically offer a range of truck sizes and types to accommodate different requirements. These may include small cargo vans, box trucks, pickup trucks, and larger moving trucks with various load capacities. The truck rental market growth can be attributed to increasing demand for transportation services, changing consumer preferences, and evolving business.

Consumer preferences have shifted toward experiences rather than ownership. This shift has extended to transportation, where people are more inclined to rent vehicles for specific purposes, such as moving, road trips, or hauling large items, rather than owning a truck or car full-time.

Continuous expansion of urban areas has fueled the need for transportation services within cities. Truck rental service cater to the growing demand for moving and transporting goods in urban areas where owning a large vehicle may not be practical or cost-effective. These are factors are projected to significantly drive the truck rental market demand during the forecast period.

E-commerce has witnessed growth in the last few years, with an increasing number of people turning to online shopping for convenience and accessibility. This growth has created a surge in the demand for efficient transportation and logistics services, including the need for trucks to transport goods from fulfillment centers to distribution centers and ultimately to customers' doorsteps.

Moreover, the e-commerce industry operates on tight timelines, with customers expecting fast and reliable deliveries. Truck rental services offer a time-efficient solution, allowing businesses to access the necessary vehicles promptly and ensure timely order fulfillment. This is particularly important for last-mile delivery, which involves transporting goods from local distribution centers to the customer's location.

Rising need for efficient transportation and logistics services extends beyond the e-commerce industry as well. Several industries, such as manufacturing, retail, and construction, rely on trucks for their transportation needs. Growth and evolution of these industries is boosting the demand for truck rental services and consequently propel the truck rental market value. Additionally, businesses may require trucks for short-term projects, such as moving equipment or delivering goods to trade shows or exhibitions.

There has been a significant shift in consumer behavior and business needs for the last few years, leading to an increased demand for flexible transportation options. This trend has been facilitated by various factors, including the rise of e-commerce, changing consumer preferences, and the need for cost-effective and efficient logistics solutions.

Surge in popularity of online shopping has prompted businesses to avail reliable and flexible transportation services in order to fulfill their delivery commitments. Moreover, customers expect faster delivery times and more personalized services. By leveraging truck rentals, businesses can respond quickly to changing consumer demands and optimize their logistics operations accordingly. Therefore, the ongoing trend of flexible and on-demand transportation solutions is indeed creating significant truck rental market opportunities for vendors across the globe.

The trucking industry is witnessing rapid advancements in vehicle technology, such as electric and autonomous trucks. Finance leasing allows businesses to adopt these innovations and technology advancements in the truck rental market without significant upfront costs.

Several companies are increasingly outsourcing their transportation needs to specialized service providers. Finance leasing aligns with this outsourcing trend, providing businesses with access to a dedicated fleet of trucks managed by professional rental companies. This allows companies to focus on their core competencies while benefiting from the expertise and economies of scale offered by truck rental providers.

Some businesses require specialized trucks or equipment for specific purposes, such as refrigerated trucks for transporting perishable goods or heavy-duty trucks for construction projects. Finance leasing allows businesses to access these specialized vehicles without the need for a substantial upfront investment, meeting their unique operational requirements. Consequently, the preference for finance lease rental trucks is anticipated to have a positive impact of the truck rental market forecast in the next few years.

The truck rental business in Asia Pacific region has been witnessing significant growth for the last few years. Expansion of economies, rise in industrialization, and increase in trade activities have resulted in increased construction, manufacturing, and logistics activities, which in turn has contributed significantly to the regional dynamics of the truck rental market in Asia Pacific.

Rise of online shopping in Asia Pacific has propelled the need for efficient logistics and delivery services, including truck rentals to transport goods from warehouses to distribution centers or directly to customers. Additionally, rapid urbanization in Asia Pacific has fueled the need for transportation of construction materials, equipment, and goods, thereby augmenting the commercial truck rental market.

Moreover, the truck rental market revenue in Asia Pacific is increasing due to adoption of various technological advancements to enhance operational efficiency. These include the use of telematics, GPS tracking, and online platforms that streamline the booking and management of truck rental services, making it more convenient for businesses to access trucks when needed.

The global truck rental business is highly competitive, with several major players operating in the market. Moreover, key players are following the latest truck rental market trends and adopting various strategies to gain a competitive edge and capture a larger share. Some of the prominent vendors in the global truck rental industry are Barco, Budget Car Rentals, Budget Truck Rental, LLC, Daimler AG, Element Fleet Management Corporation, Enterprise Holdings, Inc., Express 4x4 Rental, Fetch Truck Rental, Fluid Truck Share, Herc rentals, Hertz, Home Depot, Imperial Truck Rental, MAX Rental, Moving.com, PACCAR Leasing Company, Penske, Ryder System, Inc., SIXT, The Larson Group, U-Haul International Inc., and United Rentals.

Key players in the truck rental market research report have been profiled based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Size Value in 2022 |

US$ 107.2 Bn |

|

Market Forecast Value in 2031 |

US$ 156.0 Bn |

|

Growth Rate (CAGR) |

4.2% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

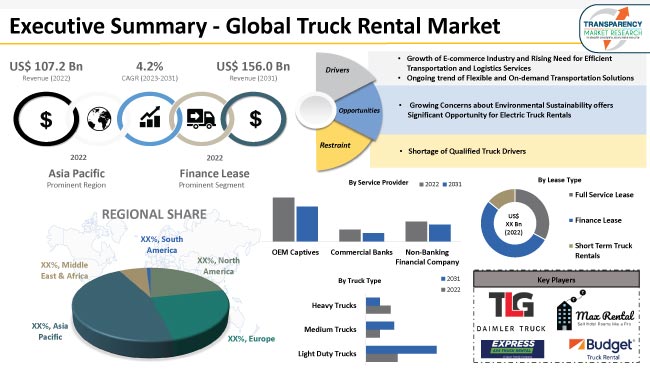

The global market was valued at US$ 107.2 Bn in 2022

It is expected to expand at a CAGR of 4.2% by 2031

The truck rental business would be worth US$ 156.0 Bn in 2031

Growth of the e-commerce industry and the rising need for efficient transportation and logistics services

In terms of lease type, the finance lease segment accounted for majority share in 2022

Asia Pacific is anticipated to be a highly lucrative region for truck rentals

Barco, Budget Car Rentals, Budget Truck Rental, LLC, Daimler AG, Element Fleet Management Corporation, Enterprise Holdings, Inc., Express 4x4 Rental, Fetch Truck Rental, Fluid Truck Share, Herc rentals, Hertz, Home Depot, Imperial Truck Rental, MAX Rental, Moving.com, PACCAR Leasing Company, Penske, Ryder System, Inc., SIXT, The Larson Group, U-Haul International Inc. and United Rentals.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.7.1. Component Manufacturer

2.7.2. Assemblers

2.7.3. OEMs

2.7.4. End User

2.8. Go to Market Strategy

2.8.1. Demand & Supply Side Trends

2.8.1.1. GAP Analysis

2.8.2. Identification of Potential Market Spaces

2.8.3. Understanding the Buying Process of the Customers

2.8.4. Preferred Sales & Marketing Strategy

3. Industry Growth Analysis

4. Commercial Truck Fleet, by

4.1. Cash purchases

4.2. Financed

4.3. Leased

4.4. Rented

5. Penetration of Digital Transformation Players

5.1. Independent

5.2. Corporate

6. Comparison Analysis

6.1. All Commercial Truck Rentals

6.2. Medium Duty Truck Rentals (including Pick-up Trucks)

7. Global Truck Rental Market, by Service Provider

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Truck Rental Market Size & Forecast, 2017-2031, by Service Provider

7.2.1. OEM Captives

7.2.2. Commercial Banks

7.2.3. Non-Banking Financial Company (NBFCs)

8. Global Truck Rental Market, by Lease Type

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Truck Rental Market Size & Forecast, 2017-2031, by Lease Type

8.2.1. Full Service Lease

8.2.2. Finance Lease

8.2.3. Short Term Truck Rentals

8.2.3.1. Based on Duration

8.2.3.1.1. Single Day

8.2.3.1.2. Multiple Days

8.2.3.2. Based on Purpose

8.2.3.2.1. Personal

8.2.3.2.2. Commercial

9. Global Truck Rental Market, by Truck Type

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Truck Rental Market Size & Forecast, 2017-2031, by Truck Type

9.2.1. Light Duty Trucks (Class 2)

9.2.1.1. Pick-up Trucks

9.2.1.2. Light Commercial Vehicles

9.2.2. Medium Trucks (Class 3 to 6)

9.2.2.1. Box Truck

9.2.2.2. Medium Duty Truck

9.2.2.3. Medium Standard Truck

9.2.2.4. Flatbed Truck

9.2.2.5. Delivery Truck

9.2.2.6. Platform Truck

9.2.3. Heavy Trucks (Class 7 and 8)

9.2.3.1. 18 Wheeler Truck

9.2.3.2. Refrigerator Truck

9.2.3.3. Dump Truck

9.2.3.4. Garbage Truck

9.2.3.5. Logging Truck

9.2.3.6. Concrete Transport Truck

9.2.3.7. Tractor Unit

9.2.3.8. Tanker Truck

9.2.3.9. Mobile Crane

10. Global Truck Rental Market, by GVWR

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Truck Rental Market Size & Forecast, 2017-2031, by GVWR

10.2.1. 6,001 - 8,500 lbs

10.2.2. 8,501 - 10,000 lbs

10.2.3. 10,001 - 14,000 lbs

10.2.4. 14,001 and 16,000 lbs

10.2.5. 16,001 and 19,500 lbs

10.2.6. 19,501 and 26,000 lbs

10.2.7. 26,001 and 33,000 lbs

10.2.8. Above 33,001 lbs

11. Global Truck Rental Market, by Truck Propulsion

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Truck Rental Market Size & Forecast, 2017-2031, by Truck Propulsion

11.2.1. ICE Trucks

11.2.1.1. Gasoline

11.2.1.2. Diesel

11.2.2. Electric Trucks

11.2.2.1. Battery Electric Trucks

11.2.2.2. Hybrid Electric Trucks

11.2.2.3. Fuel Cell Electric Trucks

12. Global Truck Rental Market, by Region

12.1. Market Snapshot

12.1.1. Introduction, Definition, and Key Findings

12.1.2. Market Growth & Y-o-Y Projections

12.1.3. Base Point Share Analysis

12.2. Global Truck Rental Market Size & Forecast, 2017-2031, by Region

12.2.1. North America

12.2.2. Europe

12.2.3. Asia Pacific

12.2.4. Middle East & Africa

12.2.5. South America

13. North America Truck Rental Market

13.1. Market Snapshot

13.2. North America Truck Rental Market Size & Forecast, 2017-2031, by Service Provider

13.2.1. OEM Captives

13.2.2. Commercial Banks

13.2.3. Non-Banking Financial Company (NBFCs)

13.3. North America Truck Rental Market Size & Forecast, 2017-2031, by Lease Type

13.3.1. Full Service Lease

13.3.2. Finance Lease

13.3.3. Short Term Truck Rentals

13.3.3.1. Based on Duration

13.3.3.1.1. Single Day

13.3.3.1.2. Multiple Days

13.3.3.2. Based on Purpose

13.3.3.2.1. Personal

13.3.3.2.2. Commercial

13.4. North America Truck Rental Market Size & Forecast, 2017-2031, by Truck Type

13.4.1. Light Duty Trucks (Class 2)

13.4.1.1. Pick-up Trucks

13.4.1.2. Light Commercial Vehicles

13.4.2. Medium Trucks (Class 3 to 6)

13.4.2.1. Box Truck

13.4.2.2. Medium Duty Truck

13.4.2.3. Medium Standard Truck

13.4.2.4. Flatbed Truck

13.4.2.5. Delivery Truck

13.4.2.6. Platform Truck

13.4.3. Heavy Trucks (Class 7 and 8)

13.4.3.1. 18 Wheeler Truck

13.4.3.2. Refrigerator Truck

13.4.3.3. Dump Truck

13.4.3.4. Garbage Truck

13.4.3.5. Logging Truck

13.4.3.6. Concrete Transport Truck

13.4.3.7. Tractor Unit

13.4.3.8. Tanker Truck

13.4.3.9. Mobile Crane

13.5. North America Truck Rental Market Size & Forecast, 2017-2031, by GVWR

13.5.1. 6,001 - 8,500 lbs

13.5.2. 8,501 - 10,000 lbs

13.5.3. 10,001 - 14,000 lbs

13.5.4. 14,001 and 16,000 lbs

13.5.5. 16,001 and 19,500 lbs

13.5.6. 19,501 and 26,000 lbs

13.5.7. 26,001 and 33,000 lbs

13.5.8. Above 33,001 lbs

13.6. North America Truck Rental Market Size & Forecast, 2017-2031, by Truck Propulsion

13.6.1. ICE Trucks

13.6.1.1. Gasoline

13.6.1.2. Diesel

13.6.2. Electric Trucks

13.6.2.1. Battery Electric Trucks

13.6.2.2. Hybrid Electric Trucks

13.6.2.3. Fuel Cell Electric Trucks

13.7. North America Truck Rental Market Size & Forecast, 2017-2031, by Country

13.7.1. U. S.

13.7.2. Canada

13.7.3. Mexico

14. Europe Truck Rental Market

14.1. Market Snapshot

14.2. Europe Truck Rental Market Size & Forecast, 2017-2031, by Service Provider

14.2.1. OEM Captives

14.2.2. Commercial Banks

14.2.3. Non-Banking Financial Company (NBFCs)

14.3. Europe Truck Rental Market Size & Forecast, 2017-2031, by Lease Type

14.3.1. Full Service Lease

14.3.2. Finance Lease

14.3.3. Short Term Truck Rentals

14.3.3.1. Based on Duration

14.3.3.1.1. Single Day

14.3.3.1.2. Multiple Days

14.3.3.2. Based on Purpose

14.3.3.2.1. Personal

14.3.3.2.2. Commercial

14.4. Europe Truck Rental Market Size & Forecast, 2017-2031, by Truck Type

14.4.1. Light Duty Trucks (Class 2)

14.4.1.1. Pick-up Trucks

14.4.1.2. Light Commercial Vehicles

14.4.2. Medium Trucks (Class 3 to 6)

14.4.2.1. Box Truck

14.4.2.2. Medium Duty Truck

14.4.2.3. Medium Standard Truck

14.4.2.4. Flatbed Truck

14.4.2.5. Delivery Truck

14.4.2.6. Platform Truck

14.4.3. Heavy Trucks (Class 7 and 8)

14.4.3.1. 18 Wheeler Truck

14.4.3.2. Refrigerator Truck

14.4.3.3. Dump Truck

14.4.3.4. Garbage Truck

14.4.3.5. Logging Truck

14.4.3.6. Concrete Transport Truck

14.4.3.7. Tractor Unit

14.4.3.8. Tanker Truck

14.4.3.9. Mobile Crane

14.5. Europe Truck Rental Market Size & Forecast, 2017-2031, by GVWR

14.5.1. 6,001 - 8,500 lbs

14.5.2. 8,501 - 10,000 lbs

14.5.3. 10,001 - 14,000 lbs

14.5.4. 14,001 and 16,000 lbs

14.5.5. 16,001 and 19,500 lbs

14.5.6. 19,501 and 26,000 lbs

14.5.7. 26,001 and 33,000 lbs

14.5.8. Above 33,001 lbs

14.6. Europe Truck Rental Market Size & Forecast, 2017-2031, by Truck Propulsion

14.6.1. ICE Trucks

14.6.1.1. Gasoline

14.6.1.2. Diesel

14.6.2. Electric Trucks

14.6.2.1. Battery Electric Trucks

14.6.2.2. Hybrid Electric Trucks

14.6.2.3. Fuel Cell Electric Trucks

14.7. Europe Truck Rental Market Size & Forecast, 2017-2031, by Country

14.7.1. Germany

14.7.2. U. K.

14.7.3. France

14.7.4. Italy

14.7.5. Spain

14.7.6. Nordic Countries

14.7.7. Russia & CIS

14.7.8. Rest of Europe

15. Asia Pacific Truck Rental Market

15.1. Market Snapshot

15.2. Asia Pacific Truck Rental Market Size & Forecast, 2017-2031, by Service Provider

15.2.1. OEM Captives

15.2.2. Commercial Banks

15.2.3. Non-Banking Financial Company (NBFCs)

15.3. Asia Pacific Truck Rental Market Size & Forecast, 2017-2031, by Lease Type

15.3.1. Full Service Lease

15.3.2. Finance Lease

15.3.3. Short Term Truck Rentals

15.3.3.1. Based on Duration

15.3.3.1.1. Single Day

15.3.3.1.2. Multiple Days

15.3.3.2. Based on Purpose

15.3.3.2.1. Personal

15.3.3.2.2. Commercial

15.4. Asia Pacific Truck Rental Market Size & Forecast, 2017-2031, by Truck Type

15.4.1. Light Duty Trucks (Class 2)

15.4.1.1. Pick-up Trucks

15.4.1.2. Light Commercial Vehicles

15.4.2. Medium Trucks (Class 3 to 6)

15.4.2.1. Box Truck

15.4.2.2. Medium Duty Truck

15.4.2.3. Medium Standard Truck

15.4.2.4. Flatbed Truck

15.4.2.5. Delivery Truck

15.4.2.6. Platform Truck

15.4.3. Heavy Trucks (Class 7 and 8)

15.4.3.1. 18 Wheeler Truck

15.4.3.2. Refrigerator Truck

15.4.3.3. Dump Truck

15.4.3.4. Garbage Truck

15.4.3.5. Logging Truck

15.4.3.6. Concrete Transport Truck

15.4.3.7. Tractor Unit

15.4.3.8. Tanker Truck

15.4.3.9. Mobile Crane

15.5. Asia Pacific Truck Rental Market Size & Forecast, 2017-2031, by GVWR

15.5.1. 6,001 - 8,500 lbs

15.5.2. 8,501 - 10,000 lbs

15.5.3. 10,001 - 14,000 lbs

15.5.4. 14,001 and 16,000 lbs

15.5.5. 16,001 and 19,500 lbs

15.5.6. 19,501 and 26,000 lbs

15.5.7. 26,001 and 33,000 lbs

15.5.8. Above 33,001 lbs

15.6. Asia Pacific Truck Rental Market Size & Forecast, 2017-2031, by Truck Propulsion

15.6.1. ICE Trucks

15.6.1.1. Gasoline

15.6.1.2. Diesel

15.6.2. Electric Trucks

15.6.2.1. Battery Electric Trucks

15.6.2.2. Hybrid Electric Trucks

15.6.2.3. Fuel Cell Electric Trucks

15.7. Asia Pacific Truck Rental Market Size & Forecast, 2017-2031, by Country

15.7.1. China

15.7.2. India

15.7.3. Japan

15.7.4. ASEAN Countries

15.7.5. South Korea

15.7.6. ANZ

15.7.7. Rest of Asia Pacific

16. Middle East & Africa Truck Rental Market

16.1. Market Snapshot

16.2. Middle East & Africa Truck Rental Market Size & Forecast, 2017-2031, by Service Provider

16.2.1. OEM Captives

16.2.2. Commercial Banks

16.2.3. Non-Banking Financial Company (NBFCs)

16.3. Middle East & Africa Truck Rental Market Size & Forecast, 2017-2031, by Lease Type

16.3.1. Full Service Lease

16.3.2. Finance Lease

16.3.3. Short Term Truck Rentals

16.3.3.1. Based on Duration

16.3.3.1.1. Single Day

16.3.3.1.2. Multiple Days

16.3.3.2. Based on Purpose

16.3.3.2.1. Personal

16.3.3.2.2. Commercial

16.4. Middle East & Africa Truck Rental Market Size & Forecast, 2017-2031, by Truck Type

16.4.1. Light Duty Trucks (Class 2)

16.4.1.1. Pick-up Trucks

16.4.1.2. Light Commercial Vehicles

16.4.2. Medium Trucks (Class 3 to 6)

16.4.2.1. Box Truck

16.4.2.2. Medium Duty Truck

16.4.2.3. Medium Standard Truck

16.4.2.4. Flatbed Truck

16.4.2.5. Delivery Truck

16.4.2.6. Platform Truck

16.4.3. Heavy Trucks (Class 7 and 8)

16.4.3.1. 18 Wheeler Truck

16.4.3.2. Refrigerator Truck

16.4.3.3. Dump Truck

16.4.3.4. Garbage Truck

16.4.3.5. Logging Truck

16.4.3.6. Concrete Transport Truck

16.4.3.7. Tractor Unit

16.4.3.8. Tanker Truck

16.4.3.9. Mobile Crane

16.5. Middle East & Africa Truck Rental Market Size & Forecast, 2017-2031, by GVWR

16.5.1. 6,001 - 8,500 lbs

16.5.2. 8,501 - 10,000 lbs

16.5.3. 10,001 - 14,000 lbs

16.5.4. 14,001 and 16,000 lbs

16.5.5. 16,001 and 19,500 lbs

16.5.6. 19,501 and 26,000 lbs

16.5.7. 26,001 and 33,000 lbs

16.5.8. Above 33,001 lbs

16.6. Middle East & Africa Truck Rental Market Size & Forecast, 2017-2031, by Truck Propulsion

16.6.1. ICE Trucks

16.6.1.1. Gasoline

16.6.1.2. Diesel

16.6.2. Electric Trucks

16.6.2.1. Battery Electric Trucks

16.6.2.2. Hybrid Electric Trucks

16.6.2.3. Fuel Cell Electric Trucks

16.7. Middle East & Africa Truck Rental Market Size & Forecast, 2017-2031, by Country

16.7.1. GCC

16.7.2. South Africa

16.7.3. Turkey

16.7.4. Rest of Middle East & Africa

17. South America Truck Rental Market

17.1. Market Snapshot

17.2. South America Truck Rental Market Size & Forecast, 2017-2031, by Service Provider

17.2.1. OEM Captives

17.2.2. Commercial Banks

17.2.3. Non-Banking Financial Company (NBFCs)

17.3. South America Truck Rental Market Size & Forecast, 2017-2031, by Lease Type

17.3.1. Full Service Lease

17.3.2. Finance Lease

17.3.3. Short Term Truck Rentals

17.3.3.1. Based on Duration

17.3.3.1.1. Single Day

17.3.3.1.2. Multiple Days

17.3.3.2. Based on Purpose

17.3.3.2.1. Personal

17.3.3.2.2. Commercial

17.4. South America Truck Rental Market Size & Forecast, 2017-2031, by Truck Type

17.4.1. Light Duty Trucks (Class 2)

17.4.1.1. Pick-up Trucks

17.4.1.2. Light Commercial Vehicles

17.4.2. Medium Trucks (Class 3 to 6)

17.4.2.1. Box Truck

17.4.2.2. Medium Duty Truck

17.4.2.3. Medium Standard Truck

17.4.2.4. Flatbed Truck

17.4.2.5. Delivery Truck

17.4.2.6. Platform Truck

17.4.3. Heavy Trucks (Class 7 and 8)

17.4.3.1. 18 Wheeler Truck

17.4.3.2. Refrigerator Truck

17.4.3.3. Dump Truck

17.4.3.4. Garbage Truck

17.4.3.5. Logging Truck

17.4.3.6. Concrete Transport Truck

17.4.3.7. Tractor Unit

17.4.3.8. Tanker Truck

17.4.3.9. Mobile Crane

17.5. South America Truck Rental Market Size & Forecast, 2017-2031, by GVWR

17.5.1. 6,001 - 8,500 lbs

17.5.2. 8,501 - 10,000 lbs

17.5.3. 10,001 - 14,000 lbs

17.5.4. 14,001 and 16,000 lbs

17.5.5. 16,001 and 19,500 lbs

17.5.6. 19,501 and 26,000 lbs

17.5.7. 26,001 and 33,000 lbs

17.5.8. Above 33,001 lbs

17.6. South America Truck Rental Market Size & Forecast, 2017-2031, by Truck Propulsion

17.6.1. ICE Trucks

17.6.1.1. Gasoline

17.6.1.2. Diesel

17.6.2. Electric Trucks

17.6.2.1. Battery Electric Trucks

17.6.2.2. Hybrid Electric Trucks

17.6.2.3. Fuel Cell Electric Trucks

17.7. South America Truck Rental Market Size & Forecast, 2017-2031, by Country

17.7.1. Brazil

17.7.2. Argentina

17.7.3. Rest of South America

18. Competitive Landscape

18.1. Company Share Analysis/ Brand Share Analysis, 2022

18.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

19. Company Profile/ Key Players

19.1. Barco

19.1.1. Company Overview

19.1.2. Company Footprints

19.1.3. Production Locations

19.1.4. Product Portfolio

19.1.5. Competitors & Customers

19.1.6. Subsidiaries & Parent Organization

19.1.7. Recent Developments

19.1.8. Financial Analysis

19.1.9. Profitability

19.1.10. Revenue Share

19.2. Budget Car Rentals

19.2.1. Company Overview

19.2.2. Company Footprints

19.2.3. Production Locations

19.2.4. Product Portfolio

19.2.5. Competitors & Customers

19.2.6. Subsidiaries & Parent Organization

19.2.7. Recent Developments

19.2.8. Financial Analysis

19.2.9. Profitability

19.2.10. Revenue Share

19.3. Budget Truck Rental, LLC

19.3.1. Company Overview

19.3.2. Company Footprints

19.3.3. Production Locations

19.3.4. Product Portfolio

19.3.5. Competitors & Customers

19.3.6. Subsidiaries & Parent Organization

19.3.7. Recent Developments

19.3.8. Financial Analysis

19.3.9. Profitability

19.3.10. Revenue Share

19.4. Daimler AG

19.4.1. Company Overview

19.4.2. Company Footprints

19.4.3. Production Locations

19.4.4. Product Portfolio

19.4.5. Competitors & Customers

19.4.6. Subsidiaries & Parent Organization

19.4.7. Recent Developments

19.4.8. Financial Analysis

19.4.9. Profitability

19.4.10. Revenue Share

19.5. Element Fleet Management Corporation

19.5.1. Company Overview

19.5.2. Company Footprints

19.5.3. Production Locations

19.5.4. Product Portfolio

19.5.5. Competitors & Customers

19.5.6. Subsidiaries & Parent Organization

19.5.7. Recent Developments

19.5.8. Financial Analysis

19.5.9. Profitability

19.5.10. Revenue Share

19.6. Enterprise Holdings, Inc.

19.6.1. Company Overview

19.6.2. Company Footprints

19.6.3. Production Locations

19.6.4. Product Portfolio

19.6.5. Competitors & Customers

19.6.6. Subsidiaries & Parent Organization

19.6.7. Recent Developments

19.6.8. Financial Analysis

19.6.9. Profitability

19.6.10. Revenue Share

19.7. Express 4x4 Rental

19.7.1. Company Overview

19.7.2. Company Footprints

19.7.3. Production Locations

19.7.4. Product Portfolio

19.7.5. Competitors & Customers

19.7.6. Subsidiaries & Parent Organization

19.7.7. Recent Developments

19.7.8. Financial Analysis

19.7.9. Profitability

19.7.10. Revenue Share

19.8. Fetch Truck Rental

19.8.1. Company Overview

19.8.2. Company Footprints

19.8.3. Production Locations

19.8.4. Product Portfolio

19.8.5. Competitors & Customers

19.8.6. Subsidiaries & Parent Organization

19.8.7. Recent Developments

19.8.8. Financial Analysis

19.8.9. Profitability

19.8.10. Revenue Share

19.9. Fluid Truck Share

19.9.1. Company Overview

19.9.2. Company Footprints

19.9.3. Production Locations

19.9.4. Product Portfolio

19.9.5. Competitors & Customers

19.9.6. Subsidiaries & Parent Organization

19.9.7. Recent Developments

19.9.8. Financial Analysis

19.9.9. Profitability

19.9.10. Revenue Share

19.10. Herc rentals

19.10.1. Company Overview

19.10.2. Company Footprints

19.10.3. Production Locations

19.10.4. Product Portfolio

19.10.5. Competitors & Customers

19.10.6. Subsidiaries & Parent Organization

19.10.7. Recent Developments

19.10.8. Financial Analysis

19.10.9. Profitability

19.10.10. Revenue Share

19.11. Hertz

19.11.1. Company Overview

19.11.2. Company Footprints

19.11.3. Production Locations

19.11.4. Product Portfolio

19.11.5. Competitors & Customers

19.11.6. Subsidiaries & Parent Organization

19.11.7. Recent Developments

19.11.8. Financial Analysis

19.11.9. Profitability

19.11.10. Revenue Share

19.12. Home Depot

19.12.1. Company Overview

19.12.2. Company Footprints

19.12.3. Production Locations

19.12.4. Product Portfolio

19.12.5. Competitors & Customers

19.12.6. Subsidiaries & Parent Organization

19.12.7. Recent Developments

19.12.8. Financial Analysis

19.12.9. Profitability

19.12.10. Revenue Share

19.13. Imperial Truck Rental

19.13.1. Company Overview

19.13.2. Company Footprints

19.13.3. Production Locations

19.13.4. Product Portfolio

19.13.5. Competitors & Customers

19.13.6. Subsidiaries & Parent Organization

19.13.7. Recent Developments

19.13.8. Financial Analysis

19.13.9. Profitability

19.13.10. Revenue Share

19.14. MAX Rental

19.14.1. Company Overview

19.14.2. Company Footprints

19.14.3. Production Locations

19.14.4. Product Portfolio

19.14.5. Competitors & Customers

19.14.6. Subsidiaries & Parent Organization

19.14.7. Recent Developments

19.14.8. Financial Analysis

19.14.9. Profitability

19.14.10. Revenue Share

19.15. Moving.com

19.15.1. Company Overview

19.15.2. Company Footprints

19.15.3. Production Locations

19.15.4. Product Portfolio

19.15.5. Competitors & Customers

19.15.6. Subsidiaries & Parent Organization

19.15.7. Recent Developments

19.15.8. Financial Analysis

19.15.9. Profitability

19.15.10. Revenue Share

19.16. PACCAR Leasing Company

19.16.1. Company Overview

19.16.2. Company Footprints

19.16.3. Production Locations

19.16.4. Product Portfolio

19.16.5. Competitors & Customers

19.16.6. Subsidiaries & Parent Organization

19.16.7. Recent Developments

19.16.8. Financial Analysis

19.16.9. Profitability

19.16.10. Revenue Share

19.17. Penske

19.17.1. Company Overview

19.17.2. Company Footprints

19.17.3. Production Locations

19.17.4. Product Portfolio

19.17.5. Competitors & Customers

19.17.6. Subsidiaries & Parent Organization

19.17.7. Recent Developments

19.17.8. Financial Analysis

19.17.9. Profitability

19.17.10. Revenue Share

19.18. Ryder System, Inc.

19.18.1. Company Overview

19.18.2. Company Footprints

19.18.3. Production Locations

19.18.4. Product Portfolio

19.18.5. Competitors & Customers

19.18.6. Subsidiaries & Parent Organization

19.18.7. Recent Developments

19.18.8. Financial Analysis

19.18.9. Profitability

19.18.10. Revenue Share

19.19. SIXT

19.19.1. Company Overview

19.19.2. Company Footprints

19.19.3. Production Locations

19.19.4. Product Portfolio

19.19.5. Competitors & Customers

19.19.6. Subsidiaries & Parent Organization

19.19.7. Recent Developments

19.19.8. Financial Analysis

19.19.9. Profitability

19.19.10. Revenue Share

19.20. The Larson Group

19.20.1. Company Overview

19.20.2. Company Footprints

19.20.3. Production Locations

19.20.4. Product Portfolio

19.20.5. Competitors & Customers

19.20.6. Subsidiaries & Parent Organization

19.20.7. Recent Developments

19.20.8. Financial Analysis

19.20.9. Profitability

19.20.10. Revenue Share

19.21. U-Haul International Inc.

19.21.1. Company Overview

19.21.2. Company Footprints

19.21.3. Production Locations

19.21.4. Product Portfolio

19.21.5. Competitors & Customers

19.21.6. Subsidiaries & Parent Organization

19.21.7. Recent Developments

19.21.8. Financial Analysis

19.21.9. Profitability

19.21.10. Revenue Share

19.22. United Rentals

19.22.1. Company Overview

19.22.2. Company Footprints

19.22.3. Production Locations

19.22.4. Product Portfolio

19.22.5. Competitors & Customers

19.22.6. Subsidiaries & Parent Organization

19.22.7. Recent Developments

19.22.8. Financial Analysis

19.22.9. Profitability

19.22.10. Revenue Share

19.23. Other Key Players

19.23.1. Company Overview

19.23.2. Company Footprints

19.23.3. Production Locations

19.23.4. Product Portfolio

19.23.5. Competitors & Customers

19.23.6. Subsidiaries & Parent Organization

19.23.7. Recent Developments

19.23.8. Financial Analysis

19.23.9. Profitability

19.23.10. Revenue Share

List of Tables

Table 1: Global Truck Rental Market Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Table 2: Global Truck Rental Market Value (US$ Bn) Forecast, by Lease Type, 2017-2031

Table 3: Global Truck Rental Market Value (US$ Bn) Forecast, by Truck Type, 2017-2031

Table 4: Global Truck Rental Market Value (US$ Bn) Forecast, by GVWR, 2017-2031

Table 5: Global Truck Rental Market Value (US$ Bn) Forecast, by Truck Propulsion, 2017-2031

Table 6: Global Truck Rental Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 7: North America Truck Rental Market Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Table 8: North America Truck Rental Market Value (US$ Bn) Forecast, by Lease Type, 2017-2031

Table 9: North America Truck Rental Market Value (US$ Bn) Forecast, by Truck Type, 2017-2031

Table 10: North America Truck Rental Market Value (US$ Bn) Forecast, by GVWR, 2017-2031

Table 11: North America Truck Rental Market Value (US$ Bn) Forecast, by Truck Propulsion, 2017-2031

Table 12: North America Truck Rental Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 13: Europe Truck Rental Market Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Table 14: Europe Truck Rental Market Value (US$ Bn) Forecast, by Lease Type, 2017-2031

Table 15: Europe Truck Rental Market Value (US$ Bn) Forecast, by Truck Type, 2017-2031

Table 16: Europe Truck Rental Market Value (US$ Bn) Forecast, by GVWR, 2017-2031

Table 17: Europe Truck Rental Market Value (US$ Bn) Forecast, by Truck Propulsion, 2017-2031

Table 18: Europe Truck Rental Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 19: Asia Pacific Truck Rental Market Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Table 20: Asia Pacific Truck Rental Market Value (US$ Bn) Forecast, by Lease Type, 2017-2031

Table 21: Asia Pacific Truck Rental Market Value (US$ Bn) Forecast, by Truck Type, 2017-2031

Table 22: Asia Pacific Truck Rental Market Value (US$ Bn) Forecast, by GVWR, 2017-2031

Table 23: Asia Pacific Truck Rental Market Value (US$ Bn) Forecast, by Truck Propulsion, 2017-2031

Table 24: Asia Pacific Truck Rental Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 25: Middle East & Africa Truck Rental Market Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Table 26: Middle East & Africa Truck Rental Market Value (US$ Bn) Forecast, by Lease Type, 2017-2031

Table 27: Middle East & Africa Truck Rental Market Value (US$ Bn) Forecast, by Truck Type, 2017-2031

Table 28: Middle East & Africa Truck Rental Market Value (US$ Bn) Forecast, by GVWR, 2017-2031

Table 29: Middle East & Africa Truck Rental Market Value (US$ Bn) Forecast, by Truck Propulsion, 2017-2031

Table 30: Middle East & Africa Truck Rental Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 31: South America Truck Rental Market Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Table 32: South America Truck Rental Market Value (US$ Bn) Forecast, by Lease Type, 2017-2031

Table 33: South America Truck Rental Market Value (US$ Bn) Forecast, by Truck Type, 2017-2031

Table 34: South America Truck Rental Market Value (US$ Bn) Forecast, by GVWR, 2017-2031

Table 35: South America Truck Rental Market Value (US$ Bn) Forecast, by Truck Propulsion, 2017-2031

Table 36: South America Truck Rental Market Value (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Truck Rental Market Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Figure 2: Global Truck Rental Market, Incremental Opportunity, by Service Provider, Value (US$ Bn), 2023-2031

Figure 3: Global Truck Rental Market Value (US$ Bn) Forecast, by Lease Type, 2017-2031

Figure 4: Global Truck Rental Market, Incremental Opportunity, by Lease Type, Value (US$ Bn), 2023-2031

Figure 5: Global Truck Rental Market Value (US$ Bn) Forecast, by Truck Type, 2017-2031

Figure 6: Global Truck Rental Market, Incremental Opportunity, by Truck Type, Value (US$ Bn), 2023-2031

Figure 7: Global Truck Rental Market Value (US$ Bn) Forecast, by GVWR, 2017-2031

Figure 8: Global Truck Rental Market, Incremental Opportunity, by GVWR, Value (US$ Bn), 2023-2031

Figure 9: Global Truck Rental Market Value (US$ Bn) Forecast, by Truck Propulsion, 2017-2031

Figure 10: Global Truck Rental Market, Incremental Opportunity, by Truck Propulsion, Value (US$ Bn), 2023-2031

Figure 11: Global Truck Rental Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 12: Global Truck Rental Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 13: North America Truck Rental Market Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Figure 14: North America Truck Rental Market, Incremental Opportunity, by Service Provider, Value (US$ Bn), 2023-2031

Figure 15: North America Truck Rental Market Value (US$ Bn) Forecast, by Lease Type, 2017-2031

Figure 16: North America Truck Rental Market, Incremental Opportunity, by Lease Type, Value (US$ Bn), 2023-2031

Figure 17: North America Truck Rental Market Value (US$ Bn) Forecast, by Truck Type, 2017-2031

Figure 18: North America Truck Rental Market, Incremental Opportunity, by Truck Type, Value (US$ Bn), 2023-2031

Figure 19: North America Truck Rental Market Value (US$ Bn) Forecast, by GVWR, 2017-2031

Figure 20: North America Truck Rental Market, Incremental Opportunity, by GVWR, Value (US$ Bn), 2023-2031

Figure 21: North America Truck Rental Market Value (US$ Bn) Forecast, by Truck Propulsion, 2017-2031

Figure 22: North America Truck Rental Market, Incremental Opportunity, by Truck Propulsion, Value (US$ Bn), 2023-2031

Figure 23: North America Truck Rental Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 24: North America Truck Rental Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 25: Europe Truck Rental Market Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Figure 26: Europe Truck Rental Market, Incremental Opportunity, by Service Provider, Value (US$ Bn), 2023-2031

Figure 27: Europe Truck Rental Market Value (US$ Bn) Forecast, by Lease Type, 2017-2031

Figure 28: Europe Truck Rental Market, Incremental Opportunity, by Lease Type, Value (US$ Bn), 2023-2031

Figure 29: Europe Truck Rental Market Value (US$ Bn) Forecast, by Truck Type, 2017-2031

Figure 30: Europe Truck Rental Market, Incremental Opportunity, by Truck Type, Value (US$ Bn), 2023-2031

Figure 31: Europe Truck Rental Market Value (US$ Bn) Forecast, by GVWR, 2017-2031

Figure 32: Europe Truck Rental Market, Incremental Opportunity, by GVWR, Value (US$ Bn), 2023-2031

Figure 33: Europe Truck Rental Market Value (US$ Bn) Forecast, by Truck Propulsion, 2017-2031

Figure 34: Europe Truck Rental Market, Incremental Opportunity, by Truck Propulsion, Value (US$ Bn), 2023-2031

Figure 35: Europe Truck Rental Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: Europe Truck Rental Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 37: Asia Pacific Truck Rental Market Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Figure 38: Asia Pacific Truck Rental Market, Incremental Opportunity, by Service Provider, Value (US$ Bn), 2023-2031

Figure 39: Asia Pacific Truck Rental Market Value (US$ Bn) Forecast, by Lease Type, 2017-2031

Figure 40: Asia Pacific Truck Rental Market, Incremental Opportunity, by Lease Type, Value (US$ Bn), 2023-2031

Figure 41: Asia Pacific Truck Rental Market Value (US$ Bn) Forecast, by Truck Type, 2017-2031

Figure 42: Asia Pacific Truck Rental Market, Incremental Opportunity, by Truck Type, Value (US$ Bn), 2023-2031

Figure 43: Asia Pacific Truck Rental Market Value (US$ Bn) Forecast, by GVWR, 2017-2031

Figure 44: Asia Pacific Truck Rental Market, Incremental Opportunity, by GVWR, Value (US$ Bn), 2023-2031

Figure 45: Asia Pacific Truck Rental Market Value (US$ Bn) Forecast, by Truck Propulsion, 2017-2031

Figure 46: Asia Pacific Truck Rental Market, Incremental Opportunity, by Truck Propulsion, Value (US$ Bn), 2023-2031

Figure 47: Asia Pacific Truck Rental Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 48: Asia Pacific Truck Rental Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 49: Middle East & Africa Truck Rental Market Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Figure 50: Middle East & Africa Truck Rental Market, Incremental Opportunity, by Service Provider, Value (US$ Bn), 2023-2031

Figure 51: Middle East & Africa Truck Rental Market Value (US$ Bn) Forecast, by Lease Type, 2017-2031

Figure 52: Middle East & Africa Truck Rental Market, Incremental Opportunity, by Lease Type, Value (US$ Bn), 2023-2031

Figure 53: Middle East & Africa Truck Rental Market Value (US$ Bn) Forecast, by Truck Type, 2017-2031

Figure 54: Middle East & Africa Truck Rental Market, Incremental Opportunity, by Truck Type, Value (US$ Bn), 2023-2031

Figure 55: Middle East & Africa Truck Rental Market Value (US$ Bn) Forecast, by GVWR, 2017-2031

Figure 56: Middle East & Africa Truck Rental Market, Incremental Opportunity, by GVWR, Value (US$ Bn), 2023-2031

Figure 57: Middle East & Africa Truck Rental Market Value (US$ Bn) Forecast, by Truck Propulsion, 2017-2031

Figure 58: Middle East & Africa Truck Rental Market, Incremental Opportunity, by Truck Propulsion, Value (US$ Bn), 2023-2031

Figure 59: Middle East & Africa Truck Rental Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Middle East & Africa Truck Rental Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 61: South America Truck Rental Market Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Figure 62: South America Truck Rental Market, Incremental Opportunity, by Service Provider, Value (US$ Bn), 2023-2031

Figure 63: South America Truck Rental Market Value (US$ Bn) Forecast, by Lease Type, 2017-2031

Figure 64: South America Truck Rental Market, Incremental Opportunity, by Lease Type, Value (US$ Bn), 2023-2031

Figure 65: South America Truck Rental Market Value (US$ Bn) Forecast, by Truck Type, 2017-2031

Figure 66: South America Truck Rental Market, Incremental Opportunity, by Truck Type, Value (US$ Bn), 2023-2031

Figure 67: South America Truck Rental Market Value (US$ Bn) Forecast, by GVWR, 2017-2031

Figure 68: South America Truck Rental Market, Incremental Opportunity, by GVWR, Value (US$ Bn), 2023-2031

Figure 69: South America Truck Rental Market Value (US$ Bn) Forecast, by Truck Propulsion, 2017-2031

Figure 70: South America Truck Rental Market, Incremental Opportunity, by Truck Propulsion, Value (US$ Bn), 2023-2031

Figure 71: South America Truck Rental Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: South America Truck Rental Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031